Metabolomics Market by Product (GC,UPLC, CE, Surface based Mass Analysis), Application (Biomarker Discovery, Drug Discovery,Functional Genomics), Indication (Cardiology, Oncology,Inborn Errors), End User (Academic Institute,CROs) & Region - Global Forecast to 2025

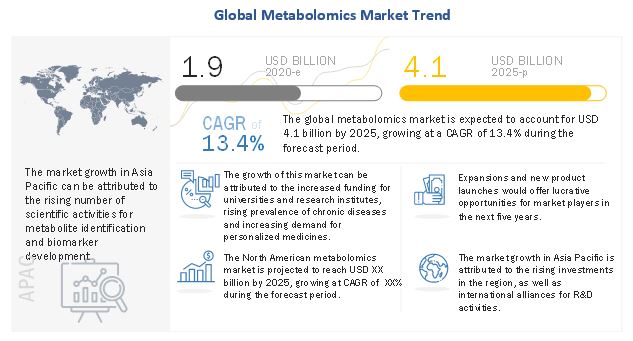

The global metabolomics market in terms of revenue was estimated to be worth $1.9 billion in 2020 and is poised to reach $4.1 billion by 2025, growing at a CAGR of 13.4% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Growing R&D expenditure in the pharmaceutical & biopharmaceutical industry, availability of government and private funding for metabolomics research, and ongoing innovations in metabolomics instruments are driving the growth of the global metabolomics industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Metabolomics Market Dynamics

Driver: Availability of government and private funding for metabolomics research

Metabolomic studies are gaining prominence in the life science industry as they help reveal the optimum level of specific metabolites associated with the onset/progression of a disease and the exposure or response to treatment. With the rising prevalence and mortality rate of life-threatening diseases, such as cancer and CVD, there is an increasing focus on novel approaches that can offer effective diagnosis and treatment of these diseases. As metabolomics is considered a novel approach with tremendous potential, additional research is being conducted in this field. Also, in recent years, the focus on metabolomic biomarkers has increased in drug development. As a result of these factors, government and private investments in metabolomics research is increasing.

According to a report by The Metabolomics Innovation Centre (TMIC), metabolomics has experienced tremendous growth since the last decade. High-impact metabolomic discoveries in several diseases, such as cancer, have increased investments in metabolomics facilities across the globe. For instance, in 2018, the US has invested more than USD 65 million in its Regional Comprehensive Metabolomics Resource Cores, while the US universities are believed to have invested an equal amount in establishing metabolomics core facilities across the country. Canada has invested more than USD 30 million in its metabolomics activities and infrastructure. These investments have helped catalyze the appearance of more than 80 university-based metabolomics facilities across North America over the past 8 years. In addition, Australia has invested more than USD 49 million in its Metabolomics Australia platform, the Netherlands has invested around USD 69 million into the Netherlands Metabolomics Centre, and the UK has invested over USD 45 million in establishing the Phenome Centre in the Imperial College London. Thus, the rising investments in metabolomics research in different countries are expected to fuel the growth of the market during the forecast period.

Restraint: Issues related to data examination and processing

Metabolomics techniques produce a substantial volume of data as they create millions of data points per second over a 10-minute or more prolonged analysis. The continuous growth in the generation of high-volume heterogeneous data is increasing data complexity and it is becoming increasingly difficult to evaluate all these data points effectively. Moreover, due to the chemical diversity of small molecule metabolites, it is impossible to study the entire metabolome using a single analytical technique. As a result, the data produced is not only complex but also leads to a proportionate increase in the demand for physical storage, correct and rigorous analysis, and suitable software/databases for visualization. Thus, the high complexity of data generated during life science research and the difficulty in managing it is expected to hinder the growth of the market.

Opportunity: Biomarker development

Metabolomics is used to identify new biomarkers through bioinformatics tools, which indicate the changes in the physiological state of a cell or tissue. Biomarkers are important for developing in-vitro diagnostic tools, environmental toxicology screening methods, and drug discovery and development techniques. The omics revolution of the last decade has increased the application of metabolomics in biomedical research. As a result of these technological developments, new biomarkers are being regularly discovered. These biomarkers are required in medical sciences to better define and diagnose diseases, predict adverse drug events, and identify patient groups who would benefit from specific treatments. Moreover, in the near future, identifying biomarkers related to safety, sensitivity, and resistance to commercially available drugs will present significant growth opportunities for the market.

