Weapons Carriage and Release System Market by Weapon Type (Bomb, Missiles, Rockets, Others), Platform (Fighter Aircraft, Combat Support Aircraft, UAV), System Component (Carriage Systems, Release System), End User and Region -Global Forecast to 2026

Update: 02/13/2025

Weapon Carriage and Release System Market Size & Growth

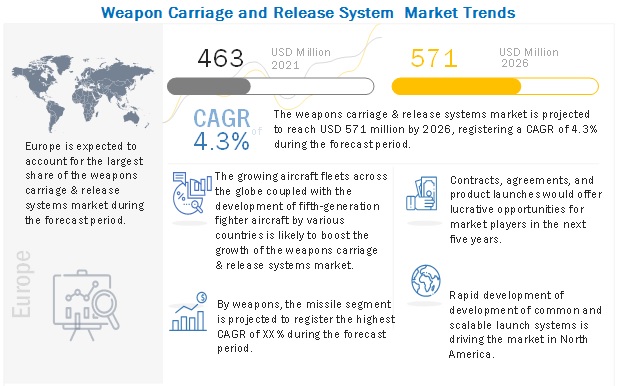

The Global Weapon Carriage and Release System Market Size was valued at USD 463 Million in 2021 and is estimated to reach USD 571 Million by 2026, growing at a CAGR of 4.3% during the forecast period. The Weapons Carriage and Release Systems Market is growing at a significant rate across the world, and a similar trend is expected to be observed during the forecast period. The rising demand of different types of missiles with various ranges to defend the nation from various threat is driving the market are fueling the growth of the Weapons Carriage and Release Systems Industry. From short-range anti-aircraft and anti-armor missiles to short, medium, and long-range air-to-air and air-to-ground weapons, ballistic and cruise missiles, they are now a vital part of the country's most capable armed forces. The rising adoption of these systems is largely a function of their perceived military effectiveness.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Weapon carriage and release system Market

The COVID-19 pandemic has caused significant damage to economic activities of countries across the world. The manufacturing of weapons carriage and release system, including systems, subsystems, and components, has also been impacted. Although carriage and release system is critically important for military aircrafts in defense, disruptions in the supply chain had halted their manufacturing processes for the time being. Resuming manufacturing activities depends on the level of COVID-19 exposure, the level at which manufacturing operations are running, and import-export regulations, among other factors. While companies may still be taking in orders, delivery schedules may not be fixed.

Weapon Carriage and Release System Market Trends

Driver: Increasing use of different types of missiles with various ranges to defend the nation from various threat

Advanced precision-guided weapon technology is now a prerequisite for a modern military inventory. From short-range anti-aircraft and anti-armor missiles to short, medium, and long range air-to-air and air-to-ground weapons, ballistic and cruise missiles, they are now a vital part of the country's most capable armed forces. The rising adoption of these systems is largely a function of their perceived military effectiveness.

Weapons designed to engage enemy aircraft at distances less than 30 km are called short-range air to air missiles (SRAAMs) and are sometimes called dogfight missiles because they are designed to optimize their agility rather than range. Mostly used infrared guidance and are called homing missiles. In contrast, medium- or long-range missiles (MRAAM or LRAAM), which both fall under the beyond visual range missile category (BVRAAM) such as MICA, METEOR missiles, tend to rely on radar guidance, which comes in the form of radar guidance. The increase in adoption of various weapons will drive the weapon carriage and release systems market.

For instance, in July 2021, Bharat Dynamics Limited signed a contract with the Indian Ministry of Defence worth around USD 66 million for the manufacture and supply of Akash missiles to the Indian Air Force.

Restraints: Regulatory obstacles related to arms transfers

Worldwide, the defense industry must comply with the laws and guidelines of various government agencies on the transfer of weapons and ammunition. The manufacture and export/import of weapons must comply with many rules and regulations, such as import and export control regimes and exchange controls. In some countries, weapons/arms manufacturers are prohibited from exporting their products, which reduces their chances of finding international customers. For instance, the US passed the Foreign Corrupt Practices Act of 1977 and the Export Administration Act of 1979 to control corrupt practices aimed at affecting foreign government officials or exporting to countries that threaten national security.

