Finance Cloud Market by Offering (Solutions (Financial Forecasting, Financial Reporting & Analysis, Security, GRC) and Services), Application, Deployment Model, Organization Size (Large Enterprises, SMEs), End User and Region - Global Forecast to 2028

Finance Cloud Market Overview

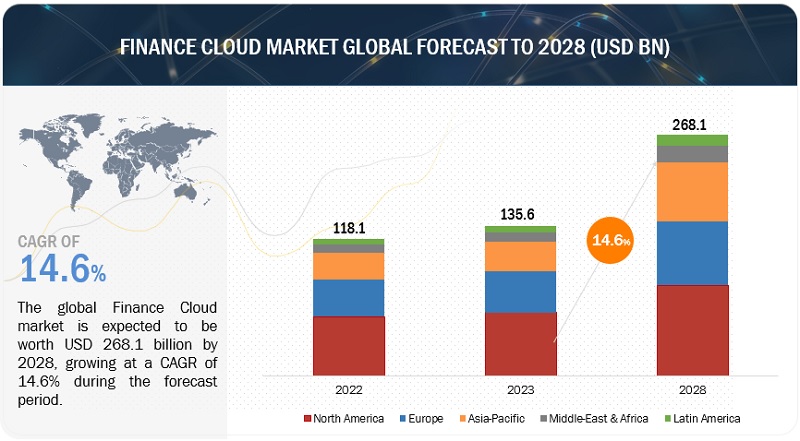

The Finance Cloud Market size is expected to reach USD 268.1 billion by 2028 from USD 135.6 billion in 2023, to grow at a CAGR of 14.6%. The impact of the recession (before and after the recession) on the market is covered throughout the report. Our modern-day lives are overfilled and loaded with the latest digital developments. Financial Cloud computing allows financial institutions to reduce capital expenditures by eliminating the need for extensive on-premises infrastructure. Instead, firms pay for their resources on a pay-as-you-go model basis and can cost-effectively scale computing capacity. This model significantly reduces upfront costs. And drives the market. With cloud-based development and testing environments, BFSI institutions can rapidly prototype and iterate ideas, accelerating the time-to-market offerings. The cloud provides on-demand scalability, allowing financial institutions to manage fluctuations in customer demand and transaction volumes effectively. These are critical driving forces for the Finance Cloud market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the global finance cloud market

With the recession threat looming over the US, chief information officers are reexamining their budgets to save expenditures. According to the Morgan Stanley analysis, cloud computing, security software, and digital transformation would remain top objectives for CIOs in such a situation. The impact of the recession on the Finance Cloud market in North America is likely to be severe as the US and Canadian economies are expected to dip in 2023 compared to 2022. A recession might affect Europe’s infrastructure markets, hampered by transportation issues and a shortage of components. Increasing interest rates will force companies to reduce bank loans, allowing slow demand for infrastructure. According to the South China Morning Post, China faces external headwinds ranging from debt shocks in the developing world to monetary policy spillovers from the United States.

In contrast to several countries worldwide, Saudi Arabia’s economy will grow this year quickly. The country’s GDP will grow by 7.6%, with inflation at 2.8% in 2022. The crisis has not hit Middle Eastern economies as hard because they are not as integrated into the global economy and have fewer ties to international financial institutions. However, they will probably experience side effects like higher unemployment and further decline in living standards due to reduced capital flows.

Finance Cloud Market Dynamics

Drivers: Personalized customer experience with cloud computing for financial services

In recent years, consumer behavior and demands have undergone significant changes. Enterprises now prioritize meeting these demands to remain competitive in the finance cloud market. Increased customer expectations and competition among market leaders have led to a need for cost-effective measures that improve operational efficiency. Enterprises that rely on manual processes for critical business activities face challenges due to these tasks’ tedious, repetitive, and time-consuming nature. Cloud computing offers new ways for enterprises to engage with employees and customers and improve overall workplace productivity.

Restraints: Increasing new regulations and financial standards

The financial services industry is evolving due to new regulations and risk assessment methods aimed at promoting global standardization. However, companies face the challenge of keeping up with these changing financial standards and regulations, including BCBS, Doff Frank, MiFID, IFRS, and others, which can limit the growth of basic financial analytics. Advanced financial analytics software with compliance capabilities can help financial institutions and personnel adapt to these regulatory changes and minimize non-compliance risk. Significant companies like Oracle, IBM, TIBCO Software, SAP, GoodData, and Qlik offer financial analytics software that adheres to these new standards and regulations. The self-learning capabilities of AI algorithms may also drive the growth of the financial analytics market by improving compliance.

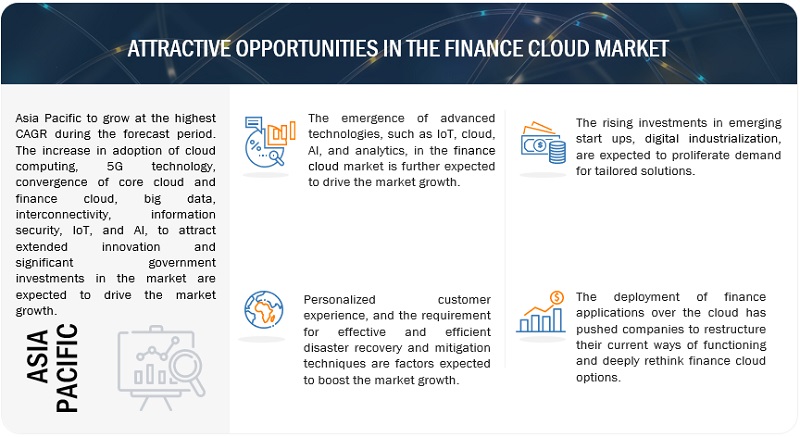

Opportunities: Evolution of AI/ML, along with other advanced technologies and implementation