By Product & Service, the separation tools accounted for the largest share of the metabolomics industry

The metabolomics instrument segment is expected to account for the largest market share in 2020. Factors such as the technological advancements in analytical instruments in terms of miniaturization, automation, and computerization; increase in the number of research-related activities worldwide in the field of medicine, nutraceuticals, and metabolomics; and strengthening healthcare infrastructure in developing nations for efficient disease diagnosis and treatment are expected to propel the growth of this segment during the forecast period

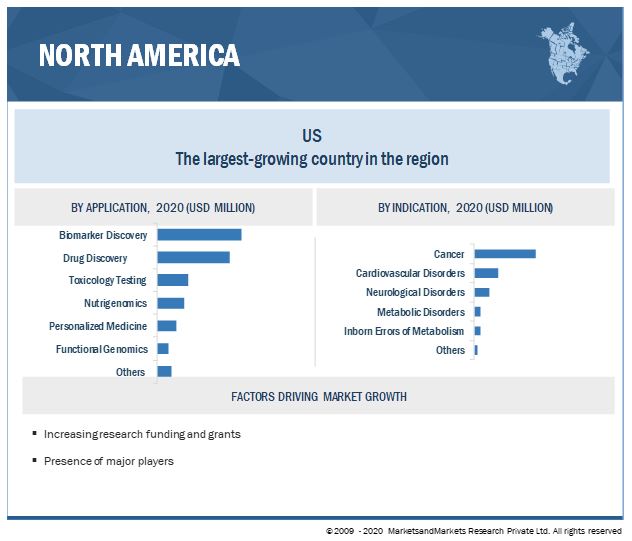

By Application, the biomarker discovery segment accounted for the largest share of the metabolomics industry

The biomarker discovery segment is expected to account for the largest market share in 2020. The use of metabolic biomarkers to assess the pathophysiological health status of patients is increasing. In recent years, as a result of significant technological advancements, metabolomics has become a vital tool in discovering biomarkers.

By Indication, Cancer segment expected to grow at the fastest growth rate during the forecast period.

Based on indication, the metabolomics market has been segmented into into cancer, cardiovascular disorders, neurological disorders, metabolic disorders, inborn errors of metabolism, and other indications (respiratory and infectious diseases. The cancer segment is expected to account for the largest market share in 2020, with the highest growth rate as well. This can primarily be attributed to the increasing number of patients who have cancer and the subsequent increase in the demand for cancer therapies.

By End User, Academic and Research Institutes accounted for the largest share of the metabolomics industry

The academic and research institutes segment accounted for the largest share of the global market in 2020. The increasing number of research activities in the field of metabolomics and funding to the academic and research institutes to conduct metabolomics research are the factors responsible for the largest share of the segment.

North America accounted for the largest share of the metabolomics industry in 2019

North America, which includes the US and Canada, accounted for the largest share of the global market. The large share of the North America region can be attributed to the presence of major players operating in the market in the US, growing biomedical research in the US, and rising preclinical activities by CROs and pharmaceutical companies in the region.

Some of the key players include Waters Corporation (US), Agilent Technologies (US), Shimadzu Corporation (Japan), Thermo Fisher Scientific (US), Danaher Corporation (US), Bruker Corporation (US), PerkinElmer (US), Merck KGaA (Germany), GE Healthcare (US), Hitachi High-Technologies Corporation (Japan), Human Metabolome Technologies, Inc. (Japan), LECO Corporation (US), Metabolon, Inc. (US), Bio-Rad Laboratories (US), Scion Instruments (US), DANI Instruments S.p.A. (Italy), GL Sciences (Japan), SRI Instruments (US), Kore Technology Ltd. (UK), and JASCO, Inc. (US)

Scope of the Metabolomics Industry:

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$1.9 billion |

|

Estimated Value by 2025 |

$4.1 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 13.4% |

|

Market Driver |

Availability of government and private funding for metabolomics research |

|

Market Opportunity |

Biomarker development |

The study categorizes the metabolomics market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Metabolomics Instruments

-

Separation Tools

- Gas Chromatography

- High-performance Liquid Chromatography

- Ultra-performance Liquid Chromatography

- Capillary Electrophoresis

-

Detection Tools

- Nuclear Magnetic Resonance (NMR) Spectroscopy

- Mass Spectrometry (MS)

- Surface-Based Mass Analysis

By Bioinformatics Tools and Services

- Bioinformatics Services

- Bioinformatics Tools and Databases

By Application

- Biomarker discovery

- Drug discovery

- Toxicology testing

- Nutrigenomics

- Functional Genomics

- Personalized medicine

- Other Applications

By Indication

- Cancer

- Cardiovascular Disorders

- Neurological Disorders

- Metabolic Disorders

- Inborn Errors of Metabolism

- Other Indications

By End User

- Academic and Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Other End Users

By Company Type

- Tier 1 Pharmaceutical Companies

- Tier 2 Pharmaceutical Companies

- Tier 3 Pharmaceutical Companies

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- The Middle East and Africa

Recent Developments of Metabolomics Industry

- In 2020, Danaher Corporation acquired GE Healthcare’s Life Sciences business.

