Hospital EMR Systems Market by Component (Software, Services, Hardware), Delivery Mode (Cloud, On-premise), Type (Specialty EMR), Hospital Size (Small, Large Hospitals) and Region (North America, Europe, Asia Pacific) - Global Forecasts to 2025

Market Growth Outlook Summary

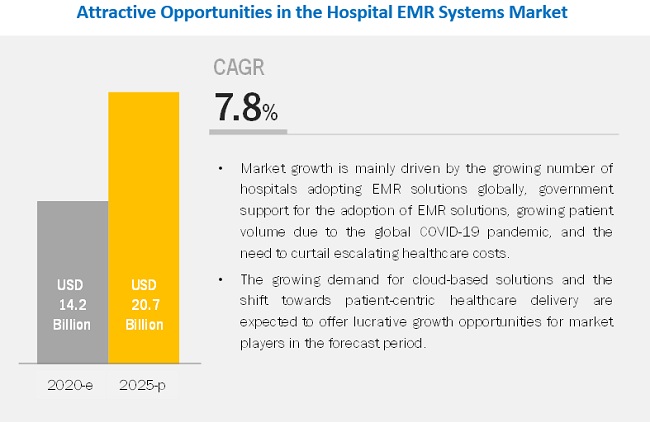

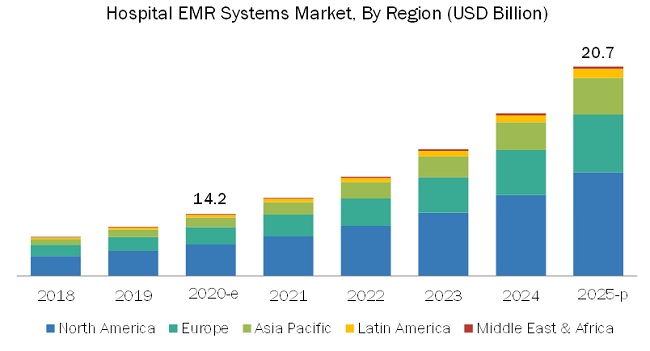

The global hospital EMR systems market growth forecasted to transform from USD 14.2 billion in 2020 to USD 20.7 billion by 2025, driven by a CAGR of 7.8%. This growth is driven by increasing hospital adoption of EMR solutions, the need to reduce healthcare costs, government mandates, and the rise in patient volume due to the COVID-19 pandemic. However, high deployment costs and data security concerns are notable limitations. In 2019, the services segment dominated the market, driven by the recurring nature of services and increased hospital admissions. The on-premise segment led in delivery mode, though cloud-based solutions are expected to grow rapidly. General EMR solutions held the largest market share by type, due to their multifunctional capabilities. Small and medium-sized hospitals dominated by hospital size, thanks to easier data transfer, lower costs, and ease of deployment. North America, led by the US, will continue to dominate the market, supported by government mandates and major EHR vendors such as Epic Systems Corporation, Cerner Corporation, and Allscripts Healthcare Solutions. Key market players include Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, and others. Recent developments include MTBC's acquisition of CareCloud, MEDITECH's collaboration with Google, NextGen Healthcare's acquisition of OTTO Health, and Epic Systems' partnership with Teledoc Health.

By component, the services segment accounted for the largest share of the hospital EMR systems market in 2019.

Based on components, the market is segmented into services, software, and hardware. In 2019, the services segment accounted for the largest share of the hospital EMR systems market. Growth in this segment is mainly due to the recurring nature of services, such as training and education, installation, consulting, and maintenance services, as well as the increase in the number of patients being admitted to hospitals.

By delivery mode, the on-premise segment accounted for the largest share of the hospital EMR systems market in 2019.

Based on the delivery mode, the market is segmented into on-premise and cloud-based solutions. The cloud-based segment is expected to be the fastest-growing segment during the forecast period. An increasing number of hospitals have shifted their preference for EMR systems from on-premise models to cloud-based models, which has contributed towards its market growth.

By type, the general EMR solutions segment accounted for the largest share of the hospital EMR systems market in 2019.

Based on type, the market is segmented into general EMR and specialty EMR solutions. In 2019, the general EMR solutions segment accounted for the largest share of the hospital EMR systems market. The large share of this market segment can be attributed to the multifunction, multi-specialty capabilities of general EMRs, enabling their use in various specialties through flexible functioning and incorporated plugins.

