Data Historian Market by Application (Production Tracking, Environmental Auditing, Asset Performance Management, and GRC Management), Component (Software/Tools, Services), Deployment Mode, Organization Size, End User, and Region - Global Forecast to 2025

Data Historian Market - Size, Trends & Growth Report

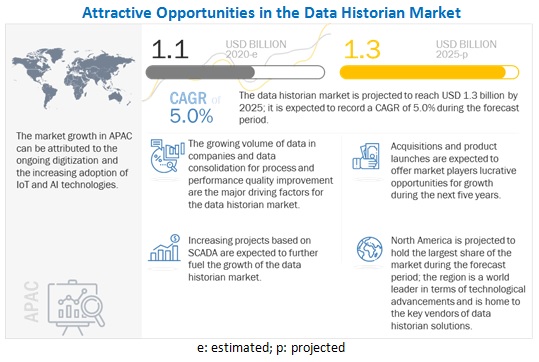

[247 Pages Report] The global Data Historian Market size was accounted for $1.1 billion in 2020 and is anticipated to achieve a market size around $1.3 billion by the end of 2025, projecting a CAGR of 5.0% from 2020 to 2025. The base year considered for estimation is 2019 and data available for the years 2016 to 2025.

Increasing demand for consolidated data for process and performance improvement, rising big industrial data, and growing investments in analytics is also expected to drive market growth. However, legal concerns and data privacy issues might hinder the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

In a short time, the COVID-19 outbreak has affected markets and customers' behavior and has a substantial impact on economies and societies. With offices, educational institutions, and manufacturing facilities shutting down for an indefinite period, major sports and events being postponed, and work-from-home and social distancing policies in effect, businesses are increasingly looking for technologies to assist them through these difficult times. Analytics professionals, business intelligence professionals, and professionals providing expertise in more advanced analytics, such as AI and ML, have been called for their expertise to help executives make business decisions on how to respond to the new business challenges caused by the COVID-19 outbreak.

Data Historian Market Growth Dynamics

Driver: Increasing demand for consolidated data for process and performance improvement

With rapid business expansions, it has become necessary for businesses to deliver the right information to the right person at the right time. Despite complications, consolidating data has become necessary for prioritizing business activities, which include enhancement in customer experience, operational process, and overall business performance. Data historian solutions play an important role in collecting, storing, and making the stored data available to users across enterprises. The data historian solutions synchronize the data, and thus eliminate the complexity of maintaining multiple connections across distant site locations. Due to reduced complexities plant managers and engineers can analyze and tune control loops, investigate incidents, and detect changes in equipment behavior. Real-time decisions and advanced analytics are expected to drive the adoption of data historian solutions. Hence, the data historian solutions have become important for integrating data from various sources. These solutions provide better operational decisions for process and performance improvement.

Restraint: Legal concerns and data privacy issues

The misuse of data, whether intentional or not, can have serious legal consequences for both organizations and customers. Businesses should clearly state clauses related to data usage, process, and retention in their project contracts to ensure that no data usage violates government laws. The risk of identity theft grows whenever entities collect profile data, especially if the information is not maintained securely. This information can get compromised by hackers, malware, disk damages, etc. If brands create strategies around this inaccurate data, it can lead to serious complications for all users involved. Hence, businesses should properly check all legal and privacy-related concerns before using data gathered from various applications.

Opportunity: Growing need for industrial 360 Hypervision

With data being the major factor for making the right decisions, it has become important to have a closer look at the process control industry. 360 Hypervision helps maintain accuracy, mitigate production costs, and enhance productivity and quality during the production life cycle., Additionally, with the increasing digitalization and falling cost of sensors, industrial data would provide a holistic view of operational performance throughout the entire production life cycle. This data can be utilized to identify and rectify bottlenecks and barriers for carrying out effective production on a real-time basis.

Challenge: Growing impact of IIoT

IIoT consists of connected industrial systems, which coordinate their information analytics to enhance overall industrial performance. A key function of IIoT and Big Data technologies is to deliver insights for enhancing operational processes and assisting decision makers in making actionable decisions across enterprises. Both data historian and IIoT solutions are capable of gathering actionable insights through sensors and actuators, which are used to obtain and gain deeper perception via records and analytics. Despite data historian represents meaningful data, it requires more time to extract the same value as compared to an IIoT solution. IIoT solutions deliver improved scalability, gather meaningful business insights, and present operational data to provide organizations with more visibility into their processes on a real-time basis.