- In 2020, Agilent and Thermo Fisher extended their agreement to enhance the compatibility of Thermo Fisher’s analytical systems with Agilent’s OpenLAb Chromatography Data System

- In 2020, Waters Corporation announced the establishment of Immerse Cambridge, a research laboratory in the heart of Cambridge’s Kendall Square. Immerse Cambridge will serve as a strategic, collaborative space in the community, where Waters can partner with academia and research to accelerate the next generation of scientific advancements.

- In 2020, Hitachi acquired the remaining shares of Hitachi High-Technologies billion and made it its subsidiary. This subsidiary will be responsible for the manufacturing of measuring and analytical equipment, along with the development of chipmaking equipment and industrial materials and systems.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global metabolomics market?

The global metabolomics market boasts a total revenue value of $4.1 billion by 2025.

What is the estimated growth rate (CAGR) of the global metabolomics market?

The global metabolomics market has an estimated compound annual growth rate (CAGR) of 13.4% and a revenue size in the region of $1.9 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 GLOBAL METABOLOMICS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

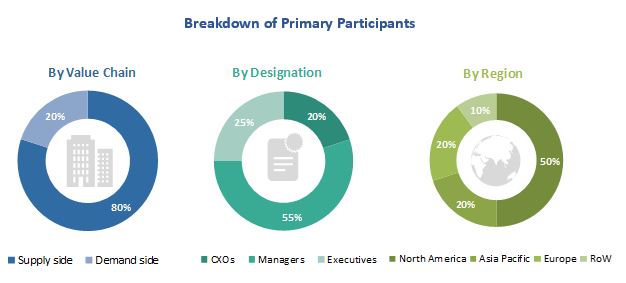

FIGURE 2 BREAKDOWN OF PRIMARIES: GLOBAL MARKET

2.1.3 MARKET DATA ESTIMATION & TRIANGULATION

2.1.4 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 4 MARKET SIZE ESTIMATION (COMPANY REVENUE ANALYSIS-BASED ESTIMATION)

FIGURE 5 GLOBAL MARKET SIZE (USD MILLION)

FIGURE 6 GLOBAL MARKET: GROWTH RATE OF TOP COMPANIES (2018−2019)

FIGURE 7 GLOBAL MARKET: FINAL CAGR PROJECTIONS (2020−2025)

FIGURE 8 GLOBAL MARKET: CAGR PROJECTIONS FROM THE ANALYSIS OF DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.3 INDUSTRY INSIGHTS

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 9 METABOLOMICS MARKET SHARE, BY PRODUCT & SERVICE, 2019 VS. 2025 (USD MILLION)

FIGURE 10 GLOBAL MARKET SHARE, BY APPLICATION, 2019

FIGURE 11 GLOBAL MARKET SIZE, BY INDICATION, 2020 VS. 2025

FIGURE 12 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 METABOLOMICS MARKET OVERVIEW

FIGURE 13 INCREASING PHARMACEUTICALS R&D ACTIVITIES AND GROWING DEMAND FOR PERSONALIZED MEDICINE WILL FAVOR MARKET GROWTH

4.2 ASIA PACIFIC: MARKET SHARE, BY PRODUCT AND SERVICE AND BY COUNTRY (2019)

FIGURE 14 METABOLOMICS INSTRUMENTS SEGMENT ACCOUNTED FOR LARGER SHARE OF ASIA PACIFIC MARKET IN 2019

4.3 GLOBAL MARKET SIZE, BY DETECTION TOOLS

FIGURE 15 MASS SPECTROMETRY (MS) SEGMENT WILL CONTINUE TO DOMINATE THE MARKET

4.4 GLOBAL MARKET SHARE, BY SEPARATION TOOLS, 2020 VS. 2025

FIGURE 16 HPLC HOLDS THE LARGEST SHARE OF THE MARKET

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 METABOLOMICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 KEY MARKET DRIVERS

