Weather Forecasting Services Market by Industry (Insurance, Transport, Marine, Aviation, O&G, Retail, Agriculture, Energy, Construction), Forecasting Type (Nowcast, Short, Medium, Extended, Long), Purpose, Organization, and Region- Global Forecast to 2028

Update:: 01.10.24

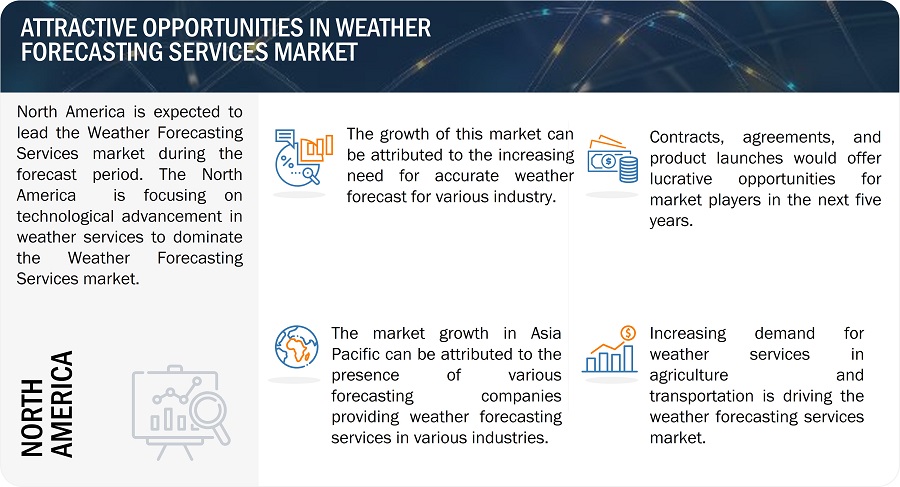

The growth of the Weather Forecasting Services Market is driven by increasing demand for accurate real-time weather data across industries, advancements in satellite and radar technologies, and rising awareness about the importance of weather prediction for disaster management, agriculture, and aviation safety.

Weather Forecasting Services Market Size & Share

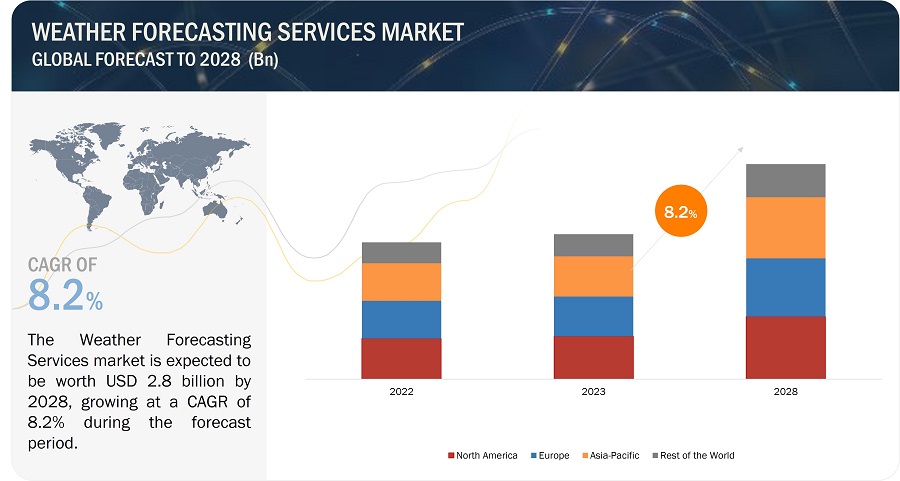

The Weather Forecasting Services market is projected to grow from USD 1.9 billion in 2023 to USD 2.8 billion by 2028, growing at a CAGR of 8.2%. The demand for enhanced safety and minimize the loss in various industry is driving the market for Weather Forecasting Services. The Forecasting services is developing rapidly by use of advanced technologies to minimize the loss due to bad weather conditions. Government support and growing investments are propelling the development of Meteological , further boosting the growth of the Weather Forecasting Services market. Increased adoption of big data, artificial intelligence (AI), the Industrial Internet of Things (IIoT), the Internet of Things (IoT), and data analytics in Weather Forecasting Services are used for accurate weather forecasting data. The Weather Forecasting Services systems help to collect and transmit the forecast data and improve safety and prevent accidents.

Weather Forecasting Services Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Weather Forecasting Services Market Trends

Driver: Integration of weather forecasting services in transport and logistics sectors

At present, there is a growing demand for faster delivery of goods, compelling the logistics sector to improve its infrastructure accordingly. To bring improvisations in infrastructure, the transport and logistics sectors largely depend on weather forecasting services. Weather patterns can create ripple effects in the manner shipments are transported all over the world, within and between countries. Weather conditions can make or break the chain of goods being transported to their final delivery stations safely and on time. Hence, it is very important for the transport and logistics service providers to pre-investigate the weather conditions for their smooth functioning. The trucking industry is a major component of logistics services to move goods daily.

According to the Federal Highway Administration (FHWA) in March 2022, weather is responsible for 23% of all roadway delays, causing over 32 billion lost vehicle hours per year and costing trucking companies between USD 2.2 billion and USD 3.5 billion. To prevent such significant losses, transport companies are utilizing weather forecasting services. By accessing these services, they can anticipate the impact of weather on their trucking routes in advance. The information from the weather service providers will also help them plan ahead for incoming delays, including whether it requires leaving early, late, or focusing on other routes. With road risk being a constant source of concern for transport and logistics companies, weather service providers can help by providing real-time updates on weather, thus helping them understand the impact of weather events like floods, fog, ice, rain, etc. Logistics companies, to keep their assets safe from damage due to harsh weather conditions, are increasingly making use of weather forecasting services.

Thus, the increasing scope of weather forecasting services in end-use industries, such as transport and logistics, is one of the key factors driving the growth of the market.

Driver: Demand for weather forecasting services in modern-day agriculture

Agriculture is mainly dependent on seasons and the weather. Taking atmospheric conditions, including temperature, into consideration is essential when it comes to the farming of different kinds of fruits, vegetables, and pulses. Weather plays an instrumental role in agriculture, and accurate weather-based information is very important for crop growth. The management of weather and climate risks has become even more important in agriculture in recent times due to climate change. It is evident that to feed the increasing population, the demand for agricultural products has increased significantly. Simultaneously, the requirement of agriculture management has increased, which requires proper planning depending upon the climatic situations. Hence, the agricultural sector is increasingly making use of weather forecasting services for planning seasonal farming.