AI in Finance is increasing as organizations look to speed up investment decisions. Machine learning and AI have improved the ability to analyze information quickly and effectively, with minimal human intervention. For example, Fukoku Mutual Life Insurance has implemented AI to calculate payouts for policyholders, ensuring they meet regulatory standards and collect high-quality data. The potential for AI to revolutionize the industry is vast, with its ability to provide regulatory compliance, accurate equity predictions, and prevent fraud and risk. It can also suggest portfolio solutions to meet the demands of individuals. Despite being in its early stages, AI is set to fuel the growth of the finance cloud market due to its increasing popularity. By adopting AI in the financial sector, the industry can improve trust, accuracy, and resilience, ultimately benefiting the entire ecosystem.

Challenges: Limitation(s) in interoperability and flexibility in operations

Organizations often find it challenging to switch from one cloud service provider to another. The reason is that applications developed for one cloud platform must undergo a rewriting process to be compatible with the new one, which can be complex and time-consuming. Moving data, setting up security measures, and configuring networks can pose further challenges when transitioning to a different cloud solution. These factors can limit an organization’s ability to switch between cloud providers quickly and efficiently.

Finance Cloud Market Ecosystem

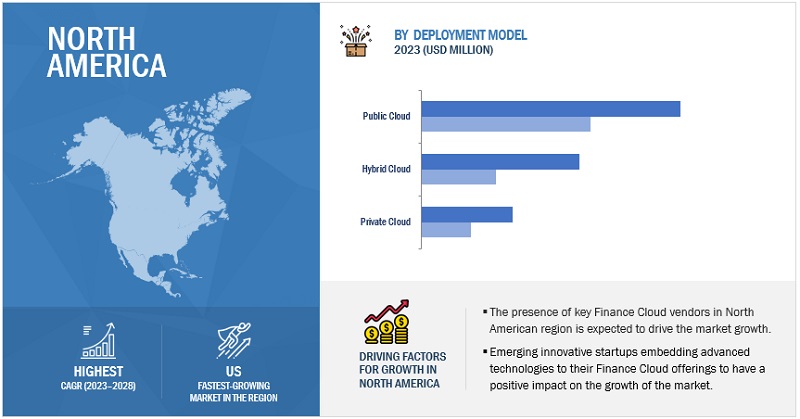

Based on the deployment model, the public cloud segment will hold the largest market share in the Finance Cloud market during the forecast period.

In cloud computing, a public cloud deployment model is when a third-party cloud service provider owns and manages cloud resources and services accessible to the general public or a wide range of customers via the Internet. Many organizations share these resources, and users typically pay for the services on a subscription or pay-as-you-go basis. The cloud provider hosts and manages public cloud services in their own data centers, which offers flexibility, scalability, and cost-effectiveness. Amazon Web Services (AWS) is a well-known public cloud provider that provides various cloud services, such as databases, storage, computing power, machine learning, and more. Customers can access these services over the Internet to host websites, run applications, store data, and perform various computing tasks without managing their physical infrastructure.

Based on offering, the services segment to hold a higher CAGR in the Finance Cloud market during the forecast period

Financial cloud services offer expert consultancy during the initial stages of implementation, helping businesses choose, configure, and customize their finance cloud solutions to meet their specific needs and industry regulations. These experts ensure a seamless transition to the cloud, optimizing financial processes and ensuring compliance with best practices. Additionally, managed services are crucial for the ongoing management and maintenance of cloud infrastructure and financial applications. Managed service providers oversee system monitoring, security management, performance optimization, and troubleshooting, allowing businesses to focus on their core financial operations while ensuring their cloud-based financial systems’ reliability, availability, and security. Together, finance cloud services provide companies with a comprehensive framework to fully utilize the benefits of cloud technology while minimizing operational complexities and enhancing financial agility.

North America to hold the largest market share in the Finance Cloud market in 2023.

North America has captured the largest market size of the finance cloud market. The US and Canada are the prime countries in North America contributing to the growth of finance cloud. According to MarketsandMarkets analysis, it has been observed that more than 91% of the companies have at least one service on the cloud and more than 55% of the organizations have deployed cloud solutions. Reduced CapEx spending, low IT management complexity, improved agility, and security are some of the major driving factors contributing to the growth of cloud computing in North America.

The increasing number of alliances and partnerships among finance cloud and other technology providers for continuous technological innovations and advancements in finance cloud have further added to the growth of the global market in North America. For example, SAS, an edge analytics solution provider, and HPE, a finance cloud service provider, collaborated to launch comprehensive IoT analytics solutions. IoT is trending in North America; with more IoT devices getting connected, the region has seen broader adoption of finance cloud solutions among end users. The presence of connectivity networks will act as a driving factor to facilitate the adoption of finance cloud. The average number of digital devices available to the citizen is increasing exponentially. People are better connected with enhanced access to brand and content. This would widen the opportunity of finance cloud in the region.

