Middle East and Africa Cybersecurity Market by Component (Software, Hardware, and Services), Software (IAM, Encryption and Tokenization, and Other Software), Security Type, Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2028

The Middle East and Africa Cybersecurity Market size is projected to grow from $22.2 billion in 2023 to $36.2 billion by 2028, at a CAGR of 10.2% during the forecast period. Factors driving market growth include the growing adoption of cybersecurity solutions and services due to the rising number of cyber-attacks, the growing era of eCommerce along with digital payment solutions, and the growing demand for digital transformation initiatives. However, insuffiecient regulatory frameworks; and low cyber security budget and spending is expected to hinder market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Middle East and Africa Cybersecurity Market Dynamics

Driver: Increased cyber threats and attacks

The Middle East and Africa region has been a target of various cyber threats and attacks in recent years. These threats and attacks are often carried out by state-sponsored groups, cybercriminals, or hacktivists seeking to disrupt the region's political and economic stability. Cyberattacks have become more frequent and sophisticated as the region's economy and businesses become more digitalized. These attacks can have significant financial and reputational impacts on businesses, leading to an increased demand for cybersecurity solutions to protect against them. A report by Trend Micro showed that the Middle East and Africa region saw a 23% increase in cybercrime from Q1 to Q2 in 2021, with the financial sector being the most targeted industry. According to a report by Cybersecurity Insiders, the Middle East and Africa region saw a 56% increase in data breaches in 2021 compared to the previous year. This highlights the growing need for businesses and governments to invest in cybersecurity solutions to protect sensitive information.

Restraint: Lack of awareness and understanding

Lack of awareness is a significant issue in the cybersecurity market in the Middle East and Africa region. Many organizations in the Middle East and Africa region have limited resources and are often unable to invest in cybersecurity measures. As a result, they may not be aware of the latest threats and vulnerabilities in the cyber landscape. Cybersecurity is often not a priority for many organizations in the Middle East and Africa region. They may focus more on other aspects of their business, such as revenue growth, and may not realize the potential damage that a cyberattack can cause. A lack of education and training in cybersecurity in the Middle East and Africa region can lead to a lack of awareness. Many organizations may not understand the potential risks associated with their IT systems and may not have the necessary skills to implement effective cybersecurity measures. Cultural factors may sometimes contribute to a lack of cybersecurity awareness. For example, some organizations may be hesitant to share information about security breaches or vulnerabilities due to concerns about reputation and loss of trust.

Opportunity: Cross sector collaboration

Cross-sector collaboration is becoming increasingly important in the cybersecurity market in the Middle East and Africa region. This collaboration involves sharing information, resources, and expertise between different sectors, such as government, finance, healthcare, and energy, to strengthen cybersecurity measures and protect against cyber threats. Several initiatives have been launched in the Middle East and Africa region to encourage cybersecurity information sharing between different sectors. For example, the UAE Computer Emergency Response Team has established partnerships with various sectors, including telecommunications, finance, and transportation, to share intelligence on cyber threats and vulnerabilities.

Challenge: Limited cybersecurity budget

Limited cybersecurity budgets are a significant challenge that many organizations in the Middle East and Africa region face when it comes to cybersecurity. With limited financial resources, it becomes difficult for these organizations to invest in advanced security technologies, hire skilled cybersecurity professionals, and build a comprehensive cybersecurity program. One of the main reasons for the limited cybersecurity budgets in the Middle East and Africa region is the low priority given to cybersecurity. Many organizations do not understand the potential impact of cyber threats or recognize the need to invest in cybersecurity. According to a survey by Ernst & Young, only 27% of organizations in the Middle East have a dedicated cybersecurity budget. Additionally, cybersecurity is often viewed as a cost center rather than a revenue generator, making it difficult for organizations to justify investing in cybersecurity.

Middle East and Africa Cybersecurity Market Ecosystem

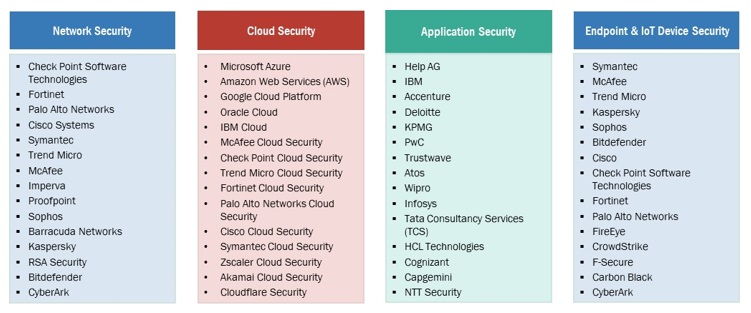

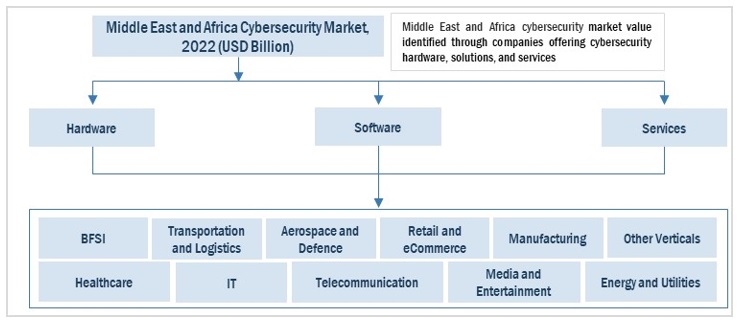

The cybersecurity ecosystem in the Middle East and Africa region is complex and dynamic, with multiple players involved in delivering cybersecurity solutions across various areas, including network, cloud, application, and endpoint & IoT device security. In terms of network security, the ecosystem includes hardware and software manufacturers, system integrators, Managed Security Service Providers (MSSPs), and end users. Network security solutions in the Middle East and Africa region include firewalls, intrusion detection and prevention systems, VPNs, and other technologies that protect networks against cyber threats.

