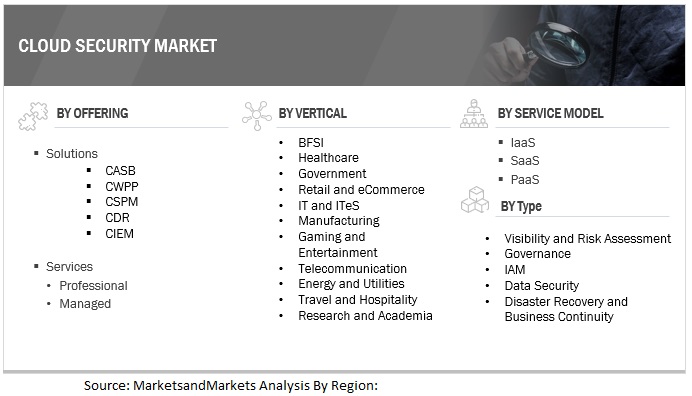

Cloud Security Market by Offering (Solution and Services), Solutions (CASB, CWPP, CSPM, CDR, and CIEM), Services (Professional and Managed), Service Model (IaaS, SaaS, and PaaS), Type, Vertical, and Region - Global Forecast to 2028

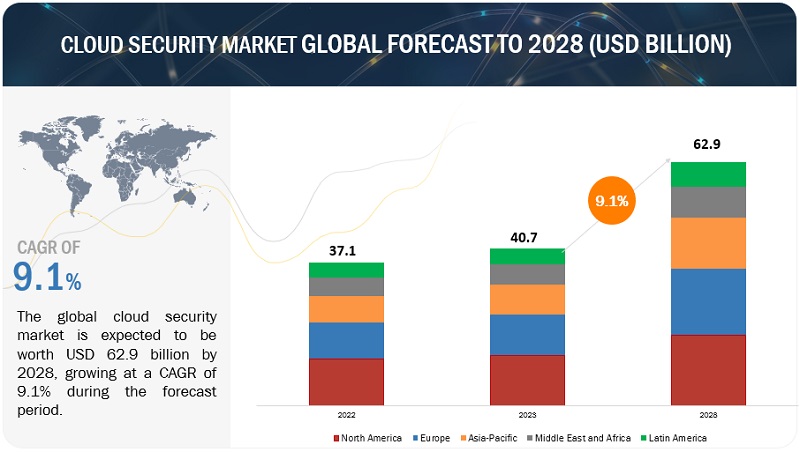

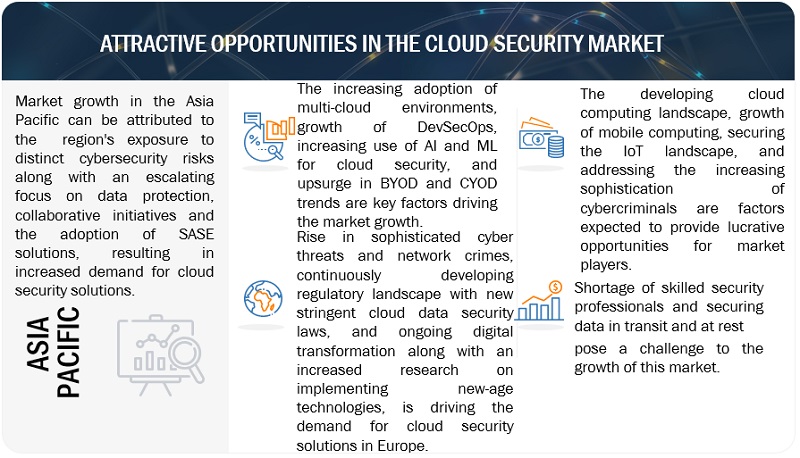

[446 Pages Report] The global cloud security market size is projected to grow from USD 40.7 billion in 2023 to USD 62.9 billion by 2028 at a CAGR of 9.1% during the forecast period. The cloud security market is witnessing significant growth driven by several factors. These include the increasing popularity of multi-cloud environments, the integration of DevSecOps practices, the utilization of AI and ML technologies for cloud security, and the rising demand for cloud security solutions due to the adoption of BYOD and CYOD trends. These trends collectively contribute to the expansion and importance of cloud security in the market. The cloud security market is benefiting from opportunities driven by the dynamic cloud computing landscape, the increasing adoption of mobile computing, the demand for securing the IoT ecosystem, and the need to combat the growing sophistication of cybercriminals. These factors create favorable conditions for the market’s growth, with organizations seeking advanced solutions to safeguard their cloud-based systems and valuable data, further contributing to the rising demand for cloud security solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

