Well Testing Services Market by Services (Downhole Well Testing, Surface Well Testing, Reservoir Sampling, Real Time Well Testing, Hydraulic Fracturing Method Testing) by Application (Onshore, Offshore), by Well Type (Horizontal Wells, Vertical Wells), by Stages (Exploration, Appraisal, Development, Production) by Region - Global Forecast to 2026

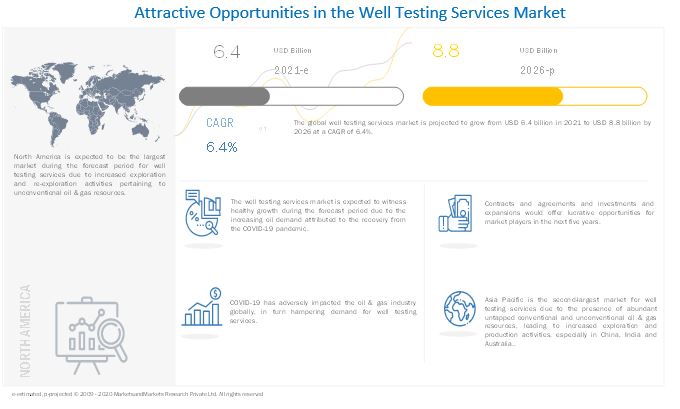

The global well testing services market in terms of revenue was estimated to be worth $6.4 billion in 2021 and is poised to reach $8.8 billion by 2026, growing at a CAGR of 6.4% from 2021 to 2026. The factors driving the growth for well testing services are the rising global oil demand and the exploration and adoption off unconventional oil & gas resources.

To know about the assumptions considered for the study, Request for Free Sample Report

Well Testing Services Market Dynamics

Driver: Exploration and adoption of unconventional oil & gas resources

Unconventional oil & gas resources are generally oil or natural gas resources that do not appear in traditional formations and require specialized extraction or production techniques. Unconventional oil & gas resources typically include shale gas, tight gas, coalbed methane (CBM), shale oil, tight oil, and natural gas hydrates. These resources are not chemically different from conventional oil & gas resources. The distinction stems from their attributes and characteristics with respect to reservoir rock type, oil & gas origin, occurrence state, position underground, or the unusual nature of their reservoirs.

Although the remaining global conventional resources are still abundant, and their production is sufficient to meet current needs, unconventional oil & gas resources are gradually becoming valuable and attracting more interest due to the increasing price of oil. Unconventional oil & gas resources are being utilized more and more as decades of oil and natural gas production have resulted in the extensive use of conventional resources. As per International Energy Agency (IEA) World Energy Outlook 2009, unconventional oil production is projected to increase from 1.8 mb/d in 2008 to 7.4 mb/d by 2030. By 2035, the world's unconventional oil production is expected to account for 15.3% of the world's total oil production. Hence, the increasing production of unconventional oil & gas paves the way for extensive exploration activities, which ultimately propels the demand for well testing services across the exploration sites.

Restraint: Volatility in oil & natural gas prices and capital expenditure by oil & gas service providers

The prices of oil products are set on a commodity basis. As a result, the volatility in oil and natural gas prices can impact exploration and drilling activities and ultimately hamper the growth of the well testing services market. The current energy prices are important contributors to the cash flow for the oil & gas companies and their ability to fund exploration and development activities. The productive capacity for oil is dependent on investment decisions of oil & gas companies to develop oil and natural gas reserves and on the regulatory environment of the oil & gas industry. The ability to produce oil and natural gas is affected by the number and productivity of new wells drilled and completed, as well as the production rate and the resulting depletion of existing wells

Opportunities: Growth in oilfield discoveries

The players operating in the oil & gas industry are focusing on making discoveries as some of the existing fields may create challenges in producing hydrocarbons at an economical rate and require plug and abandonment. Major oil & gas companies have been making extensive discoveries in the onshore and offshore regions. According to the BP Statistical Review of 2020, the world still had unexplored 1,733.9 billion barrels of proven oil reserves by the end of 2019. Such reserves create opportunities for well drilling activities, which is expected to create demand for well testing services.

Challenges: Transition toward adoption of renewable energy resources

The motive behind the global economies to reduce their carbon footprint and emission of greenhouse gases has fueled the transition toward the adoption of clean and green energy alternatives. This has led the economies to embrace renewable energy sources such as solar, wind (onshore and offshore), biomass, hydroelectric, and geothermal power for power generation. The growing energy demand further accelerates this transition as a result of rapid industrialization and urbanization.

