Micro-LED Market Size, Share, Industry Growth, Trends & Analysis by Application (Display (Smartwatch, NTE Device, Smartphone and Tablet, Television, Digital Signage), Lighting (General, Automotive)), Display Panel Size, Vertical and Region 2027

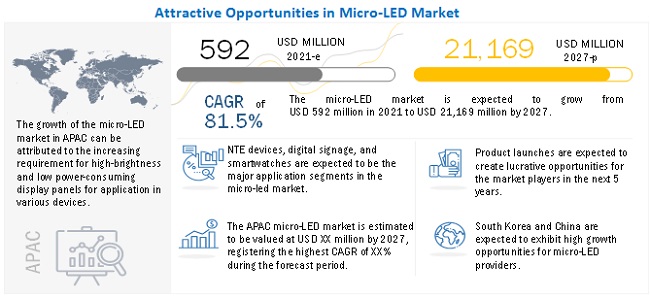

The micro-LED market Size, Share, Industry Growth, Trends & Analysis is projected reach USD 21,169 million by 2027 growing at a CAGR of 81.5% during forecast.The expected penetration of micro-LED displays in NTE devices and premium smartphones are the key factors that will accelerate the growth of the micro-LED market during the forecast period. Likewise, growing demand for wearable displays for smartwatches and head mounted displays (HMDs) are expected to create lucrative opportunities for the players in the micro-LED industry. However, absence of patents and proper supply chain are expected to restraint market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on micro-LED market:

The micro-LED market has been witnessing significant growth over the years. The sudden outbreak of the COVID-19 pandemic has impacted the demand for micro-LED-based products, especially in 2020 and 2021. The pandemic has forced companies to adopt remote working practices. The imposition of lockdown in almost all the major countries to curb the spread of COVID-19 has disrupted the supply chain, halted manufacturing activities, and impacted research and development activities, resulting in delayed production.

Market Dynamics

Drivers: Increasing demand for brighter and power-efficient display panels

The proportion of the urban population is increasing every day, causing traffic congestion. In 2000, only 46.72 percent of the world's population lived in cities; by 2007, more than half of the world's population (50.14 percent) lived in cities for the first time. Private and professional mobility presents significant challenges in urban areas. The increasing urbanization and population has been escalating the traffic density levels, making commuting tough for the common masses. Furthermore, as the urban population grows, so will the volume of business within cities and with business partners outside of cities. A higher urban population tends to increase the volume of transportation as business grows. For example, as cities' populations grow, so will traffic as businesses such as e-commerce, postal & logistics, and restaurant aggregator & food delivery companies expand their operations.

Restraints: Limited patents and inadequate supply chain

Micro-LED manufacturing, mass transferring, and panel manufacturing are the three major supply chain stages essential for the mass production of micro-LED displays. Large-scale display production will require these three stages to come together. The supply chain of micro-LED displays is complex and lengthy compared with that of LCD or OLED displays. The LCD supply chain, which involves various components and materials, is well established as the technology is mature. The OLED supply chain is evolving; however, fewer components in the display panel make it possible for one or two players to dominate the supply chain. In the micro-LED supply chain, every process is critical, and it will be a challenge to effectively manage each stage of the supply chain by one or two players. The patent portfolio of companies and the distribution of the same also indicate that no single company is positioned to cover the entire supply chain of micro-LED displays.

Opportunities: Growing demand for wearable displays for smartwatches and head-mounted displays (HMDs)

Many smart wearable manufacturers are looking to extend their product range by adding small devices with screens. Smart wearable manufacturers utilize small display panels in devices such as watches, wristbands, and smart glasses. Micro-LED technology is expected to be commercialized first for smart wearables such as NTE devices and smartwatches, and as the technology matures, it may penetrate smartphones and other larger application segments such as laptops, PC monitors, and TVs. Thus, the growing market for smart wearables is expected to create lucrative opportunities for display panel manufacturers, such as Samsung, LG, AU Optronics, and Innolux. These companies are expected to consider investing in such applications by collaborating with micro-LED startups.

Challenges: Requirement of high investments and need for different manufacturing processes and equipment computability

Manufacturers will have to adopt different manufacturing processes and equipment or upgrade their existing systems to mass-produce micro-LED chips for different applications. Industry-leading LED manufacturers, such as Epistar (Taiwan) and Cree (US), are focusing on exploring micro-LED development solutions that are compatible with the existing manufacturing processes. GLO AB (Sweden) has demonstrated nanowires that can be grown on various substrates, such as sapphire and silicon, utilizing standard industry process equipment. Making the micro-LED fabrication process compatible with the existing fabrication plants is the major focus area of leading players.

