Mass Flow Controller Market Size by Metal & Elastomer Seal, Flow Rate (<25, 25 – 1k, >1k SLM), Gas & Liquid, Thermal, Differential Pressure & Coriolis, Stainless Steel, Wafer Cleaning, Plasma Etching, Catalyst Research, Aeration - Global Forecast to 2029

Mass Flow Controller Market Size

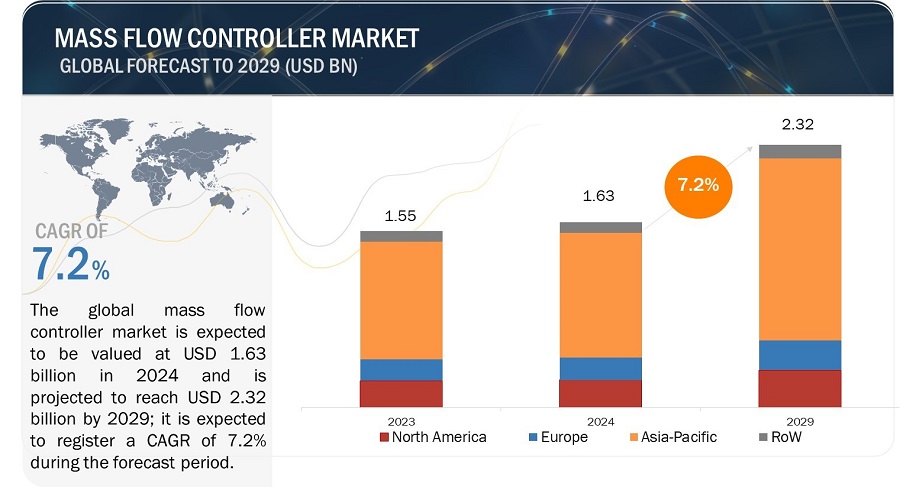

The global Mass Flow Controller Market was valued at USD 1.63 billion in 2024 and is projected to grow from USD 1.73 billion in 2025 to USD 2.32 billion by 2029, at a CAGR of 7.2% during the forecast period. This growth is fueled by the expanding semiconductor industry and the rising emphasis on developing solar projects. Innovations such as AI integration and IoT compatibility are transforming mass flow controllers, making them pivotal in renewable energy applications like hydrogen fuel cells.

Key Takeaways:

• The global Mass Flow Controller Market Market was valued at USD 1.63 billion in 2024 and is projected to grow from USD 1.73 billion in 2025 to USD 2.32 billion by 2029, at a CAGR of 7.2% during the forecast period.

• By Product: The market is driven by the demand for displays with enhanced control and visual monitoring capabilities, while low manufacturing costs for products without displays are also spurring demand.

• By Application: Rising adoption in semiconductor manufacturing is accelerating demand, with specific emphasis on high-accuracy controllers in critical environments.

• By Technology: Innovations like thermal and differential pressure technologies are boosting demand, particularly in sectors like semiconductor manufacturing and aerospace testing.

• By End User: The semiconductor and electronics sectors are leading users, driven by increasing investments and advancements in these industries.

• By Region: ASIA PACIFIC is expected to grow fastest at 7.8% CAGR, driven by the region's growing industrial economy and favorable government policies.

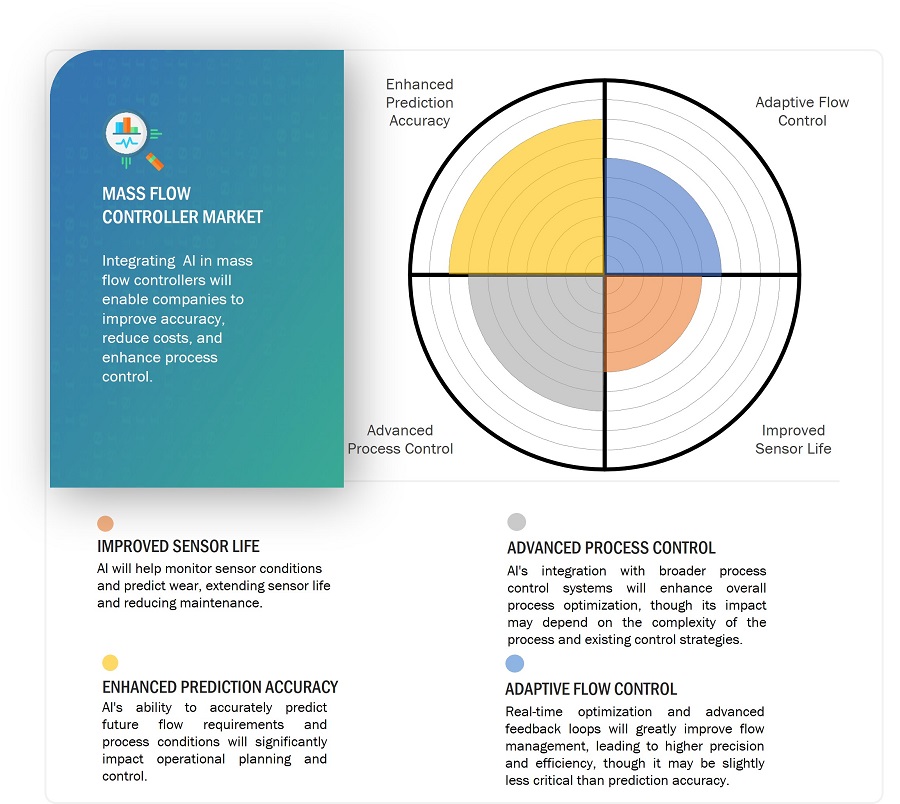

• Innovations and Ecosystem Dynamics: The integration of AI and IoT is enhancing the efficiency and accuracy of mass flow controllers, with AI applications providing better predictive analysis and operational optimization.

• Competition and Market Dynamics: The market is competitive with key players focusing on innovations to address challenges like device integration complexities and improve product features.

The Mass Flow Controller Market is poised for significant growth, driven by technological advancements and increasing applications in emerging industries. Long-term projections indicate continued innovation in AI and IoT integration, which will enhance the precision and efficiency of mass flow controllers, presenting substantial growth opportunities in sectors such as semiconductors, renewable energy, and aerospace..

