AR and VR Display Market by Device Type (AR HMDs, VR HMDs, AR HUDs, VR Projectors), Technology, Display Technology (LCD, OLED, Micro-LED), Application (Consumer, Commercial, Enterprise, Healthcare, Aerospace & Defense) & Region - Global Forecast to 2028

Updated on : Sep 12, 2024

AR and VR Display Market Size, Share and Growth

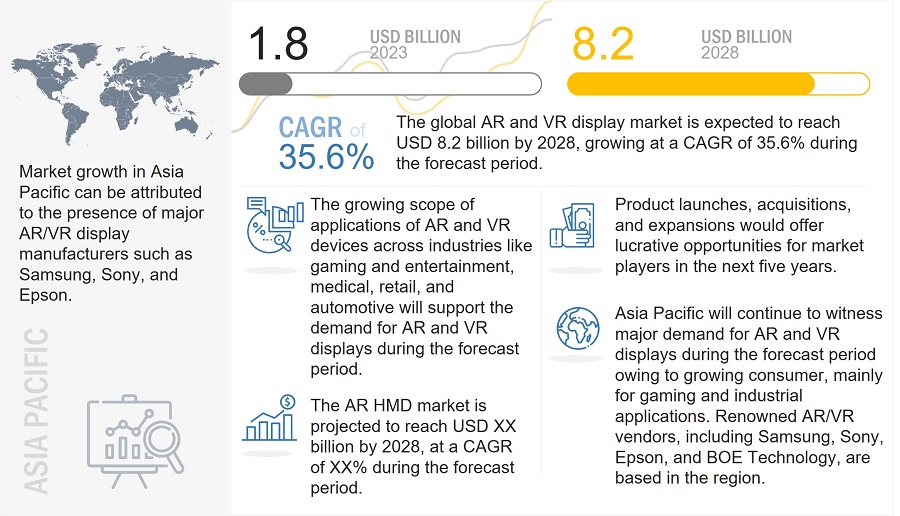

[244 Pages Report] AR and VR display market size is valued at USD 1.8 billion in 2023 and is anticipated to USD 8.2 billion by 2028; growing at a CAGR of 35.6% from 2023 to 2028.

Growing popularity of Metaverse, increasing demand for OLED displays in AR and VR devices, growing adoption of AR and VR HMDs in different industries, growing adoption of AR and VR devices in various applications, and adoption of AR and VR devices in gaming industry are key driving factors for the AR and VR display industry.

AR and VR Display Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

AR and VR Display Market Trends & Dynamics

Driver: Increasing demand for OLED displays in AR and VR devices

OLED is an emerging display technology and has become the mainstream display technology in many markets. OLED displays do not require a backlight; thus, they are thinner and more efficient than LCD displays. OLED displays offer high picture quality, bright colors, infinite contrast, fast response rate, and wide viewing angles, making them ideal for AR and VR applications. OLED microdisplays are gaining momentum due to advanced features such as higher contrast, faster response time, lighter weight, compact size, negligible image smearing, and a wider operating temperature range than LCDs. They have outperformed conventional LCD and LCoS microdisplay technologies as they are widely used in EVFs and HMDs. In the consumer sector, OLED microdisplays are used in video and VR glasses and EVFs to facilitate search, navigation, and daily personal activities, while the defense sector targets AR helmets for pilots to resolve communication issues during the battle.

Restraint: Development of widescreen alternatives

Screenless displays are interactive projection technology developed to solve problems related to miniature electronic devices. Devices such as HMDs, HUDs, and AR and VR projectors are small in size; thus, the lack of space on screen-based displays provides an opportunity for the development of screenless displays. The growing advancements in virtual retinal display and holographic display are an imminent threat to AR and VR traditional displays. Projection technology has been evolving for a long time, and its usage has increased in the last decade. Full domes, planetariums, and many other applications utilize projection technology. The increasing adoption of interactive projectors in different verticals and the low cost of interactive projectors, compared with AR and VR devices, are among the factors propelling the growth of the projectors, which hinders the growth of the AR and VR market.

Opportunity: Surging adoption of AR technology for enterprise applications

The opportunities in enterprise applications are huge. Huge investments in AR and VR devices from enterprises for smart manufacturing will be a major driver for the growth of the market. Companies having factories at varied locations can use AR and employ a small number of engineers to manage large setups. Remote collaboration using AR technology to manage machines and other setups remotely would help manage enterprises effectively. Other important applications of AR in the enterprise vertical are with regard to the instructional use for technicians and other workers in enterprises. The use of head-up displays and smart helmets to understand blueprints and instructions to provide real-time data will help workers function efficiently.

