5G Core Market by Component (Solutions and Services), Network Function (Access and Mobility Management Function, Policy Control Function, Unified Data Management), Deployment Model (Cloud and On-premises), End User, and Region - Global Forecast to 2025

5G Core Market Size - Worldwide

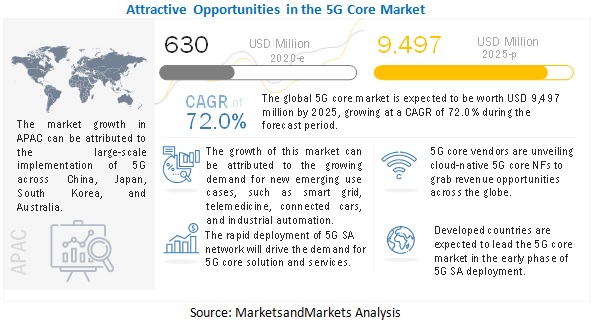

The global 5G Core Market size was surpassed $630 million in 2020. Through the projection period, the 5G Core Industry is anticipated to increase at a CAGR of 72.0% in between 2020-2025, to reach a value around $9,497 million in 2025.

The 5G Core market is gaining traction due to its cloud-native and service-based architecture that will improve the modularity of products with greater emphasis on low latency, URLLC, eMBB, and mMTC offerings. The rapid rise in the volume of data being carried by cellular networks has been driven largely by consumer demand for video, and the shift of business toward the use of cloud services. There are significant growth opportunities for 5G core vendors. The commercialization of 5G services in enterprises such as private 5G and the availability of unlicensed and shared spectrum in the globe are expected to shape the future of the 5G core market.

To know about the assumptions considered for the study, Request for Free Sample Report

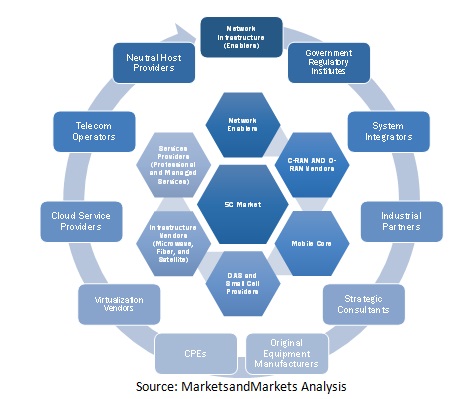

5G Core Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

5G Core Market Growth Dynamics

Driver: Industry 4.0 paved the way for mMTC

The widespread adoption of IoT and continuous advancements in Machine-to-Machine (M2M) communication networks are transforming various industries by connecting all types of devices, appliances, systems, and services. IoT is one of the many use cases that 5G core-enabled 5G would support, enabling communication between large numbers of sensors and connected devices. The requirements for IoT applications can be categorized into high-power, low-latency applications (such as mobile video surveillance); and low-power, low-latency, long-range IoT applications (smart cities and smart factories). The evolution of the 5G technology is expected to gain pace to support these requirements for emerging IoT applications, categorized as massive machine type communication and mission-critical applications.

Restraints: Security concerns in the 5G core network

CIOs are largely concern with 5G core security that can lead to a huge loss for businesses as well as service providers. The new network infrastructure has been designed with the help of SDN, NFV, and cloud-native architecture. Network functions are disaggregated from underline infrastructure and located across local, regional, and central data centers. In a cloud-based 5G network, the majority of network functions are deployed over the public and private cloud infrastructure.

Opportunity: Demand for Private 5G across enterprises, government, and industrial sectors.

Automation and digitalization have dramatically changed the adoption of mission-critical business applications in every line of business. Most sectors have undergone a digital transformation to cope with the growing need of customers and businesses for operational agility. 5G¡¯s inherent ability to support network slicing will enable broader use of private LTE across the enterprise network. Technological advancements and the evolving ecosystem have further paved the way for the emergence of new business applications across different sectors

Challenge: Heavy spending on deploying 5G

The challenge for CSPs in transitioning to 5G is to justify the multibillion dollars of investments in new network equipment required to transform their network to a virtualized infrastructure; move services from 3G and 4G to 5G; all while protecting their business against the ever-increasing risk of disruptions and cyber threats. The transition to a standalone model is essential for the telcos to capitalize on the full range of benefits that 5G offers.