Mass Flow Controller Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

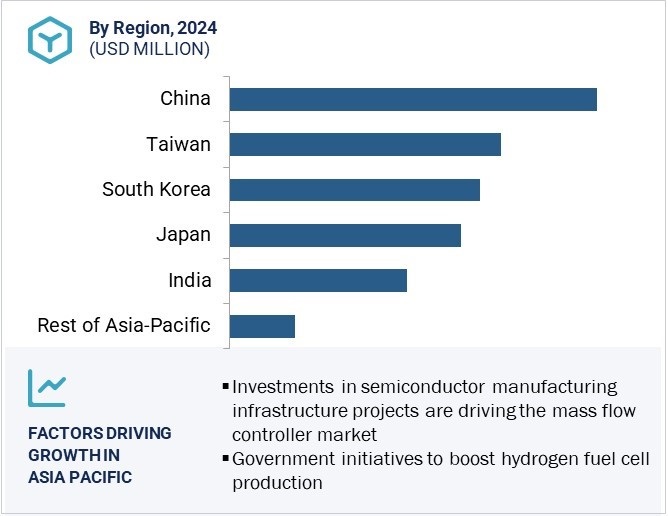

Asia Pacific accounted for a significant share of USD 1,039.1 million in the mass flow controller market in 2023. The Asia Pacific region has the largest market share in mass flow controller market due to several factors. The growing industrial economy, especially in the high-tech segments such as semiconductors, automotive, and chemical industries, requires accurate and efficient flow control products. In addition, newly constructed infrastructures for semiconductor & electronics manufacturing in countries such as India prompt great demands for enhanced automation solutions. Furthermore, favorable government policies and the changing trends in energy consumption towards energy-efficient products ensure that the market of mass flow controllers remains steady in this region.

Mass Flow Controller Market Integrating AI

Artificial intelligence has been widely applied to many industries to enhance efficiency and process optimization. The same case happens in fluid mechanics, measurement, and control technologies, where research into the potential integration of AI is going on at a fast pace. One such area of importance for AI applications is mass flow controllers, which are used to regulate the flow of gases and liquids with precision. While the application of AI-integrated mass flow controllers is at its beginning stage, research and development are in continuous processes to reach its full potential. The integration of AI into mass flow controllers is going to bring a few crucial advantages. AI can improve measurement accuracy by providing better adjustment options and predictive analysis. Further, it will extend sensor life, particularly in Coriolis mass flow controllers, by its optimized use and reduced wear. Besides, AI will support the optimization of active flow control by dynamic adaption of their operational parameters in a way that finally furthers the constancy of the desired flow conditions. Furthermore, AI will also help improve the predictive accuracy of liquid flow, which again can realize more secure and efficient process management.

Mass Flow Controller Market Dynamics:

Driver: Increased investments in semiconductor and electronics production

The significant driving force in the mass flow controller market is the increasing growth of the semiconductor industry. As semiconductor manufacturing becomes more advanced, the need for precise control over gas and liquid flows intensifies. Liquid mass flow controllers/gas mass flow controllers are essential for attaining the exact standards required in processes such as chemical vapor deposition, etching, Ion implantation, physical vapor deposition, plasma processing, and cleaning processes. Due to the complexity of semiconductor manufacturing processes, a precise flow rate is essential, as even minor changes in the gas flow may impact chip quality and yield. The development of digital mass flow controllers with real-time monitoring, AI-driven optimization, and enhanced accuracy is also contributing to market growth. Mass flow controllers provide the necessary level of accuracy and are, therefore, indispensable for all semiconductor manufacturers.

Restraint: Dependency on calibration

One of the restraints in the mass flow controller market is calibration dependency, which has a bearing on operational efficiency and accuracy. The mass flow controller is used to provide highly accurate gas flow regulation applications in industries such as semiconductor fabrication, chemical processing, and pharmaceuticals, and requires periodic calibration so that the device's measurement is compared against a standard. This process is extremely detailed and time-consuming and requires an adjustment of the internal sensors and flow measurements. The device under test is connected in series with the reference device to share the same measurement for flow. The obtained measurements from the reference device and the mass flow controller are compared for accuracy. Mass flow controllers are calibrated using the following gases: nitrogen, oxygen, argon, helium, hydrogen, methane, natural gas, propane, ammonia, carbon dioxide, and a host of others in mixed gas combinations. This type of calibration is often sufficient for lower-accuracy applications. High-accuracy and high-precision applications require calibration using the actual operating gas.

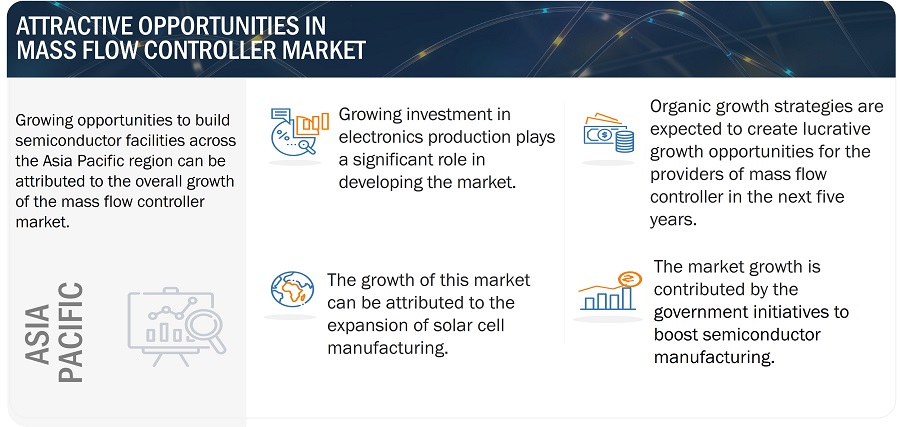

Opportunity: Government-led initiatives to boost semiconductor manufacturing

Governments across the Asia Pacific region are making significant efforts to improve semiconductor manufacturing. As a result, the demand for mass flow controllers has been widespread in the region. Major countries like China, Taiwan, South Korea, and Japan are providing various incentives such as subsidies, tax exemptions, and grants to attract investments from semiconductor manufacturers. The objective is to increase domestic capacities. These incentives are crucial for applications that require precise flow, making the use of mass flow controllers necessary. The establishment of semiconductor clusters in countries like Taiwan and South Korea has led to the development of specialized ecosystems. These clusters, driven by government infrastructure and policies, concentrate semiconductor manufacturing activities and result in increased demand for mass flow controllers to maintain the precision needed for semiconductor fabrication.