5.2.1.1 Availability of government and private funding for metabolomics research

5.2.1.2 Increasing pharmaceutical and biotech R&D expenditure

5.2.1.3 Growing demand for personalized medicine

5.2.2 KEY MARKET RESTRAINTS

5.2.2.1 Issues related to data examination and processing

5.2.2.2 High cost of tools and instruments

5.2.3 KEY MARKET OPPORTUNITIES

5.2.3.1 Biomarker development

5.2.3.2 Lucrative opportunities in emerging markets

5.2.4 KEY MARKET CHALLENGES

5.2.4.1 Complexity and diversity of biological samples

5.2.4.2 Dearth of skilled researchers

5.3 IMPACT OF COVID-19 ON GROWTH OF GLOBAL MARKET

6 INDUSTRY INSIGHTS (Page No. - 65)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 INCREASING ADOPTION OF HYPHENATED TECHNOLOGIES

6.2.2 TIE-UPS BETWEEN INSTRUMENT MANUFACTURERS AND RESEARCH LABORATORIES/ACADEMIC INSTITUTIONS

6.3 REGULATORY ANALYSIS

TABLE 1 REGULATORY STANDARD/APPROVAL REQUIRED FOR METABOLOMICS PRODUCTS, BY COUNTRY/REGION

7 TECHNOLOGY INVESTMENT POTENTIAL (Page No. - 69)

7.1 INTRODUCTION

7.2 INVESTMENT CLIENT NETWORKS

7.3 FUNDING BODIES/INITIATIVES

7.4 ANALYSIS OF POTENTIAL AREAS FOR TECHNOLOGY INVESTMENT USING STRATEGIC EVALUATION

7.4.1 PARAMETERS CONSIDERED FOR EMERGING OPPORTUNITY EVALUATION

7.4.1.1 Level of attractiveness

7.4.1.2 Probability of success

7.4.2 OPPORTUNITY STRATEGIC EVALUATION ANALYSIS

7.4.3 DESCRIPTION OF OPPORTUNITIES

7.4.3.1 Viable (Quadrant 1) – Biomarker discovery and lead optimization in drug discovery

7.4.3.1.1 Biomarker discovery

7.4.3.1.2 Lead optimization in drug discovery

7.4.3.1.3 Toxicity testing

7.4.3.2 Promising (Quadrant 2) – Companion diagnostics for personalized medicine and nutrigenomics

7.4.3.2.1 Companion diagnostics for personalized medicine

7.4.3.2.2 Nutrigenomics

7.4.3.2.3 Agriculture

7.4.3.3 Challenges (Quadrant 3) – Environmental metabolomics

7.4.3.3.1 Environmental metabolomics

7.4.3.3.2 Functional genomics

8 METABOLOMICS MARKET SIZE, BY PRODUCT AND SERVICE (Page No. - 75)

8.1 INTRODUCTION

TABLE 2 GLOBAL MARKET SIZE, BY PRODUCT & SERVICE, 2020–2025 (USD MILLION)

8.2 METABOLOMICS INSTRUMENTS

TABLE 3 GLOBAL METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 4 METABOLOMICS INSTRUMENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 5 NORTH AMERICA: METABOLOMICS INSTRUMENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 6 EUROPE: METABOLOMICS INSTRUMENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 7 ASIA PACIFIC: METABOLOMICS INSTRUMENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 8 LATIN AMERICA: METABOLOMICS INSTRUMENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.2.1 SEPARATION TOOLS

TABLE 9 GLOBAL METABOLOMICS SEPARATION TOOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 10 METABOLOMICS SEPARATION TOOLS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 NORTH AMERICA: METABOLOMICS SEPARATION TOOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 12 EUROPE: METABOLOMICS SEPARATION TOOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 13 ASIA PACIFIC: METABOLOMICS SEPARATION TOOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.2.2 HIGH-PERFORMANCE LIQUID CHROMATOGRAPHY

8.2.2.1 Growing use of HPLC in high-growth applications to drive market growth

TABLE 15 GLOBAL HPLC MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 NORTH AMERICA: HPLC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 EUROPE: HPLC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 ASIA PACIFIC: HPLC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 19 LATIN AMERICA: HPLC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.2.3 GAS CHROMATOGRAPHY

