Pharmaceutical Manufacturing Equipment Market

Pharmaceutical Manufacturing Equipment Market by Equipment Type (Packaging, Filling, Spray Drying, Mixing & Blending, Milling, Tablet Compression, Inspection, Granulation, Sterilization), End Product (Solid, Liquid), Technology - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global pharmaceutical manufacturing equipment market is likely to be valued at USD 21.24 billion in 2026 and USD 30.39 billion by 2032, registering a CAGR of 6.2% during the forecast period. Demand for pharmaceutical manufacturing equipment is driven by the rising production of generic and biologic drugs, increasing investments in pharmaceutical R&D, and the expansion of manufacturing facilities worldwide. Growing emphasis on regulatory compliance, quality assurance, and process automation further support market growth. Additionally, the adoption of advanced technologies, such as continuous manufacturing and single-use systems, enhances operational efficiency and accelerates equipment upgrades across pharmaceutical production sites.

KEY TAKEAWAYS

-

By RegionBy region, Asia Pacific is expected to dominate the pharmaceutical manufacturing equipment market, growing at a CAGR of 6.9% during the forecast period.

-

By Equipment TypeBy equipment type, the packaging machines segment is expected to hold a 52.4% share of the market in 2026.

-

By End-Product TypeBy end-product type, liquid segment is expected to grow at the highest CAGR during the forecast period.

-

By TechnologyBy technology, the automatic segment is expected to record a CAGR of 6.6% from 2026 to 2032.

-

Competitive Landscape - Key PlayersGEA Group Aktiengesellschaft (Germany), IMA Industria Macchine Automatiche S.p.A (Italy), and Syntegon Technology GmbH (Germany) were identified as some of the star players in the global pharmaceutical manufacturing equipment market, given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsMG2 s.r.l (Italy), Fette Compacting (Germany), and CVC Technologies (US), among others, have established themselves as specialized pharmaceutical manufacturing equipment providers by building strong capabilities in capsule filling, tablet compression, and packaging solutions. These companies are strengthening their market presence by offering application-specific equipment designed to enhance precision, efficiency, and regulatory compliance across solid dosage and packaging lines. Through continuous technological upgrades, automation integration, and strategic global expansion initiatives, they are scaling their commercial footprint in the global pharmaceutical manufacturing equipment market.

Major pharmaceutical and life sciences companies are integrating advanced manufacturing equipment across formulation, filling, packaging, and inspection processes to enhance production efficiency and product quality. Several equipment manufacturers are expanding their portfolios with automated, continuous manufacturing systems, single-use technologies, and integrated digital solutions to support high-volume and complex drug production, including biologics and sterile injectables. These developments accelerate the modernization of pharmaceutical facilities and strengthen the role of advanced manufacturing equipment in ensuring regulatory compliance, scalability, and cost-effective operations across global pharmaceutical manufacturing sites.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The pharmaceutical manufacturing equipment market is shifting from conventional tablet and liquid processing systems to advanced solutions, such as biologics processing, AI-based inspection, and cell and gene therapy equipment. Demand from pharmaceutical companies, CDMOs, and vaccine manufacturers is creating new growth opportunities for equipment providers. Companies focus on automation, digital integration, and compliance-driven systems to improve production efficiency and reduce costs. These trends are supporting faster drug development and more scalable manufacturing operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing commercialization of biologics and complex formulations

-

Growing preference for personalized medicines and targeted therapies

Level

-

High capital expenditure requirements

-

Issues related to integration with existing systems

Level

-

Expansion of contract development and manufacturing organizations

-

Mounting demand for sterile and aseptic injectable drugs

Level

-

Requirement for frequent technological upgrades

-

Complex validation and revalidation cycles

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing commercialization of biologics and complex formulations

The increasing development and commercialization of biologics, biosimilars, vaccines, monoclonal antibodies, and advanced drug delivery systems are significantly influencing the demand for pharmaceutical manufacturing equipment. Unlike conventional small-molecule drugs, biologics require highly controlled production environments, sterile processing systems, and precision-based filling technologies. This drives investments in advanced filling machines, sterilization equipment, spray drying systems, and high-performance mixing and blending machines.

Restraint: High capital expenditure requirements

High capital expenditure remains a primary restraint in the pharmaceutical manufacturing equipment market. Equipment such as tablet compression presses, high-speed filling machines, sterilization systems, and automated inspection units requires substantial upfront investment. The total cost extends beyond the purchase price and includes installation, facility modification, cleanroom integration, validation, automation software, and operator training.