Near-to-Eye (NTE) devices to witness the highest CAGR in the micro-LED display market during the forecast period

The Near-to-Eye (NTE) devices is estimated to grow at the highest CAGR from 2021 to 2027 during the forecast period, as the growth of this segment can be attributed because there is high demand for AR/VR devices. Also, there is need of brighter and more power-efficient LED for NTE devices. Micro-LED serves this need and hence NTE devices application is projected to grow at the highest CAGR during the forecast period.

Consumer electronics vertical is expected to hold the largest share in 2027

Consumer Electronics is expected to grow at a highest CAGR during the forecast period. The market for consumer electronics has seen the emergence of large number start-ups, with high R&D investments. Such developments are likely to lead to significant growth of micro-LED market

APAC is attributed to grow at the highest CAGR in micro-LED market during the forecast period

APAC is expected to grow at the highest CAGR in the overall micro-LED market. The fastest growth of the APAC micro-LED market is expected to be driven by the increasing interest of electronic giants in APAC in adopting micro-LED technology. For instance, Samsung, one of the electronic giants, has commercialized few products into digital signage vertical. Samsung’s “The Wall” is one of the premium product in micro: LED digital signage (advertising) vertical. Also, Sony has also launched few products using micro-LED technology in the market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Micro-LED companies such as Apple (US), Sony (Japan), Samsung Electronics (South Korea), Oculus VR (US), X-Celeprint (Ireland).

Micro-LED Market Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 592 Billion |

| Projected Market Size | USD 21,169 Million |

| Growth Rate | 81.5% |

|

Market size available for years |

2017–2027 |

|

Base year |

2020 |

|

Forecast period |

2021–2027 |

|

Units |

Value USD Million |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered |

|

This report categorizes the micro-LED market based on application, panel size, resolution and brightness, vertical, and region.

Micro-LED Market, By Application

- Display

- Lighting

By Vertical

- Consumer Electronics

- Advertising

- Automotive

- Aerospace and Defense

- Others

By Panel-size

- Micro Display

- Small and Medium-sized Panel

- Large Panel

Micro-LED Market, By Region

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, Italy)

- Asia Pacific (China, Japan, South Korea)

- Rest of the World (RoW)

Recent Developments

- In February 2021, Apple partnered with TSMC to manufacture micro-LED displays, which could be used for Apple VR glasses in the future.

- In October 2019, Apple set up a new facility for developing micro-LED technology for Apple products in collaboration with the local supply chain in Taiwan; it is located next to Apple’s Taoyuan plant.

- In October 2019, Apple was granted a new micro-LED patent; it is related to the future high-resolution displays, which are energy efficient.

Frequently Asked Questions (FAQ):

How big Micro-LED Market?

The Micro-LED Market Size is Expected to reach USD 21,169 million by 2027 from USD 592 million in 2021 and , at a CAGR of 81.5% between 2021 and 2027.

Which are the major companies in the micro-LED market?

The Apple (US), Oculus VR (US), Sony (Japan), Samsung Electronics (South Korea), X-Celeprint (Ireland), and Nanosys (US)

Which are the leading countries in the micro-LED market?

South Korea and China are the leading countries of APAC region in the micro-LED market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF STUDY

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.3 SUMMARY OF CHANGES

1.4 SCOPE OF STUDY

1.4.1 MARKETS COVERED: MICRO-LED DISPLAY MARKET

FIGURE 1 MICRO-LED DISPLAY MARKET

1.4.2 MARKETS COVERED: MICRO-LED LIGHTING MARKET

FIGURE 2 MICRO-LED LIGHTING MARKET

1.4.3 GEOGRAPHIC SCOPE

1.4.4 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 3 PROCESS FLOW: MICRO-LED MARKET SIZE ESTIMATION

FIGURE 4 RESEARCH APPROACH

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insights

2.1.3.3 Primary interviews with experts

2.1.3.4 List of key primary respondents

2.1.3.5 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Estimating market size by bottom-up approach

FIGURE 5 MICRO-LED MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 6 MICRO-LED MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

3.1 MICRO-LED MARKET: POST COVID-19

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

FIGURE 8 REALISTIC SCENARIO: MICRO-LED MARKET, 2017–2027 (USD MILLION)

3.1.2 PESSIMISTIC SCENARIO (POST-COVID-19)

FIGURE 9 PESSIMISTIC SCENARIO: MICRO-LED MARKET, 2017–2027 (USD MILLION)

3.1.3 OPTIMISTIC SCENARIO (POST-COVID-19)

FIGURE 10 OPTIMISTIC SCENARIO: MICRO-LED MARKET, 2017–2027 (USD MILLION)