Challenge: Developing user-friendly AR/VR systems

AR/VR technology suppliers and developers face the challenge of developing user-friendly AR/VR devices and tracking systems. A user-friendly virtual environment allows a user to easily navigate and interact with objects in the virtual environment. AR/VR systems are a combination of hardware and software components. AR/VR devices track a user’s movements through different sensors and array them on the virtual display. The development of AR/VR software and virtual content is a challenging task for developers as the virtual content displayed must satisfy the user’s needs.

OLED technology to hold a major share of AR and VR display market during the forecast period

OLED displays can be used for various applications, including consumer electronics, gaming, automotive, medical devices, lighting, and transportation. OLED technology is gaining popularity as OLED displays have a simple design, leading to many advantages such as rich color, wide viewing angle, low power consumption, fast response, and true black color. Moreover, the cost of OLED displays is expected to reduce in the coming years; thus, OLED technology is likely to be rapidly adopted in AR and VR devices and gain a major market share during the forecast period.

HMD devises to hold a major share of the AR and VR display market during the forecast period

The AR/VR market is expected to be led by HMDs. Head-mounted devices from companies such as Sony, Oculus, HTC, Samsung, Google, TLC Alcatel, and Osterhout Design Group have already been in use and have received an overwhelming response from users. HMDs are majorly used for gaming and entertainment applications. Gesture-tracking devices have been an integral part of VR HMDs mainly because these are used for consumer applications. The use of gesture-tracking devices provides an enhanced experience of the virtual world to gamers. The increasing number of manufacturers and the growing adoption of HMDs are among the major factors for the high estimated growth of HMDs.

Aerospace & Defense applications to grow at a higher CAGR in the AR and VR display market during the forecast period

The growing adoption of HMDs and HUDs in the aerospace & defense sector would drive the growth of the AR display market. In aerospace & defense applications, AR HUDs are used to display critical navigational, flight, targeting, and mission-related information on the windshield in front of the pilot. Owing to these benefits, new-generation aircraft are equipped with advanced AR HMDs and AR HUDs. Moreover, AR HMDs are intended to provide infantry soldiers with situational awareness, friend-or-foe identification, and night vision, as well as enhanced ability to remotely coordinate small units.

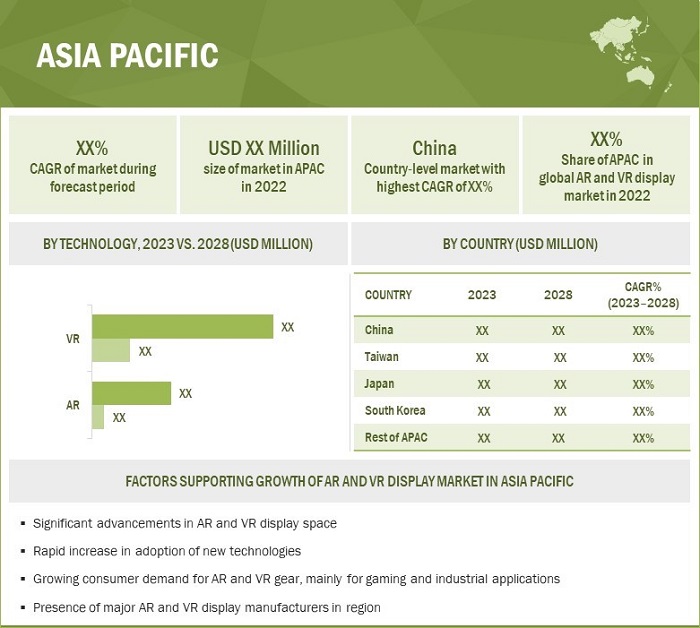

Asia Pacific region to witness the highest growth during the forecast period

Asia Pacific is expected to hold the largest share of the VR display market by 2028. It is expected to grow at the highest CAGR during the forecast period. The growth of the market in Asia Pacific can be attributed to the presence of major AR/VR display manufacturers such as Samsung, Sony, and Epson. With growing consumer demand for VR gear, mainly for gaming and industrial applications, the market growth is expected to propel further. Moreover, the market is expected to grow at a faster pace in the next few years, on account of surging consumer demand for AR and VR devices, mainly for gaming and industrial applications.

