Food Preservatives Market by Function (Antimicrobials, Antioxidants), Type (Synthetic Preservatives and Natural Preservatives), Application, and Region ( North America, Europe, Asia-Pacific, Middle-East Africa) - Global Forecast to 2028

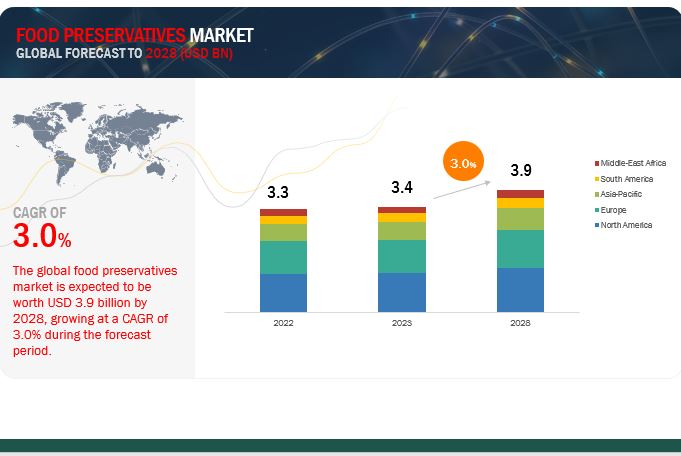

The food preservatives market, valued at US$ 3.3 billion in 2022, is set to expand from US$ 3.4 billion in 2023 to US$ 3.9 billion by 2028, driven by a steady CAGR of 3.0% during the forecast period.

Food preservatives are compounds that are added to food products to help them last longer and prevent deterioration. They aid in the inhibition of bacteria, fungus, yeasts, and other microorganisms that can cause foodborne sickness or degradation. Preservatives are widely utilised in processed and packaged foods, as well as some homemade and professionally produced goods. The food preservatives industry is bound to rise with high demand for processed food, the rise in meat consumption, and rising demand for products with an extended shelf life. New innovations are taking place in the natural preservatives segment owing to the rise in demand for clean-labeled ingredients in the European and North American market. This is also fueling the overall growth of the industry.

The latest version of the food preservatives market report provides valuable insights and data to help industry players and stakeholders make informed decisions and stay ahead of the competition. In addition, the report provides valuable insights into the market through detailed case studies, trade data, technology analyses, and updated regulations, among other key factors. The report also includes updated financials, recent developments, and product offerings of different players operating in the market, providing a clear picture of the competitive landscape.

Furthermore, the report includes an analysis of the impact of the COVID-19 pandemic on the market, taking into account the latest assumptions and data related to the pandemic. The report also provides recession impact analysis as part of regional chapters, offering a comprehensive view of the market in the current economic climate.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Preservatives Market Dynamics

Market Drivers: Growing demand for food products with an extended shelf life

With the rise in urbanization and employment globally, consumer lifestyles and eating habits have changed drastically. Consumers are thus looking for food products that are easy to prepare, consume, and have a longer shelf life. Food preservatives play a huge role in extending the shelf-life of food apart from keeping it fresh. Thus, with the rise in demand for food with longer shelf-life, the demand for food preservatives has increased in the food and beverage industry. This is because preservatives offers food manufacturers advantages in terms of storage efficacy and competitive pricing. Moreover, post COVID-19 pandemic, health consciousness has rose, which is also positively stimulating the growth of natural preservatives such as citric acid and rosemary extracts, thereby driving the overall market.

Restraints: Growing demand for organic food

Organic sales have grown exponentially over the decade, especially in North American and European countries owing to the influx of knowledge regarding good diet. The USDA (United States Department of Agriculture) prohibits organic foods from containing artificial preservatives, colors, and flavors. Organic food products are also consumed fresh by the consumers which limits the necessity of storing the food over longer period, hence no use of preservatives. Though the overall demand for organic foods is smaller than for non-organic food, the significant rise in the demand for organic food is capable to restrain the growth of food preservatives market.

Opportunities: Clean-label trend across global food markets

Recent surveys and research show a growing inclination of consumers towards reading product labels, and preferring clean food ingredients. This is because consumers these days are constantly looking to incorporate natural, fresh, wholesome, and balanced nutrition. Manufacturers in the food preservatives industry are thus focused to find out clean-labelled solutions and breakthroughs in the market. As a result, innovation around natural preservatives is spiking across the industry. Growing trend toward clean-label products is expected to create lucrative growth opportunities for market players to focus on the development of new formulations and new developments in the food & beverage industry.

Challenges: High price and limited availability of natural preservatives

There is limited availability of natural sources; natural preservatives such as nisin and natamycin are at least ten times heavier priced than chemical preservatives. Many natural preservatives are yet to be manufactured on a larger scale. The commercialization of manufacturing processes of natural preservatives is in a nascent stage. Good and reliable sources of high-quality natural preservatives are still being studied, and tests are conducted to check for efficacy. Therefore, until these challenges related to natural preservatives are acknowledged and resolved, the full growth potential of the food preservatives market is expected to be challenging to a certain extent.