8.2.3.1 Technological advancements in gas chromatography to drive adoption of GC in metabolome study

TABLE 20 GLOBAL GAS CHROMATOGRAPHY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 NORTH AMERICA: GAS CHROMATOGRAPHY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 EUROPE: GAS CHROMATOGRAPHY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 ASIA PACIFIC: GAS CHROMATOGRAPHY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 24 LATIN AMERICA: GAS CHROMATOGRAPHY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.2.4 ULTRA-PERFORMANCE LIQUID CHROMATOGRAPHY

8.2.4.1 Higher chromatographic efficiency and sensitivity of UPLC would drive market growth

TABLE 25 GLOBAL UPLC MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 NORTH AMERICA: UPLC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 EUROPE: UPLC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 28 ASIA PACIFIC: UPLC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 LATIN AMERICA: UPLC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.2.5 CAPILLARY ELECTROPHORESIS

8.2.5.1 CE is used in pathology/clinical laboratories worldwide due to the low cost of reagents, enhanced accuracy, and ease of operation

TABLE 30 GLOBAL CAPILLARY ELECTROPHORESIS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: CAPILLARY ELECTROPHORESIS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 32 EUROPE: CAPILLARY ELECTROPHORESIS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 ASIA PACIFIC: CAPILLARY ELECTROPHORESIS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 LATIN AMERICA: CAPILLARY ELECTROPHORESIS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.2.6 DETECTION TOOLS

TABLE 35 GLOBAL METABOLOMICS DETECTION TOOLS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 36 GLOBAL METABOLOMICS DETECTION TOOLS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: METABOLOMICS DETECTION TOOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 38 EUROPE: METABOLOMICS DETECTION TOOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 ASIA PACIFIC: METABOLOMICS DETECTION TOOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 LATIN AMERICA: METABOLOMICS DETECTION TOOLS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.2.7 MASS SPECTROMETRY

8.2.7.1 Increasing use of mass spectrometry in cancer and genetic disease research is propelling its demand

TABLE 41 GLOBAL MASS SPECTROMETRY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 42 NORTH AMERICA: MASS SPECTROMETRY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 EUROPE: MASS SPECTROMETRY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 ASIA PACIFIC: MASS SPECTROMETRY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 LATIN AMERICA: MASS SPECTROMETRY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.2.8 NUCLEAR MAGNETIC RESONANCE SPECTROSCOPY

TABLE 46 GLOBAL NMR SPECTROSCOPY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: NMR SPECTROSCOPY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 48 EUROPE: NMR SPECTROSCOPY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 ASIA PACIFIC: NMR SPECTROSCOPY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 LATIN AMERICA: NMR SPECTROSCOPY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.2.9 SURFACE-BASED MASS ANALYSIS

8.2.9.1 Applicability of surface-based mass analysis technology in a wide range of samples would drive its growth

TABLE 51 GLOBAL SURFACE-BASED MASS ANALYSIS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: SURFACE-BASED MASS ANALYSIS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 EUROPE: SURFACE-BASED MASS ANALYSIS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 54 ASIA PACIFIC: SURFACE-BASED MASS ANALYSIS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.3 METABOLOMICS BIOINFORMATICS TOOLS & SERVICES

TABLE 55 GLOBAL METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 56 GLOBAL BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 57 NORTH AMERICA: BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

8.3.1 BIOINFORMATICS SERVICES

8.3.1.1 Bioinformatics services offer a simplified way to derive insights from metabolomics research

TABLE 58 GLOBAL BIOINFORMATICS SERVICES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3.2 BIOINFORMATICS TOOLS & DATABASES

8.3.2.1 Application of bioinformatics tools & databases in translational research to fuel market growth

TABLE 59 GLOBAL BIOINFORMATICS TOOLS & DATABASE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 METABOLOMICS MARKET SIZE, BY APPLICATION (Page No. - 106)

9.1 INTRODUCTION

TABLE 60 GLOBAL MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.2 BIOMARKER DISCOVERY

TABLE 61 METABOLOMICS MARKET SIZE FOR BIOMARKER DISCOVERY, BY REGION, 2018–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

9.3 DRUG DISCOVERY

TABLE 66 GLOBAL MARKET SIZE FOR DRUG DISCOVERY, BY REGION, 2018–2025 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 70 LATIN AMERICA: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.4 TOXICOLOGY TESTING

TABLE 71 METABOLOMICS MARKET SIZE FOR TOXICOLOGY TESTING, BY REGION, 2018–2025 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 LATIN AMERICA: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.5 NUTRIGENOMICS