Challenge: Complexities associated in integration with other technologies

It can be quite challenging for end users to integrate mass flow controllers into other devices due to system complexity and diversity. Mass flow controllers are used to control the flow of both gases and liquids in various applications, ranging from semiconductor manufacturing to pharmaceuticals. However, integrating them with other equipment, such as data acquisition systems, is not an easy task and presents several challenges. The primary issue is the compatibility of mass flow controllers with the different communication protocols used by various systems. Conflicting signal types, varying data formats, and multiple communication standards can complicate the process of ensuring a valid and reliable data exchange. Additionally, tuning these devices to align accurately with the specifications of integrated systems is crucial to maintaining process consistency and accuracy. This alignment often involves complex adjustments, which can be further complicated by the need for real-time feedback and the variability of adjustments based on operational parameters.

Mass Flow Controller Ecosystem

Prominent companies in this market include well-established, financially stable mass flow controller manufacturers which provides both liquid mass flow controller & gas mass flow controller such as HORIBA, Ltd. (Japan), Sensirion AG (Switzerland), Teledyne Technologies Incorporated (US), Bronkhorst (Netherlands), Brooks Instrument (US). These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Along with well-established companies, there are a large number of mass flow controller distributors, such as ICES Solutions (India) and Meditech Automation (India).

By technology, Coriolis-based mass flow controllers are expected to grow at the highest during the forecast period.

Coriolis mass flow controllers provide increased accuracy and precision when measuring mass flow. Industries such as pharmaceuticals, chemicals, and food & beverages rely on this precision for critical measurements. Coriolis mass flow controllers are versatile and capable of handling both gases and liquids. Unlike mass flow controllers that are based on thermal or differential pressure methods and are highly sensitive to changes in a fluid's properties like viscosity, temperature, and pressure, Coriolis mass flow controllers maintain their accuracy under varying fluid conditions without requiring recalibration or compensation.

By end-use industry, the Semiconductors segment is expected to claim the largest market share during the forecast period.

The semiconductors segment is expected to have the highest compound annual growth rate (CAGR) during the forecast period. Several factors contribute to the significant position that the semiconductor industry enjoys in the mass flow controller market. The production of semiconductors requires very high levels of precision and reproducibility, which in turn necessitates strict control of gas streams to maintain the necessary product quality. Gas mass flow controllers play a crucial role in regulating gases in processes that require high purity, such as etching, deposition, and cleaning processes.

Mass Flow Controller Market by Region

In 2029, Asia Pacific is Projected to Exhibit the Highest CAGR in Global Mass Flow Controller Market.

Rise in innovations and developments in the semiconductors industry significantly drives the growth of the mass flow controller market in Asia Pacific at present, and a similar trend is likely to continue in the near future. The growth of the semiconductors industry including new semiconductor production facilities in developing countries, such as China and India, further propels the growth of the mass flow controller market in Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Top Companies Mass Flow Controller - Key Market Players

- HORIBA, Ltd. (Japan),

- Sensirion AG (Switzerland),

- MKS Instruments (US),

- Teledyne Technologies Incorporated (US),

- Bronkhorst (Netherlands),

- Brooks Instrument. (US),

- Christian Bürkert GmbH & Co. KG (Germany),

- Sierra Instruments, Inc. (US),

- Alicat Scientific, Inc. (US),

- PASKER HANNIFIN CORP (US),

- TOKYO KEISO CO., LTD. (Japan),

- Vögtlin Instruments GmbH (Switzerland),

- Azbil Corporation (China),

- Axetris AG (Switzerland).,

- Aalborg (US) are some of the key players in the mass flow controller companies

Scope of the Report

|

Report Coverage |

Details |

| Market Revenue in 2024 | $1.63 billion |

| Mass Flow Controller Market Size Estimated Value by 2029 | $2.32 billion |

| Growth Rate | Poised to grow at a CAGR of 7.2% |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By product specification, material type, media type, flow rate, technology, connectivity, end-user industry, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

HORIBA, Ltd. (Japan), Sensirion AG (Switzerland), MKS Instruments (US), Teledyne Technologies Incorporated (US), Bronkhorst (Netherlands), Brooks Instrument (US) Christian Bürkert GmbH & Co. KG (Germany), Sierra Instruments, Inc. (US), Alicat Scientific Inc. (US), PARKER HANIIFIN CORP (US) are some of the key players in the mass flow controller market. |

Mass Flow Controller Market Highlights

This research report categorizes the mass flow controller market based product specification, material type, media type, flow rate, technology, connectivity, end-user industry, and region.

|

Segment |

Subsegment |

|

By Product Specification |

|

|

By Material Type |

|

|

By Media Type |

|

|

By Flow Rate |

|

|

By Technology |

|

|

By Connectivity |

|

|

By End-user Industry |

|

|

By Region |

|

Recent Developments

- In January 2025, HORIBA, Ltd. launched the DZ-107 ultra-thin mass flow controller on January 14th, offering a sevenfold increase in full-scale flow over previous models. Designed for advanced semiconductor manufacturing, it also raises the maximum operating temperature from 45°C to 60°C.

- In April 2024, Bronkhorst expanded its product lineup, enhancing versatility and accuracy in gas flow measurement and control. The latest models in the FLEXI-FLOW Compact range feature innovative updates, including instruments designed for lower flow rates.

- In March 2024, Brooks Instrument introduced the GF120xHT Series, its high-temperature thermal mass flow controller. This new controller is tailored to handle solid and liquid precursors essential for semiconductor manufacturing.

- In February 2024, Alicat Scientific, Inc. enhanced its BASIS 2 line of economical MEMS thermal mass flow controllers and meters by introducing a higher flow range, broadening the product family.

- In January 2024, Bronkhorst introduced the MASS-STREAM D-6400 series of mass flow controllers and meters, succeeding the D-6300 models. This new series incorporates advanced features and ISO-1179-1 inlet threads, allowing compatibility with standard connectors.

- In September 2023, Brooks Instrument released a new series of Quantim QMC Coriolis mass flow controllers, engineered to deliver high accuracy for extremely low flow rates of liquids and gases.

Frequently Asked Questions (FAQ):

Which are the major companies in the mass flow controller market? What are their major strategies to strengthen their market presence?

The major companies in the mass flow controller market include HORIBA, Ltd. (Japan), Sensirion AG (Switzerland), MKS Instruments (US), Teledyne Technologies Incorporated (US), Bronkhorst (Netherlands), Brooks Instrument (US) Christian Bürkert GmbH & Co. KG (Germany), Sierra Instruments, Inc. (US) and the major strategies adopted by these players are product launches and developments.

What is a mass flow controller?

A mass flow controller is a device that measures and controls the flow of liquids and gases. It is operated by electric signals and designed to monitor and calibrate media flow rate according to predetermined flow rates.

Who are the key players in the global mass flow controller market?

