Data Catalog Market by Component (Solutions, Services), Deployment Mode (Cloud, On-premises), Data Consumer (BI Tools, Enterprise Applications, Mobile and Web Applications), Organization Size, Metadata Type, Vertical & Region - Global Forecast to 2027

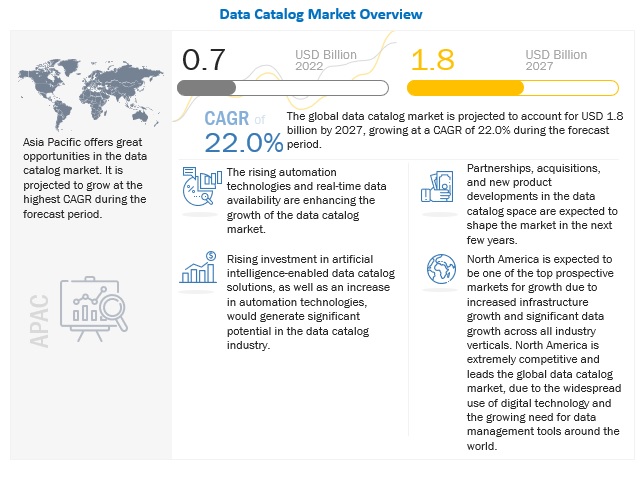

[257 Pages Report] The global Data Catalog Market size was worth approximately $0.7 billion in 2022 and poised to generate revenue around $1.8 billion by the end of 2027, projected a CAGR of 22.0%.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Catalog Market Growth Dynamics

Driver: Rising need to gather insights to form business strategies

As the use of IoT continues to increase, the generation of insights from incoming data is the need of the day. However, most unstructured data, consisting of email correspondences, account information, and old versions of related documents, obtained from various sources, does not help make business decisions. Therefore, companies prefer data catalogs to synthesize and organize their enterprise data from multiple sources into one simple and easy format. Several industry verticals, such as healthcare; banking, financial services, and insurance (BFSI); and retail and eCommerce, are using data catalog solutions to create valuable insights to form business strategies and deliver business-critical decisions.

Restraint: Misconceptions about data security and privacy risks

Security and compliance are a concern for organizations across the globe. As a result, they are reluctant to adopt new solutions involving data handling or data shifting from one platform to another. Due to a lack of proper knowledge about security frameworks and their implementation, many companies perceive that catalog management solutions might lead to data breaches in their highly abstracted data sets.

These misconceptions hinder the adoption of data catalog solutions. Users refrain from using these solutions, fearing they would lose their crucial master data and reference data due to data errors occurring during compilation or upgradation. They fear for the privacy of their data and accountability in case of data loss or theft. The few small and medium-sized enterprises (SMEs) that want to adopt cloud-based data catalog solutions withdraw their decision due to these concerns. For instance, in October 2020, Pfizer, after suffering a data breach, was reluctant to adopt a cloud-based solution due to system integration complexities.

Opportunity: Use of data catalog to improve employee productivity and quality of life

To achieve the mission of being data-driven, enterprises need to set up their systems and processes that make it easier for data citizens to quickly access the data required. However, according to a study by IBM, businesses spend 70% of their time looking for their data, and only 30% use it. Data catalogs eliminate the need for repetitive tasks and work done in silos by providing a central source of data for everyone. They help the user go through all the context they need at a glance by providing,

- Comprehensive business glossaries and descriptions

- Auto-generated data profiles

- Quality reports

- Capabilities, such as chats, in-line annotations, discussions, and data sharing with a link

Challenge: Lack of professional workforce

The team entrusted with building a data catalog has to be a balanced mix of technical and business experts. Quick learners with a background in the data line of services and data cataloging tools and who know the business value that data cataloging can add to the organization are the most essential. However, companies may strive to identify skilled and creative talent for data cataloging. Though they may have well-articulated requirements, a sound business intelligence strategy, and a good tool solution, they can lack the technical skills required for designing, building, maintaining, and supporting data. This can sometimes act as a challenge to the growth of the data catalog market.

By metadata type, Business metadata segment is estimated to grow at a higher CAGR during the forecast period

Business metadata helps companies maintain structured documentation within the business glossary of terms. It includes the definitions of data files and attributes in business terms. Business metadata also includes definitions for business rules that apply to business data attributes, data owners and stewards, data quality metrics, and similar information that helps business users in navigating the information present in the centrally managed data. It uses metadata to help organizations manage their data. It also helps data professionals collect, organize, access, and enrich metadata to support data discovery and governance.

By vertical, retail and eCommerce segment is estimated to grow at a higher CAGR during the forecast period

The retail and eCommerce industry has transformed its operations from traditional physical stores to online stores. As a result, retailers are taking advantage of online platforms to reach large numbers of people and gain a dominant position in a highly competitive industry by analyzing customer behaviors, preferences, and spending patterns. Therefore, retailers are focusing on analyzing these factors to study the large volumes of data generated through social media platforms, Point of Sale (POS) systems, mobile apps, and eCommerce and web platforms to formulate various marketing campaigns and business strategies.