By hospital size, the small and medium-sized hospitals segment accounted for the largest share of the market in 2019.

Based on hospital size, the hospital EMR systems market is segmented into small and medium-sized hospitals and large hospitals. In 2019, the small and medium-sized hospitals segment accounted for the largest share of the hospital EMR systems market. The large share of this segment can be attributed to the faster adoption of EMRs in small and medium-sized hospitals owing to factors such as ease of transfer of patient data among healthcare providers, lower upfront costs, and ease of deployment.

North America will continue to dominate the hospital EMR systems market during the forecast period.

North America accounted for the largest share of the global hospital EMR systems market, followed by Europe. The large share of this region can be attributed to the government mandates for implementing EHR solutions in hospitals; the presence of major EHR vendors such as Epic Systems Corporation (US), Cerner Corporation (US), MEDITECH (US), CPSI (US), and Allscripts Healthcare Solutions, Inc. (US) in the region; and technological advancements for the development of next-generation EHR solutions.

Key Market Players

Cerner Corporation (US), Epic Systems Corporation (US), Allscripts Healthcare Solutions, Inc. (US), MEDITECH (US), CPSI (US), GE Healthcare (US), athenahealth, Inc. (US), MEDHOST (US), eClinicalWorks (US), NextGen Healthcare (US), Intersystems Corporation (US), MTBC (US), Cantata Health (US), Advanced Data Systems Corporation (US), and CureMD (US) are the leading players in the global hospital EMR systems market.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Component, delivery mode, type, and hospital size |

|

Geographies covered |

|

|

Companies Covered |

Cerner Corporation (US), Epic Systems Corporation (US), Allscripts Healthcare Solutions, Inc. (US), MEDITECH (US), CPSI (US), GE Healthcare (US), athenahealth, Inc. (US), MEDHOST (US), eClinicalWorks (US), NextGen Healthcare (US), Intersystems Corporation (US), MTBC (US), Cantata Health (US), Advanced Data Systems Corporation (US), CureMD (US) |

The research report categorizes the hospital EMR systems market into the following segments and subsegments:

By Component

- Services

- Software

- Hardware

By Delivery Mode

- On-premise

- Cloud-based

By Type

- General EMR Solutions

- Specialty EMR Solutions

By Hospital Size

- Small and Medium-sized Hospitals

- Large Hospitals

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In 2020, MTBC acquired CareCloud Corporation that will help the company yield greater operating efficiencies, accelerate growth, and provide more flexibility for future expansion.

- In 2019, MEDITECH collaborated with Google to offer EHR data through the Google Cloud Platform. This helped to securely deliver patient data, enhance scalability, and facilitate interoperability.

- In 2019, NextGen Healthcare acquired OTTO Health that helped the company provide integrated virtual care capabilities to its software. The company has integrated the OTTO Health platform with the NextGen EHR platform.

- In 2019, Epic Systems partnered with Teledoc Health to integrate Teledoc Health’s virtual care platform with Epic’s App Orchard that would help the company conduct telehealth video visits.

Key Questions Addressed in the Report

- Who are the top 10 players operating in the global hospital EMR systems market?

- What covers the drivers, restraints, opportunities, and challenges in the hospital EMR systems market?

- What are the new technological advancements in the hospital EMR systems market?

- What are the growth trends in the hospital EMR systems market at the segmental and overall market levels?

- What are the new use cases and disruptions in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKETS COVERED

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH APPROACH

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 33)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 HOSPITAL EMR SYSTEMS MARKET OVERVIEW

4.2 HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE AND COMPONENT (2019)

4.3 HOSPITAL EMR SYSTEMS MARKET, BY REGION (2018–2025)

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Government support for the adoption of EMR solutions

5.2.1.2 Growing patient volume due to the global outbreak of COVID-19

5.2.1.3 Need to curtail escalating healthcare costs

5.2.2 RESTRAINTS

5.2.2.1 Need for significant investments in infrastructure development and high cost of deployment

5.2.2.2 Reluctance to adopt EMR solutions in developing countries

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for cloud-based EHR solutions

