Food Packaging Technology and Equipment Market by Technology (Controlled, Active, Intelligent, Aseptic, and Biodegradable), Material (Metal, Glass & Wood, Paper & Paperboard, and Plastics), Equipment, Application, and Region - Global Forecast to 2023

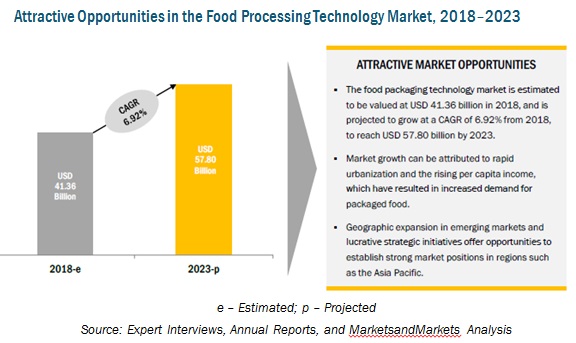

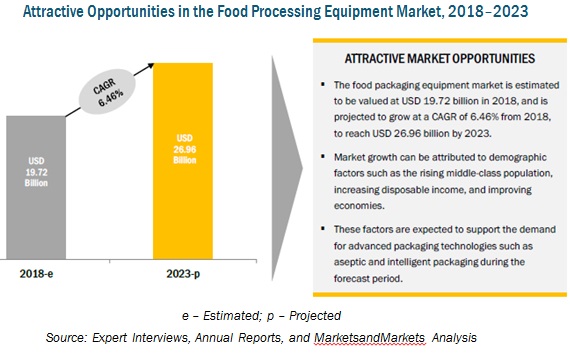

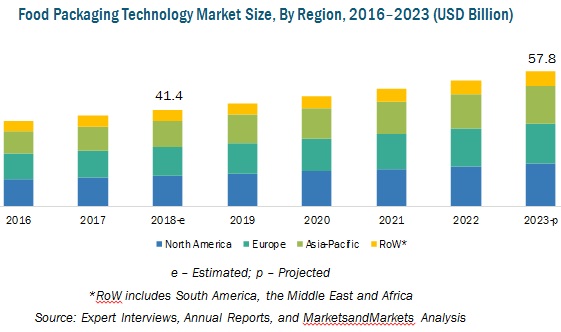

[169 Pages Report] The food packaging technology market was valued at USD 38.77 billion in 2017 and is projected to grow at a CAGR of 6.9% from 2018, to reach USD 57.80 billion by 2023. Furthermore, the global food packaging equipment market was valued at USD 18.56 billion in 2017 and is projected to grow at a CAGR of 6.5% from 2018, to reach USD 26.96 billion by 2023. The base year considered for the study is 2017, while the forecast period spans from 2018 to 2023.

The biodegradable technology type segment is projected to grow at the highest CAGR during the forecast period.

Based on type, the biodegradable segment is projected to grow at the highest CAGR during the forecast period in food packaging technology market. The demand for biodegradable packaging technology is expected to grow rapidly as the extensive use of plastic as a packaging material has led to increased environmental concerns as it is not easily decomposable. Various governments have laid down stringent regulations regarding the use of plastic and other non-decomposable packaging materials.

The plastics segment, by material, is estimated to account for the largest share of the food packaging technology market in 2017.

The plastics material segment is estimated to account for the largest share of the global food packaging technology market in 2017. Plastic packaging consists of a wide range of synthetic and semi-synthetic materials, the use of which varies with the food products being packaged. Due to their low cost, versatility, and easy availability, plastics are used in a variety of applications. Properties such as durability, safety, hygiene, and light weight have made plastic packaging popular.

Asia Pacific is projected to grow at the fastest rate in the food packaging technology and equipment market during the forecast period.

The Asia Pacific region witnessed the fastest growth in the food packaging technology and equipment market; one of the key factors being the rapid economic growth and rise in urbanization. IMF World Economic Outlook estimated that the two economic giants of the Asia Pacific region—China and Japan— were the world’s second- and third-largest economies in 2017, respectively. Other drivers that would have a positive impact on this market are the rising household incomes and the growing middle-class population which is expected to increase the demand for packaged and convenience food products in the region.