To know about the assumptions considered for the study, download the pdf brochure

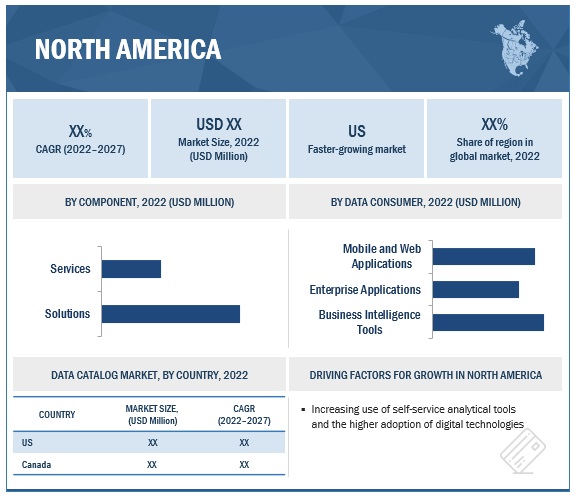

North America to account for the largest market size during the forecast period

The North American region, being the early adopter of data catalog technology, is the major revenue-generating region in the global data catalog market. It is expected to grow rapidly during the forecast period due to the increasing use of data in various BI tools and the higher adoption of digital technologies in areas, such as BFSI, telecom and IT, healthcare, and manufacturing. The region has become a leader in innovations, research, development (R&D), and technological advancements in BI technology.

Smart city initiatives are growing in North America, due to which there is an increase in raw data as well. The need to properly access such raw data through BI tools for extracting relevant information is expected to increase the demand for various data catalog solutions. Key players, such as IBM, Oracle, AWS, Informatica, Talend, TIBCO Software, and Microsoft, along with several start-ups, are offering enhanced data catalog solutions and services to cater to customer needs.

Key Market Players

The major vendors in data catalog market include IBM (US), Microsoft (US), TIBCO Software (US), Collibra (Belgium), Alation (US), Oracle (US), Google (US), Informatica (US), Alteryx (US), Zaloni (US), Cloudera (US), Talend (US), Ataccama (Canada), Quest software (Acquired Erwin), Tamr (US), Denodo (US), Tableau (US), AWS (US), Cambridge Semantics (US), Octopai (Israel), Alex Solutions (Australia), Immuta (US), Data.World (US), Solidatus (UK), Atlan (Singapore), Stemma (US), Castor (US), and Zeenea (France).

These vendors have a strong foothold in local and global markets due to their strong product portfolios and well-established strategic alliances. Besides, in the unorganized sector, there are several vendors who collectively hold a prominent share in the market. Thus, the intensity of competitive rivalry in the market is high.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attributes |

Details |

|

Market size value in 2022 |

$0.7 billion |

|

Revenue forecast for 2027 |

$1.8 billion |

|

Growth Rate |

22.0% CAGR |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Segments covered |

|

|

Regions covered |

|

|

Companies covered |

IBM (US), Microsoft (US), TIBCO Software (US), Collibra (Belgium), Alation (US), Oracle (US), Google (US), Informatica (US), Alteryx (US), Zaloni (US) |

This research report categorizes the data catalog market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component, the data catalog market has the following segments:

- Solutions

- Services

Based on Organization Size, the market has the following segments:

- SMEs

- Large Enterprises

Based on Deployment Mode, the market has the following segments:

- Cloud

- On-Premises

Based on Data Consumer, the market has the following segments:

- Business Intelligence tools

- Enterprise Applications

- Mobile and Web Applications

Based on Metadata Type, the market has the following segments:

- Technical Metadata

- Business Metadata

Based on Vertical, the market has the following segments:

- BFSI

- Retail and eCommerce

- Manufacturing

- Government and Defence

- Healthcare and Life Sciences

- Telecom

- Ites

- Media and Entertainment

- Transportation and Logistics

- Other Verticals

Based on regions, the data catalog market has the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

MEA

- Middle East

- Africa

Recent Developments:

- In July 2022, Talend, a global leader in data integration and data management, announced its enhanced support for Cloudera with the addition of new certification for Cloudera Data Platform (CDP) on the Public Cloud, as well as CDP data services, including Data Hub and Data Engineering

- In July 2022, Data Catalog, a part of Dataplex, provides a complete data management and governance experience with built-in data intelligence and automation capabilities.

- In September 2021, Alation a leader in enterprise data intelligence solutions, announced the release and general availability of the company’s Data Governance App. The new app revolutionizes multi-cloud governance and security and delivers autonomous, continual data governance using machine learning and AI.

