HUD Helmet Market by Connectivity, Component, Display, Outer Shell Material, Technology, End-User (Racing Professional, Personal Use), Function (Navigation, Communication, Performance Monitoring), Power Supply, and Region - Global Forecast to 2030

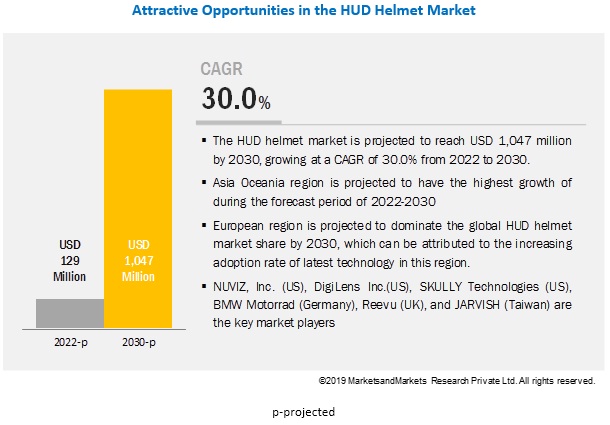

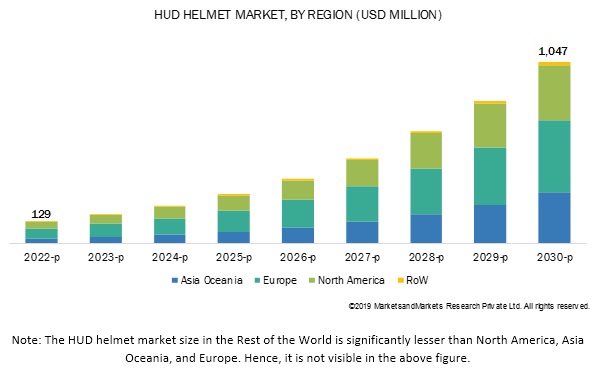

[184 Pages Report] The global HUD helmet market size is projected to reach USD 1,047 million by 2030, at a CAGR of 30.0% from 2022 to 2030. The key growth drivers of the market are increasing luxury motorcycle sales and rising adoption of technologically advanced accessories by motorcycle enthusiasts.

The tethered type of connectivity is expected to hold the largest share in the HUD helmet market during the forecast period.

The tethered connectivity type enhances the performance of navigation and communication functions of the HUD helmet. The increasing trend of connected motorcycles is another key factor that drives the tethered connectivity type in the market. Some of the leading companies in the market use tethered connectivity. For instance, REYEDR is a New Zealand based HUD helmet solution provider. The connectivity of the REYEDR HUD with smartphone app offers features such as speed, turn by turn navigation, caller ID, audio alerts, manual SOS, and music. The smartphone app further provides details such as route and ride, stats of travel, and GFX data.

Carbon fiber is expected to hold the largest share in the HUD helmet market by outer shell material type.

The properties of carbon fiber, such as high tensile strength, ability to absorb high impacts, and lightweight, make it a suitable for the manufacture of HUD helmet. As it is lightweight, carbon fiber enhances safety and comfort. Leading players in the market including Schuberth GmbH and BMW Motorrad offer helmets made of full carbon shell.

Asia Oceania region is projected to register the highest growth in the HUD helmet market during the forecast period.

The market growth in Asia Oceania can be attributed to the increasing purchasing power of the consumer in countries such as India, China, Indonesia, and Thailand. The presence of HUD helmet manufacturers, such as SHOEI CO. LTD., Crosshelmet, and Japan Display Inc. (JDI), has also fueled the growth of the market in the region. Increasing sales of motorcycles and growing demand for safety of the motorcycle rider in India and China are expected to drive the market in the region. Japan is projected to lead the Asia Oceania market. The Japanese motorcycle market has shown slight growth in sales in the year 2019, till August. Motorcycle sales during the specified period were recorded to be 245,992 units, which is 0.7% higher compared to the same period in 2018. Honda and Yamaha dominate the Japanese motorcycle market. These two companies sold 118,000 and 54,562 units, respectively in the year 2019, till August.