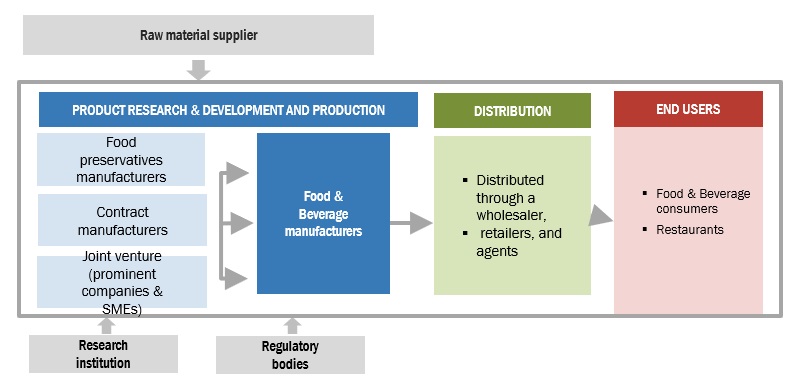

Food Preservatives Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of food preservatives. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market are Cargill, Incorporated (US), Kerry Group plc. (Ireland), DSM (Netherlands), Kemin Industries Inc. (US), and ADM (US).

To know about the assumptions considered for the study, download the pdf brochure

Synthetic preservatives by type are estimated to account for the largest market share of the food preservatives market

Based by type, synthetic preservatives are estimated to account for the largest market share. Factors responsible for the wide-scale popularity of synthetic preservatives in the food preservatives market include their large-scale commercialization, easy availability, proven efficacy and cost-effectiveness. Less R&D investment, and low regulatory norms in the emerging Asia-Pacific economies is also contributing significantly in the large market share of synthetic preservatives.

By function, antimicrobials are anticipated to dominate the market during the forecast period

Based on function, the market is segmented into antimicrobials, antioxidants, and other functions. Antimicrobials are anticipated to dominate the market during the forecast period. There is a rise in demand for frozen food products. Packaged foods when kept over a period of time are highly prone to microbial spoilage owing to temperature, moisture, and pH changes. Usage of antimicrobials such as nitrites, nitrates, and sulfur dioxide prevents degradation of food. This is facilitating the dominance of antimicrobials in the food preservatives market.

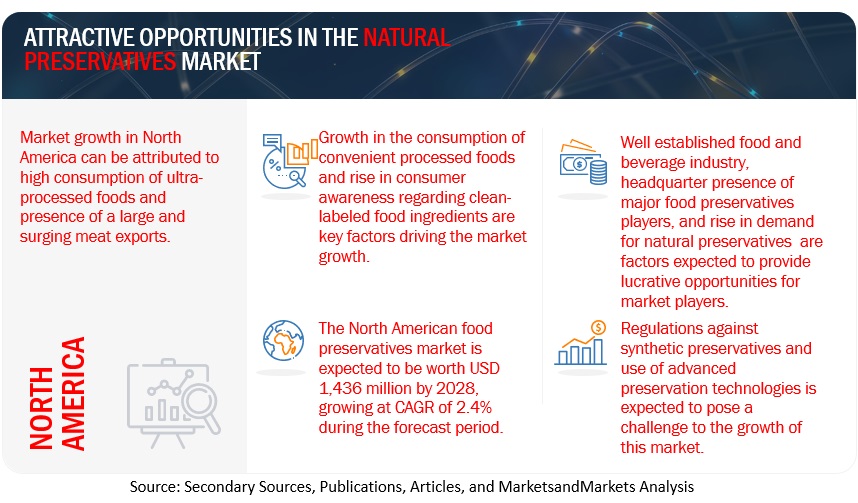

North America is projected to be the largest region in the food preservatives market, in 2022; it is anticipated to grow at a significant CAGR

North America has always been an attractive and huge market for processed food industries due to large consumption of packaged and ready-to-eat foods. It is also among the biggest exporters of meat and meat products. These food products need incorporation of food preservatives which are responsible for their longer shelf-life. As a result with high demand for meat exports and processed food, the demand for food preservatives in the region is high. Moreover, North America has a well established food & beverage industry with the presence of leading players such as PepsiCo (US), McCain Foods Limited(Canada), Tyson Foods (US), among others.

To cater these players, there is also a well-established market ecosystem for food preservatives. As a result, most of the leading players in the food preservatives industry such as Cargill, Incorporated (US), Kemin Industries Inc. (US), ADM (US), and International Flavors & Fragrances Inc. (US) are headquartered in the region, further enhancing the dominating position of North America in the food preservatives market.

Key Market Players

The key players in this market include Cargill, Incorporated (US), Kerry Group plc (Ireland), ADM (US), DSM (Netherlands), and, Kemin Industries Inc. (US).

Food Preservatives Market Report Scope

|

Report Metric |

Details |

|

Market valuation in 2023 |

USD 3.4 billion |

|

Revenue prediction in 2028 |

USD 3.9 billion |

|

Progress rate |

CAGR of 3.0% from 2023-2028 |

|

Market size available for years |

2019-2028 |

|

Base year for estimation |

2022 |

|

Forecast period |

2023-2028 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Application, Region, Type |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Prominent firms featured |

Cargill, Incorporated (US), Kerry Group plc. (Ireland), DSM (Netherlands), Kemin Industries Inc. (US), and ADM (US) |

|

Essential drivers of market prosperity |

|

Food Preservatives Market Report Segmentation

|

By Function |

By Type |

By Application |

By Region |

|

|

|

|

Food Preservatives Market Recent Developments

- In March 2022, Kerry Group plc (Ireland) expanded its food manufacturing facilities with the newly upgraded facility in Rome, Georgia. A total of USD 141 million has been invested in creating the largest food manufacturing facility in the US. This facility aims to provide integrated taste and nutrition solutions to meet the growing consumer demand in the poultry, seafood, and alternative protein markets across the US and Canada.