- In August 2021, Cloudera launched Cloudera DataFlow for the Public Cloud, a cloud-native service for data flows, to process hybrid streaming workloads on the CDP. It enables users to automate complex data flow operations, boost the operational efficiency of streaming data flows with auto-scaling capabilities and cut down on cloud costs by eliminating infrastructure sizing guesswork.

- In July 2021, A new version of the Oracle Cloud Infrastructure (OCI) Data Catalog was released. Through this product, Oracle would expedite data cataloging by introducing automation into data asset discovery and creation for technical metadata harvesting.

- In June 2021, Alation launched Alation Cloud Service, a cloud-based platform for data intelligence. It enables customers to leverage innovations faster through continuous integration and deployment options

Frequently Asked Questions (FAQ):

How big is the Data Catalog Market?

What is the estimated growth rate (CAGR) of the global Data Catalog Market?

Who are the key players in Data Catalog Market?

What are the major revenue pockets in the global Data Catalog Market currently?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATE, 2019–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 DATA CATALOG MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary interviews

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES IN MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF SOLUTIONS/SERVICES IN MARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY — APPROACH 3, BOTTOM-UP (DEMAND SIDE): SHARE OF DATA CATALOG MARKET THROUGH OVERALL DATA CATALOG SPENDING

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 RESEARCH ASSUMPTIONS

2.8 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 3 GLOBAL DATA CATALOG MARKET AND GROWTH RATE, 2017–2021 (USD MILLION, Y-O-Y %)

TABLE 4 GLOBAL MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

FIGURE 10 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

FIGURE 11 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 12 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

FIGURE 13 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 14 BUSINESS INTELLIGENCE TOOLS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

FIGURE 15 TECHNICAL METADATA SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 16 RETAIL AND ECOMMERCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 17 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH IN 2022

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN DATA CATALOG MARKET

FIGURE 18 RAPID DIGITIZATION ACROSS SECTORS AND RISE IN DATA GENERATION TO DRIVE ADOPTION OF DATA CATALOG SOLUTIONS

4.2 MARKET, BY TOP THREE VERTICALS

FIGURE 19 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 20 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4.4 NORTH AMERICA: MARKET, BY COMPONENT AND SERVICE

FIGURE 21 SOLUTIONS AND PROFESSIONAL SERVICES SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DATA CATALOG MARKET

5.2.1 DRIVERS

5.2.1.1 Growing proliferation of data

5.2.1.2 Rising need to gather insights for business strategies

5.2.1.3 Growing adoption of cloud-based solutions

5.2.1.4 Increasing use of self-service analytics

5.2.2 RESTRAINTS

5.2.2.1 Lack of standardization of data

5.2.2.2 Misconceptions about risks

5.2.3 OPPORTUNITIES

5.2.3.1 Use of data catalog to improve employee productivity

5.2.3.2 Rising automation and AI-enabled technologies

5.2.4 CHALLENGES

5.2.4.1 Lack of technical skills in workforce

5.2.4.2 Inconsistent data upkeeping

5.3 EVOLUTION: DATA CATALOG

FIGURE 23 EVOLUTION OF DATA CATALOG

5.4 ESSENTIAL FEATURES OF DATA CATALOG

5.4.1 DATA SEARCH AND DISCOVERY

5.4.2 BUSINESS GLOSSARY

5.4.3 DATA LINEAGE

5.4.4 COLLABORATION

5.4.5 DATA GOVERNANCE

5.4.6 INTEGRATION

5.5 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: DATA CATALOG MARKET

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 25 SUPPLY CHAIN ANALYSIS: MARKET

5.7 ECOSYSTEM

TABLE 5 ECOSYSTEM: MARKET

5.8 MARKET: IMPACT OF COVID-19

5.9 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF DATA CATALOGS

FIGURE 26 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.10 TECHNOLOGICAL ANALYSIS

5.10.1 ARTIFICIAL INTELLIGENCE AND AUTOMATION

5.10.2 MACHINE LEARNING

5.11 CASE STUDY ANALYSIS

5.11.1 INFORMATION SERVICES

5.11.1.1 Case Study 1: Creditsafe uses Waterline Smart Data Catalog to improve its common processes to manage data

5.11.2 BFSI

5.11.2.1 Case Study 2: Nordea automates its data management processes using Waterline Smart Data Catalog

5.11.3 HEALTHCARE AND LIFE SCIENCES

5.11.3.1 Case Study 3: Southeastern Med strengthens its BI reporting capabilities through Datawatch Managed Analytics platform

5.11.4 RETAIL AND ECOMMERCE

5.11.4.1 Case Study 4: eBay gains centralized access to data using Alation’s data catalog solution

5.11.5 GOVERNMENT AND DEFENSE

5.11.5.1 Case Study 5: With Collibra, George Washington University automates its governance processes

5.12 PATENT ANALYSIS

5.12.1 METHODOLOGY

5.12.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED, 2019-2022

5.12.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 27 TOTAL NUMBER OF PATENTS GRANTED ANNUALLY, 2019–2022