AR and VR Display Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players - AR and VR Display Market

The AR and VR display companies such as Samsung Electronics (South Korea), Sony (Japan), LG Display (South Korea), eMagin Corporation (US), Kopin Corporation (US), AU Optronics (Taiwan), Japan Display (Japan), Barco (Belgium), BOE Technology (China), and Syndiant (US).

Scope of the AR and VR Display Market Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019-2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

By Technology, By Display Technology, By Device Type, By Application, By Region |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, Rest of World (RoW) |

|

Companies Covered |

The major players include Samsung Electronics (South Korea), Sony (Japan), LG Display (South Korea), eMagin Corporation (US), Kopin Corporation (US), AU Optronics (Taiwan), Japan Display (Japan), Barco (Belgium), BOE Technology (China), and Syndiant (US). (Total 25 companies) |

AR and VR Display Market Highlights

This report categorizes the AR and VR display market based on technology, display technology, device type, application, and region available at the regional and country level.

|

Segment |

Subsegment |

|

By Technology |

|

|

By Display Technology |

|

|

By Device Type: |

|

|

AR Display Application: |

|

|

VR Display Application: |

|

|

By Region |

|

Recent Developments

- In March 2022, Samsung announced the development of an AR device to utilize novel hologram screen technology, which will run on Android as its operating system.

- In February 2022, Sony announced a collaboration with Niantic to develop and expand its AR hardware portfolio. The collaboration will mainly focus on the development of AR for headphones.

- In January 2022, Kopin Corporation partnered with RealWear by supplying the Golden Pearl display module for RealWear's recently launched RealWear Navigator 500 wearable device. The updated Golden Pearl features a 0.32", 24-bit full-color, high-brightness LCD microdisplay for easy outdoor/sunlight use and comfortable long-term viewing.

- In December 2021, eMagin Corporation showcased a direct patterning (dpd) technique on a widescreen ultra-extended graphics array (WUXGA) (1920x1200 pixels) OLED Microdisplay for monocular and binocular AR headsets at the 2021 Interservice/Industry Training, Simulation and Education Conference (I/ITSEC). The company aims to commercialize WUXGA dPd OLED Microdisplay by 2023. Through this conference, the company aimed to enhance its product portfolio along with its customer base.

- In December 2021, Sony enhanced and developed a PSVR headset to offer a smoother and better user virtual and visual experience with an 8 K VR headset.

Frequently Asked Questions (FAQ):

What is the current size of the global AR and VR display market?

The AR and VR display market is projected to grow from USD 1.8 billion in 2023 to USD 8.2 billion by 2028; it is expected to grow at a CAGR of 35.6% from 2023 to 2028.

Which devices are expected to dominate the AR and VR display market?

The VR HMDs are expected to dominate the AR and VR display market in terms of market size during the forecast period. The high demand for VR HMDs in gaming and entertainment would drive the market for AR and VR displays in terms of volume.

What are the challenges in the AR and VR display market?

Display latency and limited field of view, complex processes involved in manufacturing AR and VR displays, and developing user-friendly AR/VR systems are some of the challenges faced by the AR and VR display market.

What are the technological trends disrupting the AR and VR display market?

High adoption of AR smart glasses to improve work efficiency, increasing demand for AR for rugged display applications, and growing demand for microdisplays for VR technology have a major impact on the AR and VR display market in terms of technologies.

Which are the major companies in the AR and VR display market?

Samsung Electronics (South Korea), Sony (Japan), LG Display (South Korea), eMagin Corporation (US), Kopin Corporation (US), AU Optronics (Taiwan), Japan Display (Japan), Barco (Belgium), BOE Technology (China), and Syndiant (US) are the players dominating the AR and VR display market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing adoption of AR and VR devices in various applications- Increasing demand for OLED displays in AR and VR devices- Growing adoption of AR and VR HMDs in different industries- Adoption of AR and VR devices in gaming industry- Growing popularity of MetaverseRESTRAINTS- Development of widescreen alternatives- Limited availability of relevant content- Health issues associated with excessive use of AR and VR devicesOPPORTUNITIES- Growing demand for AR and VR devices post-COVID-19 outbreak- Rising investments in AR and VR ecosystem- Rising technological advancements and growing use of microdisplays in AR and VR devices- Surging adoption of AR technology for enterprise applicationsCHALLENGES- Display latency and limited field of view- Complex processes involved in manufacturing AR and VR displays- Developing user-friendly AR/VR systems

-

5.3 VALUE CHAIN ANALYSISVALUE CHAIN ANALYSIS: AR AND VR DISPLAY- Research & development- Manufacturing- Assembly, packaging, and integration- Material & equipment supply and distribution- Marketing and post-sales services