To know about the assumptions considered for the study, download the pdf brochure

By Component, the hardware segment to grow at the highest CAGR during the forecast period

Hardware devices are an essential component of cybersecurity, including encryption, network access control (NAC), firewalls, and authentication tokens. Hardware encryption provides protection to data both at rest and in transit by utilizing specialized electronic circuits integrated with storage drives, enabling full channel speed encryption without requiring software or driver installation. This technology safeguards data stored on devices from various attacks, such as malicious codes, brute force attacks, and cold boot attacks. As technology continues to evolve, smaller and more efficient neuromorphic chip-based systems are expected to replace larger hardware devices. High-computational hardware devices are designed to handle graphic-intensive applications, enabling high-quality image rendering, animations, and videos. These advancements are among the factors driving the growth of the cybersecurity market in the Middle East and Africa.

By Software, the Log Management and SIEM segment to grow at the highest CAGR during the forecast period

IT organizations utilize software tools such as Security Information and Event Management (SIEM) and log management to monitor their security posture, detect and respond to Indicators of Compromise (loC), and conduct forensic data analysis and investigations into network events and possible attacks using log files. Log management is a continuous practice that involves the collection, storage, processing, synthesis, and analysis of data from various programs and applications to improve system performance, identify technical issues, manage resources effectively, enhance security, and ensure compliance. Log files, which are computer-generated files, capture activity within the operating system or software applications and document system administrator-designed information such as error reports, messages, file requests, and file transfers automatically.

By Service, the professional segment is expected to account for largest market share during the forecast period

Professional services are the services provided by product vendors to strategically help clients organize, design, analyze, implement, and manage technological systems. These services play a vital role in any ecosystem. The professional services include consulting, training and education, design and implementation, risk and threat assessment, and support and maintenance. As these services are complex, service providers must possess high-level technical skills and expertise.

By Security Type, the Application Security segment is expected to grow at the highest CAGR during the forecast period

Security solutions enable enterprises to secure their business-sensitive applications through greater visibility and control. Using existing security solutions, such as IAM, web filtering, and application whitelisting, enables the security of enterprise applications and software codes from external and internal threats, including web attacks, DDoS, site scraping, and fraud. Business-sensitive applications are one of the primary targets of attackers, as they carry information about critical assets and processes followed by enterprises. Several organizations rely on network security and neglect applications, which creates a security gap and makes them susceptible to attacks. Cybersecurity solutions and services prevent user applications from being attacked. These solutions and services collect security and event information from all web applications, after which they analyze the data for vulnerable or malicious events and study the event behavior to protect user applications.

By Deployment Mode, the Cloud segment is expected to grow at the highest CAGR during the forecast period

The cloud deployment mode is the fastest-growing segment in the Middle East and Africa cybersecurity market. Using cloud-based cybersecurity solutions, organizations can avoid hardware, software, storage, and technical staff costs. Cloud-based platforms offer a unified way to secure business applications via SaaS-based security services. These platforms are beneficial for organizations that have strict budgets for security investments. SMEs deploy their solutions in the cloud, enabling them to focus on their core competencies rather than invest their capital in security infrastructures. The cloud deployment mode is growing as cloud cybersecurity solutions are easy to maintain and upgrade. Furthermore, deploying security solutions in the cloud can help businesses focus on their core operational functionalities rather than increasingly investing in capital infrastructure for IT security. Cloud-based cybersecurity solutions help secure Access Control Management (ACM) in a physical and virtualized cloud data center environment. Enterprises that have completely migrated their IT capabilities to the cloud increasingly deploy cloud-based cybersecurity solutions, driving the market growth.

By vertical, the healthcare segment is expected to grow at the highest CAGR during the forecast period

The future of healthcare lies in the increase in interconnected IoMT devices, augmented reality, and robotics. This clarifies that most healthcare organizations' current perimeter-based security model will no longer be effective. To stay ahead of these trends, healthcare organizations are expected to invest in the basics while making a fundamental shift from the castle-and-moat approach to a cybersecurity model. Various compliance acts, such as HIPPA and PCI DSS, also encourage the adoption of cybersecurity solutions in the healthcare vertical. Recent attacks on Electronic Health Records (EHRs) have led SMEs and large healthcare organizations to invest in cybersecurity architecture and defend and prevent attacks from internal and external threat actors. Healthcare IT security teams are strengthening their network infrastructure with different security solutions by considering each endpoint device as a hostile device, thereby encouraging the growth of the Middle East and Africa cybersecurity market.

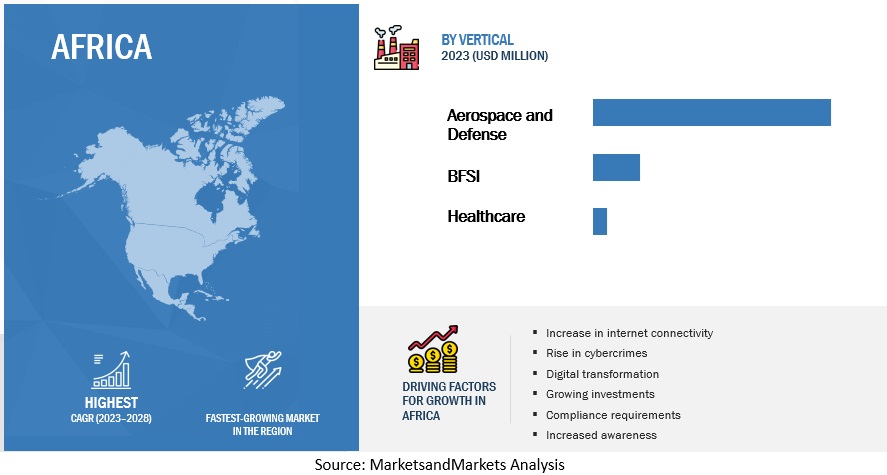

By region, Africa is expected to grow at the highest CAGR during the forecast period

Africa has experienced a significant surge in internet usage, leading to a rise in cybercrime as hackers exploit weaknesses to gain access to sensitive information. African nations are also struggling to establish a robust cybersecurity framework to defend against these threats. This requires investing in cybersecurity technology, crafting policies and laws, and developing a competent workforce to handle cyber attacks. However, Africa faces exceptional challenges, including insufficient resources and infrastructure, political instability, and inadequate law enforcement, which complicate the cybersecurity landscape. These challenges make it more challenging to combat cybercrime effectively.

