Electrophysiology Market: Growth, Size, Share, and Trends

Electrophysiology Market by Product (Lab Devices (3D Mapping, Recording, ICE, X-ray Systems), Ablation Catheters (Cryoablation, Radiofrequency, Laser, Microwave), Diagnostic Catheters (Conventional, Advanced, Ultrasound)), End Use-Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

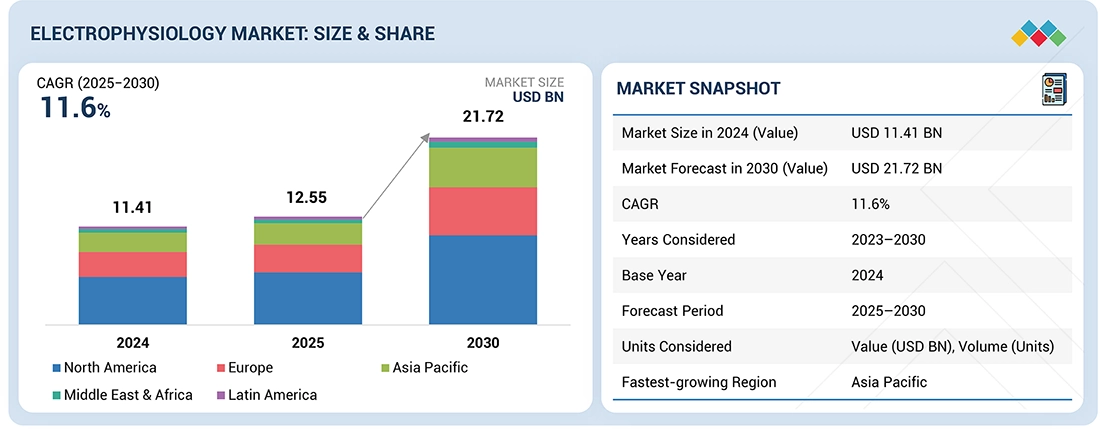

The electrophysiology market is projected to reach USD 21.72 billion by 2030 from USD 12.55 billion in 2025, at a CAGR of 11.6% from 2025 to 2030. The growth of the electrophysiology market is driven by the the rising prevalence of cardiac arrhythmias, increasing technological innovations in advanced electrophysiological devices , and high geriatric population.

KEY TAKEAWAYS

-

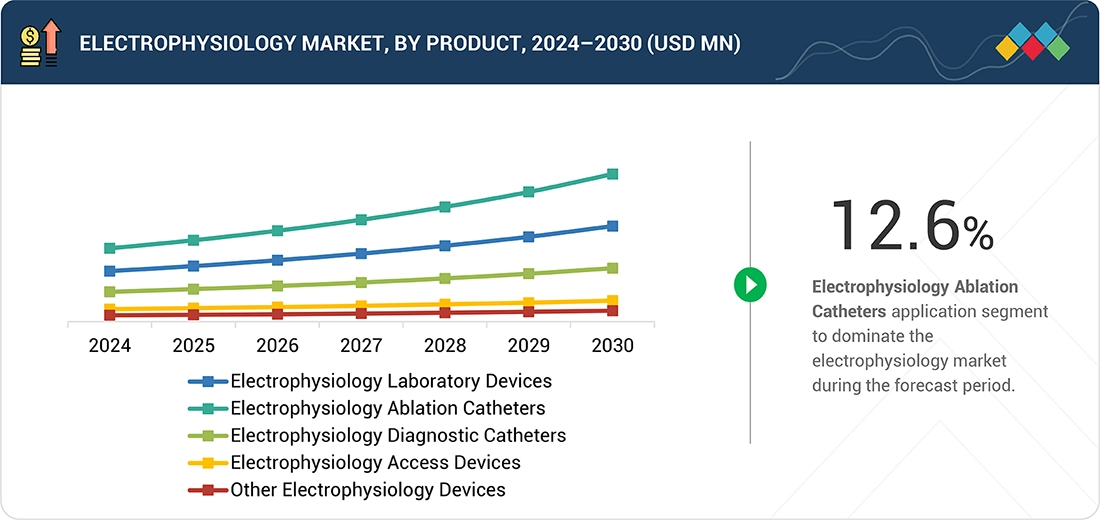

BY PRODUCTThe electrophysiology market comprises electrophysiology laboratory devices, electrophysiology ablation catheters, electrophysiology diagnostic catheters, electrophysiology access devices, and other electrophysiology devices. Electrophysiology ablation catheters was the largest segment due to the increasing adoption of catheter ablation as a preferred treatment for arrhythmias and technological advancements such as contact-force sensing, high-density mapping, and the development of cryoablation and laser ablation techniques

