Parking Management Market Size, Share, Growth, Latest Trends

Parking Management Market by Solutions (Parking Reservation Management, Parking Access & Revenue Control), Parking Site (Off-street, On-street), and End Use (Commercial, Government, Transport & Transit, Industrial, Residential) - Global Forecast to 2030

OVERVIEW

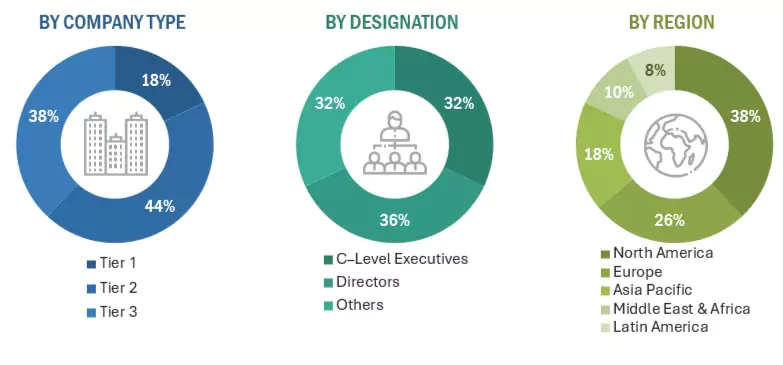

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The parking management market is projected to reach USD 12.41 billion by 2030 from USD 7.22 billion in 2025, at a CAGR of 11.4% from 2025 to 2030. Parking management offers a comprehensive suite of solutions, including parking guidance, reservation systems, permit management, enforcement, access control with integrated revenue collection, security surveillance, and data analytics. By integrating these solutions, the parking management market cultivates a more efficient, user-friendly, and secure parking ecosystem. This data-driven approach optimizes traffic flow, maximizes operator revenue, and enhances the overall parking experience. Parking management helps increase efficiency in parking operations, reduce congestion in the lot, and increase revenues for parking lot owners. It also enables a good customer experience by reducing the time spent looking for a parking spot and simplifying the payment process.

KEY TAKEAWAYS

- The Asia Pacific Parking Management Market is expected to grow fastest, with a CAGR of 12.8% during the forecast.

- By Component, the services segment is expected to register the highest CAGR of 12.6%.

- By Parking Site, Off-Street parking accounted for a 64.0% revenue share in 2030.

- AMANO, SKIDATA, GROUP Indigo are players in the parking management market, as they have focused on innovation and have broad industry coverage and offer integrated hardware-software systems, strong global footprints, and advanced access-control, payment, and automation solutions that enable efficient, scalable, and secure parking operations for diverse commercial and urban environments.

- Spothero, TCS International, and Urbiotica have distinguished themselves among startups and SMEs by using digital reservations and platform integrations, deploying advanced parking-guidance systems and consulting, and delivering IoT sensor-based smart-parking analytics for operators and cities.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The parking management market is undergoing a significant transformation, driven by emerging trends and disruptions that directly influence the business outcomes of customers’ customers. Key trends include the adoption of integrated mobility-as-a-service (MaaS) platforms, which combine parking services with public transit, ride-hailing, and EV charging, enabling seamless travel and enhancing passenger experience. Dynamic pricing and demand-based revenue management allow operators to optimize occupancy and revenue through real-time data analytics, while data monetization and targeted advertising open new revenue streams by leveraging user behavior and digital signage. Additionally, the shift toward subscription-based access and Parking-as-a-Service (PaaS) models facilitates recurring revenue while offering convenience and efficiency for end users. These technological and business-model innovations drive distinct imperatives across sectors. Commercial property owners focus on revenue optimization and enhanced customer experience. Municipal authorities prioritize traffic decongestion, revenue transparency, and sustainability compliance, while residential complexes emphasize resident satisfaction, security, and efficient space utilization. Transportation hubs benefit from operational efficiency, scalability, and integrated mobility, whereas hospitality and entertainment venues enhance guest experience, brand differentiation, and crowd management. Collectively, these trends enable faster, safer, and more convenient parking experiences, driving measurable value across all client segments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising urbanization and increasing global population density

-

Growing demand for seamless traffic flow and reduction in fuel consumption

Level

-

Shared mobility adoption limiting demand for conventional parking infrastructure

-

Infrastructure limitations hinder scalability of advanced parking solutions

Level

-

Rising smart city initiatives globally

-

Demand for innovative parking management solutions

Level

-

Revenue management and dynamic pricing complexity

-

Scalability limitations and growth management

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for seamless traffic flow and reduction in fuel consumption