Key Market Players

Key players in the Middle East and Africa Cybersecurity market include IBM (US), Cisco (US), Palo Alto Networks (US), Check Point (Israel), Trend Micro (Japan), Fortinet (US), Norton LifeLock (US), Sophos (UK), Kaspersky (Russia), Trellix (US) and ESET (Slovakia).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

Component, Software, Service, Security Type, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

Middle East and Africa |

|

Major companies covered |

IBM (US), Cisco (US), Palo Alto Networks (US), Check Point (Israel), Trend Micro (Japan), Fortinet (US), Norton LifeLock (US), Sophos (UK), Kaspersky (Russia), Trellix (US), ESET (Slovakia), DTS Solution (UAE), RAS Infotech (UAE), SpiderSilk (UAE), CYBERSEC CONSULTING (UAE), AHAD (UAE), CodeGreen (UAE), LogRhythm (US), Malwarebytes (US), Safe Decision (KSA), Security Matterz (KSA), Infratech (KSA), Cato Networks (Israel), Help AG (UAE), Cysiv (Egypt), CyberGate (UAE), Augmenta Cyber Security (South Africa), CipherWave (Gauteng), Defendza (UK), SecureTech (Israel), Tactical Intelligence Security Ltd. (Ghana), and ZINAD (UAE). |

Market Segmentation

Recent Developments

- In February 2023, Cisco fulfilled its commitment to simplifying IT operations by unveiling new advancements in cloud-managed networking. The company has introduced robust cloud management tools specifically designed for industrial IoT applications, streamlined dashboards that merge IT and OT operations, and adaptable network intelligence to monitor and secure industrial assets. This results in a cohesive experience that offers genuine business flexibility.

- In December 2022, Palo Alto Networks announced the successful acquisition of Cider Security, a leader in application security and software supply chain security. This acquisition will enhance Palo Alto Networks' cybersecurity offerings.

- In December 2022, Fortinet and Rockwell Automation formed a partnership to offer robust cybersecurity solutions to customers worldwide by combining advanced networking and security capabilities. The distinctive features of OT and IT environments result in varied cybersecurity risks and a distinct threat landscape for ICS systems. Hence, the need for customized security solutions to address the specific challenges arising.

Frequently Asked Questions (FAQ):

What is the definition of cybersecurity?

MarketsandMarkets defines cybersecurity as a set of technologies, processes, and practices to fortify critical systems, such as networks, physical devices, programs, information from unauthorized access, insider threats, and malicious attacks. These cyberattacks can affect data transmission across networks, cause operational disruptions, and result in money extortion-ransomware. Cybersecurity, or information security, can be provided in the form of hardware, software, and services.

What is the projected value of the Middle East and Africa Cybersecurity market?

The Middle East and Africa Cybersecurity market is expected to grow from an estimated USD 22.2 billion in 2022 to 36.1 billion USD by 2027, at a Compound Annual Growth Rate (CAGR) of 10.2% from 2023 to 2028.

Which are the key companies influencing the growth of the Middle East and Africa Cybersecurity market?

Cisco, Palo Alto Networks, Fortinet, Check Point, IBM, and Trend Micro are recognized as star players in the Middle East and Africa cybersecurity market. These companies account for a significant share of the Middle East and Africa Cybersecurity market. They offer comprehensive solutions related to cybersecurity solutions and services. These vendors offer customized solutions as per user requirements and adopt growth strategies to consistently achieve the desired growth and mark their presence in the market.

Which vertical segment is expected to grow at the highest CAGR during the forecast period?

The healthcare vertical is expected to grow at the highest CAGR during the forecast period.

Which country in the Middle East region is expected to hold the largest market size during the forecast period?

Kingdom of Saudi Arabia is expected to hold the largest market size during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased cyber threats and attacks- Growth of eCommerce and digital payment solutions- Stringent regulations and compliance requirements- Digital transformation initiativesRESTRAINTS- Lack of awareness and understanding- Inadequate infrastructure and lack of skilled professionals- Rapidly evolving threat landscapeOPPORTUNITIES- Cross-sector collaboration- International cooperationCHALLENGES- Limited cybersecurity budgets- Insufficient regulatory frameworks

-

5.3 ECOSYSTEM

-

5.4 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE/MACHINE LEARNINGBIG DATA ANALYTICSCLOUD COMPUTINGINTERNET OF THINGS

-

5.5 REGULATORY IMPLICATIONSPAYMENT CARD INDUSTRY DATA SECURITY STANDARDHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACTFEDERAL INFORMATION SECURITY MANAGEMENT ACTGRAMM-LEACH-BLILEY ACTSARBANES-OXLEY ACTINTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) STANDARD 27001EUROPEAN UNION GENERAL DATA PROTECTION REGULATIONSERVICE ORGANIZATION CONTROL 2 (SOC2)REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.6 PATENT ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 PORTER’S FIVE FORCES MODEL ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 USE CASESUSE CASE 1: SYMANTEC HELPED SAUDI ARAMCO BY PROVIDING COMPREHENSIVE VISIBILITY AND CONTROL OVER IT INFRASTRUCTUREUSE CASE 2: PALO ALTO NETWORKS HELPED SABB BY PROVIDING REAL-TIME THREAT DETECTION AND RESPONSE CAPABILITIESUSE CASE 3: FORTINET’S UNIFIED THREAT MANAGEMENT HELPED NBK PREVENT PHISHING ATTACKS ON ITS BANKING INFRASTRUCTUREUSE CASE 4: MCAFEE ENABLED QATAR AIRWAYS TO ESTABLISH COMPLETE CONTROL OVER ENDPOINT DEVICES

-

5.10 PRICING ANALYSISCYBERSECURITY SOLUTIONS AND SERVICES PRICED ACCORDING TO FOLLOWING METHODS:

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.13 KEY CONFERENCES & EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 HARDWAREDEVELOPMENTS IN HARDWARE DEVICES TO DRIVE MARKET GROWTHHARDWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

6.3 SOFTWARESMART TECHNOLOGIES FOR MITIGATING ADVANCED CYBERATTACKS TO PROPEL MARKETSOFTWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