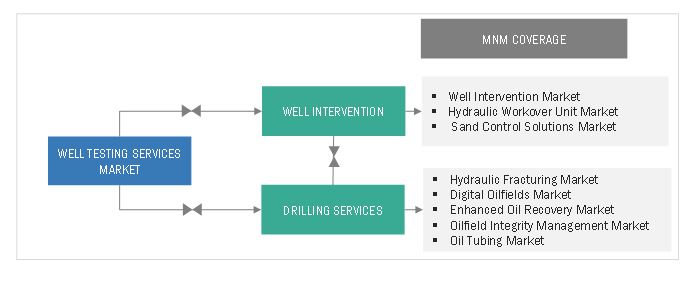

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

The real time well testing segment is expected to be the largest segment of the well testing services market, by services, during the forecast period

The well testing services market, by services, is segmented into Downhole Well Testing, Surface Well Testing, Real Time Well Testing, Reservoir Sampling and Hydraulic Fracturing Method Testing. The real time well testing segment is estimated to have the largest market share and expected to grow at the highest rate during the forecast period. The higher growth rate of this segment is due to its increased adoption due to cost and operational efficiency and enhanced accuracy of data acquired on performing real time well testing.

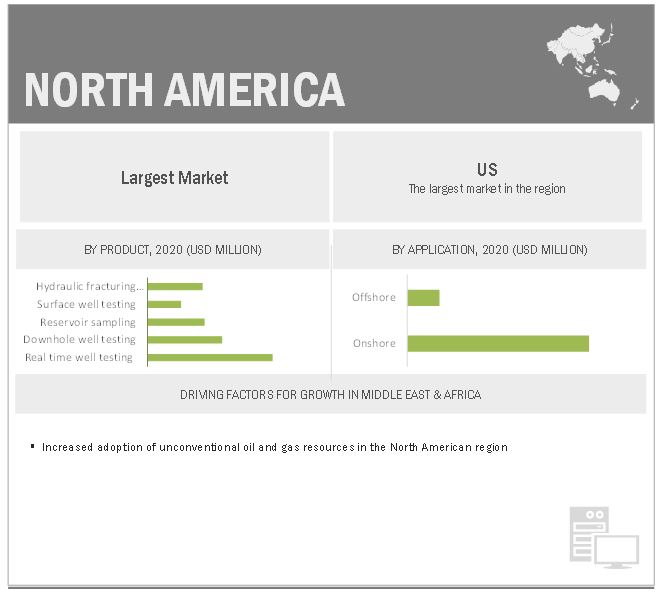

The onshore segment is expected to be the largest contributor to the well testing services market, by application, during the forecast period

The well testing services market, by application, is segmented into Onshore and Offshore. The onshore segment holds the largest share in the market, followed by offshore. The onshore exploration and re-exploration activities are expected to fuel the growth of the onshore segment of the market. Further, the technological advancements to achieve cost and operational efficiency is expected to boost the market for offshore segment of the market during the forecast period.

The horizontal wells segment is expected to be the fastest-growing market, by product, during the forecast period

The well testing service market, by well type, is segmented into Horizontal wells and Vertical Wells. The horizontal wells segment accounted for a 86.1% share of the market in 2020. The major advantages, such as increased production rate due to long wellbore length, reduced pressure drop around the wellbore, the requirement of less remedial work in the future, and lower fluid velocities around the wellbore, are expected to drive the drilling of new horizontal wells, which consequently increases the demand for well testing services.

North America is expected to dominate the global well testing services market

The North America region is estimated to be the largest market for the well testing services, followed by APAC. The North America region is also projected to be the fastest growing market during the forecast period. The presence of vast shale reserves in the North American region encourages the oilfield operators to invest in the exploration and production of these resources, which consequently drives the demand for the well testing services in the North American region during the forecast period.

Key Market Players

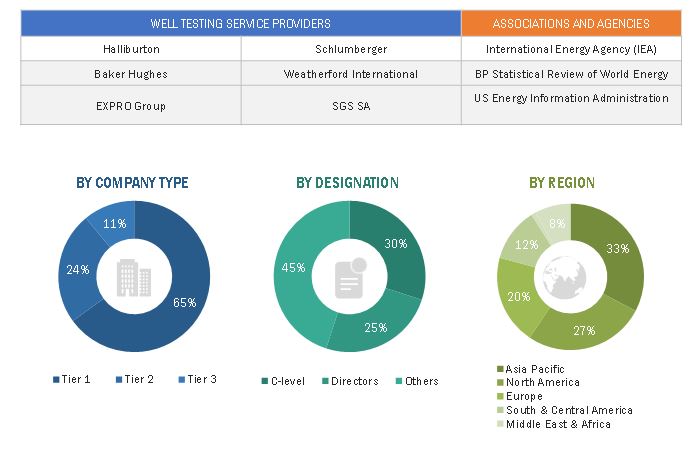

The major players in the well testing services market are Schlumberger (US), Halliburton (US), EXPRO Group (UK), Baker Hughes (US) and Weatherford(US). Between 2017 and 2021, the companies adopted growth strategies such as contracts & agreements, investments & expansions, partnerships, collaborations, alliances & joint ventures to capture a larger share of the market.

Scope of the report

|

Report Coverage |

Details |

|

Market size: |

USD 6.4 billion in 2021 to USD 8.8 billion by 2026 |

|

Growth Rate: |

6.4% |

|

Largest Market: |

North America |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2021-2026 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Services, Application, Well Type, Stages, and Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Growth in oilfield discoveries |

|

Key Market Drivers: |

Exploration and adoption of unconventional oil & gas resources |

This research report categorizes the well testing service market by technology, application, product, and region.

