Industrial IoT Market by Offering (Hardware (Processors, Connectivity ICs, Sensors, Memory Devices, Logic Devices), Software (PLM, MES, SCADA, OMS), Platforms), Connectivity Technology, Deployment, Vertical and Region - Global Forecast to 2029

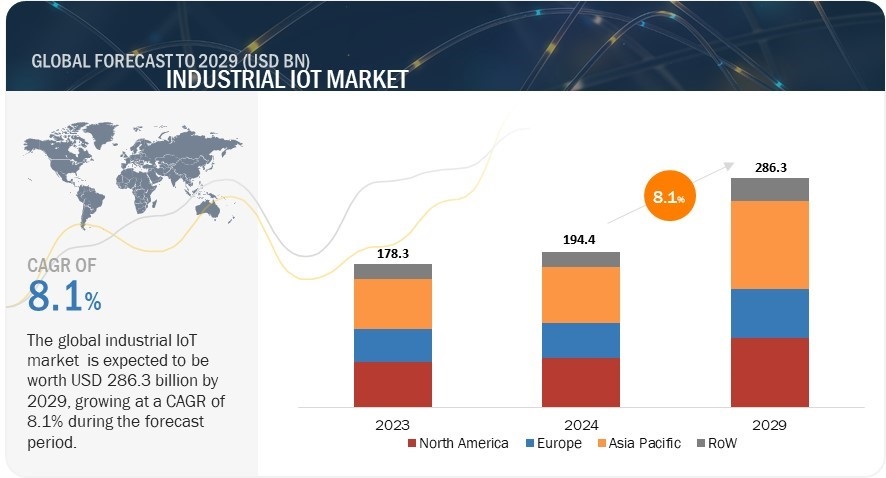

[243 Pages Report] The industrial IoT market is valued at USD 194.4 billion in 2024 and is projected to reach USD 286.3 billion by 2029; it is expected to grow at a CAGR of 8.1% from 2024 to 2029. Rise in demand for IoT-enabled digital transformation in businesses across verticals, and predictive maintenance of machinery create lucrative opportunities whereas lack of standardization in IoT protocols is a major restraint for the growth of the market.

Industrial IoT Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Rise in demand for automation in industries

Over the past few years, industrial automation has witnessed significant growth in the manufacturing sector. Owing to high market competition and end user demand, manufacturers are more concerned with producing higher volume and better-quality products. These efforts have led to an increased focus on core areas, such as the production process, asset monitoring, and maintenance and support of assets in the factory. The use of automation will enable manufacturers to reduce human labor costs and expenses, increase productivity, enhance the consistency of processes or products, and deliver quality products. Industrial automation processes use control systems, such as computers or robots, to monitor and handle processes and machines. Industrial IoT platforms play an important role in enhancing the process of industrial automation. Industrial IoT platforms help generate cooperative communication and interaction from manufacturing control systems like actuators, robotics, and analyzers. These platforms help to improve flexibility and deliver enhanced manufacturing.

Restraint: Lack of standardization in IoT protocols

To increase economies of scale, more technical standardization is required for reducing the industrial IoT platform market’s entry barriers. Hence, there is a need for a global governing body. The standards are to be carefully designed to enable innovations in the industrial IoT market. Often, service providers help drive large parts of the market toward an acceptable IoT communications protocol. While some preliminary protocols are visible to the market, formally available protocols remain to be seen. The International Telecommunication Union (ITU) has created an Internet of Things Global Standard Initiative (IoT-GSI) for developing a standard for IoT on a global scale. The European Commission has created many European standard bodies for IoT-specific standards, such as European Telecommunications Standards Institute (ETSI), European Committee for Standardization (CEN), and European Committee for Electro-Technical Standardization (CENELEC). These bodies develop policies referring to European standard regulations and directives.

Opportunity: Predictive maintenance of machinery

The need for predictive maintenance of assets is one of the key opportunities for the growth of the industrial IoT market globally. Predictive maintenance helps lower operating and capital costs by facilitating proactive servicing and repair of assets while allowing highly efficient use of repair resources, both human labor and replacement parts. It enables companies to accurately diagnose and prevent failures in real time, which is vital for critical infrastructure. The failure of high-tech machinery and equipment can prove to be highly expensive, in terms of repair costs, in addition to the production losses resulting from the downtime. Typically, technicians are sent to conduct routine diagnostic inspections and preventive maintenance of machinery depending on fixed schedules. However, several companies are now opting for industrial IoT-enabled predictive maintenance measures. For instance, Volvo Group Trucks invested in a new predictive analytics platform using IBM SPSS for vehicle information due to the growing business need for predictive maintenance to fulfill uptime commitments. It transformed its use of vehicle data from reactive to predictive analysis. By monitoring the truck usage and the current status of the various key components of vehicles, the company is able to tailor maintenance to individual truck-level PdM and predict component failure while the truck is on the road or in the shop.