- In April 2021, Jungbunzlauer Suisse AG (Switzerland) expanded its citric plant in Port Colborne, Canada, owing to the consistently strong and growing global demand for citric acid and citrates. These products are functional and bio-based ingredients in food, beverages, detergents, and industrial applications. This expansion will help the company improve its portfolio for customers looking for safe and biodegradable products from sustainable production plants.

- In January 2021, Corbion increased its capacity for producing lactic acid in North America by around 40% to meet the growing demand for natural ingredients in multiple industries. The investment will reinforce the company’s leadership position as a supplier of lactic acid and its derivatives worldwide.

Frequently Asked Questions (FAQ):

How big is the food preservatives market?

The global market for food preservatives is expected to increase at a compound annual growth rate of 3.0%, reaching $3.4 billion in 2023 and $3.9 billion by the end of 2028.

Which players are involved in the manufacturing of food preservatives market?

The key players in this market include Cargill, Incorporated (US), Kerry Group plc. (Ireland), DSM (Netherlands), Kemin Industries Inc. (US), and ADM (US).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for food preservatives market?

On request, We will provide details on market size, key players, and growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of food preservatives market?

The future growth potential of the food preservatives market is promising, driven by various factors shaping consumer preferences and industry dynamics. As urbanization accelerates and lifestyles become busier, the demand for convenient and processed foods is on the rise, necessitating effective preservation methods to maintain product quality and safety. Concurrently, health-conscious consumers are driving the demand for clean-label products, spurring the development of natural preservatives and alternatives to synthetic additives. Technological innovations, including advancements in nanotechnology and edible coatings, offer new avenues for enhancing preservation techniques. Regulatory changes continue to play a significant role, influencing product formulations and consumer perceptions. Additionally, emerging markets present substantial growth opportunities, fueled by increasing urbanization and changing dietary habits.

What are the different types of food preservatives?

Food preservatives can be broadly classified into two categories: natural preservatives and synthetic preservatives. Natural preservatives include substances like salt, sugar, vinegar, and certain plant extracts, while synthetic preservatives include chemicals like sorbic acid, benzoic acid, and propionic acid.

What are food preservatives?

Food preservatives are substances or chemicals used to prevent or delay the spoilage of food products. They help to maintain food quality, extend shelf life, and ensure safety by inhibiting the growth of microorganisms or slowing down chemical processes like oxidation.

Why are food preservatives important?

Food preservatives are important because they help in maintaining the freshness and nutritional value of food, reducing food waste, and preventing foodborne illnesses. They ensure that food products stay safe for consumption over extended periods.

How are natural preservatives affecting the food preservatives market?

Natural preservatives are gaining popularity due to consumer preferences for clean labels and healthier products. They are viewed as safer alternatives to synthetic chemicals, leading to innovations in their application and increasing market demand.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSRISING RETAIL SALESGROWTH OPPORTUNITIES IN EMERGING MARKETS

-

5.3 MARKET DYNAMICSDRIVERS- Growing demand for food products with an extended shelf life- Increasing preference for convenient processed food- Rising consumption of meat worldwideRESTRAINTS- Growing demand for organic food- Utilization of preservation techniquesOPPORTUNITIES- Clean-label trend across global food marketsCHALLENGES- Health concerns associated with chemical preservatives- High price and limited availability of natural preservatives

- 6.1 INTRODUCTION

-

6.2 VALUE CHAINRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGDISTRIBUTIONMARKETING AND SALES

-

6.3 TECHNOLOGY ANALYSISALKYLRESORCINOLSGRAPE POMACELACTIC ACID BACTERIA

-

6.4 PRICING ANALYSISAVERAGE SELLING PRICE, BY TYPE

-

6.5 FOOD PRESERVATIVES MARKET: ECOSYSTEM MAPPINGDEMAND SIDESUPPLY SIDE

-

6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.7 FOOD PRESERVATIVES MARKET: PATENT ANALYSIS

- 6.8 KEY CONFERENCES AND EVENTS (2023–2024)

- 6.9 TARIFF AND REGULATORY LANDSCAPE

-

6.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.12 CASE STUDIESDSM: DAIRY SAFE FOR CHEESE BIOPRESERVATIONCHINOVA BIOWORKS INC.: MYCOBRIO FOR LOW TO NON-ALCOHOLIC BEVERAGES

- 7.1 INTRODUCTION

-

7.2 SYNTHETIC PRESERVATIVESCOST-EFFECTIVENESS AND EASY AVAILABILITY TO DRIVE MARKETSORBATES- Sorbic acid (E200)- Potassium sorbate (E202)BENZOATES- Benzoic acid (E210)- Sodium benzoate (E211)PROPIONATES- Propionic acid (E280)- Sodium propionate (E281)- Calcium propionate (E282)OTHERS- Nitrites- Sulfates