On the basis of by Services, the market has been segmented as follows:

- Downhole Well Testing

- Surface Well Testing

- Reservoir Sampling

- Real Time Well Testing

- Hydraulic Fracturing Method Testing

On the basis of by application, the market has been segmented as follows:

- Onshore

- Offshore

On the basis of by well type, the market has been segmented as follows:

- Horizontal wells

- Vertical wells

On the basis of by stages, the market has been segmented as follows:

- Exploration, Appraisal and Development

- Production

On the basis of region, the market has been segmented as follows:

- North America

- South America

- Europe

- Asia Pacific

- Middle East & Africa

Recent Developments

- In October 2021, EXPRO Group has completed its previously announced merger with Frank’s International N.V., a global oil services company offering a broad range of highly engineered drilling and completions solutions and services, thus reinforcing its service offering portfolio.

- In April 2021, NESR acquired specific oilfield service lines of Action Energy Company W.L.L. Combining with NESR's existing portfolio, the transaction will position NESR to become a top-tier provider in Kuwait, with operations across the Production and Drilling and Evaluation segments.

- In January 2021, NESR was contracted to provide testing and associated services in Kuwait. The contract term is for five years and marks the entry of NESR into the Evaluation services sphere in Kuwait.

- In December 2020, Stuart Well Limited was subcontracted to provide packer testing services in accordance with BS EN ISO 22282-3:2012, geophysical logging and a series of pumping tests in accordance with BS ISO 14686:2003, as part of ground investigation works in Wendover, Buckinghamshire.

- In July 2020, Weatherford has signed an 18-month contract with Iraqi Drilling Company (IDC) to provide services and project management for the drilling and completion of twenty wells in Southern Iraq. As per the contract, IDC will provide rigs, civil works, and drilling services; Weatherford will provide project management and all other associated services, including well test services.

Frequently Asked Questions (FAQs):

What is the current size of the well testing services market?

The current market size of global well testing services market is USD 6.4 billion in 2021.

What is the major drivers for the well testing services market?

The factors driving the growth for well testing services are the rising global oil demand and the exploration and adoption off unconventional oil & gas resources.

Which is the fastest-growing region during the forecasted period in well testing services market?

North America region is expected to grow at the highest CAGR during the forecast period, driven mainly by activities in US and Canada.

Which is the fastest growing segment, by services during the forecasted period in well testing services market?

The real time well testing segment is estimated to have the largest market share and expected to grow at the highest rate during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 WELL TESTING SERVICES MARKET, BY SERVICE: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY WELL TYPE: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATION

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 WELL TESTING SERVICES MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 IDEAL DEMAND-SIDE ANALYSIS

2.4.1 KEY INFLUENCING FACTORS/DRIVERS

2.4.1.1 Well Count

2.4.1.2 Rig Count

2.4.1.3 Crude oil prices

2.4.1.4 Impact of COVID-19 on oil & gas activities

2.4.2 DEMAND-SIDE METRICS

FIGURE 6 MAIN METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR WELL TESTING SERVICES

2.4.2.1 Assumptions for demand-side analysis

2.5 SUPPLY-SIDE ANALYSIS

FIGURE 7 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF WELL TESTING SERVICES MARKET

FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

2.5.1 CALCULATIONS FOR SUPPLY SIDE

2.5.2 ASSUMPTIONS FOR SUPPLY SIDE

FIGURE 9 COMPANY REVENUE ANALYSIS, 2020

2.6 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 1 WELL TESTING SERVICES MARKET SNAPSHOT

FIGURE 10 REAL TIME WELL TESTING SEGMENT EXPECTED TO DOMINATE MARKET, BY SERVICE, DURING FORECAST PERIOD

FIGURE 11 ONSHORE SEGMENT EXPECTED TO DOMINATE MARKET, BY APPLICATION, DURING FORECAST PERIOD

FIGURE 12 HORIZONTAL WELLS SEGMENT EXPECTED TO HOLD LARGEST SIZE OF MARKET, BY PRODUCT, DURING FORECAST PERIOD

FIGURE 13 NORTH AMERICA DOMINATED MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 14 GROWING GLOBAL OIL DEMAND AND INCREASING EXPLORATION ACTIVITIES PERTAINING TO UNCONVENTIONAL OIL & GAS RESOURCES EXPECTED TO DRIVE MARKET FROM 2021 TO 2026

4.2 MARKET, BY REGION

FIGURE 15 NORTH AMERICA TO WITNESS FASTEST GROWTH IN MARKET DURING FORECAST PERIOD

4.3 MARKET, BY SERVICE

FIGURE 16 REAL TIME WELL TESTING SEGMENT DOMINATED MARKET, BY SERVICE, IN 2020

4.4 MARKET, BY APPLICATION

FIGURE 17 ONSHORE SEGMENT DOMINATED MARKET, BY APPLICATION, IN 2020

4.5 MARKET, BY WELL TYPE

FIGURE 18 HORIZONTAL WELL SEGMENT DOMINATED MARKET, BY PRODUCT, IN 2020

4.6 WELL TESTING SERVICES MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

FIGURE 19 ONSHORE APPLICATIONS AND THE US DOMINATED MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY, IN 2020

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COVID-19 GLOBAL PROPAGATION

FIGURE 21 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 22 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 24 WELL TESTING SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Exploration and adoption of unconventional oil & gas resources

