Ultra-low-power Microcontroller Market Size, Share & Trends

Ultra-low-power Microcontroller Market by Peripheral Device (Analog, Digital), Packaging Type (8-bit, 16-bit, 32-bit), End-use Application (Consumer Electronics, Healthcare, Automotive, Telecommunications, Manufacturing), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The ultra-low-power microcontroller market is projected to reach USD 15.27 billion in 2030 from USD 9.78 billion in 2025, growing at a CAGR of 9.3% from 2025 to 2030. Ultra-low-power microcontrollers (ULP MCUs) are energy-efficient processors designed to deliver optimized performance while consuming minimal power, enabling long battery life in portable and connected devices. The market is driven by the rising adoption of battery-powered devices, such as wearables, medical monitors, and IoT sensors, which demand extended operation without frequent charging. Additionally, advancements in low-power architectures, wireless connectivity integration, and the push for energy-efficient electronics across automotive, healthcare, and industrial sectors are fueling growth.

KEY TAKEAWAYS

-

BY PERIPHERAL DEVICEThe market is split into analog and digital devices, with analog peripherals witnessing strong demand due to their role in energy-efficient sensor integration, while digital devices are gaining traction for AI-driven edge processing and signal conditioning.

-

BY PACKAGING TYPE32-bit packaging holds the largest market share and is set to grow at the fastest rate, driven by its ability to support AI inference, higher computational performance, and energy-efficient processing in IoT, automotive, and industrial applications.

-

BY END-USE APPLICATIONConsumer electronics currently account for the largest market share, driven by the rising adoption of wearables, smart home devices, and IoT ecosystems. The healthcare sector is projected to record the highest growth rate, fueled by the escalating use of energy-efficient MCUs in portable medical devices, patient monitoring, and AI-powered diagnostic tools.

-

BY REGIONAsia Pacific is expected to be the fastest-growing market, supported by strong semiconductor manufacturing capabilities and rising smart device adoption across China, Japan, South Korea, and India. North America and Europe are key markets for automotive, healthcare, and industrial applications, while the RoW region is gradually adopting ULP MCUs through telecom and defense.

-

COMPETITIVE LANDSCAPEMajor players are focusing on integrating AI capabilities, expanding battery-powered applications, and building strategic partnerships across IoT, healthcare, and automotive ecosystems. Companies such as Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), Renesas Electronics Corporation (Japan), STMicroelectronics (Switzerland), and Microchip Technology Inc. (US) are investing in next-generation ULP MCUs to enhance edge intelligence and energy efficiency.

The ultra-low power microcontroller (ULP MCU) industry growth is projected to be driven by the rising adoption of IoT devices, wearable electronics, and edge AI applications that demand minimal power consumption with maximum efficiency. Increasing deployment in consumer electronics ensures a strong base, while healthcare applications such as portable medical devices and continuous monitoring systems are accelerating growth at a high rate. Coupled with advances in 32-bit packaging and the integration of AI capabilities, ULP MCUs are becoming critical enablers of next-generation connected ecosystems, setting the foundation for sustained market expansion across industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The ultra-low-power microcontroller market is experiencing a significant transformation as new technologies reshape revenue streams across various industries. Currently, the revenue mix is still largely dominated by general-purpose and high-power microcontrollers in consumer electronics and traditional industrial control applications. However, the shift toward ULP microcontrollers is being driven by promising trends such as edge AI processing, energy harvesting with advanced power management, next-generation wireless integration, secure edge computing, and advanced packaging for miniaturization. These innovations are creating new opportunities in consumer electronics, automotive, manufacturing, healthcare, telecommunications, servers and data centers, aerospace, and defense sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising need for energy efficiency in consumer electronics

-

Increasing demand from smart home and building management applications

Level

-

Limited memory and peripheral integration

-

Manufacturing complexities and unsuitability for power-critical applications

Level

-

Growing adoption of power electronics in EV industry

-

Government policies and investments for IoT and semiconductors

Level

-

Lower penetration rate of ultra-low-power MCUs than high- and low-power MCUs

-

Integration with diverse connectivity protocols

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing number of connected devices in IoT network

The exponential rise in IoT-connected devices across smart homes, wearables, industrial automation, and smart city projects is driving demand for ultra-low power microcontrollers. These MCUs are designed to enable continuous operation of sensors, data processing, and wireless connectivity with minimal power consumption. Their role in supporting real-time monitoring, predictive maintenance, and automation makes them a backbone of the IoT ecosystem, creating strong growth momentum for the market as billions of devices come online.

