Dark Fiber Market Size, Share, Industry Growth, Trends & Analysis by Single-mode Fiber, Multimode Fiber (Step-index, Graded-Index), Network Type (Metro, Long Haul), Material (Glass, Plastic), End User (Telecommunication, BFSI, Aerospace, Oil & Gas, Healthcare) & Region - Global Forecast to 2028

Updated on : Sep 12, 2024

Dark Fiber Market Size, Share & Growth

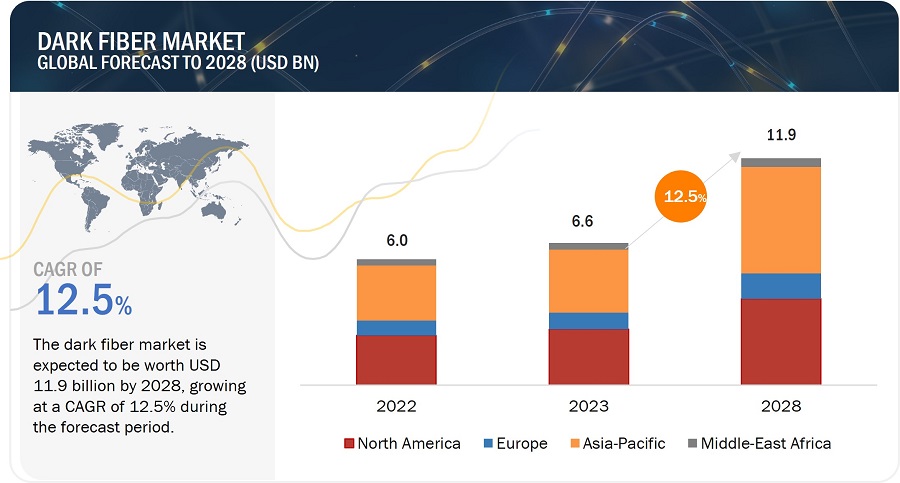

The dark fiber market Size, Share, Industry Growth, Trends & Analysis was valued at USD 6.6 billion in 2023 and is estimated to reach USD 11.9 billion by 2028, registering a CAGR of 12.5% during the forecast period. The growth of the dark fiber market is governed by the rising demand for 5G network, increasing demand for internet bandwidth, and growing demand for reliable and secure network.

Dark Fiber Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Dark Fiber Market Expands with Growing Demand for Single-mode and Multimode Fiber

The dark fiber market is witnessing substantial growth, driven by increasing demand for high-speed internet, data center connectivity, and enhanced network infrastructure. Dark fiber, which refers to unused optical fiber that can be leased to individuals or companies, is being increasingly utilized to meet the rising data transmission needs. The market is segmented into single-mode fiber and multimode fiber, each serving distinct applications and offering unique advantages.

Single-mode Fiber: The Backbone of Long-Distance Connectivity

Single-mode fiber is characterized by its ability to carry light signals over long distances with minimal signal loss, making it ideal for applications requiring high bandwidth and long-haul transmission.

Telecommunications: Single-mode fiber is widely used in telecommunications to connect regional and international networks. Its high capacity and long-distance capabilities make it the preferred choice for backbone networks that require reliable and high-speed data transmission over vast distances.

Data Centers: As the demand for cloud services and data storage grows, data centers are increasingly adopting single-mode fiber to ensure efficient and high-speed connectivity. This fiber type supports the high bandwidth requirements of modern data centers, facilitating seamless data transfer and reducing latency.

Enterprise Networks: Large enterprises with extensive networking needs are leveraging single-mode fiber to connect multiple office locations and ensure robust and secure communication channels. The scalability and high performance of single-mode fiber make it an attractive option for enterprises looking to future-proof their network infrastructure.

Multimode Fiber: Optimizing Short-Range Communications

Multimode fiber is designed for shorter distances, offering high data transmission rates over a limited range. It is suitable for applications where cost-effectiveness and ease of installation are crucial.

Local Area Networks (LANs): Multimode fiber is commonly used in LANs within buildings or campuses. Its ability to handle high data rates over shorter distances makes it ideal for connecting various devices and facilitating high-speed data exchange within localized environments.

Campus Networks: Educational institutions and corporate campuses utilize multimode fiber to connect multiple buildings. This application benefits from the cost-effective and efficient nature of multimode fiber, providing high-speed connectivity across short to medium distances.

Broadcasting: The broadcasting industry uses multimode fiber for video transmission and other media applications within studio environments. The high bandwidth and reliability of multimode fiber ensure quality transmission of high-definition content over relatively short distances.

Dark Fiber Market Trends & Dynamics

Driver: Rising demand for 5G network

In the telecom and networking industry, there is an increased demand for the 5G network and its needs, such as cloud-based networking, gaming, video streaming, etc. The increased demand for high internet speed with proper connectivity can be assured by dark fibers. Digital transformation is affecting almost every industry, with volumes of data are growing rapidly. Intelligent networking of machines and sensors require data to be transmitted for analysis and control purposes within a specific radius. A 5G campus network provides all the solutions for this.