6.4 SERVICESHUGE PRESENCE OF CYBERSECURITY SERVICE PROVIDERS TO BOOST MARKETSERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

- 7.1 INTRODUCTION

-

7.2 IAMREDUCTION IN RISK OF UNAUTHORIZED ACCESS TO SECURE CRITICAL SYSTEMS TO BOOST MARKETIAM: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

7.3 ANTIVIRUS/ANTIMALWAREINNOVATIVE SOLUTIONS TO OFFER SECURED TEST ENVIRONMENT TO PROPEL MARKETANTIVIRUS/ANTIMALWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

7.4 LOG MANAGEMENT AND SIEM360-DEGREE APPROACH TO FIGHT AGAINST CYBER THREATS TO BOOST MARKETLOG MANAGEMENT AND SIEM: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

7.5 FIREWALLEXTENSIVE ADOPTION OF FIREWALL ACROSS INDUSTRIES TO BOOST MARKETFIREWALL: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

7.6 ENCRYPTION AND TOKENIZATIONTO SAFEGUARD SENSITIVE DATA OUTSIDE INTERNAL SYSTEMS TO PROPEL MARKETENCRYPTION AND TOKENIZATION: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

7.7 COMPLIANCE AND POLICY MANAGEMENTSTRICT LAWS AND REGULATIONS FOR HELPING COMPANIES IDENTIFY CRITICAL IT ASSETS TO DRIVE MARKETCOMPLIANCE AND POLICY MANAGEMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

7.8 PATCH MANAGEMENTSHORT-TERM SOLUTIONS FOR DETECTION AND PREVENTION TO BOOST MARKETPATCH MANAGEMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

- 7.9 OTHER SOFTWARE

- 8.1 INTRODUCTION

-

8.2 PROFESSIONAL SERVICESEXTENSIVE PRESENCE OF SERVICE PROVIDERS FOR FACILITATING SECURITY CONCERNS TO BOOST MARKETPROFESSIONAL SERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERSDESIGN, CONSULTING, AND IMPLEMENTATIONRISK AND THREAT MANAGEMENTTRAINING AND EDUCATIONSUPPORT AND MAINTENANCE

-

8.3 MANAGED SERVICESHIGHER ADOPTION OF SERVICES DUE TO HIGH COST AND RESOURCE CONSTRAINTS TO DRIVE MARKETMANAGED SERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 NETWORK SECURITYINCREASING BYOD TREND TO GENERATE GREATER DEMAND FOR CYBERSECURITY SOLUTIONSNETWORK SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

9.3 CLOUD SECURITYINCREASED ADOPTION OF CLOUD SOLUTIONS ACROSS ENTERPRISES TO DRIVE DEMAND FOR CYBERSECURITY SOLUTIONSCLOUD SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

9.4 APPLICATION SECURITYRISING DEMAND FOR CYBERSECURITY SOLUTIONS TO REDUCE ATTACKS ON BUSINESS-SENSITIVE APPLICATIONSAPPLICATION SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

9.5 ENDPOINT AND IOT SECURITYINCREASING NUMBER OF MOBILE DEVICES EXPOSING NETWORKS VULNERABLE TO CYBERATTACKS TO DRIVE MARKETENDPOINT AND IOT SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

- 10.1 INTRODUCTION

-

10.2 CLOUDGROWING ADOPTION OF CLOUD DEPLOYMENT MODE DUE TO EASY MAINTENANCE AND UPGRADECLOUD: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

10.3 ON-PREMISESON-PREMISES DEPLOYMENT TO MAKE ADOPTION OF CYBERSECURITY SOLUTIONS FLEXIBLEON-PREMISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

- 11.1 INTRODUCTION

-

11.2 SMALL AND MEDIUM-SIZED ENTERPRISESDIGITAL TRANSFORMATION AND LEVERAGED CLOUD COMPUTING TO HELP SMALL AND MEDIUM-SIZED ENTERPRISES GROWSMALL AND MEDIUM-SIZED ENTERPRISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

11.3 LARGE ENTERPRISESLARGE ORGANIZATIONS TO FACILITATE PRIVILEGED ACCESS TO SERVERS AND WEB APPLICATIONSLARGE ENTERPRISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

- 12.1 INTRODUCTION

-

12.2 AEROSPACE AND DEFENSEINCREASING DIGITALIZATION TO LEAD TO GREATER ATTACKS ON CONFIDENTIAL AND SENSITIVE DATAAEROSPACE AND DEFENSE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

12.3 BANKING, FINANCIAL SERVICES, AND INSURANCERISING DEMAND FOR NEW AND IMPROVED FINANCIAL PRODUCTS TO PRIORITIZE ADOPTION OF CYBERSECURITY SOLUTIONSBANKING, FINANCIAL SERVICES, AND INSURANCE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

12.4 IT AND ITESPRESENCE OF LARGE AMOUNTS OF DATA MAKING ORGANIZATIONS PRONE TO CYBERATTACKS TO BOOST MARKETIT AND ITES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

12.5 HEALTHCARESECURITY BREACHES AND UNAUTHORIZED ACCESS TO PERSONAL PATIENT INFORMATION TO CREATE DEMAND FOR SOLUTIONSHEALTHCARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

12.6 RETAIL AND ECOMMERCENEED TO PROTECT STORES, WAREHOUSES, AND FULFILMENT CENTERS FROM THREATS TO DRIVE MARKETRETAIL AND ECOMMERCE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

12.7 MANUFACTURINGCYBERSECURITY SOLUTIONS AND SERVICES TO SMOOTHEN BUSINESS FUNCTIONS IN MANUFACTURING ORGANIZATIONSMANUFACTURING: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

12.8 ENERGY AND UTILITIESRAPID ADOPTION OF INNOVATIVE TECHNOLOGIES TO ENABLE MORE FLEXIBILITY AND SECURITYENERGY AND UTILITIES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

12.9 TELECOMMUNICATIONCYBERSECURITY SOLUTIONS AND SERVICES TO HELP ORGANIZATIONS MANAGE RISKS AND COMPLIANCES EFFICIENTLYTELECOMMUNICATION: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