5.5.1.2 Increase in global oil demand

FIGURE 25 GLOBAL OIL DEMAND, 2019–2026

TABLE 2 GLOBAL OIL DEMAND (OECD VS. NON-OECD), 2019–2026

5.5.2 RESTRAINTS

5.5.2.1 Volatility in oil and natural gas prices and capital expenditure by oil & gas service providers

FIGURE 26 WEST TEXAS INTERMEDIATE (WTI) CRUDE OIL PRICES, JANUARY 2018–OCTOBER 2021

5.5.2.2 Introduction of stringent government regulations on upstream activities

5.5.3 OPPORTUNITIES

5.5.3.1 Growth in oilfield discoveries

5.5.3.2 Advancements in enhanced oil recovery technologies

5.5.4 CHALLENGES

5.5.4.1 Transition toward adoption of renewable energy sources

FIGURE 27 RENEWABLE CAPACITY ADDITIONS BY COUNTRY/REGION, 2019–2021

5.6 COVID-19 IMPACT

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN WELL TESTING SERVICES MARKET

FIGURE 28 REVENUE SHIFT OF WELL TESTING SERVICES PROVIDERS

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 29 MARKET: SUPPLY CHAIN ANALYSIS

TABLE 3 MARKET: VALUE CHAIN

5.8.1 RAW MATERIAL SUPPLIERS

5.8.2 WELL TESTING EQUIPMENT MANUFACTURERS

5.8.3 WELL TESTING SERVICE PROVIDERS

5.8.4 OILFIELD OPERATORS

5.9 MARKET MAP

FIGURE 30 WELL TESTING SERVICES: MARKET MAP

5.10 INNOVATIONS & PATENT REGISTRATION

5.11 TECHNOLOGY ANALYSIS

5.12 MARKET: REGULATIONS

5.13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 31 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF SUBSTITUTES

5.13.5 DEGREE OF COMPETITION

5.14 CASE STUDY ANALYSIS

5.14.1 EXPRO GROUP’S IMPACTFUL SOLUTION TO HELP ACHIEVE BRUNEI VISION 2035

6 WELL TESTING SERVICES MARKET, BY STAGE (Page No. - 70)

6.1 INTRODUCTION

6.2 EXPLORATION, APPRAISAL AND DEVELOPMENT

FIGURE 32 GLOBAL CONVENTIONAL RESOURCE DISCOVERIES AND EXPLORATION SPENDING AS A PERCENTAGE OF UPSTREAM INVESTMENT, 2010–2020

6.3 PRODUCTION

FIGURE 33 CHANGE IN OIL PRODUCTION IN OECD COUNTRIES, 2018—2020

FIGURE 34 CHANGE IN OIL PRODUCTION IN OPEC COUNTRIES, 2018—2020

7 WELL TESTING SERVICES MARKET, BY SERVICE (Page No. - 74)

7.1 INTRODUCTION

FIGURE 35 MARKET, BY SERVICE, 2020

TABLE 5 MARKET, BY SERVICE, 2019–2026 (USD MILLION)

7.2 DOWNHOLE WELL TESTING

7.2.1 INCREASING INVESTMENTS BY OILFIELD OPERATORS TO BOOST GROWTH OF DOWNHOLE WELL TESTING SERVICES

TABLE 6 MARKET FOR DOWNHOLE WELL TESTING, BY REGION, 2019–2026 (USD MILLION)

7.3 SURFACE WELL TESTING

7.3.1 ADOPTION OF UNCONVENTIONAL OIL & GAS RESOURCES LIKELY TO FUEL DEMAND FOR SURFACE WELL TESTING SERVICES

TABLE 7 MARKET FOR SURFACE WELL TESTING, BY REGION, 2019–2026 (USD MILLION)

7.4 RESERVOIR SAMPLING

7.4.1 TECHNOLOGICAL ADVANCEMENTS TO IMPROVE OPERATIONAL AND COST EFFICIENCY LIKELY TO BOOST DEMAND FOR RESERVOIR SAMPLING

TABLE 8 MARKET FOR RESERVOIR SAMPLING, BY REGION, 2019–2026 (USD MILLION)

7.5 REAL TIME WELL TESTING

7.5.1 INCREASING INVESTMENTS IN EXPLORATION AND PRODUCTION OF UNCONVENTIONAL RESOURCES EXPECTED TO FUEL GROWTH OF REAL TIME WELL TESTING SEGMENT

TABLE 9 MARKET FOR REAL TIME WELL TESTING, BY REGION, 2019–2026 (USD MILLION)