FIGURE 11 IMPACT OF COVID-19 ON MICRO-LED MARKET

FIGURE 12 DISPLAY APPLICATION TO BE DOMINANT SEGMENT IN MICRO-LED MARKET DURING FORECAST PERIOD

FIGURE 13 AEROSPACE & DEFENCE VERTICAL TO REGISTER HIGHEST CAGR FROM 2021 TO 2027

FIGURE 14 APAC TO REGISTER HIGHEST CAGR IN GLOBAL MICRO-LED MARKET FROM 2021 TO 2027

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MICRO-LED MARKET

FIGURE 15 GROWING ADOPTION OF MICRO-LEDS IN APAC TO DRIVE MARKET GROWTH

4.2 MICRO-LED MARKET, FOR DISPLAY AND LIGHTING APPLICATIONS

FIGURE 16 DISPLAY TO BE DOMINANT APPLICATION SEGMENT DURING FORECAST PERIOD

4.3 MICRO-LED DISPLAY MARKET, BY APPLICATION

FIGURE 17 NEAR-TO-EYE (NTE) DEVICES TO BE DOMINANT SEGMENT IN MICRO-LED DISPLAY MARKET IN 2027

4.4 MICRO-LED DISPLAY MARKET, BY VERTICAL

FIGURE 18 AEROSPACE & DEFENSE VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 MICRO-LED MARKET IN APAC, BY APPLICATION AND COUNTRY

FIGURE 19 CHINA AND DISPLAY SEGMENT TO HOLD LARGEST SHARES OF APAC MICRO-LED MARKET BY 2027

4.6 MICRO-LED MARKET, BY COUNTRY

FIGURE 20 US TO HOLD LARGEST SHARE OF MICRO-LED MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 COVID-19 IMPACT ON MICRO-LED MARKET

5.3 MARKET DYNAMICS

FIGURE 21 MICRO-LED MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

FIGURE 22 IMPACT ANALYSIS: DRIVERS

5.3.1.1 Increasing demand for brighter and power-efficient display panels

5.3.1.2 Increasing application of micro-LED displays in near-to-eye (NTE) devices

5.3.1.3 Growing adoption of micro-LED displays in premium smartphones

5.3.1.4 Increasing interest of electronics giants in micro-LED technology

5.3.2 RESTRAINTS

FIGURE 23 IMPACT ANALYSIS: RESTRAINTS

5.3.2.1 Limited patents and inadequate supply chain

5.3.2.2 Increasing demand for organic light-emitting diodes (OLEDs)

5.3.2.3 High growth of flexible display market and rise in adoption of folded displays for smartphones in near future

5.3.3 OPPORTUNITIES

FIGURE 24 IMPACT ANALYSIS: OPPORTUNITIES

5.3.3.1 Manufacturing of micro-LEDs on large silicon wafers

5.3.3.2 Growing demand for wearable displays for smartwatches and head-mounted displays (HMDs)

5.3.3.3 High penetration of micro-LED-based products in display panel market

5.3.4 CHALLENGES

FIGURE 25 IMPACT ANALYSIS: CHALLENGES

5.3.4.1 Requirement of high investments and need for different manufacturing processes and equipment computability

5.3.4.2 Low yield, high cost, and need for improving micro-LED production and mass transfer processes

5.3.4.3 Trade-off between pixel volume and pixel size

5.4 VALUE CHAIN ANALYSIS

FIGURE 26 MICRO-LED MARKET VALUE CHAIN

5.4.1 R&D (PROTOTYPE & IP DEVELOPMENT)

5.4.2 MICRO-LED MANUFACTURING (LED FOUNDRY)

5.4.3 MASS TRANSFER

5.4.4 PANEL MANUFACTURING

5.4.5 PRODUCT INTEGRATION

5.4.6 INPUT SUPPLIERS

5.4.6.1 Wafer suppliers

5.4.6.2 Driver/controller suppliers

5.4.6.3 Manufacturing equipment suppliers

5.4.6.4 Other suppliers

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 MICRO-LED MARKET: PORTER’S FIVE FORCES ANALYSIS, 2020

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 DEGREE OF COMPETITION

5.6 TRADE ANALYSIS FOR MICRO-LED MARKET

FIGURE 27 INDICATOR PANELS INCORPORATING LIQUID CRYSTAL DEVICES (LCDS) OR LIGHT-EMITTING DIODES (LEDS): GLOBAL IMPORTS DATA, 2016–2020 (USD THOUSAND)

TABLE 3 INDICATOR PANELS INCORPORATING LIQUID CRYSTAL DEVICES (LCDS) OR LIGHT-EMITTING DIODES (LEDS): GLOBAL IMPORT DATA, 2016–2020 (USD THOUSAND)