Restraint: Limited Memory and Peripheral Integration

Ultra-low power MCUs are optimized for energy efficiency but often face restrictions in memory capacity, processing power, and peripheral integration. This limitation reduces their ability to handle computationally intensive workloads or complex system requirements without additional external components. The need for supplementary chips increases both system costs and design complexity, creating barriers in applications demanding higher processing performance. Consequently, this technical restraint slows broader adoption in advanced use cases such as AI at the edge and high-performance IoT devices.

Opportunity: Growing Adoption of Power Electronics in EV Industry

The rapid growth of electric vehicles (EVs) presents a significant opportunity for ULP MCUs, particularly in applications such as battery management systems (BMS), motor control, and energy monitoring. Their ability to operate efficiently at low power makes them critical for extending battery life and enhancing EV system performance. With automakers prioritizing lightweight, energy-efficient electronics, ULP MCUs are becoming essential in enabling smarter power electronics, aligning with the global transition toward sustainable mobility and electrification of transportation.

Challenge: Integration with Diverse Connectivity Protocols

The expansion of IoT and connected ecosystems demands support for multiple wireless protocols, including Bluetooth Low Energy, Zigbee, LoRa, Wi-Fi, and NB-IoT. Ensuring seamless compatibility across these diverse standards remains a major challenge for ULP MCUs, as lack of integration can hinder interoperability and slow adoption. Manufacturers must design flexible solutions that accommodate evolving connectivity requirements without compromising energy efficiency, making protocol integration a critical challenge in scaling IoT deployments across industries.

Ultra-low-power Microcontroller Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developed a future-ready smart door lock (Halo Select) with hub-free Wi-Fi, Matter over Thread compatibility, and dual-mode Bluetooth 5, enabling flexible connectivity, extended battery life, and compact form factor design | Extended battery life | Hub-free remote access | Seamless integration with smart home platforms | Enhanced RF performance and security | Reduced maintenance | Accelerated time-to-market |

|

Created an always-on AI-Lynx vehicle surveillance system using AML100 analog ML platform with ultra-low-power wireless connectivity for accurate event detection without draining vehicle battery | Continuous battery-friendly monitoring | High accuracy with reduced false alerts | Real-time notifications | Reliable cloud connectivity | Benchmark-setting automotive security |

|

Applied multimodal generative AI and RAG to extract knowledge from diagram-heavy PowerPoints, converting them into structured data for accelerated modeling and reuse in collision-safety development | 67% reduction in documentation time, 30–50% savings in development work, reduced handbook creation from 3 years to 1, improved knowledge reuse, and proof-of-concept for future AI-driven production |

|

Built the Makalu Computing Platform for immersive digital cockpits, delivering 8K/4K display support, advanced 3D HMI, AR/VR capabilities, and multi-threaded computing for in-vehicle entertainment | 67% reduction in documentation time | 30–50% savings in development work | Reduced handbook creation from 3 years to 1 | Improved knowledge reuse | Proof-of-concept for future AI-driven production |

|

Upgraded EyeSight ADAS from ASICs to adaptive SoCs, enabling real-time stereo vision, AI inference, firmware upgradability, and ASIL-D safety compliance for advanced driver assistance | Up to 3x AI processing power | Enhanced scene perception and recognition | Improved real-time safety features (braking, steering) | Firmware adaptability | Progress toward zero road fatalities by 2030 |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ultra-low-power microcontroller ecosystem is composed of interdependent segments including ULP microcontroller designers, component manufacturers, system integrators, and global distributors. Designers focus on developing optimized architectures and IP cores that minimize energy usage while maintaining performance. Manufacturers such as Texas Instruments, NXP Semiconductors, STMicroelectronics, Renesas Electronics, Infineon Technologies, and Microchip Technology transform these designs into physical chips using advanced low-power process technologies. System integrators embed these microcontrollers into diverse applications spanning consumer devices, industrial automation, automotive systems, and healthcare equipment. Distributors ensure efficient global supply and accessibility. This collaborative structure enables continuous innovation, accelerates commercialization, and supports the growing demand for energy-efficient embedded solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Ultra-low-power Microcontroller Market, by Peripheral Device

Analog peripheral devices command a strong share in the ULP MCU market, as they enable efficient sensing, conversion, and monitoring in real-time applications. Their role is critical in wearables, medical devices, smart meters, and automotive systems where low power and accuracy are essential. Growing IoT adoption and integration with 32-bit MCUs are expanding their use in connected ecosystems. With rising demand for reliable, power-efficient analog interfaces, this segment is set to grow significantly alongside emerging smart applications.

Ultra-low-power Microcontroller Market, by Packaging Type

The 32-bit packaging segment dominates the ULP MCU market, driven by its ability to deliver higher performance, memory capacity, and scalability. These MCUs power complex applications including edge AI, wearables, EV systems, and industrial automation while maintaining ultra-low power efficiency. Their versatility in handling secure communication, real-time analytics, and advanced peripheral integration makes them the preferred choice across industries. With IoT deployments expanding rapidly, 32-bit MCUs are expected to retain their leadership in both share and growth.

Ultra-low-power Microcontroller Market, by End-use Application

Consumer electronics hold the largest market share of the ULP MCU market, by end-use application, fueled by their increasing use in smartphones, wearables, and smart home devices. ULP MCUs enhance energy efficiency, extend battery life, and support features such as biometric sensing, wireless connectivity, and voice recognition. The growing adoption of health-tracking wearables and connected appliances further strengthens this dominance. Compact form factors and low-power designs align with consumer expectations for smarter, longer-lasting devices, ensuring consumer electronics remain the leading application segment for ULP MCUs.

REGION

Asia Pacific to be fastest-growing region in global ultra-low-power microcontroller market during forecast period

Asia Pacific is expected to be the fastest-growing market for ULP MCUs, driven by large-scale electronics manufacturing, IoT adoption, and EV development in China, Japan, South Korea, and India. Government-supported digitalization initiatives, increasing healthcare technology adoption, and strong consumer electronics demand are driving market growth. With strong semiconductor ecosystems and investments in automation, the region is becoming a global hub for ULP MCU innovation. As industries seek energy-efficient solutions, Asia Pacific is set to remain the key growth engine for the market.

Ultra-low-power Microcontroller Market: COMPANY EVALUATION MATRIX

In the ultra-low power microcontroller (ULP MCU) companies matrix, Infineon Technologies AG (Star) leads with a strong market presence and diverse product portfolio, catering to high-growth sectors such as automotive, industrial automation, and consumer electronics. Its focus on energy-efficient designs and integration of advanced security features drives large-scale adoption across connected ecosystems. Texas Instruments (Emerging Leader) is gaining traction with its robust ULP MCU offerings, particularly in IoT devices, healthcare, and wearables. While Infineon dominates with scale and ecosystem depth, Texas Instruments demonstrates strong innovation momentum and is well-positioned to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.92 Billion |

| Market Forecast in 2030 (Value) | USD 15.27 Billion |

| Growth Rate | CAGR of 9.3% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and Rest of the World |

WHAT IS IN IT FOR YOU: Ultra-low-power Microcontroller Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Consumer Electronics OEM | • Competitive benchmarking of ULP MCU vendors (Infineon, TI, NXP, Microchip) for wearables and smart devices • Power efficiency and memory integration analysis • Packaging roadmap comparison (8-bit, 16-bit, 32-bit) | • Helped identify most cost-efficient ULP MCU supplier • Optimized device design with better battery life • Aligned procurement with future product packaging trends |

| Automotive Tier-1 Supplier | • Assessment of ULP MCU adoption in EV power electronics and ADAS modules • Lifecycle cost analysis of 32-bit MCUs • Vendor sourcing strategy for automotive-grade MCUs | • Enabled EV-ready architecture development • Reduced long-term TCO for automotive applications • Strengthened supplier diversification |

| Healthcare Device Manufacturer | • Market entry roadmap for medical-grade ULP MCUs in wearables and remote monitoring devices • Regulatory and compliance mapping (FDA, CE) • Case studies of MCU adoption in healthcare IoT | • Accelerated time-to-market for compliant devices • Mapped untapped growth opportunities in healthcare IoT • Enhanced positioning in regulated healthcare markets |

| Telecom IoT Solutions Provider | • Demand analysis for ULP MCUs in telecom IoT sensors and 5G edge devices • Benchmarking connectivity support (LoRa, NB-IoT, Bluetooth Low Energy) • Strategic fit evaluation of MCU vendors for telecom workloads | • Improved product design with multi-protocol compatibility • Strengthened competitive positioning in IoT-enabled telecom services • Opened new revenue streams in edge IoT |

| Investment Firm Exploring Semiconductors | • Funding landscape analysis of ULP MCU startups • Identification of acquisition targets in low-power MCU packaging and peripherals • Long-term market size projections by end-use application | • Supported portfolio diversification in semiconductors • Pinpointed high-growth acquisition opportunities • Strengthened investment strategy with long-term demand forecasts |

RECENT DEVELOPMENTS

- June 2025 : Renesas Electronics Corporation launched the RA2L2 MCU group, featuring ultra-low power consumption and industry-first support for the new USB-C Revision 2.4 standard. Based on a 48 MHz Arm Cortex-M23 core, these MCUs are ideal for portable devices and PC peripherals such as gaming mice and keyboards. They offer advanced low-power features, USB-C connectivity, and wake-on-UART capability for Wi-Fi/Bluetooth modules.

- March 2025 : STMicroelectronics launched STM32U3 microcontrollers featuring advanced power-saving technologies for IoT applications in remote or energy-constrained environments. Ideal for utility meters, medical devices, animal and environmental monitors, and consumer wearables, these MCUs support long-term, low-maintenance operation on minimal power sources such as coin cells or ambient energy.

- January 2025 : NXP launched the MCX L14x and L25x microcontrollers, part of its new ultra-low-power MCX L series, designed for battery-powered, always-on sensing applications. Featuring a dual-core architecture with an independent ultra-low-power sense domain, these MCUs enable continuous data collection even in sleep mode, making them ideal for industrial monitoring, building management, and flow metering.

- April 2024 : Microchip Technology Inc. (US) expanded its partnership with TSMC (Taiwan) to secure specialized 40nm manufacturing capabilities at its subsidiary—Japan Advanced Semiconductor Manufacturing (JASM). This initiative forms part of Microchip's strategy to enhance supply chain resilience. The company aims to strengthen internal manufacturing capabilities, increase capacity, and establish geographic diversity and redundancy across its wafer fab, foundry, assembly, test, and OSAT partnerships.

- April 2024 : Infineon Technologies launched the PSOC Edge MCU family—E81, E83, and E84—designed for machine learning applications in IoT, consumer, and industrial use cases. These scalable MCUs feature Arm Cortex-M55 or M33 cores with Helium DSP, Arm Ethos-U55 micro-NPU, and Infineon’s ultra-low power NNLite neural network accelerator.

Table of Contents

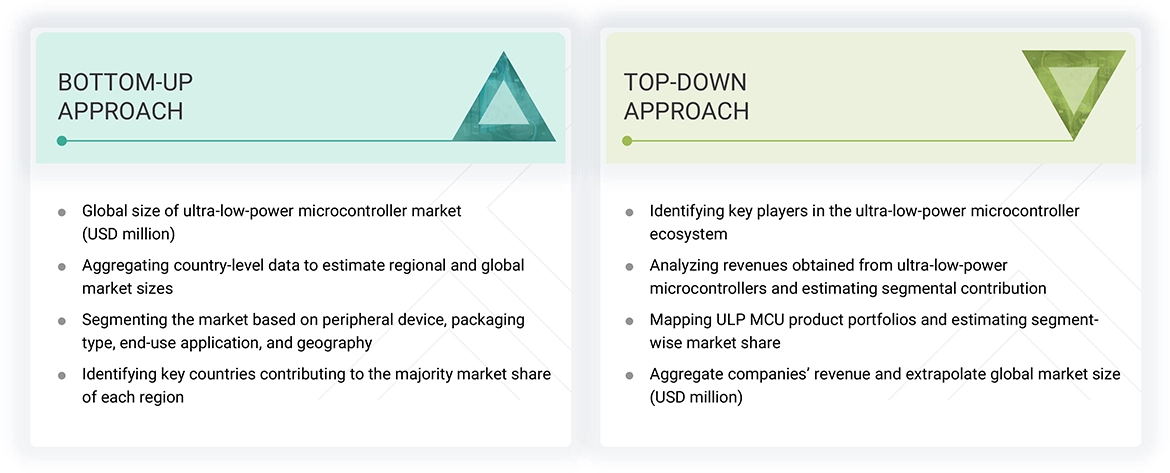

Methodology

The study involved four major activities in estimating the current size of the ultra-low-power microcontroller market. Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process has referred to various secondary sources to identify and collect necessary information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research was conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. Secondary data was collected and analyzed to determine the overall market size, which was further validated through primary research.

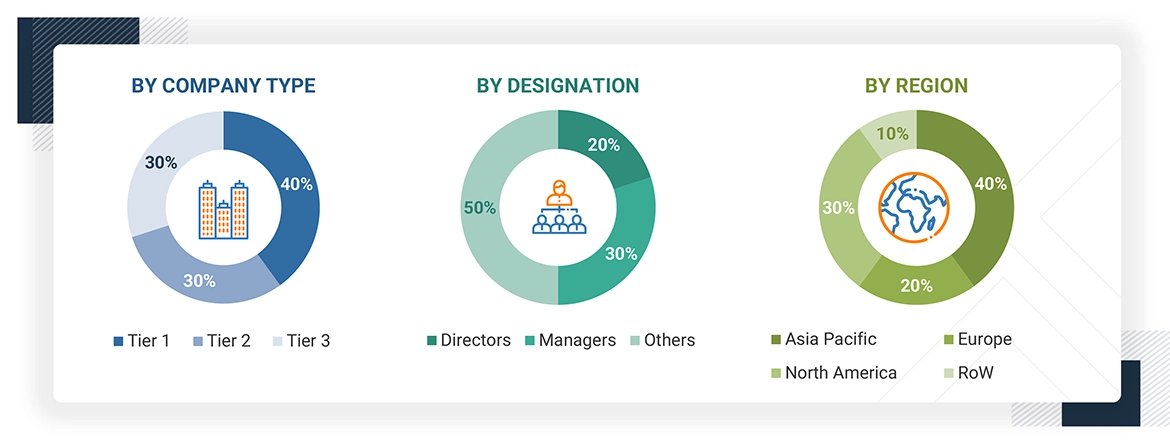

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the ultra-low-power microcontroller market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions: North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephone interviews.

Note 1: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

Note 2: The three tiers of the companies are based on their total revenues as of 2024; Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Ultra-low-power Microcontroller Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments using the market size estimation processes explained above. Data triangulation and market breakdown procedures were employed to complete the entire market engineering process and determine the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides in the ultra-low-power microcontroller market.

Market Definition

An ultra-low-power microcontroller (ULP MCU) is a compact, programmable integrated circuit designed to execute control and processing tasks while consuming minimal electrical power, making it ideal for battery-operated and energy-constrained applications. These MCUs incorporate advanced power management techniques such as dynamic voltage and frequency scaling, multi-power domain architectures, and deep sleep modes to extend operational life without sacrificing performance. Typically built on optimized semiconductor process nodes, ULP MCUs support a wide range of peripherals—both analog and digital—and are commonly deployed in IoT devices, wearable electronics, medical monitoring equipment, industrial sensors, and smart home systems, where extended battery life and energy efficiency are critical design priorities.

Key Stakeholders

- Semiconductor foundries

- Original equipment manufacturers (OEMs)—application or electronic product manufacturers

- Original design manufacturers (ODMs) and original equipment manufacturers (OEMs)—technology solution providers

- Printed circuit board (PCB) designers and manufacturers

- Automotive component manufacturers

- Research institutes and clinical research organizations (CROs)

- Microcontroller forums, alliances, and associations

- Technology investors

- Government bodies and policymakers

- Raw material suppliers and distributors

- System integrators

Report Objectives

- To define, describe, and forecast the ultra-low-power microcontroller market size, by peripheral device, packaging type, end-use application, and region

- To forecast the market size for various segments, in terms of value, with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To forecast the size of the global ultra-low-power microcontroller market, in terms of volume

- To provide detailed information regarding major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter’s Five Forces analysis, regulations, impact of AI, and impact of US tariff pertaining to the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the ultra-low-power microcontroller market

- To strategically profile key players and comprehensively analyze their market rank and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as agreements, contracts, partnerships, mergers and acquisitions, and product launches in the ultra-low-power microcontroller market

- To analyze the impact of the macroeconomic outlook for each region

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and the Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Which end-use application in the ultra-low-power microcontroller market is likely to hold the largest market share during the forecast period?

Consumer electronics is expected to hold the largest share in the ultra-low-power MCU market due to the high demand for energy-efficient, battery-powered devices like wearables, smart home products, and portable gadgets.

Which packaging type in the ultra-low-power microcontroller market is likely to drive growth over the coming years?

The 32-bit packaging segment will drive growth for the ULP MCU market by delivering high processing performance, scalability, and advanced functionality while maintaining ultra-low-power consumption for complex, connected applications.

What are the drivers and opportunities for the ultra-low-power microcontroller market?

The rising need for energy efficiency in consumer electronics, rising deployment in battery-powered industrial sensors, growing adoption of power electronics in EV industry, and government policies and investments for IoT and semiconductors are the major drivers and opportunities for the ultra-low-power microcontroller market.

What are the restraints and challenges for the players in the ultra-low-power microcontroller market?

Limited memory and peripheral integration, manufacturing complexities and unsuitability for power-critical applications, and integration with diverse connectivity protocols are the key challenges faced by the market players.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Ultra-low-power Microcontroller Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Ultra-low-power Microcontroller Market