The cloud segment to account for a larger CAGR during the forecast period

Cloud-based data historian solutions facilitate various advantages, such as scalability, adaptability, easy deployment, and cost-effectiveness, and these advantages promote the adoption of the cloud deployment mode among organizations. Low costs and the ease of implementation have made cloud a highly desirable deployment mode among organizations. SMEs tend to adopt cloud-based data historian solutions as compared to the on-premises solutions, owing cloud solutions’ low costs and the 24x7 support and maintenance provided by the software vendors. A majority of the vendors offer cloud-based data historian solutions to lure customers. For example, enterprises such as Open Automation Software, Honeywell, and OSIsoft offer cost-effective, cloud-based data historian software solutions and services to their clients.

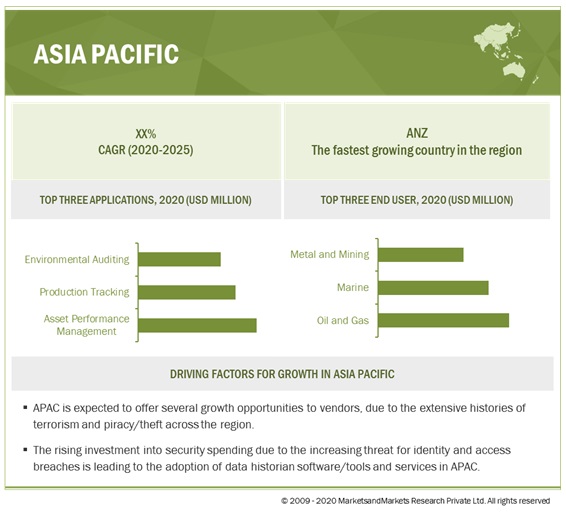

Asia Pacific is the leading data historian market, globally, by volume in 2020

The increasing need for improved business productivity, supported by competently designed data management solutions offered by vendors operating in the APAC region, is expected to make it a high potential region for the growth of the data historian market. Many Asian countries have adopted the latest technologies, which have turned data into a major asset for development. Therefore, information-intensive data management technologies are the leading technology trends. With the increasing number of partnerships and mergers in this region, the necessity for data consolidation has given rise to the migration of data in a centralized environment. The major countries in APAC are technology-driven and have major opportunities in terms of investments and revenues. These countries include Australia and New Zealand (ANZ), China, Japan, and Singapore. Rapid digitalization in these countries has resulted in the production of bulks of unstructured data. The region has shown an untapped potential in the adoption of enterprise data management solutions, as a result of which, most of the companies are entering the APAC region to enhance their market reach.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for years |

2016-2025 |

|

Base year considered |

2019 |

|

Forecast Period |

2020-2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Component, By Application, By End User, Deployment Mode, Organization Size and By Region |

|

Geographies covered |

North America, APAC, Europe, MEA and Latin America |

|

Companies covered |

The major market players include GE (US), ABB (Switzerland), Emerson (US), Siemens (Germany), AVEVA (UK), Honeywell (US), Rockwell Automation (US), OSIsoft (US), ICONICS (US), IBM (US), Yokogawa (Japan), PTC (US), Inductive Automation (US), Canary Labs (US), Open Automation Software (US), InfluxData (US), Progea (Italy), Kx Systems (US), SORBA (US), Savigent Software (US), Automsoft (Ireland), LiveData Utilities (US), Industrial Video & Control (US), Aspen Technology (US), and COPA-DATA (Austria). (Total 25 companies) |

The study categorizes the Data Historian Market based on component, application, end user, deployment mode, organization size at the regional and global levels.

By Component

- Software/Tools

-

Services

- Managed Services

-

Professional Services

- Consulting

- Support and Maintenance

By Application

- Production Tracking

- Environmental Auditing

- Asset Performance Management

- GRC Management

- Predictive Maintenance

- Others (security and quality control management)

By Deployment Mode

- On-premises

- Cloud

By Organization Size

- SMEs

- Large Enterprises

By End User

- Oil and Gas

- Marine

- Chemicals and Petrochemicals

- Paper and Pulp

- Metal and Mining

- Power and Utilities

- Others (IT and data centers, transportation, and pharmaceuticals)

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Key Market Players

The data historian platform vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors offering Data historian solutions are GE (US), ABB (Switzerland), Emerson (US), Siemens (Germany), AVEVA (UK), Honeywell (US), Rockwell Automation (US), OSIsoft (US), ICONICS (US), IBM (US), Yokogawa (Japan), PTC (US), Inductive Automation (US), Canary Labs (US), Open Automation Software (US), InfluxData (US), Progea (Italy), Kx Systems (US), SORBA (US), Savigent Software (US), Automsoft (Ireland), LiveData Utilities (US), Industrial Video & Control (US), Aspen Technology (US), and COPA-DATA (Austria).

