Visitor Management System Market by Offering (Software (Mobile-based & Web-based), Services), Application (Compliance Management & Fraud Detection, Security Management, Historical Visitor Tracking), End User and Region - Global Forecast to 2028

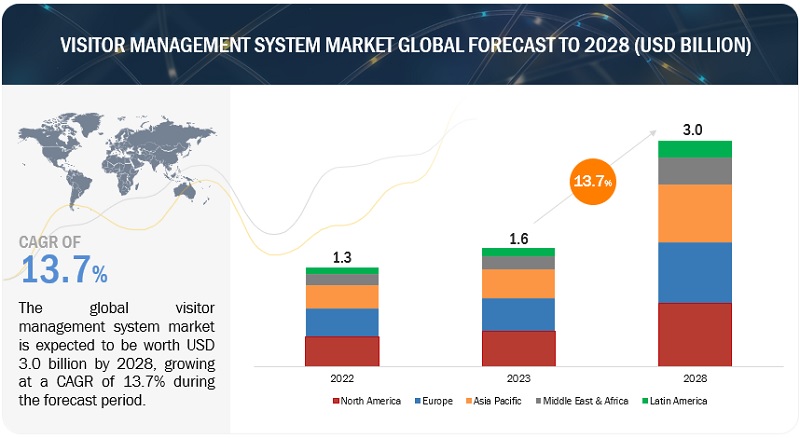

[297 Pages Report] The global market for visitor management system market is projected to grow from USD 1.6 billion in 2023 to USD 3.0 billion by 2028, at a CAGR of 13.7% during the forecast period. The growth of the visitor management system market is driven by various factors, including increased focus on security, demand for streamlined and effective experiences, and the requirement to adhere to regulations and legal standards.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Need for regulatory compliance and meeting legal requirements

VMS are increasingly popular due to regulatory compliance and legal requirements. In today's business environment, companies must adhere to strict data protection laws, industry-specific regulations, and privacy requirements. Manual visitor logs or outdated check-in processes often fail to meet these legal obligations, leaving businesses open to potential penalties and legal liabilities. For example, healthcare facilities must comply with the Health Insurance Portability and Accountability Act (HIPAA), safeguarding patient information and controlling access to medical areas.

Restraint: Privacy and security concerns for visitor’s information

When implementing VMS, concerns about privacy and data security are significant. VMS solutions handle private visitor information, including names, contact details, identification documents, and sometimes even biometric data. This collection, storage, and processing of personal information raises legitimate concerns among individuals and regulatory authorities. Cloud-based VMS may introduce additional privacy risks, and organizations must verify that data stored in the cloud is encrypted and backed up securely.

Opportunity: Enhanced analytics and reporting capabilities to optimize VMS

In the world of visitor management, integrating advanced analytics and reporting capabilities is becoming increasingly popular. VMS solutions are utilizing AI and analytics to provide more comprehensive data analysis and improve decision-making. AI-powered VMS can automatically detect suspicious behavior or irregularities, alerting security personnel to potential security threats. Real-time data and analytics provide useful information on visitor traffic and behavior, enabling real estate organizations to make informed decisions regarding resource allocation and security measures.

Challenge: Risks of potential malfunctions and technical issues

As VMS become more advanced and integrated with other building systems, they become more complex and prone to malfunctions and technical issues. VMS now interact with access control, security cameras, biometric devices, mobile applications, and cloud-based databases, among others, creating a network of interconnected components that may fail. Each additional piece in the VMS puzzle becomes a potential point of failure, leading to system downtime, security vulnerabilities, and disruptions in visitor processing.

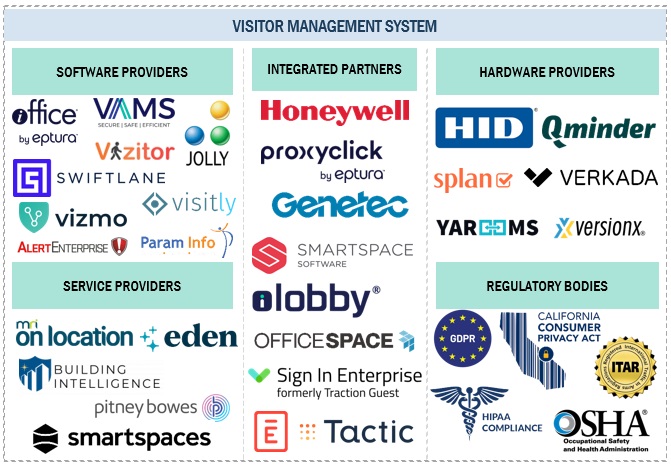

Visitor Management System Market Ecosystem

The visitor management system market report covers market ecosystem which comprises software providers, hardware providers, service providers, integrated partners and regulators.

By End User, BFSI segment accounts for the largest market size during the forecast period

In the Banking, Financial Services, and Insurance (BFSI), the visitor management system emerges as a pivotal tool to address the unique security and operational challenges faced by institutions within this sector. With heightened concerns over financial data breaches and regulatory compliance, BFSI entities turn to visitor management systems to fortify their visitor screening and access control protocols. These systems facilitate efficient check-in procedures, bolstering security by verifying visitor identities, capturing photographs, and printing personalized badges.