According to the Ookla, LLC (US), the number of 5G deployments and 5G operators worldwide reached 18,731 and 157, respectively, in 2020. According to Telefonaktiebolaget LM Ericsson, it was forecasted that there would be 190 million 5G subscriptions by the end of 2020 and 2.8 billion by 2025. Despite the unexpected events of 2020, 5G deployment and adoption kept increasing. Also, the 5G ecosystem is broadening because the pace of 5G introduction has accelerated during 2020 with many network developments and devices. 5G adoption is growing in momentum in both the network and device domains, with over 150 5G devices launched commercially in 2020. Thus, the rising demand for the 5G network is one of the major drivers for market growth.

Restraint: High initial Investment and regular maintenance

Deploying dark fiber infrastructure requires significant upfront investment in laying and maintaining the fiber optic cables. The costs associated with installation, equipment, permits, and ongoing maintenance can be substantial, posing a barrier for some organizations. Dark fiber networks require regular maintenance and monitoring to ensure optimal performance and reliability. This includes activities such as periodic inspections, troubleshooting, repairing fiber cuts, and upgrading equipment. The cost of maintenance personnel, tools, and spare parts contributes to the overall investment. Other expenses such as project management, legal fees, insurance, and administrative costs should also be considered as part of the initial investment.

Opportunity: Augmented global demand for data centers

Data centers are playing a major role with rising technologies like IoT, AI and 5G. The global data center market is expected to register an impressive growth rate of 7.5%. The market garnered a valuation of USD 101.79 Billion in 2022 and is expected to accumulate a market value of USD 209.8 Billion by 2032. The growth in the cloud migration has accelerated growth and expansion of data centers globally, resulting in major data center operators to expand their footprints. In 2021, US users absorbed 500 megawatts (MW) of data space. Most of the absorption was governed by hyperscalers, the largest occupiers of data centers, which are mostly cloud services firms including Google Cloud, Amazon Web Services (AWS) and Microsoft. For instance, in 2019 Google Cloud plans to build new data centers in Nebraska, South Carolina, Virginia, Nevada and Texas. Similarly, Apple will also begin construction of its data center in Waukee, Iowa with an investment of USD 1.3 billion which is expected to commence from 2023. In September 2022, Meta (Facebook) announced a mega expansion to its massive Eagle Mountain data center near Kuna, Idaho, to support its future metaverse. Microsoft unveiled an aggressive plan to build 50 to 100 new data centers across the U.S. These investments will boost the demand for dark fiber services. Dark fiber enables reliable and high-bandwidth connections between data centers, supporting efficient data transfer and ensuring seamless access to cloud services. As the demand for data centers continues to rise, so does the need for dark fiber connectivity to interconnect these facilities.

Challenge: Lack of proper monitoring systems

The challenge is integration of a fiber segment to the base platform in the most efficient manner, which can be assumed that it will pass a large amount of sensitive data. There are certain technical and operational implications in this integration that could become a challenging task for computer scientists in charge. For avoiding such problems, a platform could be used for integration, on which a high level of governance is exercised, both at the physical level as well as servers and applications. Alternative to this can be to take support of a general-purpose monitoring system, such as Pandora FMS, however , that needs to be acquired and implemented. For both these solutions, companies require to invest more money and put large amounts of data at potential risk. Moreover, platform personnel training would have to be provided, or a trained person should be hired, adding to the overall costs.

Another option can be the support of a general-purpose monitoring system, such as Pandora FMS, which needs to be acquired and implemented.

Dark Fiber Ecosystem

Single mode fiber to hold larger market share during the forecast period.

Single mode fiber held a larger share of the dark fiber market in 2022, and this segment will continue to hold a dominant position in the market during the forecast period. Single-mode fiber is most suitable for longer transmission distances, such as multi-channel television broadcast systems and long-distance telephony. In the current scenario, majority of dark fibers leased out are underground fiber networks. Single-mode fiber has lower fiber attenuation and transmits more information per unit of time compared to the multimode fiber. Single-mode optical fiber is designed to carry a single mode of light as a carrier that is used for long-distance signal transmission. There is an increasing deployment of single-mode fiber for 5G/LTE networks across various regions. Single-mode fiber is commonly used in long-haul telecommunications networks, such as undersea cables, intercity connections, and backbone infrastructure. It is also used in applications that require high-speed data transmission, such as data centers, metropolitan networks, and high-speed internet connections. The growth of this segment is also accelerated due to the increasing prevalence of optical fiber networks across the world, which is expected to increase demand for more dark fiber networks in the near future.

Long-haul fiber to account for the larger share of the dark fiber market for durin the forecast period

The long haul segment held the largest share of the dark fiber market in 2022 and is estimated to grow at the highest CAGR during the forecast period. The deployment of long haul networks has been increasing to meet the growing demand for high-speed and reliable connectivity across different regions. The proliferation of digital services, cloud computing, streaming media, and Internet of Things (IoT) devices has led to an exponential increase in data traffic. Long haul networks are essential for transporting this massive volume of data over long distances efficiently. The growth of IXPs has led to an increased demand for long haul networks. To keep up with the increasing demand, telecommunication companies, infrastructure providers, and governments are continuing to invest in expanding and upgrading long haul networks, deploying new submarine cables, expanding fiber-optic networks, and exploring innovative technologies to enhance long-distance connectivity.