Urban congestion continues to rise as vehicle density increases, leading to longer travel times and higher fuel consumption. A major contributor to wasted fuel is the time drivers spend searching for available parking, which studies estimate accounts for up to 30% of inner-city traffic. Parking management systems powered by IoT and AI help address this challenge by optimizing parking space utilization and guiding drivers directly to available spots. Real-time data collection, sensors, and cameras integrated with mobile applications or digital signage ensure that drivers are notified about vacant spaces, minimizing unnecessary circulation around parking zones. For instance, Barcelona’s smart parking initiative has reduced vehicle idle time and fuel usage by enabling dynamic guidance to open spaces. Similarly, San Francisco’s SFpark program reported a measurable reduction in vehicle miles traveled during parking searches, which directly lowered fuel consumption and greenhouse gas emissions. By reducing search-related traffic, these solutions improve urban traffic flow and support more eco-friendly, energy-efficient transportation systems.

Restraint: Shared mobility adoption limits demand for conventional parking infrastructure

The growing adoption of alternative mobility options, such as ride-hailing, car-sharing, bike-sharing, and micro-mobility services (e-scooters, e-bikes), is reducing the dependence on private vehicle ownership, thereby lowering demand for traditional parking spaces. According to the International Transport Forum, shared mobility could reduce the number of cars in cities by up to 90% if widely adopted, drastically transforming the urban parking landscape. For instance, New York, Paris, and Singapore are witnessing rising investments in shared mobility infrastructure, pushing commuters away from private vehicle use. As a result, parking operators face declining utilization rates, making it harder to justify large investments in smart parking systems. While these services improve urban sustainability, they create a significant restraint for the parking management market by shifting demand away from conventional parking solutions, challenging operators to adapt to new mobility dynamics.

Opportunity: Rising smart city initiative globally

The rising adoption of Smart City programs globally presents a major opportunity for the parking management Market. As urban areas increasingly incorporate IoT sensors, AI-driven analytics, and data platforms into their infrastructure, parking management systems can seamlessly integrate into these ecosystems to deliver real-time visibility of parking space availability. This not only helps reduce traffic congestion but also contributes to lower fuel consumption and emissions, aligning with sustainability goals. For example, cities such as Barcelona and Amsterdam have successfully embedded smart parking solutions within their broader smart city frameworks, enabling dynamic pricing, mobile-enabled payments, and digital enforcement. Such systems generate valuable datasets that support urban planning and optimize transport networks, while also enhancing revenue streams for municipalities. Moreover, collaboration between governments, technology providers, and private operators fosters innovation and expands the scope of applications, making smart parking a key enabler of sustainable, efficient, and future-ready cities.

Challenge: Inefficient Utilization of Urban Parking Spaces

A major challenge for the parking management market stems from the inefficient utilization of existing urban parking spaces. Despite the growing number of vehicles in cities, many parking areas remain underused due to poor layout, lack of real-time information, or fragmented management. This underutilization leads to increased traffic congestion, longer search times for drivers, and lost revenue for operators, highlighting the need for more intelligent parking systems. For parking management solution providers, this represents a significant operational challenge: deploying technology that not only increases occupancy rates but also seamlessly integrates with urban infrastructure, mobile applications, and payment systems. Cities require platforms capable of providing real-time guidance, dynamic pricing, and predictive analytics to optimize space usage. Without such solutions, the potential of digital and automated parking systems remains underexploited, slowing market adoption and limiting the effectiveness of investments in smart parking infrastructure. Addressing this challenge is critical for unlocking the full growth potential of the parking management market.

Parking Management Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implemented comprehensive access control and parking management system at Perini Business Park in Brazil, managing 10,000+ daily visitors and 4,500+ vehicles with touchless entry and automated processing capabilities | Reduced entry processing time from 90 seconds to touchless operation, improved security with real-time monitoring, enhanced visitor experience, and provided scalable solution for large-scale operations across multiple segments |

|

Automated parking expense management for pharmaceutical company with 500+ car-using staff, integrating with ERP cloud solution for seamless invoice processing and cost center identification with real-time expense tracking | Achieved 22% budget savings by eliminating 1200+ manual processing hours annually, reduced administrative burden by 48 days, improved staff morale, and enhanced procurement efficiency through streamlined operations |

|

Deployed X60 ticketless solution with license plate recognition, integrated security cameras, and SPARK cloud platform and provided customizable configurations supporting diverse garage operations and various industry verticals globally | Eliminated paper ticket costs and administrative burden, enhanced security through integrated monitoring, improved user experience with scan-to-pay options, and supported eco-friendly operations by reducing paper waste significantly |

