Enterprise Video Market by Solutions (Video Conferencing, Video Content Management, Webcasting), Application (Corporate communications, Training & Development, Marketing & Client Engagement), Vertical (BFSI, Telecom, Retail) - Global Forecast to 2029

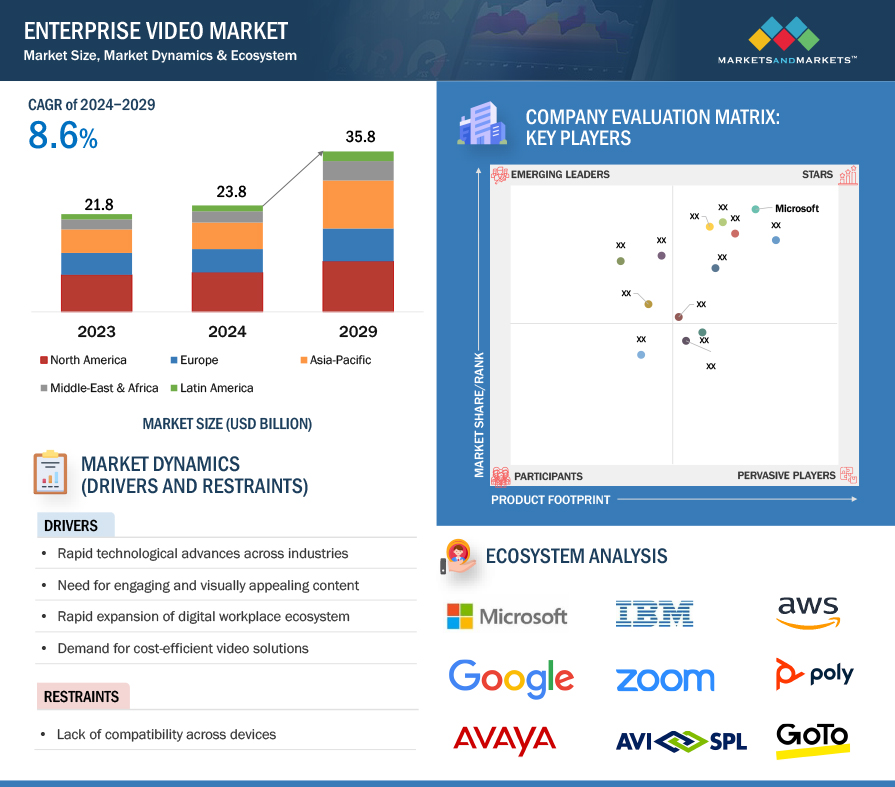

The global enterprise video market size was valued at USD 21.8 billion in 2024 and is projected to reach USD 35.8 billion by 2029, growing at a CAGR of 8.6% from 2024 to 2029. The impact of the recession (before, during, and after the recession) on the market is covered throughout the report. Some of the key driving factors of the market include increased demand for remote collaboration tools, growing preference for video content in corporate communication, the rise of hybrid work environments, and advancements in video streaming technology, among others.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Global Enterprise Video Market

A recession can significantly impact the Enterprise video market across organizations, industry verticals, and regions. Businesses may delay investments in advanced technologies as they prioritize cost-cutting over innovation. Startups in the field may struggle to secure funding as investors become more risk-averse. The impact of a recession on the digital media enterprise video market could be mitigated to some extent by the growth of online advertising. However, the industry/market might encounter hurdles due to reduced consumer spending and intensified competition for advertising revenue. Declining consumer expenditure during economic downturns could dampen the demand for entertainment offerings such as recreational tickets and cable TV subscriptions, reducing the earnings of video solutions and service firms engaged in their production and distribution.

Enterprise video Market Dynamics

Driver: Expansion of the digital workplace ecosystem across various devices and platforms

The expansion of the digital workplace ecosystem is a significant driving force in the enterprise video market. Businesses increasingly recognize the importance of integrating video solutions into their digital workflows to enhance employee communication, collaboration, and knowledge sharing. As organizations embrace remote work and flexible work arrangements, there is a growing demand for integrated video solutions that facilitate seamless content creation, management, and distribution across diverse devices and platforms across enterprises, irrespective of size. This trend underscores the need for robust and scalable video platforms that can accommodate the evolving needs of modern workplaces, driving innovation and growth in the enterprise video market. The expansion of the digital workplace ecosystem refers to the growing scope and integration of digital technologies within modern workplaces. This expansion involves businesses adopting various digital tools and solutions to enhance productivity, collaboration, and employee communication. Specifically, companies are increasingly seeking integrated solutions for content creation, management, and distribution. This means they are looking for comprehensive platforms or software that can handle all aspects of creating, organizing, and sharing content seamlessly across different devices (such as computers, tablets, and smartphones) and platforms (such as web browsers, mobile apps, and cloud storage services) (diversified). The goal is to streamline workflows, improve efficiency, and facilitate collaboration in the digital workplace environment.

Restraints: Lack of compatibility across a wide range of devices

The compatibility of video solutions across different devices and platforms is crucial for ensuring widespread accessibility and usability. However, the lack of compatibility with all devices and platforms poses a significant limitation for enterprise video solutions. Users may encounter difficulties accessing or viewing video content if the solution is incompatible with their preferred devices or operating systems. This limitation hampers the seamless integration of video into various workflows and communication channels within organizations, restricting its effectiveness as a communication and collaboration tool. Furthermore, limited compatibility may also hinder the adoption of video solutions among employees or stakeholders who rely on specific devices or platforms, thereby impeding the overall uptake and utilization of enterprise video solutions in diverse organizational settings.