BFSI end-user segment to exhibit significant growth in terms of dark fiber market during the forecast period

Dark fiber can play a crucial role in a BFSI organization's disaster recovery and business continuity strategy. Institutions can create geographically diverse and independent network paths by establishing redundant connections through dark fiber. In the event of a network failure or a disaster in one location, traffic can be seamlessly rerouted to alternative paths, ensuring uninterrupted services and minimizing downtime. Banks and financial services companies are increasingly turning to dark fiber for their bandwidth-intensive core transport, including file sharing, large file transfers, business intelligence applications, and data analysis. .

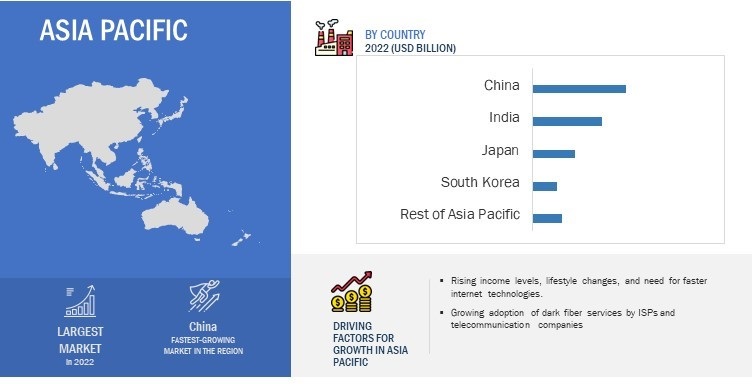

Dark fiber market in Asia Pacific estimated to grow at the fastest rate during the forecast period

The dark fiber market,in Asia Pacific is expected to grow at the highest CAGR during the forecast period. Major countries in Asia Pacific, such as China, India, Japan, and South Korea, are having a huge capacity for dark fiber network services. Some of the major drivers that are responsible for increasing the demand for dark fiber in Asia Pacific include the rise in the income levels, lifestyle changes, and need for faster internet technologies. With emergence of advanced technologies such as AI, IoT, and Big Data, there is an increased momentum for the implementation of large-scale data centers across the region. Major technology gaiants like Alibaba (China), Facebook (US), Amazon (US), Microsoft (US), Google (US), and Baidu (China) have not only established their datacenters in the region but are also planning to expand their dominance in other regions. In Asia Pacific, the market is currently governed by Chinese and Indian consumers due of their increasing adoption rate of high-speed broadband services and mobile devices.

Dark Fiber Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Dark Fiber Market Companies - Key Market Players:

Major vendors in the dark fiber market include AT&T (US), Verizon Communications, Inc. (US), CenturyLink (Lumen Technologies) (US) Colt Technology Services Group Limited (UK), Comcast Corporation (US), Consolidated Communications (US), Exa Infrastructure (GTT Communications, Inc.) (US), CenturyLink, Inc. (US), NTT Communications Corporation (Japan), Verizon Communications, Inc. (US), Windstream Communications (US), and Zayo Group, LLC (US), are some of the key players in the dark fiber market.

Dark Fiber Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 6.6 billion in 2023 |

| Projected Market Size | USD 11.9 billion by 2028 |

| Growth Rate | At a CAGR of 12.5% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered |

AT&T (US), Verizon Communications, Inc. (US), CenturyLink (Lumen Technologies) (US), Consolidated Communications (US), EXA Infrastructure (GTT Communications, Inc.) (US), Comcast Corporation (US), Colt Technology Services Group Limited (UK), NTT Communications (Japan), Windstream Communications (US), Zayo Group, LLC (US), GlobalConnect Group (Denmark), Dark Fibre Africa (Pty) Ltd (South Africa), Frontier Communications Corporation (US), Cologix (US), Crown Castle (US), Dinesh Engineers Limited (India), FirstLight (US), UFINET (Spain), Dobson Technologies (US), Sterlite Power (India), Sorrento Networks (US), Microscan (India) |

Dark Fiber Market Highlights

This research report categorizes the dark fiber market based on type, network type, material, end user , and Region.

|

Segment |

Subsegment |

|

Dark Fiber Market, Type : |

|

|

Dark Fiber Market, Network Type : |

|

|

Dark Fiber Market, by Material: |

|

|

Dark Fiber Market, by End User: |

|

|

Dark Fiber Market, By Region: |

|

Recent Developments

- In May 2023, Zayo Group Holdings, Inc., (US) announced its strategic partnership with Fermaca Networks, a leading provider of long-haul dark fiber infrastructure in Mexico. The partnership will provide the most modern and diverse connectivity between the United States and Mexico. Fermaca is set to launch a new long-haul dark fiber route in Mexico in 2025, which will be the newest and longest long-haul dark fiber route in Mexico in 20 years. The partnership will leverage this route from Fermaca and Zayo’s redundant route north of the border to provide customers with reliable, secure, and diverse cross-border connectivity.