Challenges: Maintenance and updates of IIoT systems

Industrial IoT systems require regular maintenance and updates to keep up with changing business requirements. As new components are added to these systems, their software also require upgrading. These upgraded systems need to be integrated with the existing equipment, as well as with the additional systems. The addition of new components to industrial IoT systems results in increased maintenance activities. Companies find it challenging to maintain and upgrade industrial IoT systems even while ensuring uninterrupted services.

Industrial IoT Market Map:

The hardware segment accounts for the largest market share of the industrial IoT market during forecast period.

The hardware segment currently holds the largest market share and is expected to maintain its position during the forecast period. Industrial automation and sensor technology have been established for decades, resulting in a wide range of existing hardware solutions readily available for IIoT deployments. Diverse industrial applications require a variety of specialized hardware components such as sensors, processors, and connectivity ICs, contributing to a larger market size compared to software and platforms that cater to a broader range of functionalities.

Healthcare sector accounts for the largest market share of the industrial IoT market in North America during the forecast period.

The healthcare sector has the largest market share in the North American industrial IoT market. There are compelling reasons for significant industrial IoT adoption and growth in the healthcare sector in North America. An aging population is driving the demand for remote patient monitoring, telehealth solutions, and connected medical devices. Industrial IoT improves healthcare delivery by optimizing workflows, tracking equipment, and facilitating data-driven decision-making. Advancements in wearables, remote monitoring devices, and data analytics are creating new opportunities for industrial IoT in healthcare.

Asia Pacific holds the largest market share in industrial IoT market during the forecast period

Asia Pacific is a global manufacturing hub; it is also emerging as an important hub for the metals & mining vertical. Infrastructural and industrial developments in emerging economies such as China, India, and Singapore are contributing to the development of the industrial IoT market in Asia Pacific. The region is expected to be the leading market for industrial IoT solutions during the forecast period. The market in North America is flourishing owing to various initiatives undertaken by governments of different countries and leading companies to encourage the development and adoption of industrial IoT.

Industrial IoT Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Huawei Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), ABB (Switzerland), Siemens (Germany), Intel Corporation (US), General Electric (US), Emerson Electric Co. (US), SAP SE (Germany), Honeywell International Inc. (US), Rockwell Automation (US), among others, are some key players operating in the Industrial IoT companies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Estimated Market Size | USD 194.4 billion in 2024 |

| Projected Market Size | USD 286.3 billion by 2029 |

| Growth Rate | CAGR of 8.1% |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

USD Million/Billion |

|

Segments Covered |

Offering, Connectivity Technology, Deployment, Vertical, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies covered |

Some of the leading companies operating in the industrial IoT market are ABB (Switzerland), General Electric (US), Emerson Electric Co. (US), Intel Corporation (US), Cisco Systems, Inc. (US), SAP SE (Germany), Honeywell International Inc. (US), Siemens (Germany), Huawei Technologies Co., Ltd. (China), Rockwell Automation (US), Arm Limited (UK), PTC (US), Dassault Systèmes (France), IBM (US), Robert Bosch GmbH (Germany), NEC Corporation (Japan), ANSYS, Inc. (US), Worldsensing (Spain), Arundo (Norway), Software AG (Germany), Texas Instruments Incorporated (US), KUKA AG (Germany), Dragos, Inc. (US), Google LLC (US), and Microsoft Corporation (US). |

Industrial IoT Market Highlights

This research report categorizes the industrial IoT market based on Offering, Connectivity Technology, Deployment, Vertical, and Region

|

Segment |

Subsegment |

|

By Offering |

|

|

By Connectivity Technology |

|

|

By Deployment |

|

|

By Vertical |

|

|

By Region |

|

Recent developments

- In April 2023, Rockwell Automation (US) recently introduced a new human-machine interface (HMI) platform called FactoryTalk Optix. This cloud-enabled platform allows users in the Asia Pacific region to design, test, and deploy their applications directly from a web browser. FactoryTalk Optix is one of the five core solutions in FactoryTalk Design Hub, which aims to help industrial organizations simplify and enhance their automation design capabilities, making their work processes more productive.