Recent Developments in Data Historian Market:

- In November 2020, InfluxData announced the general availability of the next-generation open source platform for time series data, InfluxDB 2.0.

- In October 2020, ICONICS launched new Virtual Machine (VM) offers on the Azure Marketplace. This VM contains the complete installation of GENESIS64, Hyper Historian, IoTWorX, and AnalytiX Suite.

- In July 2020, Siemen launched digital solutions for post-COVID-19 workplaces. The solution aims to ensure social distancing and other safety measures. It includes IoT solutions, which support adherence to social distancing and contact tracing guidelines, body temperature detection integrated with access control, indoor air quality optimization, and secured remote monitoring of a building's systems.

- In July 2020, GE released Proficy Historian for Linux Version 2.3. This version would provide improved data collection at edge devices, delivering distributed data management to support IoT.

- In August 2020, AVEVA announced an agreement to acquire OSIsoft for USD 5.0 billion. Both companies will combine their complementary product offerings, bringing together industrial software and data management to help customers in industrial and essential organizations, accelerating their digital transformational strategies.

Frequently Asked Questions (FAQ):

How big is the Data Historian market?

What is the Data Historian Market Growth?

What are the key opportunities in the global Data Historian Market?

Who are the key players in Data Historian market?

Who will be the leading hub for Data Historian market?

What is the Data Historian market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 6 DATA HISTORIAN MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 DATA HISTORIAN MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF DATA HISTORIAN MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3—BOTTOM-UP (DEMAND SIDE): SHARE OF DATA HISTORIAN THROUGH OVERALL DATA HISTORIAN SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 53)

TABLE 4 DATA HISTORIAN MARKET SIZE AND GROWTH RATE, 2016–2019 (USD MILLION, Y-O-Y %)

TABLE 5 MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y %)

FIGURE 13 MARKET SNAPSHOT, BY COMPONENT

FIGURE 14 MARKET SNAPSHOT, BY APPLICATION

FIGURE 15 MARKET SNAPSHOT, BY SERVICE

FIGURE 16 MARKET SNAPSHOT, BY PROFESSIONAL SERVICE

FIGURE 17 MARKET SNAPSHOT, BY DEPLOYMENT MODE

FIGURE 18 MARKET SNAPSHOT, BY ORGANIZATION SIZE

FIGURE 19 MARKET SNAPSHOT, BY END USER

FIGURE 20 MARKET SNAPSHOT, BY REGION

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN DATA HISTORIAN MARKET

FIGURE 21 REAL-TIME CONDITIONING MONITORING FOR TAKING PROMPT ACTIONS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 MARKET: TOP THREE APPLICATIONS

FIGURE 22 ENVIRONMENTAL AUDITING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 23 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2020

4.4 MARKET, TOP TWO APPLICATIONS AND END USERS

FIGURE 24 ASSET PERFORMANCE MANAGEMENT, AND OIL AND GAS TO ACCOUNT FOR LARGE SHARES OF DATA HISTORIAN MARKET IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DATA HISTORIAN MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for consolidated data for process and performance improvement

5.2.1.2 Rising industrial big data

5.2.1.3 Growing investments in analytics

5.2.2 RESTRAINTS

5.2.2.1 High deployment costs

5.2.2.2 Legal concerns and data privacy issues

5.2.3 OPPORTUNITIES

5.2.3.1 Growing need for industrial 360 Hypervision

5.2.3.2 COVID-19 pandemic increases need for remote monitoring and management of assets and business processes

5.2.4 CHALLENGES

5.2.4.1 Growing impact of IIoT

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 DATA HISTORIAN MARKET: COVID-19 IMPACT