Companies such as HORIBA, Ltd. (Japan), Sensirion AG (Switzerland), MKS Instruments (US), Teledyne Technologies Incorporated (US), and Bronkhorst (Netherlands) fall under the key player category. These companies cater to the requirements of their customers by providing mass flow controllers. Moreover, these companies are highly adopting inorganic growth strategies to strengthen their global market position and customer base.

What are the drivers and opportunities for the mass flow controller market?

Increasing Investments in semiconductor and electronics production is the driver, and government initiatives to boost semiconductor manufacturing are the prevailing opportunity in the market.

What are the restraints and challenges for the mass flow controller market?

Calibration dependency and complexities associated with integrating with other technologies are the restraints and challenges in the mass flow controller market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising emphasis on developing solar projects- Expanding semiconductor industry- Generation of renewable energy with hydrogen fuel cellsRESTRAINTS- Dependency on calibrationOPPORTUNITIES- Application in space stations- Government-led initiatives to boost semiconductor manufacturingCHALLENGES- Complexities associated with integrating mass flow controllers within other devices

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY CONNECTIVITYAVERAGE SELLING PRICE TREND OF MASS FLOW CONTROLLERS, 2019–2023INDICATIVE PRICING TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

-

5.8 IMPACT OF AI/GENERATIVE AI ON MASS FLOW CONTROLLER MARKETINTRODUCTIONAI/GENERATIVE AI-SPECIFIC USE CASES

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Micro-electro-mechanical systems- IoTCOMPLIMENTARY TECHNOLOGIES- Industrial ethernet- Digital signal processingADJACENT TECHNOLOGIES- Nanotechnology

-

5.10 PATENT ANALYSIS

-

5.11 TRADE ANALYSISIMPORT DATA (HS CODE 902610)EXPORT DATA (HS CODE 902610)

- 5.12 KEY CONFERENCES AND EVENTS, 2025–2026

-

5.13 CASE STUDY ANALYSISILS COLLABORATED WITH ALICAT TO ADDRESS MASS FLOW CONTROLLERS SOURCING-RELATED CHALLENGESHORIBA HELPED NOAA WITH Z500 FLOW CONTROLLERS THAT PROVIDED STABLE AND CONSISTENT FLOW RATEALICAT ASSISTED VALCO INTEGRATE MULTIPLE BASIS OEM MASS FLOW CONTROLLERS INTO DYNACAL DEVICES THAT MANAGED LOW GAS FLOW RATESBROOKS ASSISTED RAHR WITH SLAMF MASS FLOW CONTROLLERS THAT IMPROVED BREWERIES' PRODUCTION AND EFFICIENCYDURALAR PARTNERED WITH ALICAT TO ENGINEER CORROSION-RESISTANT FLOW CONTROLLER WITH CUSTOM GAS CALIBRATION

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

-

5.15 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.16 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 DISPLAYSWITH DISPLAY- Enhanced control through immediate visual monitoring to drive marketWITHOUT DISPLAY- Low manufacturing costs to spur demand

-

6.3 SEALSMETALS- Ability to withstand harsh environmental conditions to boost demandELASTOMER- Reduced friction and minimal gas leakages to drive market

-

6.4 ACCURACYSTANDARD- Increasing adoption in HVAC systems and non-critical laboratory environments to fuel market growthHIGH- Rising adoption in semiconductor manufacturing to accelerate demand

- 7.1 INTRODUCTION

-

7.2 STAINLESS STEELHIGH RESISTANCE TO CORROSION AND SULFIDES TO DRIVE MARKET

-

7.3 ALLOYSRISING NEED FOR ALLOYS CONTAINING CHROME AND MOLYBDENUM TO BOOST DEMAND

- 7.4 OTHER MATERIALS

- 8.1 INTRODUCTION

-

8.2 GASGROWING ADOPTION FOR CATALYST RESEARCH TO SPUR DEMAND

-

8.3 LIQUIDABILITY TO OFFER FAST AND ACCURATE MEASURING SIGNALS TO BOOST DEMAND

- 9.1 INTRODUCTION

-

9.2 LOWINCREASING APPLICATION IN MANUFACTURING SEMICONDUCTOR CHIPS TO DRIVE MARKET

-

9.3 MEDIUMRISING USE IN FLUID AND GAS MIXING AND DOSING SYSTEMS TO SPUR DEMAND

-

9.4 HIGHGROWING APPLICATION IN GAS MEASUREMENT TO ACCELERATE DEMANDMASS FLOW CONTROLLER MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

-

10.2 THERMALABILITY TO HANDLE DIVERSE RANGE OF GASES WITH VARYING THERMAL PROPERTIES TO DRIVE MARKET

-

10.3 DIFFERENTIAL PRESSUREINCREASING APPLICATION IN SEMICONDUCTOR MANUFACTURING, CHEMICAL PROCESSING, AND AEROSPACE TESTING TO BOOST DEMAND

-

10.4 CORIOLISELIMINATION OF ADDITIONAL COMPENSATION FOR TEMPERATURE OR PRESSURE VARIATIONS TO SPUR DEMAND

- 11.1 INTRODUCTION

-

11.2 ANALOGINCREASING DEMAND FOR COST-EFFECTIVE CONTROL SYSTEMS TO SPUR DEMAND

-

11.3 DIGITALIMPLEMENTATION OF ADVANCED MICROPROCESSOR TECHNOLOGY TO OBTAIN REAL-TIME MONITORING TO ACCELERATE DEMANDPROFIBUSRS–485PROFINETETHERCATETHERNET/IPMODBUS RTUMODBUS TCP/IPDEVICENETFOUNDATION FIELDBUS

- 12.1 INTRODUCTION

-

12.2 SEMICONDUCTORSINCREASING APPLICATION FOR WAFER CLEANING AND PCB TREATMENT TO BOOST DEMANDWAFER CLEANINGTHIN FILM DEPOSITIONSPRAY COATINGPLASMA ETCHINGVACUUM SPUTTERING

-

12.3 OIL & GASRISING ADOPTION FOR UPSTREAM PRODUCTION AND PIPELINE DETECTION TO SPUR DEMANDODORIZATION OF BIOGASHEAVY FUEL OIL ADDITIVE DOSINGFRACKING

-

12.4 CHEMICALSINCREASING APPLICATION IN CHEMICAL REACTORS AND GAS SAMPLING TO DRIVE MARKETCATALYST RESEARCHLIQUEFIED GAS DOSING

-

12.5 PHARMACEUTICALSIMPROVED ACCURACY OF VENTILATION DEVICES TO DRIVE MARKETPILL COATINGCONTINUOUS MANUFACTURING

-

12.6 METALS & MININGREDUCED WASTAGE AND DOWNTIME TO SPUR DEMANDSELECTIVE LASER MELTINGSMELTING

-

12.7 WATER & WASTEWATER TREATMENTEXPANDING GLOBAL POPULATION AND RAPID INDUSTRIALIZATION TO DRIVE DEMANDPH CONTROL

-

12.8 FOOD & BEVERAGESGROWING APPLICATION FOR ADJUSTING PH-LEVEL AND BLANKETING OF INERT GASES TO BOOST DEMANDAERATIONASEPTIC PACKAGING

-

12.9 OTHER END-USE INDUSTRIESLAMBDA PROBE TESTING

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Growing application for catalyst research and spray coating to drive marketCANADA- Expanding pharmaceutical and medical research industries to spur demandMEXICO- Rising industrial expansion to accelerate demand

-

13.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEGERMANY- Government-led initiatives to address energy crisis to boost demandUK- Increasing need for efficient control mechanisms in pharmaceutical and semiconductor industries to drive marketFRANCE- Growing need for chemicals in metal & mining and automotive industries to fuel market growthREST OF EUROPE

-

13.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Government-led initiatives to support connected technologies to offer lucrative growth opportunitiesINDIA- Rising inflow of FDIs in semiconductor industry to accelerate demandJAPAN- Growing emphasis on innovating mass flow controllers to offer lucrative growth opportunitiesTAIWAN- Presence of leading players to drive marketSOUTH KOREA- Thriving consumer electronics industry to boost demandREST OF ASIA PACIFIC

-

13.5 ROWMACROECONOMIC OUTLOOK FOR ROWSOUTH AMERICA- Growing demand in semiconductor, chemical, and oil & gas industries to fuel market growthMIDDLE EAST & AFRICA- Rising economic and industrial transformation to offer lucrative growth opportunities- GCC- Rest of Middle East & Africa

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2024

- 14.3 REVENUE ANALYSIS, 2019–2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

-

14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Region footprint- Material footprint- Media type footprint- End-use industry footprint

-

14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

-

14.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

15.1 KEY PLAYERSHORIBA, LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSENSIRION AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMKS INSTRUMENTS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTELEDYNE TECHNOLOGIES INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBRONKHORST- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBROOKS INSTRUMENT- Business overview- Products/Solutions/Services offered- Recent developmentsCHRISTIAN BÜRKERT GMBH & CO. KG- Business overview- Products/Solutions/Services offered- Recent developmentsSIERRA INSTRUMENTS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsALICAT SCIENTIFIC, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsPARKER HANNIFIN CORP- Business overview- Products/Solutions/Services offered

-

15.2 OTHER PLAYERSTOKYO KEISO CO., LTD.VÖGTLIN INSTRUMENTS GMBHAZBIL CORPORATIONSABLE SYSTEMS INTERNATIONALKOFLOCAALBORGAXETRIS AGDWYER INSTRUMENTS, LLC.FCON CO., LTD.KELLY PNEUMATICS, INC.IMIPROTERIAL, LTD.MTI CORPORATIONOHKURA ELECTRIC CO., LTD.DAKOTA INSTRUMENTS, INC.PROPORTION-AIR, INC.

- 16.1 INTRODUCTION

- 16.2 MARKET SCOPE

-

16.3 SEMICONDUCTOR MANUFACTURING EQUIPMENT MARKET, BY FAB FACILITY EQUIPMENTINTRODUCTION

-

16.4 AUTOMATIONINCREASING DEMAND FOR FACTORY AUTOMATION IN SEMICONDUCTOR INDUSTRY TO BOOST DEMAND

-

16.5 CHEMICAL CONTROLRISING DEMAND FOR HIGH-QUALITY PRODUCTS TO DRIVE MARKET

-

16.6 GAS CONTROLNECESSITY TO PROVIDE PRECISE CONTROL AND MIXING OF INDUSTRIAL PROCESS GASES TO FUEL MARKET GROWTH

- 16.7 OTHER FAB FACILITY EQUIPMENT

- 17.1 INSIGHTS OF INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE TREND OF MASS FLOW CONTROLLERS OFFERED BY KEY PLAYERS, BY CONNECTIVITY (USD)

- TABLE 2 INDICATIVE PRICING TREND OF MASS FLOW CONTROLLERS, BY REGION (USD)

- TABLE 3 ROLES OF COMPANIES IN MASS FLOW CONTROLLER ECOSYSTEM

- TABLE 4 LIST OF APPLIED/GRANTED PATENTS RELATED TO MASS FLOW CONTROLLERS, 2024

- TABLE 5 IMPORT DATA FOR HS CODE 902610-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 6 EXPORT DATA FOR HS CODE 902610-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 7 MASS FLOW CONTROLLER MARKET: LIST OF CONFERENCES AND EVENTS, 2025–2026

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MASS FLOW CONTROLLER: STANDARDS

- TABLE 13 MASS FLOW CONTROLLER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USE INDUSTRIES (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP END USE INDUSTRIES

- TABLE 16 MASS FLOW CONTROLLER MARKET, BY DISPLAY, 2020–2023 (USD MILLION)

- TABLE 17 MASS FLOW CONTROLLER MARKET, BY DISPLAY, 2024–2029 (USD MILLION)

- TABLE 18 MASS FLOW CONTROLLER MARKET, BY SEAL, 2020–2023 (USD MILLION)

- TABLE 19 MASS FLOW CONTROLLER MARKET, BY SEAL, 2024–2029 (USD MILLION)

- TABLE 20 MASS FLOW CONTROLLER MARKET, BY MATERIAL, 2020–2023 (USD MILLION)

- TABLE 21 MASS FLOW CONTROLLER MARKET, BY MATERIAL, 2024–2029 (USD MILLION)

- TABLE 22 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE, 2020–2023 (USD MILLION)

- TABLE 23 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE, 2024–2029 (USD MILLION)

- TABLE 24 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE, 2020–2023 (THOUSAND UNITS)

- TABLE 25 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE, 2024–2029 (THOUSAND UNITS)

- TABLE 26 MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020–2023 (USD MILLION)

- TABLE 27 MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024–2029 (USD MILLION)

- TABLE 28 LOW: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 29 LOW: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 30 MEDIUM: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 31 MEDIUM: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 32 HIGH: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 33 HIGH: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 34 MASS FLOW CONTROLLER MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 35 MASS FLOW CONTROLLER MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 36 MASS FLOW CONTROLLER MARKET, BY CONNECTIVITY, 2020–2023 (USD MILLION)

- TABLE 37 MASS FLOW CONTROLLER MARKET, BY CONNECTIVITY, 2024–2029 (USD MILLION)

- TABLE 38 MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 39 MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 40 SEMICONDUCTORS: MASS FLOW CONTROLLER MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 41 SEMICONDUCTORS: MASS FLOW CONTROLLER MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 42 SEMICONDUCTORS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020–2023 (USD MILLION)

- TABLE 43 SEMICONDUCTORS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024–2029 (USD MILLION)

- TABLE 44 OIL & GAS: MASS FLOW CONTROLLER MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 45 OIL & GAS: MASS FLOW CONTROLLER MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 46 OIL & GAS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020–2023 (USD MILLION)

- TABLE 47 OIL & GAS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024–2029 (USD MILLION)

- TABLE 48 CHEMICALS: MASS FLOW CONTROLLER MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 49 CHEMICALS: MASS FLOW CONTROLLER MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 50 CHEMICALS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020–2023 (USD MILLION)

- TABLE 51 CHEMICALS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024–2029 (USD MILLION)

- TABLE 52 PHARMACEUTICALS: MASS FLOW CONTROLLER MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 53 PHARMACEUTICALS: MASS FLOW CONTROLLER MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 54 PHARMACEUTICALS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020–2023 (USD MILLION)

- TABLE 55 PHARMACEUTICALS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024–2029 (USD MILLION)

- TABLE 56 METALS & MINING: MASS FLOW CONTROLLER MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 57 METALS & MINING: MASS FLOW CONTROLLER MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 58 METALS & MINING: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020–2023 (USD MILLION)

- TABLE 59 METALS & MINING: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024–2029 (USD MILLION)

- TABLE 60 WATER & WASTEWATER TREATMENT: MASS FLOW CONTROLLER MARKET, BY REGION, 2020–2023 (USD THOUSAND)

- TABLE 61 WATER & WASTEWATER TREATMENT: MASS FLOW CONTROLLER MARKET, BY REGION, 2024–2029 (USD THOUSAND)

- TABLE 62 WATER & WASTEWATER TREATMENT: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020–2023 (USD MILLION)

- TABLE 63 WATER & WASTEWATER TREATMENT: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024–2029 (USD MILLION)

- TABLE 64 FOOD & BEVERAGES: MASS FLOW CONTROLLER MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 65 FOOD & BEVERAGES: MASS FLOW CONTROLLER MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 66 FOOD & BEVERAGES: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020–2023 (USD MILLION)

- TABLE 67 FOOD & BEVERAGES: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024–2029 (USD MILLION)

- TABLE 68 OTHER END-USE INDUSTRIES: MASS FLOW CONTROLLER MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 69 OTHER END-USE INDUSTRIES: MASS FLOW CONTROLLER MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 70 OTHER END-USE INDUSTRIES: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020–2023 (USD MILLION)

- TABLE 71 OTHER END-USE INDUSTRIES: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024–2029 (USD MILLION)

- TABLE 72 MASS FLOW CONTROLLER MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 73 MASS FLOW CONTROLLER MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 74 NORTH AMERICA: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 75 NORTH AMERICA: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 76 NORTH AMERICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 78 US: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 79 US: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 80 CANADA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 81 CANADA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 82 MEXICO: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 83 MEXICO: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 84 EUROPE: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 85 EUROPE: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 86 EUROPE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 87 EUROPE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 88 GERMANY: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 89 GERMANY: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 90 UK: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 91 UK: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 92 FRANCE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 93 FRANCE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 94 REST OF EUROPE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 95 REST OF EUROPE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 100 CHINA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 101 CHINA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 102 INDIA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 103 INDIA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 104 JAPAN: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 105 JAPAN: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 106 TAIWAN: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 107 TAIWAN: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 108 SOUTH KOREA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 109 SOUTH KOREA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD THOUSAND)

- TABLE 111 REST OF ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD THOUSAND)

- TABLE 112 ROW: MASS FLOW CONTROLLER MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 113 ROW: MASS FLOW CONTROLLER MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 116 ROW: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 117 ROW: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 118 SOUTH AMERICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 119 SOUTH AMERICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 122 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2024

- TABLE 123 MASS FLOW CONTROLLER MARKET: DEGREE OF COMPETITION, 2023

- TABLE 124 MASS FLOW CONTROLLER MARKET: REGION FOOTPRINT

- TABLE 125 MASS FLOW CONTROLLER MARKET: MATERIAL FOOTPRINT

- TABLE 126 MASS FLOW CONTROLLER MARKET: MEDIA TYPE FOOTPRINT

- TABLE 127 MASS FLOW CONTROLLER MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 128 MASS FLOW CONTROLLER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 129 MASS FLOW CONTROLLER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 130 MASS FLOW CONTROLLER MARKET: PRODUCT LAUNCHES, JANUARY 2022–JANUARY 2025

- TABLE 131 MASS FLOW CONTROLLER MARKET: DEALS, JANUARY 2022–JANUARY 2025

- TABLE 132 HORIBA, LTD.: COMPANY OVERVIEW

- TABLE 133 HORIBA, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 HORIBA, LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 135 HORIBA, LTD.: EXPANSIONS

- TABLE 136 SENSIRION AG: COMPANY OVERVIEW

- TABLE 137 SENSIRION AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 SENSIRION AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 139 MKS INSTRUMENTS: COMPANY OVERVIEW

- TABLE 140 MKS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 MKS INSTRUMENTS: EXPANSIONS

- TABLE 142 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 143 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 145 BRONKHORST: COMPANY OVERVIEW

- TABLE 146 BRONKHORST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 BRONKHORST: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 148 BROOKS INSTRUMENT: COMPANY OVERVIEW

- TABLE 149 BROOKS INSTRUMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 BROOKS INSTRUMENT: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 151 BROOKS INSTRUMENT: DEALS

- TABLE 152 BROOKS INSTRUMENT: EXPANSIONS

- TABLE 153 CHRISTIAN BÜRKERT GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 154 CHRISTIAN BÜRKERT GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 CHRISTIAN BÜRKERT GMBH & CO. KG: DEALS

- TABLE 156 CHRISTIAN BÜRKERT GMBH & CO. KG: EXPANSIONS

- TABLE 157 SIERRA INSTRUMENTS, INC.: COMPANY OVERVIEW

- TABLE 158 SIERRA INSTRUMENTS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 SIERRA INSTRUMENTS, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 160 ALICAT SCIENTIFIC, INC.: COMPANY OVERVIEW

- TABLE 161 ALICAT SCIENTIFIC, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 ALICAT SCIENTIFIC, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 163 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 164 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 SEMICONDUCTOR MANUFACTURING EQUIPMENT MARKET

- TABLE 166 SEMICONDUCTOR MANUFACTURING EQUIPMENT MARKET, BY FAB FACILITY EQUIPMENT, 2019–2022 (USD MILLION)

- TABLE 167 SEMICONDUCTOR MANUFACTURING EQUIPMENT MARKET, BY FAB FACILITY EQUIPMENT, 2023–2028 (USD MILLION)

- FIGURE 1 MASS FLOW CONTROLLER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MASS FLOW CONTROLLER MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY MASS FLOW CONTROLLER MANUFACTURERS/PROVIDERS

- FIGURE 4 MASS FLOW CONTROLLER MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MASS FLOW CONTROLLER MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ALLOYS SEGMENT TO DOMINATE MARKET IN 2029

- FIGURE 8 LOW FLOW RATE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 9 GAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 10 SEMICONDUCTOR SEGMENT TO COMMAND MARKET IN 2029

- FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 EXPANDING SEMICONDUCTOR INDUSTRY TO DRIVE MARKET

- FIGURE 13 ALLOYS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 LOW FLOW RATE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 15 GAS SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 SEMICONDUCTOR INDUSTRY TO DOMINATE MARKET IN 2024

- FIGURE 17 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN 2024

- FIGURE 18 CORIOLIS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 DIGITAL SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 20 CHINA DOMINATED MARKET IN 2023

- FIGURE 21 MASS FLOW CONTROLLER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 MASS FLOW CONTROLLER MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 23 MASS FLOW CONTROLLER MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 24 MASS FLOW CONTROLLER MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 25 MASS FLOW CONTROLLER: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF MASS FLOW CONTROLLERS OFFERED BY KEY PLAYERS, BY CONNECTIVITY

- FIGURE 28 AVERAGE SELLING PRICING TREND OF MASS FLOW CONTROLLERS, 2019–2023

- FIGURE 29 MASS FLOW CONTROLLER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 MASS FLOW CONTROLLER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO

- FIGURE 32 AI/GENERATIVE AI USE CASES IN MASS FLOW CONTROLLER MARKET

- FIGURE 33 IMPACT OF AI/GENERATIVE AI ON MASS FLOW CONTROLLER MARKET

- FIGURE 34 PATENTS APPLIED AND GRANTED, 2015–2024

- FIGURE 35 IMPORT DATA FOR HS CODE 902610-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 36 EXPORT DATA FOR HS CODE 902610-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 37 MASS FLOW CONTROLLER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USE INDUSTRIES

- FIGURE 39 BUYING CRITERIA FOR TOP THREE END USE INDUSTRIES

- FIGURE 40 MASS FLOW CONTROLLER MARKET, BY PRODUCT SPECIFICATION

- FIGURE 41 WITH DISPLAY SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 ELASTOMER SEALS SEGMENT TO LEAD MARKET IN 2029

- FIGURE 43 MASS FLOW CONTROLLER MARKET, BY MATERIAL

- FIGURE 44 ALLOYS SEGMENT TO DOMINATE MARKET IN 2029

- FIGURE 45 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE

- FIGURE 46 GAS SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 47 MASS FLOW CONTROLLER MARKET, BY FLOW RATE

- FIGURE 48 LOW FLOW RATE SEGMENT TO LEAD MARKET IN 2029

- FIGURE 49 PHARMACEUTICAL INDUSTRY TO EXHIBIT HIGHEST CAGR IN MEDIUM FLOW RATE MASS FLOW CONTROLLER MARKET DURING FORECAST PERIOD

- FIGURE 50 MASS FLOW CONTROLLER MARKET, BY TECHNOLOGY

- FIGURE 51 THERMAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 52 MASS FLOW CONTROLLER MARKET, BY CONNECTIVITY

- FIGURE 53 DIGITAL SEGMENT TO LEAD MARKET IN 2029

- FIGURE 54 MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY

- FIGURE 55 SEMICONDUCTOR INDUSTRY TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 56 EUROPE TO DOMINATE WATER & WASTEWATER TREATMENT MARKET IN 2024

- FIGURE 57 MASS FLOW CONTROLLER MARKET, BY REGION

- FIGURE 58 CHINA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 59 NORTH AMERICA: MASS FLOW CONTROLLER MARKET SNAPSHOT

- FIGURE 60 EUROPE: MASS FLOW CONTROLLER MARKET SNAPSHOT

- FIGURE 61 ASIA PACIFIC: MASS FLOW CONTROLLER MARKET SNAPSHOT

- FIGURE 62 SOUTH AMERICA TO LEAD MASS FLOW CONTROLLER MARKET IN ROW IN 2024

- FIGURE 63 MASS FLOW CONTROLLER MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2019–2023

- FIGURE 64 MARKET SHARE ANALYSIS OF KEY PLAYERS OFFERING MASS FLOW CONTROLLERS, 2023

- FIGURE 65 COMPANY VALUATION, 2023

- FIGURE 66 FINANCIAL METRICS, 2023 (EV/EBITDA)

- FIGURE 67 MASS FLOW CONTROLLER MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 68 MASS FLOW CONTROLLER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 69 MASS FLOW CONTROLLER MARKET: COMPANY FOOTPRINT

- FIGURE 70 MASS FLOW CONTROLLER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 71 HORIBA, LTD.: COMPANY SNAPSHOT

- FIGURE 72 SENSIRION AG: COMPANY SNAPSHOT

- FIGURE 73 MKS INSTRUMENTS: COMPANY SNAPSHOT

- FIGURE 74 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 75 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

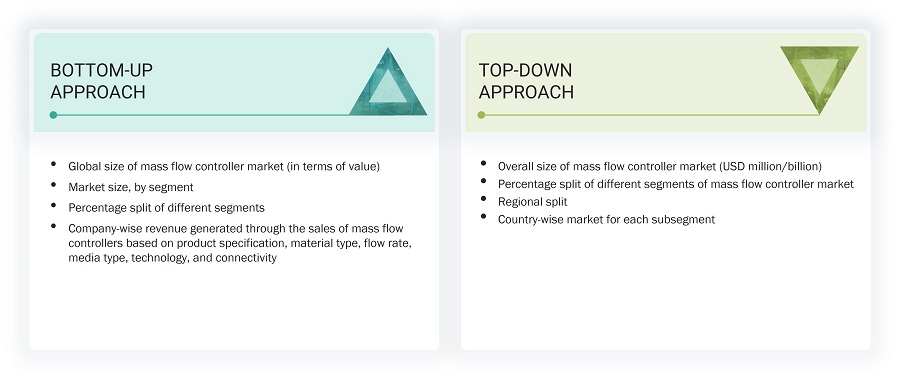

The study involved four major activities in estimating the size of the mass flow controller market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering mass flow controller have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the mass flow controller market. Secondary sources considered for this research study include government sources, corporate filings, and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of mass flow controller to identify key players based on their products and prevailing industry trends in the mass flow controller market by product specification, media type, material type, flow rate, technology, connectivity, end-user industry, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

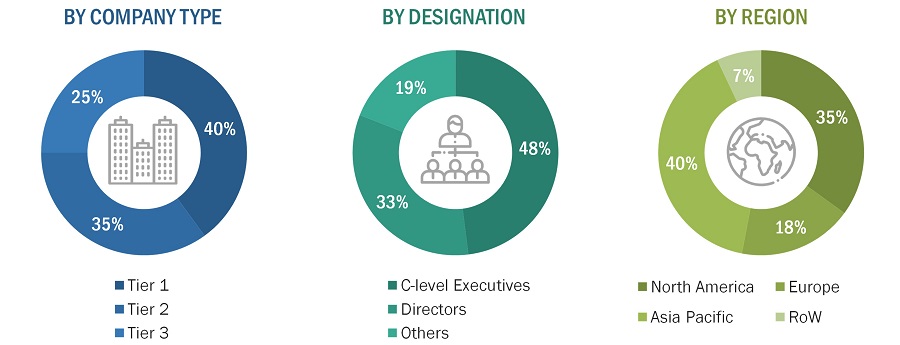

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the mass flow controller market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the mass flow controller market.

- Initially, more than 35 companies offering mass flow controller were identified. Their offerings were mapped based on product specification, material type, media type, flow rate, and end–user industry.

- After understanding the different types of mass flow controllers offered by various manufacturers, based on the data gathered through primary and secondary sources, the market was categorized into different segments.

- To derive the global mass flow controller market, global server shipments of top players for each device type that were considered in the scope of the report were tracked.

- A suitable penetration rate was assigned for the shipment of each of these device types to derive the shipments of mass flow controller.

- Using the average selling price (ASP) at which a particular company offers its devices, we derived the mass flow controller market based on different device types. The ASP of each device was identified based on secondary sources and validated from primaries.

- For the projected market values of each of the device types, the Y-o-Y projections showed a steep growth initially until 2019. COVID-19 has not impacted market much and it is expected that market will grow positively during forecast period. The market is expected to witness a sharp ascent, thereafter, considering the demand for mass flow controller for different applications.

- For the CAGR, the market trend analysis was carried out by understanding the industry penetration rate and the demand and supply of mass flow controller in different applications.

- We also tracked the mass flow controller market through the data sanity method. The revenues of more than 25 key providers were analyzed through annual reports and press releases and summed to derive the overall market.

- For each company, a percentage is assigned to its overall revenue or, in a few cases, segmental revenue, to derive its revenue for the mass flow controller. This percentage for each company is assigned based on the company’s product portfolio and its range of mass flow controller offerings.

- Verifying and crosschecking the estimates at every level by discussing with key opinion leaders, including CXOs, directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

The top-down approach has been used to estimate and validate the total size of the mass flow controller market.

- The global market size of maass flow controllers was estimated through the data sanity of 35 major companies.

- The growth of the mass flow controller market witnessed an upward slope trend during the studied period, as it is currently in the initial stage of the product cycle, with major players beginning to expand their business into various application areas of the market.

- Types of mass flow controllers, their features and properties, geographical presence, and key applications served by all players in the mass flow controller market were studied to estimate and arrive at the percentage split of the segments.

- Different types of mass flow controllers and their penetration for the end-user industries were also studied.

- The market split for mass flow controller by product specification, material type, media type, technology, connectivity, and end-user industry based on secondary research was estimated.

- The demand generated by companies operating in different application segments of the end-usee industry was analyzed.

- Multiple discussions with key opinion leaders across major companies involved in the development of mass flow controller and related components were conducted to validate the market split of technology, flow rate, and connectivity.

- The regional splits were estimated using secondary sources, based on factors such as the number of players in a specific country and region and the adoption and use cases of each implementation type with respect to applications in the region

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the mass flow controller market.

Market Definition

A mass flow controller is a device that measures and controls the flow of liquids and gases. It is operated by electric signals and designed to monitor and calibrate media flow rate according to predetermined flow rates. It is implemented in various industries where accurate control and calibration of flow rates are required. The mass flow controller market is highly competitive, with more than 30 companies competing against each other to sustain their position in the market and increase their market share. The mass flow controller market is likely to witness significant growth in the coming years mainly owing to the growing demand for such controllers in the semiconductor industry and surging demand for intelligent flow meters in the chemical and water & wastewater industries.

Key Stakeholders

- End–users

- Government bodies, venture capitalists, and private equity firms

- Mass flow controller manufacturers

- Mass flow controller distributors

- Mass flow controller industry associations

- Professional service/solution providers

- Research institutions and organizations

- Standards organizations and regulatory authorities related to the mass flow controller market

- System integrators

- Technology consultants

Report Objectives

- To define, describe, segment, and forecast the mass flow controller market, by product specification, material type, media type, flow rate, technology, connectivity, and end-user industry, in terms of value

- To forecast the market for mass flow controllers, in terms of volume

- To describe and forecast the market for various segments, with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the mass flow controller market

- To provide a detailed overview of the mass flow controller market’s supply chain, along with the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis for the market

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) related to the mass flow controllers.

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market share and core competencies2

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches/developments, collaborations, partnerships, acquisitions, and research & development (R&D) activities, carried out by players in the mass flow controller market

- To profile key players in the mass flow controller market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies2

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mass Flow Controller Market

I want to understand the competitive scenario and market players share for especially for Semiconductor application. Do you have anything related to the same?

My current focus is on MFC for low flow applications. Have you covered it in your report? With which granularity?

Mass flow controller is a pretty big market.

I have more interest to know about the mass flow controller market in North America and its penetration. Kindly provide me same executive summary on the same

Dose this report covers mass flow sensors? As we are interested to know about latest technology in mass flow sensor and major companies in the European market.

our company is open for mass flow controls applications across the industries, hence we would like to know overall industry behavior for MFC. What all is included in this report for mentioned industries?