Managed Services segment is projected to grow at the highest CAGR during the forecast period

Visitor management system managed services offer a comprehensive solution for organizations seeking a hassle-free and expertly managed visitor management process. With these services, a specialized team takes on the responsibility of overseeing and maintaining the entire visitor management system. This includes tasks such as system configuration, updates, troubleshooting, data security, and user support. Managed services providers ensure that the system operates at peak efficiency, remains up to date with the latest security measures, and aligns with regulatory requirements.

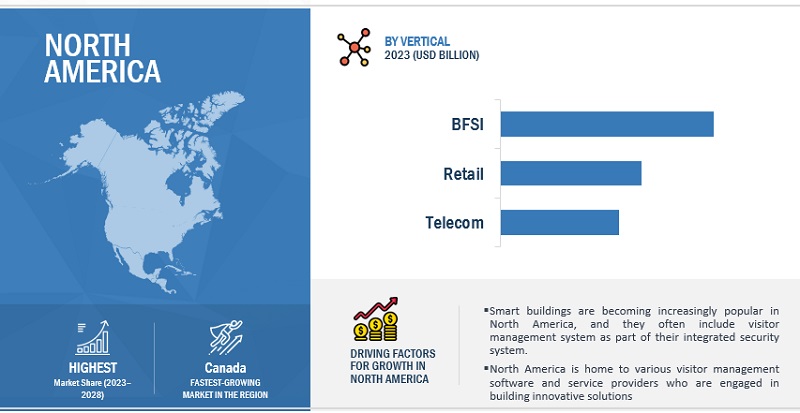

North America to account for the largest market size during the forecast period

Organizations across North America are increasingly turning to visitor management system to ensure security, safety, and data privacy. This system, utilized by businesses, schools, government agencies, healthcare facilities, and more, efficiently manage and track visitors. Leading providers, such as Honeywell, AlertEnterprise, MRI Software, and Jolly Technologies, offer features such as registration, check-in and check-out, badge printing, watchlist screening, photo capture, and real-time reporting.

Key Market Players

The major visitor management system software and service providers include Honeywell (US), Pitney Bowes (US), SmartSpace Software PLC (US), Eptura (US), Envoy (US), AlertEnterprise (US), HID Global (US), Genetec (Canada), MRI Software (US), Jolly Technologies (US), Digicred Technologies (India), Sign In Solutions (US), Eden Software Solutions (US), Building Intelligence (US), Splan (US), iLobby (Canada), OfficeSpace Software (US), VAMS Global (US), Qminder (UK), Raptor Technologies (US). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the visitor management system market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments covered |

Offering (Software – [Type, Deployment Mode], Services) Application, End User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Honeywell (US), Pitney Bowes (US), SmartSpace Software PLC (US), Eptura (US), Envoy (US), AlertEnterprise (US), HID Global (US), Genetec (Canada), MRI Software (US), Jolly Technologies (US), Digicred Technologies (India), Sign In Solutions (US), Eden Software Solutions (US), Building Intelligence (US), Splan (US), iLobby (Canada), OfficeSpace Software (US), VAMS Global (US), Qminder (UK), Raptor Technologies (US), Verkada (US), Carson Living (US), VersionX (US), Vizmo (US), Visitly (US), Transmission (US), Swiftlane (US), Vizitor (India), Visitorz.io (India) and Tactic (US). |

This research report categorizes the visitor management system market based on Offering, Application, End User, and Region.

By Offering:

-

Software

-

Type

- Mobile based

- Web based

-

Deployment Mode

- Cloud

- On Premises

-

Type

-

Services

-

Professional Services

- Consulting

- System Integration and Implementation

- Support and Maintenance

- Managed Services

-

Professional Services

By Application:

- Security Management

- Historical visitor tracking

- Compliance Management and Fraud Detection

- Parking Management

- Meeting Room Management

- Contact Tracing

- Other Applications

By End User:

- BFSI

- Retail

- Telecom

- Healthcare and Life Sciences

- Manufacturing

- Travel and Hospitality

- Government and Defense

- Transportation and Logistics

- Energy & Utilities

- IT&ITeS

- Residential

- Media & Entertainment

- Others (Education, Research, and Real Estate)

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments:

- In May 2023, Eden Software Solutions shared an overview of its latest product updates, including expanded visitor check-in times where Visitors can check in anytime on the day of their visit rather than being limited to 30 minutes before their invited time and SMS notifications for hosts.

- In April 2023, SmartSpace Software Plc announced the launch of SwipedOn's SaaS visitor management platform in Taiwan, China, and Germany. The launch of a fully localized German version marks the first full market release in Europe.

- In March 2023, Building Intelligence acquired Veristream, a visitor management system provider. This strategic move brings together the capabilities of both companies' platforms, offering enhanced value and benefits to their partners, clients, and future stakeholders.

- In December 2022, Sine announced the release of its newest feature, Lobbies. It is an addition to the Sine platform that facilitates multi-tenant visitor management solutions. This new feature enables easy customization of Sine configurations to meet the unique requirements of various tenants while ensuring a seamless and user-friendly check-in experience for all end users.