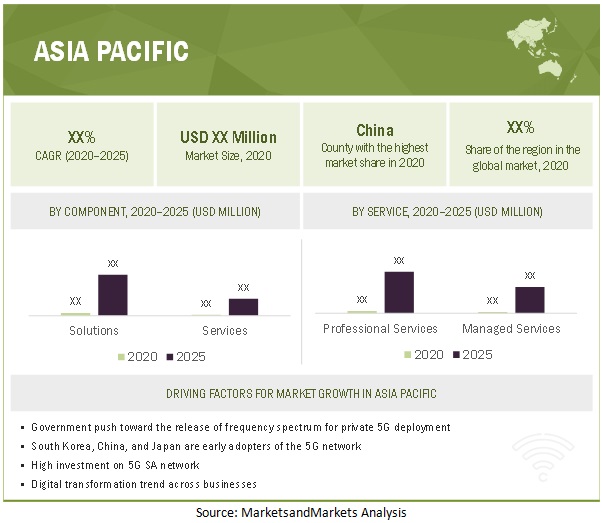

APAC to account for the highest CAGR during the forecast period

APAC has several growing economies, such as China, India, and Japan, which are expected to register high growth in the 5G core market. These countries have always supported and promoted industrial and technological growth. Also, they possess a developed technological infrastructure, which is promoting the adoption of 5G core solutions across all industry verticals. The network market in APAC is driven by the growing acceptance of cloud-based solutions, emerging technologies such as the IoT, and big data analytics and mobility. APAC is one of the biggest markets for connected devices

List of 5G Core Companies:

This research study outlines the market potential, market dynamics, and major vendors operating in the 5G core market. Key and innovative 5G core companies include Nokia (Finland),Ericsson (Sweden), Huawei (China),ZTE (China), Samsung (South Korea), Affirmed Networks(US), Mavenir(US), NEC(Japan), Cisco(US), HPE(US), Oracle(US), Athonet(Italy), Casa Systems(US), Cumucore(Finland), Druid Software (Ireland), IPLOOK (China), and Metaswitch (UK). The study includes an in-depth competitive analysis of these key players in the 5G core market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Attribute |

Details |

|

Revenue Forecast in 2025 |

$9,497 million |

|

Market Value in 2020 |

$630 million |

|

Growth Rate |

CAGR of 72% |

|

Key Market Growth Drivers |

Industry 4.0 paved the way for mMTC |

|

Key Market Opportunities |

Demand for Private 5G across enterprises, government, and industrial sectors. |

|

Market size available for years |

2020-2025 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Component (solutions and services), deployment model, network functions, and end user |

|

Regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Nokia (Finland), Ericsson (Sweden), Huawei (China),ZTE (China), Samsung (South Korea), Affirmed Networks(US), Mavenir(US), NEC(Japan), Cisco(US), HPE(US), Oracle(US), Athonet(Italy), Casa Systems(US), Cumucore(Finland), Druid Software(Ireland), IPLOOK (China), and Metaswitch(UK). |

This research report categorizes the 5G Core Market to forecast revenue and analyze trends in each of the following submarkets:

5G Core Market Based on Components :

- Solutions

- Services

5G Core Industry Based on Solutions:

- Professional services

- Managed Services

5G Core Market Based on Network Functions:

- AMF

- SMF

- UPF

- PCF

- NEF

- NRF

- UDM

- AUSF

- AF

- NSSF

- Others*

5G Core Industry Based on End user:

- Telecom operators

- Enterprises

5G Core Market Based on Deployment model:

- Cloud

- On-Premises

5G Core Industry Based on regions:

- North America

- Europe

- APAC

- RoW

Frequently Asked Questions (FAQ):

What is the future for 5G Core Market?

What is the 5G Core Market Growth?

What are the challenges in the global 5G Core Market?

Which are the top 5G Core companies included in the report?

Who will be the leading hub for 5G core market?

What is the 5G Core Market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT¡ªSCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 6 5G CORE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 RESEARCH METHODOLOGY: APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1: SUPPLY SIDE ANALYSIS OF REVENUE FROM SOLUTION AND SERVICES IN THE 5G CORE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY©¤ APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF THE 5G CORE VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF COMPANY¡¯S 5G CORE REVENUE ESTIMATION

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY©¤ APPROACH 2 (DEMAND SIDE): DEMAND SIZE MARKET ESTIMATIONS THROUGH END USER

2.4 IMPLICATION OF COVID-19 ON THE MARKET

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY: COVID-19 IMPACT ON THE 5G CORE MARKET

2.5 MARKET FORECAST

TABLE 1 FACTOR ANALYSIS

2.6 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 14 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.7.1 ASSUMPTIONS FOR THE STUDY

2.7.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 15 5G CORE MARKET: HOLISTIC VIEW

FIGURE 16 MARKET: GROWTH TREND

FIGURE 17 ASIA PACIFIC TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN THE 5G CORE MARKET

FIGURE 18 INCREASING DEMAND FOR ENHANCED MOBILE BROADBAND SERVICES TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 MARKET IN NORTH AMERICA, BY COMPONENT AND END USER