|

Implemented comprehensive parking solution at Teesside Park retail space with dynamic parking guidance systems, RGB traffic information signs, and real-time occupancy monitoring for 12+ million annual visitors management | Reduced traffic congestion during peak times, improved driver experience through clear signposting to available spaces, maximized parking space utilization, and enhanced overall retail park operational efficiency |

|

Implemented fully integrated smart parking ecosystem including single-space meters, multi-space pay stations, vehicle detection sensors, and centralized data management with real-time analytics for various municipal operations | Enhanced enforcement efficiency through real-time technology, improved customer convenience with mobile payment options, optimized resource allocation with data analytics, and streamlined parking operations management capabilities |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The current parking management ecosystem is a multi-layered network where diverse stakeholders collaborate to deliver end-to-end solutions. Cloud service providers, such as AWS and Azure, host scalable platforms, while connectivity providers like Huawei, Cisco, and Sigfox ensure reliable data transmission from IoT sensors. IoT application vendors, including Chetu, TIBA, and Propark Mobility, develop analytics and control software, and system integrators such as Siemens, SKIDATA, and Indigo Group customize and deploy these solutions on-site. Independent software providers, such as Park Assist and Get My Parking, offer niche modules for reservation, enforcement, or payment, while network operators such as AT&T and Verizon maintain seamless connectivity. Service providers and government bodies collaborate on standards, funding, and regulatory frameworks, and research institutions and startups drive innovation in AI-driven guidance and EV integration.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Parking Management Market, By Offering

Solutions are expected to hold the largest market share in the offerings segment of the parking management market as they form the backbone of modern parking operations, enabling automation, efficiency, and scalability. With rapid urbanization and limited parking spaces, cities and private operators are increasingly investing in integrated parking management platforms, access control systems, license plate recognition, and smart payment solutions. These technologies streamline operations, reduce manual intervention, enhance security, and improve the overall customer experience. Additionally, the growing adoption of cloud-based platforms and IoT-enabled systems supports real-time monitoring, data-driven decision-making, and predictive analytics for demand management. As governments and municipalities prioritize smart city initiatives, the demand for robust, end-to-end parking management solutions continues to rise. Their ability to optimize space utilization, increase compliance, and generate higher revenues makes solutions the dominant segment in the market.

Parking Management Market, By Parking Site

On-street parking is expected to record the highest CAGR in the parking site segment of the parking management market due to increasing urbanization, rising vehicle ownership, and growing demand for efficient curbside management in congested city centers. Municipalities are actively deploying smart meters, mobile payment systems, and sensor-based occupancy detection to optimize space utilization and reduce traffic congestion caused by vehicles searching for parking. Digital enforcement tools, such as license plate recognition and integrated payment platforms, are further streamlining operations and improving compliance. Additionally, governments are leveraging dynamic pricing models to maximize revenue while encouraging efficient use of limited curbside space. The integration of on-street parking within broader smart city and Mobility-as-a-Service (MaaS) frameworks is also creating new value streams, enhancing user convenience, and driving adoption. These factors collectively position on-street parking as the fastest-growing segment in the market.

Parking Management Market, By End Use

The commercial end-use segment is expected to achieve the largest market share in the parking management market, as retail complexes, office buildings, and mixed-use developments increasingly adopt smart solutions to improve customer convenience and optimize operations. In Dubai, The Dubai Mall has deployed an advanced parking guidance system with real-time availability displays and mobile app integration, helping manage thousands of vehicles daily and significantly reducing congestion during peak shopping hours. In the United States, several commercial real estate operators, such as Brookfield Properties, are implementing ticketless, app-based parking across office towers, enabling employees and visitors to access seamless digital payments and reservations. Similarly, in Europe, Westfield London has embraced a fully automated system using license plate recognition, providing frictionless entry and exit for shoppers while improving turnover rates for retailers. These deployments show how commercial operators view smart parking as a value-added service that enhances customer experience, maximizes space utilization, and supports revenue growth. With rising competition in retail and commercial real estate, parking management solutions are evolving from operational necessities into strategic differentiators, driving robust adoption in this segment.