According to the Intergovernmental Panel on Climate Change (IPCC), there are multiple climate risks for agriculture and food security, along with the potential to improve weather and climate early warning systems to assist farmers. In India, the Agromet Advisory Services helps in developing sustainable and economically viable agricultural systems; improving production and quality; reducing losses, risks, and costs; increasing efficiency in the use of water, labor, and energy; conserving natural resources; and decreasing pollution by agricultural chemicals or other agents that contribute to the degradation of the environment. The Agromet Advisory Services provides information on weather and climate-related risks in agriculture. Effective weather and climate information and advisory services can aid in the decision-making of farmers and improve their management of related agricultural risks.

The goal of weather forecasting services in agriculture is to maximize growth efficiency to meet the needs of the growing population globally.

Restraints: Complexity and lack of specialized weather forecasting models

Weather Forecasting is done by using various computational models by extensive data. The weather data is very crucial for forecasting model to give accurate Weather Forecast. There is limited availability of data and resources in some regions. The lack of specialized weather forecasting models results into less accurate predictions for certain regions. It becomes challenging to anticipate extreme weather events like hurricanes, tornadoes, or severe storms accurately due to complexity and lack of data. Some of the weather forecasting models are complex which can effect the forecasting accuracy. This is expected to restrain the growth of the market, as the entire weather forecasting process entails various functions that need to be considered to arrive at an accurate analysis.

Restraints: Dynamic nature of atmospheric variables

Most atmospheric phenomena studied in weather forecasting processes are non-linear and highly dependent on the initial weather conditions of specific areas. Although several phenomena can be predicted based on a thorough understanding of the initial conditions of a numerical weather forecasting model, weather conditions are dynamic in nature and vary due to changes in several atmospheric variables. This makes the process of weather forecasting highly complex, in addition to the intrinsic non-linearity of weather data collected by weather stations. Proper integration and analysis of a large amount of weather data make these processes complex. This is expected to restrain the growth of the weather forecasting services market

Opportunities: Development of high-end radars and satellites for weather monitoring

The incorporation of various new technologies in weather monitoring and weather forecasting services is leading to highly accurate weather predictions. Scientists and engineers are developing different types of high-end radar, satellites, and supercomputers capable of sensing natural calamities such as tornadoes, floods, and thunderstorms beforehand to enable early issuance of warnings. Continuous efforts are being made to upgrade different satellite systems used for weather forecasting. Existing climate and weather models rely on data from satellites in high orbits. These satellites are unable to provide immediate data with enough detail to observe changes and developments in weather patterns. Small satellites can get close to storms to study them and help improve future predictions of weather and climate change.

Opportunities: Increasing computing capabilities of supercomputers

Weather forecasting centers use complex and energy-intensive infrastructure. Environmental observation data is a part of big data and has registered exponential growth in the last few years. Thus, weather forecasting centers are expected to provide integrated solutions that not only address the computing requirements of weather forecasters but also enable data movement and management, along with the ownership of the total cost involved in these processes.

The enhancement of the computational capabilities of supercomputers is expected to support the execution of very high-resolution weather forecasts and models of the Earth’s climate, resulting in highly accurate weather forecasts. Furthermore, the use of simulation-based approaches and advanced software models enables weather forecasters to obtain an enhanced understanding of weather trends. Since weather forecasting is augmented with data-driven models for predictive modeling and knowledge discovery, simulation-based approaches, coupled with the computational capabilities of supercomputers, ensure highly accurate weather forecasts. Therefore, the enhancement of the computing capabilities of supercomputers is expected to act as a growth opportunity for the weather forecasting services market.

Challenges: Lack of effective automation

The involvement of humans in weather forecasting is a time-consuming process. It may also lead to errors while analyzing the forecast data. Manual data logging or collection may also introduce errors in these processes.

Additionally, the lack of requisite analytical skills to correctly interpret the data received from different sources may also cause errors in weather forecasting. The inability of weather forecasters to correctly interpret the data could also lead to faulty analysis. Thus, the need to provide time-to-time training to weather forecasters for accurate reading and analysis of weather-related data also acts as a challenge to the growth of the market. Automation of weather forecasting services may help overcome this challenge, but only to a certain extent, since weather forecasting processes cannot be fully automated. Human intervention in weather forecasting processes for the effective analysis of weather data prior to prediction will always be required. Hence, the lack of effective automation of weather forecasting services poses a challenge to the growth of the weather forecasting services market.

Challenges: Frequent occurrence of false weather alarms

The occurrence of false alarms or a high False Alarm Ratio (FAR) could pose a challenge to the growth of the weather forecasting services market. A false alarm occurs when a warning is issued for an expected hazard, but that hazard never occurs. However, it is observed that 3 out of 4 alarms are false. A weather alarm is issued when any hazard, such as a tornado, is expected so that necessary precautions can be taken. However, on average, roughly 70% of tornado warnings issued in the US are false alarms. This means only three in 10 tornado warnings contain a verified tornado within the warned area at the time of warning. Too many false alarms may psychologically affect people and lead to the ignoring of the true alarms. The National Weather Service (NWS) has been taking initiatives to tackle this issue of false alarms.

Though technological advancements in recent years have improved the efficiency of weather forecasting services, the occurrence of false alarms still poses a challenge to the growth of the weather forecast services market.

Weather Forecasting Services Market Ecosystem

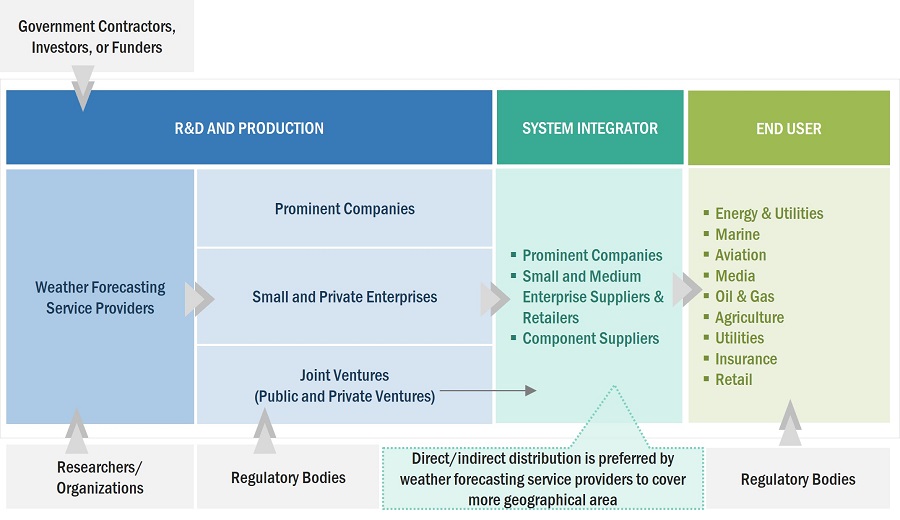

Companies that provides services Weather Forecasting Services, includes government firms, industries as key stakeholders in Weather Forecasting Services Market. Investors, funders, academic researchers, integrators, service providers, and licensing authorities are the major influencers in this market. Prominent companies in this market include The Weather Company (US), DTN (US), Accuweather (US), Fugro (Netherlands), and Enav S.P.A (Italy), Global Weather Corporation (US), Skymet Weather Services Pvt. Ltd. (India), Foreca Ltd. (Finland), Weather Routing Inc. (US), and MetraWeather (New Zealand).