FIGURE 19 SOLUTIONS AND TELECOM OPERATORS SEGMENTS TO ACCOUNT FOR HIGHER MARKET SHARES IN NORTH AMERICA IN 2020

4.3 MARKET IN EUROPE, BY COMPONENT AND END USER

FIGURE 20 SOLUTIONS AND TELECOM OPERATORS SEGMENTS TO ACCOUNT FOR HIGHER MARKET SHARES IN EUROPE IN 2020

4.4 MARKET IN ASIA PACIFIC, BY COMPONENT AND END USER

FIGURE 21 SOLUTIONS AND TELECOM OPERATORS SEGMENTS TO ACCOUNT FOR HIGHER MARKET SHARES IN ASIA PACIFIC IN 2020

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: 5G CORE MARKET

5.2.1 DRIVERS

5.2.1.1 Cloud-native and service-based architecture

FIGURE 23 5GC SERVICE-BASED ARCHITECTURE

5.2.1.2 Telecom operators emphasize on eMBB services

FIGURE 24 5G-ENHANCED MOBILE BROADBAND USE CASES

5.2.1.3 Industry 4.0 paved way for mMTC

FIGURE 25 GLOBAL INTERNET OF THINGS CONNECTIONS (BILLION)

5.2.1.4 Development of smart infrastructure

5.2.1.5 Differentiated 5G services via network slicing

TABLE 2 EMERGING USE CASES SUPPORTED BY NETWORK SLICING

5.2.2 RESTRAINTS

5.2.2.1 Security concerns in the 5G core network

FIGURE 26 5G SECURITY THREAT LANDSCAPE

5.2.3 OPPORTUNITIES

5.2.3.1 Low latency connectivity with URLLC

FIGURE 27 TIME-CRITICAL USE CASES COMMON ACROSS VARIOUS SECTORS

FIGURE 28 REVENUE STREAMS FOR 5G SERVICES

5.2.3.2 Demand for private 5G across enterprises, government, and industrial sectors.

FIGURE 29 KEY FUNCTIONAL AREAS TO DEPLOY PRIVATE WIRELESS NETWORKS IN MANUFACTURING

5.2.4 CHALLENGES

5.2.4.1 Heavy spending on deploying 5G core

5.2.4.2 Uncertainty around RoI and other unprecedented challenges

5.3 CASE STUDY ANALYSIS

5.3.1 T-MOBILE

5.3.2 SK TELECOM

5.3.3 NOKIA

5.3.4 ERICSSON

5.4 TECHNOLOGY ANALYSIS

5.4.1 INTRODUCTION

5.4.2 WI-FI

5.4.3 WIMAX

5.4.4 NETWORK SLICING IN RADIO ACCESS NETWORK

5.4.5 NETWORK SLICING IN CORE NETWORK

5.4.6 NETWORK SLICING IN TRANSPORT NETWORK

5.4.7 SMALL CELL NETWORKS

5.4.8 LONG TERM EVOLUTION NETWORK

FIGURE 30 LTE NETWORK LAUNCHED WORLDWIDE (2019)

5.4.9 CITIZENS BROADBAND RADIO SERVICE

FIGURE 31 THREE-TIER MODEL FOR CITIZENS BROADBAND RADIO SERVICE SPECTRUM ACCESS

5.4.10 MULTEFIRE

5.5 REGULATORY IMPLICATIONS

5.5.1 GENERAL DATA PROTECTION REGULATION

5.5.2 CALIFORNIA CONSUMER PRIVACY ACT

5.5.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.5.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.5.5 DIGITAL IMAGING AND COMMUNICATIONS IN MEDICINE

