Fruit Fillings Market by Filling Type (Fruit Filling without Pieces, Fruit Filling with Pieces, Candied or Semi- Candied Fruit Filling, Other Fillings), Fruit Type (Berries, Citrus Fruits, Tropical Fruits), Application (Bakery, Confectionery, Dairy, Ice Cream, Beverages), and Region (North America, Europe, Asia Pacific, RoW) - Global Forecast to 2028

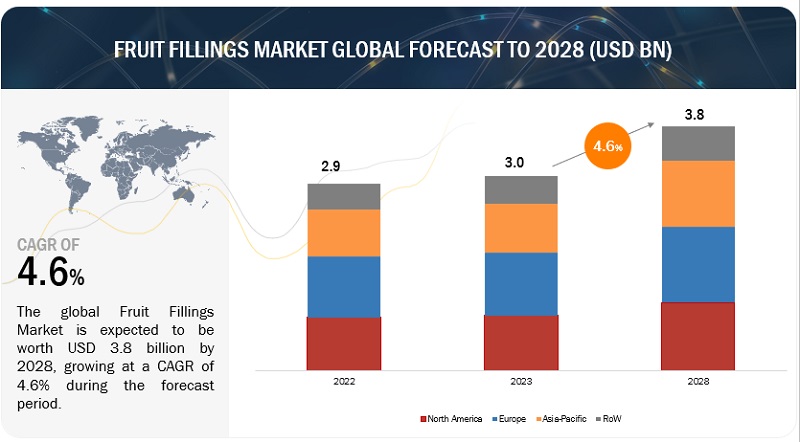

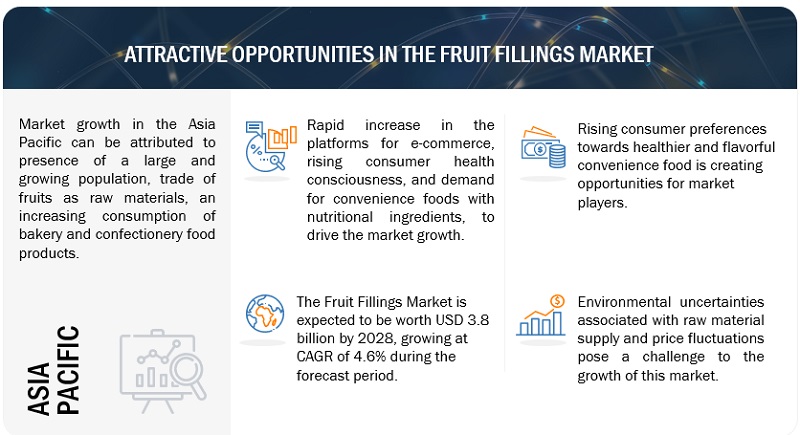

[299 Pages Report] The global fruit fillings market is projected to reach USD 3.8 billion by 2028 from USD 3.0 billion by 2023, at a CAGR of 4.6% during the forecast period in terms of value. With the rise in the per capita income of the population, consumers are becoming more health-conscious and are seeking convenient and flavourful food. Asia Pacific has a growing middle-class population which is consequently increasing the buying power worldwide. According to OECD, the continent’s share of total middle-class consumer spending worldwide may escalate to 59% by 2030. Thus, the ascending middle-class population coupled with an increase in consumer spending capability are fueling the demand for convenient and tasty ways with natural ingredients to the food and beverage products, which in turn creates demand for fruit fillings in the region.

The desire to eat healthier has gradually increased interest in seeking convenient, tasty, and enjoyable ways to bakery and confectionery products. Fruit fillings offer a healthy and tasty alternative to artificial sweeteners to the food products. The demand for fruit fillings is driven by the changing consumers’ lifestyle, preferences towards healthy and flavored food.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers:Increasing demand for convenience foods

Convenience food is often a meal prepared commercially for ease of consumption. Convenience food includes products from the bakery industry, such as cakes and pastries, and other ready-to-eat food products. Flavors & color mixes of fruits fillings appeal to the people. They can be added as fillings with pieces, without pieces, in candied & semi-candied forms. People are driven to processed foods due to a lack of culinary skills and excessive working hours. As people relocate to cities, changing customer patterns have contributed to expanding the convenience food retail business. Growing need for ready-to-eat food, high demand from emerging countries, rising disposable income, a sedentary lifestyle, and an increase in the working population are all factors driving the expansion of the convenience food industry. With the increase in the number of convenience food eaters globally, the industry is witnessing a rise in the market potential of the fruit fillings market.

Restraints: Seasonal availability of raw materials for fruit fillings

While the fruit fillings market has many advantages, there are also some potential drawbacks to consider. One of the main concerns for the market is that the fruit fillings heavily rely on seasonal fruit availability. This means that the seasonality of certain fruits can impact the market demand and supply. Many fruits have a limited growing season, meaning they are only available during specific times of the year. This can lead to fluctuations in supply, which can impact both the availability and the price of fruits. For example, berries such as strawberries, raspberries, and blueberries are typically in season during the summer months. This means they are readily available during this time but may be difficult to find or more expensive during other times of the year. Similarly, apples are typically harvested in the fall, so their supply is limited during other seasons. This leads to fluctuations in the prices of fruits restraining market growth.

Opportunities: Increasing health awareness among consumers

Health and wellness are vital to the food industry, and the fruit fillings market is no exception. With consumers looking for healthier options, manufacturers are developing fruit fillings with less sugar, fat, and calorie content. Additionally, they incorporate functional ingredients like fiber into their products to meet consumer demand for healthier options. Fruit fillings provide an excellent source of nutrients, such as vitamins and fiber, which can benefit overall health. For instance, blueberry filling can be a great source of antioxidants, while apple filling can be a source of dietary fiber. Fruit fillings are therefore used as a natural sweetener and substitute for refined sugars, which can help reduce the overall sugar content in baked goods and other food products. This benefits people trying to manage their blood sugar levels or reduce their sugar intake. Hence, it can be projected that the growing healthier food options would foster the growth of the fruit fillings market.