Weather Forecasting Services Market Segmentation

Based on the Industry, the Energy and utilities segment is estimated to grow at highest rate during the forecast period.

Based on the Industry, the Energy & Utilities is estimated to grow at highest rate. Solar application are a rising in energy & utilities industry and are expected to grow by adopting advanced solar energy solutions. The generation of the energy are based on weather. The hydropower and solar energy are totally dependent on weather conditions and hence proper forecasting is needed. The Accurate Weather Forecasting is essential for the Energy and Utilities industry for optimization of energy production and distribution, anticipating energy demand, integrating renewable energy sources, responding to emergencies, and making informed business decisions.

Based on Purpose, the Safety is anticipated to dominate the Weather Forecasting Services market.

Based on the Purpose, the Safety holds the largest market share. Weather forecasting plays a prominent role in ensuring safety of our lives and minimizing the infrastructural lose. The Forecasted Data provides crucial information to individuals, communities, and authorities to prepare for and respond to weather-related calamities. Safety of citizens and individuals are primary focus of any country. Weather forecasting are crucial for public safety for timely warnings and advisories, facilitating evacuations, road closures, and the activation of emergency response teams. For example, The construction industry uses site-specific weather forecasting services to ensure site safety and time management of construction projects. These services help in increasing the safety of site personnel from severe weather conditions.

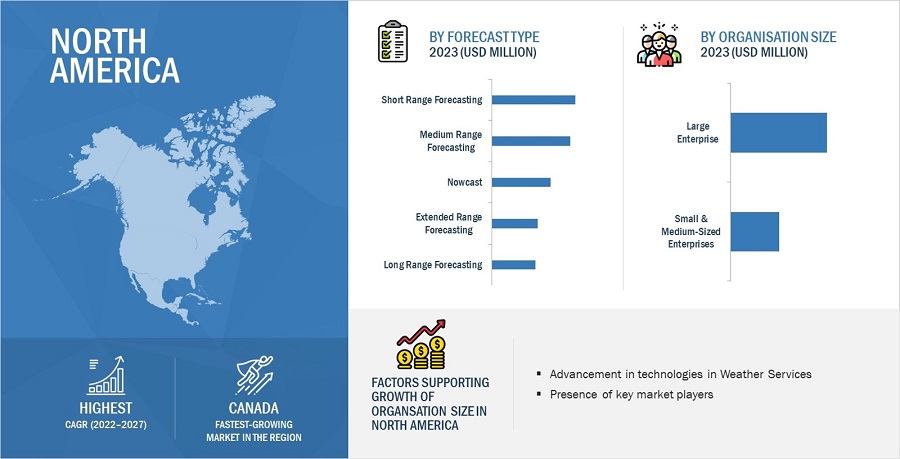

The Short-Range Forecasting segment of the Weather Forecasting Services market by Forecasting type is projected to dominate the market.

The Short- Range Forecasting holds the major market share of the Weather Forecasting Services market by Forecasting type segment. Short- Range Forecasting refers to prediction of weather conditions for short period of time ranging from hours to some days. The short- range forecasting are very important for meteorological research and various industries like Agriculture, Transport & logistics and others. Short-range forecasting provides timely and accurate information for immediate decision-making, emergency response and to minimize the loss in various sectors. The accuracy of short-range forecasts is better than for long-range forecasts. The reason for accuracy is the atmosphere is more predictable over shorter timescales. The short-range weather forecasting method provides information on the upcoming weather where the projection time ranges from a few hours to 48 hours or, in some cases, up to 72 hours. It is capable of forecasting weather information for a particular location or area that covers up to a few million square kilometers.

The Large Enterprise of the Weather Forecasting Services market by Organisation Size is projected to dominate the market.

The Large Enterprise Segment holds the major market share of the Weather Forecasting Services market by Organisation Size segment. Large enterprises in the weather forecasting services industry provides accurate and reliable weather information for a wide range of industries. The Large Enterprise focus on more investment to adopt advanced technology, vast data resources, and a network of meteorologists and scientists to deliver comprehensive weather forecasts. Large enterprises need accurate and reliable weather forecasts to make informed decisions about their operations. They use weather forecasting services for a variety of purposes like planning and scheduling, risk management, and opportunity identification for new products. The services include both short-term and long-term weather predictions, as well as historical weather data for trend analysis and planning to improve business decisions.

Weather Forecasting Services Market Regional Analysis

The North America market is projected to dominate Weather Forecasting Services market.

North America is projected to dominate the Weather Forecasting Services market during the forecast period.Canada is projected to show highest growth rate for the Weather Forecasting Services market in North America. The domination of the Weather Forecasting Services market in North America can be attributed by the presence of top weather forecasting services providers. The Weather Forecasting Services market in Canada was predicted to develop and evolve in future years, owing to advancements in technologies and rising demand for Forecasting services. Organizations in this region have been the early adopters of advanced technologies. Technological advancements, such as improvements in data analytics and computer forecast models and an increase in the use of supercomputers delivering more computing power, are working in favor of the market in North America.

Weather Forecasting Services Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Weather Forecasting Services Companies - Key Market Players

The Weather Forecasting Services market is dominated by a few globally established players such as The Weather Company (US), DTN (US), Accuweather (US), Fugro (Netherlands), Enav S.P.A (Italy), Saildrone Inc. (US), UBIMET GmbH (Austria), Meteo-Logic (Israel), Speedwell Climate (UK), and Understory (US) are some of the leading players operating in the Weather Forecasting Services market; they are the key service providers that secured Weather Forecasting Services contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of commercial, government and navy.

Weather Forecasting Services Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.9 billion in 2023 |

|

Projected Market Size |

USD 2.8 billion by 2028 |

|

Growth Rate (CAGR) |

8.2 % |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Forecast Type, By Purpose, By Industry, By Organisation Size |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, Rest of the World |

|

Companies covered |

The Weather Company (US), DTN (US), Accuweather (US), Fugro (Netherlands), and Enav S.P.A (Italy) and among others. |

Weather Forecasting Services Market Highlights

The study categorizes Weather Forecasting Services market based on Forecast Type, Purpose, Industry,Organisation Size, and Region.

|

Segment |

Subsegment |

|

By Forecast Type |

|

|

By Purpose |

|

|

By Industry |

|

|

By Organisation Size |

|

|

By Region |

|

Recent Developments

- In April 2023, The Weather Company :- The Weather Company is offering cloud-based services that will take map experiences to the next level by expanding high-resolution. It will provide new material and rendering techniques to create more detailed and exciting map views, especially in 3D.