-

BY INDICATIONKey indications include atrial fibrillation, atrial flutter, atrioventricular nodal reentry tachycardia (AVNRT), Wolff-Parkinson-White syndrome (WPW), and other indications. Atrial fibrillation is projected to witness the highest CAGR throughout the forecast period, largely attributable to the increasing prevalence of risk factors such as hypertension and diabetes.

-

BY END USERIn the electrophysiology market, hospitals & cardiac centers lead in demand due to rising prevalence of cardiac arrhythmias and complex cardiovascular conditions that demands for dedicated EP services, followed by ambulatory surgery centers and other end users.

-

BY REGIONThe aerospace materials market covers North America, Europe, Asia Pacific, Latin America and the Middle East & Africa. North America has the largest share for the electrophysiology market due the increasing prevalence of cardiac arrhythmias, well-established healthcare infrastructure, and a high rate of adoption of cutting-edge technologies that enhance diagnostic and treatment capabilities.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Johnson & Johnson Services, Inc. (US), Abbott (US), Medtronic (Ireland), have entered into a number of agreements and partnerships to enhance the development of advanced electrophysiology devices, expand their product portfolios, and cater to the growing demand for innovative treatments in arrhythmia management.

The electrophysiology market is witnessing steady growth, driven by the increasing prevalence of cardiac arrhythmias, rising adoption of advanced diagnostic and therapeutic devices, and growing awareness of heart health. New developments, including innovations in catheter-based ablation technologies, wearable monitoring devices, and strategic collaborations between medical device companies and healthcare providers, are reshaping the industry landscape.

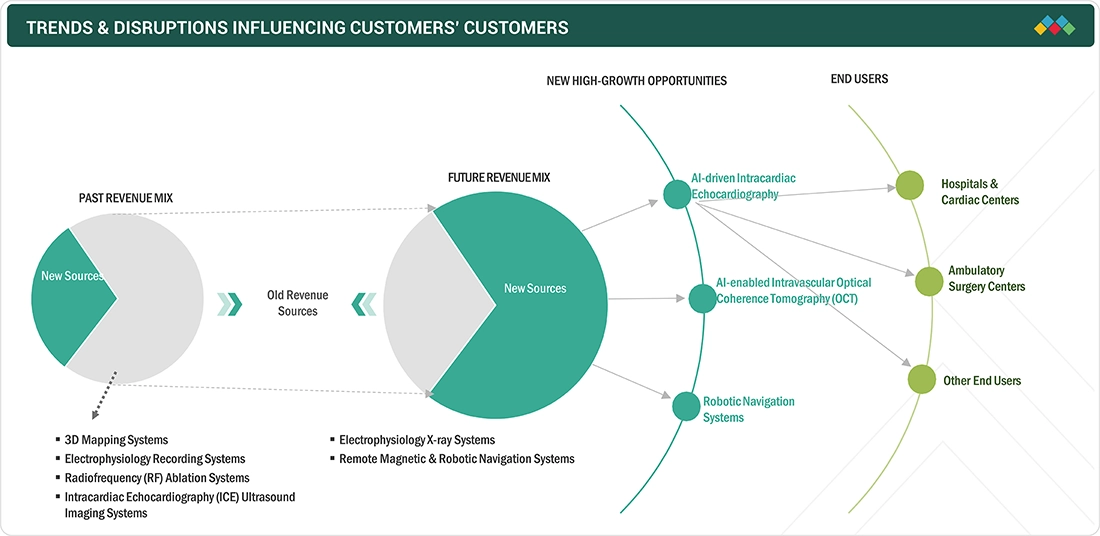

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Electrophysiology market is undergoing a significant transformation driven by technological, regulatory, and healthcare delivery trends. A key disruption is the increasing shift toward noninvasive and continuous monitoring solutions, spurred by growing demand for remote patient care and chronic disease management, especially for cardiovascular and respiratory conditions.|