TABLE 76 GLOBAL MARKET SIZE FOR NUTRIGENOMICS, BY REGION, 2018–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 80 LATIN AMERICA: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.6 PERSONALIZED MEDICINE

TABLE 81 GLOBAL MARKET SIZE FOR PERSONALIZED MEDICINES, BY REGION, 2018–2025 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

9.7 FUNCTIONAL GENOMICS

TABLE 85 METABOLOMICS MARKET SIZE FOR FUNCTIONAL GENOMICS, BY REGION, 2018–2025 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

9.8 OTHER APPLICATIONS

TABLE 89 GLOBAL MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10 METABOLOMICS MARKET SIZE, BY INDICATION (Page No. - 123)

10.1 INTRODUCTION

TABLE 93 METABOLOMICS MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

10.2 CANCER

TABLE 94 GLOBAL MARKET SIZE FOR CANCER, BY REGION, 2018–2025 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 98 LATIN AMERICA: MARKET SIZE, BY COUNTRY 2018–2025 (USD MILLION)

10.3 CARDIOVASCULAR DISORDERS

TABLE 99 GLOBAL MARKET SIZE FOR CARDIOVASCULAR DISORDERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 103 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.4 NEUROLOGICAL DISORDERS

TABLE 104 METABOLOMICS MARKET SIZE FOR NEUROLOGICAL DISORDERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 108 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.5 METABOLIC DISORDERS

TABLE 109 GLOBAL MARKET SIZE FOR METABOLIC DISORDERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 113 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.6 INBORN ERRORS OF METABOLISM

TABLE 114 GLOBAL MARKET SIZE FOR INBORN ERRORS OF METABOLISM, BY REGION, 2018–2025 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 118 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.7 OTHERS

TABLE 119 GLOBAL MARKET SIZE FOR OTHER INDICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 123 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11 METABOLOMICS MARKET SIZE, BY END USER (Page No. - 139)

11.1 INTRODUCTION

TABLE 124 GLOBAL MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

11.2 ACADEMIC RESEARCH INSTITUTES

TABLE 125 GLOBAL MARKET SIZE FOR ACADEMIC AND RESEARCH INSTITUTES, BY REGION, 2018–2025 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 127 EUROPE: MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

11.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

TABLE 129 METABOLOMICS MARKET SIZE FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 131 EUROPE: MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

11.4 CONTRACT RESEARCH ORGANIZATIONS (CROS)

TABLE 133 GLOBAL MARKET SIZE FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2018–2025 (USD MILLION)

11.5 OTHERS

TABLE 134 GLOBAL MARKET SIZE FOR OTHER END USER, BY REGION, 2018–2025 (USD MILLION)

12 GLOBAL METABOLOMICS MARKET SIZE, BY REGION (Page No. - 146)

12.1 INTRODUCTION

FIGURE 18 GLOBAL MARKET: GEOGRAPHICAL SNAPSHOT

TABLE 135 GLOBAL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 19 NORTH AMERICA: METABOLOMICS MARKET SNAPSHOT

TABLE 136 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 138 NORTH AMERICA: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 139 NORTH AMERICA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 140 NORTH AMERICA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 141 NORTH AMERICA: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 142 NORTH AMERICA: METABOLOMICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 143 NORTH AMERICA: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 144 NORTH AMERICA: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.2.1 US

TABLE 145 US: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 146 US: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 147 US: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 148 US: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 149 US: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 150 US: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 151 US: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 152 US: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Growing metabolomics research centers in the country to support market growth

TABLE 153 CANADA: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 154 CANADA: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 155 CANADA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 156 CANADA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 157 CANADA: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 158 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 159 CANADA: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 160 CANADA: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.3 EUROPE

TABLE 161 EUROPE: METABOLOMICS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 162 EUROPE: SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 163 EUROPE: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 164 EUROPE: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 165 EUROPE: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 166 EUROPE: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 167 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 168 EUROPE: MARKET ,SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 169 EUROPE: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.3.1 UK

12.3.1.1 Increasing focus on cancer research in the UK is a key growth driver

TABLE 170 UK: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 171 UK: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 172 UK: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 173 UK: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 174 UK: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 175 UK: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 176 UK: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 177 UK: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Significant R&D in the country to drive market growth

TABLE 178 GERMANY: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 179 GERMANY: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 180 GERMANY: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 181 GERMANY: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 182 GERMANY: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 183 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 184 GERMANY: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 185 GERMANY: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Increased investments in biomedical research are likely to fuel market growth