- In July 2023, ABB (Switzerland) has partnered with Microsoft Corporation (US) to integrate Azure OpenAI Service into their ABB Ability Genix Industrial Analytics and AI suite. The collaboration aims to help industrial customers uncover insights hidden in operational data by implementing generative AI technology. ABB will integrate generative AI, such as large language models (LLMs) like GPT-4, through Azure OpenAI Service into the Genix platform and applications. This will enable functionality like code, image, and text generation. The new application, Genix Copilot, will be launched soon. It will offer intuitive functionality and streamline the flow of contextualized data across processes and operations, enhancing the user experience.

- In July 2022, Emerson Electric Co. (US) and Nozomi Networks (US), one of the leaders in cybersecurity for operational technology (OT) and Internet of Things (IoT), partnered to meet the increasing demand for OT cybersecurity solutions across their respective industries. As part of the agreement, Emerson will offer Nozomi Networks' advanced solutions to enhance industrial control system cyber resiliency and provide real-time operational visibility to customers worldwide. By combining Nozomi Networks' expertise in OT and IoT security with Emerson's DeltaV distributed control system (DCS), consulting, and professional services, the companies aim to provide comprehensive solutions to strengthen cybersecurity and reduce the risk of downtime caused by cyberattacks or process anomalies.

Critical questions answered by this report:

What are the key strategies adopted by key companies in the industrial IoT market?

Product launches, acquisitions, and collaborations have been and continue to be some of the major strategies the key players adopted to grow in the industrial IoT market.

What region dominates the industrial IoT market?

The Asia Pacific region will dominate the industrial IoT market.

Which vertical segment dominates the industrial IoT market?

Manufacturing segment is expected to dominate the industrial IoT market.

Which offering segment dominates the industrial IoT market?

The hardware segment is expected to have the largest market size during the forecast period.

Who are the major industrial IoT market companies?

ABB (Switzerland), General Electric (US), Emerson Electric Co. (US), Intel Corporation (US), Cisco Systems, Inc. (US), SAP SE (Germany), Honeywell International Inc. (US), Siemens (Germany), Huawei Technologies Co., Ltd. (China), Rockwell Automation (US), Arm Limited (UK), PTC (US), among others, are some key players operating in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