Key Market Players

The HUD helmet market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are NUVIZ, Inc. (US), DigiLens Inc. (US), SKULLY Technologies (US), BMW Motorrad (Germany), Reevu (UK), and JARVISH (Taiwan). These companies have strong distribution networks at a global level. Also, these companies offer an extensive range of products in the aftermarket. The key strategies adopted by these companies to sustain their market position are new product developments, mergers & acquisitions, and expansions.

Scope of Report

|

Report Metric |

Details |

|

Market size available for years |

2022–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2030 |

|

Forecast units |

Value (USD million) and volume (‘000 units) |

|

Segments covered |

Component, connectivity, display, end-user, outer shell material, power supply, technology, function, and region |

|

Geographies covered |

Europe, North America, Asia Oceania, and RoW |

|

Companies covered |

|

This research report categorizes the HUD helmet market based on connectivity, component, display, outer shell material, technology, end-user, power supply system, function, and region.

By Connectivity

- Tethered

- Embedded

By Component

- Hardware

- Software

By Display

- OLED

- LCOS

- LCD & LED

By Outer shell material

- Carbon fiber

- Kevlar

- Plastic & glass fiber

By Power supply

- Rechargeable batteries

- Solar-powered system

- Vehicle battery powered

By Technology

- Conventional HUD

- AR HUD

By End-user

- Racing professionals

- Personal use

By Function

- Navigation

- Communication

- Performance monitoring

By Region

- Europe

- North America

- Asia Oceania

- Rest of the World

Recent Developments

- In May 2019, DigiLens Inc. announced the first full-color eyeglass display using robust plastic substrates. The news comes on the heels of the company’s recent announcement of the closing of a USD 50 million Series C round of funding. The unique plastic sheet with TTV (total thickness variation) leverages Mitsubishi Chemical’s strong background in advanced polymer and DigiLens’ expertise in creating holographic waveguide displays and materials for global automotive, enterprise, consumer, avionics, and military brands. DigiLens’ Holocrystal photopolymer is an extraordinarily high-index modulation system that combines proven liquid crystal (LC) and monomer components. It works by creating optical “nano-structures” within the waveguides that direct and diffract light to produce an inexpensive and highly efficient wide field-of-view for eyeglass and other large-format head-up displays (HUDs).

- In May 2019, SKULLY Technologies announced the launch of a new version of the FENIX AR: 2.1.0. This version improves, among other elements, the performance of music and voice commands and the text-to-speech module making the FENIX more efficient in its use.

-

In January 2019, LIVEMAP showcased its new smart Helmet prototype at the CES in Las Vegas. Its head-up display projection technology is expected to offer the best motorcycle riding experience with unique navigation services, hands-free communication, video recording, and voice control all in one Livemap helmet. Special information sessions with Livemap management are available for media representatives and motorcycle bloggers.

Critical Questions:

- How will motorcycle sales trends impact the HUD helmet market in the long term?

- How will government regulations impact the HUD helmet market?

- What are the upcoming trends in the HUD helmet market? What impact would they make post 2022?

- What are the key strategies adopted by leading market players to increase their revenue?

- Which regions and countries are expected to be the key markets for HUD helmet over the next decade?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Segmental Definitions, Inclusions, and Exclusions

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Study

1.4 Package Size

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Base Numbers

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Data Triangulation Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown

2.6 Assumptions

2.7 Risk Assessment & Ranges

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 43)

4.1 Attractive Opportunities in the HUD Helmet Market

4.2 Market, By Country

4.3 European Market, By Component Type & Country

4.4 Market, By Technology Type

4.5 Market, By Outer Shell Material Type

4.6 Market, By Display Type

5 Market Overview (Page No. - 48)

5.1 Introduction

5.1.1 HUD Helmet Related Standards

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Concern for Safety of Motorcycle Riders