- In June 2023, AccuWeather, Inc. : - AccuWeather, Inc. introduced the AccuWeather HeatWave Counter and Severity Index, a new heat index to help people better understand the severity, intensity, and duration of heat waves.

- In January 2023, DTN :- DTN introduced WeatherFactor API to improve pre-voyage planning and better anticipate voyage duration risks. Further expanding its suite of marine data APIs for the shipping industry, the API blends and seamlessly delivers insights not only on voyage duration, but also weather impacts, fuel consumption, carbon emissions, and other bid profitability indicators.

Frequently Asked Questions (FAQs) Addressed by the Report:

Which are the major companies in the Weather Forecasting Services market? What are their major strategies to strengthen their market presence?

Some of the key players in the Weather Forecasting Services market The Weather Company (US), DTN (US), Accuweather (US), Fugro (Netherlands), and Enav S.P.A (Italy) and among others, are the key service providers that secured Weather Forecasting Services system contracts in the last few years.

What are the drivers and opportunities for the Weather Forecasting Services market?

The market for Weather Forecasting Services has grown substantially across the globe, especially in Asia Pacific. With new capabilities, including faster data rates, accurate forecasting, and increased efficiency. Due to this increased demand, there is an increased need for Weather Forecasting Services market with the necessary capabilities. Several advancements in Weather Forecasting Services have been made recently, and the adoption of cutting-edge technologies such as Internet Of Things (IOT), Data Analytics and Artificial Intelligence. Because of these developments, accurate and real-time weather forecasted data can be available.

Which region is expected to grow at the highest rate in the next five years?

The market in the Asia Pacific region is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for Weather Forecasting Services in the region. Several Asia Pacific countries and organizations are also actively investing in the development of Weather Forecasting Services around the region.

What is the CAGR of the Weather Forecasting Services Market?

The CAGR of the Weather Forecasting Services Market is 8.2%

Which function of Weather Forecasting Services is expected to significantly lead in the coming years?

The Industry segment of the Weather Forecasting Services market is projected to witness the highest CAGR. There have been various application of Weather Forecasting Services in different industries like Agriculture, Aviation, Transport & Utilities, Marine, Insurance, Retail and others. The market will be driven by the widespread usage of Weather Forecasting Services to minimize loss due to bad weather conditions

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Integration of weather forecasting services in transport and logistics sectors- Demand for weather forecasting services in modern-day agriculture- Growing need for weather forecasting services to ensure flight safety- Rise in climate-change patterns resulting in uncertainties related to rainfall- Increase in weather monitoring for disaster managementRESTRAINTS- Dynamic nature of atmospheric variables- Complexity and lack of specialized weather forecasting modelsOPPORTUNITIES- Growth of renewable energy sector- Increasing computing capabilities of supercomputers- Development of high-end radars and satellites for weather monitoring- Increasing use of big data analytics in weather forecasting servicesCHALLENGES- Lack of effective automation- Frequent occurrence of false weather alarms

- 5.3 RECESSION IMPACT ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW TECHNOLOGY ADOPTION BY SERVICE PROVIDERS

-

5.6 WEATHER FORECASTING SERVICES MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE RANGE OF WEATHER FORECASTING SERVICES, BY INDUSTRY, 2022

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.10 TRADE ANALYSIS

-

5.11 PATENT ANALYSIS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 TECHNOLOGY ANALYSISDUAL-POLARIZATION RADARADVANCED SATELLITES

-

5.15 CASE STUDY ANALYSISUSE CASE: ARTIFICIAL INTELLIGENCE (AI) IN WEATHER FORECASTING FOR FAST PREDICTIONSUSE CASE: MACHINE LEARNING ALGORITHMS TO INCREASE WEATHER FORECASTING ACCURACYUSE CASE: AUTOMATED WEATHER ANALYSIS USING IMAGE RECOGNITIONUSE CASE: DUAL-POLARIZATION TECHNOLOGYUSE CASE: THE WEATHER COMPANY’S GLOBAL HIGH-RESOLUTION ATMOSPHERIC FORECASTING SYSTEM (GRAF)USE CASE: WEATHER FORECASTING IN CLOUD APPLICATIONS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 EMERGING INDUSTRY TRENDS

-

6.4 TECHNOLOGY TRENDSDISRUPTIVE TECHNOLOGIES: IOT, AI, AND BIG DATA ANALYTICSWEATHER DRONESSUPERCOMPUTERSCOMPUTERS WITH FAST PROCESSORSEMERGENCE OF NEXT-GENERATION RADAR TECHNOLOGYBIG WEATHER DATA ANALYSISINTELLIGENT WEATHER PREDICTING MODULES

-

6.5 NEW WEATHER FORECASTING MODELSHORIZONTAL WIND MODEL (HWM)ADVANCED WEATHER INTERACTIVE PROCESSING SYSTEM (AWIPS) IIEVEN NEWER DYNAMICS FOR GENERAL ATMOSPHERIC MODELING OF THE ENVIRONMENT (ENDGAME)