5.2.3.2 Shift towards patient-centric healthcare delivery

5.2.4 CHALLENGES

5.2.4.1 Interoperability issues

5.2.4.2 Data security concerns

6 INDUSTRY INSIGHTS (Page No. - 47)

6.1 INTRODUCTION

6.2 IMPACT OF COVID-19 ON THE HOSPITAL EMR SYSTEMS MARKET

6.2.1 LIMITATIONS OF EMR DURING COVID-19

6.2.2 STRATEGIES ADOPTED BY EMR VENDORS DURING COVID-19

6.3 INCREASED ADOPTION OF EMR

6.4 TECHNOLOGY GIANTS ENTERING THE HEALTHCARE IT MARKET

6.5 INCREASED PREFERENCE FOR CLOUD-BASED EMR IN HOSPITALS

6.6 TECHNOLOGICAL ADVANCEMENTS IN EMR SOLUTIONS

7 HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT (Page No. - 56)

7.1 INTRODUCTION

7.2 SERVICES

7.2.1 INTRODUCTION OF COMPLEX SOFTWARE AND NEED FOR SOFTWARE INTEGRATION & INTEROPERABILITY ARE SUPPORTING MARKET GROWTH

7.3 SOFTWARE

7.3.1 FREQUENT NEED FOR UPGRADES AND IMPROVEMENTS IN SOFTWARE APPLICATIONS ARE MAJOR FACTORS DRIVING GROWTH

7.4 HARDWARE

7.4.1 NEED FOR FASTER DATA EXCHANGE & BETTER INTEROPERABILITY ARE INCREASING THE ADOPTION OF HARDWARE IN HOSPITALS

8 HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE (Page No. - 63)

8.1 INTRODUCTION

8.2 ON-PREMISE

8.2.1 ENHANCED CONTROL AND COST BENEFITS OFFERED BY ON-PREMISE SOLUTIONS ARE MAJOR FACTORS SUPPORTING MARKET GROWTH

8.3 CLOUD-BASED

8.3.1 INCREASING NUMBER OF HEALTHCARE ORGANIZATIONS SHIFTING FROM ON-PREMISE TO CLOUD-BASED MODELS TO DRIVE GROWTH

9 HOSPITAL EMR SYSTEMS MARKET, BY TYPE (Page No. - 69)

9.1 INTRODUCTION

9.2 GENERAL EMR SOLUTIONS

9.2.1 MULTI-FUNCTIONAL AND MULTI-SPECIALTY CAPABILITIES OF GENERAL EMR SOLUTIONS ARE MAJOR FACTORS SUPPORTING MARKET GROWTH

9.3 SPECIALTY EMR SOLUTIONS

9.3.1 INCREASING NUMBER OF SPECIALTY HOSPITALS GLOBALLY TO DRIVE GROWTH

10 HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE (Page No. - 75)

10.1 INTRODUCTION

10.2 SMALL AND MEDIUM-SIZED HOSPITALS

10.2.1 SMALL AND MEDIUM-SIZED HOSPITALS PROVIDE HIGH GROWTH OPPORTUNITIES FOR CLOUD-BASED EMRS

10.3 LARGE HOSPITALS

10.3.1 ADMISSION OF A LARGE NUMBER OF COVID-19 PATIENTS TO BOOST THE ADOPTION OF EMR IN LARGE HOSPITALS

11 HOSPITAL EMR SYSTEMS MARKET, BY REGION (Page No. - 79)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 US

11.2.1.1 Large number of COVID-19 patients and growing need to curtail soaring healthcare costs to drive market growth in the US

11.2.2 CANADA

11.2.2.1 Deployment of digital health initiatives to propel market growth

11.3 EUROPE

11.3.1 GERMANY

11.3.1.1 Government initiatives to boost the adoption of EMRs in the country to drive market growth

11.3.2 UK

11.3.2.1 Government initiatives to improve the adoption of EMR and eHealth solutions are a major driving factor

11.3.3 FRANCE

11.3.3.1 Upcoming retirement of a large number of French doctors will draw attention to the need for effective patient management solutions

11.3.4 REST OF EUROPE (ROE)

11.4 ASIA PACIFIC

11.4.1 JAPAN

11.4.1.1 Japan is the largest hospital EMR systems market in the APAC

11.4.2 CHINA

11.4.2.1 China is a lucrative market for EMR solutions due to strong government support for healthcare reforms

11.4.3 INDIA

11.4.3.1 Presence of a large number of hospitals and increasing incidence of chronic diseases to boost the demand for EMR solutions in hospitals

11.4.4 REST OF ASIA PACIFIC (ROAPAC)

11.5 LATIN AMERICA

11.5.1 DEVELOPMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

11.6 MIDDLE EAST & AFRICA

11.6.1 GROWING MEDICAL TOURISM TO SUPPORT MARKET GROWTH IN THE MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE (Page No. - 123)