5.2.1.2 Rising Preference for Connected Motorcycles

5.2.1.3 Increasing Government Regulation on Wearing Helmets

5.2.1.3.1 Legal Age for Children to Ride as A Motorcycle Passenger in Select European Countries

5.2.2 Restraints

5.2.2.1 Lack of Accuracy in Distance Estimation

5.2.2.2 Difficulty in Attaining Optical Contrast and Perceptual Tunneling

5.2.3 Opportunities

5.2.3.1 Increased On-Board Diagnostics Information Displayed on HUD

5.2.3.2 Improvements in 5g Network Technology

5.2.4 Challenges

5.2.4.1 High Cost of HUD Helmet

5.3 HUD Helmet Market, Scenarios (2022–2030)

5.3.1 Market, Most Likely Scenario

5.3.2 Market, Optimistic Scenario

5.3.3 Market, Pessimistic Scenario

6 Industry Trends (Page No. - 61)

6.1 Porter’s 5 Forces

6.2 Value Chain Analysis

6.3 Technological Overview

6.3.1 Hardware Requirements

6.3.2 On-Board Diagnostics

7 HUD Helmet Market, By Component Type (Page No. - 65)

7.1 Introduction

7.2 Research Methodology

7.3 Hardware

7.3.1 Display

7.3.2 Connectivity Devices

7.3.3 Sensors

7.3.4 Power Supply Devices

7.3.5 Microcontroller Unit

7.3.6 Audio Devices

7.3.7 Sensors Have the Largest Share of the Total Cost of HUD Helmet

7.4 Software

7.4.1 Integration of Advanced Features Will Drive the Software Segment of HUD Helmet Market

7.5 Key Industry Insights

8 HUD Helmet Market, By Outer Shell Material Type (Page No. - 72)

8.1 Introduction

8.2 Research Methodology

8.3 Carbon Fiber

8.3.1 High Tensile Strength and Lightweight of Carbon Fiber Will Boost the Demand for Carbon Fiber in Market

8.4 Plastic & Glass Fiber

8.4.1 Flexibility and Ability to Absorb and Dissipate Impact Energy Efficiently Will Drive the Market for Glass Fiber

8.5 Kevlar

8.5.1 Lightweight and Impact and Abrasion Resistance Will Boost the Demand for Kevlar in Market

8.6 Key Industry Insights

9 HUD Helmet Market, By Connectivity Type (Page No. - 78)

9.1 Introduction

9.2 Research Methodology

9.3 Tethered System

9.3.1 Easy Connectivity With Smartphones Via Bluetooth Would Drive the Tethered System Market

9.4 Embedded System

9.4.1 Better Performance for Specific Tasks and Low Cost Would Drive the Embedded System Market

9.5 Key Industry Insights

10 HUD Helmet Market, By Display Type (Page No. - 82)

10.1 Introduction

10.2 Research Methodology

10.3 Liquid Crystal on Silicon (LCOS) Display

10.3.1 Better Visibility and Low Optical Viewing Distance Would Drive the LCOS Display Market

10.4 Liquid Crystal Display (LCD) & Light Emitting Diode (LED)

10.4.1 Low Cost of LCD Can Help to Reduce the Overall Cost of HUD Helmet

10.5 Organic Light-Emitting Diode (OLED) Display

10.5.1 High Cost and Limited Lifetime are Major Drawbacks of Using OLED Display in HUD Helmet

10.6 Key Industry Insights

11 HUD Helmet Market, By End-User Type (Page No. - 88)

11.1 Introduction

11.2 Research Methodology

11.3 Racing Professionals

11.3.1 High Risk of Accident in Racing Events Would Boost the Demand for HUD Helmet in Racing Professional Segment

11.4 Personal Use

11.4.1 Growing Number of Motorcycle Enthusiasts Would Drive the Personal Use Segment of Market

11.5 Key Industry Insights

12 HUD Helmet Market, By Technology Type (Page No. - 92)

12.1 Introduction

12.2 Research Methodology

12.3 Conventional HUD

12.3.1 Asia Oceania is Projected to Be the Fastest Growing Market for Conventional HUD Segment

12.4 Augmented Reality (AR) HUD

12.4.1 Technological Advancements and Increasing Demand for Advanced Safety Would Drive the Ar-Based Market

12.5 Key Industry Insights

13 HUD Helmet Market, By Power Supply Type (Page No. - 96)

13.1 Introduction

13.2 Rechargeable Batteries

13.3 Solar Powered Supply

13.4 Vehicle Battery Powered

14 HUD Helmet Market, By Function Type (Page No. - 98)

14.1 Introduction

14.2 Navigation

14.3 Communication

14.4 Performance Monitoring

14.5 Others

15 HUD Helmet Market, By Region (Page No. - 100)

15.1 Introduction

15.2 Europe

15.2.1 France

15.2.1.1 Operational Data

15.2.1.2 Growing Motorcycle Sales Would Drive the Market in France

15.2.2 Germany

15.2.2.1 Operational Data

15.2.2.2 Presence of Key Market Players Would Drive the German Market

15.2.3 Spain

15.2.3.1 Operational Data

15.2.3.2 Racing Professionals Segment is Projected to Lead the HUD Helmet Market in Spain

15.2.4 Italy

15.2.4.1 Operational Data

15.2.4.2 Growing Motorcycle Sales Would Drive the Market in Italy

15.2.5 Turkey

15.2.5.1 Operational Data

15.2.5.2 Turkey is Projected to Witness Significant Growth in Market

15.2.6 UK

15.2.6.1 Operational Data

15.2.6.2 High Demand for Luxury Motorcycles Equipped With Advanced Features Would Drive the Uk HUD Helmet Market

15.3 North America

15.3.1 US

15.3.1.1 Operational Data

15.3.1.2 Increasing Number of HUD Helmet Suppliers in the US Would Fuel the Market

15.3.2 Canada

15.3.2.1 Increasing Number of Motorcycle Enthusiasts Would Drive the Market in Canada

15.3.3 Mexico

15.3.3.1 Operational Data

15.3.3.2 Racing Professional Segment is Projected to Be the Largest Market for HUD Helmet in Mexico

15.4 Asia Oceania

15.4.1 Japan

15.4.1.1 Operational Data

15.4.1.2 Japan is Projected to Be the Largest Market for HUD Helmet in Asia Oceania

15.4.2 Taiwan

15.4.2.1 Operational Data

15.4.2.2 Growing Adoption of High-Tech Electronic Products in Taiwan Would Drive the HUD Helmet Market

15.4.3 China

15.4.3.1 Operational Data

15.4.3.2 Low Manufacturing Cost Would Drive the Market in China

15.4.4 Indonesia

15.4.4.1 Operational Data

15.4.4.2 Increasing Demand for Electric Motorcycles Would Drive the Market for HUD Helmet in Indonesia

15.4.5 India

15.4.5.1 Operational Data

15.4.5.2 India is Expected to Witness Significant Growth of Market

15.4.6 Thailand

15.4.6.1 Operational Data

15.4.6.2 Growing Demand for Luxury Motorcycle Brands in Thailand Would Drive the HUD Helmet Market

15.5 RoW

15.5.1 Brazil

15.5.1.1 Operational Data

15.5.1.2 Brazil is Projected to Hold A Significant Share of Market in RoW Region

15.5.2 South Africa

15.5.2.1 South Africa is Expected to Witness Significant Growth of HUD Helmet Market

16 Competitive Landscape (Page No. - 136)

16.1 Overview

16.2 Market Ranking Analysis

16.3 Competitive Scenario

16.3.1 New Product Developments/Launches

16.3.2 Collaboration

16.3.3 Partnership

16.4 Competitive Leadership Mapping

16.4.1 Terminology

16.4.2 Visionary Leaders

16.4.3 Innovators

16.4.4 Dynamic Differentiators

16.4.5 Emerging Companies

16.5 Strength of Product Portfolio

16.6 Business Strategy Excellence

16.7 Winners vs. Losers

16.7.1 Winners

16.7.2 Tail-Enders/Losers

17 Company Profiles (Page No. - 145)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

17.1 NUVIZ, Inc.

17.2 Digilens Inc.

17.3 SKULLY Technologies

17.4 Reyedr

17.5 Bikesystems

17.6 Intelligent Cranium Helmets LLC (ICH)

17.7 Livemap

17.8 SHOEI CO. Ltd.

17.9 Nolan Communication System

17.10 Crosshelmet

17.11 Whyre

17.12 JARVISH Inc.

17.13 Texas Instruments

17.14 BMW Motorrad

17.15 Japan Display Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

17.16 Other Key Players

17.16.1 Reevu

17.16.2 Sena Technologies, Inc.

17.16.3 Schuberth GmbH

17.16.4 Cardo Systems

17.16.5 Hudway, LLC.

17.16.6 Forcite Helmet Systems

18 Appendix (Page No. - 177)

18.1 Insights of Industry Experts

18.2 Currency & Pricing

18.3 Discussion Guide

18.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

18.5 Available Customizations

18.6 Related Reports

18.7 Author Details

List of Tables (132 Tables)

Table 1 HUD Helmet Market: Segmental Definitions, Inclusions, and Exclusions

Table 2 Risk Assessment & Ranges

Table 3 Facts About Motorcycle Helmets

Table 4 HUD Helmet Related Standards

Table 5 Human Errors That Lead to Crashes

Table 6 Fatalities By Type of Area and Mode of Transport in European Union, 2016

Table 7 Applications That Benefit From HUD

Table 8 Legal Age for Children to Ride as A Motorcycle Passenger in Select European Countries

Table 9 Properties of Helmet Parts as Per United Nations Economic Commission for Europe Regulation 22

Table 10 Summary of Systematic Review of Effectiveness of Motorcycle Helmets

Table 11 Data Collected By Obd-Ii From Vehicle Ecu

Table 12 4g vs. 5g Specification

Table 13 Market (Most Likely), By Region, 2022–2030 (USD Million)

Table 14 Market (Optimistic), By Region, 2022–2030 (USD Million)

Table 15 Market (Pessimistic), By Region, 2022–2030 (USD Million)

Table 16 Market, By Component Type, 2022–2030 (USD Million)

Table 17 Microcontroller Specification Comparison Chart

Table 18 Hardware: Market, By Region, 2022–2030 (USD Million)

Table 19 Hardware: Market, By Component Type, 2022–2030 (USD Million)

Table 20 Software: Market, By Region, 2022–2030 (USD Million)

Table 21 Comparison of Properties of Materials

Table 22 Average Sharp Safety Score of Material Types

Table 23 HUD Helmet Market, By Outer Shell Material Type, 2022–2030 (Thousand Units)

Table 24 Carbon Fiber Material: Market, By Region, 2022–2030 (Thousand Units)

Table 25 Plastic & Glass Fiber: Market, By Region, 2022–2030 (Thousand Units)

Table 26 Kevlar: Market, By Region, 2022–2030 (Thousand Units)

Table 27 Market, By Connectivity Type, 2022–2030 (Thousand Units)

Table 28 Tethered System: Market, By Region, 2022–2030 (Thousand Units)

Table 29 Embedded System: Market, By Region, 2022–2030 (Thousand Units)

Table 30 Market, By Display Type, 2022–2030 (Thousand Units)

Table 31 OLED vs. LCD vs. Micro OLED vs. LCOS: Maximum Performance Specification Comparison

Table 32 LCOS Display: Market, By Region, 2022–2030 (Thousand Units)

Table 33 LCD & LED Display: Market, By Region, 2022–2030 (Thousand Units)

Table 34 OLED Display: Market, By Region, 2022–2030 (Thousand Units)

Table 35 Market, By End-User, 2022–2030 (Thousand Units)

Table 36 Racing Professionals: Market, By Region, 2022–2030 (Thousand Units)

Table 37 Personal Use: Market, By Region, 2022–2030 (Thousand Units)

Table 38 HUD Helmet Market, By Technology Type, 2022–2030 (USD Million)

Table 39 Conventional HUD: Market, By Region, 2022–2030 (USD Million)

Table 40 Augmented Reality HUD: Market, By Region, 2022–2030 (USD Million)

Table 41 Battery Type Comparison

Table 42 Market, By Region, 2022–2030 (Thousand Units)

Table 43 Market, By Region, 2022–2030 (USD Million)

Table 44 Motorcycle Number Per Fatality By Country

Table 45 Europe: Market, By Country, 2022–2030 (‘000 Units)

Table 46 Europe: Market, By Country, 2022–2030 (USD Million)

Table 47 Europe: Market, By Technology Type, 2022–2030 (USD Million)

Table 48 Europe: Market, By Component Type, 2022–2030 (USD Million)

Table 49 Europe: Market, By Hardware Component Type, 2022–2030 (USD Million)

Table 50 Europe: Market, By Outer Shell Material Type, 2022–2030 (Thousand Units)

Table 51 Europe: Market, By Connectivity Type, 2022–2030 (Thousand Units)

Table 52 Europe: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 53 Europe: Market, By Display Type, 2022–2030 (Thousand Units)

Table 54 France: HUD Helmet Market, By End-User Type, 2022–2030 (Thousand Units)

Table 55 Germany: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 56 Spain: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 57 Italy: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 58 Turkey: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 59 Uk: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 60 North America: Market, By Country, 2022–2030 (Thousand Units)

Table 61 North America: Market, By Country, 2022–2030 (USD Million)

Table 62 North America: Market, By Technology Type, 2022–2030 (USD Million)

Table 63 North America: Market, By Component Type, 2022–2030 (USD Million)

Table 64 North America: Market, By Hardware Component Type, 2022–2030 (USD Million)

Table 65 North America: Market, By Outer Shell Material Type, 2022–2030 (Thousand Units)

Table 66 North America: Market, By Connectivity Type, 2022–2030 (‘Thousand Units)

Table 67 North America: HUD Helmet Market, By End-User Type, 2022–2030 (Thousand Units)

Table 68 North America: Market, By Display Type,2022–2030 (Thousand Units)

Table 69 US: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 70 Canada: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 71 Mexico: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 72 Asia Oceania: Market, By Country, 2022–2030 (Thousand Units)

Table 73 Asia Oceania: Market, By Country, 2022–2030 (USD Million)

Table 74 Asia Oceania: Market, By Technology Type, 2022–2030 (USD Million)

Table 75 Asia Oceania: Market, By Component Type, 2022–2030 (USD Million)

Table 76 Asia Oceania: Market, By Hardware Component Type, 2022–2030 (USD Million)

Table 77 Asia Oceania: Market, By Outer Shell Material Type, 2022–2030 (Thousand Units)

Table 78 Asia Oceania: Market, By Connectivity Type, 2022–2030 (Thousand Units)

Table 79 Asia Oceania: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 80 Asia Oceania: HUD Helmet Market, By Display Type, 2022–2030 (Thousand Units)

Table 81 Japan: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 82 Taiwan: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 83 China: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 84 Indonesia: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 85 India: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 86 Thailand: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 87 RoW: Market, By Country, 2022–2030 (Thousand Units)

Table 88 RoW: Market, By Country, 2022–2030 (USD Million)

Table 89 RoW: Market, By Technology Type, 2022–2030 (USD Million)

Table 90 RoW: Market, By Component Type, 2022–2030 (USD Million)

Table 91 RoW: Market, By Hardware Component Type, 2022–2030 (USD Million)

Table 92 RoW: Market, By Outer Shell Material Type, 2022–2030 (Thousand Units)

Table 93 RoW: Market, By Connectivity Type, 2022–2030 (Thousand Units)

Table 94 RoW: HUD Helmet Market, By End-User Type, 2022–2030 (‘000 Units)

Table 95 RoW: Market, By Display Type, 2022–2030 (Thousand Units)

Table 96 Brazil: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 97 South Africa: Market, By End-User Type, 2022–2030 (Thousand Units)

Table 98 New Product Developments/Launches

Table 99 Collaboration

Table 100 Partnership

Table 101 Product Offerings

Table 102 New Product Launch

Table 103 Partnerships

Table 104 Product Offerings

Table 105 New Product Launches

Table 106 Collaborations

Table 107 Partnership

Table 108 Product Offerings

Table 109 New Product Launches

Table 110 Product Offerings

Table 111 New Product Launches

Table 112 Product Offerings

Table 113 Product Offerings

Table 114 Product Offerings

Table 115 New Product Launches

Table 116 Product Offerings

Table 117 Collaborations

Table 118 Product Offerings

Table 119 Collaborations

Table 120 Product Offerings

Table 121 Product Offerings

Table 122 New Product Launches

Table 123 Product Offerings

Table 124 New Product Launches

Table 125 Collaborations

Table 126 Product Offerings

Table 127 New Product Launches

Table 128 Product Offerings

Table 129 New Product Launches

Table 130 Product Offerings

Table 131 New Product Launches

Table 132 Currency Exchange Rates (W.R.T. USD)

List of Figures (47 Figures)

Figure 1 HUD Helmet Market: Research Design

Figure 2 Research Design Model

Figure 3 Breakdown of Primary Interviews

Figure 4 Market Estimation Methodology and Key Assumptions

Figure 5 Top-Down Approach: Market

Figure 6 Market Overview

Figure 7 Market: Market Dynamics

Figure 8 Europe is Projected to Hold the Largest Share of HUD Helmet Market in 2022

Figure 9 Hardware is Projected to Be the Largest Segment of Market in 2022

Figure 10 Carbon Fiber is Projected to Be the Largest Market of HUD Helmet, By Outer Shell Material Type, in 2030

Figure 11 Emerging Opportunity and Future Revenue Mix for Market

Figure 12 Increasing Concern About Safety of Motorcycle Riders and Improving Road Safety Regulation are Expected to Drive the Market

Figure 13 Asia Oceania is Projected to Be the Fastest Growing Market During the Forecast Period, By Value

Figure 14 Hardware Segment is Projected to Account for the Largest Share of European Market in 2030

Figure 15 Conventional HUD is Projected to Be the Largest Segment of Market in 2030

Figure 16 Carbon Fiber is Projected to Be the Largest Market, in Terms of Volume, in 2030

Figure 17 OLED is Projected to Be the Fastest Growing Market During the Forecast Period

Figure 18 Bike Mounted Motorcycle Interface Module

Figure 19 Menu Flow Chart of Helmet HUD

Figure 20 HUD Helmet Market: Market Dynamics

Figure 21 HUD Benefits for End-Users

Figure 22 Categories of HUD Design

Figure 23 Value Chain Analysis of HUD Helmet

Figure 24 Flow Chart of HUD Working With Technology Types

Figure 25 Market, By Component Type, 2022 vs. 2030 (USD Million)

Figure 26 Market, By Outer Shell Material Type, 2022 vs. 2030 (Thousand Units)

Figure 27 Market, By Connectivity Type, 2022 vs. 2030 (Thousand Units)

Figure 28 Market, By Display Type, 2022 vs. 2030 (Thousand Units)

Figure 29 Market, By End-User, 2022 vs. 2030 (Thousand Units)

Figure 30 HUD Helmet Market, By Technology Type, 2022 vs. 2030 (USD Million)

Figure 31 Bike-Mounted Motorcycle Interface Module Overview

Figure 32 Market, By Region, 2022 vs. 2030 (USD Million)

Figure 33 Europe: Market Snapshot

Figure 34 North America: Market Snapshot

Figure 35 New Registration of Motorcycle in the Us, 2013 vs. 2017 (Thousand Units)

Figure 36 Asia Oceania: Market Snapshot

Figure 37 RoW: Market, 2022 vs. 2030 (USD Million)