TABLE 186 FRANCE: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 187 FRANCE: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 188 FRANCE: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 189 FRANCE: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 190 FRANCE: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 191 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 192 FRANCE: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 193 FRANCE: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.3.4 ITALY

12.3.4.1 Growth in nutrigenomics to drive market growth

TABLE 194 ITALY: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 195 ITALY: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 196 ITALY: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 197 ITALY: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 198 ITALY: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 199 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 200 ITALY: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 201 ITALY: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.3.5 SPAIN

12.3.5.1 Growth in the food, agriculture, and biotechnology industries will drive market growth

TABLE 202 SPAIN: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 203 SPAIN: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 204 SPAIN: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 205 SPAIN: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 206 SPAIN: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 207 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 208 SPAIN: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 209 SPAIN: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.3.6 REST OF EUROPE (ROE)

TABLE 210 REST OF EUROPE: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 211 ROE: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 212 ROE: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 213 ROE: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 214 ROE: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 215 ROE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 216 ROE: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 217 ROE: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 20 ASIA PACIFIC: METABOLOMICS MARKET SNAPSHOT

TABLE 218 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 219 ASIA PACIFIC: MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 220 ASIA PACIFIC: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 221 ASIA PACIFIC: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 222 ASIA PACIFIC: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 223 ASIA PACIFIC: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 224 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 225 ASIA PACIFIC: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 226 ASIA PACIFIC: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.4.1 CHINA

12.4.1.1 International alliances for R&D activities are driving the market

TABLE 227 CHINA: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 228 CHINA: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 229 CHINA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 230 CHINA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 231 CHINA: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 232 CHINA: METABOLOMICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 233 CHINA: METABOLOMICS MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 234 CHINA: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Increasing focus on personalized diagnostics products to support market growth in Japan

TABLE 235 JAPAN: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 236 JAPAN: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 237 JAPAN: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 238 JAPAN: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 239 JAPAN: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 240 JAPAN: METABOLOMICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 241 JAPAN: METABOLOMICS MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 242 JAPAN: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Initiatives to increase the adoption of metabolomics in India to drive the market

TABLE 243 INDIA: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 244 INDIA: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 245 INDIA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 246 INDIA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 247 INDIA: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 248 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 249 INDIA: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 250 INDIA: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.4.4 REST OF APAC

TABLE 251 ROAPAC: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 252 ROAPAC: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 253 ROAPAC: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 254 ROAPAC: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 255 ROAPAC: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 256 ROAPAC: METABOLOMICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 257 ROAPAC: METABOLOMICS SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 258 ROAPAC: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.5 LATIN AMERICA

TABLE 259 LATIN AMERICA: METABOLOMICS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 260 LATIN AMERICA: MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 261 LATIN AMERICA: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 262 LATIN AMERICA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 263 LATIN AMERICA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 264 LATIN AMERICA: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 265 LATIN AMERICA: METABOLOMICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 266 LATIN AMERICA: METABOLOMICS MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 267 LATIN AMERICA: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Growing biologics sector in the country to drive the market

TABLE 268 BRAZIL: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 269 BRAZIL: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 270 BRAZIL: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 271 BRAZIL: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 272 BRAZIL: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 273 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 274 BRAZIL: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 275 BRAZIL: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.5.2 MEXICO

12.5.2.1 Favorable business environment for market players to support market growth

TABLE 276 MEXICO: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 277 MEXICO: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 278 MEXICO: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 279 MEXICO: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 280 MEXICO: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 281 MEXICO: METABOLOMICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 282 MEXICO: METABOLOMICS MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 283 MEXICO: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.5.3 REST OF LATIN AMERICA

TABLE 284 ROLA: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 285 ROLA: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 286 ROLA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 287 ROLA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 288 ROLA: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 289 ROLA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 290 ROLA: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 291 ROLA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

12.6 MIDDLE EAST & AFRICA

TABLE 292 MIDDLE EAST & AFRICA: METABOLOMICS MARKET SIZE, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 293 MIDDLE EAST & AFRICA: METABOLOMICS INSTRUMENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 294 MIDDLE EAST & AFRICA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR SEPARATION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 295 MIDDLE EAST & AFRICA: METABOLOMICS INSTRUMENTS MARKET SIZE FOR DETECTION TOOLS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 296 MIDDLE EAST & AFRICA: METABOLOMICS BIOINFORMATICS TOOLS & SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 297 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 298 MIDDLE EAST & AFRICA: MARKET SIZE, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 299 MIDDLE EAST & AFRICA: METABOLOMICS MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 218)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS (2019)