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technological innovations for advanced, effective, and easy-to-use electrophysiological devices

-

High geriatric population and increased prevalence of cardiovascular diseases

Level

-

High product cost and inadequate reimbursement in developing and under-resourced healthcare settings

-

Unfavorable healthcare reforms in US

Level

-

Substantial growth opportunities in emerging economies

-

Popularity of ambulatory surgical centers offering cost-effective outpatient electrophysiology services

Level

-

Global shortage of skilled and experienced personnel

-

High treatment costs and complexity of procedures

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Technological innovations for advanced, effective, and easy-to-use electrophysiological devices

Technological advancements are pivotal in accelerating the electrophysiology market's growth by enabling more accurate diagnosis, precise treatment, and improved patient outcomes. A major innovation has been the development of advanced 3D electro-anatomical mapping systems, which create high-resolution, real-time maps of the heart's electrical activity. Additionally,robot-assisted electrophysiology procedures are becoming more prevalent in specialized centers.

Restraint: High product cost and inadequate reimbursement in developing and under-resourced healthcare settings

One of the main barriers to the growth of the electrophysiology market is the high cost of EP equipment, technologies, and procedures. Electrophysiology labs need advanced infrastructure, such as state-of-the-art 3D electro-anatomical mapping systems, ablation generators, fluoroscopy units, intracardiac echocardiography (ICE) machines, and high-precision catheters—each with a substantial price tag.

Opportunity: Substantial growth opportunities in emerging economies

Emerging markets—India, Brazil, Mexico, Indonesia, and South Africa—offer significant growth opportunities for electrophysiology. With rising GDP, increasing urbanization, and government efforts to enhance healthcare infrastructure, these countries are seeing a boost in healthcare investments. Many emerging countries are skipping older technologies and directly adopting next-generation solutions, such as 3D mapping, contact-force sensing catheters, and cryoablation.

Challenge: Global shortage of skilled and experienced personnel

Despite the growing demand for electrophysiology services, a critical shortage of skilled professionals remains a pressing challenge worldwide, particularly in developing and under-resourced settings. Electrophysiology is a highly specialized field within cardiology, requiring extensive training in advanced mapping, ablation techniques, and interpretation of complex cardiac signals. Additionally, the lack of training centers, standardized EP curricula, and limited hands-on exposure further hinders the ability to scale the workforce.

Electrophysiology Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizes TactiCath Contact Force Ablation Catheter with integrated force sensing for atrial fibrillation procedures. | Enables precise lesion formation, reduces recurrence rates, and improves procedural safety. |

|

CARTO 3 System for advanced 3D electroanatomical cardiac mapping. | Provides real-time visualization, enhances navigation accuracy, and minimizes fluoroscopy exposure. |

|

AcQMap High-Resolution Imaging and Mapping System using ultrasound and charge density mapping. | Enables comprehensive visualization of arrhythmia patterns and improves treatment precision. |

|

Farapulse Pulsed Field Ablation (PFA) System for atrial fibrillation (AF) treatment. | Offers precise tissue ablation with minimal collateral damage, reducing procedure time and enhancing safety. |

|

PulseSelect PFA System for AF ablation. | Provides targeted energy delivery, improving procedural efficiency and patient outcomes. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the electrophysiology (EP) market is composed of a complex network of stakeholders that collectively drive innovation, product development, clinical adoption, and market growth. At the core are medical device manufacturers such as Johnson & Johnson Services, Inc., Abbott, Medtronic, and Boston Scientific Corporation, which lead in producing advanced technologies such as 3D cardiac mapping systems, ablation catheters, diagnostic electrodes, and recording systems. Supporting them are software and Al developers specializing in real-time signal processing, arrhythmia detection, and integrated procedural planning, many of whom partner with device OEMs to embed intelligent solutions into EP platforms).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electrophysiology Market, By Product

As of 2024, electrophysiology ablation catheters held the largest share of the electrophysiology market due to the convergence of clinical, technological, and healthcare system factors. A key factor is the increasing clinical acceptance of catheter ablation as a first-line treatment for arrhythmias, especially atrial fibrillation, supported by evolving clinical guidelines and robust outcomes data. Technological innovations, such as high-resolution mapping systems and integration with advanced imaging modalities, have greatly improved procedural accuracy and outcomes, encouraging wider adoption.