5.5.6 HEALTH LEVEL SEVEN

5.5.7 GRAMM-LEACH-BLILEY ACT

5.5.8 SARBANES-OXLEY ACT

5.5.9 SOC2

5.5.10 COMMUNICATIONS DECENCY ACT

5.5.11 DIGITAL MILLENNIUM COPYRIGHT ACT

5.5.12 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

5.5.13 LANHAM ACT

5.6 VALUE CHAIN ANALYSIS

FIGURE 32 5G CORE MARKET: VALUE CHAIN ANALYSIS

5.6.1 TELECOM ORIGINAL EQUIPMENT MANUFACTURERS

5.6.2 5G RADIO

5.6.3 5G CORE

5.6.4 5G TRANSPORT

5.6.5 NETWORK FUNCTION VIRTUALIZATION/SOFTWARE DEFINED NETWORKING/CLOUD SERVICE PROVIDERS

5.6.6 SYSYTEM INTEGRATORS/MANAGED SERVICE PROVIDERS

5.6.7 END USERS

5.7 ECOSYSTEM

FIGURE 33 5G CORE MARKET: ECOSYSTEM

5.7.1 NETWORK INFRASTRUCTURE ENABLERS

5.7.2 GOVERNMENT REGULATORY AUTHORITIES

5.7.3 SYSTEM INTEGRATORS

5.7.4 INDUSTRIAL PARTNERS

5.7.5 STRATEGIC CONSULTANTS

5.7.6 ORIGINAL EQUIPMENT MANUFACTURERS

5.7.7 CUSTOMER PREMISES EQUIPMENT

5.7.8 VIRTUALIZATION VENDORS

5.7.9 CLOUD SERVICE PROVIDERS

5.7.10 NEUTRAL HOST PROVIDERS

5.8 PATENT ANALYSIS

TABLE 3 EUROPE PATENT APPLICATION, BY COUNTRY

TABLE 4 EUROPE PATENT APPLICATION, BY TECHNOLOGY FIELD

FIGURE 34 EUROPE PATENT APPLICATION: DIGITAL TECHNOLOGY, BY APPLICANT

FIGURE 35 STANDARD ESSENTIAL PATENTS: 5G

FIGURE 36 4G AND 5G DECLARED PATENT PORTFOLIOS BY DECLARING THE COMPANY

5.9 PRICING ANALYSIS

5.10 COVID-19 MARKET OUTLOOK FOR 5G CORE

FIGURE 37 INCREASING DEMAND FOR THE 5G CORE MARKET DUE TO URLLC, EMBB, AND MMTC

FIGURE 38 SECURITY CONCERNS IN 5G CORE AND HIGH INVESTMENT IN DEPLOYMENTS OF 5G CORE ARE THE KEY ISSUES

5.11 PORTER¡¯S FIVE FORCES MODEL

FIGURE 39 5G CORE PORTER¡¯S FIVE FORCES MODEL

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 BARGAINING POWER OF SUPPLIERS

5.11.5 COMPETITION RIVALRY

6 5G CORE MARKET, BY COMPONENT (Page No. - 86)

6.1 INTRODUCTION

FIGURE 40 MARKET SCENARIO: OPTIMISTIC, REALISTIC, AND PESSIMISTIC

FIGURE 41 SERVICES SEGMENT TO EXHIBIT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 5 MARKET SIZE, BY COMPONENT, 2020¨C2025 (USD MILLION)

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: MARKET SCENARIO, COVID-19

6.2 SOLUTIONS

TABLE 6 SOLUTIONS: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

6.3 SERVICES

FIGURE 42 MANAGED SERVICES SEGMENT TO EXHIBIT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 7 5G CORE MARKET SIZE, BY SERVICE, 2020¨C2025 (USD MILLION)

TABLE 8 SERVICES: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

TABLE 9 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

6.3.2 MANAGED SERVICES

TABLE 10 MANAGED SERVICES: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

7 5G CORE MARKET ANALYSIS, BY DEPLOYMENT MODEL (Page No. - 94)

7.1 INTRODUCTION

FIGURE 43 CLOUD DEPLOYMENT MODEL TO EXHIBIT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 11 MARKET SIZE, BY DEPLOYMENT MODEL, 2020¨C2025 (USD MILLION)

7.1.1 DEPLOYMENT MODEL: MARKET DRIVERS

7.1.2 DEPLOYMENT MODEL: MARKET SCENARIO; COVID-19

7.2 ON-PREMISES

TABLE 12 ON-PREMISES: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

7.3 CLOUD

TABLE 13 CLOUD: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

8 5G CORE MARKET, BY END USER (Page No. - 98)

8.1 INTRODUCTION

FIGURE 44 ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 14 MARKET SIZE, BY END USER, 2020¨C2025 (USD MILLION)

8.1.1 END USERS: MARKET DRIVERS

8.1.2 END USERS: COVID-19 IMPACT

FIGURE 45 5G FREQUENCY BANDS WORLDWIDE

8.2 TELECOM OPERATORS

8.2.1 STATE OF 5G COMMERCIALIZATION

TABLE 15 GLOBAL 5G LAUNCH

TABLE 16 TELECOM OPERATORS: CAPITAL EXPENDITURE, 2017¨C2019 (USD MILLION)

TABLE 17 TELECOM OPERATORS: 5G CORE MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

8.3 ENTERPRISES

TABLE 18 NUMBER OF INDUSTRIES, BY SECTOR

TABLE 19 GLOBAL PRIVATE LTE AND 5G SPECTRUM, BY COUNTRY

TABLE 20 ENTERPRISES: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9 5G CORE MARKET, BY NETWORK FUNCTION (Page No. - 111)

9.1 INTRODUCTION

FIGURE 46 USER PLANE FUNCTION SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 21 MARKET SIZE, BY NETWORK FUNCTION, 2020¨C2025 (USD MILLION)