Opportunities: AI and Analytics integration plays a pivotal role for more startups to monetize their enterprise video offerings by embedding integration into their offerings

Integrating AI and advanced analytics presents a significant opportunity in the Enterprise Video market by enhancing the capabilities of video solutions in several key areas. AI-powered features such as facial recognition, sentiment analysis, and natural language processing (NLP) enable organizations to extract valuable insights from video content, such as viewer engagement, sentiment trends, and content effectiveness. Additionally, AI-driven video analytics can automate tasks such as content tagging, indexing, and searching, making it easier for users to discover and navigate video content. Furthermore, predictive analytics can anticipate viewer preferences and behavior, enabling organizations to personalize video content and improve audience engagement. Overall, integrating AI and analytics in Enterprise Video solutions empowers organizations to leverage video data more effectively, optimize content delivery, and enhance user experiences, driving innovation and differentiation in the market.

Challenges: Lack of sufficient bandwidth for High-quality video streaming

The demand for high-quality video streaming in the enterprise video market poses a challenge due to its intensive bandwidth requirements. This strain on network resources can result in performance issues such as buffering, latency, and degraded video quality. Organizations may struggle to maintain a smooth and reliable video streaming experience, especially during peak usage. Additionally, the need for robust network infrastructure to support high-bandwidth video transmission adds to the cost and complexity of implementing enterprise video solutions. As a result, the bandwidth constraints and associated network performance issues serve as a restricting factor against the widespread adoption of enterprise video solutions, particularly for organizations with limited network capabilities.

Based on the offering, Solutions will hold a larger market share in the Enterprise video market during the forecast period.

Enterprise video solutions help increase the remote workforce's overall productivity and reduce the costs associated with traveling and engagement. Thus, enterprise video solutions are crucial in reducing the overall Operational Expenditure (OPEX) and Capital Expenditure (CAPEX). Effective enterprise collaboration offers a seamless video experience for various application areas, such as marketing, client engagement, knowledge sharing, team collaboration, and employee training. The advanced enterprise video solutions also comply with regulations, such as HIPPA and GDPR, making adopting these solutions easier for highly regulated industries. Major enterprise video solution vendors are gradually adopting technologies, such as DRM, NLP, AR/VR, 5G, and AI/ML, to offer an advanced suite of solutions to cater to the business needs of the customers; this factor is expected to provide growth opportunities to the enterprise video solutions in the upcoming years. Vendors are offering cloud and on-premises solutions to meet customers' business needs.

Based on solutions, the Webcasting segment will record the highest CAGR in the Enterprise video market during the forecast period.

Webcasting solutions are integral to the global enterprise video market, enabling organizations to broadcast live or on-demand video content to a large online audience. These solutions facilitate virtual events, corporate communications, training sessions, and product launches. For instance, a multinational corporation might use a webcasting solution to stream its annual shareholder meeting to stakeholders worldwide in real time, ensuring broad accessibility and engagement. With features like interactive Q&A sessions and analytics tracking, webcasting solutions offer a versatile platform for enterprises to connect with their audiences effectively, irrespective of geographical barriers.

North America is predicted to hold the largest Enterprise video market share during the forecast period.

Enterprises are increasing their budgets to accommodate Enterprise video, thus supporting the growth of the Enterprise video market in North America. The US and Canada are the key North American enterprise video market countries. As a major economy, the US holds a significant market share due to the country's technological advancements, the inclination toward innovation, and the adoption of new technologies. Organizations have invested substantially in advanced technologies to gain a competitive advantage and increase business productivity. The Enterprise video market is expected to grow steadily as enterprises adopt cloud-based solutions and services at various levels to sustain themselves and achieve improved business functioning. Some of the top vendors in the market include IBM, Microsoft, Zoom, Google, and AWS, among others.

Key market players

The Enterprise video market is dominated both by established companies as well as startups such as IBM (US), Zoom (US), Google (US), Microsoft (US), Avaya (US), AWS (US), Cisco (US), GoTo (US), Adobe (US). These vendors have a large customer base, a strong geographic footprint, and organized distribution channels. They incorporate organic and inorganic growth strategies, including product launches, deals, and business expansions, boosting revenue generation.

The study includes an in-depth competitive analysis of these critical enterprise video market players with their company profiles, recent developments, and key market strategies.

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

Offering, Application, Deployment Model, Organization Size, and Vertical |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Zoom (US), Microsoft (US), Google (US), Avaya (US), AWS (US), Cisco (US), Poly (US), Adobe (US), GoTo (US), RingCentral (US), Kaltura (US), Haivision (Canada), Kollective Technology (US), MediaPlatform (), Notified (Sweden), ON24 (US), Enghouse systems (Canada), Brightcove (US), VIDIZMO (US), Panopto (US), VBrick (US), Qumu (US), Sonic Foundry (US) |

This research report categorizes the Open Banking solutions market to forecast revenue and analyze trends in each of the following submarkets:

Based on Offering:

-

Solutions

- Video conferencing

- Video content management

- Webcasting

-

Services

- Professional services

- Managed services

Based on Application:

- Corporate Communications

- Training & Development

- Marketing & Client Engagement

Based on Deployment model:

- On-premises

- Cloud

Based on Organization Size:

- SMEs

- Large Enterprises

Based on Verticals:

- BFSI

- Telecommunications

- Media & Entertainment

- Retail & Consumer Goods

- Healthcare & Life Sciences

- Education

- IT & ITeS

- Other Verticals

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

-

Latin Americ

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2024, IBM partnered with Wipro, where it announced the launch of the Wipro Enterprise AI-ready Platform. This service will allow clients to create enterprise-level, fully integrated, customized AI environments.

- In January 2024, Zoom launched the Zoom application for Apple Vision Pro, which seamlessly integrates video conferencing with users' physical surroundings, blurring the boundaries between in-person and virtual meetings. Through the expansive canvas offered by Apple Vision Pro, distributed teams can experience a heightened sense of connection and inclusivity during meetings. Zoom on Apple Vision Pro creates an immersive experience (spatial experience) to scale.

- In September 2023, Microsoft Advertising launched a new video ad offering called Video and Connected TV (CTV) ads (advertising strategy). CTV feature expands ad-serving possibilities simultaneously while leveraging audience intelligence, targeting high-value customers, and increasing the conversion rate. CTV ads are served across Microsoft's sites, publisher partners, and on connected TV in the US, namely (CTV) Microsoft Start, MSN, CNN, Hulu, the Washington Post, and the Wall Street Journal, among others.