12.1 OVERVIEW

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 STARS

12.2.2 EMERGING LEADERS

12.2.3 PERVASIVE PLAYERS

12.2.4 EMERGING COMPANIES

12.3 PRODUCT AND REGIONAL MATRIX: BY COMPANY

12.4 MARKET SHARE ANALYSIS

12.4.1 MARKET RANKING ANALYSIS METHODOLOGY

12.4.2 MARKET RANKING ANALYSIS FOR THE ASIA PACIFIC REGION

12.4.2.1 Key player analysis of the hospital EMR systems market in Japan

12.4.2.2 Key player analysis of the hospital EMR systems market in China

12.4.2.3 Key player analysis of the hospital EMR systems market in India

12.4.2.4 Key player analysis of the hospital EMR systems market in Australia and New Zealand

12.5 COMPETITIVE SITUATION & TRENDS

12.5.1 NEW PRODUCT LAUNCHES

12.5.2 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

12.5.3 ACQUISITIONS

13 COMPANY PROFILES (Page No. - 136)

(Business Overview, Products Offered, Recent Developments, MnM View)*

13.1 EPIC SYSTEMS CORPORATION

13.2 CERNER CORPORATION

13.3 MEDICAL INFORMATION TECHNOLOGY, INC.

13.4 COMPUTER PROGRAMS AND SYSTEMS, INC. (CPSI)

13.5 MEDHOST

13.6 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

13.7 ATHENAHEALTH, INC.

13.8 ECLINICALWORKS

13.9 GE HEALTHCARE

13.10 NEXTGEN HEALTHCARE

13.11 INTERSYSTEMS CORPORATION

13.12 CANTATA HEALTH

13.13 MTBC

13.14 ADVANCED DATA SYSTEMS CORPORATION

13.15 CUREMD

13.16 OTHER COMPANIES

13.16.1 DRCHRONO

13.16.2 KAREO

13.16.3 GREENWAY HEALTH

13.16.4 MODERNIZING MEDICINE

13.16.5 ADVANCEDMD

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 169)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (106 TABLES)

TABLE 1 DRIVERS: IMPACT ANALYSIS

TABLE 2 RESTRAINTS: IMPACT ANALYSIS

TABLE 3 OPPORTUNITIES: IMPACT ANALYSIS

TABLE 4 CHALLENGES: IMPACT ANALYSIS

TABLE 5 STAGES OF EMR ADOPTION

TABLE 6 COMPARISON OF VARIOUS TYPES OF EMR SOFTWARE PROVIDED BY SOME KEY PLAYERS

TABLE 7 HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 8 HOSPITAL EMR SERVICES PROVIDED BY KEY PLAYERS

TABLE 9 HOSPITAL EMR SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 10 HOSPITAL EMR SOFTWARE MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 11 HOSPITAL EMR HARDWARE MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 12 HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 13 ON-PREMISE DELIVERY MODE: PROS AND CONS

TABLE 14 ON-PREMISE HOSPITAL EMR SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 15 CLOUD-BASED DELIVERY MODE: PROS AND CONS

TABLE 16 CLOUD-BASED HOSPITAL EMR SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 18 KEY VENDORS OFFERING GENERAL EMR SOLUTIONS

TABLE 19 GENERAL HOSPITAL EMR SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 20 KEY VENDORS OFFERING SPECIALTY EMR SOLUTIONS

TABLE 21 SPECIALTY HOSPITAL EMR SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 23 HOSPITAL EMR SYSTEMS MARKET FOR SMALL AND MEDIUM-SIZED HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 24 HOSPITAL EMR SYSTEMS MARKET FOR LARGE HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 25 HOSPITAL EMR SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 NORTH AMERICA: HOSPITAL EMR SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 NORTH AMERICA: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 28 NORTH AMERICA: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 31 US: KEY MACROINDICATORS

TABLE 32 US: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 33 US: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 34 US: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 35 US: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 36 CANADA: KEY MACROINDICATORS

TABLE 37 CANADA: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 38 CANADA: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 39 CANADA: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 40 CANADA: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 41 EHEALTH PRIORITIES FOR HEALTHCARE PROVIDERS IN EUROPE, BY COUNTRY

TABLE 42 EUROPE: HOSPITAL EMR SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 EUROPE: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 44 EUROPE: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 45 EUROPE: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 46 EUROPE: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 47 GERMANY: KEY MACROINDICATORS