FIGURE 26 MARKET TO WITNESS DECLINE IN GROWTH IN 2020

5.4 CASE STUDY ANALYSIS

5.4.1 USE CASE 1: ENHANCED VISIBILITY OF DATA RESULTED IN GREATER PRODUCTIVITY

5.4.2 USE CASE 2: MOVING DATA FROM PROGRAMMABLE LOGIC CONTROLLER (PLC) TO OPEN DATABASES FOR HISTORICAL LOGGING AND ANALYSIS

5.4.3 USE CASE 3: DATA MINING AND DATA AGGREGATION NEEDS

5.5 DATA HISTORIAN: EVOLUTION

5.6 REGULATIONS

5.6.1 EU GENERAL DATA PROTECTION REGULATION (GDPR)

5.6.2 CLOUD STANDARD CUSTOMER COUNCIL (CSCC)

6 DATA HISTORIAN MARKET, BY COMPONENT (Page No. - 67)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 27 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 6 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 7 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

6.2 SOFTWARE/TOOLS

6.3 SERVICES

FIGURE 28 MANAGED SERVICES SEGMENT IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 8 MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 9 MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 29 CONSULTING SERVICES SEGMENT IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 10 PROFESSIONAL SERVICES: DATA HISTORIAN MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 11 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

6.3.1.1 Consulting

6.3.1.2 Support and Maintenance

6.3.2 MANAGED SERVICES

7 DATA HISTORIAN MARKET, BY APPLICATION (Page No. - 74)

7.1 INTRODUCTION

7.1.1 APPLICATIONS: MARKET DRIVERS

7.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 30 ENVIRONMENTAL AUDITING SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 12 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 13 MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

7.2 PRODUCTION TRACKING

7.3 ENVIRONMENTAL AUDITING

7.4 ASSET PERFORMANCE MANAGEMENT

7.5 GOVERNANCE, RISK, AND COMPLIANCE MANAGEMENT

7.6 PREDICTIVE MAINTENANCE

7.7 OTHERS

8 DATA HISTORIAN MARKET, BY DEPLOYMENT MODE (Page No. - 79)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODES: MARKET DRIVERS

8.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 31 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 14 MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 15 MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

8.2 ON-PREMISES

8.3 CLOUD

9 DATA HISTORIAN MARKET, BY ORGANIZATION SIZE (Page No. - 83)

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

9.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 32 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 16 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 17 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

9.3 LARGE ENTERPRISES

10 DATA HISTORIAN MARKET, BY END USER (Page No. - 87)

10.1 INTRODUCTION

10.1.1 END USERS: MARKET DRIVERS

10.1.2 END USERS: COVID-19 IMPACT

FIGURE 33 CHEMICALS AND PETROCHEMICALS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 19 MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

10.2 OIL AND GAS

10.3 MARINE

10.4 CHEMICALS AND PETROCHEMICALS

10.5 PAPER AND PULP

10.6 METALS AND MINING

10.7 POWER AND UTILITIES

10.8 OTHERS

11 DATA HISTORIAN MARKET, BY REGION (Page No. - 92)

11.1 INTRODUCTION

FIGURE 34 AUSTRALIA AND NEW ZEALAND TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 35 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

TABLE 20 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 22 NORTH AMERICA: DATA HISTORIAN MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 23 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 25 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 26 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 31 NORTH AMERICA: DATA HISTORIAN MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.2.3 UNITED STATES

11.2.4 CANADA

11.3 EUROPE

11.3.1 EUROPE: MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

TABLE 38 EUROPE: DATA HISTORIAN MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 39 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 40 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 41 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 42 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 43 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 47 EUROPE: DATA HISTORIAN MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.3.3 UNITED KINGDOM

11.3.4 GERMANY

11.3.5 FRANCE

11.3.6 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 54 ASIA PACIFIC: DATA HISTORIAN MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 61 ASIA PACIFIC: DATA HISTORIAN MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.4.3 CHINA

11.4.4 JAPAN

11.4.5 ANZ

11.4.6 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 70 MIDDLE EAST AND AFRICA: DATA HISTORIAN MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA: DATA HISTORIAN MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

11.5.3 MIDDLE EAST

11.5.4 AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 86 LATIN AMERICA: DATA HISTORIAN MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 87 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 88 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 89 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 90 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 91 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 92 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 93 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 94 LATIN AMERICA: DATA HISTORIAN MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 95 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 96 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 97 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 98 LATIN AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 99 LATIN AMERICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 100 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 101 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.6.2.1 Brazil

