Content Delivery Network Market

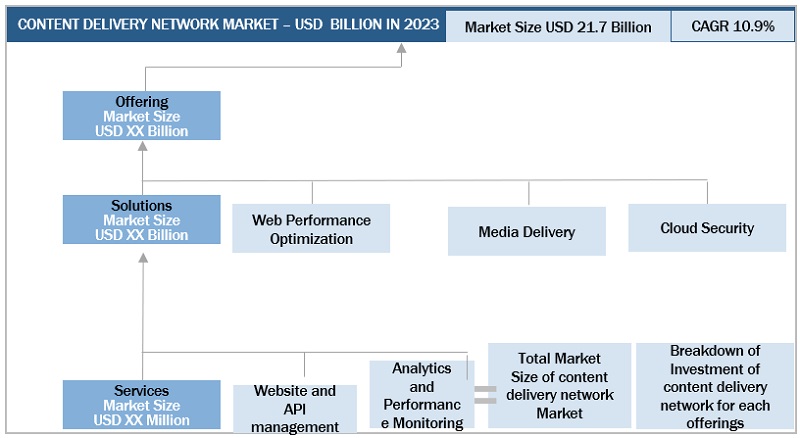

Content Delivery Network Market By Offering [Solutions (Web Performance Optimization, Media Delivery, Cloud Security) & Services], By Content Type (Static & Dynamic), By Application Area (Media & Entertainment, Online Gaming) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Content Delivery Network (CDN ) Market Size is estimated to reach USD 27.25 billion in 2025 and is projected to grow to USD 42.89 billion by 2030, registering a CAGR of 9.5% during the forecast period. The CDN market is evolving as digital services become more performance-sensitive and geographically distributed. Content delivery is no longer handled primarily through a small number of centralized data centers. Instead, applications, media platforms, and enterprise systems are increasingly supported through cloud infrastructure and edge locations distributed across regions. As access patterns widen, expectations around load times, service availability, and delivery consistency have become more defined, particularly for video streaming, e-commerce platforms, and software-as-a-service applications.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific is expected to register the highest growth rate of 11.3% during the forecast period.

-

By Content TypeThe dynamic content segment is expected to register the highest CAGR of 9.7%.

-

By Provider TypeBy Provider Type, the P2P CDN segment is projected to grow at the fastest rate from 2025 to 2030.

-

By Application AreaBy application area, the media & entertainment segment accounted for 27.4% of the total market in 2024.

-

Competitive LandscapeAkamai Technologies, Microsoft, IBM, Google, AWS were identified as some of the star players in the CDN market, given their strong market share and product footprint.

-

Competitive Landscape Startup/SMEsBroadpeak, Onapp Limited, StackPath, Bunny.NET, have distinguished themselves among startups and SMEs in the CDN Market

-

US Content Delivery Network MarketThe US content delivery network market is expected to reach USD 9.77 billion by 2030 from USD 6.91 billion in 2025, at a CAGR of 7.2% during 2025–2030.

-

Europe Content Delivery Network MarketThe Europe content delivery network market is projected to reach USD 11.99 billion by 2030 from USD 7.75 billion in 2025, at a CAGR of 9.1%.

CDN platforms play a central role in this transition by caching content closer to end users and dynamically routing traffic based on real-time network conditions. With digital engagement expanding across mobile devices, connected televisions, and browser-based platforms, earlier delivery approaches often fall short of meeting latency and reliability requirements. As a result, CDN usage is extending beyond static content delivery to include application support, handling of application programming interface (API) traffic, and security functions at the network edge. This broader role places CDNs closer to the core of modern digital infrastructure planning. These changes position CDNs as a foundational layer supporting modern digital infrastructure rather than a standalone optimization tool.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The CDN market is shifting as digital services increasingly prioritize real-time performance and reliability, a defining Content Delivery Network Market Trend. Content delivery has moved beyond static website acceleration to support interactive applications, live streaming, and cloud-based workloads. Greater emphasis on real-time performance has also introduced higher variability in traffic behavior. Live events, time-bound promotions, and on-demand consumption contribute to uneven load patterns across networks. In response, CDN architectures are being adjusted toward edge-based delivery models that combine routing logic, monitoring, and security controls. These developments are influencing how digital services are structured and how user experience expectations are managed across large and distributed audiences.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth of Performance-critical Digital Content