FIGURE 21 GLOBAL METABOLOMICS MARKET SHARE, BY KEY PLAYER, 2019

13.3 KEY MARKET DEVELOPMENTS

13.3.1 PRODUCT LAUNCHES

13.3.2 ACQUISITIONS

13.3.3 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

13.3.4 EXPANSIONS

14 COMPANY EVALUATION MATRIX (Page No. - 222)

14.1 OVERVIEW

14.2 COMPETITIVE LEADERSHIP MAPPING: MAJOR MARKET PLAYERS (2019)

14.2.1 STARS

14.2.2 EMERGING LEADERS

14.2.3 PERVASIVE

14.2.4 PARTICIPANTS

FIGURE 22 METABOLOMICS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

14.3 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View)*

14.3.1 THERMO FISHER SCIENTIFIC INC.

FIGURE 23 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2019)

14.3.2 AGILENT TECHNOLOGIES, INC.

FIGURE 24 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2019)

14.3.3 WATERS CORPORATION

FIGURE 25 WATERS CORPORATION: COMPANY SNAPSHOT (2019)

14.3.4 DANAHER CORPORATION

FIGURE 26 DANAHER CORPORATION: COMPANY SNAPSHOT (2019)

14.3.5 SHIMADZU CORPORATION

FIGURE 27 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2019)

14.3.6 BIO-RAD LABORATORIES, INC.

FIGURE 28 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2019)

14.3.7 BRUKER CORPORATION

FIGURE 29 BRUKER CORPORATION: COMPANY SNAPSHOT (2019)

14.3.8 PERKINELMER, INC.

FIGURE 30 PERKINELMER, INC.: COMPANY SNAPSHOT (2019)

14.3.9 MERCK KGAA

FIGURE 31 MERCK KGAA: COMPANY SNAPSHOT (2019)

14.3.10 GE HEALTHCARE

FIGURE 32 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

14.3.11 HITACHI HIGH-TECHNOLOGIES CORPORATION

FIGURE 33 HITACHI HIGH-TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT (2019)

14.3.12 HUMAN METABOLOME TECHNOLOGIES, INC.

14.3.13 LECO CORPORATION

14.3.14 METABOLON, INC.

14.3.15 DANI INSTRUMENTS

14.3.16 SCION INSTRUMENTS

14.3.17 GL SCIENCES

14.3.18 SRI INSTRUMENTS

14.3.20 KORE TECHNOLOGY

14.3.21 JASCO, INC.

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 270)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

This market research study involved extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the global metabolomics market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, and to assess market prospects. The size of the metabolomics market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from the National Institutes of Health (NIH), Centers for Disease Control and Prevention (CDC), US Food and Drug Administration (FDA), World Bank, World Health Organization (WHO), American Society for Mass Spectrometry (ASMS), National Environmental Engineering Research Institute (NEERI), National Institute of Public Health and the Environment (NIPHE), National Center for Biotechnology Information (NCBI), Society for Applied Spectroscopy (SAS), Metabolomics Society, Oxford Journals, European Bioinformatics Institute (EMBL-EBI), The Chromatographic Society (ChromSoc), Chinese American Chromatography Association (CACA), Chromatographic Society of India, European Society for Separation Science, International Mass Spectrometry Society (IMSS). Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global metabolomics market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global metabolomics market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand side (such as personnel from the pharmaceutical and biopharmaceutical industries) and the supply side (such as C-level and D-level executives, business heads, marketing and sales managers of key manufacturers, and distributors) across four major regions—North America, Europe, the Asia Pacific, Latin America and Rest of the World (RoW). Approximately 80% and 20% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by product & service, application, indication, end user,company type, and region).

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Report Objectives

- To define, describe, and measure the global metabolomics market based on product& service, application, indication, end user, and region

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the global metabolomics market

- To analyze the opportunities in the global metabolomics market for key stakeholders and provide details of the competitive landscape for major market leaders

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America and Middle East & Africa

- To profile the key players and comprehensively analyze their core competencies2 in terms of key developments, product portfolios, and financials

- To track and analyze competitive developments such as partnerships, agreements, alliances, joint ventures, collaborations, product launches, expansions, acquisitions, grants/funds, and licensing agreements, among others, in the metabolomics market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metabolomics Market