Electrophysiology Market, By Indication

In 2024, atrial fibrillation (AF) dominated the electrophysiological market, driven by the increasing global demographic of aging individuals, alongside rising rates of obesity, hypertension, diabetes, and sedentary behaviors, has led to a notable surge in AF prevalence. This growing burden of AF is driving heightened demand for EP diagnostics and therapeutic interventions. Moreover, significant advancements in EP procedural techniques, such as enhanced catheter ablation methods, state-of-the-art mapping systems, and sophisticated intracardiac imaging technologies, have markedly improved both the efficacy and safety profiles of interventions.

Electrophysiology Market, By End User

The hospitals & cardiac centers segment is expected to dominate the eletrophysiological market, hospitals integrate electrophysiology services into their cardiology departments, enabling cardiologists, electrophysiologists, and other healthcare providers to collaborate more effectively. These institutions are equipped with the necessary infrastructure, advanced technologies, and skilled professionals required for performing electrophysiology procedures such as catheter ablation. With high patient demand for comprehensive cardiac care, hospitals and cardiac centers serve as the primary providers for diagnosing and treating arrhythmias and other heart diseases.

REGION

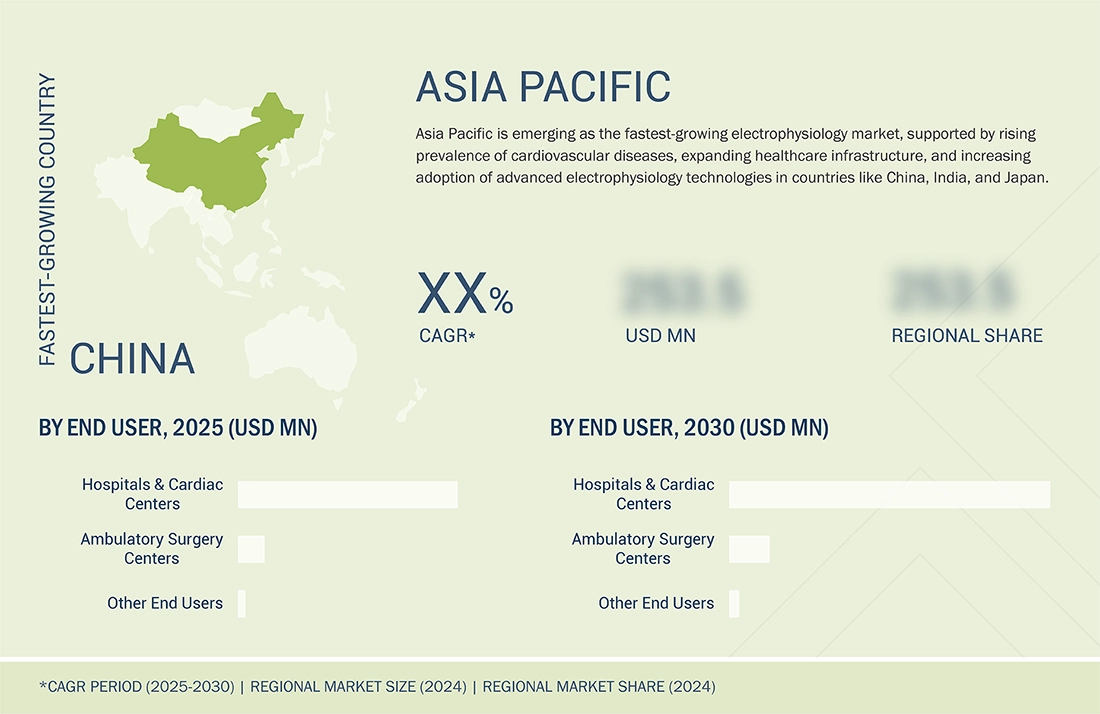

Asia Pacific to be fastest-growing region in global electrophysiology market during forecast period

The Asia Pacific electrophysiology market is expected to register the highest CAGR during the forecast period, driven by a large population, an increasing geriatric population, the growing incidence of chronic diseases, rising healthcare spending, healthcare reforms for infrastructural development, increasing demand for advanced technologies, the growing emphasis of prominent players on emerging markets, and less stringent regulations are also fueling the demand for electrophysiology devices in this region. Changing lifestyles and eating habits, increasing stress, and rising habitual smoking & drinking in these countries have resulted in growing health-related problems such as obesity, heart disease, and other chronic diseases, which further boosts growth of the market.