-

Rising Demand for Low-latency User Experiences

Level

-

Integration Complexity Across Hybrid Infrastructure

-

Cost Sensitivity Among Mid-sized Enterprises

Level

-

Expansion of Edge Computing and Application Delivery

-

CDN Adoption in Emerging Digital Economies

Level

-

Managing Security and Compliance at Scale

-

Traffic Volatility and Capacity Planning

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth of Performance-critical Digital Content

A growing share of internet traffic is now generated by applications where response consistency matters. Video streaming, online gaming, transaction platforms, and enterprise software are commonly accessed across regions and device types. In these environments, centralized delivery architectures are often found to be less effective, particularly when traffic patterns vary by location. Content delivery networks (CDNs) are therefore used to place content closer to users and to adjust routing paths based on network conditions. Over time, delivery performance has become a consideration during infrastructure planning rather than an afterthought. As a result, CDN deployment is increasingly treated as a foundational layer within distributed application environments.

Restraint: Integration Complexity Across Hybrid Infrastructure

In many organizations, CDN adoption is shaped by the structure of existing network environments. Hybrid architectures that combine on-premises systems with multiple public cloud platforms remain common. Integrating CDN services into these setups often requires changes to routing logic, security controls, and application workflows. Legacy application systems, in particular, may not align easily with edge-based delivery models. Integration changes can increase implementation effort and place additional demands on internal teams. Where in-house networking expertise is limited, the deployment scope is often reduced. As a result, CDN usage is frequently introduced in phases rather than applied consistently across all digital services.

Opportunity: Expansion of Edge Computing and Application Delivery

In recent deployments, CDN infrastructure has been used for more than static content caching. Parts of application processing are now handled closer to end users, including request handling, data processing, and localized logic execution. This shift has been observed as applications rely more on real-time interactions and region-specific responses. Latency reduction remains a key consideration, particularly where centralized cloud processing introduces delays. As a result, edge-based delivery capabilities are being explored across multiple use cases. In environments where traffic volumes fluctuate or workloads are distributed, this approach helps reduce reliance on core data centers. Demand for integrated delivery and processing models is therefore increasing, especially in distributed application environments.

Challenge: Managing Security and Compliance at Scale

With a larger share of application traffic passing through CDN platforms, security and compliance requirements have become more difficult to manage. Network-level protections are expected to address traffic surges, malicious requests, and application exposure in real time. At the same time, data handling practices are subject to regional regulations, which vary across jurisdictions. These requirements add operational layers to globally distributed delivery networks. Visibility into traffic behavior and control mechanisms can also be limited when services are managed externally. As CDN usage expands across business-critical applications, risk exposure widens. Maintaining uniform controls across performance, security, and compliance has therefore become an ongoing challenge rather than a one-time configuration task.

CONTENT DELIVERY NETWORK MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Akamai supports global media companies by distributing video-on-demand and live streaming content across its edge network. The CDN is used to handle traffic spikes during major sports and entertainment events while maintaining consistent video quality across regions. | Improved video delivery quality | Reduced buffering and latency | Stable performance during peak traffic |

|

Cloudflare’s CDN is used by digital publishers and Software-as-a-Service (SaaS) platforms to accelerate dynamic web content and protect applications from distributed denial-of-service (DDoS) attacks. Its edge caching and security services support global user access with minimal configuration effort. | Faster page load times | Enhanced application security | Lower infrastructure management overhead |