- In December 2022, AT&T (US) expanded its Hyper-Gig Fiber services by partnering with BlackRock Alternatives to extend its footprint beyond its 21-state nationwide. This joint venture, Gigapower, aimed to provide a commercial fiber platform to internet service providers (ISPs) and other businesses across the United States

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of dark fiber market based on type?

The single mode fiber is expected to hold larger share of the dark fiber market during the the forecast period. Single-mode optical fiber is designed to carry a single mode of light as a carrier that is used for long-distance signal transmission. There is an increasing deployment of single-mode fiber for 5G/LTE networks across various regions. Single-mode fiber is commonly used in long-haul telecommunications networks, such as undersea cables, intercity connections, and backbone infrastructure. It is also used in applications that require high-speed data transmission, such as data centers, metropolitan networks, and high-speed internet connections. The growth of this segment is also accelerated due to the increasing prevalence of optical fiber networks across the world, which is expected to increase demand for more dark fiber networks in the near future.

Which end user segment will contribute more to the overall market share by 2028?

The ISPs and telecommunications industry segment will contribute the most to the dark fiber market. The market for ISPs and telecommunications industry segment segment is expected to account for largest share of the dark fiber market during the forecast period owing to the ongoing adoption of cloud storage and increasing technological developments taking place in the field of machine learning, artificial intelligence, and deep learning. This, in turn, increases data traffic across networks, thereby leading to significant demand for high data transmission along with efficient data communication. The development of internet service providers and telecom towers globally is also driving the growth of the dark fiber market. Moreover, leading cloud service providers such as Google, Amazon, and Microsoft are implementing dark fiber to serve their traffic.

How will technological developments such as Internet of Things (IoT), artificial intelligence (AI) technology change the dark fiber market landscape in the future?

IoT devices are becoming increasingly prevalent, connecting various devices and sensors for data collection and communication. Dark fiber can support the massive data transmission requirements of IoT by providing reliable and high-bandwidth connectivity. As the number of IoT devices continues to grow, dark fiber networks can enable seamless data transfer and support the expanding IoT ecosystem. AI and ML applications often involve handling massive datasets and require high-performance computing. Dark fiber can support the fast and reliable transfer of data between AI/ML systems, data storage facilities, and processing units. Dark fiber infrastructure enables the seamless transmission of large volumes of data, which is essential for training and deploying AI models.

Which region is expected to adopt dark fiber services at a fast rate?

Asia Pacific region is expected to adopt dark fiber services at the fastest rate. Developing countries such as India and China are expected to have a high potential for the future growth of the market.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

In the telecom and networking industry, there is an increased demand for the 5G network and its needs, such as cloud-based networking, gaming, video streaming, etc. The increased demand for high internet speed with proper connectivity can be assured by dark fibers. Digital transformation is affecting almost every industry, with volumes of data are growing rapidly. Intelligent networking of machines and sensors require data to be transmitted for analysis and control purposes within a specific radius. A 5G campus network provides all the solutions for this.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for 5G network- Increasing demand for internet bandwidth- Growing demand for reliable and secure networkRESTRAINTS- Risky installation- High initial investment and regular maintenanceOPPORTUNITIES- Telecommunications industry to create lucrative opportunities- Need for heavy data handling in manufacturing and logistics- Increasing demand for data centersCHALLENGES- Lack of proper monitoring systems

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR DARK FIBER MARKET

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 CASE STUDY ANALYSISBANDWIDTH IG AND FLEXENTIAL BROUGHT ADDITIONAL DARK FIBER CAPACITY TO OREGON DATA CENTERPAC-12 NETWORKS TEAMED UP WITH ZAYO TO BOOST ITS PRODUCTION CAPABILITYFIRSTLIGHT PROVIDED DARK FIBER SOLUTIONS TO MEET SOPHISTICATED CONNECTIVITY REQUIREMENTSTELLUS VENTURE ASSOCIATES HELPED CITY OF SAN LEANDRO DEVELOP 11-MILE FIBER LOOPFIBERLIGHT EXPANDED DARK FIBER NETWORK CAPABILITIES FOR ROSWELLFIBERLIGHT EXPANDED FIBER NETWORKING AND DEDICATED INTERNET ACCESS (DIA) IN BASTROP

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Internet of Things- Edge computing- Artificial intelligence and machine learningRELATED TECHNOLOGIES- Wavelength division multiplexing- Microwave data transmission

- 5.9 AVERAGE RENTAL SERVICE PRICE FOR DARK FIBER

- 5.10 TRADE ANALYSIS

-

5.11 PATENT ANALYSIS, 2019–2022

- 5.12 TARIFFS

-

5.13 REGULATORY STANDARDSREGULATORY COMPLIANCESTANDARDS

- 6.1 INTRODUCTION

-

6.2 SINGLE-MODE FIBERWIDE USE IN LONG-DISTANCE DATA TRANSMISSIONS TO DRIVE MARKET

-

6.3 MULTIMODE FIBERABILITY TO PROVIDE HIGH BANDWIDTH WITH HIGH SPEED TO BOOST DEMANDSTEP-INDEX MULTIMODE FIBERGRADED-INDEX MULTIMODE FIBER