5.12.3.1 Top applicants

FIGURE 28 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 IMPACT OF PORTER’S FIVE FORCES ON DATA CATALOG MARKET

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF SUPPLIERS

5.13.4 BARGAINING POWER OF BUYERS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

5.14 REGULATORY IMPLICATION

5.14.1 GENERAL DATA PROTECTION REGULATION

5.14.2 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION/INTERNATIONAL ELECTROTECHNICAL COMMISSION 27000 STANDARDS

5.14.3 CLOUD SECURITY ALLIANCE CONTROLS

5.14.4 SYSTEM AND ORGANIZATION CONTROL REPORTS

5.14.4.1 System and Organization Control 1

5.14.4.2 System and Organization Control 2

5.14.5 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.14.6 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.14.7 SARBANES-OXLEY ACT OF 2002

5.14.8 THE GRAMM–LEACH–BLILEY ACT

5.14.9 EUROPEAN UNION DATA PROTECTION REGULATION

5.14.10 CAN-SPAM ACT

5.15 TARIFF AND REGULATORY LANDSCAPE

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.16 PRICING ANALYSIS

5.16.1 AVERAGE SELLING PRICE OF SUBSCRIPTION-BASED DATA CATALOG SOLUTIONS

TABLE 13 AVERAGE SELLING PRICE OF SUBSCRIPTION-BASED DATA CATALOG SOLUTIONS

5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS (%)

5.17.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 15 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

6 DATA CATALOG MARKET, BY COMPONENT (Page No. - 77)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

FIGURE 31 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 16 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 17 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 GROWING DIGITIZATION AND USE OF CLOUD COMPUTING

TABLE 18 SOLUTIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 19 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 32 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 20 SERVICES: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 21 SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

6.3.1.1 Growing need to manage complex operations

TABLE 22 PROFESSIONAL SERVICES: DATA CATALOG MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 23 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 24 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.2 Support and maintenance services

6.3.1.2.1 Need for solving complex product issues

6.3.1.3 Consulting services

6.3.1.3.1 Data catalog services help organizations formulate strategies

6.3.1.4 Deployment and integration services

6.3.1.4.1 Need for cost optimization

6.3.2 MANAGED SERVICES

6.3.2.1 Rising need for innovation, good customer experience, and efficiency

TABLE 26 MANAGED SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 DATA CATALOG MARKET, BY DEPLOYMENT MODE (Page No. - 85)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

FIGURE 33 CLOUD SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 28 MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 29 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 CLOUD

7.2.1 COST-BASED SOLUTIONS PROVIDE ROBUST PROCESSES TO MEET OBJECTIVES

TABLE 30 CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ON-PREMISES

7.3.1 SECURITY CONCERNS OVER SENSITIVE DATA

TABLE 32 ON-PREMISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 DATA CATALOG MARKET, BY DATA CONSUMER (Page No. - 89)

8.1 INTRODUCTION

8.1.1 DATA CONSUMER: MARKET DRIVERS

FIGURE 34 MOBILE AND WEB APPLICATIONS SEGMENT TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 34 MARKET, BY DATA CONSUMER, 2017–2021 (USD MILLION)

TABLE 35 MARKET, BY DATA CONSUMER, 2022–2027 (USD MILLION)

8.2 BUSINESS INTELLIGENCE TOOLS

TABLE 36 BUSINESS INTELLIGENCE TOOLS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 BUSINESS INTELLIGENCE TOOLS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2.1 DATA INTEGRATION AND ETL

8.2.1.1 Data catalog solutions to facilitate efficient data management and derive valuable insights

8.2.2 REPORTING AND VISUALIZATION

8.2.2.1 Data solutions help turn insights into actions

8.2.3 QUERY AND ANALYSIS

8.2.3.1 Need for efficient governance and better compliance

8.3 ENTERPRISE APPLICATIONS

TABLE 38 ENTERPRISE APPLICATIONS: DATA CATALOG MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 ENTERPRISE APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3.1 ENTERPRISE RESOURCE PLANNING (ERP)

8.3.1.1 Growth in automation of business processes to drive data catalog services

8.3.2 SUPPLY CHAIN MANAGEMENT SYSTEM

8.3.2.1 Analysis of data essential to predict demand

8.4 MOBILE AND WEB APPLICATIONS

TABLE 40 MOBILE AND WEB APPLICATIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 MOBILE AND WEB APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4.1 HEAT MAP ANALYTICS