Key Market Players

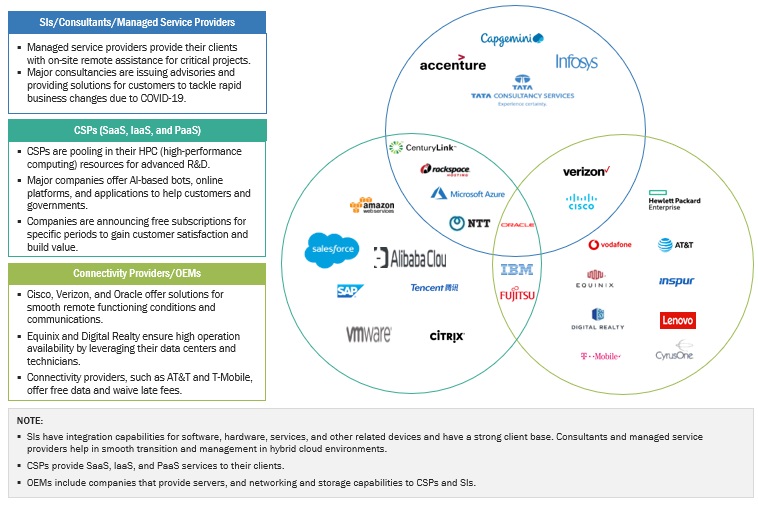

The Finance Cloud market is dominated both by established companies as well as startups such as AWS (US), Microsoft (US), Google (US), IBM (US), Salesforce (US), Tencent (China), Oracle (US), Alibaba (China), Workday (US), SAP (Germany), HPE (US), VMware (US), Cisco (US), Huawei (China), ServiceNow (US), DXC technology (US), SAGE Group (UK), Snowflake (US), Nutanix (US), Acumatica (US), RapidScale (US), AtemisCloud (US), Rambase (Norway), OVHcloud (France). These vendors have a large customer base, a strong geographic footprint, and organized distribution channels. They incorporate organic and inorganic growth strategies including product launches, deals, and business expansions, boosting revenue generation.

The study includes an in-depth competitive analysis of these key players in the Finance Cloud market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2023 |

USD 135.6 billion |

|

Revenue forecast for 2028 |

USD 268.1 billion |

|

Growth Rate |

14.6% CAGR |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

Offering, Deployment Model, Organization Size, Application, and End User |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

AWS (US), Microsoft (US), Google (US), IBM (US), Tencent Cloud (China), Salesforce (US), Oracle (US), Alibaba Cloud (China), Workday (US), SAP (Germany), HPE (US), VMware (US), Cisco (US), Huawei (China), ServiceNow (US), DXC Technology (US), SAGE Group (UK), Snowflake (US), Nutanix (US), Acumatica (US), RapidScale (US), AtemisCloud (US), Rambase (Norway), OVHcloud (France), FreeAgent (Scotland), Freshbooks (Canada), Kashoo (US), and Wave (US) |

This research report categorizes the Finance Cloud Market to forecast revenue and analyze trends in each of the following submarkets:

Based on Offering:

-

Solutions

- Financial forecasting

- Financial Reporting & Analysis

- Security

- Governance, Risk & Compliance

- Other solutions

-

Services

-

Professional Services

- Support & Maintenance

- Deployment & Integration

- Consulting

- Managed Services

-

Professional Services

- Managed Cloud Infrastructure Services

- Managed Network Services

- Managed Security Services

- Other Managed Services

Based on Application:

- Revenue management

- Wealth management

- Customer management

- Account management

- Other applications

Based on the Deployment model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Based on Organization Size:

- Large Enterprises

- SMEs

Based on End User:

- Banks

- Financial service providers

- Insurance companies

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In September 2023, Workday partnered with Accenture. This partnership aims to help organizations reinvent their finance functions to become more agile, data-driven, and customer-centric. This global partnership between Workday and Accenture brings together the power of its cloud-native platform with AI and ML at the core and some of the industry’s most forward-thinking and innovative experts to help its customers take advantage of transformative technologies to accelerate change across their financial operations while being adaptable and resilient.

- In September 2023, Tencent Cloud launched Tencent Cloud Blockchain RPC. This product is developed with Ankr. By introducing Blockchain RPC, Tencent Cloud strives to provide a blockchain node infrastructure solution that has speed and is robust, enabling developers to stay ahead in the rapidly evolving Web3 environment continuously.

- In August 2023, Google partnered with Brillio. This partnership will expand Brillio’s ability to infuse generative AI into its customer experience (UI/UX/web experience), engineering, and data offerings, thus enabling clients to unlock more excellent value by industrializing processes and reducing time-to-market and cost-to-serve. Brillio’s generative AI solutions, powered by Google Cloud’s Vertex AI, will enable financial services organizations to interpret loan applications better, empower call center executives, provide investment advice, and summarize portfolios more effectively.

- In July 2023, SAP launched its SAP S/4HANA Cloud, Public Edition 2308 Release. This latest release would deliver a built-in, intelligent, modern experience across all SAP’s business processes and several enhancements to help make the SAP S/4HANA Cloud, public edition user experience more modern, productive, and collaborative for end users and IT.

- In June 2023, Microsoft partnered with Wipro. This partnership will bring together Microsoft Cloud capabilities with Wipro FullStride Cloud and leverage Wipro’s and Capco’s deep domain expertise in financial services. Capco is a business and technology management consultancy firm owned by Wipro, operating primarily in the financial services and energy vertical(s). Using Microsoft Cloud for Financial Services, Wipro has already delivered various innovative solutions that will assist financial institutions in speeding up time to value and drive sustainable growth.

Frequently Asked Questions (FAQ):

What is the projected market value of the Finance Cloud market?

The global Finance Cloud market is expected to grow from USD 135.6 billion in 2023 to USD 268.1 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 14.6% during the forecast period.

Which region has the highest CAGR in the Finance Cloud market?

The Asia Pacific region has the highest CAGR in the Finance Cloud market.

Which offering holds the larger market share above during the forecast period?

The solutions segment is forecasted to hold the larger market share in the Finance Cloud market.

Which are the major vendors in the Finance Cloud market?

AWS, IBM, SAP, Microsoft, and Google are significant vendors in the Finance Cloud market.