9.1.1 NETWORK FUNCTIONS: MARKET DRIVERS

9.1.2 NETWORK FUNCTIONS: COVID-19 IMPACT

9.2 ACCESS AND MOBILITY MANAGEMENT FUNCTION

TABLE 22 ACCESS AND MOBILITY MANAGEMENT FUNCTION: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9.3 SESSION MANAGEMENT FUNCTION

TABLE 23 SESSION MANAGEMENT FUNCTION: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9.4 USER PLANE FUNCTION

TABLE 24 USER PLANE FUNCTION: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9.5 POLICY CONTROL FUNCTION

TABLE 25 POLICY CONTROL FUNCTION: 5G CORE MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9.6 NETWORK EXPOSURE FUNCTION

TABLE 26 NETWORK EXPOSURE FUNCTION: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9.7 NF REPOSITORY FUNCTION

TABLE 27 NF REPOSITORY FUNCTION: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9.8 UNIFIED DATA MANAGEMENT

TABLE 28 UNIFIED DATA MANAGEMENT: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9.9 AUTHENTICATION SERVER FUNCTION

TABLE 29 AUTHENTICATION SERVER FUNCTION: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9.10 APPLICATION FUNCTION

TABLE 30 APPLICATION FUNCTION: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9.11 NETWORK SLICE SELECTION FUNCTION

TABLE 31 NETWORK SLICE SELECTION FUNCTION: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

9.12 OTHERS

TABLE 32 OTHERS: MARKET SIZE, BY REGION, 2020¨C2025 (USD MILLION)

10 5G CORE MARKET, BY REGION (Page No. - 120)

10.1 INTRODUCTION

FIGURE 47 ASIA PACIFIC TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 48 ASIA PACIFIC TO LEAD THE MARKET DURING THE FORECAST PERIOD

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: PESTLE ANALYSIS OF THE MARKET

TABLE 33 NORTH AMERICA: PESTLE ANALYSIS

10.2.3 NORTH AMERICA: COVID-19 IMPACT

FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

TABLE 34 NORTH AMERICA: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY NETWORK FUNCTION, 2020-2025 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.2.4 UNITED STATES

FIGURE 50 UNITED STATES: TELECOM OPERATOR¡¯S CAPITAL EXPENDITURE, 2017-2019 (USD MILLION)

FIGURE 51 UNITED STATES: WIRELESS INDUSTRY¡¯S CUMULATIVE CAPITAL EXPENDITURE, 2001-2019

10.2.4.1 United States: Regulatory Norms

TABLE 40 UNITED STATES: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 41 UNITED STATES: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 42 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 43 UNITED STATES: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

10.2.5 CANADA

FIGURE 52 CANADA: TELECOM OPERATOR¡¯S CAPITAL EXPENDITURE, 2017-2019 (USD MILLION)

10.2.5.1 Canada: Regulatory Norms

TABLE 44 CANADA: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 45 CANADA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 46 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 47 CANADA: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: PESTLE ANALYSIS OF MARKET

TABLE 48 EUROPE: PESTLE ANALYSIS

10.3.3 EUROPE: COVID-19 IMPACT

FIGURE 53 EUROPEAN UNION RESPONSE TO THE COVID-19 CRISIS

TABLE 49 EUROPE: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY NETWORK FUNCTION, 2020-2025 (USD MILLION)

TABLE 54 EUROPE: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.3.4 UNITED KINGDOM

FIGURE 54 UNITED KINGDOM: TELECOM OPERATOR¡¯S CAPITAL EXPENDITURE, 2017-2019 (USD MILLION)

10.3.4.1 United Kingdom: Regulatory Norms

TABLE 55 UNITED KINGDOM: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 56 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 57 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 58 UNITED KINGDOM: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

10.3.5 GERMANY

FIGURE 55 GERMANY: TELECOM OPERATOR¡¯S CAPITAL EXPENDITURE, 2017-2019 (USD MILLION)

10.3.5.1 Germany: Regulatory Norms

TABLE 59 GERMANY: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 60 GERMANY: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 61 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 62 GERMANY: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: PESTLE ANALYSIS OF MARKET

TABLE 63 ASIA PACIFIC: PESTLE ANALYSIS

10.4.3 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 56 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 64 ASIA PACIFIC: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY NETWORK FUNCTION, 2020-2025 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.4.4 CHINA

FIGURE 57 CHINA: TELECOM OPERATOR¡¯S CAPITAL EXPENDITURE, 2017-2019 (USD MILLION)

10.4.4.1 China: Regulatory Norms

TABLE 70 CHINA: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 71 CHINA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 72 CHINA: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 73 CHINA: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

10.4.5 JAPAN

10.4.5.1 Japan: Regulatory Norms

TABLE 74 JAPAN: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 75 JAPAN: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 76 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 77 JAPAN: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