Opportunities : Advanced weapon launchers

Cobham has built the AML-016 based on the design of the next-generation AML-014 short range air to air missile (SRAAM) launcher. The AML-016 will enable carriage of short, medium, and beyond visual range air to air missile (BVRAAM) missiles on inboard and outboard wing stations. The AML-016 embodies several key design features and meets all military design specification requirements for safe weapon carrier and will ensure optimum performance of current and future air-to-air missiles. The Multi-Missile Launcher (MML) is a state-of-the-art rail launcher capable of carrying a range of various missiles without the need for role change. A unique modular construction allows the MML to interface with short, medium, and beyond visual range missiles.

Challenges: Reducing performance failures

Weapons carriage and release systems face various performance issues while delivering weapons. The problems include failure to release or launch weapons, irregular release of stores, and irregular functioning. The problems arise due to several factors, including improper maintenance of release systems, improper attachment of weapons and stores, and failure of components, among others. The failure of weapons carriage and release systems may also result in damage to the airborne platform carrying the weapons and mission payloads.

Weapon Carriage and Release System Market Segments

Increase in procurement of fighter aircrafts will drive the market

Procurement programs for fighter aircraft around the world have led to a continuous increase in combat aircraft fleets. The increasing fleets of aircraft have created an increasing demand for modular carriage and release systems. These systems are being employed on combat aircraft, combat support aircraft, helicopters, and unmanned aerial vehicles.

According to the World Air Forces 2021 report released by Flight International in partnership with Embraer, the U.S. Air Force, Army, Navy and Marine Corps together operate just over 13,000 military aircraft. Although the F35 entered service, the F16C remains the most common fighter aircraft in the US with 803 in service. It is also the most widely used fighter jet in the world, with 2,267 operated by air forces of various countries, according to the report. Russia has the second-largest fleet of fighter aircraft in the world in 2021 with just over 4,000 in service. The Su27 / Su30 Flanker is still the backbone of the Russian Air Force and is the second most common fighter jet in service today with around 1,000 in use by a long list of operators such as the 'Ukraine, India and Malaysia. It is now integrated into the service by the advanced Su57. China has the third-largest inventory of fighter aircraft with 3,160 aircraft in service.

The missiles segment is projected to lead the weapons carriage and release system market from 2021 to 2026.

Based on weapon type, the weapons carriage and release system market has been classified into missiles, bombs, rockets, and torpedoes. The missiles segment is estimated to account for the largest share of the weapons carriage and release system market in 2021. The growth of this segment can be attributed to the increased deployment of missiles in fighter aircraft, helicopters, and combat support aircraft for a range of operations. Fighter aircraft deploy missiles according to mission needs. They carry air-to-air and air-to-ground missiles having varied range and capabilities. Weapons carriage and release systems are used to carry and release single and multiple missiles. Companies such as ALKAN, L3Harris Corporation, Cobham PLC, and Marvin Engineering, among others, provide weapons carriage and release systems for carrying single and multiple missiles.

Based end user, OEM is projected to lead the weapons carriage and release system market from 2021 to 2026.

Based on end use, the weapons carriage and release system market has been classified into original equipment manufacturer (OEM) and aftermarket. The OEM is estimated to be a larger market then aftermarket segment. The weapons carriage and release systems installed in new aircraft are covered under the OEM segment. This segment includes the installation of weapons carriage and release systems in various airborne platforms, including fighter aircraft, combat support aircraft, helicopters, and UAVs. The OEM segment is expected to grow at a higher CAGR. This can be attributed to the increasing inventory of newly inducted airborne platforms, including unmanned aerial vehicles, fourth-, fifth-, and sixth-generation fighter aircraft, and helicopters. The use of these airborne platforms is increasing in applications such as anti-submarine warfare, air-to-ground support, and air defense roles. Moreover, the development of new missiles such as beyond-visual-range missiles, anti-radiation missiles, etc., for newly inducted platforms have also added to the demand at the OEM level.