- In January 2022, Condeco, a leading workspace management suite provider, recently announced the strategic acquisition of Proxyclick, a visitor management platform. This acquisition aims to fulfill the customers' demands for connecting people in the workplace while adhering to emerging legal and compliance requirements for employees and visitors before entering the premises.

Frequently Asked Questions (FAQ):

What is Visitor Management System?

A Visitor Management System is a digital solution that efficiently and securely manages the entry and exit of visitors to a premises. It automates the check-in process, verifies identities, issues badges, and enhances security through features like background checks and real-time monitoring.

Which region is expected to hold the highest share in the visitor management system market?

North America is expected to dominate the visitor management system market in 2028. Heightened security threats, data breaches, and incidents of workplace violence have made organizations more vigilant about managing visitor access in North America

Which are key end users adopting visitor management system software and services?

Key end users adopting visitor management system software and services include BFSI, Retail, Healthcare & Lifesciences, Manufacturing, Travel & Hospitality, Government & Defense, Telecom, Transportation & Logistics, Energy & Utilities, IT&ITeS, Residential, Media & Entertainment and others end users, which comprise Education, Research and Real Estate.

Which are the key drivers supporting the market growth for visitor management system?

The key drivers supporting the market growth for visitor management system include increased emphasis on security fostering market growth, need to provide seamless and efficient experiences and need for regulatory compliance and meeting legal requirements.

Who are the key vendors in the market for visitor management system?

The key vendors in the global visitor management system market include are Honeywell (US), Pitney Bowes (US), SmartSpace Software PLC (US), Eptura (US), Envoy (US), AlertEnterprise (US), HID Global (US), Genetec (Canada), MRI Software (US), Jolly Technologies (US), Digicred Technologies (India), Sign In Solutions (US), Eden Software Solutions (US), Building Intelligence (US), Splan (US), iLobby (Canada), OfficeSpace Software (US), VAMS Global (US), Qminder (UK), Raptor Technologies (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased emphasis on security to foster market growth- Need to provide seamless and efficient experiences- Need for regulatory compliance and meeting legal requirementsRESTRAINTS- Privacy and security concerns for visitor information- Cost considerations to limit implementation of VMSOPPORTUNITIES- Enhanced analytics and reporting capabilities to optimize VMS- Integration of tenant apps with VMS- Customization options to represent compelling opportunitiesCHALLENGES- Training of security personnel, building staff, and visitors- Risks of potential malfunctions and technical issues

-

5.3 INDUSTRY TRENDSVALUE CHAIN ANALYSIS- Inbound logistics- Operations- Outbound logistics- Marketing and sales- Services- Supporting activitiesECOSYSTEM ANALYSISPRICING ANALYSIS- Selling prices of key players, by application- Indicative pricing analysis of visitor management system softwarePORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryTRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENT BUSINESSTECHNOLOGY ANALYSIS- Key technologies- Adjacent technologiesCASE STUDY ANALYSIS- Retail- BFSI- Manufacturing- Healthcare & life sciences- Media & entertainment- IT & ITeS- Transportation & logistics- EducationPATENT ANALYSIS- Methodology- Document type- Innovation and patent applicationsBRIEF HISTORY EVOLUTION OF VISITOR MANAGEMENT SYSTEM MARKETKEY CONFERENCES & EVENTS, 2023–2024TARIFFS AND REGULATORY LANDSCAPE- Regulatory bodies, government agencies, and other organizationsKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaTECHNOLOGY ROADMAP OF VISITOR MANAGEMENT SYSTEM MARKETBUSINESS MODELS OF VISITOR MANAGEMENT SYSTEM MARKET- Software-as-a-Service (SaaS)- Enterprise License Model- Hardware Bundled Model

-

6.1 INTRODUCTIONOFFERING: VISITOR MANAGEMENT SYSTEM MARKET DRIVERS

-

6.2 SOFTWARENEED TO IMPROVE EFFICIENCY, REDUCE WAIT TIMES, ENHANCE SECURITY MEASURES, AND PROVIDE PROFESSIONAL EXPERIENCE TO DRIVE MARKETMOBILE-BASED- Increasing reliance on mobile technologies and hassle-free set up to fuel demand for mobile-based VMSWEB-BASED- Cost-effective and flexible, and ability to access remotely to fuel demand for web-based VMS

-

6.3 BY DEPLOYMENT MODENEED TO ALIGN INFRASTRUCTURE WITH SECURITY REQUIREMENTS AND OPERATIONAL GOALS TO DRIVE MARKETCLOUD- Need to modernize visitor management process and provide smoother experience to drive demand for cloud servicesON-PREMISES- On-premises visitor management system to capture visitor information, issue digital badges, and control access privileges

-

6.4 SERVICESNEED FOR SEAMLESS AND SECURE VISITOR EXPERIENCE TO BOOST DEMAND FOR VISITOR MANAGEMENT SYSTEM SERVICESPROFESSIONAL SERVICES- Need to ensure seamless integration and tailored implementation to fuel demand for professional services- Consulting- System integration & implementation- Support & maintenanceMANAGED SERVICES- Managed services to operate system efficiently, help align with regulatory requirements, and offer high level of scalability