|

Fastly supports real-time digital platforms, including news portals and online marketplaces, by accelerating frequently updated content. Its edge computing capabilities allow rapid content updates and personalization without compromising delivery speed. | Low-latency content updates | Improved site responsiveness | Support for real-time digital experiences |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The CDN ecosystem comprises platform providers responsible for delivering infrastructure and routing traffic, as well as service providers that support deployment and operational management. Additionally, system integrators are involved in implementing and performing performance tuning across enterprise environments. These roles are typically divided across infrastructure provisioning, configuration, and ongoing optimization. Together, they reflect the layered structure of CDN adoption, where delivery platforms are supported by external services to meet scale and reliability requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Content Delivery Network Market, By Solution

Web performance optimization is receiving greater attention as digital teams examine how application responsiveness affects user interaction and backend efficiency. Delays in page loading and uneven response times are increasingly associated with session drop-offs and higher resource utilization. At the same time, modern applications are built on dynamic content, third-party services, and real-time processing layers, which limits the effectiveness of network tuning through legacy methods alone. CDN-based optimization tools are therefore being applied to address routing inefficiencies, manage payload delivery, and process requests closer to users. As performance indicators become more closely monitored within operational metrics, optimization capabilities delivered through CDN platforms are being incorporated more consistently into application delivery and infrastructure planning.

Content Delivery Network Market, By Provider Type

Traditional CDN providers continue to account for the largest Content Delivery Network Market share, largely due to their mature infrastructure and long-standing role in large-scale content distribution. These providers operate extensive global networks designed to deliver content consistently across regions with varying traffic conditions. Their platforms support a mix of static and dynamic content and are commonly integrated into media, enterprise, and cloud delivery architectures. In addition, established CDNs have expanded beyond basic delivery to include traffic management, security controls, and performance monitoring. While alternative delivery models are gaining attention, traditional CDN platforms continue to be a central component of global distribution strategies, particularly for high-volume and performance-sensitive workloads.

REGION

Asia Pacific to be fastest-growing region in global content delivery network market during forecast period.

Asia Pacific is expected to see strong Content Delivery Network Market Growth as digital consumption continues to rise across both emerging and developed economies. Expanding broadband access, higher smartphone usage, and sustained growth in video streaming are increasing demand for localized and reliable content delivery. Enterprises in the region are also scaling cloud-based services, which places greater emphasis on application performance and regional traffic management. In parallel, content providers are adapting services to local languages and usage patterns, adding further complexity to delivery requirements. Combined with a large and diverse user base, these factors are supporting steady expansion of CDN adoption across Asia Pacific.

CONTENT DELIVERY NETWORK MARKET: COMPANY EVALUATION MATRIX

In content delivery network market matrix, Akamai Technologies leads the CDN market with its large global edge footprint and strong capabilities in content delivery, traffic management, and security for enterprise and media workloads. Cloudflare is an emerging leader, gaining traction through its integrated edge platform that combines delivery, security, and developer services, particularly among cloud-native and digital-first organizations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Akamai Technologies (US)

- Microsoft (US)

- IBM (US)

- Google (US)

- AWS (US)

- Cloudflare (US)

- Lumen Technologies (US)

- Deutsche Telekom (Germany)

- Fastly (US)

- NTT Communications (Japan)

- Comcast Technologies (US)

- Rackspace Technology (US)

- CDNetworks (South Korea)

- Tata Communications (India)

- Imperva (US)

- Broadpeak (France)

- Quantil (US)

- StackPath (US)

- G Core Labs SA (Luxembourg)

- Tencent Cloud (China)

- Bunny.net (Slovenia)