FIGURE 28 INDICATOR PANELS INCORPORATING LIQUID CRYSTAL DEVICES (LCDS) OR LIGHT-EMITTING DIODES (LEDS): GLOBAL EXPORT DATA, 2016–2020 (USD THOUSAND)

TABLE 4 INDICATOR PANELS INCORPORATING LIQUID CRYSTAL DEVICES (LCDS) OR LIGHT-EMITTING DIODES (LEDS): GLOBAL EXPORT DATA, 2016–2020 (USD THOUSAND)

5.7 ECOSYSTEM

FIGURE 29 MICRO-LED MARKET: ECOSYSTEM

TABLE 5 MICRO-LED MARKET: ECOSYSTEM

FIGURE 30 REVENUE SHIFT IN MICRO-LED MARKET

5.8 CASE STUDY ANALYSIS

5.8.1 CORRECTING VISUAL QUALITY OF MICRO-LED DISPLAYS FOR EFFICIENT PRODUCTION

5.8.2 ENGAGING SENSES: THE WALL’S SUPERIOR MICRO-LED TECHNOLOGY

5.9 TECHNOLOGY ANALYSIS

5.9.1 APPLE WON PATENT IN JUNE 2020 FOR FITNESS BAND

5.9.2 COMPETING IN GLOBAL LED INDUSTRY

5.9.3 NANOSYS MADE REMARKABLE ACQUISITION IN MICRO-LED MARKET BY ACQUIRING GLO

5.9.4 ROHINNI MICRO-LEDS

5.9.5 TOP HAT APPLICATION– MICRO-LED LASER LIFT-OFF

5.10 PATENT ANALYSIS

TABLE 6 NUMBER OF PATENTS REGISTERED IN MICRO-LED MARKET IN LAST 10 YEARS

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 7 GLOBAL PATENTS PERTAINING TO THE MICRO-LED MARKET

5.11 COMMERCIALIZATION POTENTIAL OF MICRO-LED IN DIFFERENT DEVICES

TABLE 8 INDUSTRY CAPABILITY ANALYSIS: PIXEL PRODUCTION/TRANSFER RATE FOR COMMERCIALIZATION, BY DEVICE

FIGURE 32 PIXEL (RGB LED) PRODUCTION/TRANSFER RATE FOR COMMERCIALIZATION, BY DEVICE

5.12 DEVICE COMPARISON AND SPECIFICATION REQUIREMENT

5.12.1 SMALL- AND MEDIUM-SIZED DEVICES

FIGURE 33 SMALL- AND MEDIUM-SIZED DEVICE ANALYSIS: PIXEL PITCH, PIXELS PER PANEL, PIXEL SIZE REQUIREMENT, AND EXPECTED COMMERCIALIZATION

5.12.2 LARGE DEVICES

FIGURE 34 LARGE DEVICE ANALYSIS: PIXEL PITCH, PIXELS PER PANEL, PIXEL SIZE REQUIREMENT, AND EXPECTED COMMERCIALIZATION

5.13 RESEARCH INSTITUTES AND LABS

5.13.1 INDUSTRIAL TECHNOLOGY RESEARCH INSTITUTE (ITRI) (EOSRL)

5.13.2 CHANGCHUN INSTITUTE

5.13.3 III-V LAB

5.13.4 CEA-LETI

5.13.5 HONG KONG UNIVERSITY OF SCIENCE AND TECHNOLOGY

5.13.6 FRAUNHOFER-GESELLSCHAFT

5.14 INPUT SUPPLIERS

5.14.1 JASPER DISPLAY

5.14.2 CRYSTALWISE TECHNOLOGY

5.14.3 UNIMICRON

5.14.4 LUMINIT

5.14.5 MACROBLOCK

5.14.6 HIMAX

5.15 MAJOR DISPLAY PROVIDERS ENTERING MARKET

5.15.1 FOXCONN (SHARP/ELUX/INNOLUX)

5.15.2 BOE TECHNOLOGY

5.15.3 AU OPTRONICS

5.15.4 LG DISPLAY

5.16 STANDARDS

5.16.1 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)

6 MICRO-LED MARKET, BY APPLICATION (Page No. - 81)

6.1 INTRODUCTION

TABLE 9 MICRO-LED MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 10 MICRO-LED MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

6.2 DISPLAY

FIGURE 35 MICRO-LED DISPLAY MARKET, BY APPLICATION

FIGURE 36 MICRO-LED DISPLAY MARKET, BY APPLICATION, 2017–2027 (USD MILLION)