What are some of the drivers in the Finance Cloud market?

Exponentially increasing data volume and network traffic

Growing adoption of cloud technology, along with advanced ones such as AI, ML, and real-time analytics across industries

Significant reduction in cost

Significant reduction in time consumed with a more efficient outcome

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of cloud computing services due to growing remote workforce count- Compliance with stringent industry regulations- Personalized customer experience- Need for disaster recovery and contingency plansRESTRAINTS- Protection of Intellectual Property Rights (IPR)- Rise in new regulations and financial standards- Lack of technical knowledge and expertiseOPPORTUNITIES- Increasing government initiatives- Evolution of AI and ML- Deployment of applications via cloudCHALLENGES- High dependency on networks- Issues with interoperability and flexibility- Effective management of associated cost

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: ORACLE HELPED FINANCIAL INSTITUTION TO BUILD UNIFIED PLATFORMCASE STUDY 2: MICROSOFT RENOVATED BANKING ARCHITECTURE AND CUSTOMER UI/UX CAPABILITIESCASE STUDY 3: HUAWEI ENABLED BFSI GIANT TO STREAMLINE OPERATIONSCASE STUDY 4: CAPGEMINI ENABLED EFFECTIVE AND EFFICIENT AUTOMATION FOR CONSTRUCTION VENDORCASE STUDY 5: ALIBABA ENABLED OPTIMIZATION OF RESOURCES AND FLASH TURNAROUND TIME TO PSX

-

5.4 ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCEBIG DATAINTERNET OF THINGSDATA ANALYTICSMACHINE LEARNING5G

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE TREND

- 5.8 FINANCE CLOUD MARKET: BUSINESS MODEL ANALYSIS

-

5.9 PATENT ANALYSIS

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 REGULATIONSNORTH AMERICAEUROPEASIA PACIFICREST OF THE WORLD

- 5.12 KEY CONFERENCES AND EVENTS IN 2023–2024

- 5.13 FINANCE CLOUD MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- 5.14 EMERGING TRENDS IN FINANCE CLOUD MARKET

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONOFFERING: FINANCE CLOUD MARKET DRIVERS

-

6.2 SOLUTIONSFINANCIAL FORECASTING- Organizations to utilize financial forecasting to make data-driven decisions that can impact financial health positively- Budgeting & Planning- Cash Flow Forecasting- Revenue Forecasting- Other Financial Forecasting SolutionsFINANCIAL REPORTING & ANALYSIS- Finance cloud solutions to offer real-time reporting capabilities, enabling organizations to access up-to-the-minute financial data- Financial Reporting- Business Intelligence (BI) & Analytics- Performance Analytics- Other Financial Reporting & Analysis SolutionsSECURITY- Financial organizations to adopt advanced security solutions to combat evolving cybersecurity threats- Data Encryption & Protection- Identity & Access Management (IAM)- Security Information & Event Management (SIEM)- Other Security SolutionsGOVERNANCE, RISK, AND COMPLIANCE (GRC)- GRC solutions to enable organizations to stay up-to-date with regulatory changes and streamline compliance efforts- Risk Management- Compliance Management- Audit Management- Other GRC SolutionsOTHER SOLUTIONS

-

6.3 SERVICESPROFESSIONAL SERVICES- Lack of in-house expertise and increasing complexity of cloud ecosystems to fuel demand for professional services- Consulting- Deployment & Integration- Training & SupportMANAGED SERVICES- Managed services to enable financial organizations to focus on core competencies instead of managing complex IT infrastructure- Managed Cloud Infrastructure Services- Managed Network Services- Managed Security Services- Other Managed Services

-

7.1 INTRODUCTIONAPPLICATION: FINANCE CLOUD MARKET DRIVERS

-

7.2 REVENUE MANAGEMENTBUSINESSES INCREASINGLY RELYING ON DATA-DRIVEN REVENUE MANAGEMENT TO INCREASE PROFITABILITY AND COMPETITIVENESSBILLING & INVOICINGSUBSCRIPTION MANAGEMENTREVENUE FORECASTING & ANALYSISOTHER REVENUE MANAGEMENT APPLICATIONS

-

7.3 WEALTH MANAGEMENTCLIENTS’ DEMAND FOR TAILORED INVESTMENT STRATEGIES AND FINANCIAL ADVICE TO DRIVE GROWTH OF WEALTH MANAGEMENTPORTFOLIO MANAGEMENTFINANCIAL PLANNINGRISK & COMPLIANCE MANAGEMENTOTHER WEALTH MANAGEMENT APPLICATIONS

-

7.4 ACCOUNT MANAGEMENTDEMAND FOR MORE CONVENIENT AND SELF-SERVICE ACCOUNT MANAGEMENT WITH INCREASING DIGITALIZATION OF FINANCIAL SERVICES TO DRIVE GROWTHCLIENT ONBOARDINGACCOUNT MAINTENANCE & SUPPORTACCOUNT ANALYTICS & REPORTINGOTHER ACCOUNT MANAGEMENT APPLICATIONS

-

7.5 CUSTOMER MANAGEMENTCUSTOMER EXPECTATIONS FOR SEAMLESS INTERACTIONS WITH FINANCIAL INSTITUTIONS TO DRIVE GROWTH OF CUSTOMER MANAGEMENTCUSTOMER RELATIONSHIP MANAGEMENT (CRM)MARKETING AUTOMATIONCUSTOMER SUPPORT & SERVICEOTHER CUSTOMER MANAGEMENT APPLICATIONS