-

7.1 INTRODUCTIONAPPLICATION: VISITOR MANAGEMENT SYSTEM MARKET DRIVERS

-

7.2 SECURITY MANAGEMENTCHECK-IN PROCESS, CAPTURING VISITOR IDENTIFICATION DETAILS, AND CROSS-REFERENCING INFORMATION TO DRIVE DEMAND FOR SECURITY MANAGEMENT

-

7.3 HISTORICAL VISITOR TRACKINGNEED TO CAPTURE DETAILS AND RECORD AND STORE VISITOR DATA TO FUEL DEMAND FOR HISTORICAL VISITOR TRACKING

-

7.4 COMPLIANCE MANAGEMENT & FRAUD DETECTIONCOMPLIANCE MANAGEMENT & FRAUD DETECTION TO ENSURE REGULATORY COMPLIANCE AND PREVENT FRAUDULENT ACTIVITIES

-

7.5 PARKING MANAGEMENTVISITOR MANAGEMENT SYSTEM TO AUTOMATE REGISTRATION AND ALLOCATION AND ENSURE EFFICIENT MANAGEMENT OF PARKING SPOTS

-

7.6 MEETING ROOM MANAGEMENTNEED TO MANAGE MEETING ROOMS EFFICIENTLY TO BOOST DEMAND FOR MEETING ROOM MANAGEMENT SOLUTIONS

-

7.7 CONTACT TRACINGNEED TO AUTOMATE CONTACT TRACING PROCESS AND EXPEDITE PUBLIC HEALTH RESPONSE TO FUEL DEMAND FOR CONTACT TRACING SOLUTIONS

- 7.8 OTHER APPLICATIONS

-

8.1 INTRODUCTIONEND USER: VISITOR MANAGEMENT SYSTEM MARKET DRIVERS

- 8.2 BFSI

- 8.3 RETAIL

- 8.4 TELECOM

- 8.5 HEALTHCARE & LIFE SCIENCES

- 8.6 MANUFACTURING

- 8.7 TRAVEL & HOSPITALITY

- 8.8 GOVERNMENT & DEFENSE

- 8.9 TRANSPORTATION & LOGISTICS

- 8.10 ENERGY & UTILITIES

- 8.11 IT & ITES

- 8.12 RESIDENTIAL

- 8.13 MEDIA & ENTERTAINMENT

- 8.14 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Necessity to meet regulatory requirements to fuel demand for visitor management system in USCANADA- Focus on security, compliance, and efficiency to boost demand for visitor management system in Canada

-

9.3 EUROPEEUROPE: VISITOR MANAGEMENT SYSTEM MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Strong focus on technology and innovation to fuel demand for visitor management system in UKGERMANY- Need to enhance security, streamline digital transformation efforts, and optimize cloud management to drive marketFRANCE- Favorable political environment, local and foreign investors, and technological drivers to propel marketITALY- Government funding and initiatives to fuel demand for visitor management system solutionsSPAIN- Digital transformation, innovation, and government support to fuel demand for visitor management system in SpainREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Increased use of AI-based applications and government initiatives to boost demand for visitor management system in ChinaJAPAN- Japan's vision of Society 5.0 with tech-savvy population and strong mobile culture to drive marketINDIA- India's thriving startup ecosystem to fuel demand for visitor management systemSOUTH KOREA- Intense government support for digital transformation to fuel demand for visitor management system in South KoreaAUSTRALIA & NEW ZEALAND- Need to enhance visitor experience and safety to propel demand for visitor management systemASEAN- Investments in technological advancements and innovations to drive marketREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKSA- Investments in smart city initiatives to boost visitor management system in KSAUAE- Dubai 2040 Urban Master Plan to promote sustainable urban development and improve quality of lifeISRAEL- Innovative ecosystem and strong technological landscape to drive demand for visitor management system in IsraelTURKEY- Rapid technological enhancement and adoption of AI solutions to drive marketSOUTH AFRICA- Strong focus on research & development to drive demand for visitor management system in South AfricaREST OF MIDDLE EAST & AFRICA

-

9.6 LATIN AMERICALATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Government initiatives including digital transformation strategies and policies to drive marketMEXICO- Increasing government support for emerging technologies to fuel demand for visitor management system in MexicoREST OF LATIN AMERICA

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

10.3 REVENUE ANALYSISBUSINESS SEGMENT REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

-

10.6 COMPANY EVALUATION MATRIX, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.7 STARTUP/SME EVALUATION MATRIX, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 10.8 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 10.9 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