- 7.1 INTRODUCTION

-

7.2 METROCOST-EFFECTIVE CONTROL AND PHYSICAL ROUTING TO DRIVE DEMAND

-

7.3 LONG HAULDEMAND FOR HIGH-SPEED AND RELIABLE CONNECTIVITY TO SUPPORT MARKET

- 8.1 INTRODUCTION

-

8.2 GLASSGROWING DEMAND FOR RUGGED FIBER TO PROPEL MARKET

-

8.3 PLASTICLOWER SIGNAL ATTENUATION THAN GLASS FIBER TO AUGMENT DEMAND

- 9.1 INTRODUCTION

-

9.2 INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRYUSE OF DARK FIBER TO REDUCE CAPITAL EXPENDITURE IN TELECOMMUNICATIONS INDUSTRY

-

9.3 BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRYNEED FOR SCALABILITY TO MEET GROWING BANDWIDTH DEMAND IN FINANCIAL INSTITUTIONS TO DRIVE MARKET

-

9.4 IT-ENABLED SERVICESABILITY TO MINIMIZE DOWNTIME OF NETWORK TO INCREASE DEMAND FOR DARK FIBER

-

9.5 MILITARY & AEROSPACE INDUSTRYDEMAND FOR DARK FIBER TO INCREASE DUE TO ITS UNLIMITED BANDWIDTH AND HIGH-SECURITY FEATURES

-

9.6 OIL & GAS INDUSTRYULTRA-LOW OPTICAL LOSS AND HIGH OPTICAL RETURN LOSS OF DARK FIBER TO DRIVE MARKET

-

9.7 HEALTHCARE INDUSTRYDARK FIBER AS OPTIMAL CONNECTIVITY SOLUTION TO DRIVE MARKET

-

9.8 RAILWAYS INDUSTRYUSE OF DARK FIBER TO MAKE OPERATIONS FUTURE-PROOF

- 9.9 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT ANALYSISUS- To dominate regional market during forecast periodCANADA- To hold significant share of regional market during forecast periodMEXICO- Expanding telecommunications industry to drive market

-

10.3 EUROPERECESSION IMPACT ANALYSISUK- Focus on accelerating cloud adoption across public organizations to drive marketGERMANY- Investments in network upgrades to drive marketFRANCE- Increasing focus on 5G to contribute to market growthREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Boom in internet and telecommunications users to boost marketJAPAN- Investments in telecom industry to propel marketINDIA- Unprecedented increase in data consumption to fuel demandSOUTH KOREA- Increasing focus on rolling out 5G network to drive marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)RECESSION IMPACT ANALYSISMIDDLE EAST & AFRICA- Increasing data center establishments to fuel demandSOUTH AMERICA- To hold larger share of RoW dark fiber market than Middle East & Africa

- 11.1 INTRODUCTION

- 11.2 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- 11.3 MARKET SHARE ANALYSIS (2022)

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSDARK FIBER MARKET: COMPANY FOOTPRINT

-

11.6 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY COMPANIESAT&T- Business overview- Products and services offered- Recent developments- MnM viewVERIZON COMMUNICATIONS, INC.- Business overview- Products and services offered- Recent developments- MnM viewCENTURYLINK, INC. (LUMEN TECHNOLOGIES)- Business overview- Products and services offered- Recent developments- MnM viewCONSOLIDATED COMMUNICATIONS- Business overview- Products and services offered- Recent developments- MnM viewEXA INFRASTRUCTURE- Business overview- Products and services offered- Recent developments- MnM viewCOMCAST CORPORATION- Business overview- Products and services offered- Recent developmentsCOLT TECHNOLOGY SERVICES GROUP LIMITED- Business overview- Products and services offered- Recent developmentsNTT COMMUNICATIONS CORPORATION- Business overview- Products and services offered- Recent developmentsWINDSTREAM COMMUNICATIONS- Business overview- Products and services offered- Recent developmentsZAYO GROUP, LLC- Business overview- Products and services offered- Recent developments

-

12.2 OTHER PLAYERSGLOBALCONNECT GROUPDARK FIBRE AFRICA (PTY) LTD.FRONTIER COMMUNICATIONS CORPORATIONCOLOGIXCROWN CASTLEDEPLFIRSTLIGHTUFINETDOBSON TECHNOLOGIESSTERLITE POWERSORRENTO NETWORKSMICROSCAN

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 DARK FIBER MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 2 DARK FIBER MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 AVERAGE RENTAL SERVICE PRICE FOR DARK FIBER

- TABLE 4 AVERAGE RENTAL SERVICE PRICE FOR DARK FIBER, BY END USER

- TABLE 5 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 6 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 7 NUMBER OF PATENTS REGISTERED IN DARK FIBER MARKET FROM 2013 TO 2022