Challenges: Fluctuations in raw material prices

Fruit fillings require high-quality fruits that meet specific standards, such as size, flavor, and texture. So, vendors must ensure that the fruits they supply consistently meet these standards to avoid product rejections. Raw materials of lousy quality can lead to an increase in wastage and would hamper the speed of operations. Artificial inflation can be a big problem if a company does not have a contract with its vendor. External factors such as weather conditions, political instability, trade disputes, transportation disruptions, and natural disasters can significantly impact the supply of raw materials for fillings. These uncertainties can result in price fluctuations and supply chain disruptions, affecting the production and profitability of businesses. Thus, the price fluctuations of raw materials acts as a major challenge for the growth of the market.

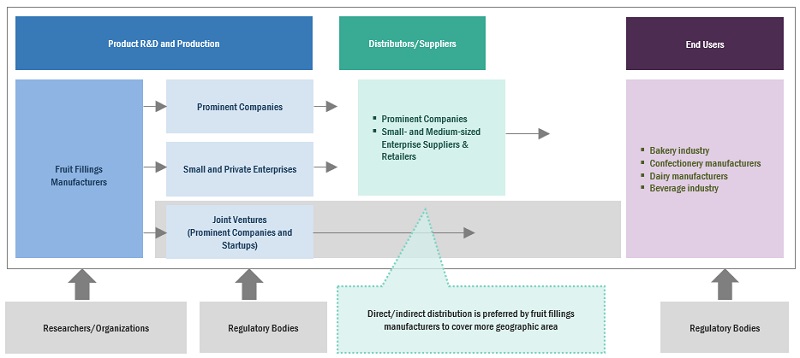

Fruit Fillings Market Ecosystem

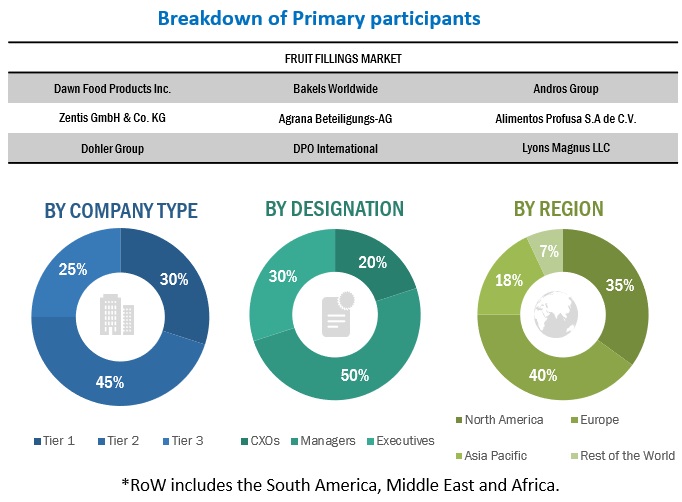

Prominent companies in this market include well-established, financially stable manufacturers of fruit fillings. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

Key Market Players in the Fruit Fillings Market

The key players in this market include Puratos Group (Belgium), Dawn Food Products Inc. (US), Agrana Beteiligungs- AG (Austria), CSM Ingredients (Luxembourg), Bakels Worldwide (Switzerland), Barry Callebaut (Switzerland), Andros Group (France), Zentis Gmbh & Co. KG (Germany), Rice & Company Inc. (US), and Fruit Filling Inc. (US).

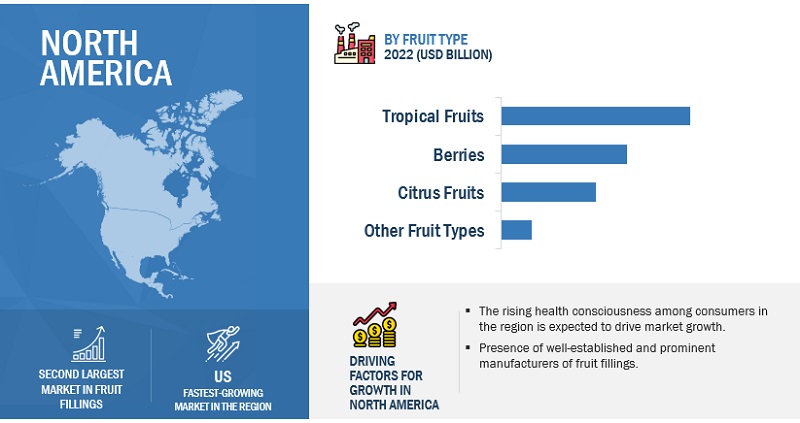

Fruit Fillings Without Pieces Accounted Highest Market Share in North America

Fruit fillings without pieces contain fruits in paste, puree, or crush format. These fillings may or may not contain some traces of fruit pieces, which provide diversified applications for bakery fillings in tarts, Danish pastries, sweet pies, dessert fillings, decoration and stuffing for dairy products, ice creams, desserts, and beverages.

Fruit fillings without pieces is the most preferred filling type among the American consumers owing to the convenience of use and wide range of applications. Additionally, the food market in the region is continuously growing, with new trends influencing the eating preferences of consumers and creating opportunities for fruit fillings manufacturers aiming to capitalize on this growth.

Dairy Industry has Wide Range of Applications of Fruit Fillings

Fillings are used in dairy products like yogurt, cheesecake, dairy-based desserts, cream cheese spreads, milkshakes, and whipped cream, to provide a sweet, savory, or fruity flavor along with a creamy texture. In recent days, it is witnessed that American consumers highly prefer to incorporate innovative fruits such as peach, passionfruit, guava and other tropical, citrus and fruit flavors to the cultured dairy products.