7.6 HYDRAULIC FRACTURING METHOD TESTING

7.6.1 HYDRAULIC FRACTURING ACTIVITIES CONCERNED WITH PRODUCTION OF UNCONVENTIONAL RESOURCES EXPECTED TO FUEL DEMAND FOR HYDRAULIC PACKER TESTING

TABLE 10 MARKET FOR HYDRAULIC FRACTURING METHOD TESTING, BY REGION, 2019–2026 (USD MILLION)

8 WELL TESTING SERVICES MARKET, BY APPLICATION (Page No. - 80)

8.1 INTRODUCTION

FIGURE 36 MARKET, BY APPLICATION, 2020

TABLE 11 MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 ONSHORE

8.2.1 ONSHORE EXPLORATION AND RE-EXPLORATION ACTIVITIES EXPECTED TO FUEL GROWTH OF ONSHORE MARKET

TABLE 12 MARKET FOR ONSHORE, BY REGION, 2019–2026 (USD MILLION)

8.3 OFFSHORE

8.3.1 ACHIEVING OF COST AND OPERATIONAL EFFICIENCY THROUGH TECHNOLOGICAL ADVANCEMENTS TO BOOST GROWTH OF OFFSHORE MARKET

TABLE 13 MARKET FOR OFFSHORE, BY REGION, 2019–2026 (USD MILLION)

9 WELL TESTING SERVICES MARKET, BY WELL TYPE (Page No. - 84)

9.1 INTRODUCTION

FIGURE 37 MARKET, BY WELL TYPE, 2020

TABLE 14 MARKET, BY WELL TYPE, 2019–2026 (USD MILLION)

9.2 HORIZONTAL WELLS

9.2.1 INCREASE IN DRILLING ACTIVITIES IN HORIZONTAL WELLS TO DRIVE MARKET

TABLE 15 MARKET FOR HORIZONTAL WELLS, BY REGION, 2019–2026 (USD MILLION)

9.3 VERTICAL WELLS

9.3.1 INCREASE IN INVESTMENTS IN EXPLORATION AND PRODUCTION OF UNCONVENTIONAL RESOURCES EXPECTED TO FUEL GROWTH OF VERTICAL WELLS SEGMENT

TABLE 16 MARKET FOR VERTICAL WELLS, BY REGION, 2019–2026 (USD MILLION)

10 WELL TESTING SERVICES MARKET, BY REGION (Page No. - 88)

10.1 INTRODUCTION

FIGURE 38 MARKET SHARE (VALUE), BY REGION, 2020

TABLE 17 MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: REGIONAL SNAPSHOT

10.2.1 MACRO TRENDS

10.2.1.1 Shale gas reserves

TABLE 18 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN ASIA PACIFIC, BY COUNTRY (TCF)

10.2.1.2 Shale/ tight oil reserves

TABLE 19 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN ASIA PACIFIC, BY COUNTRY (BILLION BBL)

10.2.2 BY SERVICE

TABLE 20 MARKET IN ASIA PACIFIC, BY SERVICE, 2019–2026 (USD MILLION)

10.2.3 BY APPLICATION

TABLE 21 MARKET IN ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

10.2.4 BY WELL TYPE

TABLE 22 MARKET IN ASIA PACIFIC, BY WELL TYPE, 2019–2026 (USD MILLION)

10.2.5 BY COUNTRY

TABLE 23 MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

10.2.5.1 China

10.2.5.1.1 Government initiatives to increase oil production and surge in exploration of unconventional resources expected to drive well testing services market in China

TABLE 24 MARKET IN CHINA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 25 MARKET IN CHINA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 26 MARKET IN CHINA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.2.5.2 India

10.2.5.2.1 Redevelopment of legacy oilfields and government initiatives to improve exploration activities to drive growth of market in India

TABLE 27 MARKET IN INDIA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 28 MARKET IN INDIA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 29 MARKET IN INDIA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.2.5.3 Australia

10.2.5.3.1 Development of unconventional shale resources and focus on redeveloping mature fields to create growth opportunities for market in Australia

TABLE 30 MARKET IN AUSTRALIA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 31 MARKET IN AUSTRALIA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 32 MARKET IN AUSTRALIA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.2.5.4 Rest of Asia Pacific

TABLE 33 MARKET IN REST OF ASIA PACIFIC, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 34 MARKET IN REST OF ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 35 MARKET IN REST OF ASIA PACIFIC, BY WELL TYPE, 2019–2026 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 40 NORTH AMERICA: REGIONAL SNAPSHOT

10.3.1 MACRO TRENDS

10.3.1.1 Shale gas reserves

TABLE 36 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN NORTH AMERICA, BY COUNTRY (TCF)

10.3.1.2 Shale/tight oil reserves

TABLE 37 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN NORTH AMERICA, BY COUNTRY (BILLION BBL)

10.3.2 BY SERVICE

TABLE 38 MARKET IN NORTH AMERICA, BY SERVICE, 2019–2026 (USD MILLION)

10.3.3 BY APPLICATION

TABLE 39 MARKET IN NORTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.4 BY WELL TYPE

TABLE 40 MARKET IN NORTH AMERICA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.3.5 BY COUNTRY