- TABLE 8 LIST OF MAJOR PATENT REGISTRATIONS RELATED TO DARK FIBER MARKET

- TABLE 9 DARK FIBER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 10 DARK FIBER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 11 SINGLE-MODE DARK FIBER MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 12 SINGLE-MODE DARK FIBER MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 13 SINGLE-MODE DARK FIBER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 14 SINGLE-MODE DARK FIBER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 15 SINGLE-MODE DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 16 SINGLE-MODE DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 SINGLE-MODE DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 18 SINGLE-MODE DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 SINGLE-MODE DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 20 SINGLE-MODE DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 SINGLE-MODE DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 SINGLE-MODE DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SINGLE-MODE DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 SINGLE-MODE DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 SINGLE-MODE DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 SINGLE-MODE DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 SINGLE-MODE DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 SINGLE-MODE DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 SINGLE-MODE DARK FIBER MARKET FOR OTHERS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 SINGLE-MODE DARK FIBER MARKET FOR OTHERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MULTIMODE DARK FIBER MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 32 MULTIMODE DARK FIBER MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 33 MULTIMODE DARK FIBER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 MULTIMODE DARK FIBER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 MULTIMODE DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 MULTIMODE DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MULTIMODE DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 MULTIMODE DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 MULTIMODE DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 MULTIMODE DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 MULTIMODE DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 MULTIMODE DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 MULTIMODE DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 MULTIMODE DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 MULTIMODE DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 MULTIMODE DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MULTIMODE DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 MULTIMODE DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MULTIMODE DARK FIBER MARKET FOR OTHERS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 MULTIMODE DARK FIBER MARKET FOR OTHERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 DARK FIBER MARKET, BY NETWORK TYPE, 2019–2022 (USD MILLION)

- TABLE 52 DARK FIBER MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 53 DARK FIBER MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 54 DARK FIBER MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 55 DARK FIBER MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 56 DARK FIBER MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 57 DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 58 DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 62 DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 63 DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 66 DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 70 DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 71 DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 74 DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 75 DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 78 DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 79 DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 82 DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 83 DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 DARK FIBER MARKET FOR OTHERS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 86 DARK FIBER MARKET FOR OTHERS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 DARK FIBER MARKET FOR OTHERS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 DARK FIBER MARKET FOR OTHERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 DARK FIBER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 DARK FIBER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 DARK FIBER MARKET IN NORTH AMERICA, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 92 DARK FIBER MARKET IN NORTH AMERICA, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 93 DARK FIBER MARKET IN NORTH AMERICA, BY END USER, 2019–2022 (USD MILLION)

- TABLE 94 DARK FIBER MARKET IN NORTH AMERICA, BY END USER, 2023–2028 (USD MILLION)

- TABLE 95 DARK FIBER MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 DARK FIBER MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 DARK FIBER MARKET IN EUROPE, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 98 DARK FIBER MARKET IN EUROPE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 DARK FIBER MARKET IN EUROPE, BY END USER, 2019–2022 (USD MILLION)

- TABLE 100 DARK FIBER MARKET IN EUROPE, BY END USER, 2023–2028 (USD MILLION)

- TABLE 101 DARK FIBER MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 DARK FIBER MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 DARK FIBER MARKET IN ASIA PACIFIC, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 104 DARK FIBER MARKET IN ASIA PACIFIC, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 105 DARK FIBER MARKET IN ASIA PACIFIC, BY END USER, 2019–2022 (USD MILLION)

- TABLE 106 DARK FIBER MARKET IN ASIA PACIFIC, BY END USER, 2023–2028 (USD MILLION)

- TABLE 107 DARK FIBER MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 DARK FIBER MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 DARK FIBER MARKET IN REST OF THE WORLD, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 110 DARK FIBER MARKET IN REST OF THE WORLD, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 DARK FIBER MARKET IN REST OF THE WORLD, BY END USER, 2019–2022 (USD MILLION)

- TABLE 112 DARK FIBER MARKET IN REST OF THE WORLD, BY END USER, 2023–2028 (USD MILLION)

- TABLE 113 DARK FIBER MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD MILLION)

- TABLE 114 DARK FIBER MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 DARK FIBER MARKET: KEY GROWTH STRATEGIES ADOPTED BY COMPANIES FROM 2019 TO 2022

- TABLE 116 DARK FIBER MARKET: DEGREE OF COMPETITION

- TABLE 117 LIST OF START-UPS/SMES IN DARK FIBER MARKET

- TABLE 118 COMPANY FOOTPRINT

- TABLE 119 COMPANY END USER FOOTPRINT

- TABLE 120 COMPANY REGION FOOTPRINT

- TABLE 121 PRODUCT LAUNCHES, 2019–2023

- TABLE 122 DEALS, 2019–2023

- TABLE 123 OTHERS, 2019–2023

- TABLE 124 AT&T: COMPANY OVERVIEW

- TABLE 125 AT&T: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 126 AT&T: DEALS

- TABLE 127 AT&T: OTHERS

- TABLE 128 VERIZON COMMUNICATIONS, INC.: COMPANY OVERVIEW

- TABLE 129 VERIZON COMMUNICATIONS, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 130 VERIZON: DEALS

- TABLE 131 CENTURYLINK, INC. (LUMEN TECHNOLOGIES): COMPANY OVERVIEW

- TABLE 132 CENTURYLINK, INC. (LUMEN TECHNOLOGIES): PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 133 CENTURYLINK, INC. (LUMEN TECHNOLOGIES): DEALS