8.4.1.1 Data analysis leads to improved site designs

8.4.2 WEB BEHAVIORAL ANALYSIS

8.4.2.1 Data analytics help understand human behavior

8.4.3 MARKETING AUTOMATION

8.4.3.1 Data consolidation to drive mobile app development

9 DATA CATALOG MARKET, BY METADATA TYPE (Page No. - 98)

9.1 INTRODUCTION

9.1.1 METADATA TYPE: MARKET DRIVERS

FIGURE 35 BUSINESS METADATA SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 42 MARKET, BY METADATA TYPE, 2017–2021 (USD MILLION)

TABLE 43 MARKET, BY METADATA TYPE, 2022–2027 (USD MILLION)

9.2 BUSINESS METADATA

9.2.1 HELPS USERS NAVIGATE THROUGH CENTRALLY MANAGED DATA

TABLE 44 BUSINESS METADATA: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 BUSINESS METADATA: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 TECHNICAL METADATA

9.3.1 BUILDS AND MAINTAINS ENTERPRISE DATA ENVIRONMENT

TABLE 46 TECHNICAL METADATA: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 TECHNICAL METADATA: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 DATA CATALOG MARKET, BY ORGANIZATION SIZE (Page No. - 103)

10.1 INTRODUCTION

10.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 36 LARGE ENTERPRISES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 48 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 49 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.2 LARGE ENTERPRISES

10.2.1 INCREASING DEMAND FOR CLOUD COMPUTING AND GROWING USE OF SMARTPHONES

TABLE 50 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 SMALL AND MEDIUM-SIZED ENTERPRISES

10.3.1 COST-EFFECTIVENESS AND INCREASED PRODUCTIVITY TO DRIVE DEMAND FOR DATA CATALOG SOLUTIONS AMONG SMES

TABLE 52 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 DATA CATALOG MARKET, BY VERTICAL (Page No. - 108)

11.1 INTRODUCTION

11.1.1 VERTICAL: CATALOG MANAGEMENT SYSTEMS MARKET DRIVERS

FIGURE 37 RETAIL AND ECOMMERCE SEGMENT TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 54 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 55 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2 MANUFACTURING

11.2.1 DATA CATALOG SOLUTIONS HELP MANUFACTURERS GAIN BETTER BUSINESS INSIGHTS

TABLE 56 MANUFACTURING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 HEALTHCARE AND LIFE SCIENCES

11.3.1 DATA SOLUTIONS GIVE DOCTORS REAL-TIME ACCESS TO MEDICAL DATA

TABLE 58 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 59 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.4.1 INCREASING DEMAND FOR DIGITAL BANKING SOLUTIONS

TABLE 60 BFSI: DATA CATALOG MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 61 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 TRANSPORTATION AND LOGISTICS

11.5.1 NEED TO IMPROVE CORE TRANSPORTATION AND LOGISTICS OPERATIONS

TABLE 62 TRANSPORTATION AND LOGISTICS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 63 TRANSPORTATION AND LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 MEDIA AND ENTERTAINMENT

11.6.1 NEED FOR DATA SOLUTIONS TO EXTRACT VALUABLE INFORMATION TO GAIN INSIGHTS

TABLE 64 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 65 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 RETAIL AND ECOMMERCE

11.7.1 RAPID DIGITAL TRANSFORMATION TO DRIVE GROWTH

TABLE 66 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 67 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 GOVERNMENT AND DEFENSE

11.8.1 ACCESSIBILITY ISSUES TACKLED IN GOVERNMENT SECTOR USING DATA CATALOG SOLUTIONS

TABLE 68 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 69 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.9 TELECOM

11.9.1 NEED FOR ROBUST SYSTEM TO MANAGE MOBILE DATA TRAFFIC

TABLE 70 TELECOM: DATA CATALOG MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 71 TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.10 ITES

11.10.1 NEED TO STANDARDIZE DATA QUALITY, GOVERNANCE, AND DATA PREPARATION PROCESSES

TABLE 72 ITES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 73 ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.11 OTHER VERTICALS

TABLE 74 OTHER VERTICALS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 75 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 DATA CATALOG MARKET, BY REGION (Page No. - 121)

12.1 INTRODUCTION

FIGURE 38 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 76 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 77 MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 39 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

TABLE 78 NORTH AMERICA: DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY DATA CONSUMER, 2017–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY DATA CONSUMER, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY METADATA TYPE, 2017–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY METADATA TYPE, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.2 US

12.2.2.1 Increasing adoption of self-service and data propagation analytics

TABLE 94 US: DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 95 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 96 US: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 97 US: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Growing need for transparency in financial services sector

TABLE 98 CANADA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 99 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 100 CANADA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 101 CANADA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: DATA CATALOG MARKET DRIVERS

TABLE 102 EUROPE: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY DATA CONSUMER, 2017–2021 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY DATA CONSUMER, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY METADATA TYPE, 2017–2021 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY METADATA TYPE, 2022–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 UK