11.6.2.2 Mexico

11.6.2.3 Rest of Latin America

12 COMPETITIVE LANDSCAPE (Page No. - 135)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 38 MARKET EVALUATION FRAMEWORK

12.3 MARKET SHARE, 2020

FIGURE 39 ABB LED DATA HISTORIAN MARKET IN 2020

12.4 KEY MARKET DEVELOPMENTS

12.4.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 102 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2020

12.4.2 BUSINESS EXPANSIONS

TABLE 103 BUSINESS EXPANSIONS, 2018–2020

12.4.3 MERGERS AND ACQUISITIONS

TABLE 104 MERGERS AND ACQUISITIONS, 2018–2020

12.4.4 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 105 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2019–2020

12.5 COMPANY EVALUATION MATRIX, 2020

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

FIGURE 40 DATA HISTORIAN MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

13 COMPANY PROFILES (Page No. - 144)

13.1 INTRODUCTION

(Business and Financial Overview, Solutions and Service Offered, Recent Developments, SWOT Analysis, and MNM View)*

13.2 ABB

FIGURE 41 ABB: COMPANY SNAPSHOT

FIGURE 42 ABB: SWOT ANALYSIS

13.3 IBM

FIGURE 43 IBM: COMPANY SNAPSHOT

FIGURE 44 IBM: SWOT ANALYSIS

13.4 HONEYWELL

FIGURE 45 HONEYWELL: COMPANY SNAPSHOT

FIGURE 46 HONEYWELL: SWOT ANALYSIS

13.5 SIEMENS

FIGURE 47 SIEMENS: COMPANY SNAPSHOT

FIGURE 48 SIEMENS: SWOT ANALYSIS

13.6 AVEVA

FIGURE 49 AVEVA: COMPANY SNAPSHOT

FIGURE 50 AVEVA: SWOT ANALYSIS

13.7 GE

FIGURE 51 GE: COMPANY SNAPSHOT

FIGURE 52 GE: SWOT ANALYSIS

13.8 YOKOGAWA

FIGURE 53 YOKOGAWA: COMPANY SNAPSHOT

FIGURE 54 YOKOGAWA: SWOT ANALYSIS

13.9 ASPEN TECHNOLOGY

FIGURE 55 ASPEN TECHNOLOGY: COMPANY SNAPSHOT

13.10 EMERSON

FIGURE 56 EMERSON: COMPANY SNAPSHOT

13.11 ROCKWELL AUTOMATION

FIGURE 57 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

13.12 PTC

FIGURE 58 PTC: COMPANY SNAPSHOT

13.13 AUTOMSOFT

13.14 ICONICS

13.15 OSISOFT

13.16 CANARY LABS

13.17 COPA-DATA

13.18 INDUCTIVE AUTOMATION

13.19 INDUSTRIAL VIDEO & CONTROL

13.20 INFLUXDATA

13.21 KX SYSTEMS

13.22 LIVEDATA UTILITIES

13.23 OPEN AUTOMATION SOFTWARE

13.24 PROGEA

13.25 SAVIGENT SOFTWARE

13.26 SORBA

*Details on Business and Financial Overview, Solutions and Service Offered, Recent Developments, SWOT Analysis, and MNM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 202)

14.1 ADJACENT AND RELATED MARKETS

14.1.1 INTRODUCTION

14.1.2 IOT DATA MANAGEMENT MARKET– GLOBAL FORECAST TO 2022

14.1.2.1 Market definition

14.1.2.2 IoT Data Management Market, By Component

TABLE 106 IOT DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

14.1.2.3 IoT Data Management Market, By Solution

TABLE 107 IOT DATA MANAGEMENT MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

14.1.2.4 IoT Data Management Market, by Service

TABLE 108 IOT DATA MANAGEMENT MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

14.1.2.5 IoT Data Management Market, by Deployment Type

TABLE 109 IOT DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2022 (USD MILLION)

14.1.2.6 IoT Data Management Market, by Organization Size

TABLE 110 IOT DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

14.1.2.7 IoT Data Management Market, by Application Area

TABLE 111 IOT DATA MANAGEMENT MARKET SIZE, BY APPLICATION AREA, 2015–2022 (USD MILLION)