Market Dynamics

Shift toward convenient food packaging

On-the-go lifestyles have emerged as a result of several factors. Longer working hours & commuting time and the growing number of smaller households contribute to the increased demand for convenient single serving or packaged food products. This is expected to drive the demand for the food packaging technology & equipment market as this trend has resulted in food manufacturers innovating and providing convenience food products to their customers.

Convenient packaging features such as easy opening, portability, resealable, micro-perforation, lightweight, and easy handling are increasingly gaining popularity and are driving the demand for food packaging technology & equipment for a wide range of products such as snacks, meat & poultry products, candy bars, chocolates, sauces, processed fruits & vegetables, and dairy products. This has encouraged food packaging technology & equipment manufacturers in investing in research & development activities and develop technologies to cater to the increased demand for convenient food packaging. They also emphasize on developing easy-to-handle mechanisms for food packaging for convenient usage.

Stringent environmental regulations

Packaging waste harms the ecosystem as it takes decades to decompose. Governments of several countries are addressing this issue by imposing strict laws that the food packaging industry must adhere to. For instance, governments in Europe take various steps to deal with packaging waste and recycling issues. For instance, the Packaging and Packaging Waste Directive 94/62/ EC (a.27) was introduced in the European Union with the aim to reduce or minimize the environmental impact of packaging and packaging wastes. This also restricts the use of recycled materials for food packaging as they might release toxic substances in food products. Furthermore, developing nations are also following their example by imposing strict regulations for food packaging and by promoting sustainable or biodegradable packaging solutions. This affects the overall food packaging market revenues as the profits decrease, which, in turn, would act as a restraint to the growth of the food packaging technology & equipment market.

Emergence of packaging as a tool for product differentiation

Packaging has played a critical role as a differentiator in promoting brands, especially for packaged food products. With the increase in urbanization and emergence of supermarkets and hypermarkets, differentiating food products through the aesthetic appeal of packaging has become important for food manufacturers. Furthermore, consumers are increasingly paying more attention to the ingredients and contents of the package. This provides an opportunity for the food packaging technology & equipment manufacturers as food manufacturers need to differentiate their products by conveying the benefits of packaging technology on the labels and packets, such as shelf life, the time required for preparing the food, and nutritional contents to the consumers.

Increased occurrence of counterfeit packaging

With increasingly easy access to food packaging materials and manufacturing processes, a large number of illicit packaging manufacturers have emerged in the field who supply counterfeit products. The growth of the food packaging technology & equipment market is affected by the growth of counterfeit food packaging. These counterfeit products harm the companies in terms of loss of revenue and also hamper their brand image. Thus, the packaging industry is adversely affected by counterfeit packaging.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Type, Material, Application, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Robert Bosch (Germany), GEA Group (Germany), IMA Group (Italy), COESIA Group (Italy), Ishida (Japan), ARPAC (US), Multivac (Germany), Omori Machinery Company (Japan), Nichrome India (India), Adelphi Group (UK), Kaufman Engineered Systems (US), and Lindquist Machine Corporation (US). |

This research report categorizes the food packaging technology market based on type, material, application, and region

On the basis of type, the food packaging technology market has been segmented as follows:

- Controlled

- Active

- Intelligent

- Aseptic

- Biodegradable

- Others (edible and nano-enabled technology)

On the basis of material, the food packaging technology market has been segmented as follows:

- Metal

- Glass & wood

- Paper & paperboard

- Plastics

- Others (polysaccharides, proteins, and lipids)

On the basis of application, the food packaging technology market has been segmented as follows:

- Dairy & dairy products

- Bakery products

- Confectionery products

- Poultry, seafood, and meat products

- Convenience foods

- Fruits & vegetables

- Others (sauces & dressings and condiments)

On the basis of region, the food packaging technology market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South America and the Middle East & Africa)

This research report categorizes the food packaging equipment market based on type, application, and region.