- In January 2023, IBM Watson Media launched its brand-new IBM live-streaming video mobile application. The mobile app for video streaming enables simultaneous live streaming of multiple videos. Specifically designed for businesses, it includes AI-powered closed captioning. Administrators have the flexibility to edit these captions for better context and comprehension.

- In July 2022, Google partnered strategically with Miro, a visual collaboration tool provider. Miro will use Google Workspace to integrate its collaboration tools with the Google Meet video conferencing platform. The partnership will enable customers to share and access new and existing Miro boards during a video meeting over Google Meet.

Frequently Asked Questions (FAQ):

What is the projected market value of the Enterprise Video Market?

The global Enterprise video market is expected to grow from USD 23.8 billion in 2024 to USD 35.8 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 8.6% during the forecast period.

Which region has the highest CAGR in the Enterprise Video Market?

The Asia Pacific region has the highest Enterprise video Market CAGR.

Which offering holds a more significant market share during the forecast period?

The solutions segment is forecasted to hold a larger market share in the Enterprise Video Market.

Which are the major vendors in the Enterprise Video Market?

The vendors IBM, Microsoft, Zoom, and Google are prominent in the enterprise video market.

What are some of the drivers in the Enterprise Video Market?

Enhanced collaboration among the remote workforce, convenient virtual meetings with reduced downtime, reduced cost and time-saving approach, and improved and effective engagement with customers worldwide. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rapid technological advances across industries- Need for engaging and visually appealing content- Rapid expansion of digital workplace ecosystem- Demand for cost-efficient video solutionsRESTRAINTS- Lack of compatibility across devicesOPPORTUNITIES- Expansion of virtual events to open avenues for enterprise video market exploration- Integration of AI with advanced analytics- Development of industry-specific video solutions- Demand for mobile and remote workforce- Expansion of modern, fast-paced business environments- Demand for video communication and collaboration tools and platforms to facilitate zero barrier/buffer interactionsCHALLENGES- Lack of sufficient bandwidth for high-quality video streaming solutions- Lack of relevant technical skillset and expertise

-

5.3 CASE STUDY ANALYSISAVAYA’S VIDEO CONFERENCING SOLUTION ENABLED REAL-TIME TRANSMISSION OF HIGH-DEFINITION VIDEOS FOR KOCH MEDIAAWS OFFERED SEAMLESS VIDEO UPLOAD AND PLAYBACK CAPABILITIES FOR VIDYARD’S GLOBAL CUSTOMER BASEKALTURA OFFERED VIDEO MANAGEMENT SOLUTIONS TO ENSURE CONTENT ACCESSIBILITY FOR CALIFORNIA STATE UNIVERSITY’S DIVERSE STUDENT POPULATIONFORBES LEVERAGED ZOOM’S ROBUST FEATURES TO CREATE SEAMLESS VIRTUAL EXPERIENCESSTARLING BANK DEPLOYED LIFESIZE’S INTEGRATED SOLUTION TO OPTIMIZE ITS COMMUNICATION INFRASTRUCTURE

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 VALUE CHAIN ANALYSISENTERPRISE VIDEO PLATFORM/SOLUTION VENDORSENTERPRISE VIDEO SERVICE PROVIDERSVIDEO EQUIPMENT MANUFACTURERSSYSTEM INTEGRATORSNETWORK SERVICE PROVIDERSVERTICALS

-

5.6 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Video analytics- AI & ML- Augmented & virtual reality (AR/VR)- Digital rights management (DRM)COMPLIMENTARY TECHNOLOGIES- 5G networks- Edge computing- Blockchain- Natural language processing (NLP)ADJACENT TECHNOLOGIES- Internet of things (IoT)- Content delivery networks (CDNs)

-

5.7 PRICING ANALYSISINDICATIVE PRICING ANALYSIS- Average selling price (ASP) trend

-

5.8 BUSINESS MODEL ANALYSISADVERTISING MODELFREEMIUM MODELSERVICE-BASED MODELPAY-AS-YOU-GO MODELSUBSCRIPTION-BASED MODELLICENSING MODELPARTNERSHIPS, RESELLER MODEL, AND COLLABORATIONS

- 5.9 INVESTMENT LANDSCAPE

-

5.10 PATENT ANALYSIS

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDSGENERAL DATA PROTECTION REGULATION (GDPR)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)CALIFORNIA CONSUMER PRIVACY ACT (CCPA)FAMILY EDUCATIONAL RIGHTS AND PRIVACY ACT (FERPA)PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI DSS)SYSTEM AND ORGANIZATION CONTROLS 2 (SOC 2)INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)REGULATORY LANDSCAPE

-

5.13 KEY CONFERENCES & EVENTS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONOFFERINGS: ENTERPRISE VIDEO MARKET DRIVERS

-

6.2 SOLUTIONSENTERPRISE VIDEO SOLUTIONS HELP INCREASE REMOTE WORKFORCES’ OVERALL PRODUCTIVITY AND REDUCE COSTSVIDEO CONFERENCING- Unified communications platform- Huddle room systems- Telepresence systems- Desktop & mobile applications- Web-based conferencing solutionsVIDEO CONTENT MANAGEMENT- Video hosting & streaming platforms- Content creation & editing software- Digital asset management (DAM) systems- Learning management systems (LMSs)- Video analytics & optimization softwareWEBCASTING- Virtual event platforms- Live streaming software- On-demand video platforms- Hybrid event solutions

-

6.3 SERVICESENTERPRISE VIDEO SERVICES IMPROVE BUSINESS PROCESSES AND OPTIMIZE BUSINESS OPERATIONSPROFESSIONAL SERVICES- Consulting & advisory- Deployment & integration- Training & educationMANAGED SERVICES- Support & maintenance- Performance monitoring & optimization- Security & compliance