12.10 TRANSPORTATION AND LOGISTICSTECHNOLOGIES TO PROVIDE INNOVATIVE SERVICES RELATED TO DIFFERENT MODES OF TRANSPORT AND TRAFFIC MANAGEMENTTRANSPORTATION AND LOGISTICS: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

-

12.11 MEDIA AND ENTERTAINMENTNEW DIGITAL TECHNOLOGIES TO DRIVE DEMAND FOR CYBERSECURITY SOLUTIONSMEDIA AND ENTERTAINMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERS

- 12.12 OTHER VERTICALS

- 13.1 INTRODUCTION

-

13.2 MIDDLE EASTMIDDLE EAST: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET DRIVERSMIDDLE EAST: RECESSION IMPACTBAHRAIN- Rising demand for cybersecurity to strengthen critical infrastructure and build resilient digital ecosystemEGYPT- Presence of major vendors to drive demand for cybersecurity solutionsISRAEL- Advancement in cybersecurity industry through strategies and partnerships to propel marketKUWAIT- Rising cyber threats in government sector to propel marketOMAN- Rising instances of sabotaging critical infrastructure in oil and gas industry to boost marketQATAR- Government initiatives and adoption of cybersecurity solutions in critical sectors to drive marketKSA- Growing investment in cybersecurity solutions for securing oil infrastructure to boost marketTURKEY- Rising efforts for enhancing cyber defense techniques to propel marketUAE- Increasing demand for cybersecurity measures and response to cyber threats to drive marketREST OF MIDDLE EAST

-

13.3 AFRICAAFRICA: CYBERSECURITY MARKET DRIVERSAFRICA: RECESSION IMPACTNORTHERN AFRICAWESTERN AFRICACENTRAL AFRICAEASTERN AFRICASOUTHERN AFRICA

- 14.1 OVERVIEW

- 14.2 REVENUE ANALYSIS OF LEADING PLAYERS

- 14.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 14.4 HISTORICAL REVENUE ANALYSIS

- 14.5 RANKING OF KEY PLAYERS IN MIDDLE EAST AND AFRICA CYBERSECURITY MARKET

-

14.6 KEY COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.7 COMPETITIVE BENCHMARKINGKEY COMPANY EVALUATION QUADRANTEVALUATION CRITERIA OF SMES/STARTUPS

-

14.8 SME/STARTUP EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

14.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

-

15.1 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCISCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPALO ALTO NETWORKS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHECK POINT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTREND MICRO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFORTINET- Business overview- Products/Solutions/Services offered- Recent developmentsNORTONLIFELOCK- Business overview- Products/Solutions/Services offered- Recent developmentsSOPHOS- Business overview- Products/Solutions/Services offered- Recent developmentsKASPERSKY- Business overview- Products/Solutions/Services offered- Recent developmentsTRELLIX- Business overview- Products/Solutions/Services offeredESET- Business overview- Products/Solutions/Services offered- Recent DevelopmentEDGE GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsBEACON RED- Business overview- Products/Solutions/Services offered- Recent developmentsMORO HUB- Business overview- Products/Solutions/Services offered- Recent developmentsINJAZAT- G42- Business overview- Products/Solutions/Services offered- Recent developmentsPARAMOUNT COMPUTER SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsSECURELINK- Business overview- Products/solutions/services offered- Recent developmentsSECUREWORKS- Business overview- Products/Solutions/Services offered- Recent developmentsOBRELA SECURITY INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developmentsCPX- Business overview- Products/Solutions/Services offered- Recent developmentsMDS UAE- Business overview- Products/Solutions/Services offered

-

15.2 OTHER PLAYERSDTS SOLUTIONRAS INFOTECHSPIDERSILKCYBERSEC CONSULTINGAHADCODEGREENLOGRHYTHMMALWAREBYTESSAFE DECISIONSECURITY MATTERZINFRATECHCATO NETWORKSHELP AGCYSIV (ACQUIRED BY LIQUID INTELLIGENT TECHNOLOGIES)CYBERGATEAUGMENTA CYBER SECURITYCIPHERWAVEDEFENDZASECURETECHTACTICAL INTELLIGENCE SECURITY LTDZINAD

- 15.3 OTHER REGIONAL AND GLOBAL PLAYERS

- 16.1 ADJACENT MARKETS

-

16.2 LIMITATIONSCYBER SECURITY MARKETTHREAT INTELLIGENCE MARKET

- 16.3 DISCUSSION GUIDE

- 16.4 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.5 CUSTOMIZATION OPTIONS

- 16.6 RELATED REPORTS

- 16.7 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET SIZE AND GROWTH, 2023–2028 (USD MILLION, Y-O-Y GROWTH)