As dairy and dairy-alternative categories continue to innovate, such as artisan butter and nutrient-rich beverages, there has been a growing demand for fruit and vegetable-based inclusions into dairy products to attract the customer base. This is the major driving factor for the fruit fillings added to the dairy applications to boost the market growth in North America. Additionally, there is a growing awareness and interest in health and wellness in North America, and fruit filling incorporated food and beverages are seen as a convenient and accessible way to support overall health and wellbeing which contributes to the popularity of fruit fillings in North America.

US is One of the Major Market for Fruit Fillings in North America

The United States is one of the largest markets for fruit fillings in North America. The popularity of fruit fillings has increased significantly in recent years due to various factors, including the rising consumer health awareness, increasing demand for vitamin C based food ingredients, and the preference for natural and flavorful food and beverage products. Fruit fillings are a convenient and tasty way to supplement the consumers’ preferred food and beverages.

The availability of various types of fruit fillings, such as berry fillings, apple fillings, citrus fruit-based fillings, and mixed fruit fillings among others, is driving the growth of fruit fillings market in the United States.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD Billion), Volume (KT) |

|

Segments covered |

By Filling Type, By Fruit Type, By Application, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

Report Scope:

Fruit Fillings Market:

By Filling Type

-

Fruit Fillings without Pieces

- Ambient Fillings

- Frozen Fillings

- Fruit Fillings with Pieces

- Candied or Semi-candied Fruit Fillings

- Other Filling Types

By Fruit Type

- Berries

- Citrus Fruits

- Tropical Fruits

- Other Fruit Types

By Application

- Bakery

- Confectionery

- Dairy

- Ice Cream

- Beverages

- Other Applications

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)**

**Rest of the World (RoW) includes the South America, Middle East and Africa.

Fruit Fillings Market Industry News

- In January 2023, Dawn Foods announced a three-year partnership with Goodness Cakes. Dawn thinks that people need to be honored and everyone should have their birthday celebrated. The company was moved by the Goodness Cakes mission and saw similar principles of organization.

- In August 2022, Puratos announced a partnership with Shiru, a functional ingredient company for the food industry. The collaboration with Shiru aims to find new functional, plant-based ingredients that can bring innovation to bakery, patisserie, and chocolate products.

- In June 2022, Barry Callebaut signed a strategic distribution agreement with Colombian food ingredient supplier, Levapan, for global brands Callebaut, Mona Lisa, and Sicao under a long-term agreement. Levapan has wide distribution networks in Colombia, Ecuador, the Dominican Republic, and other countries. This would help Berry to strengthen and expand its distribution in Latin America.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the Fruit fillings market?

The market is expected to grow in Europe and is expected to dominate during the forecast period. The key factors like the growing food and beverage industry in the region and the demand for convenience foods, along with changing consumer lifestyles, preferences, and tastes for a variety of flavorful food, are driving the demand for the fillings market in the region.

What is the current size of the Fruit fillings Market?

The global Fruit fillings Market is projected to reach USD 3.8 billion by 2028 from USD 3.0 billion by 2023, at a CAGR of 4.6% during the forecast period in terms of value.

Which are the key players in the market, and how intense is the competition?

The key players in this market include Puratos Group (Belgium), Dawn Food Products Inc. (US), Agrana Beteiligungs- AG (Austria), CSM Ingredients (Luxembourg), Bakels Worldwide (Switzerland), Barry Callebaut (Switzerland), Andros Group (France), Zentis Gmbh & Co. KG (Germany), Rice & Company Inc. (US), and Fruit Filling Inc. (US).

The Fruit fillings Market witnesses increased scope for growth. The market is seeing an increase in the number of mergers and acquisitions and new product launches. Moreover, the companies involved in the production of Fruit fillingss are investing a considerable proportion of their revenues in research and development activities.

Which type of fillings is projected to account for the largest share of the Fruit fillings market?

Fruit fillings without pieces is projected to have the largest share in the fruit fillings market with USD 1.1 Billion owing to increasing demand for convenient, verasatile usage of fruit fillings into convenience foods.

Which application is projected to account for the largest share of the Fruit fillings market?

Dairy industry is expected to hold the largest share of Fruit fillingss Market among all other apllications with a value of USD 1.6 Billion during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Boost in demand for convenience food- Growing bakery and confectionery industry- Increase in number of institutional bakery & eCommerce channels- Availability of wide range of flavorsRESTRAINTS- Seasonality of raw materials- Perishability of fruit fillings- Declining share of artisanal bakeries- Stringent international quality standards and regulationsOPPORTUNITIES- New growth opportunities in developing regions- Increasing health awarenessCHALLENGES- Rising preference for clean-label products- Fluctuations in raw material prices

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMERS’ BUSINESSES

-

6.3 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGQUALITY AND SAFETY CONTROLLERSMARKETING AND DISTRIBUTIONEND USERS

-

6.4 FRUIT FILLINGS MARKET: TRADE DATAIMPORT ANALYSIS: FRUIT PUREE AND PASTEEXPORT ANALYSIS: FRUIT PUREE AND PASTE

-

6.5 MARKET MAPPING AND ECOSYSTEM ANALYSISDEMAND SIDESUPPLY SIDE

-

6.6 PRICING ANALYSISAVERAGE SELLING PRICE, BY FILLING TYPEAVERAGE SELLING PRICE, BY COMPANY

-

6.7 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT FROM SUBSTITUTESTHREAT FROM NEW ENTRANTS

-

6.8 TECHNOLOGY ANALYSISHIGH-PRESSURE PROCESSING TECHNOLOGY FOR BETTER SHELF LIFE OF FRUIT PRODUCTSNIR SPECTROSCOPY AND CHEMOMETRICS FOR FRUIT QUALITY ASSURANCE