TABLE 41 MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.3.5.1 US

10.3.5.1.1 Increasing E&P activities concerned with shale and tight oil reserves to drive market growth in US

TABLE 42 MARKET IN US, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 43 MARKET IN US, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 44 MARKET IN US, BY WELL TYPE, 2019–2026 (USD MILLION)

10.3.5.2 Canada

10.3.5.2.1 Potential exploration and drilling of oil sands and offshore exploration to provide lucrative growth opportunities in Canada

TABLE 45 MARKET IN CANADA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 46 MARKET IN CANADA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 47 MARKET IN CANADA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.3.5.3 Mexico

10.3.5.3.1 Development of unconventional shale resources and focus on redeveloping mature fields to offer growth opportunities in Mexico

TABLE 48 MARKET IN MEXICO, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 49 MARKET IN MEXICO, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 50 MARKET IN MEXICO, BY WELL TYPE, 2019–2026 (USD MILLION)

10.4 EUROPE

10.4.1 MACRO TRENDS

10.4.1.1 Shale gas reserves

TABLE 51 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN EUROPE, BY COUNTRY (TCF)

10.4.1.2 Shale/ tight oil reserves

TABLE 52 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN EUROPE, BY COUNTRY (BILLION BBL)

10.4.2 BY SERVICE

TABLE 53 MARKET IN EUROPE, BY SERVICE, 2019–2026 (USD MILLION)

10.4.3 BY APPLICATION

TABLE 54 MARKET IN EUROPE, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.4 BY WELL TYPE

TABLE 55 MARKET IN EUROPE, BY WELL TYPE, 2019–2026 (USD MILLION)

10.4.5 BY COUNTRY

TABLE 56 MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

10.4.5.1 Russia

10.4.5.1.1 Increasing exploration and production activities in Russia’s Far East region to drive market growth

TABLE 57 MARKET IN RUSSIA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 58 MARKET IN RUSSIA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 59 MARKET IN RUSSIA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.4.5.2 UK

10.4.5.2.1 Potential E&P activities concerned with enhancing production in mature fields and new discoveries are expected to provide lucrative growth opportunities

TABLE 60 MARKET IN UK, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 61 MARKET IN UK, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 62 MARKET IN UK, BY WELL TYPE, 2019–2026 (USD MILLION)

10.4.5.3 Norway

10.4.5.3.1 Rapidly depleting mature oil & gas fields and increase in exploration activities in Norwegian Continental Shelf to drive market growth

TABLE 63 MARKET IN NORWAY, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 64 MARKET IN NORWAY, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 65 MARKET IN NORWAY, BY WELL TYPE, 2019–2026 (USD MILLION)

10.4.5.4 Rest of Europe

10.4.5.4.1 New discoveries followed by subsequent drilling and production activities to fuel market growth

TABLE 66 MARKET IN REST OF EUROPE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 67 MARKET IN REST OF EUROPE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 68 MARKET IN REST OF EUROPE, BY WELL TYPE, 2019–2026 (USD MILLION)

10.5 SOUTH AMERICA

10.5.1 MACRO TRENDS

10.5.1.1 Shale gas reserves

TABLE 69 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN SOUTH AMERICA, BY COUNTRY (TCF)

10.5.1.2 Shale/tight oil reserves

TABLE 70 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN SOUTH AMERICA, BY COUNTRY (BILLION BBL)

10.5.2 BY SERVICE

TABLE 71 MARKET IN SOUTH AMERICA, BY SERVICE, 2019–2026 (USD MILLION)

10.5.3 BY APPLICATION

TABLE 72 MARKET IN SOUTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

10.5.4 BY WELL TYPE

TABLE 73 MARKET IN SOUTH AMERICA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.5.5 BY COUNTRY

TABLE 74 MARKET IN SOUTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.5.5.1 Argentina

10.5.5.1.1 Shale developments to create potential demand for market in Argentina

TABLE 75 MARKET IN ARGENTINA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 76 MARKET IN ARGENTINA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 77 MARKET IN ARGENTINA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.5.5.2 Brazil

10.5.5.2.1 Increasing offshore exploration and production activities to boost market growth in Brazil

TABLE 78 MARKET IN BRAZIL, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 79 MARKET IN BRAZIL, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 80 MARKET IN BRAZIL, BY WELL TYPE, 2019–2026 (USD MILLION)

10.5.5.3 Rest of South America

TABLE 81 MARKET IN REST OF SOUTH AMERICA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 82 MARKET IN REST OF SOUTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 83 MARKET IN REST OF SOUTH AMERICA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST

10.6.1 MACRO TRENDS

10.6.1.1 Shale gas reserves

TABLE 84 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN MIDDLE EAST, BY COUNTRY (TCF)

10.6.1.2 Shale/ tight oil reserves

TABLE 85 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN MIDDLE EAST, BY COUNTRY (BILLION BBL)

10.6.2 BY SERVICE

TABLE 86 MARKET IN MIDDLE EAST, BY SERVICE, 2019–2026 (USD MILLION)

10.6.3 BY APPLICATION

TABLE 87 MARKET IN MIDDLE EAST, BY APPLICATION, 2019–2026 (USD MILLION)