-

7.3 NATURAL PRESERVATIVESHIGH CONSUMER AWARENESS AND PREFERENCE FOR NATURAL FOOD INGREDIENTS TO DRIVE MARKETSUGARSALTALCOHOLVINEGARHONEYEDIBLE OILROSEMARY EXTRACTS (E392)NISIN (E234)NATAMYCIN (E235)ONIONS

- 8.1 INTRODUCTION

-

8.2 MEAT, POULTRY, AND SEAFOODRISING CONSUMPTION OF MEAT AND SEAFOOD WORLDWIDE TO DRIVE MARKET

-

8.3 BEVERAGESRISING PREFERENCE FOR NATURALLY FLAVORED HEALTH DRINKS TO INCREASE ADOPTION OF BENZOATES AND SORBATES

-

8.4 CONFECTIONERYINCREASING DEMAND FOR AESTHETIC FOOD PRODUCTS TO DRIVE MARKET

-

8.5 BAKERY PRODUCTSINCREASING ADOPTION OF CALCIUM & SODIUM PROPIONATES IN BAKING GOODS TO SUPPORT MARKET GROWTH

-

8.6 SNACKSRISING PREFERENCE FOR CONVENIENT AND ULTRA-PROCESSED FOOD PRODUCTS TO FUEL MARKET

-

8.7 DAIRY AND FROZEN PRODUCTSRISING CONSUMPTION OF DAIRY PRODUCTS TO SUPPORT MARKET GROWTH

-

8.8 FATS AND OILSHIGH DEMAND FOR NATURAL ANTIOXIDANTS IN VEGETABLE OIL PRESERVATION TO FUEL MARKET

- 8.9 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 ANTIMICROBIALSRISING GLOBAL DEMAND FOR FROZEN FOODS TO FUEL MARKET

-

9.3 ANTIOXIDANTSSURGE IN TRADE AND CONSUMPTION OF MEAT TO DRIVE MARKET

- 9.4 OTHER FUNCTIONS

- 10.1 INTRODUCTION

- 10.2 MACROINDICATORS OF RECESSION

-

10.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- High consumption of processed & packaged foods to drive marketCANADA- Rising growth of food processing industry to drive marketMEXICO- Increasing exports and rising domestic demand for meat to support market growth

-

10.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- High growth potential of food & beverage industry and rising demand for baked goods to drive marketUK- High consumption of dairy products & beverages to fuel marketFRANCE- Growing demand for food items with natural additives to drive marketITALY- Rising consumption of processed meat and baked goods to support market growthSPAIN- Changing consumer preferences and demand for high-quality meals to drive marketREST OF EUROPE

-

10.5 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- High production and export of food additives to drive marketJAPAN- Global partnerships and agreements for import of food preservatives to drive marketAUSTRALIA & NEW ZEALAND- Production of high-quality confectionery and bakery products to drive marketINDIA- Rise in RTE exports and consumer preferences for convenience store food products to fuel marketREST OF ASIA PACIFIC

-

10.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- High consumption of ultra-processed foods and high meat exports to drive marketARGENTINA- Rising demand for processed food & beverages to support market growthCHILE- Increasing consumption of alcoholic beverages to drive marketREST OF SOUTH AMERICA

-

10.7 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACT ANALYSISAFRICA- Growing consumer inclination toward processed foods to support market growthMIDDLE EAST- Growing food processing industry to fuel market

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2021

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 11.4 KEY PLAYER STRATEGIES

-

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 PRODUCT FOOTPRINT

-

11.7 GLOBAL FOOD PRESERVATIVES MARKET: EVALUATION QUADRANT FOR STARTUPS/SMES, 2021PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY COMPANIESCARGILL, INCORPORATED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDSM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewADM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKERRY GROUP PLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKEMIN INDUSTRIES, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewJUNGBUNZLAUER SUISSE AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGALACTIC- Business overview- Products/Services/Solutions offered- MnM viewCELANESE CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewINTERNATIONAL FLAVORS & FRAGRANCES INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFOODCHEM INTERNATIONAL CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewBASF SE- Business overview- Products/Services/Solutions offered- MnM viewCORBION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewARJUNA NATURAL- Business overview- Products/Services/Solutions offered- MnM viewMAYSA GIDA- Business overview- Products/Services/Solutions offered- MnM viewCHINOVA BIOWORKS INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTATE & LYLE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewITA 3 S.R.L.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLALLEMAND INC.- Business overview- Products/Services/Solutions offered- MnM viewCHIHONBIO CO., LTD.- Business overview- Products/Services/Solutions offered- MnM viewPRASAN SOLUTIONS (INDIA) PRIVATE LTD- Business overview- Products/Services/Solutions offered- MnM view

-

12.2 OTHER PLAYERSFBC INDUSTRIESFINE ORGANICSLANXESSALBEMARLE CORPORATIONDESIRE CHEMICAL PVT. LTD.

- 13.1 INTRODUCTION

- 13.2 RESEARCH LIMITATIONS

-

13.3 PLANT EXTRACTS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.4 FOOD EMULSIFIERS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 FOOD PRESERVATIVES MARKET, 2022 VS. 2028

- TABLE 3 FOOD PRESERVATIVES: AVERAGE SELLING PRICE, BY TYPE, 2020–2022 (USD/TON)

- TABLE 4 SYNTHETIC FOOD PRESERVATIVES: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 5 NATURAL FOOD PRESERVATIVES: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 6 FOOD PRESERVATIVES MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 7 PATENTS RELATED TO FOOD PRESERVATIVES, 2021–2022

- TABLE 8 KEY CONFERENCES AND EVENTS IN FOOD PRESERVATIVES MARKET, 2023–2024

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 FOOD PRESERVATIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PRESERVATIVES, BY TYPE (%)

- TABLE 14 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 15 FOOD PRESERVATIVES MARKET: FUNCTIONS AND PERMISSIBLE LIMITS IN FOOD PRODUCTS

- TABLE 16 FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 17 FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 18 FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 19 FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 20 SYNTHETIC FOOD PRESERVATIVE APPLICATIONS AND ASSOCIATED HEALTH RISKS

- TABLE 21 SYNTHETIC FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 SYNTHETIC FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SYNTHETIC FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 24 SYNTHETIC FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 25 SORBATES IN FOOD APPLICATIONS WITH ADMISSIBLE CONCENTRATIONS

- TABLE 26 BENZOATES IN FOOD APPLICATIONS WITH ADMISSIBLE CONCENTRATIONS

- TABLE 27 SULFATES IN FOOD APPLICATIONS WITH ADMISSIBLE CONCENTRATIONS

- TABLE 28 NATURAL PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 NATURAL PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 NATURAL PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 31 NATURAL PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 32 NATAMYCIN IN FOOD & BEVERAGE PRODUCTS WITH ADMISSIBLE CONCENTRATIONS

- TABLE 33 FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 34 FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 36 FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 37 MEAT, POULTRY, AND SEAFOOD: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 MEAT, POULTRY, AND SEAFOOD: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 MEAT, POULTRY, AND SEAFOOD: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 40 MEAT, POULTRY, AND SEAFOOD: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 41 BEVERAGES: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 BEVERAGES: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 BEVERAGES: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 44 BEVERAGES: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 45 CONFECTIONERY: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 CONFECTIONERY: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 CONFECTIONERY: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 48 CONFECTIONERY: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 49 BAKERY PRODUCTS: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 BAKERY PRODUCTS: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 BAKERY PRODUCTS: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 52 BAKERY PRODUCTS: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 53 SNACKS: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 SNACKS: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 SNACKS: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 56 SNACKS: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 57 DAIRY AND FROZEN PRODUCTS: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 DAIRY AND FROZEN PRODUCTS: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 DAIRY AND FROZEN PRODUCTS: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 60 DAIRY AND FROZEN PRODUCTS: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 61 FATS AND OILS: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 FATS AND OILS: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 FATS AND OILS: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 64 FATS AND OILS: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 65 OTHER APPLICATIONS: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 OTHER APPLICATIONS: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 OTHER APPLICATIONS: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 68 OTHER APPLICATIONS: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 69 FOOD PRESERVATIVES MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 70 FOOD PRESERVATIVES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 71 FOOD PRESERVATIVES MARKET FOR ANTIMICROBIALS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 FOOD PRESERVATIVES MARKET FOR ANTIMICROBIALS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 FOOD PRESERVATIVES MARKET FOR ANTIOXIDANTS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 FOOD PRESERVATIVES MARKET FOR ANTIOXIDANTS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 FOOD PRESERVATIVES MARKET FOR OTHER FUNCTIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 FOOD PRESERVATIVES MARKET FOR OTHER FUNCTIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 80 FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 81 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 84 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 85 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 88 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 89 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 92 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 93 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 95 US: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 96 US: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 97 US: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 98 US: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 99 US: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 100 US: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 CANADA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 102 CANADA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 CANADA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 104 CANADA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 105 CANADA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 CANADA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 MEXICO: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 108 MEXICO: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 MEXICO: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 110 MEXICO: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 111 MEXICO: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 112 MEXICO: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2019–2022 (USD MILLION)

- TABLE 114 EUROPE: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2019–2022 (KT)

- TABLE 116 EUROPE: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2023–2028 (KT)

- TABLE 117 EUROPE: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 118 EUROPE: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 EUROPE: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 120 EUROPE: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 121 EUROPE: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 EUROPE: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 124 EUROPE: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 125 EUROPE: FOOD PRESERVATIVES MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 126 EUROPE: FOOD PRESERVATIVES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 127 GERMANY: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 128 GERMANY: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 129 GERMANY: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 130 GERMANY: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 131 GERMANY: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 132 GERMANY: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 UK: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 134 UK: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 135 UK: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 136 UK: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 137 UK: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 138 UK: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 FRANCE: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 140 FRANCE: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 141 FRANCE: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 142 FRANCE: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 143 FRANCE: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 144 FRANCE: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 145 ITALY: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 146 ITALY: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 147 ITALY: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 148 ITALY: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 149 ITALY: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 150 ITALY: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 SPAIN: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 152 SPAIN: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 153 SPAIN: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 154 SPAIN: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 155 SPAIN: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 156 SPAIN: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 REST OF EUROPE: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 158 REST OF EUROPE: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 159 REST OF EUROPE: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 160 REST OF EUROPE: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 161 REST OF EUROPE: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 162 REST OF EUROPE: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2019–2022 (USD MILLION)

- TABLE 164 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 165 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2019–2022 (KT)

- TABLE 166 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2023–2028 (KT)

- TABLE 167 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 168 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 169 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 170 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 171 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 172 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 174 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 175 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 177 CHINA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 178 CHINA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 179 CHINA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 180 CHINA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 181 CHINA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 182 CHINA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 183 JAPAN: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 184 JAPAN: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 JAPAN: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 186 JAPAN: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 187 JAPAN: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 188 JAPAN: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 189 AUSTRALIA & NEW ZEALAND: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 190 AUSTRALIA & NEW ZEALAND: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 191 AUSTRALIA & NEW ZEALAND: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 192 AUSTRALIA & NEW ZEALAND: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 193 AUSTRALIA & NEW ZEALAND: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 194 AUSTRALIA & NEW ZEALAND: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 195 INDIA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 196 INDIA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 197 INDIA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 198 INDIA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 199 INDIA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 200 INDIA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 204 REST OF ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 205 REST OF ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 207 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 208 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 209 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 210 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 211 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 212 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 213 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 214 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 215 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 216 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 217 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 218 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 219 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 220 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 221 BRAZIL: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 222 BRAZIL: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 223 BRAZIL: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 224 BRAZIL: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 225 BRAZIL: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 226 BRAZIL: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 227 ARGENTINA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 228 ARGENTINA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 229 ARGENTINA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 230 ARGENTINA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 231 ARGENTINA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 232 ARGENTINA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 233 CHILE: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 234 CHILE: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 235 CHILE: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 236 CHILE: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 237 CHILE: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 238 CHILE: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 239 REST OF SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 240 REST OF SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 241 REST OF SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 242 REST OF SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 243 REST OF SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 244 REST OF SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 245 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 246 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 247 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KT)

- TABLE 248 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 249 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 250 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 251 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 252 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 253 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 254 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 255 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 256 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 257 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 258 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 259 AFRICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 260 AFRICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 261 AFRICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 262 AFRICA: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 263 AFRICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 264 AFRICA: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 265 MIDDLE EAST: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 266 MIDDLE EAST: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 267 MIDDLE EAST: FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 268 MIDDLE EAST: FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 269 MIDDLE EAST: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 270 MIDDLE EAST: FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 271 FOOD PRESERVATIVES MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- TABLE 272 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 273 COMPANY FUNCTION FOOTPRINT

- TABLE 274 COMPANY APPLICATION FOOTPRINT

- TABLE 275 COMPANY REGIONAL FOOTPRINT

- TABLE 276 OVERALL COMPANY FOOTPRINT

- TABLE 277 GLOBAL FOOD PRESERVATIVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 278 GLOBAL FOOD PRESERVATIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 279 FOOD PRESERVATIVES MARKET: PRODUCT LAUNCHES (2019–2022)

- TABLE 280 FOOD PRESERVATIVES MARKET: DEALS (2018–2022)

- TABLE 281 FOOD PRESERVATIVES MARKET: OTHER DEVELOPMENTS (2019–2022)

- TABLE 282 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 283 CARGILL, INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 284 CARGILL, INCORPORATED: DEALS

- TABLE 285 CARGILL, INCORPORATED: OTHER DEVELOPMENTS

- TABLE 286 DSM: BUSINESS OVERVIEW

- TABLE 287 DSM.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 288 DSM: PRODUCT LAUNCHES

- TABLE 289 ADM: BUSINESS OVERVIEW

- TABLE 290 ADM: PRODUCTS/ SERVICES/SOLUTIONS OFFERED

- TABLE 291 ADM: OTHERS

- TABLE 292 KERRY GROUP PLC.: BUSINESS OVERVIEW

- TABLE 293 KERRY GROUP PLC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 294 KERRY GROUP PLC.: OTHER DEVELOPMENTS

- TABLE 295 KEMIN INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 296 KEMIN INDUSTRIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 297 KEMIN INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 298 KEMIN INDUSTRIES, INC.: DEALS

- TABLE 299 KEMIN INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 300 JUNGBUNZLAUER SUISSE AG: BUSINESS OVERVIEW

- TABLE 301 JUNGBUNZLAUER SUISSE AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 302 JUNGBUNZLAUER SUISSE AG: OTHER DEVELOPMENTS

- TABLE 303 GALACTIC: BUSINESS OVERVIEW

- TABLE 304 GALACTIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 305 CELANESE CORPORATION: BUSINESS OVERVIEW

- TABLE 306 CELANESE CORPORATION: PRODUCTS/ SERVICES/SOLUTIONS OFFERED

- TABLE 307 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- TABLE 308 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 309 INTERNATIONAL FLAVORS AND FRAGRANCES INC.: OTHER DEVELOPMENTS

- TABLE 310 FOODCHEM INTERNATIONAL CORPORATION.: BUSINESS OVERVIEW

- TABLE 311 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 312 BASF SE: BUSINESS OVERVIEW

- TABLE 313 BASF SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 314 CORBION: BUSINESS OVERVIEW

- TABLE 315 CORBION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 316 CORBION: OTHER DEVELOPMENTS

- TABLE 317 ARJUNA NATURAL: BUSINESS OVERVIEW

- TABLE 318 ARJUNA NATURAL: PRODUCTS/ SERVICES/ SOLUTIONS OFFERED

- TABLE 319 MAYSA GIDA: BUSINESS OVERVIEW

- TABLE 320 MAYSA GIDA: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 321 CHINOVA BIOWORKS INC.: BUSINESS OVERVIEW

- TABLE 322 CHINOVA BIOWORKS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 323 CHINOVA BIOWORKS INC.: PRODUCT LAUNCHES

- TABLE 324 CHINOVA BIOWORKS INC.: OTHER DEVELOPMENTS

- TABLE 325 TATE & LYLE: BUSINESS OVERVIEW

- TABLE 326 TATE & LYLE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 327 TATE & LYLE.: OTHER DEVELOPMENTS

- TABLE 328 ITA 3 S.R.L.: BUSINESS OVERVIEW

- TABLE 329 ITA 3 S.R.L.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 330 LALLEMAND INC.: BUSINESS OVERVIEW

- TABLE 331 LALLEMAND INC.: PRODUCTS/ SERVICES/SOLUTIONS OFFERED

- TABLE 332 CHIHONBIO CO., LTD.: BUSINESS OVERVIEW

- TABLE 333 CHIHONBIO CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 334 PRASAN SOLUTIONS (INDIA) PRIVATE LTD: BUSINESS OVERVIEW

- TABLE 335 PRASAN SOLUTIONS (INDIA) PRIVATE LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 336 FBC INDUSTRIES: COMPANY OVERVIEW

- TABLE 337 FINE ORGANICS: COMPANY OVERVIEW

- TABLE 338 LANXESS: COMPANY OVERVIEW

- TABLE 339 ALBEMARLE CORPORATION: COMPANY OVERVIEW

- TABLE 340 DESIRE CHEMICAL PVT. LTD.: COMPANY OVERVIEW

- TABLE 341 ADJACENT MARKETS

- TABLE 342 PLANT EXTRACTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 343 FOOD EMULSIFIERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 FOOD PRESERVATIVES MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 FOOD PRESERVATIVES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 5 FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 FOOD PRESERVATIVES MARKET, BY FUNCTION, 2023 VS. 2028 (USD MILLION)

- FIGURE 7 FOOD PRESERVATIVES MARKET, BY REGION (2022)

- FIGURE 8 GROWING DEMAND FOR CONVENIENT PROCESSED FOOD WITH AN EXTENDED SHELF LIFE TO DRIVE MARKET

- FIGURE 9 SYNTHETIC PRESERVATIVES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 10 SYNTHETIC PRESERVATIVES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 MEAT, POULTRY, AND SEAFOOD PRODUCTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 ANTIMICROBIALS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 RETAIL AND FOOD SERVICE SALES IN US (USD BILLION)

- FIGURE 14 GDP GROWTH RATE IN ASIAN COUNTRIES, 2020-2021

- FIGURE 15 MARKET DYNAMICS

- FIGURE 16 FOOD PRESERVATIVES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 17 GLOBAL: AVERAGE SELLING PRICE, BY TYPE (USD/TON)

- FIGURE 18 FOOD PRESERVATIVES: MARKET MAP

- FIGURE 19 FOOD PRESERVATIVES: ECOSYSTEM MAPPING

- FIGURE 20 REVENUE SHIFT FOR FOOD PRESERVATIVES MARKET

- FIGURE 21 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2022

- FIGURE 22 TOP 10 INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 23 LEADING APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PRESERVATIVES, BY TYPE

- FIGURE 25 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- FIGURE 26 SYNTHETIC PRESERVATIVES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 27 FOOD PRESERVATIVES MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 28 FOOD PRESERVATIVES MARKET, BY FUNCTION, 2023 VS. 2028 (USD MILLION)

- FIGURE 29 FOOD PRESERVATIVES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 30 INDICATORS OF RECESSION

- FIGURE 31 WORLD INFLATION RATE: 2011-2021

- FIGURE 32 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 33 RECESSION INDICATORS AND THEIR IMPACT ON FOOD PRESERVATIVES MARKET

- FIGURE 34 GLOBAL FOOD PRESERVATIVES MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 35 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 36 NORTH AMERICA FOOD PRESERVATIVES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 37 NORTH AMERICA: FOOD PRESERVATIVES MARKET SNAPSHOT

- FIGURE 38 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 39 FOOD PRESERVATIVES MARKET: EUROPE RECESSION IMPACT ANALYSIS

- FIGURE 40 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 41 FOOD PRESERVATIVES MARKET: ASIA PACIFIC RECESSION IMPACT ANALYSIS

- FIGURE 42 FOOD PRESERVATIVES MARKET: ASIA PACIFIC SNAPSHOT

- FIGURE 43 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 44 FOOD PRESERVATIVES MARKET: SOUTH AMERICA RECESSION IMPACT ANALYSIS

- FIGURE 45 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 46 FOOD PRESERVATIVES MARKET: REST OF THE WORLD RECESSION IMPACT ANALYSIS

- FIGURE 47 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD BILLION)

- FIGURE 48 GLOBAL FOOD PRESERVATIVES MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- FIGURE 49 GLOBAL FOOD PRESERVATIVES MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

- FIGURE 50 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 51 DSM: COMPANY SNAPSHOT

- FIGURE 52 ADM: COMPANY SNAPSHOT

- FIGURE 53 KERRY GROUP PLC.: COMPANY SNAPSHOT

- FIGURE 54 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 56 BASF SE: COMPANY SNAPSHOT

- FIGURE 57 CORBION: COMPANY SNAPSHOT

- FIGURE 58 TATE & LYLE: COMPANY SNAPSHOT

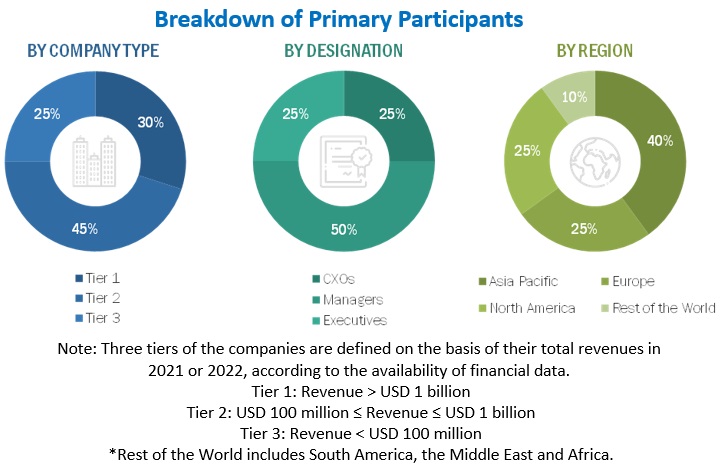

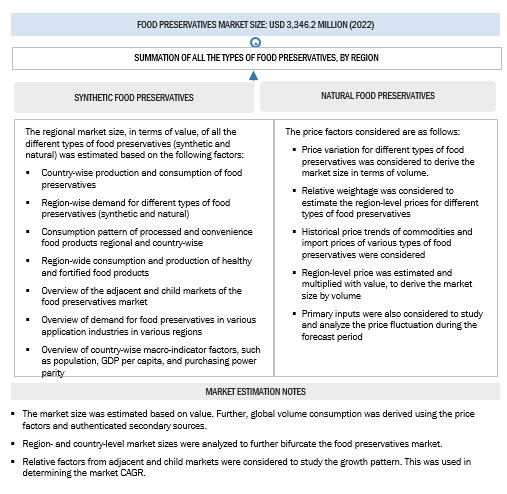

The study involved four major activities in estimating the current size of the food preservatives market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Food Preservatives Market Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering food preservatives and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the food preservatives market, which was validated by the primary respondent.

Food Preservatives Market Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the food preservatives market.

To know about the assumptions considered for the study, download the pdf brochure

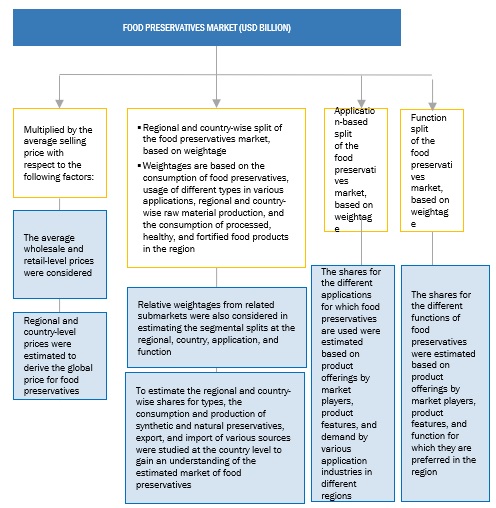

Food Preservatives Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food preservatives market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major food preservatives-based food manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the food preservatives market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Food Preservatives Market Size Estimation Methodology: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Food Preservatives Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Food Preservatives Market Definition

Food preservatives are the ingredients that are used in food processing to slow down the spoilage of the food caused by mold, yeast, bacteria, fungi, and air. Food preservatives maintain the quality of the food and keep them fresh. Additionally, they also help in controlling contamination, which can lead to foodborne diseases, such as botulism and campylobacteriosis. Food preservatives used are of either natural or synthetic origin, which act as antimicrobial, antioxidant, chelating, or enzymatic agents.

Key Stakeholders

- Regulatory bodies

- Food Standards Australia New Zealand (Australia)

- US Food and Drug Administration (FDA) (US)

- European Food Safety Authority (EFSA) (Italy)

- Intermediary suppliers such as traders, distributors, and suppliers of food preservatives.

- Food preservatives manufacturers & suppliers

- Associations and industry bodies

- Food & beverage products manufacturers and suppliers

- Food preservatives traders and distributors

- Commercial research & development (R&D) institutions

- Government and research organizations

- Technology providers to food companies

Food Preservatives Market Report Objectives

- To define, segment, and project the global market for food preservatives on the basis of type, function, application, and region.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies.

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the food preservatives market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe region for food preservatives market into Ireland, Netherlands, Sweden, Turkey, Belgium, and other EU & non-EU countries.

- Further breakdown of the Asia Pacific region for food preservatives market into Vietnam, Malaysia, Thailand, Indonesia, the Philippines, and South Korea.

- Further breakdown of other countries in the South American region for food preservatives market into Columbia, Peru, and Venezuela.

- Further breakdown of other countries in the Rest of the World market for food preservatives market into Middle East and Africa.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Preservatives Market