The cloud security market is projected to provide billion-dollar opportunities for solutions and service providers. The recession would also have a substantial impact on the cloud security market. During a potential slowdown, the impact on the cloud security market is likely to be influenced by CIOs’ budget considerations and cost-control measures. While there may be a moderation in IT budget growth and tightening budgets, cloud computing, security software, and digital transformation are expected to remain key priorities for enterprises. Despite the possibility of cuts in data center build-outs and consulting projects, the IT services and product firms are well-positioned to make incremental gains and emerge stronger from this phase of economic uncertainty. The resilience of cloud security solutions in times of recession lies in their ability to provide cost-effective options while addressing critical security needs, making them a valuable investment for enterprises seeking to navigate challenging economic conditions.

Cloud Security Market Dynamics

Driver: Growth of DevSecOps

The rise of DevSecOps is driving the growth of the cloud security market. DevSecOps combines development, security, and operations to ensure security is integrated throughout the software development process. It focuses on identifying and addressing security issues early on, making cloud environments safer. Using DevSecOps practices, organizations proactively detect and fix security vulnerabilities during development, reducing the risk of breaches. Automated security testing and continuous monitoring also help keep cloud environments secure. Overall, the adoption of DevSecOps is playing a crucial role in driving the expansion of cloud security.

Restraint: Lack of Awareness

A significant restraint in the cloud security market is the insufficient awareness among businesses regarding the potential security risks associated with cloud computing. Despite the widespread adoption of cloud technologies, many organizations lack a comprehensive understanding of the vulnerabilities and threats present in the cloud environment. This lack of awareness often leads to misconceptions, such as assuming the sole responsibility for security lies with the cloud service provider, overlooking the shared responsibility model. Additionally, some businesses may be unaware of specific security risks, such as data breaches, unauthorized access, or misconfigurations. As a result, crucial security practices like robust access controls, data encryption, regular security audits, and incident response plans may not be adequately implemented or prioritized. Moreover, the lack of awareness can hinder informed decision-making when selecting cloud service providers or security solutions.

Opportunity: Securing the IoT landscape

The rise of IoT devices offers a significant opportunity for the cloud security market. These devices, like smart home appliances and industrial sensors, are becoming common and create a vast network of connected devices that collect and analyze data. While they offer many benefits, they also pose security challenges. IoT devices often lack robust security features and can be vulnerable to cyber-attacks, potentially leading to data breaches and disruptions. Cloud security providers can benefit from it by offering specialized solutions for IoT security, such as strong authentication, secure communication, and real-time monitoring. They can also work with IoT device makers and regulators to establish security standards and best practices, building trust and improving overall IoT security.

Challenge: Securing data in transit and at rest

Keeping data safe during its transfer and storage presents a big challenge for cloud security. When data moves between devices and the cloud or rests within cloud systems, it becomes vulnerable to breaches and unauthorized access. Ensuring data confidentiality, integrity, and availability throughout its lifecycle is crucial. Protecting data in transit involves using encryption to keep it secure while it travels between devices and networks. However, managing encryption keys and configuring specific communication channels can be complex. Securing data at rest, stored within the cloud or databases, also requires careful measures. Cloud providers offer encryption options, but organizations must manage encryption keys properly. Robust access controls, IAM policies, and regular monitoring are essential to protect data at rest and detect any unauthorized access.

Cloud security Market Ecosystem

By Offering, the Services segment accounts for the highest CAGR during the forecast period.