REGION

Asia Pacific to be fastest-growing region in global parking management market during forecast period

Asia Pacific is projected to achieve the highest CAGR in the parking management market, driven by significant government initiatives and regulatory support for the digital transformation of urban mobility. In Singapore, the Land Transport Authority replaced paper coupons with the nationwide Parking.sg system, enabling app-based payments and remote extensions across all public on-street spaces, setting a benchmark for digital enforcement and analytics. Hong Kong has deployed over 11,000 smart meters with occupancy sensors and the HKeMeter app, providing real-time data for improved curbside management and dynamic pricing. In Australia, the New South Wales government’s Park’nPay program is expanding across councils, including the City of Ryde, offering live availability, ticketless payments, and accessibility-focused features, reflecting a commitment to standardized parking solutions. Seoul is scaling IoT-enabled shared parking integrated within its smart mobility framework, supported by open APIs and real-time information platforms. These initiatives underscore a strong governmental push to modernize parking infrastructure, enhance operational efficiency, and improve user convenience, positioning Asia Pacific as the fastest-growing region for parking management solutions.

Parking Management Market: COMPANY EVALUATION MATRIX

In the parking management market matrix, AMANO (Star) leads with a strong market presence and wide product portfolio, offering solutions and services across residential, commercial, and industrial end uses. Verra Mobility (Emerging Leader) is gaining traction in the parking management market through strategic acquisitions and technological advancements. The company acquired T2 Systems, a leading provider of parking management solutions, enhancing its capabilities in smart parking technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 39.0 Billion |

| Market Forecast in 2030 (value) | USD 62.3 Billion |

| Growth Rate | CAGR of 11.4% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD) Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Parking Management Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| KSA-based infrastructure development arm of a Municipality |

|

|

RECENT DEVELOPMENTS

- June 2024 : Swarco acquired Lacroix’s traffic technology division, including the City-Mobility companies specializing in signal heads, controllers, and VMS, as well as C-ITS and V2X software. This move strengthens Swarco’s integrated Intelligent Transportation Systems portfolio, broadening its capabilities and reach in traffic and parking management across French-speaking and Spanish markets.

- June 2024 : INRIX partnered with HERE Technologies to deliver an end-to-end parking ecosystem combining real-time on-street and off-street parking data in over 1,100 cities globally. This integration enables dynamic space availability, pricing, and indoor navigation, improving driver experience by reducing congestion and optimizing parking utilization through connected vehicle platforms.

- September 2024 : INDIGO Group acquired 100% of APCOA Belgium, including stakes in ParcBrux BV and Maatschap Parkeren Leuven. This strategic consolidation expands INDIGO’s Belgian portfolio, enhances its leadership in the regional parking market, and accelerates integration with EV charging and on-street parking operations, setting new benchmarks for network efficiency and mobility services.

- April 2024 : INDIGO Group acquired 100% of APCOA Belgium, including stakes in ParcBrux BV and Maatschap Parkeren Leuven. This strategic consolidation expands INDIGO’s Belgian portfolio, enhances its leadership in the regional parking market, and accelerates integration with EV charging and on-street parking operations, setting new benchmarks for network efficiency and mobility services.

- June 2023 : INDIGO Group acquired 100% of APCOA Belgium, including stakes in ParcBrux BV and Maatschap Parkeren Leuven. This strategic consolidation expands INDIGO’s Belgian portfolio, enhances its leadership in the regional parking market, and accelerates integration with EV charging and on-street parking operations, setting new benchmarks for network efficiency and mobility services.

Table of Contents

Methodology

The research study involved four major activities in estimating the parking management market size. Exhaustive secondary research was done to collect important information about the market and peer markets. The next step was to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. The top-down and bottom-up approaches were used to estimate the market size, following which the market breakdown and data triangulation were adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size for companies providing parking management solutions to different end users was established using secondary data from both paid and unpaid sources. This analysis involved examining the product portfolios of major companies in the industry and evaluating their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Secondary research was used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the parking management market.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from software and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use parking management, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of parking management solutions which is expected to affect the overall parking management market growth.

Note 1: Tier 1 companies have revenues of more than USD 10 billion; tier 2 companies’ revenue ranges

from USD 1 billion to USD 10 billion; and tier 3 companies’ revenue ranges from USD 500 million

to USD 1 billion

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the parking management market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Focusing on top-line investments and spending in the ecosystems and considering developments in the critical market area

- Tracking the recent and upcoming developments in the parking management market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Conducting multiple discussions with key opinion leaders to learn about the diverse types of authentications and brand protection offerings used, and the applications for which they are used, in order to analyze the breakdown of the scope of work carried out by major companies

- Segmenting the market by technology types and their applications, while also determining the size of the global application market

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operations managers, and finally with the domain experts at MarketsandMarkets

Parking Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the above estimation process, the parking management market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from the demand and supply sides. The parking management market size was validated using top-down and bottom-up approaches.