-

7.1 INTRODUCTIONDEPLOYMENT MODES: MARKET DRIVERS

-

7.2 ON-PREMISESON-PREMISE DEPLOYMENT OF ENTERPRISE VIDEO SOLUTIONS REDUCES SERVICE MAINTENANCE COSTS

-

7.3 CLOUDCLOUD-BASED ENTERPRISE VIDEO SOLUTIONS ALLOW ORGANIZATIONS TO ADJUST TO DYNAMIC BUSINESS ENVIRONMENT

-

8.1 INTRODUCTIONORGANIZATION SIZES: MARKET DRIVERS

-

8.2 LARGE ENTERPRISESUSE OF HIGH VOLUME OF APPLICATIONS IN LARGE ENTERPRISES TO DRIVE ADOPTION OF ENTERPRISE VIDEO SOLUTIONS

-

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)GROWING DEMAND IN SMES FOR SOLUTIONS THAT CAN RESOLVE COMPLEXITIES AND OPTIMIZE COST OF BUSINESS PROCESSES TO DRIVE MARKET

-

9.1 INTRODUCTIONAPPLICATIONS: MARKET DRIVERS

-

9.2 CORPORATE COMMUNICATIONSVIDEO CONFERENCING SOLUTIONS HELP PROVIDE EFFECTIVE PERSONALIZED COMMUNICATION WITHIN ORGANIZATIONSINTERNAL ANNOUNCEMENTS & UPDATESLIVE EVENTS & CONFERENCESEMPLOYEE TRAINING & ONBOARDINGTOWN HALL MEETINGS

-

9.3 TRAINING & DEVELOPMENTNEED FOR EFFECTIVE ELEARNING AND INTERACTIVE DISTANCE LEARNING TOOLS TO BOOST MARKET GROWTHEMPLOYEE SKILLS DEVELOPMENTCOMPLIANCE TRAININGSOFT SKILLS TRAININGCERTIFICATION PROGRAMS

-

9.4 MARKETING & CLIENT ENGAGEMENTENTERPRISE VIDEO SOLUTIONS ENHANCE CUSTOMER ENGAGEMENT AND PROVIDE EFFECTIVE COMMUNICATIONPRODUCT DEMONSTRATIONS & TUTORIALSCUSTOMER TESTIMONIALS & CASE STUDIESWEBINARSVIRTUAL EVENTS & TRADE SHOWS

-

10.1 INTRODUCTIONVERTICALS: ENTERPRISE VIDEO MARKET DRIVERS

-

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)USE OF VIDEO SOLUTIONS IMPROVES ACCOUNTABILITY IN BFSI ORGANIZATIONSBFSI: APPLICATION AREAS- Virtual banking- Training & compliance- Remote financial advisory- Other application areas

-

10.3 TELECOMMUNICATIONSENTERPRISE VIDEO SOLUTIONS HELP IT ORGANIZATIONS MANAGE DIGITAL CONTENT FROM CENTRALIZED PLATFORMSTELECOMMUNICATIONS: APPLICATION AREAS- Customer support- Product demonstrations- Internal training & knowledge sharing- Other application areas

-

10.4 HEALTHCARE & LIFE SCIENCESENTERPRISE VIDEO COLLABORATIONS OFFER HEALTHCARE PROVIDERS EFFECTIVE COMMUNICATION OPTIONS TO HELP THEM PROVIDE ENHANCED PATIENT CAREHEALTHCARE & LIFE SCIENCES: APPLICATION AREAS- Telemedicine consultations- Medical training & education- Patient education & wellness programs- Other application areas

-

10.5 EDUCATIONENTERPRISE VIDEO SOLUTIONS HELP COLLEGES AND UNIVERSITIES ENHANCE CLASSROOM EXPERIENCEEDUCATION: APPLICATION AREAS- Distance learning & online classes- Virtual laboratories- Teachers' professional development- Other application areas

-

10.6 MEDIA & ENTERTAINMENTVIDEO STREAMING AND WEBCASTING SOLUTIONS ENHANCE PERSONALIZED VIEWING EXPERIENCEMEDIA & ENTERTAINMENT: APPLICATION AREAS- Content creation & production- Live event streaming- Audience engagement & interactivity- Other application areas

-

10.7 RETAIL & CONSUMER GOODSONLINE VIDEO ADVERTISING AND CAMPAIGNS ALLOW RETAILERS TO STRENGTHEN BRAND IMAGE COMMUNICATION TO HELP INCREASE CUSTOMER BRAND LOYALTYRETAIL & CONSUMER GOODS: APPLICATION AREAS- Virtual product demonstrations- Personalized shopping experiences- Training & onboarding- Other application areas

-

10.8 IT & ITESENTERPRISE VIDEO SOLUTIONS ENCOURAGE IT COMPANIES TO TRANSFER KNOWLEDGE AND INFORMATION THROUGH VIDEOSIT & ITES: APPLICATION AREAS- Remote technical support- Internal communication & collaboration- Software training & demo- Other application areas

- 10.9 OTHER VERTICALS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- High adoption of enterprise video solutions and associated services to drive market growthCANADA- Remote work culture and enhanced collaboration to benefit Canadian market, driving high adoption of enterprise video solutions

-

11.3 EUROPEEUROPE: ENTERPRISE VIDEO MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Increasing adoption of enterprise video solutions across verticals and companies to drive marketGERMANY- Need for implementing enterprise video usage into employee training, customer support, and marketing campaigns to propel marketFRANCE- Effective usage of enterprise video solutions toward digital transformation efforts to drive marketITALY- Rise in demand for innovative, customizable, effective, and efficient solutions from vendors to leverage market proliferationREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: ENTERPRISE VIDEO MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Rapid proliferation and surge in adoption of enterprise video solutions to drive marketJAPAN- Significant boost by government and initiatives taken toward high adoption of enterprise video solutions to propel marketAUSTRALIA & NEW ZEALAND (ANZ)- Large-scale adoption of enterprise video solutions in healthcare industry to leverage market proliferationREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTGCC (GULF COOPERATION COUNCIL) COUNTRIES- KSA (Kingdom of Saudi Arabia)- United Arab Emirates (UAE)- Other GCC countriesSOUTH AFRICA- Emergence of cloud-based video conferencing solutions to leverage market growthREST OF MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: ENTERPRISE VIDEO MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Rapid adoption of digital technologies and growing internet penetration rate to boost growthMEXICO- Recent structural reforms to create opportunities for entrepreneurs and investorsREST OF LATIN AMERICA