TABLE 11 MICRO-LED DISPLAY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 12 MICRO-LED DISPLAY MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

6.2.1 NEAR-TO-EYE (NTE) DEVICES

6.2.1.1 Increasing demand for brighter and more power-efficient display panels to boost demand for micro-LEDs for NTE devices

TABLE 13 MICRO-LED DISPLAY MARKET FOR NEAR-TO-EYE (NTE) DEVICES, BY TYPE, 2021–2027 (USD MILLION)

TABLE 14 MICRO-LED DISPLAY MARKET FOR NEAR-TO-EYE (NTE) DEVICES, BY REGION, 2021–2027 (USD MILLION)

TABLE 15 MICRO-LED DISPLAY MARKET FOR AR DEVICES, BY REGION, 2021–2027 (USD MILLION)

TABLE 16 MICRO-LED DISPLAY MARKET FOR VR DEVICES, BY REGION, 2021–2027 (USD MILLION)

6.2.2 SMARTWATCH

6.2.2.1 Low power consumption feature of micro-LED to fuel its adoption rate in smartwatch displays

TABLE 17 MICRO-LED DISPLAY MARKET FOR SMARTWATCH, BY REGION, 2021–2027 (USD MILLION)

6.2.3 TELEVISIONS

6.2.3.1 Problems associated with mass production of televisions using micro-LED technology to hamper market growth

TABLE 18 MICRO-LED DISPLAY MARKET FOR TELEVISIONS, BY REGION, 2021–2027 (USD MILLION)

6.2.4 HEAD-UP DISPLAYS (HUDS)

6.2.4.1 Growing demand for head-up displays in automotive industry to drive market growth

TABLE 19 MICRO-LED DISPLAY MARKET FOR HEAD-UP DISPLAYS (HUDS), BY REGION, 2021–2027 (USD MILLION)

6.2.5 SMARTPHONES AND TABLETS

6.2.5.1 High luminosity and power efficiency offered by micro-LED technology to boost their adoption in smartphone manufacturing

TABLE 20 MICRO-LED DISPLAY MARKET FOR SMARTPHONES AND TABLETS BY REGION, 2021–2027 (USD MILLION)

6.2.6 MONITORS AND LAPTOPS

6.2.6.1 Limitations associated with implementing micro-LED technology in large-format devices may result in late commercialization of micro-LED technology for laptops and monitors

TABLE 21 MICRO-LED DISPLAY MARKET FOR LAPTOPS AND MONITORS, BY REGION, 2021–2027 (USD MILLION)

6.2.7 DIGITAL SIGNAGE

6.2.7.1 High brightness and better contrast ratio are driving adoption of micro-LED technology in digital signage application

TABLE 22 MICRO-LED DISPLAY MARKET FOR DIGITAL SIGNAGE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 MICRO-LED DISPLAY MARKET FOR DIGITAL SIGNAGE, BY REGION, 2021–2027 (USD MILLION)

6.3 LIGHTING

FIGURE 37 MICRO-LED LIGHTING MARKET, BY TYPE

FIGURE 38 AUTOMOTIVE LIGHTING APPLICATION TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

TABLE 24 MICRO-LED LIGHTING MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 25 MICRO-LED LIGHTING MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

6.3.1 GENERAL LIGHTING

6.3.1.1 Increase in use of backlighting panels for manufacturing of consumer products

FIGURE 39 APAC TO WITNESS HIGHEST GROWTH IN MICRO-LED LIGHTING MARKET FOR GENERAL LIGHTING DURING FORECAST PERIOD

TABLE 26 MICRO-LED LIGHTING MARKET FOR GENERAL LIGHTING, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 MICRO-LED LIGHTING MARKET FOR GENERAL LIGHTING, BY REGION, 2021–2027 (USD MILLION)

6.3.2 AUTOMOTIVE LIGHTING

6.3.2.1 Surging demand for smart headlights in automotive industry to boost adoption of micro-LEDs

TABLE 28 MICRO-LED LIGHTING MARKET FOR AUTOMOTIVE LIGHTING, BY REGION, 2021–2027 (USD MILLION)