Figure 38 Market Ranking Analysis: Market

Figure 39 HUD Helmet Market (Global): Competitive Leadership Mapping, 2019

Figure 40 NUVIZ, Inc: SWOT Analysis

Figure 41 Digilens, Inc: SWOT Analysis

Figure 42 SKULLY Technologies: SWOT Analysis

Figure 43 Reyedr: SWOT Analysis

Figure 44 Bikesystems: SWOT Analysis

Figure 45 SHOEI CO. Ltd: Company Snapshot

Figure 46 Texas Instruments: Company Snapshot

Figure 47 Japan Display Inc: Company Snapshot

The study involved four major activities for projecting the size of the HUD helmet market, which include, exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size. Post that, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

The study involves a country-level analysis of the HUD helmet market. This analysis involves historical trends as well as existing penetrations by country and end-user type. The analysis is projected based on various factors such as growth trends in motorcycle production and regulations or mandates on the use of helmets and electronics on motorcycles. In the secondary research process, various secondary sources have been used to identify and collect information useful for an extensive commercial study of the market. Secondary sources include company annual reports/presentations, press releases, industry association publications [for example, Automobile Organizations/Associations, Traders, Distributors, and Suppliers of HUD helmets, Telematics vendors, and Government entities], motorcycle magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva).

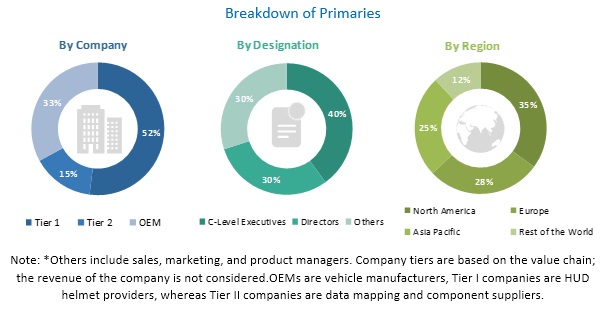

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the HUD helmet market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across four major regions, namely, North America, Asia Oceania, Europe, and Rest of the World. Approximately, 60% and 40% of primary interviews have been conducted from the supply-side and industry associations and dealers/distributors, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert’s opinions, has led us to the findings as described in the remainder of this report. The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the HUD helmet market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

The top-down approach has been used to estimate and validate the size of the HUD helmet market. The market size, by volume, has been derived using primary insights and secondary sources. The number of motorcyclists with per capita income equal to or more than USD 100 thousand is derived using secondary sources. This number is considered as the target customer base of HUD helmets. The number of target customers is then multiplied with the projected conversion rate of target customers into actual customers to derive the total number of HUD helmet buyers. The conversion rate is identified using primary insights and secondary sources. It has been assumed that each helmet buyer will purchase one HUD helmet to derive the market, in terms of volume.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides.

Report Objectives

- To define, describe, and project the HUD helmet market, by volume (000’ units) and value (USD million), during 2022–2030

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the market

- To analyze and forecast the market, by value, based on component (hardware and software)

- To analyze and forecast the HUD helmet, by value, based on technology (conventional HUD and AR HUD)

- To analyze and forecast the HUD helmet market, by volume, based on outer shell material (carbon fiber, kevlar, and plastic & glass fiber)

- To analyze and forecast the market, by volume, based on end-user (racing professionals and personal use)

- To analyze and forecast the market, by volume, based on display type (OLED, LCOS, and LCD & LED)

- To analyze and forecast the market, by volume, based on connectivity type (tethered and embedded)

- To provide qualitative information of the market for HUD helmet based on function (navigation, communication, and performance monitoring)

- To provide qualitative information of the market for HUD helmet based on power supply type (rechargeable batteries, solar-powered, and vehicle battery powered)

- To forecast the HUD helmet market, by value and volume, with respect to 4 regions, namely, Europe, North America, Asia Oceania, and the Rest of the World (RoW)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions in the market

Available Customizations

- HUD helmet market, by end user at country level

- HUD helmet market, by connectivity at country level

- Profiling of additional market players (Up to 3)

Growth opportunities and latent adjacency in HUD Helmet Market