-

5.4 AR AND VR DISPLAY MARKET: ECOSYSTEM

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.8 PATENT ANALYSIS

- 5.9 KEY CONFERENCES & EVENTS, 2023–2024

-

5.10 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSTARIFFS AND REGULATIONS- Tariffs- Standards- Regulations

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 CASE STUDIESINTRODUCTIONAR IN CORPORATEAR IN WAREHOUSE MANAGEMENTAR IN RETAILVR IN MANUFACTURINGVR IN CORPORATEAR IN MARKETING

-

5.13 TECHNOLOGY TRENDSHIGH ADOPTION OF AR SMART GLASSES TO IMPROVE WORK EFFICIENCYINCREASED DEMAND FOR AR FOR RUGGED DISPLAY APPLICATIONSMICRODISPLAYS FOR VRWEB ARMOBILE AUGMENTED REALITY (MAR)

-

5.14 PRICING ANALYSISAVERAGE SELLING PRICE TREND

- 6.1 INTRODUCTION

-

6.2 AUGMENTED REALITYMICRO-LED DISPLAY TECHNOLOGY TO LEAD AR DISPLAY MARKET

-

6.3 VIRTUAL REALITYNEW OLED DISPLAY TECHNOLOGY LIKELY TO BE WIDELY ADOPTED IN VR IN COMING YEARS

- 7.1 INTRODUCTION

-

7.2 OLEDADAPTIVE FREQUENCY AND LOW POWER CONSUMPTION TO INCREASE DEMAND FOR OLED DISPLAYS IN VR HMDS

-

7.3 LCDTECHNOLOGICAL ADVANCEMENTS AND DECREASING PRICES TO SUPPORT DEMAND FOR LCD TECHNOLOGY-BASED AR/VR DEVICES

-

7.4 OTHERSMICRO-LEDLIQUID CRYSTAL ON SILICON (LCOS)DIGITAL LIGHT PROCESSING (DLP)

- 8.1 INTRODUCTION

-

8.2 HEAD-MOUNTED DISPLAYSAR HEAD-MOUNTED DISPLAYS- Use of AR HMDs for enterprise and healthcare applications to be major driving factorVR HEAD-MOUNTED DISPLAYS- OLED technology fast replacing LCD in VR HMDs

-

8.3 AR HEAD-UP DISPLAYSEXTENSIVE USE OF AR HUDS IN AUTOMOTIVE APPLICATIONS TO DRIVE MARKET GROWTH

-

8.4 VR PROJECTORSRISE IN DEMAND FOR VR PROJECTORS DUE TO VIRTUAL WORKING CULTURE TO SUPPORT MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 AR DISPLAY APPLICATIONSCONSUMER- Gaming- Sports & entertainmentCOMMERCIAL- AR HMDs widely used for commercial applicationsENTERPRISE (MANUFACTURING)- AR devices improve efficiency and accuracy in manufacturing industryAUTOMOTIVE- AR HUDs and AR glasses extensively used in automobilesHEALTHCARE- Can help reduce complexities in surgeries and other medical proceduresAEROSPACE & DEFENSE- AR HMDs and HUDs adopted by leading aircraft manufacturers such as Boeing and AirbusENERGY- Improving safety, maintenance & repair, training, and knowledge sharing – crucial energy applications of AR devicesOTHERS

-

9.3 VR DISPLAY APPLICATIONSCONSUMER- Gaming- Sports & entertainmentCOMMERCIAL- VR HMDs used in commercial applications such as advertising, marketing & retail, and fashionENTERPRISE (MANUFACTURING)- Used in manufacturing sector for personnel training, remodeling & redesigning, and industrial simulationsHEALTHCARE- Help in pain management, exposure therapy, stroke rehabilitation, education, and surgical planningAEROSPACE & DEFENSE- Used to create combat simulations and maneuvers in aerospace & defense applicationsOTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Concentration of major AR HMD companies to drive market growthCANADA- Increase in AR/VR device providers to fuel market growthMEXICO- Increasing awareness regarding AR and VR devices to lead to steady market growth

-

10.3 EUROPEUK- Demand from gaming industry to boost market growthGERMANY- Broad industrial base and established automobile industry to support growthFRANCE- Aerospace & defense vertical to drive growthREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- Presence of established and emerging AR and VR device manufacturing companies to drive marketJAPAN- Demand from entertainment industry to fuel growthSOUTH KOREA- 6G network technology to boost growthTAIWAN- Increasing number of AR and VR startups to drive marketREST OF ASIA PACIFIC- India