-

6.6 IMPACT OF MEGATRENDSAUTOMATIONDIGITIZATION

- 7.1 INTRODUCTION

-

7.2 TRANSPORT & LOGISTICSGROWING NEED FOR WEATHER FORECASTING TO CONTROL LOSSES DUE TO BAD WEATHER CONDITIONS

-

7.3 MARINEDEMAND FOR MARINE WEATHER FORECASTING DRIVEN BY NEED TO ANALYZE WEATHER CONDITIONS

-

7.4 AVIATIONNEED FOR ACCURATE WEATHER FORECASTING TO REDUCE AVIATION ACCIDENTS AND ENSURE AIR PASSENGER SAFETY

-

7.5 MEDIANEED FOR WEATHER WARNING SYSTEMS TO HELP IN EFFICIENT EVENT HANDLING

-

7.6 OIL & GASWEATHER FORECASTING SERVICES TO HELP IN VOYAGE PLANNING

-

7.7 AGRICULTUREWEATHER FORECASTING SERVICES TO HELP MITIGATE RISKS IN AGRICULTURE

-

7.8 INSURANCEINCREASING NEED FOR WEATHER DATA FOR FUTURE CLAIMS

-

7.9 RETAILINCREASING USE OF WEATHER FORECASTING SERVICES TO ANALYZE SALES TRENDS

-

7.10 ENERGY & UTILITIESUPSURGE IN RENEWABLE ENERGY PRODUCTION TO DRIVE DEMAND

-

7.11 CONSTRUCTION & MININGEFFECTIVE PLANNING TO HELP MITIGATE WEATHER RISKS

- 7.12 OTHERS

- 8.1 INTRODUCTION

-

8.2 NOWCASTINCREASING NEED FOR ACCURATE PREDICTION OF WEATHER CONDITIONS WITHIN 6 HOURS TO DRIVE MARKET

-

8.3 SHORT-RANGEGROWING USE IN FISHERIES AND TRANSPORTATION TO BOOST DEMAND FOR SHORT-RANGE FORECASTING

-

8.4 MEDIUM-RANGEREQUIREMENT FOR MEDIUM-RANGE FORECAST IN AGRICULTURAL INDUSTRY TO DRIVE MARKET

-

8.5 EXTENDED-RANGEGROWING DEMAND FROM RESOURCE MANAGEMENT AND CITY PLANNING SECTORS TO DRIVE MARKET

-

8.6 LONG-RANGEINCREASING DEMAND FROM WEATHER-SENSITIVE INDUSTRIES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 LARGE ENTERPRISESINCREASING DEPENDENCE OF LARGE ENTERPRISES ON WEATHER FORECASTING SERVICES TO IMPROVE BUSINESS DECISIONS TO DRIVE MARKET

-

9.3 SMALL & MEDIUM-SIZED ENTERPRISESGROWING NEED FOR WEATHER FORECASTING IN SMALL & MEDIUM-SIZED ENTERPRISES TO ENSURE RISK MANAGEMENT TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 SAFETYGROWING FOCUS ON WEATHER SAFETY TO ELIMINATE FATALITY RISKS AT MANUFACTURING SITES TO DRIVE MARKET

-

10.3 OPERATIONAL EFFICIENCYRISING DEPENDENCE ON WEATHER FORECASTING FOR EFFICIENT DAY-TO-DAY PLANNING AND INFORMED DECISION-MAKING TO DRIVE MARKET

- 10.4 OTHERS

- 11.1 INTRODUCTION

- 11.2 DRIVERS AND OPPORTUNITIES FOR WEATHER DATA SERVICES MARKET

-

11.3 TECHNOLOGY ANALYSISINTEGRATION OF BIG DATA ANALYTICS IN WEATHER DATAINCORPORATION OF WEATHER DATA INTO INTERNET OF THINGS (IOT)CLOUD COMPUTING IN WEATHER DATAHIGH-PERFORMANCE COMPUTING FOR WEATHER DATA

-

11.4 USE CASES IN WEATHER DATA SERVICES MARKETPRECISION AGRICULTURE USES CLIMACELL WEATHER DATAUBER USES CLIMACELL WEATHER DATA FOR WEATHER-RELATED INSIGHTS

-

11.5 WEATHER DATA SERVICES MARKET, BY DATA TYPEREAL-TIME DATAFORECAST DATAHISTORICAL DATA

-

11.6 WEATHER DATA SERVICE PROVIDERSOPENWEATHERMAPACCUWEATHER, INC.TOMORROW.IOUNDERSTORYMETEOMATICSWEATHER UNDERGROUNDWEATHERSTACK

- 11.7 MNM VIEW ON WEATHER DATA SERVICES MARKET

-

12.1 INTRODUCTIONMARINE- Need to plan route and prevent accidents to drive demandPRIVATE AIRCRAFT OWNERS- Need to ensure flight crew safety to drive demandFARMERS- Need to mitigate farming risks to drive demandGENERAL CONSUMERS

-

12.2 MEDIUM USED TO PROVIDE DIRECT-TO-CONSUMER WEATHER FORECASTING SERVICESMEDIAWEB-BASEDAPPLICATION-BASED

-

12.3 REVENUE STREAMS IN DIRECT-TO-CONSUMER WEATHER FORECASTING SERVICES MARKETSUBSCRIPTION-BASEDPAY-PER-USEAD-BASED

- 12.4 WEATHER FORECASTING SERVICE PROVIDERS

- 12.5 KEY DEVELOPMENTS

- 13.1 INTRODUCTION

- 13.2 REGIONAL RECESSION IMPACT ANALYSIS

-

13.3 NORTH AMERICANORTH AMERICA: PESTLE ANALYSISUS- Implementation of high-performance systems by US weather forecasting service companies to drive marketCANADA- Presence of leading players and developments undertaken by them to drive market

-

13.4 EUROPEEUROPE: PESTLE ANALYSISUK- Development of next-generation weather forecasting models to drive marketGERMANY- Development of forecasting solutions to enhance power generation from renewable sources to drive marketFRANCE- Increasing investments in advanced weather forecasting service technologies to drive marketITALY- Development of advanced weather prediction technologies to drive marketRUSSIA- Expanding meteorology techniques with hydrometeorology to drive marketREST OF EUROPE

-

13.5 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISCHINA- Advancements in conventional weather forecasting methods to drive marketJAPAN- Rising use of advanced weather forecasting services across industries to drive marketINDIA- Increased applications of weather forecasting services in agriculture sector to drive marketAUSTRALIA- Growing efforts to improve numerical weather prediction and next-generation satellites to drive marketSOUTH KOREA- Increasing number of weather observation stations reporting to global telecommunication networks to boost marketREST OF ASIA PACIFIC

-

13.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: PESTLE ANALYSISSAUDI ARABIA- Development of advanced weather research and forecasting (WRF) modeling system to drive marketISRAEL- Incorporation of latest technologies in weather forecasting models to drive marketTURKEY- Increasing demand from marine, renewables, and oil & gas companies to drive marketSOUTH AFRICA- Increasing use of weather forecasting services across industries to boost marketREST OF MIDDLE EAST & AFRICA

-

13.7 LATIN AMERICALATIN AMERICA: PESTLE ANALYSISBRAZIL- Increasing investments in forecasting infrastructure to drive marketMEXICO- Growing focus on strengthening forecasting capabilities to mitigate effects of natural disasters to drive market

- 14.1 INTRODUCTION

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 RANKING ANALYSIS OF KEY PLAYERS

- 14.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2019–2022

- 14.5 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- 14.6 MARKET SHARE OF KEY PLAYERS, 2022

-

14.7 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 14.8 COMPANY BENCHMARKING

-

14.9 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

14.10 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALS

- 15.1 INTRODUCTION

-

15.2 KEY PLAYERSTHE WEATHER COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewACCUWEATHER, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFUGRO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDTN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewENAV S.P.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBMT GROUP LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsSTORMGEO- Business overview- Products/Solutions/Services offered- Recent developmentsPRECISION WEATHER- Business overview- Products/Solutions/Services offeredTHE TOMORROW COMPANIES INC.- Business overview- Products/Solutions/Services offered- Recent developmentsGLOBAL WEATHER CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsMET OFFICE- Business overview- Products/Solutions/Services offeredSKYVIEW SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsSPEEDWELL WEATHER LTD.- Business overview- Products/Solutions/Services offeredCUSTOMWEATHER- Business overview- Products/Solutions/Services offered- Recent developmentsWEATHER ROUTING INC.- Business overview- Products/Solutions/Services offeredEARTH NETWORKS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsJUPITER INTELLIGENCE INC.- Business overview- Products/Solutions/Services offered- Recent developmentsMETEOSIM- Business overview- Products/Solutions/Services offered- Recent developmentsSAILDRONE- Business overview- Products/Solutions/Services offeredUBIMET GMBH- Business overview- Products/Solutions/Services offered