10.6.4 BY WELL TYPE

TABLE 88 MARKET IN MIDDLE EAST, BY WELL TYPE, 2019–2026 (USD MILLION)

10.6.5 BY COUNTRY

TABLE 89 MARKET IN MIDDLE EAST, BY COUNTRY, 2019–2026 (USD MILLION)

10.6.5.1 Saudi Arabia

10.6.5.1.1 Enhanced crude oil production from onshore fields and surge in offshore exploration to drive growth of market in Saudi Arabia

TABLE 90 MARKET IN SAUDI ARABIA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 91 MARKET IN SAUDI ARABIA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 92 MARKET IN SAUDI ARABIA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.6.5.2 Oman

10.6.5.2.1 Rise in upstream activities corresponding to exploration and production of total oil reserves expected to increase demand for market in Oman

TABLE 93 MARKET IN OMAN, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 94 MARKET IN OMAN, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 95 MARKET IN OMAN, BY WELL TYPE, 2019–2026 (USD MILLION)

10.6.5.3 Kuwait

10.6.5.3.1 Upcoming and recent investments in oilfields likely to boost growth of well testing services market in Kuwait

TABLE 96 MARKET IN KUWAIT, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 97 MARKET IN KUWAIT, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 98 MARKET IN KUWAIT, BY WELL TYPE, 2019–2026 (USD MILLION)

10.6.5.4 UAE

10.6.5.4.1 Need to understand reservoir’s productive capacity led to increased demand for well testing services in UAE

TABLE 99 MARKET IN UAE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 100 MARKET IN UAE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 101 MARKET IN UAE, BY WELL TYPE, 2019–2026 (USD MILLION)

10.6.5.5 Rest of Middle East

TABLE 102 MARKET IN REST OF MIDDLE EAST, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 103 MARKET IN REST OF MIDDLE EAST, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 104 MARKET IN REST OF MIDDLE EAST, BY WELL TYPE, 2019–2026 (USD MILLION)

10.7 AFRICA

10.7.1 MACRO TRENDS

10.7.1.1 Shale gas reserves

TABLE 105 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN AFRICA, BY COUNTRY (TCF)

10.7.1.2 Shale/ tight oil reserves

TABLE 106 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN AFRICA, BY COUNTRY (BILLION BBL)

10.7.2 BY SERVICE

TABLE 107 MARKET IN AFRICA, BY SERVICE, 2019–2026 (USD MILLION)

10.7.3 BY APPLICATION

TABLE 108 MARKET IN AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

10.7.4 BY WELL TYPE

TABLE 109 MARKET IN AFRICA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.7.5 BY COUNTRY

TABLE 110 MARKET IN AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.7.5.1 Egypt

10.7.5.1.1 Active upstream operations funded by international oil companies to fuel the well testing services market

TABLE 111 MARKET IN EGYPT, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 112 MARKET IN EGYPT, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 113 MARKET IN EGYPT, BY WELL TYPE, 2019–2026 (USD MILLION)

10.7.5.2 Algeria

10.7.5.2.1 Initiatives proposed and executed by upstream oilfield operators in Algeria to drive demand for well testing services

TABLE 114 MARKET IN ALGERIA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 115 MARKET IN ALGERIA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 116 MARKET IN ALGERIA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.7.5.3 Nigeria

10.7.5.3.1 Rise in exploration activities and developments in mature oil & gas fields to boost market growth

TABLE 117 MARKET IN NIGERIA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 118 MARKET IN NIGERIA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 119 MARKET IN NIGERIA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.7.5.4 South Africa

10.7.5.4.1 Presence of large shale gas reserves in Karoo Basin to drive market growth

TABLE 120 MARKET IN SOUTH AFRICA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 121 MARKET IN SOUTH AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 122 MARKET IN SOUTH AFRICA, BY WELL TYPE, 2019–2026 (USD MILLION)

10.7.5.5 Rest of Africa

10.7.5.5.1 Rise in offshore deepwater and ultra-deepwater E&P activities to fuel market growth

TABLE 123 MARKET IN REST OF AFRICA, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 124 MARKET IN REST OF AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 125 MARKET IN REST OF AFRICA, BY WELL TYPE, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 140)

11.1 OVERVIEW

FIGURE 41 KEY DEVELOPMENTS IN MARKET, 2017 TO 2021

11.2 SHARE ANALYSIS OF KEY PLAYERS, 2020

TABLE 126 MARKET: DEGREE OF COMPETITION

FIGURE 42 SHARE ANALYSIS OF TOP PLAYERS IN MARKET, 2020

11.3 MARKET EVALUATION FRAMEWORK

TABLE 127 MARKET EVALUATION FRAMEWORK, 2017–2021

11.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 43 5-YEAR SEGMENTAL REVENUE ANALYSIS OF TOP PLAYERS IN MARKET, 2016–2020