-

10.5 ROWMIDDLE EAST & AFRICA- Expanding healthcare and automotive industries to propel demand for AR VR display devicesSOUTH AMERICA- Growing gaming and entertainment verticals in Brazil to drive growth

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WINPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 MARKET SHARE ANALYSIS, 2022

- 11.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 COMPETITIVE SCENARIOS AND TRENDSAR AND VR DISPLAY MARKET: PRODUCT LAUNCHES, 2020–2022AR AND VR DISPLAY MARKET: DEALS, 2020–2022

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSSAMSUNG ELECTRONICS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLG DISPLAY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAU OPTRONICS (AUO)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSONY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEMAGIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKOPIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJAPAN DISPLAY INC.- Business overview- Products/Solutions/Services offered- Recent developmentsBARCO- Business overview- Products/Solutions/Services offered- Recent developmentsBOE TECHNOLOGY- Business overview- Products/Solutions/Services offered- Recent developmentsSYNDIANT- Business overview- Products/Solutions/Services offered- Recent developments

-

12.3 OTHER PLAYERSTIANMA MICROELECTRONICS- Business overviewTRULY INTERNATIONAL- Business overviewHIMAX TECHNOLOGIES- Business overviewINNOLUX CORPORATION- Business overviewSEIKO EPSON- Business overviewHOLOEYE PHOTONICS- Business overviewJASPER DISPLAY CORP. (JDC)- Business overviewYUNNAN OLIGHTEK OPTO-ELECTRONIC TECHNOLOGY- Business overviewPANASONIC- Business overviewUNIVERSAL DISPLAY CORPORATION- Business overviewRAONTECH- Business overviewEVERDISPLAY OPTRONICS- Business overviewCREAL- Business overviewPLESSEY- Business overviewNEW VISION DISPLAY (NVD)- Business overview

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 AR AND VR DISPLAY MARKET: KEY PLAYERS INTERVIEWED

- TABLE 2 ASSUMPTIONS FOR RESEARCH STUDY

- TABLE 3 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON AR AND VR DISPLAY MARKET

- TABLE 4 LIMITATIONS & ASSOCIATED RISKS

- TABLE 5 COMPARISON OF DIFFERENT DISPLAY TECHNOLOGIES

- TABLE 6 DISPLAY TECHNOLOGIES USED IN POPULAR AR AND VR DEVICES

- TABLE 7 NOTICEABLE INVESTMENTS IN AR AND VR MARKET

- TABLE 8 AR AND VR DISPLAY MARKET: ECOSYSTEM

- TABLE 9 PORTER’S FIVE FORCES ANALYSIS: AR AND VR DISPLAY MARKET

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 12 NUMBER OF PATENTS REGISTERED IN AR AND VR MARKET IN LAST 10 YEARS

- TABLE 13 PATENTS PERTAINING TO AR AND VR DISPLAYS, 2020–2022

- TABLE 14 AR AND VR DISPLAY MARKET: CONFERENCES & EVENTS, 2023–2024

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 KEY REGULATIONS: DISPLAY PANELS

- TABLE 20 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 21 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 22 AR FOR TRAINING AND KNOWLEDGE SHARING

- TABLE 23 AR FOR BETTER WAREHOUSE MANAGEMENT

- TABLE 24 AR FOR SHOPPING

- TABLE 25 VR FOR DESIGN AND PROTOTYPING

- TABLE 26 VR FOR SAFETY AND QUALITY

- TABLE 27 VR FOR REAL-TIME EXPERIENCES AND TRAINING

- TABLE 28 AR FOR MEDIA ATTENTION

- TABLE 29 USE CASE FOR WEB AR

- TABLE 30 AVERAGE SELLING PRICE FOR AR AND VR DISPLAYS, BY DEVICE TYPE, (USD PER UNIT)

- TABLE 31 AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 32 AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 33 AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2019–2022 (MILLION UNITS)

- TABLE 34 AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2023–2028 (MILLION UNITS)