-

15.3 OTHER PLAYERSUNDERSTORYTEMPOQUESTWEATHERBELL ANALYTICS, LLCSKYMET WEATHER SERVICES PVT. LTD.METEO-LOGIC

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE

- TABLE 2 DETAILS OF PRIMARY INTERVIEWEES

- TABLE 3 WEATHER FORECASTING SERVICES MARKET ECOSYSTEM

- TABLE 4 PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 COUNTRY-WISE EXPORTS, 2021–2022 (USD THOUSAND)

- TABLE 10 COUNTRY-WISE IMPORTS, 2021–2022 (USD THOUSAND)

- TABLE 11 THERMOMETERS & PYROMETERS NOT COMBINED WITH OTHER INSTRUMENTS, COUNTRY-WISE EXPORTS, 2021–2022 (USD THOUSAND)

- TABLE 12 THERMOMETERS & PYROMETERS NOT COMBINED WITH OTHER INSTRUMENTS, COUNTRY-WISE IMPORTS, 2021–2022 (USD THOUSAND)

- TABLE 13 MAJOR PATENTS FOR WEATHER FORECASTING SERVICES MARKET

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY ORGANIZATION SIZE (%)

- TABLE 15 KEY BUYING CRITERIA FOR WEATHER FORECASTING SERVICES, BY ORGANIZATION SIZE

- TABLE 16 CONFERENCES AND EVENTS, 2023–2024

- TABLE 17 ADVANCEMENTS IN AUTONOMOUS SHIPS IN KEY NATIONS

- TABLE 18 WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 19 WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 20 WEATHER FORECASTING RANGES

- TABLE 21 WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2020–2022 (USD MILLION)

- TABLE 22 WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2023–2028 (USD MILLION)

- TABLE 23 WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2020–2022 (USD MILLION)

- TABLE 24 WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 25 WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 26 WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 27 PRICING ANALYSIS OF OPENWEATHERMAP

- TABLE 28 KEY WEATHER FORECASTING SERVICE PROVIDERS: MARINE

- TABLE 29 KEY WEATHER FORECASTING SERVICE PROVIDERS: PRIVATE AIRCRAFT OWNERS

- TABLE 30 KEY WEATHER FORECASTING SERVICE PROVIDERS: FARMERS

- TABLE 31 WEATHER FORECASTING SERVICE PROVIDERS: GENERAL CONSUMERS

- TABLE 32 MONTHLY AND ANNUAL SUBSCRIPTION MODEL

- TABLE 33 WEATHER FORECASTING SERVICE PROVIDERS

- TABLE 34 KEY DEVELOPMENTS BY LEADING PLAYERS IN DIRECT-TO-CONSUMER WEATHER FORECASTING SERVICES MARKET, 2020–2023

- TABLE 35 WEATHER FORECASTING SERVICES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 36 WEATHER FORECASTING SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 42 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2020–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2020–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 47 US: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 48 US: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 49 US: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 50 US: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 51 CANADA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 52 CANADA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 53 CANADA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 54 CANADA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 55 EUROPE: WEATHER FORECASTING SERVICES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 56 EUROPE: WEATHER FORECASTING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 57 EUROPE: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 58 EUROPE: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 59 EUROPE: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 60 EUROPE: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 61 EUROPE: WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2020–2022 (USD MILLION)

- TABLE 62 EUROPE: WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2023–2028 (USD MILLION)

- TABLE 63 EUROPE: WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2020–2022 (USD MILLION)

- TABLE 64 EUROPE: WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 65 UK: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 66 UK: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 67 UK: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 68 UK: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 69 GERMANY: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 70 GERMANY: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 71 GERMANY: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 72 GERMANY: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 73 FRANCE: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 74 FRANCE: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 75 FRANCE: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 76 FRANCE: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 77 ITALY: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 78 ITALY: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 79 ITALY: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 80 ITALY: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 81 RUSSIA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 82 RUSSIA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 83 RUSSIA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 84 RUSSIA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 85 REST OF EUROPE: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 86 REST OF EUROPE: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 87 REST OF EUROPE: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 88 REST OF EUROPE: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2020–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2020–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 99 CHINA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 100 CHINA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 101 CHINA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 102 CHINA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 103 JAPAN: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 104 JAPAN: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 105 JAPAN: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 106 JAPAN: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 107 INDIA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 108 INDIA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 109 INDIA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 110 INDIA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 111 AUSTRALIA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 112 AUSTRALIA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 113 AUSTRALIA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 114 AUSTRALIA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 115 SOUTH KOREA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 116 SOUTH KOREA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 117 SOUTH KOREA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 118 SOUTH KOREA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2020–2022 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2023–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2020–2022 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 133 SAUDI ARABIA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 134 SAUDI ARABIA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 135 SAUDI ARABIA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 136 SAUDI ARABIA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 137 ISRAEL: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 138 ISRAEL: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 139 ISRAEL: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 140 ISRAEL: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 141 TURKEY: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 142 TURKEY: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 143 TURKEY: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 144 TURKEY: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 145 SOUTH AFRICA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 146 SOUTH AFRICA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 147 SOUTH AFRICA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 148 SOUTH AFRICA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 152 REST OF MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 153 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 154 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 155 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 156 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 157 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 158 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 159 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2020–2022 (USD MILLION)

- TABLE 160 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET, BY FORECAST TYPE, 2023–2028 (USD MILLION)

- TABLE 161 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2020–2022 (USD MILLION)

- TABLE 162 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 163 BRAZIL: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 164 BRAZIL: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 165 BRAZIL: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 166 BRAZIL: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 167 MEXICO: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 168 MEXICO: WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 169 MEXICO: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2020–2022 (USD MILLION)

- TABLE 170 MEXICO: WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- TABLE 171 STRATEGIES ADOPTED BY KEY PLAYERS IN WEATHER FORECASTING SERVICES MARKET, 2019–2023

- TABLE 172 WEATHER FORECASTING SERVICES MARKET: DEGREE OF COMPETITION

- TABLE 173 COMPANY BENCHMARKING OF KEY PLAYERS AND OTHER PLAYERS

- TABLE 174 WEATHER FORECASTING SERVICES MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 175 WEATHER FORECASTING SERVICES MARKET: PRODUCT LAUNCHES, AUGUST 2019–JUNE 2023