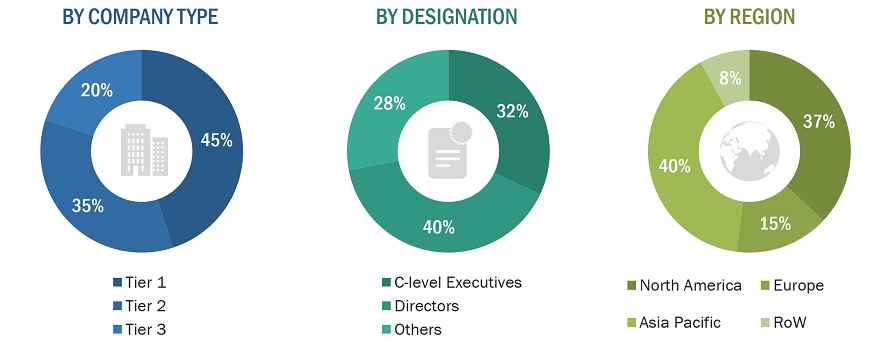

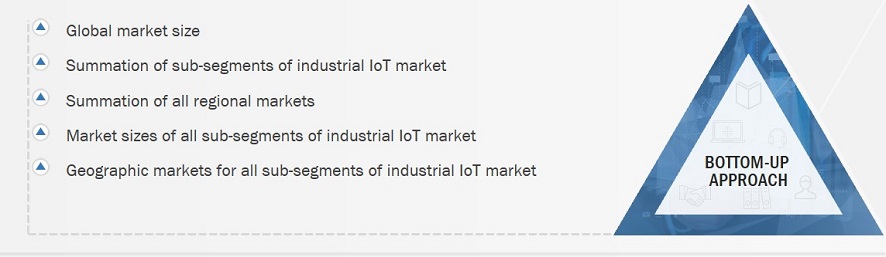

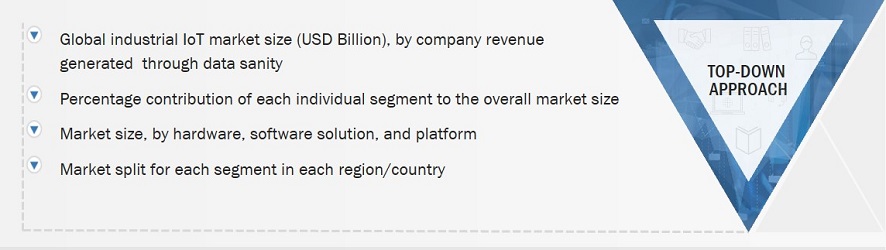

The study involved four major activities in estimating the current size of the industrial IoT market-exhaustive secondary research collected information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. These secondary sources include high-speed data converter technology journals and magazines, annual reports, press releases, investor presentations of companies, white papers, certified publications and articles from recognized authors, and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

Various primary sources from both supply and demand sides have been interviewed in the primary research process to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the industrial IoT market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market estimation process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the industrial IoT market and other dependent submarkets listed in this report.

- Extensive secondary research has identified key players in the industry and market.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Industrial Iot Market: Bottom-Up Approach

Industrial Iot Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments and subsegments. The data has been triangulated by studying several factors and trends identified from both the demand and supply sides.

Market Definition

Industrial Internet of Things (IIoT) can be defined as an environment wherein complex industrial systems are networked together in a way that their sensor data is transmitted over the Internet for remote monitoring and performance analysis. In this research study, the IIoT market has been analyzed for the manufacturing, energy, oil & gas, metals & mining, transportation, healthcare, retail, and agriculture verticals. Sensors and networking technologies are the key IIoT enablers in each of these verticals.

Key Stakeholders

- Semiconductor component manufacturers and distributors

- Industrial automation equipment providers

- Semiconductor component providers

- Companies providing wired and wireless connectivity services

- Software application and platform providers

- Data analytics and cloud computing solution providers

- Original design manufacturers (ODM) and original equipment manufacturers (OEM) providing technology solutions

- Intellectual property (IP) core and license providers

- Research organizations and consulting companies

- Government bodies, such as regulating authorities and policymakers

- Venture capitalists and private equity firms

- Associations, organizations, and alliances related to IIoT

- End users of IIoT solutions across different verticals

Report Objectives

The following are the primary objectives of the study.

- To forecast the size of the industrial IoT market, in terms of value, based on offering, connectivity technology, deployment, vertical, and region

- To define, describe, and forecast the industrial IoT market size, in terms of volume, based on hardware

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete value chain and related industry segments and conduct a value chain analysis of the industrial IoT market landscape

- To describe and forecast the market, in terms of value, for various segments across four main regions: North America, Asia Pacific, Europe, and Rest of the World (RoW)

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s Five Forces, import and export scenarios for products covered under HS code 903190 trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and provide a detailed competitive landscape of the industrial IoT market

- To analyze strategic approaches adopted by the leading players in the industrial IoT market, including product launches, recent developments, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial IoT Market

Which is the leading application for IoT? Where would the market lie in the future for IoT?

I would like to understand what kind of components are included in the revenue forecast of IoT in each industry vertical.

We are specifically interested in Gateway Appliances, Analytics Software, Sensors, and vertical industries. Does the IoT study scope revolve around these pointers?

Need to know the Industrial IoT for discrete manufacturing industries growth and forecast by region wise and technology wise. Also would like to know the methodology you have considered in the research.

Interested in price--does TI receive any discounts? Also wondering if my team can request additional data/analysis that's important to us. What are the other future trends considered?

I require the ability to determine the market size, growth rate etc. for industrial edge computing. Specifically for the oil and gas market. Does the research include these?

We are formulating standards on IOT, we need to understand the technology and the trends worldwide. Can you provide us with the regional trends for the same?

I would like to know more about the segments that you have considered for IoT. Does the report contain ranking of the various applications?

How are adjacent market such as industrial control and factory automation, Smart Factory, Digital Twin, and Industrial Networking Solutions markets are going impact the revenue of players operating in Industrial IOT Market ?

Our business is consulting and engineering services for manufacturing and process industries in the field of IIoT. Therefore we're always looking for studies and trend forecasts in this area. Can you provide us with the inclusions or the scope of your study?

Good morning, I am interesting in understanding if the reports provides a view on how much is valued the industrial IoT market for Italian manufacturing sector. Moreover, does the report have specific section about Italy? Have you included any other future trends in IoT?

to identify the biggest shipment for the device driven by IIOT and also new applications which can generate the big potential shipment to the IIOT market.