- TABLE 134 CENTURYLINK, INC. (LUMEN TECHNOLOGIES): OTHERS

- TABLE 135 CONSOLIDATED COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 136 CONSOLIDATED COMMUNICATIONS: DEALS

- TABLE 137 CONSOLIDATED COMMUNICATIONS: OTHERS

- TABLE 138 EXA INFRASTRUCTURE: COMPANY OVERVIEW

- TABLE 139 EXA INFRASTRUCTURE: DEALS

- TABLE 140 EXA INFRASTRUCTURE : OTHERS

- TABLE 141 COMCAST CORPORATION: COMPANY OVERVIEW

- TABLE 142 COMCAST CORPORATION: DEALS

- TABLE 143 COMCAST CORPORATION: OTHERS

- TABLE 144 COLT TECHNOLOGY SERVICES GROUP LIMITED: COMPANY OVERVIEW

- TABLE 145 COLT TECHNOLOGY SERVICES GROUP LIMITED: DEALS

- TABLE 146 COLT TECHNOLOGY SERVICES GROUP LIMITED: OTHERS

- TABLE 147 NTT COMMUNICATIONS CORPORATION: COMPANY OVERVIEW

- TABLE 148 NTT COMMUNICATIONS CORPORATION: DEALS

- TABLE 149 NTT COMMUNICATIONS CORPORATION: OTHERS

- TABLE 150 WINDSTREAM COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 151 WINDSTREAM COMMUNICATIONS: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 152 WINDSTREAM COMMUNICATIONS CORPORATION: DEALS

- TABLE 153 WINDSTREAM COMMUNICATIONS: OTHERS

- TABLE 154 ZAYO GROUP, LLC: COMPANY OVERVIEW

- TABLE 155 ZAYO GROUP, LLC: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 156 ZAYO GROUP, LLC: DEALS

- TABLE 157 ZAYO GROUP, LLC: OTHERS

- FIGURE 1 DARK FIBER MARKET SEGMENTATION

- FIGURE 2 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 3 DARK FIBER MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DARK FIBER MARKET: DATA TRIANGULATION

- FIGURE 8 SINGLE-MODE FIBER SEGMENT TO HOLD LARGER MARKET SHARE THAN MULTIMODE FIBER SEGMENT DURING FORECAST PERIOD

- FIGURE 9 LONG HAUL SEGMENT TO WITNESS HIGHER GROWTH RATE THAN METRO SEGMENT FROM 2023 TO 2028

- FIGURE 10 INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY TO EXHIBIT HIGHEST CAGR IN DARK FIBER MARKET FROM 2023 TO 2028

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF DARK FIBER MARKET IN 2022

- FIGURE 12 RISING DEMAND FOR 5G NETWORK TO FUEL DARK FIBER MARKET

- FIGURE 13 SINGLE-MODE FIBER SEGMENT TO REGISTER HIGHER CAGR THAN MULTIMODE FIBER SEGMENT DURING FORECAST PERIOD

- FIGURE 14 LONG HAUL SEGMENT TO CAPTURE LARGER MARKET SHARE THAN METRO SEGMENT DURING FORECAST PERIOD

- FIGURE 15 GLASS SEGMENT TO CAPTURE LARGER MARKET SHARE THAN PLASTIC SEGMENT DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA TO CAPTURE LARGEST MARKET SHARE BY 2028

- FIGURE 17 INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS AND CHINA SEGMENTS ACCOUNTED FOR LARGEST SHARES

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 DARK FIBER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 DARK FIBER MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 21 DARK FIBER MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 22 GLOBAL CLOUD DATA CENTER IP TRAFFIC FROM 2015 TO 2021

- FIGURE 23 DARK FIBER MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 24 DARK FIBER MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 25 DARK FIBER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DARK FIBER SERVICE PROVIDERS

- FIGURE 27 DARK FIBER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 DARK FIBER MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 DARK FIBER PATENTS PUBLISHED BETWEEN 2013 AND 2022

- FIGURE 30 DARK FIBER PATENTS PUBLISHED BETWEEN 2013 AND 2022

- FIGURE 31 DARK FIBER MARKET, BY TYPE

- FIGURE 32 SINGLE-MODE FIBER TO HOLD LARGER MARKET SHARE THAN MULTI-MODE FIBER DURING FORECAST PERIOD

- FIGURE 33 DARK FIBER MARKET, BY NETWORK TYPE

- FIGURE 34 LONG HAUL SEGMENT TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

- FIGURE 35 DARK FIBER MARKET, BY MATERIAL

- FIGURE 36 GLASS SEGMENT TO CAPTURE LARGER MARKET SHARE THAN PLASTIC SEGMENT DURING FORECAST PERIOD

- FIGURE 37 DARK FIBER MARKET, BY END USER

- FIGURE 38 INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 DARK FIBER MARKET, BY REGION