Electrophysiology Market: COMPANY EVALUATION MATRIX

In the electrophysiology market matrix, Johnson & Johnson Services, Inc. (Star) leads with a strong market share and extensive product portfolio, driven by its advanced electrophysiology devices which are widely adopted for treating arrhythmias in both commercial and clinical settings. The company’s dominance is supported by its robust research capabilities, broad distribution network, and strong brand reputation in the cardiovascular space. Stereotaxis, Inc. (Emerging Leader) is gaining visibility with its robotic navigation systems and innovative solutions for electrophysiology procedures which enhances precision in catheter-based ablation. Stereotaxis is strengthening its position through continuous innovation, partnerships, and a growing adoption of its robotic-assisted technologies. While Johnson & Johnson dominates with its scale and comprehensive product offerings, Stereotaxis shows significant potential to move toward the leaders’ quadrant as demand for minimally invasive, precision-driven electrophysiology procedures continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 11.41 Billion |

| Market Forecast in 2030 (Value) | USD 21.72 Billion |

| Growth Rate | CAGR of 11.6% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

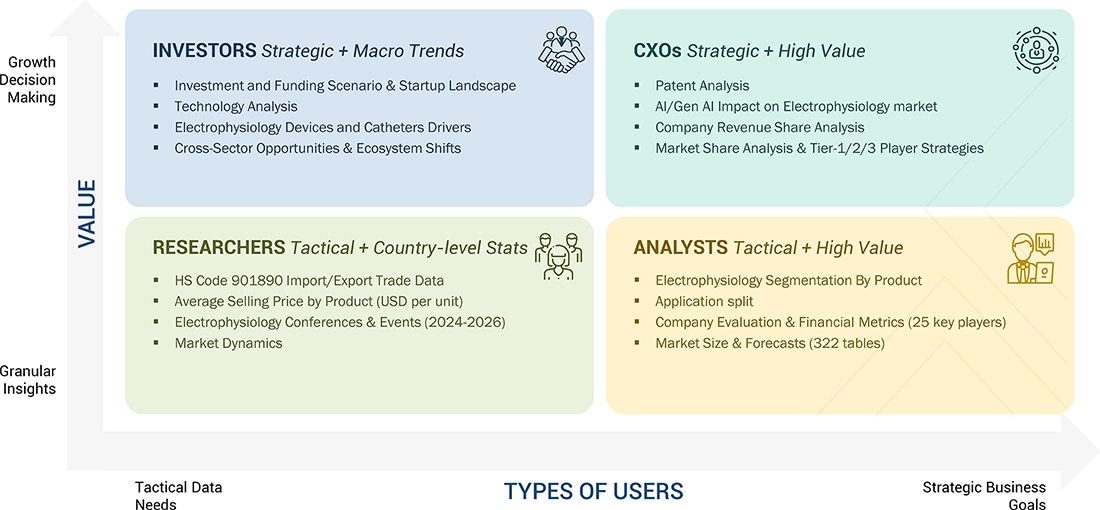

WHAT IS IN IT FOR YOU: Electrophysiology Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of leading electrophysiology devices:Electrophysiology Laboratory Devices, Electrophysiology Ablation Catheters, Electrophysiology Diagnostic Catheters and Electrophysiology Access Devices. Electrophysiology Ablation Catheters dominate due to their essential role in minimally invasive arrhythmia treatment, high success rates, and continuous technological advancements enhancing precision and safety. | Enables identification of product adoption shifts across care settings; Detects safety and compliance-related trends impacting purchasing. |

| Company Information | Key players: Johnson & Johnson Services, Inc., Abbott, Koninklijke Philips N.V., Medtronic and GE Healthcare. Top 3-5 players market share analysis at APAC and European country level. | Insights on revenue shifts towards emerging therapeutic applications and device innovations. |

| Geographic Analysis | Detailed analysis on Rest of APAC was provided to one of the top players. Client focused on ASEAN Market country level analysis for device market. | Country level demand mapping for new product launches and localization strategy planning. |

RECENT DEVELOPMENTS

- November 2024 : Johnson & Johnson MedTech, a global leader in cardiac arrhythmia treatment, announced the U.S. Food & Drug Administration (FDA) approval of the VARIPULSE Platform for the treatment of drug-refractory paroxysmal Atrial Fibrillation (AFib).