On the basis of type, the food packaging equipment market has been segmented as follows:

- Form-fill-seal

- Filling & dosing

- Cartoning

- Case packing

- Wrapping & bundling

- Labeling & coding

- Inspecting, detecting, and check weighing machines

- Others (palletizing, cleaning, and capping & sealing machines)

On the basis of application, the food packaging equipment market has been segmented as follows:

- Dairy & dairy products

- Bakery products

- Confectionery products

- Poultry, seafood, and meat products

- Convenience foods

- Fruits & vegetables

- Others (sauces & dressings and condiments)

On the basis of region, the food packaging equipment market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South America and the Middle East & Africa)

Recent developments

| Date |

Company |

Description |

|

Sep 2017 |

IMA Group |

IMA announced the merger of its fully owned subsidiary at Zola Predosa (Bologna), which is a specialist in designing and producing automatic machines for food packaging. It can be used for the packaging of confectionery, capping of coffee, and in assembly solutions. |

|

Aug 2017 |

MULTIVAC |

MULTIVAC Marking & Inspection expanded its production capacity with an investment of USD 2.7 million. This expansion will help the company to meet the continuous increase in the demand for packaging machines from the food industry. |

|

May 2017 |

MULTIVAC |

MULTIVAC Sepp Haggenmüller SE & Co. KG (Germany), Cabinplant A/S (Denmark), and Meyn Food Processing Technology (Netherlands) entered into a strategic alliance with a motive to offer a better experience to its customers by providing complete solutions ranging from processing, filling, and inspection to packaging. |

|

Sep 2015 |

Robert Bosch |

Bosch acquired Kliklok-Woodman (US). The acquisition will help Bosch to strengthen its product portfolio in the mid-range secondary packaging. |

|

Sep 2015 |

Robert Bosch |

Bosch Packaging Technology acquired Osgood Industries (US), a filling and packaging machine expert. This acquisition will help the company to strengthen its position in the liquid food industry and expand its product portfolio. |

|

Jun 2015 |

Robert Bosch |

Bosch Packaging Technology and Klenzaids Contamination Controls (India) entered into a joint venture. This will help the company to expand its geographical operations. |

|

Mar 2014 |

GEA Group |

The company plans to develop a new technology center and a production facility for vertical packaging and confectionery equipment at Weert, Netherlands with an investment of around USD 2.7 million. |

|

Mar 2014 |

MULTIVAC |

MULTIVAC and KREHALON (Japan) entered into a joint agreement for the distribution of FormShrink thermoforming films. The agreement includes various markets in Europe, Middle East, Americas, Africa, and Asia. |

|

Feb 2013 |

Robert Bosch |

Bosch opened a new facility in Egypt. The new facility is expected to serve to the African and the Middle Eastern markets. The new sales facility is expected to support areas in the growing packaging market. |

|

Jan 2013 |

Nichrome |

The company inaugurated its new R&D center and office building in Pune. The facility spans over 12,000 sq. ft. and can accommodation 150 people. |

Key Questions Answered

- Who are the major market players in the food packaging technology and equipment market?

- What are the regional growth trends and the largest revenue-generating regions for the food packaging technology and equipment market?

- Which are the major regions for different industries that are projected to witness a significant growth for the food packaging technology and equipment market?

- What are the major types of food packaging technology and equipment that are projected to gain maximum market revenue and share during the forecast period?

- Which is the major type of applications where food packaging technology and equipment are used that will be accounting for the majority of the revenue over the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives Of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regions Covered

1.3.3 Periodization

1.4 Currency

1.5 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Market Share Estimation

2.2.1 Secondary Data

2.2.2 Primary Data

2.2.2.1 Key Industry Insights

2.2.2.2 Breakdown Of Primaries

2.3 Market Size Estimation

2.3.1 Food Packaging Technology Market

2.3.2 Food Packaging Equipment Market

2.4 Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in the Food Processing Technology Market

4.2 Attractive Opportunities in the Food Processing Equipment Market

4.3 Food Packaging Technology Market Size, By Application, 2018–2023

4.4 Food Processing Technology Market Size, By Material, 2017

4.5 Food Packaging Technology & Equipment Market, By Type

5 Market Overview

5.1 Introduction

5.2 Evolution

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Demand for Hygienic Food Packaging