10.4.6 AUSTRALIA

TABLE 78 AUSTRALIAN BUSINESS SUMMARY BY INDUSTRY (JUNE 2019)

10.4.6.1 Australia: Regulatory Norms

TABLE 79 AUSTRALIA: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 80 AUSTRALIA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 81 AUSTRALIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 82 AUSTRALIA: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

10.4.7 SOUTH KOREA

10.4.7.1 South Korea: Regulatory Norms

TABLE 83 SOUTH KOREA: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 84 SOUTH KOREA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 85 SOUTH KOREA: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 86 SOUTH KOREA: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

10.4.8 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD

TABLE 87 REST OF THE WORLD: 5G CORE MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

TABLE 88 REST OF THE WORLD: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 89 REST OF THE WORLD: MARKET SIZE, BY DEPLOYMENT MODEL, 2020-2025 (USD MILLION)

TABLE 90 REST OF THE WORLD: MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

TABLE 91 REST OF THE WORLD: MARKET SIZE, BY NETWORK FUNCTION, 2020-2025 (USD MILLION)

10.5.1 MIDDLE EAST AND AFRICA

10.5.1.1 Middle East and Africa: 5G Core Market Drivers

10.5.1.2 Middle East and Africa: Covid-19 Impact

10.5.1.3 Kingdom of Saudi Arabia

10.5.1.3.1 Kingdom of Saudi Arabia: Regulatory Norms

10.5.1.4 United Arab Emirates

10.5.1.4.1 United Arab Emirates: Regulatory Norms

10.5.1.5 South Africa

10.5.1.5.1 South Africa: Regulatory Norms

10.5.1.6 Rest of the Middle East and Africa

10.5.2 LATIN AMERICA

10.5.2.1 Latin America: 5G Core Market Drivers

10.5.2.2 Latin America: Covid-19 Impact

10.5.2.3 Brazil

10.5.2.3.1 Brazil: Regulatory Norms

10.5.2.4 Mexico

10.5.2.4.1 Mexico: Regulatory Norms

10.5.2.5 Rest of Latin America

11 COMPETITIVE LANDSCAPE (Page No. - 185)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 58 MARKET EVALUATION FRAMEWORK, 2019-2020

11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 59 HISTORIC FIVE YEARS REVENUE ANALYSIS OF LEADING PLAYERS

11.4 MARKET SHARE ANALYSIS

11.4.1 INTRODUCTION

FIGURE 60 MARKET SHARE ANALYSIS OF 5G CORE PLAYERS

11.5 RANKING OF KEY PLAYERS IN THE 5G CORE MARKET, 2020

FIGURE 61 RANKING OF KEY PLAYERS, 2020

11.6 COMPANY EVALUATION MATRIX

11.6.1 STAR

11.6.2 EMERGING LEADER

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 62 5G CORE MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

11.7 PRODUCT PORTFOLIO AND BUSINESS STRATEGY ANALYSIS OF 5G CORE VENDORS

FIGURE 63 PRODUCT PORTFOLIO ANALYSIS OF 5G CORE VENDORS

FIGURE 64 BUSINESS STRATEGY ANALYSIS OF 5G CORE VENDORS

12 COMPANY PROFILES (Page No. - 193)

12.1 INTRODUCTION

(Business Overview, Solutions & Services, Key Insights, Recent Developments, MnM View)*

12.2 ERICSSON

FIGURE 65 ERICSSON: COMPANY SNAPSHOT

12.3 HUAWEI

FIGURE 66 HUAWEI: COMPANY SNAPSHOT

12.4 NOKIA

FIGURE 67 NOKIA: COMPANY SNAPSHOT

12.4.2 SOLUTIONS AND SERVICES OFFERED

12.5 SAMSUNG

FIGURE 68 SAMSUNG: COMPANY SNAPSHOT

12.6 ZTE

FIGURE 69 ZTE: COMPANY SNAPSHOT

12.7 AFFIRMED NETWORKS

12.8 CISCO

FIGURE 70 CISCO: COMPANY SNAPSHOT

12.9 MAVENIR

12.10 NEC

FIGURE 71 NEC: COMPANY SNAPSHOT

12.11 ORACLE

FIGURE 72 ORACLE: COMPANY SNAPSHOT

12.12 ATHONET

12.13 CASA SYSTEMS

12.14 CUMUCORE

12.15 DRUID SOFTWARE

12.16 HPE

12.17 IPLOOK

12.18 METASWITCH

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 244)

13.1 5G INFRASTRUCTURE MARKET

13.1.1 MARKET DEFINITION

13.1.2 LIMITATIONS OF THE STUDY

13.1.3 MARKET OVERVIEW

13.1.4 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE

TABLE 92 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018¨C2027 (USD MILLION)