Weapon Carriage and Release System Market Regions

The North America is projected to grow at a the highest rate within the weapons carriage and release system market from 2021 to 2026

Based on region, North America is projected to grow at the highest rate within the weapons carriage and release system market from 2021 to 2026. Significant investments in RandD activities for the development of advanced weapons carriage and release systems by key players and increased demand for fighter aircraft fleet are some of the factors expected to fuel the growth of the weapons carriage and release system market in this region. The US is expected to drive the growth of the North American weapons carriage and release system market during the forecast period, owing to easy access to various innovative technologies and significant investments being made by manufacturers in the country for the development of improved military weapon systems. Several developments have taken place in the field of weapons carriage and release system in the region. For instance, as per DoD 2019 – Five Year Plan, the US is projected to induct more than 1500 F-35s in the coming years. This is expected to result in an increasing demand for weapon carriage and release systems. Companies such as Harris, Cobham, and others are focusing on the development of internal carriage and release systems for fifth-generation aircraft.

To know about the assumptions considered for the study, download the pdf brochure

Weapons Carriage and Release System Companies: Top Key Market Players

Prominent companies in this market include well-established, financially stable manufacturers of carriage and release system providers with a global presence. These companies have been operating in the market for several years and have a diversified product portfolio, state-of-the-art technologies, and robust global sales and marketing networks. The Weapons Carriage and Release System Companies is dominated by globally established players such as:

- L3Harris Technologies (US)

- Cobham PLC (UK)

- Systima Technologies (US)

These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East and Rest of the World. COVID-19 has impacted their businesses as well.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 463 Million in 2021 |

|

Projected Market Size |

USD 571 Million by 2026 |

|

Growth Rate (CAGR) |

4.3% |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Weapon Type, By System Component, By Platform, By End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Rest of the World |

|

Companies covered |

Cobham PLC (UK) |

The study categorizes the weapons carriage and release system market based on weapon type, platform, system component, end user, and region.

By Solution

- Bomb

- Missile

- Rockets

- Torpedos

By Platform

- Fighter Aircrafts

- Combat Support Aircrafts

- Helicopter

- UAV

By System Components

- Carriage System

- Release System

By End User

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In September 2021, L3Harris Technologies has received a 10-year contract worth of USD 947 million for engineering services in support of an aircraft electronic warfare system initiative from the US Air Force.

- In April 2021, Cobham Mission Systems, a business division of Cobham PLC, announced that it has won subcontracts to provide chaff and flare dispenser equipment for the German Air Force’s Quadriga Tranche 4 Eurofighter Typhoon fleet.

- In January 2021, Marotta Controls had designed and will be manufacturing a new Control Actuation System (CAS) for the U.S. Navy’s Supersonic Propulsion Enabled Advanced Ramjet (SPEAR) project. The Navy’s Naval Air Warfare Center Weapons Division is co-developing the SPEAR demonstrator with Boeing, which will help the Navy determine technical requirements for future carrier-based weapons systems.

- In October 2020, The US Navy awarded an Engineering and Manufacturing Development (EMD) contract worth USD 496 million to L3Harris Technologies for further the Next Generation Jammer Low Band (NGJ-LB) capability. The contract includes the final design efforts and manufacturing of eight operational prototype pods and four test pods that will be used for numerous levels of testing and fleet employment to include reliability, functionality, and integration with and carriage on the EA-18G Growler host aircraft.

- In September 2020, Marvin Group’s engineering unit had secured a seven-year contract to provide missile launch systems and bomb ejector racks for the US Navy’s fighter and electronic warfare aircraft platforms worth of USD 132.5 million. Marvin Engineering will supply 1,339 BRU-32B/A ejector rack assemblies and 1,056 LAU-127E/A single-rail guided missile launchers to the service branch for use on the F/A-18E/F Super Hornet and EA-18G Growler planes.