7 MICRO-LED DISPLAY MARKET, BY RESOLUTION AND BRIGHTNESS (Page No. - 100)

7.1 INTRODUCTION

7.2 RESOLUTION

7.2.1 INCREASING DEMAND FOR HIGH-RESOLUTION DISPLAYS TO DRIVE GROWTH OF MICRO-LED DISPLAY MARKET

FIGURE 40 MICRO-LED DISPLAY MARKET, BY RESOLUTION TYPE

7.3 BRIGHTNESS

7.3.1 HIGH BRIGHTNESS QUALITY OF MICRO-LED OVER OLEDS

FIGURE 41 MICRO-LED DISPLAY MARKET, BY BRIGHTNESS

8 MICRO-LED DISPLAY MARKET, BY PANEL SIZE (Page No. - 102)

8.1 INTRODUCTION

FIGURE 42 MICRO-LED DISPLAY MARKET, BY PANEL SIZE

FIGURE 43 SMALL- AND MEDIUM-SIZED PANELS SEGMENT TO HOLD LARGEST SHARE OF MICRO-LED DISPLAY MARKET DURING FORECAST PERIOD

TABLE 29 MICRO-LED DISPLAY MARKET, BY PANEL SIZE, 2017–2020 (USD MILLION)

TABLE 30 MICRO-LED DISPLAY MARKET, BY PANEL SIZE, 2021–2027 (USD MILLION)

8.2 MICRO DISPLAYS

8.2.1 COMPANIES ARE FOCUSING ON DEVELOPING PROTOTYPES OF MICRO DISPLAYS

8.3 SMALL- AND MEDIUM-SIZED PANELS

8.3.1 MASS PRODUCTION OF MICRO-LED-BASED SMALL- AND MEDIUM-SIZED PANELS CURRENTLY HAS FEW UNRESOLVED ISSUES

8.4 LARGE PANELS

8.4.1 MICRO-LED-BASED LARGE DISPLAY PANELS INCREASE COST OF END PRODUCTS

9 MICRO-LED DISPLAY MARKET, BY VERTICAL (Page No. - 107)

9.1 INTRODUCTION

FIGURE 44 MICRO-LED DISPLAY MARKET, BY VERTICAL

FIGURE 45 AEROSPACE & DEFENSE VERTICAL TO REGISTER HIGHEST CAGR IN MICRO-LED DISPLAY MARKET DURING FORECAST PERIOD

TABLE 31 MICRO-LED DISPLAY MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

9.2 CONSUMER ELECTRONICS

9.2.1 CONSUMER ELECTRONICS TO BE MOST ATTRACTIVE SEGMENT IN MICRO-LED DISPLAY MARKET

9.3 ADVERTISING

9.3.1 MICRO-LED MARKET HAS MOST POTENTIAL FOR GROWTH IN DIGITAL SIGNAGE SEGMENT

9.3.2 MICRO-LED MARKET FOR ADVERTISING VERTICAL: COVID-19 IMPACT

FIGURE 46 IMPACT OF COVID-19 ON MICRO-LED MARKET FOR ADVERTISING VERTICAL

TABLE 33 POST-COVID-19: MICRO-LED MARKET FOR ADVERTISING VERTICAL, 2017–2027 (USD MILLION)

9.4 AUTOMOTIVE

9.4.1 HUD HOLDS HIGHEST POTENTIAL IN MICRO-LED MARKET FOR AUTOMOTIVE VERTICAL

9.5 AEROSPACE & DEFENSE

9.5.1 AR AND VR HMDS ARE KEY APPLICATIONS FOR MICRO-LED DISPLAYS IN AEROSPACE & DEFENSE VERTICAL

9.6 OTHERS

10 MICRO-LED MARKET, BY REGION (Page No. - 114)

10.1 INTRODUCTION

FIGURE 47 MICRO-LED MARKET, BY REGION

FIGURE 48 MICRO-LED DISPLAY MARKET: RAPIDLY GROWING MARKETS & NEW HOTSPOTS

FIGURE 49 APAC TO REGISTER HIGHEST CAGR IN MICRO-LED MARKET DURING FORECAST PERIOD

TABLE 34 MICRO-LED MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MICRO-LED MARKET, BY REGION, 2021–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 50 NORTH AMERICA: MICRO-LED MARKET SNAPSHOT

FIGURE 51 US TO HOLD LARGEST SHARE OF MICRO-LED MARKET IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 36 MICRO-LED MARKET FOR NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 37 MICRO-LED MARKET FOR NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 38 MICRO-LED MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 39 MICRO-LED MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 40 MICRO-LED DISPLAY MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 41 MICRO-LED DISPLAY MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 42 MICRO-LED LIGHTING MARKET FOR NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 43 MICRO-LED LIGHTING MARKET FOR NORTH AMERICA, BY APPLICATION, 2021–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Increased investments and large presence of consumer electronics manufacturers to boost US market growth

TABLE 44 MICRO-LED MARKET IN US, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 45 MICRO-LED MARKET IN US, BY APPLICATION, 2021–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Economic growth in Canada to create growth opportunities for micro-LED market