12.3.2.1 Increasing adoption of new technologies and innovations

TABLE 118 UK: DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 119 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 120 UK: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 121 UK: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.3.3 GERMANY

12.3.3.1 Growth in digital transformation

TABLE 122 GERMANY: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 123 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 124 GERMANY: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 125 GERMANY: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Significant potential for growth of AI

TABLE 126 FRANCE: DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 127 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 128 FRANCE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 129 FRANCE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.3.5 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: MARKET DRIVERS

FIGURE 41 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 130 ASIA PACIFIC: DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY DATA CONSUMER, 2017–2021 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY DATA CONSUMER, 2022–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY METADATA TYPE, 2017–2021 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY METADATA TYPE, 2022–2027 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Big data usage to transform traditional industry sectors

TABLE 146 CHINA: DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 147 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 148 CHINA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 149 CHINA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Abundance of skilled labor and enhanced technological capabilities

TABLE 150 INDIA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 151 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 152 INDIA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 153 INDIA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 Growing need to deal with significant volume of data

TABLE 154 JAPAN: DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 155 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 156 JAPAN: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 157 JAPAN: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.4.5 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

TABLE 158 MIDDLE EAST AND AFRICA: DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET, BY DATA CONSUMER, 2017–2021 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET, BY DATA CONSUMER, 2022–2027 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET, BY METADATA TYPE, 2017–2021 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET, BY METADATA TYPE, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.2 MIDDLE EAST

12.5.2.1 Increasing initiatives to change cloud computing landscape

TABLE 174 MIDDLE EAST: DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 175 MIDDLE EAST: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 176 MIDDLE EAST: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 177 MIDDLE EAST: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.5.3 AFRICA

12.5.3.1 High growth of complex corporate data

TABLE 178 AFRICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 179 AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 180 AFRICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 181 AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: DATA CATALOG MARKET DRIVERS

TABLE 182 LATIN AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET, BY DATA CONSUMER, 2017–2021 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET, BY DATA CONSUMER, 2022–2027 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY METADATA TYPE, 2017–2021 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY METADATA TYPE, 2022–2027 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Adoption of comprehensive approach to migrate to cloud

TABLE 198 BRAZIL: DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 199 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 200 BRAZIL: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 201 BRAZIL: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.6.3 MEXICO

12.6.3.1 Good data management leads to improved customer experience

TABLE 202 MEXICO: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 203 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 204 MEXICO: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 205 MEXICO: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

12.6.4 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 168)

13.1 OVERVIEW

13.2 STRATEGIES OF KEY PLAYERS

TABLE 206 OVERVIEW OF STRATEGIES ADOPTED BY KEY DATA CATALOG VENDORS

13.3 REVENUE ANALYSIS

13.3.1 HISTORICAL REVENUE ANALYSIS

FIGURE 42 HISTORICAL REVENUE ANALYSIS OF TWO LEADING PLAYERS, 2017–2021 (USD MILLION)

13.4 MARKET SHARE ANALYSIS

FIGURE 43 MARKET SHARE ANALYSIS FOR KEY COMPANIES

TABLE 207 DATA CATALOG MARKET: DEGREE OF COMPETITION

13.5 MARKET EVALUATION FRAMEWORK

FIGURE 44 MARKET EVALUATION FRAMEWORK: EXPANSIONS AND CONSOLIDATIONS IN MARKET, 2020-2022

13.6 COMPANY EVALUATION QUADRANT

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 45 MARKET: COMPANY EVALUATION QUADRANT, 2022

13.7 COMPETITIVE BENCHMARKING

TABLE 208 COMPANY PRODUCT FOOTPRINT

TABLE 209 COMPANY REGION FOOTPRINT

13.8 STARTUP/SME EVALUATION QUADRANT

13.8.1 PROGRESSIVE COMPANIES

13.8.2 RESPONSIVE COMPANIES

13.8.3 DYNAMIC COMPANIES

13.8.4 STARTING BLOCKS

FIGURE 46 DATA CATALOG MARKET, STARTUP/SME EVALUATION QUADRANT, 2022

13.9 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

TABLE 210 MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2022

TABLE 211 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES], 2022

13.10 COMPETITIVE SCENARIOS AND TRENDS

13.10.1 PRODUCT LAUNCHES

TABLE 212 SERVICE/PRODUCT LAUNCHES, 2019–2022

13.10.2 DEALS

TABLE 213 DEALS, 2019–2022

14 COMPANY PROFILES (Page No. - 190)

14.1 INTRODUCTION

14.2 MAJOR PLAYERS

(Business Overview, Solutions, Products & Services offered, Recent Developments, MnM View)*