-

10.10 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSHONEYWELL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPITNEY BOWES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSMARTSPACE SOFTWARE PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEPTURA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewENVOY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALERTENTERPRISE- Business overview- Products/Solutions/Services offered- Recent developmentsHID GLOBAL- Business overview- Products/Solutions/Services offered- Recent developmentsGENETEC- Business overview- Products/Solutions/Services offered- Recent developmentsMRI SOFTWARE- Business overview- Products/Solutions/Services offered- Recent developmentsJOLLY TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsSIGN IN SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developmentsDIGICRED TECHNOLOGIES PRIVATE LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsEDEN SOFTWARE SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developmentsBUILDING INTELLIGENCE- Business overview- Products/Solutions/Services offered- Recent developmentsSPLAN- Business overview- Products/Solutions/Services offered- Recent developmentsILOBBYOFFICESPACE SOFTWAREVAMS GLOBALQMINDERRAPTOR TECHNOLOGIES

-

11.3 OTHER PLAYERSVERKADACARSON LIVINGVERSIONXVIZMOVISITLYTRANSMISSIONSWIFTLANEVIZITORVISITORZ.IOTACTIC

- 12.1 INTRODUCTION

-

12.2 SMART BUILDINGS MARKET—GLOBAL FORECAST TO 2026MARKET DEFINITIONMARKET OVERVIEWSMART BUILDINGS MARKET, BY COMPONENTSMART BUILDINGS MARKET, BY TYPESMART BUILDINGS MARKET, BY SOLUTIONSMART BUILDINGS MARKET, BY BUILDING TYPESMART BUILDINGS MARKET, BY REGION

-

12.3 PARKING MANAGEMENT MARKET—GLOBAL FORECAST TO 2028MARKET DEFINITIONMARKET OVERVIEWPARKING MANAGEMENT MARKET, BY OFFERINGPARKING MANAGEMENT MARKET, BY SOLUTIONPARKING MANAGEMENT MARKET, BY SERVICEPARKING MANAGEMENT MARKET, BY PROFESSIONAL SERVICEPARKING MANAGEMENT MARKET, BY PARKING SITEPARKING MANAGEMENT MARKET, BY APPLICATIONPARKING MANAGEMENT MARKET, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 VISITOR MANAGEMENT SYSTEM MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y%)

- TABLE 5 VISITOR MANAGEMENT SYSTEM MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y%)

- TABLE 6 VISITOR MANAGEMENT SYSTEM MARKET: SOFTWARE PROVIDERS

- TABLE 7 VISITOR MANAGEMENT SYSTEM MARKET: HARDWARE PROVIDERS

- TABLE 8 VISITOR MANAGEMENT SYSTEM MARKET: SERVICE PROVIDERS

- TABLE 9 VISITOR MANAGEMENT SYSTEM MARKET: INTEGRATION PARTNERS

- TABLE 10 VISITOR MANAGEMENT SYSTEM MARKET: REGULATORS

- TABLE 11 SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD)

- TABLE 12 VISITOR MANAGEMENT SYSTEM: PRICING LEVELS

- TABLE 13 PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 PATENTS FILED, 2013–2023