- 7.6 OTHER APPLICATIONS

-

8.1 INTRODUCTIONORGANIZATION SIZE: FINANCE CLOUD MARKET DRIVERS

-

8.2 LARGE ENTERPRISESRISING DIGITAL TRANSFORMATION TO MODERNIZE OPERATIONS AND STAY COMPETITIVE TO DRIVE FINANCE CLOUD ADOPTION

-

8.3 SMALL AND MEDIUM-SIZED ENTERPRISESSMES TO ADOPT FINANCE CLOUD SOLUTIONS DUE TO AVAILABILITY OF COST-EFFECTIVE SCALABILITY OPTIONS

-

9.1 INTRODUCTIONDEPLOYMENT MODEL: FINANCE CLOUD MARKET DRIVERS

-

9.2 PUBLIC CLOUDPAY-AS-YOU-GO PRICING MODEL OF PUBLIC CLOUD TO HELP CONTROL EXPENSES AND IMPROVE BUDGET MANAGEMENT

-

9.3 PRIVATE CLOUDABILITY TO CUSTOMIZE SECURITY MEASURES AND COMPLIANCE CONTROLS TO MEET INDUSTRY-SPECIFIC AND REGIONAL REQUIREMENTS TO DRIVE GROWTH

-

9.4 HYBRID CLOUDFINANCIAL INSTITUTIONS TO UTILIZE HYBRID CLOUD MODEL TO SEGMENT AND PRIORITIZE DATA TO REDUCE STORAGE COST

-

10.1 INTRODUCTIONEND USER: FINANCE CLOUD MARKET DRIVERS

-

10.2 BANKSBANKS ADOPT FINANCE CLOUD TO REDUCE OPERATIONAL COSTS WHILE MAINTAINING SERVICE QUALITYRETAIL & COMMERCIAL BANKSCENTRAL BANKSINVESTMENT BANKSCREDIT UNIONS & NON-BANKING FINANCIAL COMPANIES

-

10.3 FINANCIAL SERVICE PROVIDERSFINANCE CLOUD TO ENABLE FINANCIAL SERVICE PROVIDERS TO SCALE UP RESOURCES DURING PEAK PERIODS AND DOWN DURING SLOWER TIMESASSET & WEALTH MANAGEMENT COMPANIESPAYMENT PROCESSING COMPANIESOTHER FINANCIAL SERVICE PROVIDERS

-

10.4 INSURANCE COMPANIESFINANCE CLOUD TO ENHANCE CUSTOMER EXPERIENCES, STREAMLINE CLAIMS PROCESSING, AND OFFER INNOVATIVE INSURANCE PRODUCTSLIFE INSURANCE COMPANIESHEALTH INSURANCE COMPANIESPROPERTY & CASUALTY (P&C) INSURANCE COMPANIESOTHER INSURANCE COMPANIES

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: FINANCE CLOUD MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Convergence of finance cloud with IoT to encourage US service providers to scaleCANADA- Emerging startups to provide innovative platforms and solutions catering to Canadian market

-

11.3 EUROPEEUROPE: FINANCE CLOUD MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Companies in UK to adopt finance cloud solutions to enhance operational efficiencyGERMANY- German finance cloud and telecom companies to witness increased collaborations to build robust finance cloud solutionsFRANCE- Huge investments by global finance cloud providers because of changing customer behavior to drive growth in FranceREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: FINANCE CLOUD MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Adoption of finance cloud in China to help achieve resiliency and scalabilityJAPAN- Technology providers in Japan to introduce cutting-edge finance cloud technologiesINDIA- Cloud-computing for financial services to enhance capabilities for Indian marketREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: FINANCE CLOUD MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTSAUDI ARABIA- Increase in purchasing power and inclination toward advanced technologies to propel market growth in KSAUAE- IT resource deployment, intelligent storage services, and remote monitoring capabilities drive adoption of finance cloud in UAEREST OF MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: FINANCE CLOUD MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Rising technology assimilation among enterprises and consumers to present significant opportunity for BrazilMEXICO- Migration of applications and IT infrastructure to cloud to drive demand for finance cloud solutions in MexicoREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 FINANCIAL METRICS OF COMPANIES

- 12.5 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 12.6 MARKET SHARE ANALYSIS

- 12.7 FINANCE CLOUD MARKET: VENDOR PRODUCTS/BRANDS COMPARISON

-

12.8 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY PRODUCT FOOTPRINT ANALYSIS

-

12.9 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

12.10 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSMICROSOFT- Business overview- Products offered- Recent developments- Recent developments- MnM viewGOOGLE- Business overview- Products offered- Recent developments- MnM viewAWS- Business overview- Products offered- Recent developments- MnM viewIBM- Business overview- Products offered- Recent developments- MnM viewTENCENT CLOUD- Business overview- Products offered- Recent developmentsSALESFORCE- Business overview- Products offered- Recent developmentsORACLE- Business overview- Products offered- Recent developmentsALIBABA CLOUD- Business overview- Products offered- Recent developmentsWORKDAY- Business overview- Products offered- Recent developmentsSAP- Business overview- Products offered- Recent developments

-

13.3 OTHER COMPANIESHPEVMWARECISCOHUAWEISERVICENOWDXC TECHNOLOGYUNIT4SAGE GROUPSNOWFLAKENUTANIXACUMATICARAPIDSCALEATEMISCLOUDRAMBASEOVHCLOUDFREEAGENTFRESHBOOKSWAVEKASHOO

-

14.1 INTRODUCTIONRELATED MARKETS

- 14.2 CLOUD COMPUTING MARKET

- 14.3 FINANCIAL ANALYTICS MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 RECESSION IMPACT

- TABLE 4 FINANCE CLOUD MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 5 TOP TEN PATENT OWNERS

- TABLE 6 PATENTS GRANTED TO VENDORS IN FINANCE CLOUD MARKET

- TABLE 7 FINANCE CLOUD MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS (IN %)