- TABLE 35 AR DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 36 AR DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 37 VR DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 38 VR DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 39 AR AND VR DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 40 AR AND VR DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 41 OLED: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 42 OLED: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 43 LCD: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 44 LCD: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 45 OTHER DISPLAY TECHNOLOGIES: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 46 OTHER DISPLAY TECHNOLOGIES: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 47 AR AND VR DISPLAY MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 48 AR AND VR DISPLAY MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 49 AR HMD DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 AR HMD DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 VR HMD DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 52 VR HMD DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 53 AR HUD DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 54 AR HUD DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 VR PROJECTOR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 56 VR PROJECTOR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 57 AR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 58 AR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 VR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 60 VR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 AR DISPLAY MARKET FOR CONSUMER APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 AR DISPLAY MARKET FOR CONSUMER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 AR DISPLAY MARKET FOR COMMERCIAL APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 AR DISPLAY MARKET FOR COMMERCIAL APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 AR DISPLAY MARKET FOR ENTERPRISE APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 AR DISPLAY MARKET FOR ENTERPRISE APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 AR DISPLAY MARKET FOR AUTOMOTIVE APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 68 AR DISPLAY MARKET FOR AUTOMOTIVE APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 69 AR DISPLAY MARKET FOR AUTOMOTIVE APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 AR DISPLAY MARKET FOR AUTOMOTIVE APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 AR DISPLAY MARKET FOR HEALTHCARE APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 AR DISPLAY MARKET FOR HEALTHCARE APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 AR DISPLAY MARKET FOR AEROSPACE & DEFENSE APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 74 AR DISPLAY MARKET FOR AEROSPACE & DEFENSE APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 75 AR DISPLAY MARKET FOR AEROSPACE & DEFENSE APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 AR DISPLAY MARKET FOR AEROSPACE & DEFENSE APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 AR DISPLAY MARKET FOR ENERGY APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 AR DISPLAY MARKET FOR ENERGY APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 AR DISPLAY MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 AR DISPLAY MARKET FOR OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 VR DISPLAY MARKET FOR CONSUMER APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 82 VR DISPLAY MARKET FOR CONSUMER APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 83 VR DISPLAY MARKET FOR CONSUMER APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 VR DISPLAY MARKET FOR CONSUMER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 VR DISPLAY MARKET FOR COMMERCIAL APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 86 VR DISPLAY MARKET FOR COMMERCIAL APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 87 VR DISPLAY MARKET FOR COMMERCIAL APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 VR DISPLAY MARKET FOR COMMERCIAL APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 VR DISPLAY MARKET FOR ENTERPRISE APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 90 VR DISPLAY MARKET FOR ENTERPRISE APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 91 VR DISPLAY MARKET FOR ENTERPRISE APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 VR DISPLAY MARKET FOR ENTERPRISE APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 VR DISPLAY MARKET FOR HEALTHCARE APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 94 VR DISPLAY MARKET FOR HEALTHCARE APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 95 VR DISPLAY MARKET FOR HEALTHCARE APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 VR DISPLAY MARKET FOR HEALTHCARE APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 VR DISPLAY MARKET FOR AEROSPACE & DEFENSE APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 98 VR DISPLAY MARKET FOR AEROSPACE & DEFENSE APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 99 VR DISPLAY MARKET FOR AEROSPACE & DEFENSE APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 VR DISPLAY MARKET FOR AEROSPACE & DEFENSE APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 VR DISPLAY MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 102 VR DISPLAY MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 103 VR DISPLAY MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 VR DISPLAY MARKET FOR OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 AR AND VR DISPLAY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 106 AR AND VR DISPLAY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 AR DISPLAY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 108 AR DISPLAY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 VR DISPLAY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 110 VR DISPLAY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: AR DISPLAY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: AR DISPLAY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: VR DISPLAY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: VR DISPLAY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: AR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: AR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: VR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: VR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 EUROPE: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 122 EUROPE: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: AR DISPLAY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 124 EUROPE: AR DISPLAY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 EUROPE: VR DISPLAY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 126 EUROPE: VR DISPLAY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 127 EUROPE: AR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 128 EUROPE: AR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 129 EUROPE: VR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 130 EUROPE: VR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AR DISPLAY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AR DISPLAY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: VR DISPLAY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: VR DISPLAY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: VR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: VR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 141 ROW: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 142 ROW: AR AND VR DISPLAY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 143 ROW: AR DISPLAY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 144 ROW: AR DISPLAY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 145 ROW: VR DISPLAY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 146 ROW: VR DISPLAY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 147 ROW: AR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 148 ROW: AR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 149 ROW: VR DISPLAY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 150 ROW: VR DISPLAY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN AR AND VR DISPLAY MARKET

- TABLE 152 AR AND VR DISPLAY MARKET: DEGREE OF COMPETITION, 2022

- TABLE 153 COMPANY APPLICATION FOOTPRINT

- TABLE 154 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 155 COMPANY REGION FOOTPRINT