- TABLE 15 TOP 20 PATENT OWNERS, 2013–2023

- TABLE 16 LIST OF PATENTS IN VISITOR MANAGEMENT SYSTEM MARKET, 2021–2023

- TABLE 17 DETAILED LIST OF KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 24 SHORT-TERM ROADMAP, 2023–2025

- TABLE 25 MID-TERM ROADMAP, 2026–2028

- TABLE 26 LONG-TERM ROADMAP, 2029–2030

- TABLE 27 VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 28 VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 29 VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 30 VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 31 SOFTWARE: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 32 SOFTWARE: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 MOBILE-BASED: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 MOBILE-BASED: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 WEB-BASED: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 WEB-BASED: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 38 VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 39 CLOUD: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 CLOUD: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 ON-PREMISES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 ON-PREMISES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 44 VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 45 PROFESSIONAL SERVICES: VISITOR MANAGEMENT SYSTEM MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 46 PROFESSIONAL SERVICES: VISITOR MANAGEMENT SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 PROFESSIONAL SERVICES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 PROFESSIONAL SERVICES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 CONSULTING: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 CONSULTING: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 SYSTEM INTEGRATION & IMPLEMENTATION: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 SYSTEM INTEGRATION & IMPLEMENTATION: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 SUPPORT & MAINTENANCE: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 SUPPORT & MAINTENANCE: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 MANAGED SERVICES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 MANAGED SERVICES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 58 VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 SECURITY MANAGEMENT: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 SECURITY MANAGEMENT: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 HISTORICAL VISITOR TRACKING: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 HISTORICAL VISITOR TRACKING: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 COMPLIANCE MANAGEMENT & FRAUD DETECTION: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 64 COMPLIANCE MANAGEMENT & FRAUD DETECTION: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 PARKING MANAGEMENT: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 PARKING MANAGEMENT: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 MEETING ROOM MANAGEMENT: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 MEETING ROOM MANAGEMENT: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 CONTACT TRACING: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 70 CONTACT TRACING: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 OTHER APPLICATIONS: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 72 OTHER APPLICATIONS: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 74 VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 75 BFSI: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 76 BFSI: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 RETAIL: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 78 RETAIL: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 TELECOM: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 80 TELECOM: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 HEALTHCARE & LIFE SCIENCES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 82 HEALTHCARE & LIFE SCIENCES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 MANUFACTURING: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 84 MANUFACTURING: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 TRAVEL & HOSPITALITY: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 86 TRAVEL & HOSPITALITY: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 GOVERNMENT & DEFENSE: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 88 GOVERNMENT & DEFENSE: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 TRANSPORTATION & LOGISTICS: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 90 TRANSPORTATION & LOGISTICS: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 ENERGY & UTILITIES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 92 ENERGY & UTILITIES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 IT & ITES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 94 IT & ITES: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 RESIDENTIAL: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 96 RESIDENTIAL: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 MEDIA & ENTERTAINMENT: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 98 MEDIA & ENTERTAINMENT: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 OTHER END USERS: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 100 OTHER END USERS: VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 102 VISITOR MANAGEMENT SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 119 US: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 120 US: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 121 US: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 122 US: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 124 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 126 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 127 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 128 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 129 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 130 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 131 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 132 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 133 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 134 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 135 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 136 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 137 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 138 EUROPE: VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 139 UK: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 140 UK: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 141 UK: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 142 UK: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 143 GERMANY: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 144 GERMANY: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 145 GERMANY: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 146 GERMANY: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 156 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 158 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 160 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 161 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 162 ASIA PACIFIC: VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 163 CHINA: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 164 CHINA: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 165 CHINA: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 166 CHINA: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 167 ASEAN: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 168 ASEAN: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 169 ASEAN: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 170 ASEAN: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 187 KSA: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 188 KSA: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 189 KSA: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 190 KSA: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 191 UAE: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 192 UAE: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 193 UAE: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 194 UAE: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 195 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 196 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 197 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 198 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 199 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 200 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 201 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 202 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 203 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 204 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 205 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 206 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 207 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 208 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 209 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 210 LATIN AMERICA: VISITOR MANAGEMENT SYSTEM MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 211 BRAZIL: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 212 BRAZIL: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 213 BRAZIL: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 214 BRAZIL: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 215 MEXICO: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 216 MEXICO: VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 217 MEXICO: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 218 MEXICO: VISITOR MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 219 STRATEGIES DEPLOYED BY KEY VISITOR MANAGEMENT SYSTEM VENDORS

- TABLE 220 VISITOR MANAGEMENT SYSTEM MARKET: DEGREE OF COMPETITION

- TABLE 221 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY SOFTWARE

- TABLE 222 COMPETITIVE BENCHMARKING FOR KEY PLAYERS, 2023

- TABLE 223 DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 224 COMPETITIVE BENCHMARKING OF SMES/STARTUPS, 2023

- TABLE 225 VISITOR MANAGEMENT SYSTEM MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 226 VISITOR MANAGEMENT SYSTEM MARKET: DEALS, 2020–2023

- TABLE 227 VISITOR MANAGEMENT SYSTEM MARKET: OTHERS, 2020–2023

- TABLE 228 HONEYWELL: COMPANY OVERVIEW

- TABLE 229 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 HONEYWELL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 231 HONEYWELL: DEALS

- TABLE 232 PITNEY BOWES: COMPANY OVERVIEW

- TABLE 233 PITNEY BOWES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 PITNEY BOWES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 235 PITNEY BOWES: DEALS

- TABLE 236 SMARTSPACE SOFTWARE PLC: COMPANY OVERVIEW

- TABLE 237 SMARTSPACE SOFTWARE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 SMARTSPACE SOFTWARE PLC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 239 SMARTSPACE SOFTWARE PLC: DEALS

- TABLE 240 SMARTSPACE SOFTWARE PLC: OTHERS

- TABLE 241 EPTURA: COMPANY OVERVIEW

- TABLE 242 EPTURA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 EPTURA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 244 EPTURA: DEALS

- TABLE 245 EPTURA: OTHERS

- TABLE 246 ENVOY: COMPANY OVERVIEW

- TABLE 247 ENVOY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 ENVOY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 249 ALERTENTERPRISE: COMPANY OVERVIEW

- TABLE 250 ALERTENTERPRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 ALERTENTERPRISE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 252 ALERTENTERPRISE: DEALS

- TABLE 253 HID GLOBAL: COMPANY OVERVIEW

- TABLE 254 HID GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 HID GLOBAL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 256 HID GLOBAL: DEALS

- TABLE 257 GENETEC: COMPANY OVERVIEW

- TABLE 258 GENETEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 GENETEC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 260 GENETEC: DEALS

- TABLE 261 GENETEC: OTHERS

- TABLE 262 MRI SOFTWARE: COMPANY OVERVIEW

- TABLE 263 MRI SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 MRI SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 265 MRI SOFTWARE: DEALS

- TABLE 266 MRI SOFTWARE: OTHERS

- TABLE 267 JOLLY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 268 JOLLY TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 JOLLY TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 270 SIGN IN SOLUTIONS: COMPANY OVERVIEW

- TABLE 271 SIGN IN SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 SIGN IN SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 273 SIGN IN SOLUTIONS: DEALS