- Baishan Cloud (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 27.25 Billion |

| Market Forecast in 2030 (Value) | USD 42.89 Billion |

| Growth Rate | CAGR of 9.5% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: CONTENT DELIVERY NETWORK MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) | Regional Analysis: • Further breakdown of the North American content delivery network market • Further breakdown of the European content delivery network market • Further breakdown of the Asia Pacific content delivery network market • Further breakdown of the Middle Eastern & African content delivery network market • Further breakdown of the Latin American content delivery network market | • Identifies high-growth regional opportunities, enabling tailored market entry strategies. • Optimizes resource allocation and investment based on region-specific demand and trends. |

| Company Information | Detailed analysis and profiling of additional market players (up to 5) | • Broadens competitive insights, helping clients make informed strategic and investment decisions. • Reveals market gaps and opportunities, supporting differentiation and targeted growth initiatives. |

RECENT DEVELOPMENTS

- September 2025 : Orange partnered with Synamedia to strengthen multi-CDN delivery by combining Orange’s telecom-grade content delivery network with Synamedia’s Quortex Switch platform. The collaboration enables content providers to orchestrate traffic across multiple CDNs, expand reach into new markets, particularly the Middle East and Africa, and improve streaming quality through intelligent routing and lower latency.

- February 2025 : Akamai introduced its Gecko initiative to extend cloud computing capabilities directly into its global edge network. The initiative allows workloads to run closer to end users, improving performance for latency-sensitive applications such as gaming, live streaming, and real-time data processing, while strengthening Akamai’s edge cloud and CDN integration.

- Ferburay 2024 : Vultr launched its CDN service to support edge-based content and media delivery across its global infrastructure. The platform focuses on secure caching and performance optimization, enabling developers to extend web applications and digital content closer to users through Vultr’s distributed network.

Table of Contents

Methodology

The content delivery network market research study involves extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial global market study. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to all the segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess growth prospects. These respondents included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. The data was also collected from secondary sources, such as The Association of International Internet of Things Consortium, Europe Research Cluster on Internet of Things, Bitkom-Germany’s Digital Association, and China Association for Science and Technology. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Content delivery network market. The primary sources from the demand side included Content delivery network end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

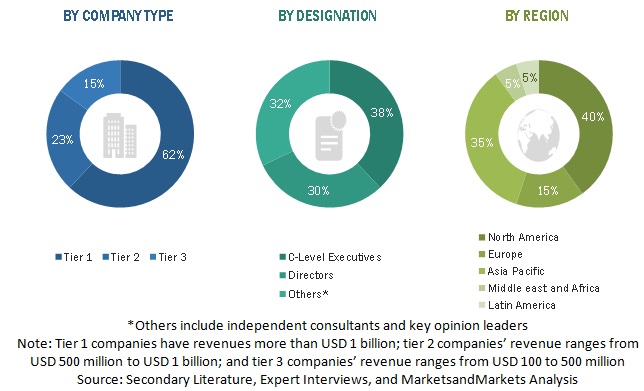

The break-up of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and develop the Content Delivery Network Market Forecast. The first approach estimates market size by summating companies’ revenue generated through Content delivery network solutions. In this approach for market estimation, we identified the key companies offering Content delivery networks by offerings: solutions and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Content delivery network market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and break-ups have been determined using secondary sources and verified through primary sources.

Content delivery network Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the content delivery network market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

A content delivery network (CDN) is a distributed network of servers located in various geographic locations. Its purpose is to efficiently deliver web content, such as images, videos, and applications, to end-users. By storing and replicating content on these servers, CDNs reduce latency, improve website loading speed, and enhance the overall user experience. They also help manage traffic spikes, improve scalability, and offer additional services like security and performance optimization.

Key Stakeholders

- Content delivery network solution providers

- Independent Software Vendors (ISVs)

- Investors and Venture Capitalists (VCs)

- Support and maintenance service providers

- Value-added Resellers (VARs) and distributors

Report Objectives

- To determine and forecast the global Content delivery network market by offering (solutions, and services), content type, provider type, application area, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Content delivery network market.

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- In the market, track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the MEA market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Content Delivery Network Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Content Delivery Network Market

Ming

Feb, 2023

Who are the major vendors in CDN Market?.