- In April 2020, Marotta Controls had designed and will be manufacturing a new Control Actuation System (CAS) for Northrop Grumman. The CAS will be integrated into Northrop’s Advanced Anti-Radiation Guided Missile – Extended Range (AARGM-ERs) specified for US Navy and Air Force use. The AARGM-ER will be integrated on the F/A-18E/F, EA-18G and F-35. The companies’ fourth collaboration, the AARGM-ER program leverages Marotta’s vertically integrated capabilities advanced technical solutions from spec to production.

- In October 2019, The Pentagon revealed that L3Harris Technologies obtained avionics supplier contracts for the US Navy F/A-18 Hornets and Super Hornets aircraft. The contract consist of building 112 Fibre Channel Network Switches for Kuwaiti E/A-18G, F/A-18 E/F and E-2D aircraft and two switches for the Naval Air Warfare Center Aircraft Center's Manned Flight Simulator Laboratory.

Frequently Asked Questions (FAQ):

Which are the major companies in the weapon carriage and release system market? What are their major strategies to strengthen their market presence?

Some of the key players in the weapon carriage and release system market are L3Harris Technologies (US), Lockheed Martin Corporation (US), Kratos Defense and Security Solutions, Inc. (US), Parsons Corporation (US), and Peraton (US), among others, are the key manufacturers that secured weapon carriage and release system contracts in the last few years. Contracts was the key strategies adopted by these companies to strengthen their weapon carriage and release system market presence.

What are the drivers and opportunities for the weapon carriage and release system market?

The market for weapon carriage and release system has grown substantially across the globe, and especially in Asia Pacific, where increase in developing new technologies in such as China, India, and South Korea, will offer several opportunities for weapon carriage and release system industry companies. The rising RandD activities to develop weapon carriage and release system are also expected to boost the growth of the market around the world.

North America and Europe are key developer of weapon carriage and release system as most key manufacturers and leading players in this market are based in these regions. Some of these manufacturers are L3Harris Technologies (US), Lockheed Martin Corporation (US), Kratos Defense and Security Solutions, Inc. (US), Parsons Corporation (US), and Peraton (US).

Which region is expected to grow at the highest rate in the next five years?

The market in North America is projected to grow at the highest CAGR of from 2021 to 2026, showcasing strong demand from weapon carriage and release system in the region. The US, with its increased investment in advancement of Weapon carriage and release system is driving the market. The US has long relied on its technological superiority and high standards of training and professionalization to offset its numerical inferiority.

Which are the key technology trends prevailing in the weapon carriage and release system market?

Triple-Rail Missile Launcher, next-generation pneumatic sonobuoy launch systems, pneumatic multi-station carriers, and pneumatic weapon ejection actuation systems. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved various activities in estimating the market size for weapons carriage & release system. Exhaustive secondary research was undertaken to collect information on the weapons carriage & release system market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the weapons carriage & release system market.

Secondary Research

Secondary sources that were referred to for this research study on the weapons carriage & release system market included government sources such as the US Department of Defense (DoD); defense budgets; military modernization program documents; corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the weapons carriage & release system market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the weapons carriage & release system market through secondary research. Several primary interviews were conducted with the market experts from both, demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and Rest of the World (RoW). This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the weapons carriage & release system market. The following figure offers a representation of the overall market size estimation process employed for this study on the weapons carriage & release system market.

The research methodology used to estimate the market size included the following details:

- Key players in the weapons carriage & release system market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the weapons carriage & release system market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the weapons carriage & release system market.

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall size of the weapons carriage & release system market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the weapons carriage & release system market.

Objectives of the Report

- To define, describe, segment, and forecast the size of the weapons carriage & release system market based on weapon type, platform, systems component, end use, and region for the forecast period from 2021 to 2026

- To forecast the size of various segments of the weapons carriage & release system market with respect to 5 major regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW), along with the major countries in each of these regions

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the weapons carriage & release system market

- To identify opportunities for stakeholders in the market by studying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and research and development (R&D) activities in the market

- To estimate the procurement of weapons carriage & release systems by different countries, to track technological advancements in weapons carriage & release systems

- To provide a comprehensive competitive landscape of the market along with an overview of the different strategies adopted by key players to strengthen their position in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the weapons carriage & release system market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the weapons carriage & release system market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Weapons Carriage and Release System Market