- TABLE 274 SIGN IN SOLUTIONS: OTHERS

- TABLE 275 DIGICRED TECHNOLOGIES PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 276 DIGICRED TECHNOLOGIES PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 DIGICRED TECHNOLOGIES PRIVATE LIMITED: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 278 DIGICRED TECHNOLOGIES PRIVATE LIMITED: DEALS

- TABLE 279 EDEN SOFTWARE SOLUTIONS: COMPANY OVERVIEW

- TABLE 280 EDEN SOFTWARE SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 EDEN SOFTWARE SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 282 BUILDING INTELLIGENCE: COMPANY OVERVIEW

- TABLE 283 BUILDING INTELLIGENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 BUILDING INTELLIGENCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 285 BUILDING INTELLIGENCE: DEALS

- TABLE 286 SPLAN: COMPANY OVERVIEW

- TABLE 287 SPLAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 SPLAN: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 289 SPLAN: DEALS

- TABLE 290 SPLAN: OTHERS

- TABLE 291 SMART BUILDINGS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

- TABLE 292 SMART BUILDINGS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 293 SMART BUILDING SERVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 294 SMART BUILDING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 295 SMART BUILDING SOLUTIONS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 296 SMART BUILDING SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 297 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2017–2020 (USD MILLION)

- TABLE 298 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2021–2026 (USD MILLION)

- TABLE 299 SMART BUILDINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 300 SMART BUILDINGS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 301 PARKING MANAGEMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 302 PARKING MANAGEMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 303 PARKING MANAGEMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 304 PARKING MANAGEMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 305 PARKING MANAGEMENT MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 306 PARKING MANAGEMENT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 307 PARKING MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 308 PARKING MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 309 PARKING MANAGEMENT MARKET, BY PARKING SITE, 2018–2022 (USD MILLION)

- TABLE 310 PARKING MANAGEMENT MARKET, BY PARKING SITE, 2023–2028 (USD MILLION)

- TABLE 311 PARKING MANAGEMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 312 PARKING MANAGEMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 313 PARKING MANAGEMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 314 PARKING MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

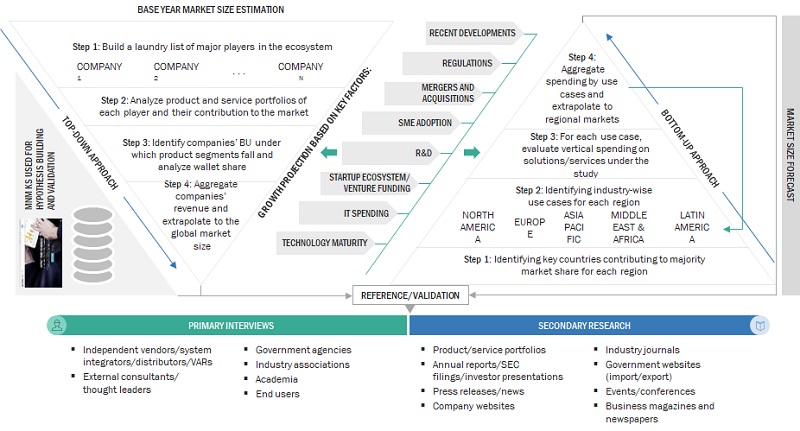

- FIGURE 1 VISITOR MANAGEMENT SYSTEM MARKET: RESEARCH DESIGN

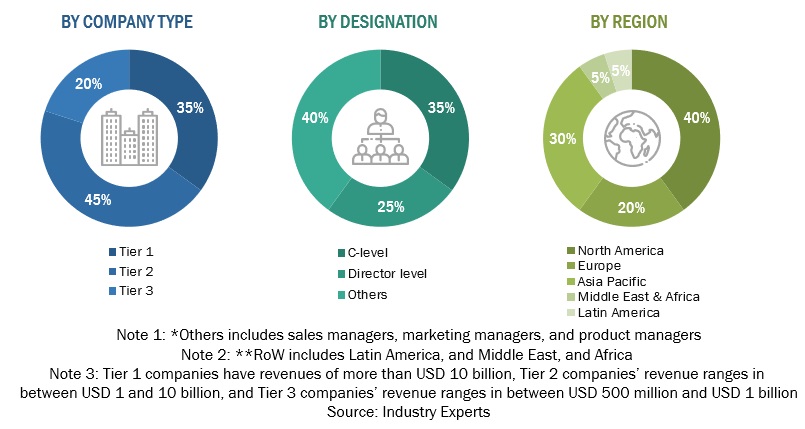

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 VISITOR MANAGEMENT SYSTEM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY SIDE): REVENUE OF SOFTWARE/SERVICES OF VISITOR MANAGEMENT SYSTEM MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2— BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOFTWARE/SERVICES OF VISITOR MANAGEMENT SYSTEM MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3, BOTTOM-UP (SUPPLY-SIDE), COLLECTIVE REVENUE FROM ALL SOFTWARE/ SERVICES OF VISITOR MANAGEMENT SYSTEM

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 4—BOTTOM-UP (DEMAND SIDE): SOFTWARE/SERVICES SOLD AND THEIR AVERAGE SELLING PRICE