-

6.9 CASE STUDYINTEGRATION OF VALORIZATION CONCEPT ALLOWED CONVERSION OF FRUIT WASTE INTO HIGH-VALUE PRODUCTS

-

6.10 PATENT ANALYSIS

-

6.11 TARIFF AND REGULATORY LANDSCAPENORTH AMERICA- Canada- USEUROPEAN UNION (EU)- UK- ItalyASIA PACIFIC- Japan- China- India- Australia & New ZealandREST OF THE WORLD (ROW)- Brazil- Argentina- South Africa

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.13 KEY CONFERENCES & EVENTS

- 7.1 INTRODUCTION

-

7.2 FRUIT FILLINGS WITHOUT PIECESEXPONENTIAL GROWTH IN FRUIT PROCESSING INDUSTRIES TO DRIVE MARKET FOR FRUIT FILLINGS WITHOUT PIECESAMBIENT FILLINGSFROZEN FILLINGS

-

7.3 FRUIT FILLINGS WITH PIECESRISING DEMAND FOR SEASONAL FRUIT PRODUCTS WITH LONG SHELF LIFE YEAR-ROUND TO DRIVE DEMAND FOR FRUIT FILLINGS WITH PIECES

-

7.4 CANDIED OR SEMI-CANDIED FRUIT FILLINGSEASE OF USE AND STORAGE TO BOOST DEMAND FOR CANDIED OR SEMI-CANDIED FRUIT FILLINGS

- 7.5 OTHER FILLING TYPES

- 8.1 INTRODUCTION

-

8.2 BERRIESRISE IN USE OF BERRIES IN FOOD & BEVERAGE APPLICATIONS TO DRIVE MARKET FOR BERRY FRUIT FILLINGS

-

8.3 CITRUS FRUITSRISING DEMAND FOR VITAMIN C-RICH FRUITS TO FUEL DEMAND FOR CITRUS FRUIT FILLINGS

-

8.4 TROPICAL FRUITSGROWING CONSUMPTION OF FRUITS WITH ANTIOXIDANT PROPERTIES TO DRIVE MARKET FOR TROPICAL FRUIT FILLINGS

- 8.5 OTHER FRUIT TYPES

- 9.1 INTRODUCTION

-

9.2 BAKERYINCREASING DEMAND FOR CUSTOMIZED BAKERY PRODUCTS TO PROPEL ADOPTION OF FRUIT FILLINGS IN BAKERY

-

9.3 CONFECTIONERYRISING CONSUMER PREFERENCE TOWARD FLAVORED CONFECTIONERY TO DRIVE NEED FOR FRUIT FILLINGS IN CONFECTIONERY

-

9.4 DAIRYDEMAND FOR FRUIT INCLUSIONS IN DAIRY PRODUCTS TO PROPEL ADOPTION OF FRUIT FILLINGS IN DAIRY APPLICATIONS

-

9.5 ICE CREAMRISE IN CONSUMPTION OF FLAVORED ICE CREAM TO DRIVE DEMAND FOR FRUIT AND NUT FILLINGS

-

9.6 BEVERAGESRAPID CHANGE IN CONSUMER LIFESTYLE TO DRIVE WIDESPREAD APPLICATION OF FRUIT-FLAVORED SYRUPS IN BEVERAGES

- 9.7 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Increasing consumption of bakery products to support growth of fruit fillings market in USCANADA- Rising consumer preference for healthy bakery products to contribute to steady growth of Canadian fruit fillings marketMEXICO- Expansion of international bakery and confectionery brands in Mexico to drive growth of fruit fillings market

-

10.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISUK- Increasing demand for healthy and natural food ingredients to provide opportunities for fruit fillings market in UKGERMANY- High demand for processed food products to drive market for fruit fillings in GermanyFRANCE- Rising demand for flavored dairy products to boost fruit fillings market in FranceITALY- Growing consumption of functional and convenience food to propel demand for fruit fillings in ItalySPAIN- Growing citrus fruit industry in Spain to offer opportunities for fruit fillings marketNETHERLANDS- Rise in consumption of healthy food and beverage ingredients to propel market for fruit fillings in NetherlandsBELGIUM- Rising popularity of bakery and confectionery products among youth to drive demand for Belgian fruit fillingsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Westernization of lifestyle and growing demand for convenience food to drive market for fruit fillings in ChinaJAPAN- Use of fruit fillings in traditional Japanese desserts to proliferate market growthINDIA- Rapid growth of processed food sector to drive fruit fillings market growthAUSTRALIA & NEW ZEALAND- Rising demand for healthy and nutritious products among young consumers to drive market for fruit and vegetable fillingsREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACTSOUTH AMERICA- Increasing demand for nutritional products to boost market growth of fruit fillings in South AmericaMIDDLE EAST- Rising adoption of healthy food habits to boost popularity of fruit fillings in Middle EastAFRICA- Increasing adoption of convenience food products to create opportunities for players in African fruit fillings market

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS FOR KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 STRATEGIES ADOPTED BY TOP FIVE PLAYERS