14.1.2.8 IoT Data Management Market, by Region

TABLE 112 IOT DATA MANAGEMENT MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.1.2.8.1 North America

TABLE 113 NORTH AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 114 NORTH AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 115 NORTH AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 116 NORTH AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2022 (USD MILLION)

TABLE 117 NORTH AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 118 NORTH AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY APPLICATION AREA, 2015–2022 (USD MILLION)

14.1.2.8.2 Europe

TABLE 119 EUROPE: IOT DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 120 EUROPE: IOT DATA MANAGEMENT MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 121 EUROPE: IOT DATA MANAGEMENT MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 122 EUROPE: IOT DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2022 (USD MILLION)

TABLE 123 EUROPE: IOT DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 124 EUROPE: IOT DATA MANAGEMENT MARKET SIZE, BY APPLICATION AREA, 2015–2022 (USD MILLION)

14.1.2.8.3 Asia Pacific

TABLE 125 ASIA PACIFIC: IOT DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 126 ASIA PACIFIC: IOT DATA MANAGEMENT MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 127 ASIA PACIFIC: IOT DATA MANAGEMENT MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 128 ASIA PACIFIC: IOT DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2022 (USD MILLION)

TABLE 129 ASIA PACIFIC: IOT DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 130 ASIA PACIFIC: IOT DATA MANAGEMENT MARKET SIZE, BY APPLICATION AREA, 2015–2022 (USD MILLION)

14.1.2.8.4 Middle East and Africa

TABLE 131 MIDDLE EAST AND AFRICA: IOT DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: IOT DATA MANAGEMENT MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: IOT DATA MANAGEMENT MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA: IOT DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2022 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: IOT DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA: IOT DATA MANAGEMENT MARKET SIZE, BY APPLICATION AREA, 2015–2022 (USD MILLION)

14.1.2.8.5 Latin America

TABLE 137 LATIN AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 138 LATIN AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 139 LATIN AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 140 LATIN AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2022 (USD MILLION)

TABLE 141 LATIN AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 142 LATIN AMERICA: IOT DATA MANAGEMENT MARKET SIZE, BY APPLICATION AREA, 2015–2022 (USD MILLION)

14.1.3 IOT IN MANUFACTURING MARKET– GLOBAL FORECAST TO 2022

14.1.3.1 Market definition

14.1.3.2 Market overview

14.1.3.3 IoT in Manufacturing Market, By Component

TABLE 143 IOT IN MANUFACTURING MARKET SIZE, BY ASSET TYPE, USD MILLION, 2015–2022 (USD MILLION)

14.1.3.4 IoT in Manufacturing Market, By Solution

TABLE 144 IOT IN MANUFACTURING MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

14.1.3.5 IoT in Manufacturing Market, By Platform

TABLE 145 IOT IN MANUFACTURING MARKET SIZE, BY PLATFORM, 2015–2022 (USD MILLION)

14.1.3.6 IoT in Manufacturing Market, By Service

TABLE 146 IOT IN MANUFACTURING MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 147 MANAGED SERVICES: IOT IN MANUFACTURING MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 148 PROFESSIONAL SERVICES: IOT IN MANUFACTURING MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

14.1.3.7 IoT in Manufacturing Market, By Application

TABLE 149 IOT IN MANUFACTURING MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

14.1.3.8 IoT in Manufacturing Market, By Vertical

TABLE 150 IOT IN MANUFACTURING MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

14.1.3.9 IoT in Manufacturing Market, By Region

TABLE 151 IOT IN MANUFACTURING MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.1.3.9.1 North America

TABLE 152 NORTH AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 153 NORTH AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 154 NORTH AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY PLATFORM, 2015–2022 (USD MILLION)

TABLE 155 NORTH AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 156 NORTH AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2022 (USD MILLION)

TABLE 157 NORTH AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY MANAGED SERVICE, 2015–2022 (USD MILLION)

TABLE 158 NORTH AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 159 NORTH AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

14.1.3.9.2 Europe

TABLE 160 EUROPE: IOT IN MANUFACTURING MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 161 EUROPE: IOT IN MANUFACTURING MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 162 EUROPE: IOT IN MANUFACTURING MARKET SIZE, BY PLATFORM, 2015–2022 (USD MILLION)

TABLE 163 EUROPE: IOT IN MANUFACTURING MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 164 EUROPE: IOT IN MANUFACTURING MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2022 (USD MILLION)