14.2.1 IBM

TABLE 214 IBM: BUSINESS OVERVIEW

FIGURE 47 IBM: COMPANY SNAPSHOT

TABLE 215 IBM: PRODUCT OFFERED

TABLE 216 IBM: SERVICES OFFERED

TABLE 217 IBM: DEALS

14.2.2 MICROSOFT

TABLE 218 MICROSOFT: BUSINESS OVERVIEW

FIGURE 48 MICROSOFT: COMPANY SNAPSHOT

TABLE 219 MICROSOFT: PRODUCTS OFFERED

TABLE 220 MICROSOFT: DEALS

14.2.3 TIBCO SOFTWARE

TABLE 221 TIBCO SOFTWARE: BUSINESS OVERVIEW

TABLE 222 TIBCO SOFTWARE: PRODUCTS OFFERED

TABLE 223 TIBCO SOFTWARE: SERVICES OFFERED

TABLE 224 TIBCO SOFTWARE: DEALS

14.2.4 COLLIBRA

TABLE 225 COLLIBRA: BUSINESS OVERVIEW

TABLE 226 COLLIBRA: PRODUCTS OFFERED

TABLE 227 COLLIBRA: DEALS

14.2.5 ORACLE

TABLE 228 ORACLE: BUSINESS OVERVIEW

FIGURE 49 ORACLE: COMPANY SNAPSHOT

TABLE 229 ORACLE: PRODUCTS OFFERED

TABLE 230 ORACLE: SERVICES OFFERED

TABLE 231 ORACLE: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 232 ORACLE: DEALS

14.2.6 INFORMATICA

TABLE 233 INFORMATICA: BUSINESS OVERVIEW

TABLE 234 INFORMATICA: PRODUCTS OFFERED

TABLE 235 INFORMATICA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 236 INFORMATICA: DEALS

14.2.7 ALATION

TABLE 237 ALATION: BUSINESS OVERVIEW

TABLE 238 ALATION: PRODUCTS OFFERED

TABLE 239 ALATION: PRODUCTS LAUNCHES AND ENHANCEMENTS

TABLE 240 ALATION: DEALS

14.2.8 GOOGLE

TABLE 241 GOOGLE: BUSINESS OVERVIEW

FIGURE 50 GOOGLE: COMPANY SNAPSHOT

TABLE 242 GOOGLE: PRODUCTS OFFERED

TABLE 243 GOOGLE: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 244 GOOGLE: DEALS

14.2.9 CLOUDERA

TABLE 245 CLOUDERA: BUSINESS OVERVIEW

FIGURE 51 CLOUDERA: COMPANY SNAPSHOT

TABLE 246 CLOUDERA: PRODUCTS OFFERED

TABLE 247 CLOUDERA: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 248 CLOUDERA: DEALS

14.2.10 ALTERYX

TABLE 249 ALTERYX: BUSINESS OVERVIEW

TABLE 250 ALTERYX: PRODUCTS OFFERED

TABLE 251 ALTERYX: DEALS

14.2.11 TALEND

TABLE 252 TALEND: BUSINESS OVERVIEW

TABLE 253 TALEND: PRODUCTS OFFERED

TABLE 254 TALEND: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 255 TALEND: DEALS

14.2.12 ATACCAMA

TABLE 256 ATACCAMA: BUSINESS OVERVIEW

TABLE 257 ATACCAMA: PRODUCTS OFFERED

TABLE 258 ATACCAMA: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 259 ATACCAMA: DEALS

14.2.13 ZALONI

TABLE 260 ZALONI: BUSINESS OVERVIEW

TABLE 261 ZALONI: PRODUCTS OFFERED

TABLE 262 ZALONI: DEALS

*Details on Business Overview, Solutions, Products & Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14.3 SMES/STARTUPS

14.3.1 DENODO

14.3.2 TABLEAU

14.3.3 AWS

14.3.4 CAMBRIDGE SEMANTICS

14.3.5 ERWIN BY QUEST

14.3.6 TAMR

14.3.7 DATA.WORLD

14.3.8 ALEX SOLUTIONS

14.3.9 OCTOPAI

14.3.10 IMMUTA

14.3.11 SOLIDATUS

14.3.12 ZEENEA

14.3.13 ATLAN

14.3.14 STEMMA

14.3.15 CASTOR

15 ADJACENT/RELATED MARKETS (Page No. - 235)

15.1 DATA GOVERNANCE MARKET – GLOBAL FORECAST TO 2025

15.1.1 MARKET DEFINITION

15.1.2 MARKET OVERVIEW

15.1.2.1 Data governance market, by application

TABLE 263 DATA GOVERNANCE MARKET, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 264 DATA GOVERNANCE MARKET, BY APPLICATION, 2019–2025 (USD MILLION)

15.1.2.2 Data governance market, by component

TABLE 265 DATA GOVERNANCE MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 266 DATA GOVERNANCE MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

15.1.2.3 Data governance market, by deployment model

TABLE 267 DATA GOVERNANCE MARKET, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 268 DATA GOVERNANCE MARKET, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