TABLE 46 MICRO-LED MARKET IN CANADA, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 47 MICRO-LED MARKET IN CANADA, BY APPLICATION, 2021–2027 (USD THOUSAND)

10.2.3 MEXICO

10.2.3.1 Rising disposable income and growth in mid-income group population to drive growth of Mexican micro-LED market

TABLE 48 MICRO-LED MARKET IN MEXICO, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 49 MICRO-LED MARKET IN MEXICO, BY APPLICATION, 2021–2027 (USD THOUSAND)

10.3 EUROPE

FIGURE 52 EUROPE: MICRO-LED MARKET SNAPSHOT

FIGURE 53 FRANCE TO REGISTER HIGHEST CAGR IN EUROPEAN MICRO-LED MARKET DURING FORECAST PERIOD

TABLE 50 MICRO-LED MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 51 MICRO-LED MARKET IN EUROPE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 52 MICRO-LED DISPLAY MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 53 MICRO-LED DISPLAY MARKET IN EUROPE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 54 MICRO-LED MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 55 MICRO-LED MARKET IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 56 MICRO-LED LIGHTING MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 57 MICRO-LED LIGHTING MARKET IN EUROPE, BY APPLICATION, 2021–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Strategic partnerships to drive growth of micro-LED market in UK

TABLE 58 MICRO-LED MARKET IN UK, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 59 MICRO-LED MARKET IN UK, BY APPLICATION, 2021–2027 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Germany to hold major share of European market

TABLE 60 MICRO-LED MARKET IN GERMANY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 61 MICRO-LED MARKET IN GERMANY, BY APPLICATION, 2021–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Presence of advanced research institutes to boost growth of micro-LED market

TABLE 62 MICRO-LED MARKET IN FRANCE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 63 MICRO-LED MARKET IN FRANCE, BY APPLICATION, 2021–2027 (USD MILLION)

10.3.4 REST OF EUROPE

TABLE 64 MICRO-LED MARKET IN REST OF EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 65 MICRO-LED MARKET IN REST OF EUROPE, BY APPLICATION, 2021–2027 (USD MILLION)

10.4 APAC

FIGURE 54 APAC: MICRO-LED MARKET SNAPSHOT

FIGURE 55 SOUTH KOREA TO REGISTER HIGHEST CAGR IN APAC MICRO-LED MARKET DURING FORECAST PERIOD

TABLE 66 MICRO-LED MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 67 MICRO-LED MARKET IN APAC, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 68 MICRO-LED MARKET FOR APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 69 MICRO-LED MARKET FOR APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 70 MICRO-LED DISPLAY MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 71 MICRO-LED DISPLAY MARKET IN APAC, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 72 MICRO-LED LIGHTING MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 73 MICRO-LED LIGHTING MARKET IN APAC, BY APPLICATION, 2021–2027 (USD MILLION)

10.4.1 SOUTH KOREA

10.4.1.1 Strong display market to drive growth of micro-LED market in South Korea

TABLE 74 MICRO-LED MARKET IN SOUTH KOREA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 75 MICRO-LED MARKET IN SOUTH KOREA, BY APPLICATION, 2021–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Presence of leading display panel manufacturers to fuel growth of micro-LED market

TABLE 76 MICRO-LED MARKET IN JAPAN, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 77 MICRO-LED MARKET IN JAPAN, BY APPLICATION, 2021–2027 (USD MILLION)

10.4.3 CHINA

10.4.3.1 Increasing research and development to boost growth of micro-LED market in China

TABLE 78 MICRO-LED MARKET IN CHIINA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 79 MICRO-LED MARKET IN CHINA, BY APPLICATION, 2021–2027 (USD MILLION)

10.4.4 REST OF APAC

TABLE 80 MICRO-LED MARKET IN REST OF APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 81 MICRO-LED MARKET IN REST OF APAC, BY APPLICATION, 2021–2027 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

TABLE 82 MICRO-LED MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 83 MICRO-LED MARKET IN ROW, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 84 MICRO-LED MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 MICRO-LED MARKET IN ROW, BY REGION, 2021–2027 (USD MILLION)

TABLE 86 MICRO-LED DISPLAY MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 87 MICRO-LED DISPLAY MARKET IN ROW, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 88 MICRO-LED LIGHTING MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 89 MICRO-LED LIGHTING MARKET IN ROW, BY APPLICATION, 2021–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Increasing demand for micro-LEDs in Brazil to boost growth of South American market

TABLE 90 MICRO-LED MARKET IN SOUTH AMERICA BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 91 MICRO-LED MARKET IN SOUTH AMERICA, BY APPLICATION, 2021–2027 (USD THOUSAND)

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Increasing demand for micro-LEDs in Middle East to boost growth of Middle East & Africa market