5.3.1.2 Shift Toward Convenient Food Packaging

5.3.1.3 Increase in Demand for Fresh and High-Quality Food Products

5.3.2 Restraints

5.3.2.1 High Cost of Development

5.3.2.2 Stringent Environmental Regulations

5.3.3 Opportunities

5.3.3.1 Increase in Demand From Developing Countries Such as China and India

5.3.3.2 Emergence of Packaging as a Tool for Product Differentiation

5.3.4 Challenges

5.3.4.1 Increased Occurrences of Counterfeit Packaging

5.3.4.2 Ensuring the Correct Mixture of Gases in Controlled Environment Packaging

6 Industry Trends

6.1 Introduction

6.2 Food Packaging Technology & Equipment Market: Supply Chain Analysis

6.2.1 Key Influencers

6.3 Pest Analysis

6.3.1 Political Factors

6.3.2 Economic Factors

6.3.3 Social Factors

6.3.4 Technological Factors

7 Food Packaging Technology Market, By Type

7.1 Introduction

7.2 Controlled Packaging

Table 3 Controlled Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

7.3 Active Packaging

Table 4 Active Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

7.4 Aseptic Packaging

Table 5 Aseptic Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

7.5 Intelligent Packaging

Table 6 Intelligent Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

7.6 Biodegradable Packaging

Table 7 Biodegradable Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

7.7 Other Types

8 Food Packaging Technology Market, By Material

8.1 Introduction

8.2 Metal

Table 10 Metal in Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

8.3 Glass & Wood

Table 11 Glass & Wood in Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

8.4 Paper & Paperboard

Table 12 Paper & Paperboard in Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

8.5 Plastics

Table 13 Plastics in Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

8.6 Other Materials

9 Food Packaging Equipment Market, By Type

9.1 Introduction

9.2 Form-Fill-Seal

Table 16 Form-Fill-Seal Equipment Market Size, By Region, 2016–2023 (USD Million)

9.3 Filling & Dosing

Table 17 Filling & Dosing Equipment Market Size, By Region, 2016–2023 (USD Million)

9.4 Cartoning

Table 18 Cartoning Equipment Market Size, By Region, 2016–2023 (USD Million)

9.5 Case Packing

Table 19 Case Packing Equipment Market Size, By Region, 2016–2023 (USD Million)

9.6 Wrapping & Bundling

Table 20 Wrapping & Bundling Equipment Market Size, By Region, 2016–2023 (USD Million)

9.7 Labeling & Coding

Table 21 Labeling & Coding Equipment Market Size, By Region, 2016–2023 (USD Million)

9.8 Inspecting, Detecting, and Check Weighing Machines

Table 22 Inspecting, Detecting, and Check Weighing Equipment Market Size, By Region, 2016–2023 (USD Million)

9.9 Other Equipment

10 Food Packaging Technology & Equipment Market, By Application

10.1 Introduction

10.2 Convenience Foods

Table 26 Convenience Foods: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 27 Convenience Foods: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

10.3 Poultry, Seafood, and Meat Products

Table 28 Poultry, Seafood, and Meat Products: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 29 Poultry, Seafood, and Meat Products: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

10.4 Bakery Products

Table 30 Bakery Products: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 31 Bakery Products: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

10.5 Confectionery Products

Table 32 Confectionery Products: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 33 Confectionery Products: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

10.6 Dairy & Dairy Products

Table 34 Dairy Products: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 35 Dairy Products: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

10.7 Fruits & Vegetables

Table 36 Fruits & Vegetables: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 37 Fruits & Vegetables: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

10.8 Others

11 Food Packaging Technology & Equipment Market, By Region

11.1 Introduction

11.2 North America

11.2.1 US

Table 49 US: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 50 US: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 51 US: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.2.2 Canada

Table 52 Canada: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 53 Canada: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 54 Canada: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.2.3 Mexico

Table 55 Mexico: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 56 Mexico: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 57 Mexico: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.3 Europe

11.3.1 Germany

Table 65 Germany: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 66 Germany: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 67 Germany: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.3.2 France

Table 68 France: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 69 France: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 70 France: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.3.3 UK

Table 71 UK: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 72UK: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 73 UK: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.3.4 Spain

Table 74 Spain: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 75 Spain: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 76 Spain: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.3.5 Italy

Table 77 Italy: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 78 Italy: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 79 Italy: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.3.6 Rest of Europe

11.4 Asia Pacific

11.4.1 China

Table 90 China: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 91 China: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 92 China: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.4.2 Japan

Table 93 Japan: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 94 Japan: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 95 Japan: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.4.3 India

Table 96 India: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 97 India: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 98 India: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.4.4 Rest of Asia Pacific

11.5 Rest of the World (Row)

11.5.1 South America

Table 109 South America: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 110 South America: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 111 South America: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

11.5.2 Middle East & Africa

Table 112 Middle East & Africa: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 113 Middle East & Africa: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 114 Middle East & Africa: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