- TABLE 4 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON MIDDLE EAST AND AFRICA CYBERSECURITY MARKET

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 7 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 8 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 9 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 10 HARDWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 11 HARDWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 12 SOFTWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 13 SOFTWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 SERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 15 SERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 17 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 18 IAM: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 19 IAM: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 ANTIVIRUS/ANTIMALWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 21 ANTIVIRUS/ANTIMALWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 LOG MANAGEMENT AND SIEM: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 23 LOG MANAGEMENT AND SIEM: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 FIREWALL: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 25 FIREWALL: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 ENCRYPTION AND TOKENIZATION: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 27 ENCRYPTION AND TOKENIZATION: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 COMPLIANCE AND POLICY MANAGEMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 COMPLIANCE AND POLICY MANAGEMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 PATCH MANAGEMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 31 PATCH MANAGEMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 OTHER SOFTWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 OTHER SOFTWARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 35 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 36 SERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 37 SERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 38 PROFESSIONAL SERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 PROFESSIONAL SERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 DESIGN, CONSULTING, AND IMPLEMENTATION: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 DESIGN, CONSULTING, AND IMPLEMENTATION: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 RISK AND THREAT MANAGEMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 RISK AND THREAT MANAGEMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 TRAINING AND EDUCATION: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 TRAINING AND EDUCATION: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 SUPPORT AND MAINTENANCE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 SUPPORT AND MAINTENANCE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 MANAGED SERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 MANAGED SERVICES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 51 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 52 NETWORK SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 NETWORK SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 CLOUD SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 CLOUD SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 APPLICATION SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 APPLICATION SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 ENDPOINT AND IOT SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 ENDPOINT AND IOT SECURITY: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 61 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 62 CLOUD: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 CLOUD: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 ON-PREMISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 65 ON-PREMISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 67 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 68 SMALL AND MEDIUM-SIZED ENTERPRISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 69 SMALL AND MEDIUM-SIZED ENTERPRISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 LARGE ENTERPRISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 71 LARGE ENTERPRISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 73 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 74 AEROSPACE AND DEFENSE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 75 AEROSPACE AND DEFENSE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 BANKING, FINANCIAL SERVICES, AND INSURANCE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 77 BANKING, FINANCIAL SERVICES, AND INSURANCE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 IT AND ITES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 79 IT AND ITES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 HEALTHCARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 81 HEALTHCARE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 RETAIL AND ECOMMERCE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 83 RETAIL AND ECOMMERCE: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 MANUFACTURING: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 85 MANUFACTURING: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 ENERGY AND UTILITIES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 87 ENERGY AND UTILITIES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 TELECOMMUNICATION: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 89 TELECOMMUNICATION: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 TRANSPORTATION AND LOGISTICS: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 91 TRANSPORTATION AND LOGISTICS: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 MEDIA AND ENTERTAINMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 93 MEDIA AND ENTERTAINMENT: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 OTHER VERTICALS: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 95 OTHER VERTICALS: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 97 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 98 MIDDLE EAST: REGULATORY LANDSCAPE

- TABLE 99 MIDDLE EAST: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 100 MIDDLE EAST: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 102 MIDDLE EAST: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 103 MIDDLE EAST: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 104 MIDDLE EAST: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 105 MIDDLE EAST: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 106 MIDDLE EAST: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 107 MIDDLE EAST: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 108 MIDDLE EAST: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 MIDDLE EAST: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 110 MIDDLE EAST: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 111 MIDDLE EAST: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 112 MIDDLE EAST: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 113 MIDDLE EAST: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 114 MIDDLE EAST: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 115 MIDDLE EAST: CYBERSECURITY MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 116 MIDDLE EAST: CYBERSECURITY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 BAHRAIN: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 118 BAHRAIN: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 119 BAHRAIN: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 120 BAHRAIN: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 121 BAHRAIN: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 122 BAHRAIN: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 123 BAHRAIN: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 124 BAHRAIN: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 125 BAHRAIN: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 126 BAHRAIN: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 BAHRAIN: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 128 BAHRAIN: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 129 BAHRAIN: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 130 BAHRAIN: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 131 BAHRAIN: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 132 BAHRAIN: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 133 EGYPT: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 134 EGYPT: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 135 EGYPT: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 136 EGYPT: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 137 EGYPT: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 138 EGYPT: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 139 EGYPT: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 140 EGYPT: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 141 EGYPT: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 142 EGYPT: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 143 EGYPT: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 144 EGYPT: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 145 EGYPT: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 146 EGYPT: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 147 EGYPT: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 148 EGYPT: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 149 ISRAEL: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 150 ISRAEL: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 151 ISRAEL: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 152 ISRAEL: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 153 ISRAEL: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 154 ISRAEL: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 155 ISRAEL: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 156 ISRAEL: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 157 ISRAEL: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 158 ISRAEL: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 159 ISRAEL: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 160 ISRAEL: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 161 ISRAEL: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 162 ISRAEL: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 163 ISRAEL: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 164 ISRAEL: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 165 KUWAIT: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 166 KUWAIT: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 167 KUWAIT: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 168 KUWAIT: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 169 KUWAIT: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 170 KUWAIT: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 171 KUWAIT: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 172 KUWAIT: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 173 KUWAIT: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 174 KUWAIT: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 175 KUWAIT: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 176 KUWAIT: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 177 KUWAIT: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 178 KUWAIT: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 179 KUWAIT: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 180 KUWAIT: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 181 OMAN: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 182 OMAN: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 183 OMAN: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 184 OMAN: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 185 OMAN: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 186 OMAN: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 187 OMAN: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 188 OMAN: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 189 OMAN: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 190 OMAN: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 191 OMAN: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 192 OMAN: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 193 OMAN: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 194 OMAN: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 195 OMAN: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 196 OMAN: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 197 QATAR: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 198 QATAR: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 199 QATAR: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 200 QATAR: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 201 QATAR: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 202 QATAR: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 203 QATAR: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 204 QATAR: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 205 QATAR: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 206 QATAR: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 207 QATAR: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 208 QATAR: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 209 QATAR: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 210 QATAR: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 211 QATAR: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 212 QATAR: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 213 KSA: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 214 KSA: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 215 KSA: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 216 KSA: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 217 KSA: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 218 KSA: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 219 KSA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 220 KSA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 221 KSA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 222 KSA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 223 KSA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 224 KSA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 225 KSA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 226 KSA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 227 KSA: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 228 KSA: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 229 TURKEY: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 230 TURKEY: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 231 TURKEY: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 232 TURKEY: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 233 TURKEY: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 234 TURKEY: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 235 TURKEY: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 236 TURKEY: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 237 TURKEY: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 238 TURKEY: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 239 TURKEY: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 240 TURKEY: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 241 TURKEY: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 242 TURKEY: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 243 TURKEY: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 244 TURKEY: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 245 UAE: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 246 UAE: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 247 UAE: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 248 UAE: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 249 UAE: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 250 UAE: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 251 UAE: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 252 UAE: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 253 UAE: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 254 UAE: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 255 UAE: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 256 UAE: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 257 UAE: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 258 UAE: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 259 UAE: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 260 UAE: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 261 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 262 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 263 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 264 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 265 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 266 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 267 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 268 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 269 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 270 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 271 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 272 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 273 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 274 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 275 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 276 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 277 AFRICA: REGULATORY LANDSCAPE