- TABLE 176 WEATHER FORECASTING SERVICES MARKET: DEALS, APRIL 2020–MAY 2023

- TABLE 177 THE WEATHER COMPANY: COMPANY OVERVIEW

- TABLE 178 THE WEATHER COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 THE WEATHER COMPANY: PRODUCT LAUNCHES

- TABLE 180 THE WEATHER COMPANY: DEALS

- TABLE 181 ACCUWEATHER, INC.: COMPANY OVERVIEW

- TABLE 182 ACCUWEATHER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 ACCUWEATHER, INC.: PRODUCTS LAUNCHES

- TABLE 184 ACCUWEATHER, INC.: DEALS

- TABLE 185 FUGRO: COMPANY OVERVIEW

- TABLE 186 FUGRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 FUGRO: PRODUCT LAUNCHES

- TABLE 188 FUGRO: DEALS

- TABLE 189 DTN: COMPANY OVERVIEW

- TABLE 190 DTN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 DTN: PRODUCT LAUNCHES

- TABLE 192 DTN: DEALS

- TABLE 193 ENAV S.P.A.: COMPANY OVERVIEW

- TABLE 194 ENAV S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ENAV S.P.A.: DEALS

- TABLE 196 BMT GROUP LTD.: COMPANY OVERVIEW

- TABLE 197 BMT GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 BMT GROUP LTD.: DEALS

- TABLE 199 STORMGEO: COMPANY OVERVIEW

- TABLE 200 STORMGEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 STORMGEO: PRODUCT LAUNCHES

- TABLE 202 STORMGEO: DEALS

- TABLE 203 PRECISION WEATHER: COMPANY OVERVIEW

- TABLE 204 PRECISION WEATHER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 THE TOMORROW COMPANIES INC.: COMPANY OVERVIEW

- TABLE 206 THE TOMORROW COMPANIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 THE TOMORROW COMPANIES INC.: PRODUCT LAUNCHES

- TABLE 208 THE TOMORROW COMPANIES INC.: DEALS

- TABLE 209 GLOBAL WEATHER CORPORATION: COMPANY OVERVIEW

- TABLE 210 GLOBAL WEATHER CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 GLOBAL WEATHER CORPORATION: DEALS

- TABLE 212 MET OFFICE: COMPANY OVERVIEW

- TABLE 213 MET OFFICE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 SKYVIEW SYSTEMS: COMPANY OVERVIEW

- TABLE 215 SKYVIEW SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 SKYVIEW SYSTEMS: DEALS

- TABLE 217 SPEEDWELL WEATHER LTD.: COMPANY OVERVIEW

- TABLE 218 SPEEDWELL WEATHER LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 CUSTOMWEATHER: COMPANY OVERVIEW

- TABLE 220 CUSTOMWEATHER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 CUSTOMWEATHER: PRODUCT LAUNCHES

- TABLE 222 CUSTOMWEATHER.: DEALS

- TABLE 223 WEATHER ROUTING INC.: COMPANY OVERVIEW

- TABLE 224 WEATHER ROUTING INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 EARTH NETWORKS, INC.: COMPANY OVERVIEW

- TABLE 226 EARTH NETWORKS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 EARTH NETWORKS, INC.: PRODUCT LAUNCHES

- TABLE 228 EARTH NETWORKS, INC.: DEALS

- TABLE 229 JUPITER INTELLIGENCE INC.: COMPANY OVERVIEW

- TABLE 230 JUPITER INTELLIGENCE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 JUPITER INTELLIGENCE INC.: PRODUCT LAUNCHES

- TABLE 232 JUPITER INTELLIGENCE INC.: DEALS

- TABLE 233 METEOSIM: COMPANY OVERVIEW

- TABLE 234 METEOSIM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 METEOSIM: PRODUCT LAUNCHES

- TABLE 236 SAILDRONE: COMPANY OVERVIEW

- TABLE 237 SAILDRONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 UBIMET GMBH: COMPANY OVERVIEW

- TABLE 239 UBIMET GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 WEATHER FORECASTING SERVICES MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 WEATHER FORECASTING SERVICES MARKET: RESEARCH DESIGN

- FIGURE 4 CAUSES OF AVIATION ACCIDENTS BETWEEN 1960 AND 2023

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 RESEARCH METHODOLOGY: DATA TRIANGULATION

- FIGURE 8 SAFETY SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 9 SMALL & MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR THAN LARGE ENTERPRISES SEGMENT DURING FORECAST PERIOD

- FIGURE 10 ENERGY & UTILITIES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 12 INCREASING SAFETY CONCERNS AMONG INDUSTRIES TO DRIVE ADOPTION OF WEATHER FORECASTING SERVICES

- FIGURE 13 SHORT-RANGE FORECASTING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 SAFETY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 INSURANCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 LARGE ENTERPRISES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR IN WEATHER FORECASTING SERVICES MARKET DURING FORECAST PERIOD

- FIGURE 18 WEATHER FORECASTING SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 ACCIDENTS IN AVIATION INDUSTRY, 1960–2022

- FIGURE 20 GLOBAL TEMPERATURE CHANGES FROM 1900 TO 2022

- FIGURE 21 RENEWABLE ENERGY CAPACITY, BY ENERGY SOURCE, 2022

- FIGURE 22 VALUE CHAIN ANALYSIS

- FIGURE 23 REVENUE SHIFT IN WEATHER FORECASTING SERVICES MARKET

- FIGURE 24 WEATHER FORECASTING SERVICES MARKET ECOSYSTEM MAP

- FIGURE 25 MAJOR PATENTS FOR WEATHER FORECASTING

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY ORGANIZATION SIZE

- FIGURE 27 KEY BUYING CRITERIA FOR WEATHER FORECASTING SERVICES, BY ORGANIZATION SIZE

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- FIGURE 29 WEATHER FORECASTING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- FIGURE 30 WEATHER FORECASTING SERVICES MARKET, BY FORECASTING TYPE, 2023–2028 (USD MILLION)

- FIGURE 31 WEATHER FORECASTING SERVICES MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- FIGURE 32 WEATHER FORECASTING SERVICES MARKET, BY PURPOSE, 2023–2028 (USD MILLION)

- FIGURE 33 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 34 NORTH AMERICA: WEATHER FORECASTING SERVICES MARKET SNAPSHOT

- FIGURE 35 EUROPE: WEATHER FORECASTING SERVICES MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: WEATHER FORECASTING SERVICES MARKET SNAPSHOT

- FIGURE 37 MIDDLE EAST & AFRICA: WEATHER FORECASTING SERVICES MARKET SNAPSHOT

- FIGURE 38 LATIN AMERICA: WEATHER FORECASTING SERVICES MARKET SNAPSHOT

- FIGURE 39 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 40 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2019–2022