- TABLE 156 COMPANY FOOTPRINT

- TABLE 157 AR AND VR DISPLAY MARKET: KEY STARTUPS/SMES

- TABLE 158 SAMSUNG ELECTRONICS: PRODUCT LAUNCHES

- TABLE 159 SAMSUNG ELECTRONICS: DEALS

- TABLE 160 SAMSUNG ELECTRONICS: OTHERS

- TABLE 161 LG DISPLAY: PRODUCT LAUNCHES

- TABLE 162 LG DISPLAY: DEALS

- TABLE 163 LG DISPLAY: OTHERS

- TABLE 164 AU OPTRONICS: PRODUCT LAUNCHES

- TABLE 165 AU OPTRONICS: DEALS

- TABLE 166 SONY: PRODUCT LAUNCHES

- TABLE 167 SONY: DEALS

- TABLE 168 EMAGIN CORPORATION: PRODUCT LAUNCHES

- TABLE 169 EMAGIN CORPORATION: DEALS

- TABLE 170 EMAGIN CORPORATION: OTHERS

- TABLE 171 KOPIN CORPORATION: PRODUCT LAUNCHES

- TABLE 172 KOPIN CORPORATION: DEALS

- TABLE 173 JAPAN DISPLAY INC.: PRODUCT LAUNCHES

- TABLE 174 JAPAN DISPLAY INC.: DEALS

- TABLE 175 BARCO: PRODUCT LAUNCHES

- TABLE 176 BOE TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 177 BOE TECHNOLOGY: DEALS

- TABLE 178 SYNDIANT: PRODUCT LAUNCHES

- FIGURE 1 AR AND VR DISPLAY MARKET SEGMENTATION

- FIGURE 2 AR AND VR DISPLAY MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 DEMAND-SIDE ANALYSIS: AR AND VR DISPLAY MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 SUPPLY-SIDE ANALYSIS: AR AND VR DISPLAY MARKET (1/2)

- FIGURE 7 SUPPLY-SIDE ANALYSIS: AR AND VR DISPLAY MARKET (2/2)

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 AR AND VR DISPLAY MARKET SIZE, 2019–2028

- FIGURE 10 RECESSION IMPACT ON AR AND VR DISPLAY MARKET, 2019–2028 (USD MILLION)

- FIGURE 11 ASIA PACIFIC TO DOMINATE AR AND VR DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 12 VR TECHNOLOGY TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 13 AUTOMOTIVE APPLICATION TO DOMINATE AR DISPLAY MARKET BY 2028

- FIGURE 14 CONSUMER APPLICATIONS TO LEAD VR DISPLAY MARKET BY 2028

- FIGURE 15 AR HMD DEVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 OLED DISPLAY TECHNOLOGY TO HOLD MAJOR SHARE OF AR AND VR DISPLAY MARKET IN 2028

- FIGURE 17 AR AND VR DISPLAY MARKET TO REGISTER HIGHEST CAGR IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 AR AND VR MARKET, 2017–2025 (USD BILLION)

- FIGURE 20 VALUE CHAIN ANALYSIS: AR AND VR DISPLAY

- FIGURE 21 DISPLAY ECOSYSTEM

- FIGURE 22 REVENUE SHIFT IN AR AND VR DISPLAY MARKET

- FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 26 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 27 NO. OF PATENTS GRANTED PER YEAR, 2012–2021

- FIGURE 28 AR AND VR DISPLAY MARKET: AVERAGE PRICE OF DISPLAYS, BY DEVICE TYPES

- FIGURE 29 AR AND VR DISPLAY MARKET, BY TECHNOLOGY

- FIGURE 30 VR TECHNOLOGY TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 31 AR AND VR DISPLAY MARKET, BY DISPLAY TECHNOLOGY

- FIGURE 32 OLED TECHNOLOGY TO HOLD MAJOR SHARE OF AR AND VR DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 33 AR AND VR DISPLAY MARKET, BY DEVICE TYPE

- FIGURE 34 AR HEAD-MOUNTED DISPLAYS TO HOLD LARGEST SIZE OF AR AND VR DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 35 ENTERPRISE APPLICATION TO HOLD LARGEST SHARE OF AR DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 36 CONSUMER APPLICATION TO DOMINATE VR DISPLAY MARKET

- FIGURE 37 AR DISPLAY MARKET, BY APPLICATION

- FIGURE 38 VR DISPLAY MARKET, BY APPLICATION

- FIGURE 39 AR AND VR DISPLAY MARKET, BY REGION

- FIGURE 40 AR AND VR DISPLAY MARKET IN ASIA PACIFIC TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: AR AND VR DISPLAY MARKET SNAPSHOT

- FIGURE 42 EUROPE: AR AND VR DISPLAY MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: AR AND VR DISPLAY MARKET SNAPSHOT

- FIGURE 44 FIVE-YEAR PRODUCT REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 45 COMPANY EVALUATION QUADRANT: AR AND VR DISPLAY MARKET, 2022

- FIGURE 46 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 47 LG DISPLAY: COMPANY SNAPSHOT

- FIGURE 48 AU OPTRONICS: COMPANY SNAPSHOT

- FIGURE 49 SONY: COMPANY SNAPSHOT

- FIGURE 50 EMAGIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 KOPIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 JAPAN DISPLAY INC: COMPANY SNAPSHOT

- FIGURE 53 BARCO: COMPANY SNAPSHOT

- FIGURE 54 BOE TECHNOLOGY: COMPANY SNAPSHOT

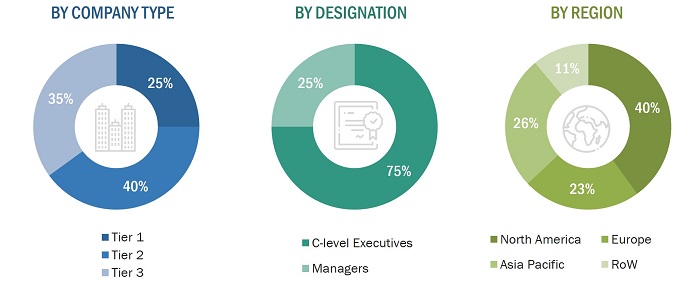

The study involved four major activities for estimating the size of the AR and VR display market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with industry experts across the value chain of the AR and VR display market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the AR and VR display market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. The secondary research referred to for this research study involves AR and VR display magazines, and journals. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the AR and VR display market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the AR and VR display market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, Asia Pacific, and Middle East, and Africa. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of AR and VR display market and its segments. The research methodology used to estimate the market size includes the following:

- Focusing on top-line investments and expenditures made in the ecosystem of AR and VR display market, initially

- Calculating the market size considering revenues generated by major players through the cost of their AR and VR displays

- Conducting multiple on-field discussion sessions with key opinion leaders of major companies providing AR and VR displays

- Segmenting each application of AR and VR display in each region and deriving the global market size based on region

- Estimating the regional split using secondary sources based on various factors such as the number of OEMs in a specific country and a region, the role of leading market players based in this country and region in the development of new and innovative products, and adoption and penetration rates of AR and VR displays for use in various applications in a particular country or region.

Global AR and VR Display Market Size: Bottom-up Approach

- Identifying entities in the AR and VR display market that influence the entire market, along with providers of related devices

- Analyzing major providers of AR and VR display and original equipment manufacturers (OEMs) as well as studying their portfolios and understanding different display technologies used

- Analyzing trends pertaining to the use of different types of AR and VR display in different applications

- Tracking the ongoing and upcoming developments in the AR and VR display market, including investments, R&D activities, product launches, collaborations, and contracts, as well as forecasting the market size based on these developments and other critical parameters

- Holding multiple discussion sessions with key opinion leaders to understand different types of AR and VR display, technologies used in them, and applications wherein they are used, as well as recent trends in the market to analyze the breakup of the scope of work carried out by major companies

- Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size

- Segmenting the overall market into various other market segments

- Verifying and cross-checking the estimate at every level through discussions with key opinion leaders such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the AR and VR display market.

Report Objectives

- To describe and forecast the size of the augmented reality (AR) and virtual reality (VR) display market, by technology, in terms of value and volume

- To describe and forecast the size of the market, by display technology, application, and device type, in terms of value

- To forecast the size of various segments of the market with respect to four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To analyze the emerging applications/use cases in the AR and VR display market

- To identify key AR and VR display manufacturers and analyze their production capabilities and new production fab construction plans in the market

- To analyze the ecosystem/supply chain of AR and VR devices consisting of material and component suppliers, driver IC suppliers, manufacturing equipment suppliers, manufacturers, and brand product manufacturers

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape

- To analyze competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers and acquisitions, and product launches and developments in the market

- To strategically profile key players and comprehensively analyze their market share and core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

- Additional country-level analysis of AR and VR display market

- Estimation of the market size of the segments of the AR and VR display market based on different subsegments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AR and VR Display Market