- TABLE 13 KEY BUYING CRITERIA FOR TOP END USERS

- TABLE 14 FINANCE CLOUD MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 15 FINANCE CLOUD MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 16 FINANCE CLOUD MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 17 FINANCE CLOUD MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 18 SOLUTIONS: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 19 SOLUTIONS: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 FINANCIAL FORECASTING: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 21 FINANCIAL FORECASTING: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 FINANCIAL REPORTING & ANALYSIS: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 FINANCIAL REPORTING & ANALYSIS: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 SECURITY: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 SECURITY: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 GOVERNANCE, RISK, AND COMPLIANCE (GRC): FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 GOVERNANCE, RISK, AND COMPLIANCE (GRC): FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 OTHER SOLUTIONS: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 OTHER SOLUTIONS: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 FINANCE CLOUD MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 31 FINANCE CLOUD MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 32 SERVICES: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 SERVICES: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 PROFESSIONAL SERVICES: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 MANAGED SERVICES: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 MANAGED SERVICES: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 FINANCE CLOUD MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 39 FINANCE CLOUD MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 REVENUE MANAGEMENT: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 REVENUE MANAGEMENT: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 WEALTH MANAGEMENT: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 WEALTH MANAGEMENT: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 ACCOUNT MANAGEMENT: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 ACCOUNT MANAGEMENT: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 CUSTOMER MANAGEMENT: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 CUSTOMER MANAGEMENT: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 OTHER APPLICATIONS: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 OTHER APPLICATIONS: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 51 FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 52 LARGE ENTERPRISES: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 LARGE ENTERPRISES: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 SMES: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 SMES: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 57 FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 58 PUBLIC CLOUD: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 PUBLIC CLOUD: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 PRIVATE CLOUD: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 PRIVATE CLOUD: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 HYBRID CLOUD: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 HYBRID CLOUD: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 FINANCE CLOUD MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 65 FINANCE CLOUD MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 66 BANKS: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 BANKS: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 FINANCIAL SERVICE PROVIDERS: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 FINANCIAL SERVICE PROVIDERS: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 INSURANCE COMPANIES: FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 INSURANCE COMPANIES: FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 FINANCE CLOUD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 FINANCE CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: FINANCE CLOUD MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: FINANCE CLOUD MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: FINANCE CLOUD MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: FINANCE CLOUD MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: FINANCE CLOUD MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: FINANCE CLOUD MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: FINANCE CLOUD MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: FINANCE CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 US: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 85 US: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 86 US: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 87 US: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 88 CANADA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 89 CANADA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 90 CANADA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 91 CANADA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: FINANCE CLOUD MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: FINANCE CLOUD MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: FINANCE CLOUD MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 95 EUROPE: FINANCE CLOUD MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: FINANCE CLOUD MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: FINANCE CLOUD MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: FINANCE CLOUD MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: FINANCE CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 UK: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 103 UK: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 104 UK: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 105 UK: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 106 GERMANY: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 107 GERMANY: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 108 GERMANY: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 109 GERMANY: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 110 FRANCE: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 111 FRANCE: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 112 FRANCE: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 113 FRANCE: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 115 REST OF EUROPE: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 116 REST OF EUROPE: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 117 REST OF EUROPE: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: FINANCE CLOUD MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: FINANCE CLOUD MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: FINANCE CLOUD MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: FINANCE CLOUD MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: FINANCE CLOUD MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: FINANCE CLOUD MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: FINANCE CLOUD MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: FINANCE CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 128 CHINA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 129 CHINA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 130 CHINA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 131 CHINA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 132 JAPAN: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 133 JAPAN: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 134 JAPAN: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 135 JAPAN: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 136 INDIA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 137 INDIA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 138 INDIA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 139 INDIA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 160 SAUDI ARABIA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 161 SAUDI ARABIA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 162 SAUDI ARABIA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 163 SAUDI ARABIA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 164 UAE: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 165 UAE: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 166 UAE: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 167 UAE: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 168 REST OF MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: FINANCE CLOUD MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 173 LATIN AMERICA: FINANCE CLOUD MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: FINANCE CLOUD MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: FINANCE CLOUD MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 177 LATIN AMERICA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: FINANCE CLOUD MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: FINANCE CLOUD MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: FINANCE CLOUD MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 181 LATIN AMERICA: FINANCE CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 182 BRAZIL: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 183 BRAZIL: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 184 BRAZIL: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 185 BRAZIL: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 186 MEXICO: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 187 MEXICO: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 188 MEXICO: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 189 MEXICO: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 190 REST OF LATIN AMERICA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2019–2022 (USD MILLION)

- TABLE 191 REST OF LATIN AMERICA: FINANCE CLOUD MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 192 REST OF LATIN AMERICA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 193 REST OF LATIN AMERICA: FINANCE CLOUD MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 194 OVERVIEW OF STRATEGIES ADOPTED BY KEY FINANCE CLOUD VENDORS

- TABLE 195 FINANCE CLOUD MARKET: DEGREE OF COMPETITION

- TABLE 196 VENDOR PRODUCTS/BRANDS COMPARISON

- TABLE 197 GLOBAL COMPANY FOOTPRINT

- TABLE 198 FINANCE CLOUD MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 199 STARTUP/SME FOOTPRINT

- TABLE 200 PRODUCT LAUNCHES AND ENHANCEMENTS, 2021–2023

- TABLE 201 DEALS, 2021–2023

- TABLE 202 MICROSOFT: BUSINESS OVERVIEW

- TABLE 203 MICROSOFT: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 204 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 205 MICROSOFT: DEALS

- TABLE 206 GOOGLE: BUSINESS OVERVIEW

- TABLE 207 GOOGLE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 208 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 209 GOOGLE: DEALS

- TABLE 210 AWS: BUSINESS OVERVIEW

- TABLE 211 AWS: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 212 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 213 AWS: DEALS

- TABLE 214 IBM: BUSINESS OVERVIEW

- TABLE 215 IBM: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 216 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 217 IBM: DEALS

- TABLE 218 TENCENT CLOUD: BUSINESS OVERVIEW

- TABLE 219 TENCENT CLOUD: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 220 TENCENT CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 221 TENCENT CLOUD: DEALS

- TABLE 222 SALESFORCE: BUSINESS OVERVIEW

- TABLE 223 SALESFORCE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 224 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 225 SALESFORCE: DEALS

- TABLE 226 ORACLE: BUSINESS OVERVIEW

- TABLE 227 ORACLE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 228 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 229 ALIBABA CLOUD: BUSINESS OVERVIEW

- TABLE 230 ALIBABA CLOUD: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 231 ALIBABA CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 232 ALIBABA CLOUD: DEALS

- TABLE 233 WORKDAY: BUSINESS OVERVIEW

- TABLE 234 WORKDAY: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 235 WORKDAY: DEALS

- TABLE 236 SAP: BUSINESS OVERVIEW

- TABLE 237 SAP: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 238 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 239 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 240 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 241 CLOUD COMPUTING MARKET, BY IAAS, 2017–2021 (USD BILLION)

- TABLE 242 CLOUD COMPUTING MARKET, BY IAAS, 2022–2027 (USD BILLION)

- TABLE 243 CLOUD COMPUTING MARKET, BY PAAS, 2017–2021 (USD BILLION)

- TABLE 244 CLOUD COMPUTING MARKET, BY PAAS, 2022–2027 (USD BILLION)

- TABLE 245 CLOUD COMPUTING MARKET, BY SAAS, 2017–2021 (USD BILLION)

- TABLE 246 CLOUD COMPUTING MARKET, BY SAAS, 2022–2027 (USD BILLION)

- TABLE 247 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2017–2021 (USD BILLION)

- TABLE 248 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD BILLION)

- TABLE 249 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 250 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 251 CLOUD COMPUTING MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 252 CLOUD COMPUTING MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 253 CLOUD COMPUTING MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 254 CLOUD COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 255 FINANCIAL ANALYTICS MARKET, BY COMPONENT, 2016–2023 (USD MILLION)

- TABLE 256 FINANCIAL ANALYTICS MARKET, BY APPLICATION, 2016–2023 (USD MILLION)

- TABLE 257 FINANCIAL ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2016–2023 (USD MILLION)

- TABLE 258 FINANCIAL ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

- TABLE 259 FINANCIAL ANALYTICS MARKET, BY VERTICAL, 2016–2023 (USD MILLION)

- TABLE 260 FINANCIAL ANALYTICS MARKET, BY REGION, 2016–2023 (USD MILLION)

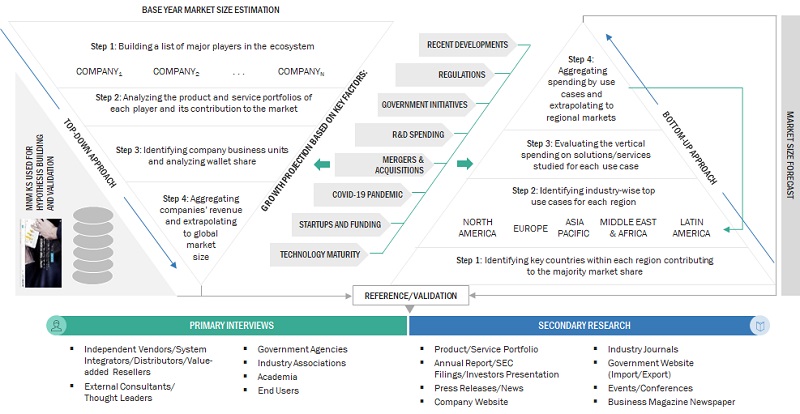

- FIGURE 1 FINANCE CLOUD MARKET: RESEARCH DESIGN

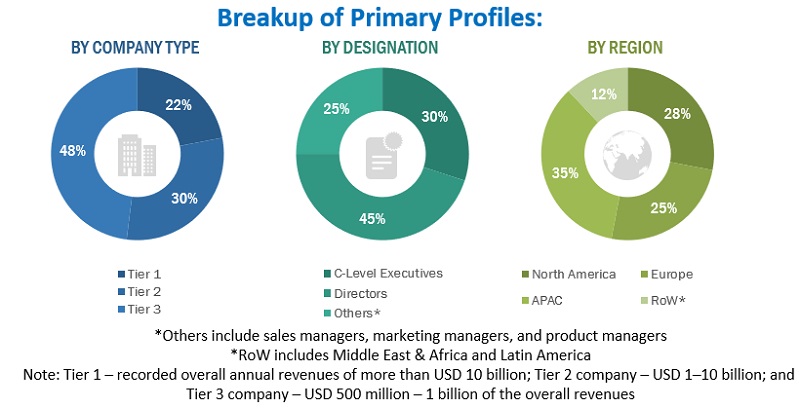

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 FINANCE CLOUD MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM FINANCE CLOUD VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF FINANCE CLOUD VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM FINANCE CLOUD OFFERINGS

- FIGURE 8 APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DIFFERENT SEGMENTS