The services segment is expected to have the highest CAGR in the cloud security market during the forecasted period. Due to increasing complexity and growing cyber threats, businesses need expert assistance to manage and secure their cloud environments. Managed services offer continuous monitoring and threat detection, while professional services provide consulting and compliance management, helping organizations stay secure and compliant with industry standards. As cloud security becomes more crucial, the demand for these services drives their growth in the market.

By Service Model, IaaS accounts for the largest market size during the forecast period.

IaaS accounts for the most significant cloud security market due to its widespread adoption by businesses. IaaS provides a flexible and cost-effective solution for organizations to access and manage IT infrastructure over the Internet. Securing their infrastructure becomes paramount as more companies shift their operations to the cloud. IaaS allows businesses to outsource their hardware and software resources, reducing the burden of managing complex infrastructure in-house. However, this outsourcing also increases security concerns, as organizations must protect their sensitive data and applications hosted on cloud servers. Therefore, robust cloud security solutions are highly demanded to safeguard IaaS environments from potential cyber threats and data breaches. With the increasing adoption of IaaS by enterprises of all sizes, its market size continues to expand, driving growth.

By Services, Managed services account for the highest CAGR during the forecast period.

Managed services account for the highest CAGR in the cloud security market during the forecasted period due to their growing popularity among businesses. With the rapid adoption of cloud technologies, organizations are increasingly seeking external expertise to manage and enhance their cloud security. Managed services offer a comprehensive approach, where specialized providers handle cloud security tasks on behalf of the businesses. It allows companies to focus on their core operations while ensuring their cloud environments remain secure. Managed service providers offer continuous monitoring, threat detection, incident response, and security updates to mitigate potential risks effectively. As cyber threats become more sophisticated, businesses realize the importance of initiative-taking security measures and managed services provide an aggressive and vigilant approach to safeguarding cloud assets. The flexibility and scalability of managed services make them suitable for businesses of all sizes, driving their increasing adoption.

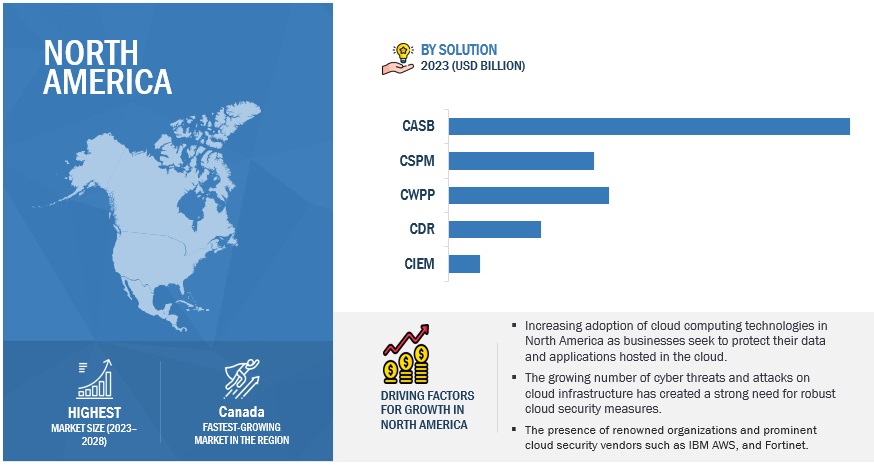

By region, North America accounts for the highest market size during the forecast period.

North America is expected to have the largest market share in the cloud security market during the forecasted period for a few important reasons. Firstly, the region has top-notch cloud service providers that offer a wide range of solutions. Businesses from different industries prefer these well-established providers. Secondly, North America has advanced IT infrastructure, making it easier for businesses to adopt cloud solutions smoothly. Additionally, companies in North America are becoming more aware of the need for strong security measures due to increasing cyber threats. Strict data protection regulations also push the demand for cloud security solutions. Furthermore, the rise of remote work and digital transformation after the pandemic has boosted the adoption of cloud services in the region.