TABLE 48 GERMANY: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 49 GERMANY: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 50 GERMANY: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 51 GERMANY: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 52 UK: KEY MACROINDICATORS

TABLE 53 UK: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 54 UK: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 55 UK: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 UK: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 57 FRANCE: KEY MACROINDICATORS

TABLE 58 FRANCE: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 59 FRANCE: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 60 FRANCE: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 FRANCE: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 62 REST OF EUROPE: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 63 REST OF EUROPE: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 64 REST OF EUROPE: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 REST OF EUROPE: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 66 ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 67 ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 68 ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 69 ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 71 JAPAN: KEY MACROINDICATORS

TABLE 72 JAPAN: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 73 JAPAN: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 74 JAPAN: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 JAPAN: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 76 CHINA: KEY MACROINDICATORS

TABLE 77 CHINA: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 78 CHINA: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 79 CHINA: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 CHINA: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 81 INDIA: KEY MACROINDICATORS

TABLE 82 INDIA: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 83 INDIA: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 84 INDIA: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 INDIA: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 86 REST OF ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 87 REST OF ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 88 REST OF ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 REST OF ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 90 LATIN AMERICA: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 91 LATIN AMERICA: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 92 LATIN AMERICA: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 LATIN AMERICA: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA: HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2018–2025 (USD MILLION)

TABLE 98 MARKET EVALUATION FRAMEWORK: 2018 AND 2019 SAW PARTNERSHIPS AND COLLABORATIONS

TABLE 99 ASIA PACIFIC: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

TABLE 100 JAPAN: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

TABLE 101 CHINA: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

TABLE 102 INDIA: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

TABLE 103 AUSTRALIA AND NEW ZEALAND: HOSPITAL EMR SYSTEMS MARKET RANKING ANALYSIS, BY PLAYER, 2019

TABLE 104 NEW PRODUCT LAUNCHES

TABLE 105 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

TABLE 106 ACQUISITIONS

LIST OF FIGURES (40 FIGURES)

FIGURE 1 HOSPITAL EMR SYSTEMS MARKET SEGMENTATION

FIGURE 2 RESEARCH DESIGN

FIGURE 3 PRIMARY SOURCES

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 7 BOTTOM-UP APPROACH

FIGURE 8 HOSPITAL EMR SYSTEMS MARKET: CAGR PROJECTIONS FROM THE SUPPLY SIDE

FIGURE 9 TOP-DOWN APPROACH

FIGURE 10 MARKET DATA TRIANGULATION METHODOLOGY

FIGURE 11 HOSPITAL EMR SYSTEMS MARKET, BY COMPONENT, 2020 VS. 2025 (USD BILLION)

FIGURE 12 HOSPITAL EMR SYSTEMS MARKET, BY DELIVERY MODE, 2020 VS. 2025 (USD BILLION)

FIGURE 13 HOSPITAL EMR SYSTEMS MARKET, BY TYPE, 2020 VS. 2025 (USD BILLION)

FIGURE 14 HOSPITAL EMR SYSTEMS MARKET, BY HOSPITAL SIZE, 2020 VS. 2025 (USD BILLION)

FIGURE 15 GEOGRAPHICAL SNAPSHOT OF THE HOSPITAL EMR SYSTEMS MARKET

FIGURE 16 GOVERNMENT SUPPORT FOR THE ADOPTION OF EMR SOLUTIONS TO DRIVE MARKET GROWTH

FIGURE 17 SERVICES ACCOUNTED FOR THE LARGEST SHARE OF THE HOSPITAL EMR SYSTEMS MARKET IN 2019

FIGURE 18 NORTH AMERICA WILL CONTINUE TO DOMINATE THE HOSPITAL EMR SYSTEMS MARKET IN 2025

FIGURE 19 HOSPITAL ELECTRONIC MEDICAL RECORDS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 20 PERCENTAGE OF NON-FEDERAL ACUTE CARE HOSPITALS ADOPTING EMR SYSTEMS, BY LEVEL OF FUNCTIONALITY, 2008–2015

FIGURE 21 US: INCREASING USE OF EMR IN MOBILE TECHNOLOGY (2017)