- FIGURE 40 DARK FIBER MARKET IN ASIA PACIFIC TO REGISTER HIGH GROWTH FROM 2023 TO 2028

- FIGURE 41 NORTH AMERICA: DARK FIBER MARKET SNAPSHOT

- FIGURE 42 EUROPE: DARK FIBER MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: DARK FIBER MARKET SNAPSHOT

- FIGURE 44 REST OF THE WORLD: DARK FIBER MARKET SNAPSHOT

- FIGURE 45 DARK FIBER MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020–2022

- FIGURE 46 DARK FIBER MARKET SHARE ANALYSIS, 2022

- FIGURE 47 DARK FIBER MARKET: KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 48 DARK FIBER MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 49 AT&T: COMPANY SNAPSHOT

- FIGURE 50 VERIZON COMMUNICATIONS, INC.: COMPANY SNAPSHOT

- FIGURE 51 CENTURYLINK, INC (LUMEN TECHNOLOGIES): COMPANY SNAPSHOT

- FIGURE 52 CONSOLIDATED COMMUNICATIONS: COMPANY SNAPSHOT

- FIGURE 53 COMCAST CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 NTT COMMUNICATIONS CORPORATION: COMPANY SNAPSHOT

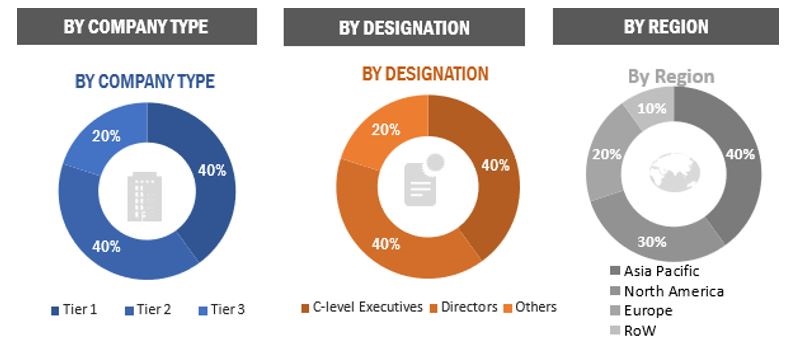

The study involved four major activities in estimating the size for dark fiber market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, and certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the dark fiber market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the dark fiber market scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (dark fiber service providers) across 4 major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the dark fiber market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Dark Fiber Market: Bottom-Up Approach

Dark Fiber Market: Top-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

Dark fiber refers to the unused fiber optic cable that has been laid. While lying unused, no light pulses are being transmitted through it. The dark strands can be leased to individuals or companies who wish to establish optical connections in their locations.

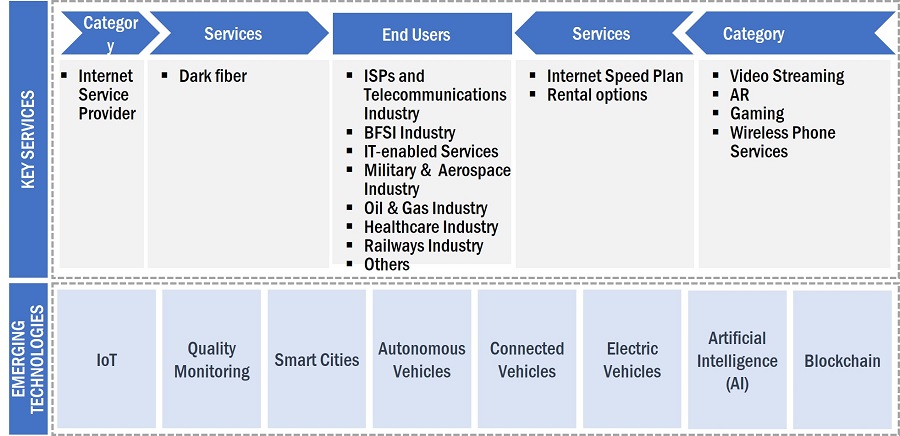

Dark fibers are used for private networking, internet access, and internet infrastructure networking. Their end users include internet service providers (ISPs) and telecommunications industry, BFSI industry, IT enabled services, military and aerospace industry, oil & gas industry, healthcare industry, railway industry, and others. Besides supporting the 5G network, some of the advantages of dark fibers include assuring data security and increasing bandwidth.

Key Stakeholders

- Senior Management

- Application

- Finance/Procurement Department

- R&D Department

Report Objectives

- To describe and forecast the global dark fiber market, by type, network type, material, end user, and region, in terms of value

- To describe and forecast the market for four key regions—North America, Europe, Asia Pacific and the Rest of the World (RoW)--in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the dark fiber market

- To provide a detailed overview of the supply chain pertaining to dark fiber ecosystems, along with the average selling price for dark fibers

- To strategically analyze the ecosystem, tariff and regulations, patent landscape, trade landscape, and various case studies pertaining to the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their position in the market in terms of their ranking and core competencies2, and detail the competitive landscape for market leaders

- To analyze competitive developments in the dark fiber market, such as product & service launches and developments, expansions, agreements, collaborations, acquisitions, and partnerships.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dark Fiber Market