- November 2024 : Abbott, the global healthcare company announced the launch of AVEIR VR single-chamber ventricular leadless pacemaker for the treatment of patients in India with slow heart rhythms. This pacemaker is now approved by Central Drugs Standard Control Organization (CDSCO) in India.

- October 2024 : Medtronic announced United States Food and Drug Administration (FDA) approval of the Affera Mapping and Ablation System with Sphere-9 Catheter, an all-in-one, high-density (HD) mapping and pulsed field (PF) and radiofrequency (RF) ablation catheter for treatment of persistent atrial fibrillation (AFib) and for RF ablation of cavotricuspid isthmus (CTI) dependent atrial flutter.

Table of Contents

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

This research study used widespread secondary sources, such as directories, databases such as Dun & Bradstreet, Bloomberg BusinessWeek, and Factiva, white papers, annual reports, and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global pulse oximeters market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends, to the bottom-most level, geographic markets, and key developments related to the market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

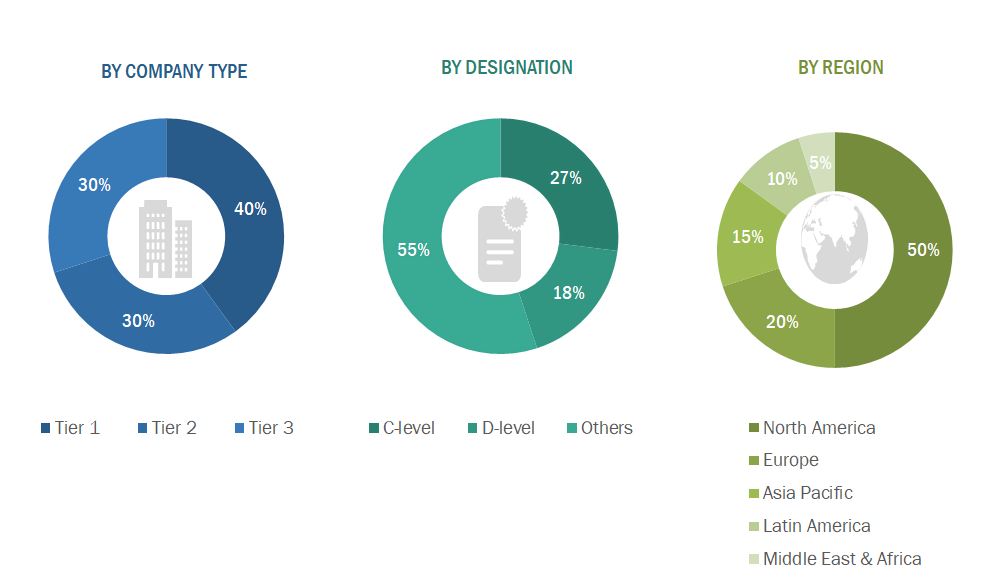

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the pulse oximeters market. The primary sources from the demand side include key executives from hospitals, physicians, clinicians, and research institutes.

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

To know about the assumptions considered for the study, download the pdf brochure