- FIGURE 9 FINANCE CLOUD MARKET: RECESSION IMPACT

- FIGURE 10 TOP-GROWING SEGMENTS IN FINANCE CLOUD MARKET

- FIGURE 11 FOCUS ON ENHANCING ENTERPRISE CUSTOMER EXPERIENCE AND SIMPLIFYING INFORMATION TECHNOLOGY OPERATIONS WORKFLOW TO DRIVE ADOPTION OF FINANCE CLOUD

- FIGURE 12 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 PUBLIC CLOUD SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 14 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- FIGURE 15 BANKS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: FINANCE CLOUD MARKET

- FIGURE 18 ENTERPRISE SECURITY ISSUES

- FIGURE 19 FINANCE CLOUD MARKET: ECOSYSTEM

- FIGURE 20 FINANCE CLOUD MARKET: VALUE CHAIN

- FIGURE 21 BUSINESS MODEL: FINANCE CLOUD MARKET

- FIGURE 22 NUMBER OF PATENTS PUBLISHED, 2012–2023

- FIGURE 23 TOP FIVE PATENT OWNERS (GLOBAL)

- FIGURE 24 FINANCE CLOUD MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 MAJOR YCC TRENDS TO DRIVE FUTURE REVENUE PROSPECTS IN FINANCE CLOUD MARKET

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP END USERS

- FIGURE 28 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 SECURITY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 CUSTOMER MANAGEMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 SMES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 HYBRID CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 INSURANCE COMPANIES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 38 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018–2022 (USD MILLION)

- FIGURE 39 TRADING COMPARABLES, 2023 (EV/EBITDA)

- FIGURE 40 FINANCE CLOUD MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- FIGURE 41 FINANCE CLOUD MARKET SHARE ANALYSIS, 2022

- FIGURE 42 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 43 FINANCE CLOUD MARKET: COMPANY EVALUATION MATRIX, 2022 (KEY PLAYERS)

- FIGURE 44 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 45 FINANCE CLOUD MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 46 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 47 GOOGLE: COMPANY SNAPSHOT

- FIGURE 48 AWS: COMPANY SNAPSHOT

- FIGURE 49 IBM: COMPANY SNAPSHOT

- FIGURE 50 TENCENT CLOUD: COMPANY SNAPSHOT

- FIGURE 51 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 52 ORACLE: COMPANY SNAPSHOT

- FIGURE 53 ALIBABA CLOUD: COMPANY SNAPSHOT

- FIGURE 54 WORKDAY: COMPANY SNAPSHOT

- FIGURE 55 SAP: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size of the Finance Cloud market. We performed extensive secondary research to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, we used the market breakup and data triangulation procedures to estimate the market size of the various segments in the Finance Cloud market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. We referred to sources for identifying and collecting valuable information for this technical, market-oriented, and commercial study of the Finance Cloud market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Executive Officers (CEOs), Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Vice Presidents (VPs), and Chief Security Officers (CSOs); the installation teams of governments/end users using asset performance management; and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of services, which would affect the overall Finance Cloud market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the Finance Cloud market and other dependent submarkets. The bottom-up procedure helped arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The bottom-up approach identified the adoption trend of Finance Cloud among industry verticals in critical countries that contribute the most to the market. The adoption trend of asset performance management and varying cases of use concerning their business segments were identified and extrapolated for cross-validation. We gave weightage to the use cases identified in different solution areas for the calculation. We prepared an exhaustive list of all vendors offering Finance Cloud in the market. We estimated the revenue contribution of all vendors in the market through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. We evaluated each vendor based on its service offerings across verticals. We extrapolated the aggregate of all companies’ revenue to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration. We determined the region split through primary and secondary sources based on these numbers.

The top-down approach prepared an exhaustive list of all vendors in the Finance Cloud market. We estimated the revenue contribution of all vendors in the market through their annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. We estimated the market size from revenues generated by vendors from different Finance Cloud offerings. We identified other vendors and revenue generated from each service type with the help of secondary and primary sources and combined them to determine the market size. Further, the procedure included an analysis of the Finance Cloud market’s regional penetration. With the data triangulation procedure and data validation through primaries, the exact values of the overall Finance Cloud market size and its segments’ market size were determined and confirmed using the study. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs, CTOs, CIOs, VPs, directors, and marketing executives. We further triangulated market numbers with the existing MarketsandMarkets repository for validation.

Finance Cloud Market: Top-Down and Bottom-Up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from the Finance Cloud market’s demand and supply sides.

Market Definition

Considering the sources and associations’ views on Finance Cloud, MarketsandMarkets defines Finance Cloud as “the segment of the cloud computing industry that specifically caters to the financial services sector. It involves providing cloud-based technology solutions and services tailored to meet financial institutions’ unique needs and requirements, including banks, insurance companies, investment firms, and other financial service providers. Finance cloud encompasses a range of cloud-based offerings designed to enhance financial operations’ efficiency, security, and agility.”

Key Stakeholders

- Technology service providers

- Cloud service providers (CSPs)

- Managed service providers (MSPs)

- Banking and financial firms

- Integrated software vendors (ISVs)

- Platform providers

- Consultancy firms/Advisory firms

- Training and education service providers

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the global Finance Cloud market based on offering (solutions and services), deployment model (public, private, and hybrid Cloud), organization size (large enterprises and SMEs), end user (banks, financial service providers, and insurance companies), and region.

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro-markets concerning growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents & innovations, and pricing data related to the Finance Cloud market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, new product launches, product enhancements, and partnerships & collaborations in the market.

Note 1. Micromarkets are defined as the further segments and subsegments of the market included in the report.

Note 2. The companies’ Core competencies are captured in terms of their key developments and essential strategies to sustain their position in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Finance Cloud Market

Interested in cloud adoption of finance, Internet, manufacturing industry in US market