-

11.5 EVALUATION QUADRANT MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 PRODUCT FOOTPRINT FOR KEY PLAYERS

-

11.7 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 COMPETITIVE BENCHMARKING OF OTHER PLAYERS

-

11.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSPURATOS GROUP- Business overview- Products offered- Recent developments- MnM viewDAWN FOOD PRODUCTS INC.- Business overview- Products offered- Recent developments- MnM viewAGRANA BETEILIGUNGS-AG- Business overview- Products offered- Recent developments- MnM viewCSM INGREDIENTS- Business overview- Products offered- Recent developments- MnM viewBARRY CALLEBAUT- Business overview- Products offered- Recent developments- MnM viewZENTIS GMBH & CO. KG- Business overview- Products offered- Recent developments- MnM viewBAKELS WORLDWIDE- Business overview- Products offered- Recent developments- MnM viewANDROS GROUP- Business overview- Products offered- Recent developments- MnM viewFRUIT FILLINGS INC.- Business overview- Products offered- Recent developments- MnM viewRICE & COMPANY INC.- Business overview- Products offered- Recent developments- MnM viewEFCO PRODUCTS INC.- Business overview- Products offered- Recent developments- MnM viewBALDWIN RICHARDSON FOODS- Business overview- Products offered- Recent developments- MnM viewBARKER FRUIT PROCESSORS LTD.- Business overview- Products offered- Recent developments- MnM viewFRUIT CROWN PRODUCTS CORPORATION- Business overview- Products offered- Recent developments- MnM viewWAWONA FROZEN FOODS- Business overview- Products offered- Recent developments- MnM view

-

12.2 OTHER PLAYERSLYONS MAGNUS LLCPREGEL S.P.A.MALAS FRUIT PRODUCTSCORNABY'S LLCALIMENTOS PROFUSA S.A. DE C.V.

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 FILLINGS AND TOPPINGS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.4 FOOD INCLUSIONS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.5 FROZEN BAKERY PRODUCTS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2019–2022

- TABLE 2 FRUIT FILLINGS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 TOP IMPORTERS OF FRUIT PUREE AND PASTE, 2022

- TABLE 4 TOP EXPORTERS OF FRUIT PUREE AND PASTE, 2022

- TABLE 5 FRUIT FILLINGS MARKET: SUPPLY CHAIN (ECOSYSTEM) ANALYSIS

- TABLE 6 AVERAGE SELLING PRICE OF FRUIT FILLINGS, BY FILLING TYPE, 2019–2023 (USD PER KG)

- TABLE 7 AVERAGE SELLING PRICE OF FRUIT FILLINGS, BY REGION, 2019–2023 (USD PER KG)

- TABLE 8 AVERAGE SELLING PRICE OF FRUIT FILLINGS, BY KEY PLAYER, 2023 (USD PER UNIT)

- TABLE 9 FRUIT FILLINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 PATENTS PERTAINING TO FRUIT FILLINGS, 2019–2023

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR FRUIT FILLING APPLICATIONS

- TABLE 17 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 18 FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 19 FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 20 FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 21 FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 22 FRUIT FILLINGS WITHOUT PIECES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 FRUIT FILLINGS WITHOUT PIECES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 FRUIT FILLINGS WITHOUT PIECES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 25 FRUIT FILLINGS WITHOUT PIECES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 26 AMBIENT FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 AMBIENT FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 AMBIENT FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 29 AMBIENT FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 30 FROZEN FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 FROZEN FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 FROZEN FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 33 FROZEN FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 34 FRUIT FILLINGS WITH PIECES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 FRUIT FILLINGS WITH PIECES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 FRUIT FILLINGS WITH PIECES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 37 FRUIT FILLINGS WITH PIECES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 38 CANDIED OR SEMI-CANDIED FRUIT FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 CANDIED OR SEMI-CANDIED FRUIT FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 CANDIED OR SEMI-CANDIED FRUIT FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 41 CANDIED OR SEMI-CANDIED FRUIT FILLINGS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 42 OTHER FILLING TYPES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 OTHER FILLING TYPES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 OTHER FILLING TYPES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 45 OTHER FILLING TYPES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 46 FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 47 FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 48 FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 49 FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 50 BERRIES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 BERRIES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 BERRIES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 53 BERRIES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 54 RECOMMENDED DIETARY ALLOWANCES FOR VITAMIN C

- TABLE 55 VITAMIN C CONTENT IN SELECTED FOOD ITEMS

- TABLE 56 CITRUS FRUITS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 CITRUS FRUITS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 CITRUS FRUITS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 59 CITRUS FRUITS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 60 ANTIOXIDANT PROPERTIES OF MAJOR TROPICAL FRUITS

- TABLE 61 TROPICAL FRUITS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 TROPICAL FRUITS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 TROPICAL FRUITS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 64 TROPICAL FRUITS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 65 OTHER FRUIT TYPES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 OTHER FRUIT TYPES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 OTHER FRUIT TYPES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 68 OTHER FRUIT TYPES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 69 FRUIT FILLINGS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 70 FRUIT FILLINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 FRUIT FILLINGS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 72 FRUIT FILLINGS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 73 BAKERY: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 BAKERY: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 BAKERY: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 76 BAKERY: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 77 CONFECTIONERY: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 CONFECTIONERY: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 CONFECTIONERY: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 80 CONFECTIONERY: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 81 DAIRY: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 DAIRY: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 DAIRY: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 84 DAIRY: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 85 ICE CREAM: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 ICE CREAM: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 ICE CREAM: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 88 ICE CREAM: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 89 BEVERAGES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 BEVERAGES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 BEVERAGES: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 92 BEVERAGES: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 93 OTHER APPLICATIONS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 OTHER APPLICATIONS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 OTHER APPLICATIONS: FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 96 OTHER APPLICATIONS: FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 97 FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 98 FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 FRUIT FILLINGS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 100 FRUIT FILLINGS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 101 NORTH AMERICA: FRUIT FILLINGS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: FRUIT FILLINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: FRUIT FILLINGS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 104 NORTH AMERICA: FRUIT FILLINGS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 105 NORTH AMERICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 108 NORTH AMERICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 109 NORTH AMERICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 112 NORTH AMERICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 113 NORTH AMERICA: FRUIT FILLINGS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: FRUIT FILLINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: FRUIT FILLINGS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 116 NORTH AMERICA: FRUIT FILLINGS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 117 US: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 118 US: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 119 US: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 120 US: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 121 US: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 122 US: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 123 US: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 124 US: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 125 CANADA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 126 CANADA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 127 CANADA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 128 CANADA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 129 CANADA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 130 CANADA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 131 CANADA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 132 CANADA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 133 MEXICO: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 134 MEXICO: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 135 MEXICO: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 136 MEXICO: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 137 MEXICO: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 138 MEXICO: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 139 MEXICO: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 140 MEXICO: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 141 EUROPE: FRUIT FILLINGS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 142 EUROPE: FRUIT FILLINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 143 EUROPE: FRUIT FILLINGS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 144 EUROPE: FRUIT FILLINGS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 145 EUROPE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 146 EUROPE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 148 EUROPE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 149 EUROPE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 150 EUROPE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 151 EUROPE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 152 EUROPE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 153 EUROPE: FRUIT FILLINGS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 154 EUROPE: FRUIT FILLINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 155 EUROPE: FRUIT FILLINGS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 156 EUROPE: FRUIT FILLINGS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 157 UK: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 158 UK: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 159 UK: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 160 UK: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 161 UK: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 162 UK: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 163 UK: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 164 UK: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 165 GERMANY: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 166 GERMANY: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 167 GERMANY: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 168 GERMANY: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 169 GERMANY: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 170 GERMANY: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 171 GERMANY: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 172 GERMANY: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 173 FRANCE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 174 FRANCE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 175 FRANCE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 176 FRANCE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 177 FRANCE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 178 FRANCE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 179 FRANCE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 180 FRANCE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 181 ITALY: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 182 ITALY: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 183 ITALY: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 184 ITALY: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 185 ITALY: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 186 ITALY: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 187 ITALY: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 188 ITALY: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 189 SPAIN: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 190 SPAIN: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 191 SPAIN: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 192 SPAIN: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 193 SPAIN: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 194 SPAIN: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 195 SPAIN: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 196 SPAIN: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 197 NETHERLANDS: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 198 NETHERLANDS: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 199 NETHERLANDS: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 200 NETHERLANDS: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 201 NETHERLANDS: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 202 NETHERLANDS: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 203 NETHERLANDS: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 204 NETHERLANDS: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 205 BELGIUM: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 206 BELGIUM: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 207 BELGIUM: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 208 BELGIUM: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 209 BELGIUM: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 210 BELGIUM: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 211 BELGIUM: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 212 BELGIUM: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 213 REST OF EUROPE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 214 REST OF EUROPE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 215 REST OF EUROPE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 216 REST OF EUROPE: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 217 REST OF EUROPE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 218 REST OF EUROPE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 219 REST OF EUROPE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 220 REST OF EUROPE: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 221 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 222 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 223 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 224 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 225 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 226 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 227 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 228 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 229 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 230 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 231 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 232 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 233 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 234 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 235 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 236 ASIA PACIFIC: FRUIT FILLINGS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 237 CHINA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 238 CHINA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 239 CHINA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 240 CHINA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 241 CHINA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 242 CHINA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 243 CHINA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 244 CHINA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 245 JAPAN: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 246 JAPAN: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 247 JAPAN: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 248 JAPAN: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 249 JAPAN: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 250 JAPAN: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 251 JAPAN: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 252 JAPAN: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 253 INDIA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 254 INDIA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 255 INDIA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 256 INDIA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 257 INDIA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 258 INDIA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 259 INDIA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 260 INDIA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 261 AUSTRALIA & NEW ZEALAND: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 262 AUSTRALIA & NEW ZEALAND: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 263 AUSTRALIA & NEW ZEALAND: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 264 AUSTRALIA & NEW ZEALAND: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 265 AUSTRALIA & NEW ZEALAND: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 266 AUSTRALIA & NEW ZEALAND: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 267 AUSTRALIA & NEW ZEALAND: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 268 AUSTRALIA & NEW ZEALAND: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 269 REST OF ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 270 REST OF ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 271 REST OF ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 272 REST OF ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 273 REST OF ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 274 REST OF ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 275 REST OF ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 276 REST OF ASIA PACIFIC: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 277 REST OF WORLD: FRUIT FILLINGS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 278 REST OF WORLD: FRUIT FILLINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 279 REST OF WORLD: FRUIT FILLINGS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 280 REST OF WORLD: FRUIT FILLINGS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 281 REST OF WORLD: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 282 REST OF WORLD: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 283 REST OF WORLD: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 284 REST OF WORLD: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 285 REST OF WORLD: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 286 REST OF WORLD: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 287 REST OF WORLD: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 288 REST OF WORLD: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 289 REST OF WORLD: FRUIT FILLINGS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 290 REST OF WORLD: FRUIT FILLINGS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 291 REST OF WORLD: FRUIT FILLINGS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 292 REST OF WORLD: FRUIT FILLINGS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 293 SOUTH AMERICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 294 SOUTH AMERICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 295 SOUTH AMERICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 296 SOUTH AMERICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 297 SOUTH AMERICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 298 SOUTH AMERICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 299 SOUTH AMERICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 300 SOUTH AMERICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 301 MIDDLE EAST: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 302 MIDDLE EAST: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 303 MIDDLE EAST: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 304 MIDDLE EAST: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 305 MIDDLE EAST: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 306 MIDDLE EAST: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 307 MIDDLE EAST: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 308 MIDDLE EAST: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 309 AFRICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (USD MILLION)

- TABLE 310 AFRICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (USD MILLION)

- TABLE 311 AFRICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2019–2022 (KT)

- TABLE 312 AFRICA: FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023–2028 (KT)

- TABLE 313 AFRICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 314 AFRICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 315 AFRICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2019–2022 (KT)

- TABLE 316 AFRICA: FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023–2028 (KT)

- TABLE 317 FRUIT FILLINGS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 318 STRATEGIES ADOPTED BY KEY FRUIT FILLING MANUFACTURERS

- TABLE 319 COMPANY FOOTPRINT FOR KEY PLAYERS, BY FILLING TYPE

- TABLE 320 COMPANY FOOTPRINT FOR KEY PLAYERS, BY APPLICATION

- TABLE 321 COMPANY FOOTPRINT FOR KEY PLAYERS, BY REGION

- TABLE 322 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 323 DETAILED LIST OF OTHER PLAYERS

- TABLE 324 COMPETITIVE BENCHMARKING FOR OTHER PLAYERS, 2022

- TABLE 325 FRUIT FILLINGS MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 326 FRUIT FILLINGS MARKET: DEALS, 2020–2023

- TABLE 327 FRUIT FILLINGS MARKET: OTHERS, 2020–2023

- TABLE 328 PURATOS GROUP: BUSINESS OVERVIEW

- TABLE 329 PURATOS GROUP: PRODUCTS OFFERED

- TABLE 330 PURATOS GROUP: PRODUCT LAUNCHES

- TABLE 331 PURATOS GROUP: DEALS

- TABLE 332 DAWN FOOD PRODUCTS INC.: BUSINESS OVERVIEW

- TABLE 333 DAWN FOOD PRODUCTS INC.: PRODUCTS OFFERED

- TABLE 334 DAWN FOOD PRODUCTS INC.: PRODUCT LAUNCHES

- TABLE 335 DAWN FOOD PRODUCTS INC.: DEALS

- TABLE 336 AGRANA BETEILIGUNGS-AG: BUSINESS OVERVIEW

- TABLE 337 AGRANA BETEILIGUNGS-AG: PRODUCTS OFFERED

- TABLE 338 AGRANA BETEILIGUNGS-AG: DEALS

- TABLE 339 AGRANA BETEILIGUNGS-AG: OTHERS

- TABLE 340 CSM INGREDIENTS: BUSINESS OVERVIEW

- TABLE 341 CSM INGREDIENTS: PRODUCTS OFFERED

- TABLE 342 CSM INGREDIENTS: DEALS

- TABLE 343 CSM INGREDIENTS: OTHERS

- TABLE 344 BARRY CALLEBAUT: BUSINESS OVERVIEW

- TABLE 345 BARRY CALLEBAUT: PRODUCTS OFFERED

- TABLE 346 BARRY CALLEBAUT: PRODUCT LAUNCHES

- TABLE 347 BARRY CALLEBAUT: DEALS

- TABLE 348 BARRY CALLEBAUT: OTHERS

- TABLE 349 ZENTIS GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 350 ZENTIS GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 351 ZENTIS GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 352 ZENTIS GMBH & CO. KG: OTHERS

- TABLE 353 BAKELS WORLDWIDE: BUSINESS OVERVIEW

- TABLE 354 BAKELS WORLDWIDE: PRODUCTS OFFERED

- TABLE 355 BAKELS WORLDWIDE: DEALS

- TABLE 356 BAKELS WORLDWIDE: OTHERS

- TABLE 357 ANDROS GROUP: BUSINESS OVERVIEW

- TABLE 358 ANDROS GROUP: PRODUCTS OFFERED

- TABLE 359 ANDROS GROUP: DEALS

- TABLE 360 ANDROS GROUP: OTHERS

- TABLE 361 FRUIT FILLINGS INC.: BUSINESS OVERVIEW

- TABLE 362 FRUIT FILLINGS INC.: PRODUCTS OFFERED

- TABLE 363 RICE & COMPANY INC.: BUSINESS OVERVIEW

- TABLE 364 RICE & COMPANY INC.: PRODUCTS OFFERED

- TABLE 365 EFCO PRODUCTS INC.: BUSINESS OVERVIEW

- TABLE 366 EFCO PRODUCTS INC.: PRODUCTS OFFERED

- TABLE 367 EFCO PRODUCTS INC.: OTHERS

- TABLE 368 BALDWIN RICHARDSON FOODS: BUSINESS OVERVIEW

- TABLE 369 BALDWIN RICHARDSON FOODS: PRODUCTS OFFERED

- TABLE 370 BALDWIN RICHARDSON FOODS: OTHERS

- TABLE 371 BARKER FRUIT PROCESSORS LTD.: BUSINESS OVERVIEW

- TABLE 372 BARKER FRUIT PROCESSORS LTD.: PRODUCTS OFFERED

- TABLE 373 FRUIT CROWN PRODUCTS CORPORATION: BUSINESS OVERVIEW

- TABLE 374 FRUIT CROWN PRODUCTS CORPORATION: PRODUCTS OFFERED

- TABLE 375 WAWONA FROZEN FOODS: BUSINESS OVERVIEW

- TABLE 376 WAWONA FROZEN FOODS: PRODUCTS OFFERED

- TABLE 377 LYONS MAGNUS LLC: COMPANY OVERVIEW

- TABLE 378 PREGEL S.P.A.: COMPANY OVERVIEW

- TABLE 379 MALAS FRUIT PRODUCTS: COMPANY OVERVIEW

- TABLE 380 CORNABY'S LLC: COMPANY OVERVIEW

- TABLE 381 ALIMENTOS PROFUSA S.A. DE C.V.: COMPANY OVERVIEW

- TABLE 382 ADJACENT MARKETS

- TABLE 383 FILLINGS AND TOPPINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 384 FILLINGS AND TOPPINGS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 385 FOOD INCLUSIONS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 386 FOOD INCLUSIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 387 FROZEN BAKERY PRODUCTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 388 FROZEN BAKERY PRODUCTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

- FIGURE 1 FRUIT FILLINGS MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- FIGURE 3 LIMITATIONS AND RISK ASSESSMENT

- FIGURE 4 RECESSION INDICATORS AND THEIR IMPACT ON FRUIT FILLINGS MARKET

- FIGURE 5 FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 7 FRUIT FILLINGS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 EUROPE ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 9 RISING DEMAND FOR CONVENIENCE FOOD, GROWING HEALTH AWARENESS, AND CHANGING LIFESTYLE TO DRIVE FRUIT FILLINGS MARKET

- FIGURE 10 FRUIT FILLINGS WITHOUT PIECES SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 11 US ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 12 TROPICAL FRUITS SEGMENT TO DOMINATE ACROSS ALL REGIONS

- FIGURE 13 FRUIT FILLINGS WITHOUT PIECES SEGMENT TO DOMINATE ACROSS ALL REGIONS

- FIGURE 14 DAIRY SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 15 FRUIT FILLINGS MARKET DYNAMICS

- FIGURE 16 REVENUE SHIFT FOR FRUIT FILLINGS MARKET

- FIGURE 17 VALUE CHAIN ANALYSIS

- FIGURE 18 FRUIT FILLINGS MARKET MAP

- FIGURE 19 NUMBER OF PATENTS GRANTED BETWEEN 2019 AND 2023

- FIGURE 20 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENTS DURING 2019–2023

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- FIGURE 23 FRUIT FILLINGS MARKET, BY FILLING TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 24 FRUIT FILLINGS MARKET, BY FRUIT TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 25 FRUIT FILLINGS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 26 INDIA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD (IN TERMS OF VALUE)

- FIGURE 27 NORTH AMERICA: FRUIT FILLINGS MARKET SNAPSHOT

- FIGURE 28 NORTH AMERICAN FRUIT FILLINGS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 29 EUROPE: FRUIT FILLINGS MARKET SNAPSHOT

- FIGURE 30 EUROPEAN FRUIT FILLINGS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 31 ASIA PACIFIC FRUIT FILLINGS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 32 REVENUE ANALYSIS FOR KEY PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 33 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2022

- FIGURE 34 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 35 BARRY CALLEBAUT: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the Fruit Fillings market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), European Food Safety Authority (EFSA), Global Alliance for Improved Nutrition (GAIN), Food additive associations, and academic references pertaining to fruit fillings, to identify and collect information for this study. The secondary sources also included fruit fillings manufacturers’ annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The Fruit Fillings Market comprises several stakeholders, including raw material suppliers, fruit fillings manufacturers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include raw material suppliers and fruit fillings manufacturers. Primary sources from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the fruit fillings manufacturing companies through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

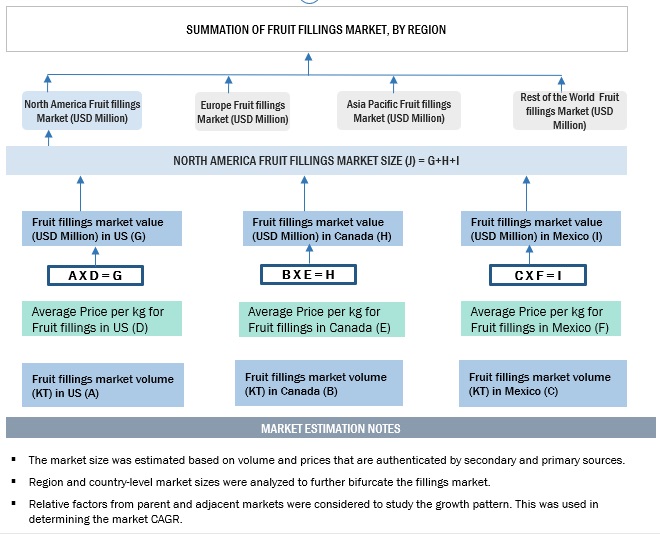

Fruit Fillings Market Size Estimation

The bottom-up approach and top-down analysis were used to estimate and validate the total size of the fillings market. These approaches were also used extensively to determine the size of various subsegments in the market for the base year in terms of value. The research methodology used to estimate the market size included the following details:

- The key players in the industry and markets were identified through extensive secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders such as CEOs, directors, and marketing executives.

Global Fruit Fillings Market: Bottom Up Approach

Global Fruit Fillings Market: Top Down Approach

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the fruit fillings market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

A fruit filling is a mixture or portion of fruits such as berries, citrus fruits, tropical fruits, and other fruity vegetables processed either into a paste, puree, pieces, or sauce format to be used for decorating, topping, injecting, and stuffing and to add taste and textures to various applications such as bakery products, confectionery, dairy products, desserts, ice creams, beverages, etc. Generally, sugar, gelatin, glucose, and other flavoring substances will be added.

Stakeholders

- Fruit filling manufacturers

- Raw material suppliers

- Fruit filling traders, distributors, and suppliers

- Fruit and vegetable processors

- Food processors and manufacturers

-

Regulatory bodies such as

- US Food and Drug Administration (FDA)

- European Commission (EC)

- European Food Safety Authority (EFSA)

- United States Department of Agriculture (USDA)

- Food Standards Australia New Zealand (FSANZ)

- Global Alliance for Improved Nutrition (GAIN)

- Government agencies and NGOs

- Commercial research & development (R&D) institutions and financial institutions

- Importers and exporters of processed fruit and vegetable ingredients

- Food and Agriculture Organization (FAO)

- World Health Organization (WHO)

- Intermediary suppliers such as wholesalers and dealers

Fruit Fillings Market Report Objectives

Market Intelligence

- To determine and project the size of the fruit fillings market with respect to filling type, fruit type, application, and region in terms of value and volume, over five years, ranging from 2023 to 2028

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- To identify and profile the key players in the fruit fillings market

-

To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

- To provide insights on key product innovations and investments in the fruit fillings market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for Fruit Fillings into Poland, Hungary, Romania, and Ireland

- Further breakdown of other countries in the RoW market for Fruit Fillings into South America, Middle East & Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fruit Fillings Market