Market Definition

Parking management offers a comprehensive suite of solutions, including parking guidance, reservation systems, permit management, enforcement, and access control with integrated revenue collection, security surveillance, and data analytics. By integrating these solutions, the parking management market cultivates a more efficient, user-friendly, and secure parking ecosystem. This data-driven approach optimizes traffic flow, maximizes operator revenue, and enhances the overall parking experience.

Parking management helps increase efficiency in parking operations, reduce congestion in the lot, and increase revenues for parking lot owners. It also enables a good customer experience by reducing the time spent looking for a parking spot and simplifying the payment process.

Stakeholders

- Parking management solution providers

- Parking management service providers/third-party vendors

- Government organizations

- Consultants/advisory firms

- System integrators (SIs)

- Training and education service providers

- Managed service providers

- Support and maintenance service providers

- System integrators

- Value-added resellers (VARs) and distributors

Report Objectives

- To determine and forecast the global parking management market by offering (solutions and services), parking site, end use, and region from 2025 to 2030, and analyze the various macroeconomic and microeconomic factors affecting the market growth

- To forecast the size of the market segments concerning five central regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To analyze each submarket concerning individual growth trends, prospects, and contributions to the overall parking management market

- To assess the market opportunities for stakeholders by identifying the high-growth segments of the parking management market

- To profile the key market players, provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape

- To track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and research and development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the definition of parking management market?

Parking management offers parking guidance, reservation systems, permit management, enforcement, access control with integrated revenue collection, security surveillance, and data analytics. By integrating these solutions, the parking management market cultivates a more efficient, user-friendly, and secure parking ecosystem. This data-driven approach optimizes traffic flow, maximizes operator revenue, and enhances the overall parking experience.

Parking management helps increase efficiency in parking operations, reduce congestion in the lot, and increase revenues for parking lot owners. It also enables a good customer experience by reducing the time spent looking for a parking spot and simplifying the payment process.

What is the market size of the parking management market?

The parking management market size is projected to grow from USD 7.22 billion in 2025 to USD 12.41 billion by 2030, at a CAGR of 11.4% during the forecast period.

What are the major factors that drive the market?

Urbanization and population growth in congested cities are creating a greater need for effective parking solutions, leading to increased use of smart parking systems. Technological advancements such as IoT-enabled sensors and mobile apps, which improve operational efficiency and user convenience, are enhancing market growth.

Requirements for sustainable city planning and the necessity to alleviate traffic congestion are also motivating factors for investment in smart parking solutions. Furthermore, the combination of AI and data analytics to provide real-time information on parking availability speeds up market growth and enhances resource usage and customer satisfaction.

Who are the key players operating in the parking management market?

The major players in the market are Amano (Japan), SKIDATA (Austria), Group Indigo (France), Arrive (Sweden), TIBA Parking Systems (Israel), SWARCO (Austria), Chetu (US), INRIX (US), IPS Group (US), Precise ParkLink (Canada), Infocomm Group (Oman), Verra Mobility (US), Egis Group (France), Passport Labs (US), SpotHero (US), Get My Parking (India), Streetline (US), Cleverciti (Germany), Wayleadr (US), Urbiotica (Spain), CivicSmart (US), Parklio (Croatia), TCS International (US), Parkable (New Zealand), Parkalot (Poland), Parking Telecom (France), and Omnitec (Dubai). These players have adopted various growth strategies, such as partnerships, agreements, and collaborations, new product launches, enhancements, and acquisitions, to expand their footprint in the Parking Management market.

What are the opportunities for new market entrants?

New entrants in the parking management market have significant opportunities to capitalize on evolving urban mobility trends and technological advancements. The increasing demand for smart parking solutions, powered by AI, IoT, and data analytics, enables optimized space utilization, reduced congestion, and improved user experience through real-time availability and dynamic pricing. As electric vehicles become more popular and sustainability mandates increase, incorporating EV charging infrastructure into parking management systems presents a significant competitive advantage.

Moreover, innovations in digital payments and contactless access systems cater to customer expectations for convenience and seamless experiences. Rapid urbanization and government-backed smart city initiatives in Asia Pacific and Europe provide fertile ground for new players to pilot and expand innovative solutions in collaboration with local authorities.

In addition, emerging trends such as micro-mobility, autonomous vehicles, and mobility-as-a-service (MaaS) ecosystems create room for integrated, multimodal parking platforms. Finally, bicycle parking and last-mile logistics hubs offer untapped potential for specialized, technology-driven business models, enabling newcomers to establish a distinct competitive edge in the market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Parking Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Parking Management Market