- TABLE 278 AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 279 AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 280 AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 281 AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 282 AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 283 AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 284 AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 285 AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 286 AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 287 AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 288 AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 289 AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 290 AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 291 AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 292 AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 293 AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 294 AFRICA: CYBERSECURITY MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 295 AFRICA: CYBERSECURITY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 296 NORTHERN AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 297 NORTHERN AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 298 NORTHERN AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 299 NORTHERN AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 300 NORTHERN AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 301 NORTHERN AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 302 NORTHERN AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 303 NORTHERN AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 304 NORTHERN AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 305 NORTHERN AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 306 NORTHERN AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 307 NORTHERN AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 308 NORTHERN AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 309 NORTHERN AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 310 NORTHERN AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 311 NORTHERN AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 312 WESTERN AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 313 WESTERN AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 314 WESTERN AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 315 WESTERN AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 316 WESTERN AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 317 WESTERN AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 318 WESTERN AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 319 WESTERN AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 320 WESTERN AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 321 WESTERN AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 322 WESTERN AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 323 WESTERN AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 324 WESTERN AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 325 WESTERN AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 326 WESTERN AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 327 WESTERN AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 328 CENTRAL AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 329 CENTRAL AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 330 CENTRAL AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 331 CENTRAL AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 332 CENTRAL AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 333 CENTRAL AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 334 CENTRAL AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 335 CENTRAL AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 336 CENTRAL AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 337 CENTRAL AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 338 CENTRAL AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 339 CENTRAL AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 340 CENTRAL AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 341 CENTRAL AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 342 CENTRAL AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 343 CENTRAL AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 344 EASTERN AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 345 EASTERN AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 346 EASTERN AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 347 EASTERN AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 348 EASTERN AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 349 EASTERN AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 350 EASTERN AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 351 EASTERN AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 352 EASTERN AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 353 EASTERN AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 354 EASTERN AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 355 EASTERN AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 356 EASTERN AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 357 EASTERN AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 358 EASTERN AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 359 EASTERN AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 360 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 361 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 362 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 363 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 364 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 365 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 366 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 367 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 368 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 369 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 370 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 371 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 372 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 373 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 374 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 375 SOUTHERN AFRICA: CYBERSECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 376 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET: DEGREE OF COMPETITION

- TABLE 377 REGION FOOTPRINT OF KEY COMPANIES

- TABLE 378 LIST OF STARTUPS/SMES

- TABLE 379 REGIONAL FOOTPRINT OF SMES/STARTUP COMPANIES

- TABLE 380 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2023

- TABLE 381 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET: DEALS, 2020–2023

- TABLE 382 IBM: BUSINESS OVERVIEW

- TABLE 383 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 384 IBM: PRODUCT LAUNCHES

- TABLE 385 IBM: DEALS

- TABLE 386 CISCO: BUSINESS OVERVIEW

- TABLE 387 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 388 CISCO: PRODUCT LAUNCHES

- TABLE 389 CISCO: DEALS

- TABLE 390 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- TABLE 391 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 392 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- TABLE 393 PALO ALTO NETWORKS: DEALS

- TABLE 394 CHECK POINT: BUSINESS OVERVIEW

- TABLE 395 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 396 CHECK POINT: PRODUCT LAUNCHES

- TABLE 397 CHECK POINT: DEALS

- TABLE 398 TREND MICRO: BUSINESS OVERVIEW

- TABLE 399 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 400 TREND MICRO: PRODUCT LAUNCHES

- TABLE 401 TREND MICRO: DEALS

- TABLE 402 TREND MICRO: OTHERS

- TABLE 403 FORTINET: BUSINESS OVERVIEW

- TABLE 404 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 405 FORTINET: PRODUCT LAUNCHES

- TABLE 406 FORTINET: DEALS

- TABLE 407 NORTONLIFELOCK: BUSINESS OVERVIEW

- TABLE 408 NORTONLIFELOCK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 409 NORTONLIFELOCK: DEALS

- TABLE 410 SOPHOS: BUSINESS OVERVIEW

- TABLE 411 SOPHOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 412 SOPHOS: PRODUCT LAUNCHES

- TABLE 413 SOPHOS: DEALS

- TABLE 414 KASPERSKY: BUSINESS OVERVIEW

- TABLE 415 KASPERSKY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 416 KASPERSKY: PRODUCT LAUNCHES

- TABLE 417 KASPERSKY: OTHERS

- TABLE 418 TRELLIX: BUSINESS OVERVIEW

- TABLE 419 TRELLIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 420 ESET: BUSINESS OVERVIEW

- TABLE 421 ESET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 422 ESET: PRODUCT LAUNCHES

- TABLE 423 ESET: DEALS

- TABLE 424 EDGE GROUP: BUSINESS OVERVIEW

- TABLE 425 EDGE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 426 EDGE GROUP: PRODUCT LAUNCHES

- TABLE 427 EDGE GROUP: DEALS

- TABLE 428 BEACON RED: BUSINESS OVERVIEW

- TABLE 429 BEACON RED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 430 BEACON RED: DEALS

- TABLE 431 MORO HUB: BUSINESS OVERVIEW

- TABLE 432 MORO HUB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 433 MORO HUB: DEALS

- TABLE 434 INJAZAT: BUSINESS OVERVIEW

- TABLE 435 INJAZAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 436 INJAZAT: PRODUCT LAUNCHES

- TABLE 437 INJAZAT: DEALS

- TABLE 438 PARAMOUNT COMPUTER SYSTEMS: BUSINESS OVERVIEW

- TABLE 439 PARAMOUNT COMPUTER SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 440 PARAMOUNT COMPUTER SYSTEMS: DEALS

- TABLE 441 SECURELINK: BUSINESS OVERVIEW

- TABLE 442 SECURELINK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 443 SECURELINK: DEALS

- TABLE 444 SECUREWORKS: BUSINESS OVERVIEW

- TABLE 445 SECUREWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 446 SECUREWORKS: PRODUCT LAUNCHES

- TABLE 447 SECUREWORKS: DEALS

- TABLE 448 OBRELA SECURITY INDUSTRIES: BUSINESS OVERVIEW

- TABLE 449 OBRELA SECURITY INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 450 OBRELA SECURITY INDUSTRIES: DEALS

- TABLE 451 CPX: BUSINESS OVERVIEW

- TABLE 452 CPX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 453 CPX: DEALS