Key Market Players

Some of the well-established and key market players in the cloud security market include IBM (US), Broadcom (US), Check Point (Israel and US), Google (US), AWS (US), Zscaler (US), Akamai Technologies (US), Forcepoint (US), Fortinet (US), F5 (US), Qualys (US), TrendMicro (Japan), Palo Alto Networks (US), Proofpoint (US), Tenable (US), Netskope (US), Microsoft (US), Cisco (US), Imperva (US), Trellix (US), Rapid7 (US), Skyhigh Security (US), FireMon (US), Sysdig (US), LookOut (US), Fidelis Cybersecurity (US), DataTheorem (US), OpsCompass (US), Tufin (US), Menlo Security (US), Tigera (US), Orca Security (US), Ascend Technologies (US), Secberus (US), Ermetic (Israel), Sonrai Security (US), Wiz (US), Caveonix (US), Banyan cloud (US), and AccuKnox (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

Offerings, Service Model, Type, Verticals, and Regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Major vendors in the global cloud security market include IBM (US), Broadcom (US), Check Point (Israel and US), Google (US), AWS (US), Zscaler (US), Akamai Technologies (US), Forcepoint (US), Fortinet (US), F5 (US), Qualys (US), TrendMicro (Japan), Palo Alto Networks (US), Proofpoint (US), Tenable (US), Netskope (US), Microsoft (US), Cisco (US), Imperva (US), Trellix (US), Rapid7 (US), Skyhigh Security (US), FireMon (US), Sysdig (US), LookOut (US), Fidelis Cybersecurity (US), DataTheorem (US), OpsCompass (US), Tufin (US), Menlo Security (US), Tigera (US), Orca Security (US), Ascend Technologies (US), Secberus (US), Ermetic (Israel), Sonrai Security (US), Wiz (US), Caveonix (US), Banyan cloud (US), and AccuKnox (US). |

The study categorizes the cloud security market by offerings, service models, types, verticals, and regions.

Recent Developments

- In May 2023, AWS introduced a new service, Amazon Security Lake, a cloud security offering that automatically centralizes an organization’s security data from multiple sources into a purpose-built data lake. It helps customers improve their security posture, respond faster to security events, and simplify security data management across hybrid and multi-cloud environments. With Amazon Security Lake, organizations can aggregate, normalize, and store security data, enabling faster threat detection, investigation, and response. It gives customers greater visibility into potential security threats and allows them to leverage their preferred analytics tools for comprehensive security insights.

- In May 2023, Check Point (US & Israel) expanded Harmony Endpoint protection solutions to include vulnerability assessment and automated patch management capabilities. It helps organizations address the growing number of cyberattacks that exploit unpatched system vulnerabilities.

- In April 2023, IBM (US) introduced a new platform, IBM Security QRadar Suite, a comprehensive cloud security offering that combines EDR/XDR, SIEM, SOAR, and cloud-native log management capabilities. It is designed to unify and streamline the security analyst experience in hybrid cloud environments. With advanced AI and automation, the suite empowers analysts to detect, investigate, and respond to threats faster and more efficiently. It is delivered as a service on AWS and provides simplified deployment, visibility, and integration across cloud environments and data sources.

- In September 2022, Google (US) acquired Mandiant (US). Integrating Mandiant’s capabilities will enhance Google Cloud’s security operations suite, providing organizations with improved threat intelligence, incident management, and exposure management. The addition of Mandiant will enable organizations to monitor assets for exposures, validate security controls, and enhance their security posture. The acquisition reinforces Google Cloud’s commitment to providing comprehensive security solutions to its customers.

- In November 2021, Qualys (US) partnered with TD SYNNEX (US). The partnership enables TD SYNNEX’s resellers to access Qualys’ cloud-based security and compliance solutions, including the VMDR app and Patch Management. It simplifies security operations, enhances threat detection, and reduces business compliance costs. This partnership strengthens Qualys’ presence and extends its access to TD SYNNEX’s partner ecosystem.

Frequently Asked Questions (FAQ):

What are the opportunities in the global cloud security market?

The developing cloud computing landscape, growth of mobile computing, securing the IoT landscape, and addressing the increasing sophistication of cybercriminals are the market opportunities for the global cloud security market.

What is the definition of the cloud security market?

According to MarketsandMarkets, cloud security falls under the umbrella of cybersecurity and is dedicated to safeguarding cloud computing systems. Its primary aim is to ensure the protection and privacy of data within online-based infrastructure, applications, and platforms.

Which region is expected to show the highest market share in the cloud security market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors, namely, include IBM (US), Broadcom (US), Check Point (Israel and US), Google (US), AWS (US), Zscaler (US), Akamai Technologies (US), Forcepoint (US), Fortinet (US), F5 (US), Qualys (US), TrendMicro (Japan), Palo Alto Networks (US), Proofpoint (US), Tenable (US), Netskope (US), Microsoft (US), Cisco (US), Imperva (US), Trellix (US), Rapid7 (US), Skyhigh Security (US), FireMon (US), Sysdig (US), LookOut (US), Fidelis Cybersecurity (US), DataTheorem (US), OpsCompass (US), Tufin (US), Menlo Security (US), Tigera (US), Orca Security (US), Ascend Technologies (US), Secberus (US), Ermetic (Israel), Sonrai Security (US), Wiz (US), Caveonix (US), Banyan cloud (US), and AccuKnox (US).

What is the current size of the global cloud security market?

The global cloud security market size is projected to grow from USD 40.7 billion in 2023 to USD 62.9 billion by 2028 at a CAGR of 9.1% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

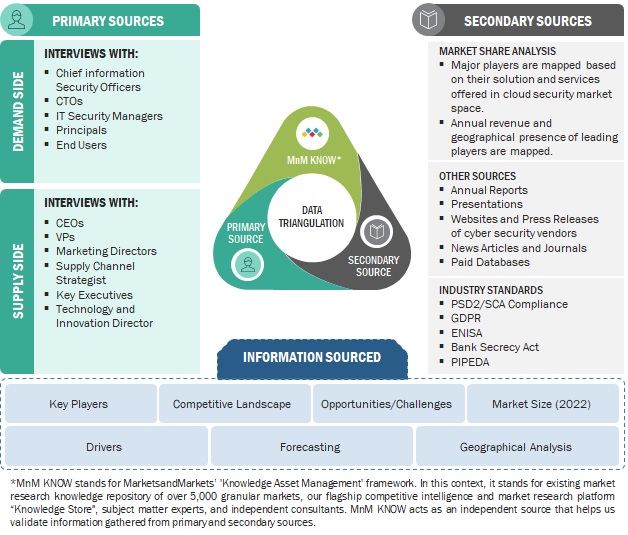

The study involved significant activities in estimating the current market size for cloud security. Intensive secondary research was conducted to collect information about cloud security and related ecosystems. The industry executives validated these findings, assumptions, and sizing across the value chain using a primary research process as a next step. Top-down and bottom-up market estimation approaches were used to estimate the market size globally, followed by the market breakup and data triangulation procedures to assess the market segment and sub-segments in cloud security.

Secondary Research Process:

In the secondary research process, various sources were referred to for identifying and collecting information regarding cloud security. These sources include annual reports, press releases, cloud security software and service vendor investor presentations, forums, vendor-certified publications, and industry/associations white papers. These secondary sources were utilized to obtain key information about the cloud security’s solutions and services supply & value chain, a list of 100+ key players and SMEs, market classification, and segmentation per the industry trends and regional markets. The secondary research also gives us insights into the key developments from market and technology perspectives, which primary respondents further validated.

The factors considered for estimating the regional market size include technological initiatives undertaken by governments of different countries, gross domestic product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of primary cloud security solutions and service vendors.

Primary Research Process:

We have conducted primary research with industry executives from both the supply and demand sides. The primary sources from the supply side include chief executive officers (CEOs), vice presidents (VPs), marketing directors, and technology and innovation executives of key companies operating in the cloud security market. We have conducted primary interviews with the executives to obtain qualitative and quantitative information for cloud security.