15.1.2.4 Data governance market, by organization size

TABLE 269 DATA GOVERNANCE MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 270 DATA GOVERNANCE MARKET, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

15.1.2.5 Data governance market, by vertical

TABLE 271 DATA GOVERNANCE MARKET, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 272 DATA GOVERNANCE MARKET, BY VERTICAL, 2019–2025 (USD MILLION)

15.1.2.6 Data governance market, by region

TABLE 273 DATA GOVERNANCE MARKET, BY REGION, 2014–2019 (USD MILLION)

TABLE 274 DATA GOVERNANCE MARKET, BY REGION, 2019–2025 (USD MILLION)

15.1.3 DATA DISCOVERY MARKET – GLOBAL FORECAST TO 2025

15.1.3.1 Market definition

15.1.3.2 Market overview

15.1.3.3 Data discovery market, by component

TABLE 275 DATA DISCOVERY MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 276 DATA DISCOVERY MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 277 DATA DISCOVERY MARKET, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 278 DATA DISCOVERY MARKET, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 279 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET, BY TYPE, 2014–2019 (USD MILLION)

TABLE 280 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET, BY TYPE, 2019–2025 (USD MILLION)

15.1.3.4 Data discovery market, by organization size

TABLE 281 DATA DISCOVERY MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 282 DATA DISCOVERY MARKET, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

15.1.3.5 Data discovery market, by deployment mode

TABLE 283 DATA DISCOVERY MARKET, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 284 DATA DISCOVERY MARKET, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 285 CLOUD: DATA DISCOVERY MARKET, BY TYPE, 2014–2019 (USD MILLION)

TABLE 286 CLOUD: DATA DISCOVERY MARKET, BY TYPE, 2019–2025 (USD MILLION)

15.1.3.6 Data discovery market, by functionality

TABLE 287 DATA DISCOVERY MARKET, BY FUNCTIONALITY, 2014–2019 (USD MILLION)

TABLE 288 DATA DISCOVERY MARKET, BY FUNCTIONALITY, 2019–2025 (USD MILLION)

15.1.3.7 Data discovery market, by application

TABLE 289 DATA DISCOVERY MARKET, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 290 DATA DISCOVERY MARKET, BY APPLICATION, 2019–2025 (USD MILLION)

15.1.3.8 Data discovery market, by vertical

TABLE 291 DATA DISCOVERY MARKET, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 292 DATA DISCOVERY MARKET, BY VERTICAL, 2019–2025 (USD MILLION)

15.1.3.9 Data discovery market, by region

TABLE 293 DATA DISCOVERY MARKET, BY REGION, 2014–2019 (USD MILLION)

TABLE 294 DATA DISCOVERY MARKET, BY REGION, 2019–2025 (USD MILLION)

16 APPENDIX (Page No. - 251)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

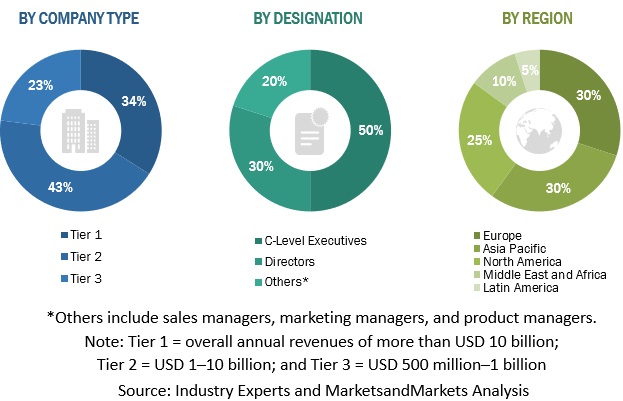

This research study involved the usage of extensive secondary sources, directories, and databases such as D&B Hoovers and Bloomberg BusinessWeek to identify and collect information useful for this technical, market-oriented, and commercial study of the global data catalog market. The primary sources were mainly several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess prospects. The following illustration shows the market research methodology applied in making this report on the global data catalog market.

Secondary Research

In the secondary research process, various sources were referred to, to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing experts; related key executives from data catalog solution vendors, system integrators, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using data catalog solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of data catalog impacting the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Data Catalog Market Size Estimation

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the data catalog market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each offering of various vendors was evaluated based on the breadth of services, deployment modes, interaction types, business functions, applications, and verticals. The aggregate revenue of all companies was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Data Catalog Market Report Objectives

- To determine and forecast the global data catalog market By Component (Solutions, Services), Deployment Mode (Cloud, On-premises), Data Consumer (BI Tools, Enterprise Applications, Mobile and Web Applications), Organization Size, Metadata Type, Vertical, and Region from 2022 to 2027, and analyze the various macroeconomic and microeconomic factors that affect market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall data catalog market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the intelligent document processing market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Catalog Market