- FIGURE 41 MARKETS SHARE ANALYSIS, 2022

- FIGURE 42 COMPANY EVALUATION MATRIX, 2022

- FIGURE 43 START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 44 IBM (PARENT COMPANY OF THE WEATHER COMPANY): COMPANY SNAPSHOT

- FIGURE 45 FUGRO: COMPANY SNAPSHOT

- FIGURE 46 ENAV S.P.A.: COMPANY SNAPSHOT

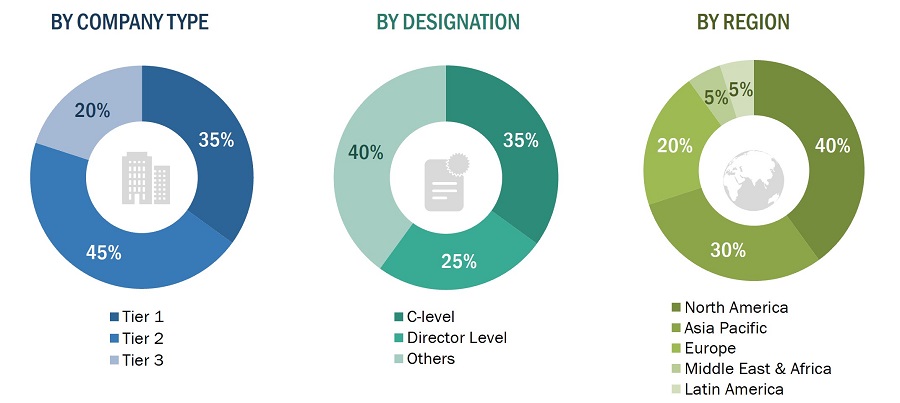

The study involved four major activities in estimating the current size of the Weather Forecasting Services market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the Weather Forecasting Services market was carried out using secondary data from paid and unpaid sources, as well as by analyzing the product portfolios and service offerings of key companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study included the conference of American Meteorological Society on Weather analysis and forecasting, corporate filings such as annual reports, investor presentations, and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Weather Forecasting Services market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from Weather Forecasting Services companies; service providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using Weather Forecasting Services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Weather Forecasting Services and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Weather Forecasting Services market includes the following details.

- The top-down and bottom-up approaches were used to estimate and validate the size of the Weather Forecasting Services market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

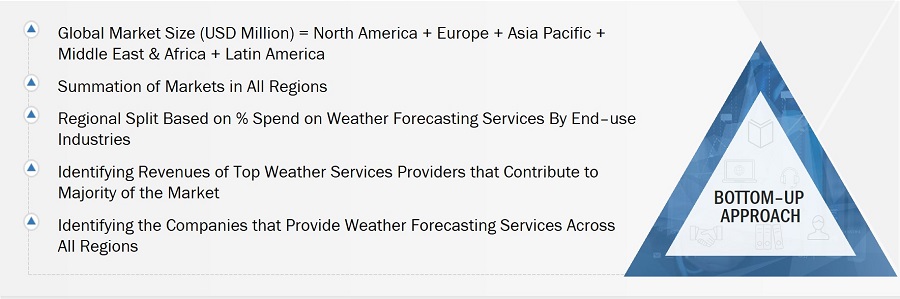

Weather Forecasting Services market size: Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the Weather Forecasting Services market from the revenues of the key players in the market.

Steps involved in the bottom-up approach:

- Identifying the companies offering weather forecasting services and the different industry verticals they provide services.

- Identifying the annual revenue of major companies operating in the weather forecasting services market.

- Identifying various potential industries in which weather forecasting services are used for safety and operational efficiency.

- Understanding the demand generated by companies operating across various industries.

- Where shares of the market were not clearly available, suitable shares were considered to analyze the weather forecasting services market size.

- Carrying out multiple discussions with industry experts to understand the type of services offered and technology used by service providers to forecast the weather. This information would help analyze the breakdown of the scope of work carried out by each major industry in the weather forecasting services market.

- Verifying and crosschecking the estimates at every level through discussions with key opinion leaders, including directors and operation managers, and, finally, with the domain expert at MarketsandMarkets.

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases for this process.

Global Weather Forecasting Services Market Size: Top-Down Approach

- In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research.

- For the calculation of specific market segments, the size of the most appropriate, immediate parent market was used to implement the top-down approach.

- The bottom-up approach was also implemented to validate the revenues obtained for various market segments.

Data Triangulation

The total market was split into several segments and subsegments after arriving at the overall weather forecasting services market size through the market size estimation process explained above. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To analyze the weather forecasting services market and provide projections for it from 2023 to 2028

- To define, describe, and forecast the size of the market by industry, forecast type, organization size, purpose, and region

- To understand the market structure by identifying its various subsegments

- To provide in-depth intelligence regarding the dynamics and the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the market for stakeholders by identifying key trends

- To forecast the market size of segments with respect to major countries

- To analyze competitive developments such as new product launches, contracts, mergers & acquisitions, partnerships, agreements, and collaborations in the market

- To provide a detailed competitive landscape of the weather forecasting systems market, along with an analysis of the strategies adopted by key market players

- To analyze micromarkets1 with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies2

Market Definition

Weather forecasting services are a set of decision-support solutions used to carry out weather-sensitive operations to safeguard people, assets, and profits. They help improve business performance and find a competitive advantage. The services differ in terms of their usage, technology, and forecast purposes. Weather forecast information helps to plan weather-sensitive operations in advance and everyday planning of onshore and offshore operations. These services have different requirements and cater to different applications in various industries, such as aviation, transport & logistics, media, insurance, retail, construction & mining, marine, agriculture, energy & utilities, and oil & gas. Accurate forecasting offers wide-ranging benefits, from increasing agricultural production to reducing damage to crops and property. Weather forecasting is conducted using forecasting tools and comprises weather observation, weather analysis, and weather predictions.

Market Stakeholders

- Government and Civil Organizations

- Community Informants

- Satellite and Drone Operators

- Research Organizations, Forums, Alliances, and Associations

- Meteorological Departments

- Academic Researchers

- Original Equipment Manufacturers

- R&D Companies

- Maintenance Providers

- Providers of Support Solutions

- Technology Vendors

- Software Developers

- End Users

Available Customizations

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Weather Forecasting Services market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Weather Forecasting Services market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Weather Forecasting Services Market

Hi, Required Sample, Doing some market sizing/research for strategy development.

Weather Market Industry, Consumer Behavior analysis data required

Looking for a list of competitors in the Weather Forecasting industry to receive an RFI.

I am looking for an analysis of the major weather forecasting companies, such as The Weather Company, Accuweather, and DTN. Is it included in the revenue by each market, industry, and region? Who are the major customers for each company?