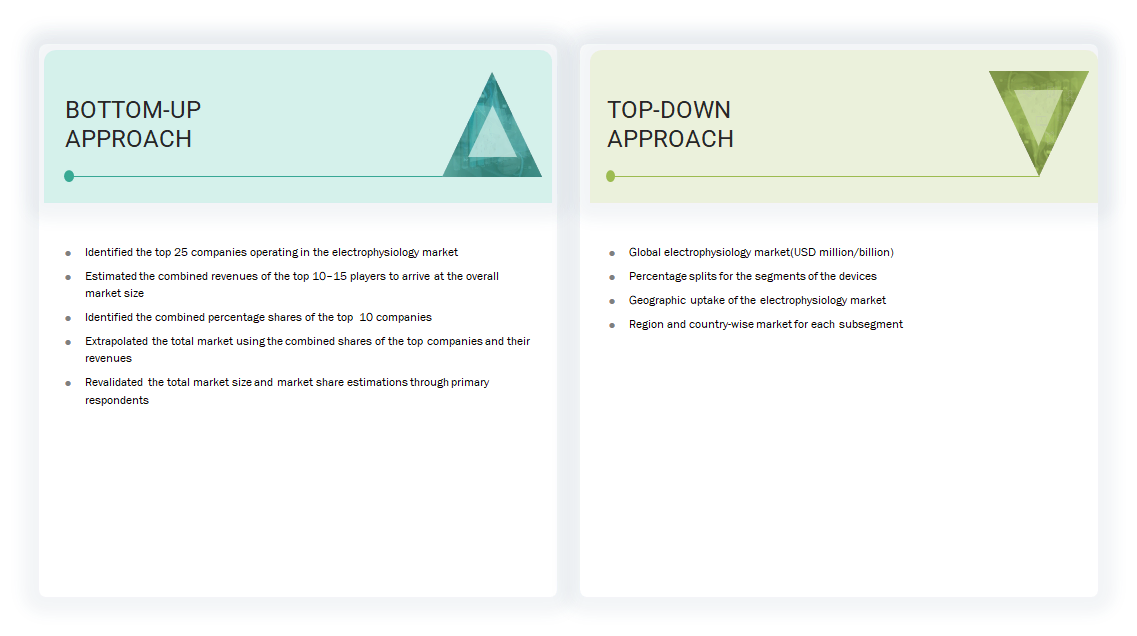

Market Size Estimation

In this report, the electrophysiology market size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the electrophysiology market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the electrophysiology market.

- Mapping annual revenues generated by major global players from the Electrophysiology market(or nearest reported business unit/product category)

- Revenue mapping of key players to cover a major share of the global market, as of 2024

- Extrapolating the global value of the electrophysiology market

Global Electrophysiology Market Size: Top-Down & Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the Electrophysiology market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the electrophysiology market was validated using both top-down and bottom-up approaches.

Market Definition

An electrophysiology (EP) test is performed to examine the electrical activities and pathways of the patient’s heart in order to diagnose and treat complex cardiac conditions. It helps electrophysiologists identify the causes of heart rhythm disorders and determine the appropriate treatment. Electrophysiology (EP) refers to the study of the heart’s electrical system to analyze and diagnose its electrical functions. Cardiac electrophysiology studies the phenomena by recording the electrical activities of the heart with an invasive catheter. This testing is useful for evaluating complex arrhythmias or heart rhythm problems.

Stakeholders

- Electrophysiology devices manufacturing companies

- Suppliers and distributors of electrophysiology products

- Third-party refurbishers/suppliers

- Hospitals

- Cardiac Centers

- Ambulatory surgery centers

- Group purchasing organizations (GPOs)

- Medical research laboratories

- Academic medical centers and universities

- Venture capitalists

- Government bodies

- Corporate entities

- Market research and consulting firms

- Accountable care organizations

- Community centers

- Regulatory authorities.

- Business research and consulting service providers

- Raw material suppliers

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the electrophysiology market by product, indication, end user, and region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micro markets concerning individual growth trends, prospects, and contributions to the overall electrophysiology market.

- To forecast the size of the electrophysiology market in five main regions, along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the electrophysiology market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; product launches; expansions; collaborations, agreements, & partnerships; and R&D activities of the leading players in the electrophysiology market

- To benchmark players within the electrophysiology market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Frequently Asked Questions (FAQ)

What is the expected addressable market value of the global Electrophysiology market over five years?

The global Electrophysiology market is expected to reach USD 21.72 billion by 2030 from USD 12.55 billion in 2025, at a CAGR of 11.6% during the forecast period.

Which segment-based products & services are expected to garner the highest traction within the Electrophysiology market?

The product segment is expected to grow at the highest rate.

What are the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use partnerships, distribution agreements, product launches, and product approvals as important growth tactics.

What are the major factors expected to limit the growth of the Electrophysiology market?

Infrastructural challenges in healthcare, affordability, and accessibility of treatments are the major challenges the market faces.

Which segment, based on Indication, is expected to garner the highest traction within the Electrophysiology market?

The atrial fibrillation segment is expected to grow at the highest rate.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electrophysiology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electrophysiology Market