- FIGURE 9 SOFTWARE SEGMENT TO HOLD LARGER MARKET SIZE IN 2023

- FIGURE 10 MOBILE-BASED SEGMENT TO HOLD LARGER MARKET SIZE IN 2023

- FIGURE 11 PROFESSIONAL SERVICES SEGMENT TO HOLD LARGER MARKET SIZE IN 2023

- FIGURE 12 SYSTEM INTEGRATION & IMPLEMENTATION SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 13 CLOUD SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- FIGURE 14 SECURITY MANAGEMENT SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 15 BFSI SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 16 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 INCREASING DEMAND FOR SOFTWARE-BASED SECURITY SYSTEMS TO REDUCE PAPER-BASED ADMINISTRATIVE WORK TO DRIVE MARKET

- FIGURE 18 SECURITY MANAGEMENT APPLICATION TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 20 SECURITY MANAGEMENT AND BFSI SEGMENTS TO ACCOUNT FOR LARGEST MARKET SHARES IN 2023

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: VISITOR MANAGEMENT SYSTEM MARKET

- FIGURE 22 VISITOR MANAGEMENT SYSTEM MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 VISITOR MANAGEMENT SYSTEM MARKET: ECOSYSTEM

- FIGURE 24 SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS

- FIGURE 25 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 VISITOR MANAGEMENT SYSTEM MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENT BUSINESS

- FIGURE 27 TOTAL NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 28 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013–2023

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 31 SERVICES SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 MOBILE-BASED SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 33 CLOUD SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 PROFESSIONAL SERVICES SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 35 CONSULTING SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 COMPLIANCE MANAGEMENT & FRAUD DETECTION APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 BFSI END USER TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 38 SOUTH AFRICA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 42 BUSINESS SEGMENT REVENUE ANALYSIS FOR KEY COMPANIES, 2018–2022 (USD MILLION)

- FIGURE 43 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- FIGURE 44 EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 45 EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 46 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 47 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

- FIGURE 48 HONEYWELL: COMPANY SNAPSHOT

- FIGURE 49 PITNEY BOWES: COMPANY SNAPSHOT

- FIGURE 50 SMARTSPACE SOFTWARE PLC: COMPANY SNAPSHOT

- FIGURE 51 SMART BUILDINGS MARKET, 2019–2026 (USD MILLION)

- FIGURE 52 PARKING MANAGEMENT MARKET, 2023–2028 (USD MILLION)

The research study involved the use of extensive secondary sources, directories, and journals, as well as several research papers, such as A Research White Paper: the Integrated Visitor Experience, Design, and Development of Visitor Management System by mekatronika – Journal of Intelligent Manufacturing and Mechatronics, and discussion papers, such as Sustainable Visitor Management System, to identify and collect information useful for this technical and market-oriented study. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, C-level executives of various companies offering visitor management system software and services, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information regarding the study. The secondary sources included annual reports; press releases; investor presentations of visitor management system solution vendors; forums; certified publications, such as Visitor Gate Pass Management System - International Journal, and new research showing visitor management software's evolution. The secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification, and segmentation from both the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the visitor management system market ecosystem were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing visitor management system solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. The primary research helped identify and validate the segmentation types; industry trends; key players; the competitive landscape of visitor management software and services offered by several market vendors; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both bottom-up and top-down approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Market Size Estimation Methodology- Top-down approach

The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research, and their revenue contributions in the respective regions were determined through primary and secondary research. The entire procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits, and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of visitor management system among different end-users in key countries with respect to their regions that contribute the most to the market share was identified. For cross-validation, the adoption of visitor management system software and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the visitor management system’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major visitor management system providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and validation of data through primaries, the exact values of the overall visitor management system market size and segments’ size were determined and confirmed using the study.

Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to Proxyclick, the visitor management system comprises software, tools, and applications that monitor and record information about business or public building visitors. The software also documents and gathers information about a visitor’s whereabouts in the facility.

According to Envoy, visitor management systems are tools that help organizations create or carry out their visitor management policies.

Visitor management systems make the visitor sign-in process more efficient, accurate, and consistent; they also provide the ability to store visitor information in a database. The visitor management software increases building security and protects facilities and employees. The software can be installed on a personal computer placed at the reception or deployed on a self-service kiosk. Visitor management software can be integrated with identity management software and can be scaled as per business sizes and needs.

Stakeholders

- Chief Technology and Data Officers

- Consulting Service Providers

- Visitor Management System Professionals

- Business Analysts

- Information Technology (IT) Professionals

- Government Agencies

- Investors and Venture Capitalists

- Small and Medium-sized Enterprises (SMEs) and Large Enterprises

- Third-party Providers

- Consultants/Consultancies/Advisory Firms

- Managed and Professional Service Providers

Report Objectives

- To describe and forecast the global visitor management system market by offering (software – [type, deployment mode], services), application, end user, and region

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the major players

- To profile the key players of the visitor management system market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakup of the North American Visitor Management System Market

- Further breakup of the European Visitor Management System Market

- Further breakup of the Asia Pacific Visitor Management System Market

- Further breakup of the Middle East & Africa Visitor Management System Market

- Further breakup of the Latin American Visitor Management System Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Visitor Management System Market