11.5 RECENT DEVELOPMENTS

11.5.1 DEALS

TABLE 128 MARKET: DEALS, 2017–2021

11.5.2 OTHERS

TABLE 129 MARKET: OTHERS, 2017–2021

11.6 COMPETITVE LEADERSHIP MAPPING

11.6.1 STAR

11.6.2 EMERGING LEADER

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 44 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

TABLE 130 COMPANY SERVICES FOOTPRINT

TABLE 131 COMPANY REGION FOOTPRINT

12 COMPANY PROFILES (Page No. - 151)

12.1 KEY COMPANIES

(Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

12.1.1 SCHLUMBERGER LIMITED

TABLE 132 SCHLUMBERGER LIMITED: BUSINESS OVERVIEW

FIGURE 45 SCHLUMBERGER LIMITED: COMPANY SNAPSHOT

TABLE 133 SCHLUMBERGER LIMITED: DEALS

TABLE 134 SCHLUMBERGER LIMITED: OTHERS

12.1.2 HALLIBURTON

TABLE 135 HALLIBURTON: BUSINESS OVERVIEW

FIGURE 46 HALLIBURTON: COMPANY SNAPSHOT

TABLE 136 HALLIBURTON: DEALS

TABLE 137 HALLIBURTON: OTHERS

12.1.3 EXPRO GROUP

TABLE 138 EXPRO GROUP: BUSINESS OVERVIEW

FIGURE 47 EXPRO GROUP: COMPANY SNAPSHOT

TABLE 139 EXPRO GROUP: DEALS

12.1.4 BAKER HUGHES

TABLE 140 BAKER HUGHES: BUSINESS OVERVIEW

FIGURE 48 BAKER HUGHES: COMPANY SNAPSHOT

TABLE 141 BAKER HUGHES: DEALS

TABLE 142 BAKER HUGHES: OTHERS

12.1.5 WEATHERFORD

TABLE 143 WEATHERFORD: BUSINESS OVERVIEW

FIGURE 49 WEATHERFORD: COMPANY SNAPSHOT

TABLE 144 WEATHERFORD: DEALS

12.1.6 TECHNIPFMC PLC

TABLE 145 TECHNIPFMC PLC: BUSINESS OVERVIEW

FIGURE 50 TECHNIPFMC PLC: COMPANY SNAPSHOT

TABLE 146 TECHNICFMC PLC: OTHERS

12.1.7 SGS SA

TABLE 147 SGS SA: BUSINESS OVERVIEW

FIGURE 51 SGS SA: COMPANY SNAPSHOT

12.1.8 NATIONAL ENERGY SERVICES REUNITED CORP.

TABLE 148 NATIONAL ENERGY SERVICES REUNITED CORP.: BUSINESS OVERVIEW

FIGURE 52 NATIONAL ENERGY SERVICES REUNITED CORP.: COMPANY SNAPSHOT

TABLE 149 NATIONAL ENERGY SERVICES REUNITED CORP.: DEALS

TABLE 150 NATIONAL ENERGY SERVICES REUNITED CORP.: OTHERS

12.1.9 TETRA TECHNOLOGIES, INC.

TABLE 151 TETRA TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 53 TETRA TECHNOLOGIES, INC.: COMPANY SNAPSHOT

12.1.10 OILSERV

TABLE 152 OILSERV: BUSINESS OVERVIEW

12.1.11 EXALO DRILLING SA

TABLE 153 EXALO DRILLING SA: BUSINESS OVERVIEW

12.1.12 GREENE’S ENERGY GROUP

TABLE 154 GREENE’S ENERGY GROUP: BUSINESS OVERVIEW

12.1.13 WELLMAX

TABLE 155 WELLMAX: BUSINESS OVERVIEW

12.1.14 STUART WELLS LIMITED

TABLE 156 STUART WELLS LIMITED: BUSINESS OVERVIEW

TABLE 157 STUART WELLS LIMITED: DEALS

12.1.15 EDGE DRILLING

TABLE 158 EDGE DRILLING: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 MB PETROLEUM SERVICES LLC

12.2.2 ENVIROPROBE SERVICE, INC.

12.2.3 MINERALS TECHNOLOGIES INC.

12.2.4 OIL STATES INTERNATIONAL, INC.

12.2.5 PARRATT-WOLFF, INC.

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 188)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the well testing services market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as water and wastewater management data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and water & environment journal to identify and collect information useful for a technical, market-oriented, and commercial study of the well testing services market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The well testing services market comprises several stakeholders such as companies related to the industry, consulting companies in the oil & gas sector, oil & gas companies, government & research organizations, organizations, forums, alliances & associations, well testing services providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by increased investment in the upstream oil & gas sector. The supply side is characterized by investments & expansion and partnerships & collaborations among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global well testing services market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Well testing services Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the well testing services market.

Objectives of the Study

- To define and describe the well testing services market based on technology, application, product, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze each segment/subsegment of the market with respect to individual growth trends, future expansions, and their contributions to the market

- To analyze growth opportunities for stakeholders and the competitive landscape for market leaders

- To forecast the growth of the market with respect to six main regions—the North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies1

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the well testing service market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Well Testing Services Market

Which are the most innovative companies in the Well Testing Services Market?