Developing correct interfaces for our line of Industrial Gateways, whether, wired, wireless, industrial or other. Can you provide us with an information for the same?

We are providing one stop IoT solution call Neqto: Power by JIG-SAW. We are expanding to US market and looking for partner in Asia so far. Can you tell us the best bet or the major market for IIoT in the US and APAC regions?

Our goal to provide Ukrainian Industry with modern trends for better and faster development and growth. We see in IoT positive challenge for our members. Have you covered Ukraine as a part of your study?

We're interested in the context of Connectivity of the devices, wireless connectivity over 5G or LPWAN. Are these covered in the scope of your study?

How Technologies such as RFID, Industrial Robotics, and Networking technology is expected to impact the growth of the industrial IOT market, also the market of RFID by region such as North America, APAC, Europe and RoW

Looking for IoT report that covers major IIoT applications including Retail/Hospitality, Agriculture, Manufacturing and Transportation. Also, includes Porter 5 forces analysis and geo breakdown (US, Europe etc.). CAGR analysis and unit shipments for key players. Also, analysis of key players in each sector.

IIoT TAM both top down and bottoms up. Also detailed company profiles with market share and units sold. Can you provide me or have you included it in the study?

1. Growth rate of processor adoption by Intel Architecture and ARM Architecture 2. Growth rate of Programmable Logic (FPGA and CPLD) devices. Have you included it in the research?

Hi, We are an Industrial IoT company with focus on power plant and manufacturing. We were trying to understand the global market size and the major applications of the same.

what are the major players operating in digital twin and Edge computing application and how its going impact the revenue of the players operating in Industrial IOT market and adjacent markets ?

Would like to know the market opportunities for SCADA systems and software for the APAC Region. Also the impact on revenue of major players operating in Smart Grid and Industrial IOT market

I am trying to obtain some facts about Industrial IOT market available in U.S. and North America. What are the estimated market shares of the major vendors in this market?

I would like to understand the history and development of the top industrial gases companies in the world and the market size and share analysis. Can you provide us with the same? Also, have you included it in your scope?

Looking to understand how ICS and robotics community is treated in calculating market sizing and growth of IIoT (in-scope or not) with regard to the three views on IIoT sizing discussed in the summary overview.

We are an automation company which is providing Industry 4.0 services. We want further expand our scope in this domain and so requesting the brochure. Also would like to know if the major applications and the connection of Industry 4.0 with IIoT along with the use cases.

I like to see if this report could be a good tool to me, because I need to prepare a business plan to sell by volume a suite build by gateways, sensors and software. My market target is world wide. Can you justify the methodology provided by you?

How I can use my eHealth kit to aggregate all vitals from thousands of patients across hospitals and provide meaningful data to healthcare professionals at point of care? Do our have any specific solution for this? Have you included it in the scope of IIoT?

How I can use my eHealth kit to aggregate all vitals from thousands of patients across hospitals and provide meaningful data to healthcare professionals at point of care? Do our have any specific solution for this? Have you included it in the scope of IIoT?

May I get a sample for this report? Interested in few sections.

Can you provide us the details in "Manufacturing"? like automotive, Electric, Chemical, foods and so on.

We're a Barcelona Based startup company willing to have a broader view of the market in order to select our path of action. We are dealing with energy harvesting and applying it in the industrial internet of things (IoT) field. How is the IIoT market related to it?

What is the type of TRAI license/Regulation for setting up a new LLP startup of Industrial Internet of Things (IIoT)

Fire Fighting & Fire Alarm Systems, Pumps, Health, Safety & Environmental Industries, and Personal Protective equipment. Have you considered it in your study?

How increasing deployment of 5G network Infrastructure would impact the growth of Industrial IoT Market and adjacent market such as smart factory and Industrial Networking Solutions markets

We are looking for the overview of market status, TAM market, trends, and industry sectors for IIoT. Also, I would like to understand the key players list and their contribution to the market share.

I would like to understand the data tables for market sizes and growth by connection or economic size/revenues by industry and business size. My regions of interest are in the US, UK or Europe, As and NZ. Have you included these in your study?

Drones, 3D printing, satellites, Virtual Reality (VR) and Augmented Reality (AR), Materials Sciences (Carbon). Does your research revolve along these parameters?

Wireless connectivity, Wi-Fi Hallow (802.11ah), ZigBee, 6LowpAN, IPV6, sensor networks, IoT and mobiles. Have you included these in your study for IIoT?