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.4 ENTERPRISE VIDEO MARKET: VENDOR/BRAND COMPARISON

- 12.5 HISTORICAL REVENUE ANALYSIS

-

12.6 COMPANY EVALUATION MATRIX: KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMESRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

-

12.9 COMPETITIVE SCENARIO & TRENDSPRODUCT/SERVICE LAUNCHES & ENHANCEMENTSDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZOOM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVAYA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCISCO- Business overview- Products/solutions/services offered- Recent developmentsPOLY- Business overview- Products/Solutions/Services offered- Recent developmentsADOBE- Business overview- Products/Solutions/Services offered- Recent developmentsGOTO- Business overview- Products/Solutions/Services offered- Recent developments

-

13.3 OTHER PLAYERSRINGCENTRALMEDIAPLATFORMNOTIFIEDKOLLECTIVE TECHNOLOGYHAIVISIONKALTURAON24ENGHOUSE SYSTEMSBRIGHTCOVEVIDIZMOPANOPTOVBRICKSONIC FOUNDRYQUMUDALET DIGITAL MEDIA SYSTEMS

-

14.1 INTRODUCTIONMARKETS ADJACENT TO ENTERPRISE VIDEO MARKET

- 14.2 VIDEO ANALYTICS MARKET

- 14.3 VIDEO STREAMING SOFTWARE MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 INDICATIVE PRICING ANALYSIS FOR KEY PLAYERS

- TABLE 4 TOP TEN PATENT OWNERS, 2023

- TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON ENTERPRISE VIDEO MARKET

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 KEY CONFERENCES & EVENTS, 2024–2025

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 14 MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 15 MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

- TABLE 16 MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 17 SOLUTIONS: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 18 SOLUTIONS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 19 VIDEO CONFERENCING: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 20 VIDEO CONFERENCING: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 21 VIDEO CONTENT MANAGEMENT: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 22 VIDEO CONTENT MANAGEMENT: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 23 WEBCASTING: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 24 WEBCASTING: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 25 MARKET, BY SERVICE, 2018–2023 (USD MILLION)

- TABLE 26 MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 27 SERVICES: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 28 SERVICES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 29 MARKET, BY PROFESSIONAL SERVICE, 2018–2023 (USD MILLION)

- TABLE 30 MARKET, BY PROFESSIONAL SERVICE, 2024–2029 (USD MILLION)

- TABLE 31 PROFESSIONAL SERVICES: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 32 PROFESSIONAL SERVICES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 33 CONSULTING & ADVISORY: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 34 CONSULTING & ADVISORY: ENTERPRISE VIDEO MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 35 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 36 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 37 TRAINING & EDUCATION: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 38 TRAINING & EDUCATION: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 39 MANAGED SERVICES: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 40 MANAGED SERVICES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 41 MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 42 MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 43 ON-PREMISES: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 44 ON-PREMISES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 45 CLOUD: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 46 CLOUD: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 47 MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

- TABLE 48 MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

- TABLE 49 LARGE ENTERPRISES: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 50 LARGE ENTERPRISES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 51 SMES: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 52 SMES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 53 MARKET, BY APPLICATION, 2018–2023 (USD MILLION)

- TABLE 54 MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 55 CORPORATE COMMUNICATIONS: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 56 CORPORATE COMMUNICATIONS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 57 TRAINING & DEVELOPMENT: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 58 TRAINING & DEVELOPMENT: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 59 MARKETING & CLIENT ENGAGEMENT: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 60 MARKETING & CLIENT ENGAGEMENT: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 61 MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

- TABLE 62 MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 63 BFSI: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 64 BFSI: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 65 TELECOMMUNICATIONS: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 66 TELECOMMUNICATIONS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 67 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 68 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 69 EDUCATION: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 70 EDUCATION: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 71 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 72 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 73 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 74 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 75 IT & ITES: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 76 IT & ITES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 77 OTHER VERTICALS: MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 78 OTHER VERTICALS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 79 MARKET, BY REGION, 2018–2023 (USD MILLION)

- TABLE 80 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY SERVICE, 2018–2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2023 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2024–2029 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2023 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

- TABLE 94 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

- TABLE 98 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 99 US: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 100 US: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 101 US: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 102 US: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 103 CANADA: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 104 CANADA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 105 CANADA: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 106 CANADA: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 108 EUROPE: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 109 EUROPE: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY SERVICE, 2018–2023 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2018–2023 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2024–2029 (USD MILLION)

- TABLE 115 EUROPE: MARKET, BY APPLICATION, 2018–2023 (USD MILLION)

- TABLE 116 EUROPE: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 117 EUROPE: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 118 EUROPE: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 119 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

- TABLE 120 EUROPE: MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

- TABLE 121 EUROPE: MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

- TABLE 122 EUROPE: MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 123 EUROPE: MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

- TABLE 124 EUROPE: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 125 UK: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 126 UK: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 127 UK: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 128 UK: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 129 GERMANY: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 130 GERMANY: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 131 GERMANY: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 132 GERMANY: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 133 FRANCE: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 134 FRANCE: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 135 FRANCE: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 136 FRANCE: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 137 ITALY: ENTERPRISE VIDEO MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 138 ITALY: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 139 ITALY: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 140 ITALY: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 141 REST OF EUROPE: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 142 REST OF EUROPE: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 143 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 144 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2023 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2018–2023 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2024–2029 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2023 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 155 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 157 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

- TABLE 158 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

- TABLE 159 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

- TABLE 160 ASIA PACIFIC: MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 161 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

- TABLE 162 ASIA PACIFIC: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 163 CHINA: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 164 CHINA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 165 CHINA: ENTERPRISE VIDEO MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 166 CHINA: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 167 JAPAN: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 168 JAPAN: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 169 JAPAN: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 170 JAPAN: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 171 AUSTRALIA & NEW ZEALAND: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 172 AUSTRALIA & NEW ZEALAND: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 173 AUSTRALIA & NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 174 AUSTRALIA & NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2023 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2023 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2024–2029 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2023 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: ENTERPRISE VIDEO MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 197 GCC COUNTRIES: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 198 GCC COUNTRIES: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 199 GCC COUNTRIES: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 200 GCC COUNTRIES: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 201 GCC COUNTRIES: MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

- TABLE 202 GCC COUNTRIES: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 203 SOUTH AFRICA: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 204 SOUTH AFRICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 205 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 206 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 211 LATIN AMERICA: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 212 LATIN AMERICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 213 LATIN AMERICA: ENTERPRISE VIDEO MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

- TABLE 214 LATIN AMERICA: MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 215 LATIN AMERICA: MARKET, BY SERVICE, 2018–2023 (USD MILLION)

- TABLE 216 LATIN AMERICA: MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 217 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2023 (USD MILLION)

- TABLE 218 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2024–2029 (USD MILLION)

- TABLE 219 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2023 (USD MILLION)

- TABLE 220 LATIN AMERICA: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 221 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 222 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 223 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

- TABLE 224 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

- TABLE 225 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

- TABLE 226 LATIN AMERICA: MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 227 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

- TABLE 228 LATIN AMERICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 229 BRAZIL: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 230 BRAZIL: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 231 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 232 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 233 MEXICO: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 234 MEXICO: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 235 MEXICO: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 236 MEXICO: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 237 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2018–2023 (USD MILLION)

- TABLE 238 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 239 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

- TABLE 240 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 241 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 242 MARKET SHARE OF KEY VENDORS, 2023

- TABLE 243 MARKET: COMPANY REGIONAL FOOTPRINT

- TABLE 244 MARKET: COMPANY OFFERING FOOTPRINT

- TABLE 245 MARKET: COMPANY APPLICATION FOOTPRINT

- TABLE 246 MARKET: COMPANY VERTICAL FOOTPRINT

- TABLE 247 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 248 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 249 MARKET: PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS, JULY 2020–JANUARY 2024

- TABLE 250 MARKET: DEALS, JUNE 2021–FEBRUARY 2024

- TABLE 251 IBM: BUSINESS OVERVIEW

- TABLE 252 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 IBM: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 254 IBM: DEALS

- TABLE 255 ZOOM: BUSINESS OVERVIEW

- TABLE 256 ZOOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 ZOOM: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 258 ZOOM: DEALS

- TABLE 259 MICROSOFT: BUSINESS OVERVIEW

- TABLE 260 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 262 MICROSOFT: DEALS

- TABLE 263 GOOGLE: BUSINESS OVERVIEW

- TABLE 264 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 266 GOOGLE: DEALS

- TABLE 267 AVAYA: BUSINESS OVERVIEW

- TABLE 268 AVAYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 AVAYA: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 270 AVAYA: DEALS

- TABLE 271 AWS: BUSINESS OVERVIEW

- TABLE 272 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 AWS: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 274 AWS: DEALS

- TABLE 275 CISCO: BUSINESS OVERVIEW

- TABLE 276 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 CISCO: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 278 CISCO: DEALS

- TABLE 279 POLY: BUSINESS OVERVIEW

- TABLE 280 POLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 POLY: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 282 POLY: DEALS

- TABLE 283 ADOBE: BUSINESS OVERVIEW

- TABLE 284 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 ADOBE: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 286 ADOBE: DEALS

- TABLE 287 GOTO: BUSINESS OVERVIEW

- TABLE 288 GOTO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 GOTO: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES & ENHANCEMENTS

- TABLE 290 GOTO: DEALS

- TABLE 291 VIDEO ANALYTICS MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 292 VIDEO ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 293 VIDEO ANALYTICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 294 VIDEO ANALYTICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 295 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 296 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 297 VIDEO ANALYTICS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 298 VIDEO ANALYTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 299 VIDEO ANALYTICS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 300 VIDEO ANALYTICS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 301 VIDEO ANALYTICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 302 VIDEO ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 303 VIDEO STREAMING SOFTWARE MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 304 VIDEO STREAMING SOFTWARE MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 305 VIDEO STREAMING SOFTWARE MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 306 VIDEO STREAMING SOFTWARE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 307 VIDEO STREAMING SOFTWARE MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 308 VIDEO STREAMING SOFTWARE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 309 VIDEO STREAMING SOFTWARE MARKET, BY STREAMING TYPE, 2019–2022 (USD MILLION)

- TABLE 310 VIDEO STREAMING SOFTWARE MARKET, BY STREAMING TYPE, 2023–2028 (USD MILLION)

- TABLE 311 VIDEO STREAMING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 312 VIDEO STREAMING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 313 VIDEO STREAMING SOFTWARE MARKET, BY DELIVERY CHANNEL, 2019–2022 (USD MILLION)

- TABLE 314 VIDEO STREAMING SOFTWARE MARKET, BY DELIVERY CHANNEL, 2023–2028 (USD MILLION)

- TABLE 315 VIDEO STREAMING SOFTWARE MARKET, BY MONETIZATION MODE, 2019–2022 (USD MILLION)

- TABLE 316 VIDEO STREAMING SOFTWARE MARKET, BY MONETIZATION MODE, 2023–2028 (USD MILLION)

- TABLE 317 VIDEO STREAMING SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 318 VIDEO STREAMING SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 319 VIDEO STREAMING SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 320 VIDEO STREAMING SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 ENTERPRISE VIDEO MARKET: MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET: RESEARCH FLOW

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY (BOTTOM-UP APPROACH): SUPPLY SIDE – COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 2): SUPPLY-SIDE ANALYSIS

- FIGURE 10 MARKET: DEMAND-SIDE APPROACH

- FIGURE 11 IMPACT OF RECESSION ON MARKET

- FIGURE 12 MARKET: SEGMENTS WITH HIGH GROWTH RATE

- FIGURE 13 ENTERPRISE VIDEO MARKET: REGIONAL SNAPSHOT

- FIGURE 14 NEED FOR UNIFIED COMMUNICATION CAPABILITIES AND REMOTE WORKFORCE COLLABORATION EFFORTS TO SUPPORT GROWTH OF MARKET

- FIGURE 15 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 VIDEO CONFERENCING SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 17 PROFESSIONAL SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 CORPORATE COMMUNICATIONS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 19 CONSULTING & ADVISORY SEGMENT TO LEAD MARKET BY 2029

- FIGURE 20 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2029

- FIGURE 21 CLOUD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 22 TELECOMMUNICATIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 23 ASIA PACIFIC TO EMERGE AS LUCRATIVE MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 24 ENTERPRISE VIDEO MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 VIDEO MARKETING STRATEGIES ADOPTED BY GLOBAL VENDORS

- FIGURE 26 PERCENTAGE OF COMPANIES THAT HAVE ADOPTED ENTERPRISE VIDEO SOLUTIONS AND SERVICES, 2016–2024

- FIGURE 27 ECOSYSTEM MAPPING

- FIGURE 28 VALUE CHAIN ANALYSIS

- FIGURE 29 LEADING MARKET VENDORS, BY NUMBER OF INVESTORS AND FUNDING ROUNDS, 2023

- FIGURE 30 NUMBER OF PATENTS PUBLISHED, 2012–2023

- FIGURE 31 TOP FIVE PATENT OWNERS (GLOBAL), 2023

- FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 33 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN ENTERPRISE VIDEO MARKET

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 36 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 WEBCASTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 TRAINING & EDUCATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 LARGE ENTERPRISES SEGMENT TO LEAD MARKET BY 2029

- FIGURE 42 MARKETING & CLIENT ENGAGEMENT SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 43 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 47 ENTERPRISE VIDEO MARKET: MARKET SHARE ANALYSIS, 2023

- FIGURE 48 VENDOR/BRAND COMPARISON

- FIGURE 49 HISTORICAL REVENUE ANALYSIS, 2019–2023 (USD MILLION)

- FIGURE 50 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 51 MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 52 MARKET: OVERALL COMPANY FOOTPRINT

- FIGURE 53 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 54 MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 55 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 56 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 57 IBM: COMPANY SNAPSHOT

- FIGURE 58 ZOOM: COMPANY SNAPSHOT

- FIGURE 59 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 60 GOOGLE: COMPANY SNAPSHOT

- FIGURE 61 AWS: COMPANY SNAPSHOT

- FIGURE 62 CISCO: COMPANY SNAPSHOT

- FIGURE 63 ADOBE: COMPANY SNAPSHOT

This research study involved extensive secondary sources, directories, and databases, such as Bloomberg BusinessWeek, EconoTimes, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the enterprise video market. The global enterprise video market size is obtained by evaluating its penetration among the major vendors and their offerings in this market. A few startups and private companies were interviewed to gain better visibility and in-depth knowledge of the market across regions. In addition, a few government associations, public sources, conferences, webinars, journals, magazines, articles, and MarketsandMarkets internal repositories were referred to arrive at the actual market size.

Secondary Research

The market size of companies offering enterprise video and services was determined based on secondary data from paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

Several sources were consulted during the secondary research phase to locate and gather data for this investigation. Annual reports, press announcements, investor presentations, white papers, journals, certified publications, and articles by renowned writers, directories, and databases were examples of secondary sources. In addition, information was gathered from additional secondary sources, including blogs, government websites, journals, and vendor websites. Furthermore, data on national spending on enterprise video was taken directly from the relevant sources. To identify the key players based on solutions, services, market classification, and segmentation according to offerings of the major players, industry trends related to offerings, users, and regions, and the key developments from both market- and technology-oriented perspectives, secondary research was primarily used to obtain the critical information related to the industry's value chain and supply chain.

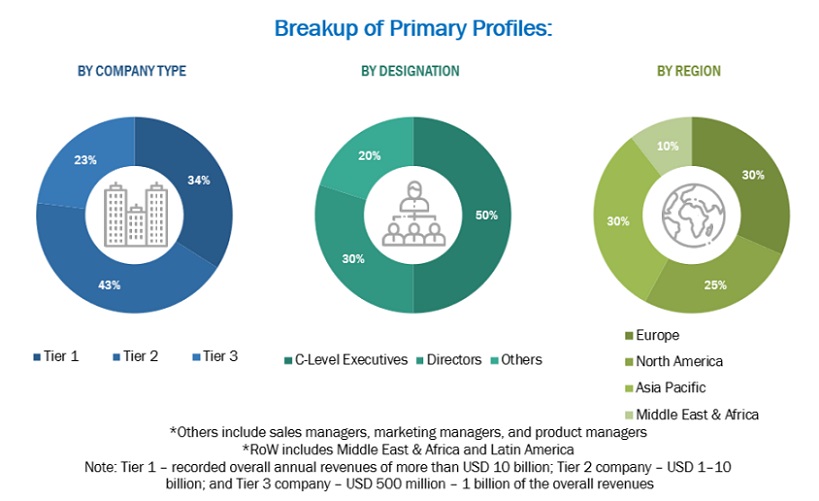

Primary Research

Various sources from the supply and demand sides were questioned during the primary research process to gather qualitative and quantitative market data. Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from the business development, marketing, and product development/innovation teams; related influential executives from enterprise video vendors, industry associations, and independent consultants; and essential opinion leaders were among the primary sources from the supply side.

Insights such as market statistics, the most recent disruptive trends, newly adopted use cases, information on income generated by goods and services, market segmentation, market size estimations, market predictions, and data triangulation were gathered through primary interviews. My understanding of numerous trends in technology, offerings, end users, and geographical areas has also improved thanks to primary research. Demand-side stakeholders were interviewed to gain insight into the buyer's viewpoint regarding suppliers, products, service providers, and their current use, which could impact the enterprise video market. These stakeholders included Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and project teams working on digital initiatives.

To know about the assumptions considered for the study, download the pdf brochure

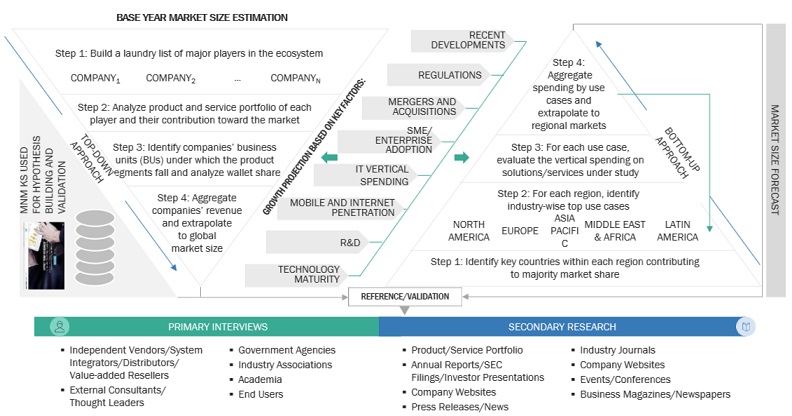

Market Size Estimation

The size of the enterprise video market, as well as the sizes of several dependent subsegments, were estimated and validated using both top-down and bottom-up methods. The following information was part of the research technique utilized to determine the market size:

- Through secondary research, the major market players were located, and primary and secondary research was used to calculate their respective revenue contributions in each region.

- Throughout the process, annual and financial reports from leading market players were examined, and in-depth interviews with directors, CEOs, VPs, and marketing executives were conducted to gather meaningful insights.

- Primary sources were used to verify all percentage splits and breakups, which were calculated using secondary sources.

- To obtain the final quantitative and qualitative data, every factor that might impact the market studied in this research study was considered, examined in great detail, confirmed by primary research, and then assessed. MarketsandMarkets provided thorough input and analysis, which helped to combine and add this data.

A comprehensive list of every vendor providing solutions in the enterprise video industry was compiled using the top-down methodology. The revenue contribution for each vendor in the market was estimated through funding, investor presentations, paid databases, annual reports, news releases, primary interviews, and investor presentations. Based on what it offered, each vendor was assessed. The total market size was calculated by summing together the enterprises' revenues. The size of the worldwide market and the degree of regional penetration of each subsegment were examined in further detail. Triangulating the markets involved using data from primary and secondary sources. The first step was getting important information from top executives, including directors, CEOs, VPs, and marketing executives. The use of enterprise video solutions by many verticals led to the development of the enterprise video market. The market numbers were further cross-checked against the current MarketsandMarkets repository to ensure validity.

The bottom-up approach identified the adoption trend of enterprise video in significant countries for regions that contribute to most of the market share. For cross-validation, the adoption trend of Enterprise video, along with different use cases concerning their business segments, was identified and extrapolated. The use cases found in other domains were given more weight in the computation. A comprehensive roster of all suppliers providing goods and services in the business video sector was compiled. The revenue contribution of all vendors in the market was estimated through funding, investor presentations, paid databases, annual reports, news releases, primary interviews, and paid databases. To determine the size of the market, vendors offering enterprise video services were taken into account. Each vendor was assessed based on what each vendor offered different user types. The total market size was calculated by summing together the revenue of all the companies. We looked at the market size and regional penetration of each subsegment.

Primary and secondary sources were used to determine the geographic divide based on these figures. A regional penetration analysis of the enterprise video market was part of the process. The socioeconomic analysis of each nation, the strategic vendor analysis of top enterprise video solutions and services providers, the regional spending on information and communications technology (ICT), and the organic and inorganic business development activities of regional and international players were all estimated using secondary research. This study ascertained and validated the precise values of the total enterprise video market size and the market sizes of its segments through the data triangulation technique and data validation through primary.

Enterprise video Market: Top-Down and Bottom-Up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The market was divided into several segments and subsegments using the previously described market size estimation procedures once the overall market size was determined. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering various sources and associations, MarketsandMarkets defines enterprise video as "the use of video technology within large organizations or enterprises for various purposes such as communication, training, collaboration, and marketing. It encompasses creating, distributing, and managing video content tailored specifically for internal or external audiences within the enterprise context. Enterprise video solutions often include features like live streaming, on-demand video playback, video conferencing, content management, analytics, and integration with other enterprise systems. The primary goal of enterprise video is to enhance communication, knowledge sharing, and engagement among employees, customers, partners, and other stakeholders, ultimately driving organizational productivity and effectiveness".

Key Stakeholders

- Enterprise Video Solution and Platform Vendors

- IT Developers

- Consulting Service Providers

- Telecom Operators

- Over-the-top (OTT) Players

- Cloud Service Providers

- Government Agencies

- Network and System Integrators

- Software Vendors

- Content Delivery Network Providers

- Web and Video Conferencing Service Providers

- Webcasting Service Providers

- Video Content Management Software Providers

Report Objectives

- To define, describe, and forecast the Enterprise video market based on offerings, applications, deployment model, organization size, verticals, and region

- To offer comprehensive details regarding the primary variables impacting the market's growth (drivers, restraints, opportunities, and challenges)

- To determine the high-growth market sectors to assess the opportunities for stakeholders in the market

- To forecast the market size for five major regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To create a thorough analysis of the market's major players' profiles, market share, and fundamental skills

- To track and analyze competitive developments in the global enterprise video market, such as product enhancements, product launches, acquisitions, partnerships, and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enterprise Video Market