Opportunity: Expansion of contract development and manufacturing organizations

The expansion of Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) represents a significant opportunity for the pharmaceutical manufacturing equipment market. Pharmaceutical companies are increasingly outsourcing production activities to reduce capital expenditure, accelerate time to market, and focus on core competencies, such as research and commercialization.

Challenge: Requirement for frequent technological upgrades

Rapid technological advancements are creating continuous upgrade pressure in the pharmaceutical manufacturing equipment market. Equipment suppliers are increasingly integrating automation, robotics, artificial intelligence-based inspection systems, real-time monitoring sensors, and data analytics platforms into packaging machines, filling systems, granulation units, and inspection equipment.

PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies end-to-end process equipment for pharmaceutical production including mixing, granulation, drying, tablet coating, sterile/aseptic processing, lyophilizers and single-use process skids for both batch and continuous manufacturing | Enables scalable, validated production with improved yield and reproducibility | Reduces contamination risk through closed/aseptic designs | Supports regulatory compliance and accelerates time-to-market |

|

Provides automated processing and primary/secondary packaging lines: tablet handling, capsule filling, blistering, cartoning, serialization, labeling and integrated end-of-line systems for oral solids and parenterals | Delivers high throughput and packaging accuracy | Lowers manual intervention and labor cost | Simplifies serialization and traceability | Improves product protection and shelf presentation |

|

Offers aseptic and non-aseptic filling systems, sterilization and inspection equipment, blister and bottle lines, track-and-trace solutions, and process automation for sterile drug manufacture | Raises product quality and batch consistency through validated aseptic technology | Strengthens GMP compliance with integrated inspection and serialization | Reduces total cost of ownership via reliable automation |

|

Supplies capsule manufacturing and filling systems, tablet compression tooling, coating machines, blister packaging and visual inspection systems tailored for small to large scale pharmaceutical producers | Provides cost-effective, energy-efficient equipment suited to emerging and established markets | Enables modular scaling of capacity | Improves production uptime | Helps meet regulatory packaging standards |

|

Delivers analytical and manufacturing support equipment including bioprocess single-use systems, environmental and process monitoring, sterilizers, analytical instruments and fill-finish support for biologics and small molecules | Strengthens quality control and process characterization | Supports scale-up from R&D to commercial production | Offers validated systems and service support that reduce technical risk and speed regulatory submissions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The pharmaceutical manufacturing equipment ecosystem comprises raw material & component suppliers, core equipment manufacturers, system integrators that collectively support end-to-end pharmaceutical production, and end users. Component suppliers provide automation, fluid control, and process technologies that are integrated into primary manufacturing and packaging equipment by OEMs. System integrators enable seamless installation, validation, and digital connectivity across production lines. End users, including pharmaceutical and biopharmaceutical manufacturers, drive the demand through requirements for compliance, scalability, and high-efficiency manufacturing, supporting continuous innovation and technology upgrades across the ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pharmaceutical Manufacturing Equipment Market, By Equipment Type

The packaging machines segment is expected to dominate the market during the forecast period due to increasing demand for high-speed, compliant, and automated packaging solutions. Growing pharmaceutical production and stringent labeling and serialization requirements are also supporting segment growth.

Pharmaceutical Manufacturing Equipment Market, By End-Product Type

The liquid segment is projected to grow at the fastest rate during the forecast period driven by the mounting demand for injectables, biologics, and sterile formulations. Expansion of vaccine and parenteral drug manufacturing is further accelerating equipment demand in this segment.

Pharmaceutical Manufacturing Equipment Market, By Technology

The automatic segment is anticipated to witness the fastest growth between 2026 and 2032 as manufacturers focus on reducing manual intervention and improving operational efficiency. Increasing adoption of automation and digital control systems is supporting advanced manufacturing practices.

REGION

Asia Pacific to be fastest-growing region across global pharmaceutical manufacturing equipment market during forecast period

Asia Pacific is expected to grow at the fastest CAGR in the pharmaceutical manufacturing equipment market during the forecast period, driven by expanding pharmaceutical production capacities in India, China, and Japan. Increasing investments in generic drug manufacturing, solid dosage equipment, and cost-effective packaging solutions are supporting regional demand. The presence of large integrated equipment providers and emerging local manufacturers is strengthening supply capabilities and enabling broader adoption of advanced manufacturing systems across the region.

PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: COMPANY EVALUATION MATRIX

In the global pharmaceutical manufacturing equipment market matrix, Syntegon Technology GmbH (Germany) and Körber AG (Germany) are positioned as STAR players with strong market presence and broad equipment portfolios across processing, packaging, and inspection solutions. Their integrated capabilities and global service networks support large-scale pharmaceutical and biopharmaceutical manufacturing operations. Thermo Fisher Scientific Inc (US), positioned as an Emerging Leader, is strengthening its presence through advanced bioprocessing technologies, expansion of high-value equipment offerings, and strategic investments aligned with growing demand for biologics and complex drug manufacturing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- GEA Group Aktiengesellschaft (Germany)

- IMA INDUSTRIA MACCHINE AUTOMATICHE S.P.A (Italy)

- Syntegon Technology GmbH (Germany)

- ACG (India)

- Thermo Fisher Scientific Inc (US)

- Körber AG (Germany)

- Coperion GmbH (Germany)

- Romaco Group (Germany)

- Marchesini Group S.p.A (Italy)

- Bausch+Ströbel SE + CO. KG (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 20.12 Billion |

| Market Forecast in 2032 (Value) | USD 30.39 Billion |

| Growth Rate | CAGR of 6.2% from 2026–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2025 |

| Forecast Period | 2026–2032 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Tablet & Capsule Manufacturing Equipment Supplier |

|

|

| Sterile Fill-Finish Equipment Provider |

|

|

| Pharmaceutical Mixing & Granulation Equipment Manufacturer |

|

|

| Cleanroom & Containment Solutions Provider |

|

|

| Pharmaceutical Packaging Equipment Developer |

|

|

RECENT DEVELOPMENTS

- January 2026 : IMA Industria Macchine Automatiche S.p.A partnered with Sharp Sterile Manufacturing to expand a sterile filling facility in Massachusetts, installing a fully automated isolated filling line for ready-to-use vials with integrated robotics, advanced weight control, and lyophilization technologies.

- April 2025 : Syntegon Technology GmbH introduced the MLD Advanced filling machine for ready-to-use nested syringes, enabling high-throughput production with integrated in-process control for enhanced quality assurance.

- June 2025 : Körber AG expanded its manufacturing presence with a new facility in Portugal, strengthening production capacity and supporting long-term investment in innovation and operational capabilities.

- March 2025 : GEA Group Aktiengesellschaft launched the kytero 10 single-use disk stack centrifuge designed for small-scale biopharmaceutical production and product development applications.

Table of Contents

Methodology

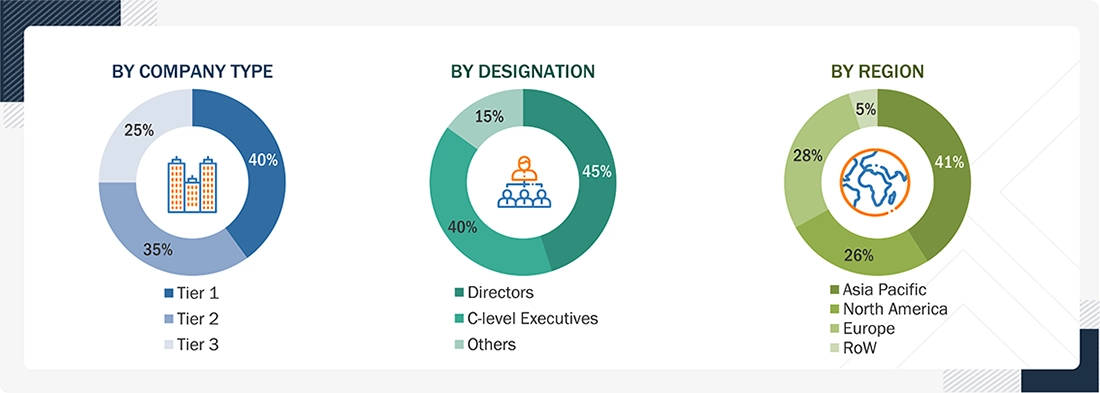

The research process for this study involved the systematic gathering, recording, and analysis of data on customers and companies operating in the pharmaceutical manufacturing equipment market. This process involved the extensive use of secondary sources, directories, and databases (Factiva and Oanda) to identify and collect valuable information for the comprehensive, technical, market-oriented, and commercial study of the pharmaceutical manufacturing equipment market. In-depth interviews were conducted with primary respondents, including experts from core and related industries, as well as preferred manufacturers, to obtain and verify critical qualitative and quantitative information and assess growth prospects. Key players in the pharmaceutical manufacturing equipment market were identified through secondary research, and their market rankings were determined through a combination of primary and secondary research. This research involved studying the annual reports of top players and conducting interviews with key industry experts, including CEOs, directors, and marketing executives.

Secondary Research

Various sources were utilized in the secondary research process to identify and collect information relevant to this study. These include company annual reports, press releases, investor presentations, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases. Secondary research was primarily used to gather key information about the industry’s value chain, the total pool of market players, market classification according to industry trends at the most detailed level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

Primary research was conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, including drivers, restraints, opportunities, challenges, and industry trends, as well as key strategies adopted by players operating in the pharmaceutical manufacturing equipment market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after gaining insights into the pharmaceutical manufacturing equipment market scenarios through secondary research. Several primary interviews were conducted with experts from the demand (region) and supply side (equipment type, end-product type, and technology) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 60% and 40% of the primary interviews were conducted from the supply and demand sides, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

Notes: The three tiers of companies have been defined based on their total/segmental revenue as of 2025: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million–USD 1 billion, and Tier 3 = <USD 500 million.

Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were implemented to estimate and validate the size of the pharmaceutical manufacturing equipment market and various other dependent submarkets. Key players were identified through secondary research, and their market share in the respective regions was determined through a combination of primary and secondary research. This entire research methodology involved studying the annual and financial reports of the top players, as well as conducting interviews with experts (CEOs, VPs, directors, and marketing executives) to gather key insights (both quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Pharmaceutical Manufacturing Equipment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process, as explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and obtain precise statistics for all segments and subsegments, market breakdown and data triangulation procedures were employed, as applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market has been validated using both top-down and bottom-up approaches.

Market Definition

The pharmaceutical manufacturing equipment market covers the global ecosystem involved in the development, production, processing, and packaging of pharmaceutical products across solid and liquid formulations. It includes machinery and integrated systems designed to ensure precision and sterility. These systems maintain regulatory compliance and operational efficiency. Equipment supports activities from raw material handling to final packaging. Manufacturers use these systems to maintain product quality. Large-scale and contract facilities rely on advanced machinery to optimize throughput.

Key Stakeholders

- Pharmaceutical manufacturing equipment manufacturers

- End users

- Automation consultants

- Research organizations

- Technology investors

- Technology standards organizations, forums, alliances, and associations

- Process automation and instrumentation solution and product suppliers

- Instrumentation and automation products’ original equipment manufacturers (OEMs)

- Energy industry associations

Report Objectives

- To describe and forecast the pharmaceutical manufacturing equipment market, by equipment type, end-product type, and technology, in terms of value

- To forecast the market size for four key regions, namely North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their country-level analyses, in terms of value

- To estimate the market size, by equipment type, in terms of volume

- To provide detailed information regarding the major factors influencing the growth of the market, namely, drivers, restraints, opportunities, and challenges

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain of the pharmaceutical manufacturing equipment ecosystem, along with market trends and use cases

- To analyze opportunities for stakeholders in the market by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as product launches, mergers, acquisitions, partnerships, collaborations, and expansions, in the pharmaceutical manufacturing equipment market.

- To benchmark market players using the company evaluation matrix, which analyzes players based on various parameters within broad business categories and product strategies

- To provide information on Porter’s five forces analysis, pricing analysis, trade analysis, investment and funding scenario, key conferences and events, regulatory landscape, ecosystem analysis, case study analysis, patent analysis, technology analysis, unmet needs of various equipment types, interconnected markets and cross-sector opportunities, macroeconomic outlook, and the impact of AI, and the impact of 2025 US tariff

- To benchmark market players using the company evaluation quadrant, which analyzes players based on various parameters within broad business categories and product strategies

- To provide a macroeconomic outlook for all regions covered in this report

- To provide information on ecosystem analysis, case study analysis, patent analysis, technology analysis, unmet needs from various applications, interconnected markets, and cross-sector opportunities, and the impact of AI and its use cases, and the 2025 US tariff impact

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pharmaceutical Manufacturing Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pharmaceutical Manufacturing Equipment Market