TABLE 93 5G COMMUNICATION INFRASTRUCTURE MARKET, BY REGION, 2018¨C2027 (USD MILLION)

TABLE 94 5G COMMUNICATION INFRASTRUCTURE MARKET IN THE REST OF THE WORLD, BY REGION, 2018¨C2027 (USD MILLION)

TABLE 95 5G COMMUNICATION INFRASTRUCTURE MARKET, BY END USER, 2018¨C2027 (USD MILLION)

13.1.5 5G INFRASTRUCTURE MARKET, BY REGION

TABLE 96 5G INFRASTRUCTURE MARKET, BY REGION, 2018¨C2027 (USD MILLION)

TABLE 97 5G INFRASTRUCTURE MARKET IN NORTH AMERICA, BY OPERATIONAL FREQUENCY, 2018¨C2027 (USD MILLION)

TABLE 98 5G INFRASTRUCTURE MARKET IN NORTH AMERICA, BY CORE NETWORK TECHNOLOGY, 2018¨C2027 (USD MILLION)

TABLE 99 5G INFRASTRUCTURE MARKET IN CANADA, BY CORE NETWORK TECHNOLOGY, 2020¨C2027 (USD MILLION)

TABLE 100 5G INFRASTRUCTURE MARKET IN MEXICO, BY COMMUNICATION INFRASTRUCTURE, 2020¨C2027 (USD MILLION)

TABLE 101 5G INFRASTRUCTURE MARKET IN EUROPE, BY OPERATIONAL FREQUENCY, 2018¨C2027 (USD MILLION)

TABLE 102 5G INFRASTRUCTURE MARKET IN GERMANY, BY COMMUNICATION INFRASTRUCTURE, 2019¨C2027 (USD MILLION)

TABLE 103 5G INFRASTRUCTURE MARKET IN ITALY, BY CORE NETWORK TECHNOLOGY, 2019¨C2027 (USD MILLION)

TABLE 104 5G INFRASTRUCTURE MARKET IN THE REST OF EUROPE, BY COMMUNICATION INFRASTRUCTURE, 2018¨C2027 (USD MILLION)

TABLE 105 5G INFRASTRUCTURE MARKET IN THE REST OF EUROPE, BY CORE NETWORK TECHNOLOGY, 2018¨C2027 (USD MILLION)

TABLE 106 5G INFRASTRUCTURE MARKET IN ASIA PACIFIC, BY COUNTRY, 2018¨C2027 (USD MILLION)

TABLE 107 5G INFRASTRUCTURE MARKET IN ASIA PACIFIC, BY COMMUNICATION INFRASTRUCTURE, 2018¨C2027 (USD MILLION)

TABLE 108 5G INFRASTRUCTURE MARKET IN ASIA PACIFIC, BY END USER, 2018¨C2027 (USD MILLION)

TABLE 109 5G INFRASTRUCTURE MARKET IN ASIA PACIFIC, BY CORE NETWORK TECHNOLOGY, 2018¨C2027 (USD MILLION)

TABLE 110 5G INFRASTRUCTURE MARKET IN JAPAN, BY COMMUNICATION INFRASTRUCTURE, 2019¨C2027 (USD MILLION)

TABLE 111 5G INFRASTRUCTURE MARKET IN JAPAN, BY CORE NETWORK TECHNOLOGY, 2019¨C2027 (USD MILLION)

TABLE 112 5G INFRASTRUCTURE MARKET IN THE REST OF ASIA PACIFIC, BY COMMUNICATION INFRASTRUCTURE, 2019¨C2027 (USD MILLION)

TABLE 113 5G INFRASTRUCTURE MARKET IN REST OF THE WORLD, BY REGION, 2018¨C2027 (USD MILLION)

TABLE 114 5G INFRASTRUCTURE MARKET IN THE REST OF THE WORLD, BY COMMUNICATION INFRASTRUCTURE, 2018¨C2027 (USD MILLION)

TABLE 115 5G INFRASTRUCTURE MARKET IN THE REST OF THE WORLD, BY END USER, 2018¨C2027 (USD MILLION)

TABLE 116 5G INFRASTRUCTURE MARKET IN THE REST OF THE WORLD, BY CORE NETWORK TECHNOLOGY, 2018¨C2027 (USD MILLION)

TABLE 117 5G INFRASTRUCTURE MARKET IN THE MIDDLE EAST AND AFRICA, BY COMMUNICATION INFRASTRUCTURE, 2018¨C2027 (USD MILLION)

TABLE 118 5G INFRASTRUCTURE MARKET IN SOUTH AMERICA, BY COMMUNICATION INFRASTRUCTURE, 2020¨C2027 (USD MILLION)

TABLE 119 5G INFRASTRUCTURE MARKET IN SOUTH AMERICA, BY CORE NETWORK TECHNOLOGY, 2020¨C2027 (USD MILLION)

13.2 LTE AND 5G BROADCAST MARKET

13.2.1 MARKET DEFINITION

13.2.2 LIMITATIONS OF THE STUDY

13.2.3 MARKET OVERVIEW

13.2.4 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY

TABLE 120 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015¨C2024 (USD MILLION)

TABLE 121 LTE AND 5G BROADCAST MARKET, BY END USER, 2015¨C2024 (USD MILLION)

13.2.5 LTE AND 5G BROADCAST MARKET, BY REGION

TABLE 122 NORTH AMERICAN LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015¨C2024 (USD MILLION)

TABLE 123 NORTH AMERICAN LTE BROADCAST MARKET, BY COUNTRY, 2015¨C2024 (USD MILLION)

TABLE 124 NORTH AMERICAN 5G-BROADCAST MARKET, BY COUNTRY, 2015¨C2024 (USD MILLION)

TABLE 125 EUROPEAN LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015¨C2024 (USD MILLION)

TABLE 126 EUROPE LTE BROADCAST MARKET, BY COUNTRY, 2015¨C2024 (USD MILLION)

TABLE 127 ASIA PACIFIC LTE BROADCAST MARKET, BY COUNTRY, 2015¨C2024 (USD MILLION)

TABLE 128 REST OF THE WORLD LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015¨C2024 (USD MILLION)

14 APPENDIX (Page No. - 260)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS¡¯ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for the 5G core market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the 5G core market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Journals such as the International Journal of Computer Science and Information Technology and Security (IJCSITS) and Scientific.Net; and various associations, including the European Association of Next Generation Telecommunications Innovators (EANGTI) and International Telecommunication Union (ITU) were referred to, for consolidating the report. Secondary research was mainly used to obtain key information about the industry insights, market¡¯s monetary chain, overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

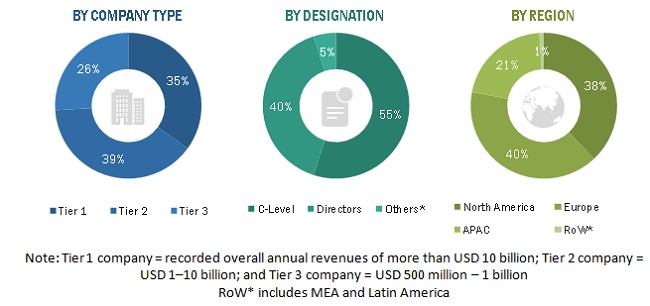

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the 5G core market. The primary sources from the demand side included telecom operators, network administrators/consultants/ specialists, Chief Information Officers (CIOs), and subject matter experts from telecom and government associations.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the 5G core market. The first approach involves the estimation of the market size by summing up companies¡¯ revenue generated through the sale of solutions and services. The top-down and bottom-up approaches were used to estimate and validate the size of the 5G core market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors who offer services in the market was prepared while using the top-down approach. The market revenue for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The aggregate of all companies¡¯ revenues was extrapolated to reach the overall market size. Further, each subsegment was studied and analyzed for its regional market size and country-level penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global 5G core market based on components (solutions and services), deployment model, end user, network functions, and regions from 2020 to 2025, and analyze various macro and microeconomic factors affecting the market growth

- To forecast the size of the market segments for 4 regions: North America, Europe, Asia Pacific (APAC), and RoW.

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To analyze each submarket for individual growth trends, prospects, and contributions to the global market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the global 5G core market

- To profile the key market players, such as top vendors and startups; provide a comparative analysis based on their business overviews, regional presence, product offerings, and business strategies; and illustrate the market¡¯s competitive landscape

- To track and analyze competitive developments, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations, in the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile key market players; provide a comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. During the COVID-19 pandemic, the telecom sector is playing a vital role across the globe to support the digital infrastructure of countries. Every individual and government, irrespective of federal, state, central, local, and provinces, has been in constant touch with one other in the society to provide and get real-time information on COVID-19. Currently, healthcare, telecommunication, media and entertainment, utilities, and government institutes are functioning day and night to stabilize the condition and facilitate prerequisite services to every individual.

COVID-19 cases are growing day-by-day, as several infected cases have been on the rise. In line with individuals, COVID-19 has a massive impact on large enterprises and SMEs. Core industries, such as manufacturing, automotive, textile, transportation and logistics, travel and hospitality, and consumer goods, have been closed due to country-level lockdown across the globe. This would have a substantial impact on the global economy in terms of the decline in GDP. For ages, SMEs are acting as the backbone of the economy. In the current situation, SMEs are the most affected due to the COVID-19 pandemic.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company¡¯s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G Core Market