12 Competitive Landscape

12.1 Overview

12.2 Competitive Situation & Trends

12.3 Market Ranking, By Key Player

12.3.1 New Product Launches and Product Enhancements

12.3.2 Expansions

12.3.3 Mergers & Acquisitions

12.3.4 Agreements/Joint Ventures/Strategic Alliances

13 Company Profiles

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Robert Bosch

13.2 GEA Group

13.3 IMA Group

13.4 COESIA Group

13.5 Ishida

13.6 ARPAC

13.7 Multivac

13.8 Omori Machinery

13.9 Nichrome India

13.10 Adelphi Packaging

13.11 Kaufman Engineered Systems

13.12 Lindquist Machine Corporation

*Details On Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured In Case of Unlisted Companies.

14 Appendix

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (119 Tables)

Table 1 US Dollar Exchange Rate, 2014–2017

Table 2 Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 3 Controlled Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 4 Active Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 5 Aseptic Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 6 Intelligent Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 7 Biodegradable Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 8 Other Types Market Size, By Region, 2016–2023 (USD Million)

Table 9 Food Packaging Technology Market Size, By Material, 2016–2023 (USD Million)

Table 10 Metal in Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 11 Glass & Wood in Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 12 Paper & Paperboard in Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 13 Plastics in Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 14 Other Materials in Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 15 Food Packaging Equipment Market Size, By Type, 2016–2023 (USD Million)

Table 16 Form-Fill-Seal Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 17 Filling & Dosing Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 18 Cartoning Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 19 Case Packing Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 20 Wrapping & Bundling Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 21 Labeling & Coding Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 22 Inspecting, Detecting, and Check Weighing Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 23 Other Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 24 Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 25food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 26 Convenience Foods: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 27 Convenience Foods: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 28 Poultry, Seafood, and Meat Products: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 29 Poultry, Seafood, and Meat Products: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 30 Bakery Products: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 31 Bakery Products: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 32 Confectionery Products: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 33 Confectionery Products: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 34 Dairy Products: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 35 Dairy Products: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 36 Fruits & Vegetables: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 37 Fruits & Vegetables: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 38 Other Applications: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 39 Other Applications: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 40 Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 41 Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 42 North America: Food Packaging Technology Market Size, By Country, 2016–2023 (USD Million)

Table 43 North America: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 44 North America: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 45 North America: Food Packaging Technology Market Size, By Material, 2016–2023 (USD Million)

Table 46 North America: Food Packaging Equipment Market Size, By Country, 2016–2023 (USD Million)

Table 47 North America: Food Packaging Equipment Market Size, By Type, 2016–2023 (USD Million)

Table 48 North America: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 49 US: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 50 US: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 51 US: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 52 Canada: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 53 Canada: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 54 Canada: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 55 Mexico: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 56 Mexico: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 57 Mexico: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 58 Europe: Food Packaging Technology Market Size, By Country, 2016–2023 (USD Million)

Table 59 Europe: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 60 Europe: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 61 Europe: Food Packaging Technology Market Size, By Material, 2016–2023 (USD Million)

Table 62 Europe: Food Packaging Equipment Market Size, By Country, 2016–2023 (USD Million)

Table 63 Europe: Food Packaging Equipment Market Size, By Type, 2016–2023 (USD Million)

Table 64 Europe: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 65 Germany: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 66 Germany: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 67 Germany: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 68 France: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 69 France: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 70 France: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 71 UK: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 72 UK: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 73 UK: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 74 Spain: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 75 Spain: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 76 Spain: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 77 Italy: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 78 Italy: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 79 Italy: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 80 Rest of Europe: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 81 Rest of Europe: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 82 Rest of Europe: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 83 Asia Pacific: Food Packaging Technology Market Size, By Country, 2016–2023 (USD Million)

Table 84 Asia Pacific: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 85 Asia Pacific: Food Packaging Technology Market Size, By Application, 2016– 2023 (USD Million)

Table 86 Asia Pacific: Food Packaging Technology Market Size, By Material, 2016–2023 (USD Million)

Table 87 Asia Pacific: Food Packaging Equipment Market Size, By Country, 2016–2023 (USD Million)

Table 88 Asia Pacific: Food Packaging Equipment Market Size, By Type, 2016–2023 (USD Million)