- TABLE 454 MDS UAE: BUSINESS OVERVIEW

- TABLE 455 MDS UAE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 456 ADJACENT MARKETS AND FORECASTS

- TABLE 457 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 458 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 459 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 460 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 461 LARGE ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 462 LARGE ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 463 THREAT INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

- TABLE 464 POST-COVID-19 THREAT INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

- TABLE 465 CLOUD: THREAT INTELLIGENCE MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 466 CLOUD: POST-COVID-19 THREAT INTELLIGENCE MARKET, BY REGION, 2019–2025 (USD MILLION)

- TABLE 467 ON-PREMISES: THREAT INTELLIGENCE MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 468 ON-PREMISES: POST-COVID-19 THREAT INTELLIGENCE MARKET, BY REGION, 2019–2025 (USD MILLION)

- FIGURE 1 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET: RESEARCH DESIGN

- FIGURE 2 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET: RESEARCH FLOW

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY-SIDE): REVENUE OF SOLUTIONS/SERVICES OF MIDDLE EAST AND AFRICA CYBERSECURITY VENDORS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1, SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM SOLUTIONS AND SERVICES OF MIDDLE EAST AND AFRICA CYBERSECURITY VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP-DOWN (DEMAND-SIDE)

- FIGURE 7 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- FIGURE 8 STARTUP EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- FIGURE 9 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 10 MIDDLE EAST TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 11 GROWING INSTANCES OF TARGET-BASED CYBERATTACKS AND ADOPTION OF CLOUD-BASED CYBERSECURITY SOLUTIONS TO DRIVE MARKET

- FIGURE 12 SOFTWARE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 13 LOG MANAGEMENT AND SIEM SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 14 ENDPOINT AND IOT DEVICE SECURITY SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 15 AEROSPACE AND DEFENSE SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 16 MIDDLE EAST TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 17 AFRICA TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET

- FIGURE 19 ECOSYSTEM: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET

- FIGURE 20 PATENT ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 PORTER’S FIVE FORCE ANALYSIS

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 25 SOFTWARE SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 26 LOG MANAGEMENT AND SIEM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 27 PROFESSIONAL SERVICES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 28 APPLICATION SECURITY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 29 ON-PREMISES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 30 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 31 AEROSPACE AND DEFENSE VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 32 AFRICA TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET: REVENUE ANALYSIS

- FIGURE 34 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING MIDDLE EAST AND AFRICA CYBERSECURITY PROVIDERS

- FIGURE 35 KEY PLAYERS RANKING

- FIGURE 36 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET: KEY COMPANY EVALUATION QUADRANT

- FIGURE 37 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET: STARTUP/SME EVALUATION QUADRANT

- FIGURE 38 IBM: COMPANY SNAPSHOT

- FIGURE 39 CISCO: COMPANY SNAPSHOT

- FIGURE 40 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 41 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 42 TREND MICRO: COMPANY SNAPSHOT

- FIGURE 43 FORTINET: COMPANY SNAPSHOT

- FIGURE 44 NORTONLIFELOCK: COMPANY SNAPSHOT

- FIGURE 45 SECUREWORKS: COMPANY SNAPSHOT

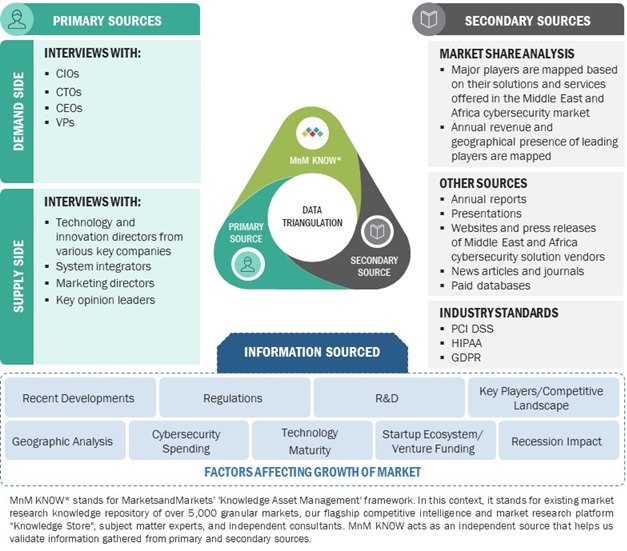

This study involved multiple steps in estimating the current size of the Middle East and Africa Cybersecuty market. Exhaustive secondary research was carried out to collect information on the Middle East and Africa Cybersecurity industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. The top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering cybersecurity solutions/ services and information from various trade, business, and professional associations. The secondary data was collated and analysed to arrive at the overall size of the Middle East and Africa Cybersecurity market, which was validated by primary respondents.

Primary Research

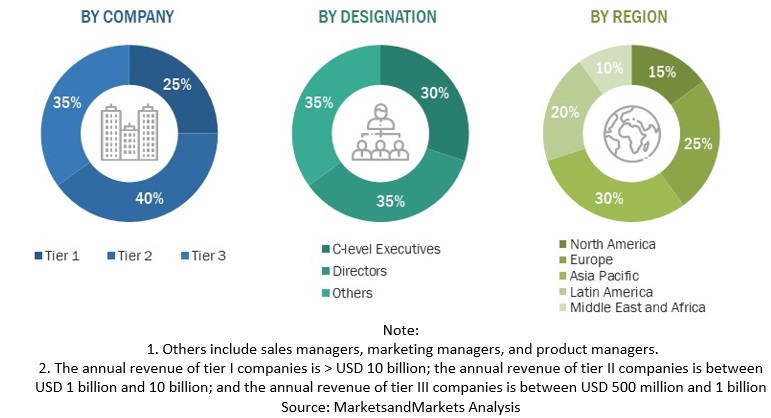

Extensive primary research was conducted after obtaining information regarding the Middle East and Africa Cybersecurity market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of Middle East and Africa. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from Middle East and Africa Cybersecurity vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using cybersecurity solutions/services were interviewed to understand the buyer's perspective on the suppliers, products, component providers, and their current usage of cybersecurity solutions/services and future outlook of their business which will affect the overall market.

The breakup of the primary interviews:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Middle East and Africa Cybersecurity Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Middle East and Africa Cybersecurity Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition