Mass Notification System Market

Mass Notification System Market by Software (Public Warning & Emergency Alerting, Operational & IT Alerting), Hardware (Fire Alarm System, Public Address Systems), Application (Critical Event Management, Reporting & Analytics) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global mass notification system market is projected to grow from USD 28.88 billion in 2025 to USD 80.44 billion by 2030, at a CAGR of 22.7% during the forecast period. Mass Notification System is a communication solution that includes basic alerting mechanisms to efficiently inform and direct individuals to safety. It comprises a comprehensive framework encompassing inputs and monitoring capabilities to provide directives during critical situations. Frequent disasters and stringent regulations in North America drive demand for advanced emergency communication systems. In Asia Pacific, vendors view the region as a major growth opportunity, as organizations increasingly look for integrated, technology-driven platforms to strengthen both public safety and business continuity. During critical events and emergency situations, mass alerting uses multiple communication channels to quickly transmit messages to ensure those affected can respond decisively.

KEY TAKEAWAYS

-

By RegionNorth America dominates the mass notification system market with a share of 28.06% in 2025.

-

By OfferingBy offering, the electronic messaging displays segment is projected to register the highest CAGR of 24.2% during the forecast period.

-

By Communication ChannelBy communication channel, the voice communication segment dominates the market with share of 40.2% in 2025.

-

By ApplicationBy application, the business continuity & disaster management is anticipated to be the fastest-growing segment during the forecast period.

-

By VerticalBy vertical, the BFSI segment dominated the overall mass notification system market in 2025.

-

Competitive Landscape - Key PlayersHoneywell, Johnson Controls, and Motorola Solutions were identified as leading players in the mass notification system market due to their strong product innovation, broad industry coverage, and solid operational and financial performance.

-

Competitive Landscape - StartupsRegroup Mass Notification, Crises Control, and CrisisGo have distinguished themselves among startups and SMEs through robust product portfolios and effective business strategies.

-

North America mass notification system (MNS) marketThe North America mass notification system (MNS) market is projected to surge from USD 8.10 billion in 2025 to USD 19.77 billion by 2030, expanding at a remarkable 19.5% CAGR.

-

Europe mass notification system marketThe Europe mass notification system market is projected to grow from USD 7.29 billion in 2025 to USD 19.87 billion by 2030, at a CAGR of 22.2% during the forecast period.

-

Asia Pacific mass notification system marketThe Asia Pacific mass notification system market is projected to grow from USD 6.48 billion in 2025 to USD 20.22 billion by 2030, at a CAGR of 25.6% during the forecast period.

-

Healthcare Mass Notification System MarketThe healthcare mass notification system market is projected to grow from USD 3.53 billion in 2025 to USD 11.27 billion by 2030, at a CAGR of 26.1% during the forecast period.

-

Military Mass Notification System (MNS) MarketThe military mass notification system (MNS) market is projected to grow from USD 0.48 billion 2025 to USD 1.50 billion by 2030, expanding at a remarkable CAGR of 25.8%.

Mass notification systems simplify safety processes by sending clear, predefined messages that inform people about emergencies and required actions. During security incidents, MNS systems deliver accurate information and support quick response to safety instructions. By integrating mass notification systems, organizations can manage risks more effectively and secure critical assets. Overall, these systems improve preparedness and strengthen structured and timely crisis management.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The mass notification system market is estimated to grow at a CAGR of 22.7% by value during the forecast period. The market is expanding due to rising safety concerns, technological advancements, and the need for real-time communication. Organizations seek efficient ways to disseminate critical information during emergencies, driving the demand for versatile notification solutions. Additionally, the integration of social media platforms has further fueled the growth by enhancing accessibility and reach. This convergence is expected to change the business revenue mix for mass notification system vendors in the next 3-5 years.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing need for real-time, multi-channel emergency communication across organizations

-

Regulatory and industry-mandated requirements for emergency preparedness

Level

-

Legacy communication infrastructure and inconsistent telecom reliability

-

Data privacy concerns and strict regulatory controls around emergency communication

Level

-

Integration of MNS with critical event management, GIS, and IoT-based sensing

-

Expansion into AI-driven alert automation, multilingual messaging, and behavioral response analytics

Level

-

Managing reliable message delivery during high-volume emergency events

-

Managing cross-channel consistency, false alarms, and governance across large distributed organizations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Growing need for real-time, multi-channel emergency communication across organizations and municipalities

Mass notification systems are used for public safety, campus security, and emergency response in organizations. Multi-channel alerting, along with alerts that comply with CAP standards and two-way communication capabilities, drives their adoption. The increasing frequency of natural disasters and security threats creates a strong need for dependable, high-speed mass communication platforms.

Legacy communication infrastructure and inconsistent telecom reliability

Many organizations still depend on outdated PBX systems and fragmented communication channels, which are not built for high-volume messaging. Telecom congestion during peak emergencies limits the number of messages that can be delivered, while old hardware restricts the modern features of mass notification systems. These infrastructure issues hinder the transition to cloud-based mass notification systems.

Integration of MNS with critical event management, GIS, and IoT-based sensing

Vendors can stand out by providing GIS-based location targeting, automated alert triggers from IoT sensors, and API-driven workflows with incident response platforms. Solutions that combine situation awareness and automated notifications across multiple devices are suited for enterprises looking for complete emergency communication systems.

Managing reliable message delivery during high-volume emergency events

During natural disasters or security incidents, traffic surges can overload networks. Ensuring there are backup routes across carriers, maintaining delivery speeds backed by SLAs, and managing millions of messages at once is technically challenging. High expectations for instant, reliable alerts put pressure on vendors to provide strong infrastructure with continuous uptime.

MASS NOTIFICATION SYSTEM MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Barren County Schools implemented OnSolve One Call Now to improve communication with parents, students, and the broader community. The system provided a centralized way to send timely notifications across all seven elementary schools, one middle school, and one high school. | The platform enhanced communication with parents and the community, enabling efficient messaging to multiple subgroups. This reduced the time spent on manual outreach and improved overall parent engagement. |

|

To improve patient-care coordination during COVID-19, the VA Medical Center partnered with Johnson Controls to install mass notification and duress systems. These technologies enabled quick detection and communication of patient conditions requiring immediate caregiver attention. | The solution enabled better management of care, resources, and exposure, and improved detection of urgent patient conditions. It also maintained the quality of care despite pandemic challenges and enhanced staff well-being and operational effectiveness. |

|

Riverside Healthcare adopted Singlewire’s InformaCast to relay critical information to crisis-response staff. The system also supported the organization’s shift from a paging setup to a more versatile mobile communication platform. | The implementation improved communication and collaboration among staff, increased patient safety, accelerated emergency response times, and reduced the time to react to critical events. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The MNS market encompasses software providers that deliver platforms for real-time alerts and emergency coordination, while hardware vendors include broadcast systems and physical alerting devices. Service providers support deployment and integration to ensure reliable, organization-wide communication during critical events. Together, these segments enable fast, secure, and scalable mass alerting across campuses, enterprises, and public safety environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Mass Notification System Market, By Offering

Public Warning & Emergency Alerting Platform is becoming central to large-scale emergency communication strategies. These systems provide expansive coverage across cities and industrial zones, enabling authorities to deliver real-time alerts during natural disasters and security threats. Their ability to reach broad populations quickly makes them a core component of modern public safety infrastructure.

Mass Notification System Market, By Communication Channel

Voice communication remains a key channel because of its clarity, immediacy, and effectiveness across diverse user groups. Organizations rely on voice alerts for urgent, high-impact messaging where tone, urgency, and direct comprehension matter. This channel supports landlines, mobile devices, and integrated PA systems, ensuring reliable delivery during critical moments.

Mass Notification System Market, By Application

Public safety and warning applications form the backbone of the mass notification ecosystem. These systems help authorities distribute timely alerts during emergencies such as severe weather events, security breaches, and infrastructure failures. Their role in safeguarding communities and coordinating response activities drives widespread adoption across government and enterprise settings.

Mass Notification System Market, By Facility Type

Outdoor facilities are increasingly deploying mass notification systems to ensure rapid communication across wide, open environments. Solutions such as outdoor speakers, sirens, and integrated digital signage help convey instructions during emergencies in locations like industrial parks, transportation hubs, and stadiums. Their coverage range and durability make them suitable for high-traffic, distributed spaces.

Mass Notification System Market, By Vertical

BFSI organizations rely on mass notification systems to maintain business continuity, protect employees and customers, and respond swiftly to operational or security-related disruptions. These systems support crisis communication, fraud alerts, evacuation coordination, and IT outage notifications. Strong compliance requirements and the need for resilient communication drive adoption across banks, insurance companies, and financial institutions.

REGION

Asia Pacific to be fastest-growing region in global mass notification system market during forecast period

Asia Pacific is expected to be the fastest-growing region in the global mass notification system market. Companies are increasing investments in emergency communication systems due to the rise in natural disasters and growing public safety needs. Rapid urbanization and major smart city projects in countries such as India, China, and Singapore are accelerating the adoption of integrated alerting platforms. Healthcare providers and transportation networks are adopting cloud-based notification systems, which is driving market growth. In addition, the increased mobile use and rollout of 5G are improving the reach and reliability of mass communication technologies across the region.

MASS NOTIFICATION SYSTEM MARKET: COMPANY EVALUATION MATRIX

In the mass notification system market matrix, Honeywell (Star) leads with its comprehensive emergency communication platforms and deep expertise in public safety and critical event management. Its scalable solutions and continuous enhancements in real-time alerting and system reliability is maintaining its position as a global leader in the market. OnSolve (Emerging Leader) is gaining momentum with its AI-driven critical event management capabilities that help organizations detect, analyze, and respond to threats with speed and precision. Its focus on intelligent alerting and cross-channel communication positions it as a rising challenger in the MNS landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Siemens AG (Germany)

- Everbridge (US)

- Honeywell (US)

- Eaton (Ireland)

- Motorola Solutions (US)

- Blackberry (Canada)

- Johnson Controls (Ireland)

- Singlewire Software (US)

- OnSolve (US)

- AlertMedia (US)

- Alertus Technologies (US)

- F24 (Germany)

- HipLink (US)

- American Signal Corporation (US)

- ATI Systems (US)

- Finalsite (US)

- Omnilert (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 23.76 BN |

| Market Forecast in 2030 (value) | USD 80.44 BN |

| Growth Rate | 22.7% |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Offering - Software, Hardware, Services Software - Type, Integration, Deployment Mode Type - Crisis & Event Notification Platform, Campus & Facility Notification Software, Public Warning & Emergency Alerting Platform, Operational & IT Alerting Software, Others Integration - Integrated, Standalone Deployment Mode - Cloud, On-premises Hardware - Fire Alarm Systems, Public Address Systems, Duress Buttons, Electronic Messaging Displays, Visual Alerts Devices, Sirens Services - Professional Services, Managed Services Professional Services - Consulting & Planning Services, Training & Support Services Communication Channel - Voice Communication, Digital Communication, Text-based Communication Facility Type - Indoor Facilities, Outdoor Facilities Application - Critical Event management, Public Safety & Warning, Business Continuity & Disaster Management, Reporting & Analytics, Other Applications Vertical - BFSI, Retail & eCommerce, Transportation & Logistics, Government & Defense, Healthcare & Life Sciences, Telecom, Energy & Utilities, Manufacturing, IT/ITeS, Media & Entertainment, Education, Other Verticals |

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: MASS NOTIFICATION SYSTEM MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Mass Notification System Vendor |

|

|

| Leading Mass Notification System Vendor |

|

|

RECENT DEVELOPMENTS

- July 2024 : Thoma Bravo completed the acquisition of Everbridge through an all-cash transaction valued at approximately USD 1.8 billion. The deal brings Everbridge, a provider of critical event management and public warning software, into Thoma Bravo’s portfolio.

- March 2024 : The state of California partnered with Motorola Solutions to strengthen its disaster preparedness and response capabilities. Through this partnership, California will utilize Rave Prepare, a solution provided by Motorola Solutions, to gather additional opt-in information.

- March 2024 : Kontakt.io, a leader in inpatient journey analytics, partnered with Singlewire Software. This partnership aims to integrate Singlewire's InformaCast mass notification and management software with Kontakt.io's staff safety solution. Through this integration, Kontakt.io smart badges will initiate InformaCast notifications, offering personalized protection for healthcare workers.

- June 2023 : Everbridge announced that the dual-island Caribbean nation of Trinidad and Tobago deployed the company’s public alerting software to help keep residents and visitors safe and informed in the event of an emergency.

- February 2023 : Singlewire Software acquired Visitor Aware to bolster safety and communication solutions by adding visitor and student management capabilities to its InformaCast software, enhancing emergency preparedness and operational efficiency.

Table of Contents

Methodology

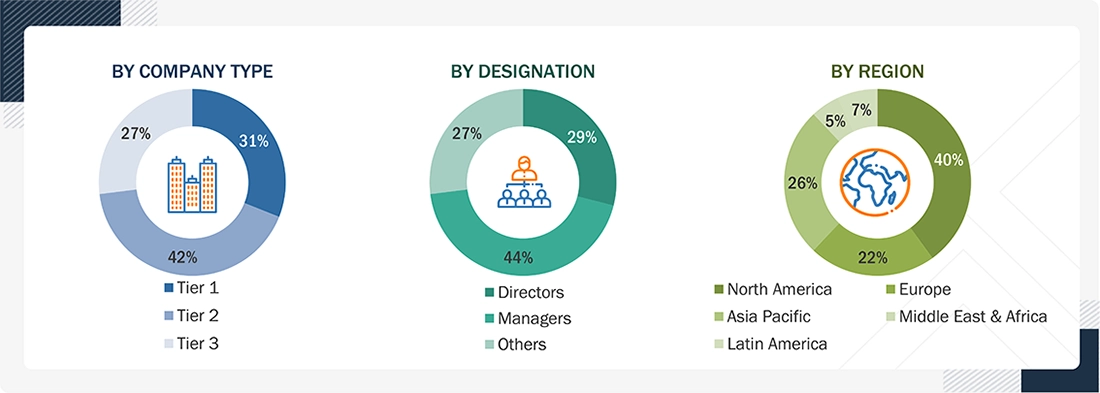

The research methodology for the Mass Notification System market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect useful information for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including software by type; software by integration; by deployment mode; verticals; high-level executives of multiple companies offering mass notification system software, hardware & services; and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

During the secondary research process, various secondary sources were consulted to identify and collect information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications.

The secondary research was utilized to gather key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation based on industry trends, and regional markets, as well as key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, a diverse range of stakeholders from both the supply and demand sides of the Mass notification system ecosystem were interviewed to gather qualitative and quantitative insights specific to this market. From the supply side, key industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology & innovation directors, as well as technical leads from vendors offering Mass notification system hardware, software & services, were consulted. Additionally, system integrators, service providers, and IT service firms that implement and support the Mass notification system solutions were included in the study. On the demand side, input from IT decision-makers, infrastructure managers, and business heads of prominent industry verticals was collected to understand the user perspectives and adoption challenges within targeted industries.

The primary research ensured that all crucial parameters affecting the Mass notification system market, from technological advancements and evolving use cases to regulatory and compliance needs, were considered. Each factor was thoroughly analyzed, verified through primary research, and evaluated to obtain precise quantitative and qualitative data for this market.

Once the initial phase of market engineering was completed, including detailed calculations for market statistics, segment-specific growth forecasts, and data triangulation, a second round of primary research was conducted. This step was crucial for refining and validating critical data points, such as Mass notification system offerings (hardware, software & services), industry adoption trends, the competitive landscape, and key market dynamics like demand drivers (Growing need for real-time, multi-channel emergency communication across organizations, Regulatory and industry-mandated requirements for emergency preparedness), challenges Balancing ease of access with strong security posture across devices and external users, Managing cross-channel consistency, false alarms, and governance across large distributed organizations), and opportunities (Advanced content lifecycle automation, intelligent sync, and metadata-driven governance, Expansion into AI-driven alert automation, multilingual messaging, and behavioral response analytics) and restraints (Balancing ease of access with strong security posture across devices and external users, Managing cross-channel consistency, false alarms, and governance across large distributed organizations).