FIGURE 22 PERCENTAGE OF HEALTHCARE PROFESSIONALS IN HOSPITALS THAT USE PUBLIC CLOUD TO STORE HEALTHCARE DATA, 2018

FIGURE 23 NORTH AMERICA: HOSPITAL EMR SYSTEMS MARKET SNAPSHOT

FIGURE 24 US: COVID-19 CASES, BY AGE GROUP

FIGURE 25 US: HOSPITAL EHR ADOPTION (2007–2018)

FIGURE 26 CANADA: EMR ADOPTION BY PRIMARY CARE PHYSICIANS (IN TERMS OF PERCENTAGE OF TOTAL NUMBER OF PHYSICIANS), 2012–2017

FIGURE 27 EUROPE: EHEALTH PRIORITIES IN HEALTH FACILITIES, 2019

FIGURE 28 EUROPE: EHEALTH CHALLENGES FACED BY HEALTHCARE PROVIDERS, 2019

FIGURE 29 EUROPE: HOSPITAL EMR SYSTEMS MARKET SNAPSHOT

FIGURE 30 APAC: HOSPITAL EMR SYSTEMS MARKET SNAPSHOT

FIGURE 31 HOSPITAL EMR SYSTEMS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING (2019)

FIGURE 32 HOSPITAL EMR SYSTEMS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2019

FIGURE 33 US: HOSPITAL EMR SYSTEMS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2019

FIGURE 34 CERNER CORPORATION: COMPANY SNAPSHOT (2019)

FIGURE 35 MEDITECH: COMPANY SNAPSHOT (2019)

FIGURE 36 CPSI: COMPANY SNAPSHOT (2019)

FIGURE 37 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2019)

FIGURE 38 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

FIGURE 39 NEXTGEN HEALTHCARE: COMPANY SNAPSHOT (2019)

FIGURE 40 MTBC: COMPANY SNAPSHOT (2019)

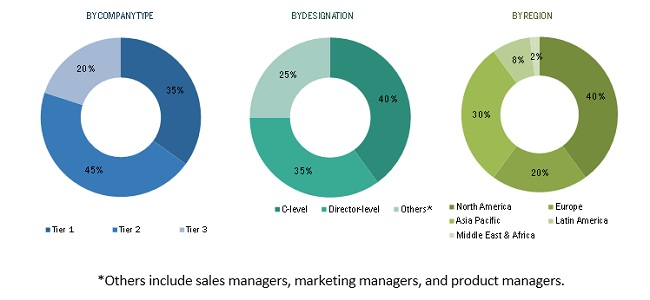

The study involved four major activities in estimating the size of the hospital EMR systems market. Exhaustive secondary research was done to collect information on the adoption of different technologies and their regional adoption trends. Industry experts further validated the data obtained through secondary research through primary research. Furthermore, the market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (country-level data for outpatient surgical procedures) and top-down approach (assessment of utilization/adoption/penetration trends, by component, delivery mode, type, and hospital size). After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources such as the US Department of Health and Human Services, Healthcare Information and Management Systems Society (HIMSS), National Association of Healthcare Quality, Centers for Disease Control and Prevention (CDC), Centers for Medicare and Medicaid Services (CMS), US Department of Labor, Agency for Healthcare Research and Quality (AHRQ), Medical Records Institute, General Physician Hospital Organization (GPHO), Association of Information and Image Management (AIIM), The Economist Intelligence Unit, American Health Information Management Association (AHIMA), Healthcare IT News, World Health Organization (WHO), annual reports/SEC filings, as well as investor presentations and press releases of key players have been used to identify and collect information useful for the study of this market.

Primary Research

Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess the dynamics of this market. The primary participants mainly include product managers, business development directors, sales managers, and healthcare providers across the industry. The breakdown of primaries is shown in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to anticipate and validate the size of the hospital EMR systems market and to estimate the size of various other dependent submarkets.

Data Triangulation

After arriving at the market size, the total hospital EMR systems market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To define, describe, and forecast the hospital EMR systems market concerning segments in component, delivery mode, type, hospital size, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall hospital EMR systems market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the hospital EMR systems market with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the hospital EMR systems market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as acquisitions, new tests/technology developments, geographical expansions, and research & development activities of the leading players in the hospital EMR systems market

Target Audience:

- Hospital EMR systems manufacturers

- Hospital EMR systems distributors

- Healthcare provider companies

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific hospital EMR systems market into South Korea, Australia, New Zealand, Singapore, and other countries

- Further breakdown of the Rest of Europe hospital EMR systems market into Italy, Spain, Russia, the Netherlands, Switzerland, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hospital EMR Systems Market