The market engineering process implemented the top-down and bottom-up approaches and various data triangulation methods to estimate and forecast the market segments and subsegments. Post-market engineering process, we conducted primary research to verify and validate the critical numbers we arrived at. The primary research was also undertaken to identify the segmentation types; industry trends; the competitive landscape of the cloud security market players; and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

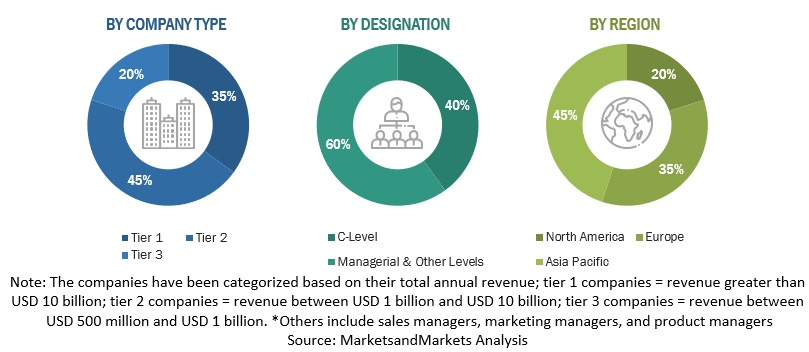

Following is the breakup of the primary research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation Process:

Both top-down and bottom-up approaches were implemented for market size estimation to estimate, project, and forecast the size of the global and other dependent sub-segments in the overall cloud security market.

The research methodology that has been used to estimate the market size includes these steps:

- The key players, SMEs, and startups were identified through secondary sources. Their revenue contributions in the market were determined through primary and secondary sources.

- Annual and financial reports of the publicly listed market players were considered for the company’s revenue details and,

- Primary interviews were also conducted with industry leaders to collect information about their companies, competitors, and key players in the market.

- All percentage splits, and breakups were determined using secondary sources and verified through primary sources.

Top-down and Bottom-up Approach-

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Data triangulation is a crucial step in the market engineering process for cloud security. It involves utilizing multiple data sources and methodologies to validate and cross-reference findings, thereby enhancing the reliability and accuracy of the market segment and subsegment statistics. To conduct data triangulation, various factors and trends related to the cloud security market are studied from both the demand and supply sides. It includes analyzing data from diverse sources such as market research reports, industry publications, regulatory bodies, financial institutions, and technology providers. By examining data from different perspectives and sources, data triangulation helps mitigate potential biases and discrepancies. It provides a more comprehensive understanding of the market dynamics, including the size, growth rate, market trends, and customer preferences.

Furthermore, data triangulation aids in identifying any inconsistencies or outliers in the data, enabling researchers to refine their analysis and make informed decisions. It strengthens the credibility of the market engineering process by ensuring that the conclusions drawn are based on robust and corroborated data. Data triangulation is a rigorous and systematic approach that enhances the reliability and validity of market segment and subsegment statistics in cloud security. It provides a solid foundation for informed decision-making and strategic planning within the industry.

Market Definition

As defined by MarketsandMarkets, cloud security is a subset of cybersecurity that pertains to the protection of cloud computing systems. Its core objective is to ensure the confidentiality and security of data across online infrastructure, applications, and platforms. This is achieved through the implementation of robust access controls, encryption techniques, IAM, and regular security audits. Cloud security also involves addressing potential vulnerabilities and threats, monitoring the cloud environment, and adhering to regulatory requirements and industry standards for data protection. Its ultimate aim is to establish trust and confidence in cloud computing by safeguarding sensitive information and maintaining the integrity and availability of resources within the cloud.

Key Stakeholders

- Chief technology and data officers

- Cloud security professionals

- Business analysts

- Information Technology (IT) professionals

- Government agencies

- Investors and venture capitalists

- Small and Medium-sized Enterprises (SMEs) and large enterprises

- Third-party service providers

- Consultants/consultancies/advisory firms

- Managed and professional service providers

Report Objectives

- To define, describe, and forecast the cloud security market based on offerings, service models, types, verticals, and regions:

- To predict and estimate the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the cloud security market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the cloud security market

- To profile the key players of the cloud security market and comprehensively analyze their market size and core competencies.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global cloud security market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Security Market

Understanding Cloud Security Market revenues and Future trends