TABLE 165 EUROPE: IOT IN MANUFACTURING MARKET SIZE, BY MANAGED SERVICE, 2015–2022 (USD MILLION)

TABLE 166 EUROPE: IOT IN MANUFACTURING MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 167 EUROPE: IOT IN MANUFACTURING MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

14.1.3.9.3 Asia Pacific

TABLE 168 ASIA PACIFIC: IOT IN MANUFACTURING MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 169 ASIA PACIFIC: IOT IN MANUFACTURING MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 170 ASIA PACIFIC: IOT IN MANUFACTURING MARKET SIZE, BY PLATFORM, 2015–2022 (USD MILLION)

TABLE 171 ASIA PACIFIC: IOT IN MANUFACTURING MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 172 ASIA PACIFIC: IOT IN MANUFACTURING MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2022 (USD MILLION)

TABLE 173 ASIA PACIFIC: IOT IN MANUFACTURING MARKET SIZE, BY MANAGED SERVICE, 2015–2022 (USD MILLION)

TABLE 174 ASIA PACIFIC: IOT IN MANUFACTURING MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 175 ASIA PACIFIC: IOT IN MANUFACTURING MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

14.1.3.9.4 Middle East and Africa

TABLE 176 MIDDLE EAST AND AFRICA: IOT IN MANUFACTURING MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: IOT IN MANUFACTURING MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: IOT IN MANUFACTURING MARKET SIZE, BY PLATFORM, 2015–2022 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: IOT IN MANUFACTURING MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: IOT IN MANUFACTURING MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2022 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: IOT IN MANUFACTURING MARKET SIZE, BY MANAGED SERVICE, 2015–2022 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: IOT IN MANUFACTURING MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: IOT IN MANUFACTURING MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

14.1.3.9.5 Latin America

TABLE 184 LATIN AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 185 LATIN AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 186 LATIN AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY PLATFORM, 2015–2022 (USD MILLION)

TABLE 187 LATIN AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 188 LATIN AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2022 (USD MILLION)

TABLE 189 LATIN AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY MANAGED SERVICE, 2015–2022 (USD MILLION)

TABLE 190 LATIN AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 191 LATIN AMERICA: IOT IN MANUFACTURING MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

14.2 INDUSTRY EXPERTS

14.3 DISCUSSION GUIDE

14.4 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.5 AVAILABLE CUSTOMIZATIONS

14.6 RELATED REPORTS

14.7 AUTHOR DETAILS

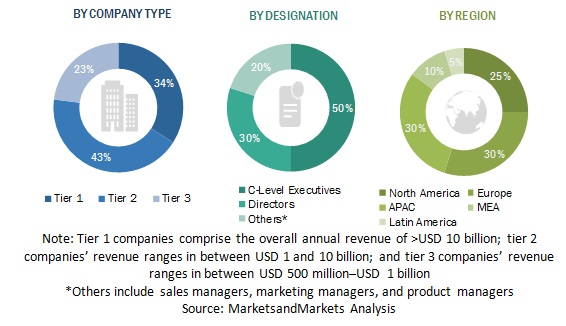

The study involved four major activities in estimating the current market size of the data historian market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the size of the data historian market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Modern data historians provide for optimization, savings and Data Historian Helps Utility Analyze Diverse Data Streams, to identify and collect relevant information, and related magazines, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases & investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Data historian solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the Data historian market's total size. The top-down approach was used to derive top vendors' revenue contribution and their offerings in the data historian market. The bottom-up approach was used to arrive at the global data historian market's overall market size using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate other individual markets' size via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the data historian market by component, application, deployment mode, organization size, end user, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments in the data historian market, such as partnerships, new product launches, and mergers and acquisitions

- To analyze the impact of the COVID-19 pandemic on the data historian market.

COVID-19 impact

COVID-19 would have an impact on all the elements of the technology sector. The global ICT spending is estimated to decline by 4%–5% by the end of 2020. The hardware business is predicted to have the most impact on the IT industry. Due to the slowdown of hardware supply and reduced manufacturing capacity, the IT infrastructure growth has slowed down. Businesses providing solutions and services are also expected to slow down for a short span of time. However, the adoption of collaborative applications, analytics, security solutions, and AI is set to increase in the remaining part of the year.

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American data historian market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Data Historian Market