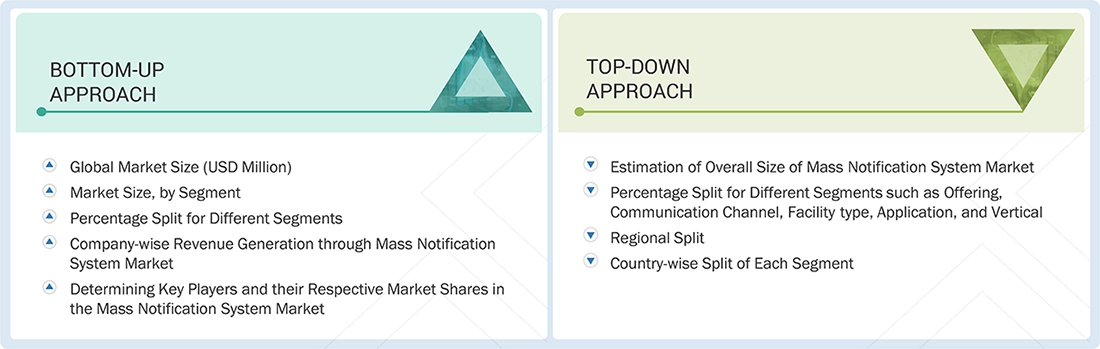

In the comprehensive market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively employed to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1 = revenue more than USD 500 million, tier 2 = revenue between USD 500 million and 100 million, tier 3 = revenue less than USD 100 million

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were employed to estimate and forecast the Mass Notification System market, as well as its dependent submarkets. This multi-layered analysis was further reinforced through data triangulation, which incorporated primary and secondary research inputs. The market figures were also validated against the existing MarketsandMarkets repository for accuracy.

Mass Notification System Market : Top-Down and Bottom-Up Approach

Data Triangulation

The market was divided into several segments and subsegments after determining the overall market size using the market size estimation processes described above. To complete the overall market engineering process and determine the exact statistics for each market segment and subsegment, data triangulation and market segmentation procedures were employed, wherever applicable. The overall market size was then used in the top-down approach to estimate the size of other individual markets by applying percentage splits to the market segmentation.

Market Definition

According to Everbridge, a mass notification system is a vital solution that enables the prompt and precise delivery of notifications to individuals or groups, irrespective of their location. It is a comprehensive platform, swiftly disseminating emergency messages through various communication channels like voice calls, SMS, push notifications, desktop alerts, and social media. By utilizing visual intelligence and user-friendly interfaces, a mass notification system ensures that the right message reaches the intended recipients during critical events, regardless of their devices or physical whereabouts. This system plays a pivotal role in protecting people, securing operations, and safeguarding the reputation of organizations by facilitating timely and accurate communication.

Key Stakeholders

- Mass Notification System Vendors

- Mass Notification Software Vendors

- Managed Service Providers

- Support and Maintenance Service Providers

- System Integrators (SIs)/Migration Service Providers

- Distributors and Value-added Resellers (VARs)

- Independent Software Vendors (ISVs)

- Cloud Service Providers

- Technology Providers

Report Objectives

- To define, describe, and predict the mass notification system market by offering (software, hardware, and services), communication channel, facility type, application, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall mass notification system market

- To analyze competitive developments, such as partnerships, new product launches, mergers & acquisitions, in the mass notification system market

- To analyze the competitive developments, such as partnerships, product launches, mergers and acquisitions, in the Mass notification system market

- To analyze the impact of macroeconomic factors on the Mass Notification System market across all regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report.

Product Analysis

- Product comparative analysis, which gives a detailed comparison of innovative products being offered by prominent vendors

Geographic analysis

- Further breakup of additional European countries by offering, communication channel, facility type, application and vertical

- Further breakup of additional Asia Pacific countries by offering, communication channel, facility type, application and vertical

- Further breakup of additional Middle East & African countries by offering, communication channel, facility type, application and vertical

- Further breakup of additional Latin American countries by offering, communication channel, facility type, application and vertical

Company information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Mass Notification System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Mass Notification System Market