Table 89 Asia Pacific: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 90 China: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 91 China: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 92 China: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 93 Japan: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 94 Japan: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 95 Japan: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 96 India: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 97 India: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 98 India: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 99 Rest of Asia Pacific: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 100 Rest of Asia Pacific: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 101 Rest of Asia Pacific: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 102 RoW: Food Packaging Technology Market Size, By Region, 2016–2023 (USD Million)

Table 103 RoW: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 104 RoW: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 105 RoW: Food Packaging Technology Market Size, By Material, 2016–2023 (USD Million)

Table 106 RoW: Food Packaging Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 107 RoW: Food Packaging Equipment Market Size, By Type, 2016–2023 (USD Million)

Table 108 RoW: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 109 South America: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 110 South America: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 111 South America: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 112 Middle East & Africa: Food Packaging Technology Market Size, By Type, 2016–2023 (USD Million)

Table 113 Middle East & Africa: Food Packaging Technology Market Size, By Application, 2016–2023 (USD Million)

Table 114 Middle East & Africa: Food Packaging Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 115 Market Ranking, 2016

Table 116 New Product Launches/Product Enhancements, 2013–December 2017

Table 117 Expansions, 2013–December 2017

Table 118 Mergers & Acquisitions, 2013–December 2017

Table 119 Agreements/Joint Ventures/Strategic Alliances, 2013–December 2017

List of Figures (40 Figures)

Figure 1 Food Packaging Technology & Equipment Market Segmentation

Figure 2 Food Packaging Technology & Equipment Market, By Region

Figure 3 Food Packaging Technology & Equipment Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Size Estimation: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Market Breakdown & Data Triangulation

Figure 10 Food Packaging Technology Market Size, By Region, 2017

Figure 11 Food Packaging Equipment Market Size, By Region, 2017

Figure 12 Food Packaging Equipment Market, By Application, 2018 vs. 2023

Figure 13 Food Packaging Equipment Market, By Type, 2018 vs. 2023

Figure 14 Food Packaging Technology Market, By Type, 2018 vs. 2023

Figure 15 Increasing Demand for Convenience Food to Drive the Food Processing Technology Market Growth

Figure 16 Increase in Demand for Hygienic Food Packaging to Drive the Food Processing Equipment Market

Figure 17 Convenience Food Is Estimated to Account for the Largest Share in the Food Packaging Technology Market in 2018

Figure 18 Plastics to Account for the Largest Share of the Food Packaging Technology Market in 2018

Figure 19 Form-Fill-Seal and Controlled Packaging to Dominate in 2017

Figure 20 Evolution of the Food Packaging Technology Industry

Figure 21 Food Packaging Technology & Equipment Market: Drivers, Restraints, Opportunities, and Challenges

Figure 22 Food Packaging Technology & Equipment Market: Supply Chain Analysis

Figure 23 Food Packaging Technology Market, By Type, 2018 vs. 2023 (USD Million)

Figure 24 Food Packaging Technology Market Size, By Material, 2018 vs. 2023 (USD Million)

Figure 25 Food Packaging Equipment Market, By Type, 2018 vs. 2023 (USD Million)

Figure 26 Food Packaging Technology Market, By Application, 2018 vs. 2023

Figure 27 Food Packaging Equipment Market, By Application, 2018 vs. 2023

Figure 28 Geographic Snapshot (2018–2023): Food Packaging Technology Market

Figure 29 Geographic Snapshot (2018–2023): Food Packaging Equipment Market

Figure 30 US Dominated the Market for Food Packaging Equipment in North America in 2017

Figure 31 Companies Adopted New Product Launches and Product Enhancements as the Key Growth Strategy During 2013–2017

Figure 32 New Product Launches and Product Enhancements Were the Key Growth Strategies (2015–2017)

Figure 33 Robert Bosch: Company Snapshot

Figure 34 Robert Bosch: Swot Analysis

Figure 35 GEA Group: Company Snapshot

Figure 36 GEA Group: Swot Analysis

Figure 37 IMA Group: Company Snapshot

Figure 38 IMA Group: Swot Analysis

Figure 39 COESIA Group: Swot Analysis

Figure 40 Ishida: Swot Analysis

Growth opportunities and latent adjacency in Food Packaging Technology and Equipment Market

Good Article. The significance of packaging technology in the food industry has been covered very well in this report.