TABLE 92 MICRO-LED MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 93 MICRO-LED MARKET OF MIDDLE EAST & AFRICA, BY APPLICATION, 2021–2027 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 144)

11.1 OVERVIEW

11.2 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 56 REVENUE ANALYSIS (USD BILLION), 2016–2020

11.3 MARKET RANK ANALYSIS, 2024

TABLE 94 KEY PLAYER MARKET RANKING (2024)

11.4 COMPANY EVALUATION QUADRANT, 2020

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 57 MICRO-LED MARKET COMPANY EVALUATION QUADRANT, 2020

11.4.5 COMPANY FOOTPRINT

TABLE 95 COMPANY FOOTPRINT: MICRO-LED MARKET

TABLE 96 VERTICAL FOOTPRINT: MICRO-LED MARKET

TABLE 97 APPLICATION FOOTPRINT: MICRO-LED MARKET

TABLE 98 REGIONAL FOOTPRINT: MICRO-LED MARKET

11.5 MICRO-LED MARKET STARTUP/SME EVALUATION QUADRANT, 2020

11.5.1 PROGRESSIVE COMPANY

11.5.2 RESPONSIVE COMPANY

11.5.3 DYNAMIC COMPANY

11.5.4 STARTING BLOCK

FIGURE 58 MICRO-LED MARKET, STARTUP/SME EVALUATION QUADRANT, 2020

11.6 COMPETITIVE SITUATIONS AND TRENDS

11.6.1 PRODUCT LAUNCHES

TABLE 99 PRODUCT LAUNCHES, 2020–2021

11.6.2 DEALS

TABLE 100 DEALS, 2019–2021

12 COMPANY PROFILES (Page No. - 157)

(Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 APPLE (LUXVUE)

TABLE 101 APPLE: BUSINESS OVERVIEW

FIGURE 59 APPLE: COMPANY SNAPSHOT

12.1.2 OCULUS VR (INFINILED)

TABLE 102 OCULUS VR: BUSINESS OVERVIEW

12.1.3 SONY

TABLE 103 SONY: BUSINESS OVERVIEW

FIGURE 60 SONY: COMPANY SNAPSHOT

12.1.4 SAMSUNG ELECTRONICS

TABLE 104 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 61 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

12.1.5 X-CELEPRINT

TABLE 105 X-CELEPRINT: BUSINESS OVERVIEW

12.1.6 EPISTAR

TABLE 106 EPISTAR: BUSINESS OVERVIEW

FIGURE 62 EPISTAR: COMPANY SNAPSHOT

12.1.7 NANOSYS

TABLE 107 NANOSYS: BUSINESS OVERVIEW

12.1.8 VERLASE TECHNOLOGIES

TABLE 108 VERLASE TECHNOLOGIES: BUSINESS OVERVIEW

12.1.9 JADE BIRD DISPLAY

TABLE 109 JADE BIRD DISPLAY: BUSINESS OVERVIEW

12.1.10 ALEDIA

TABLE 110 ALEDIA: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 MIKRO MESA TECHNOLOGY

12.2.2 VUEREAL

12.2.3 UNIQARTA

12.2.4 ALLOS SEMICONDUCTORS

12.2.5 PLESSEY SEMICONDUCTORS

12.2.6 PLAYNITRIDE

12.2.7 OSTENDO TECHNOLOGIES

12.2.8 SHARP CORPORATION (ELUX)

12.2.9 UNIVERSITY OF SHEFFIELD (EPIPIX)

12.2.10 MICLEDI

12.2.11 MICROLUCE

12.2.12 TIANMA

12.2.13 VISIONOX

12.2.14 LUMENS

12.2.15 LUMIODE

12.2.16 ROHINNI

12.2.17 COOLEDGE

12.2.18 PRP OPTOELECTRONICS

12.2.19 CSOT

12.2.20 KONKA

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 198)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

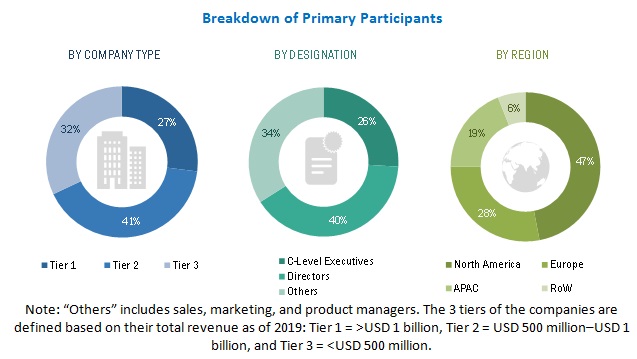

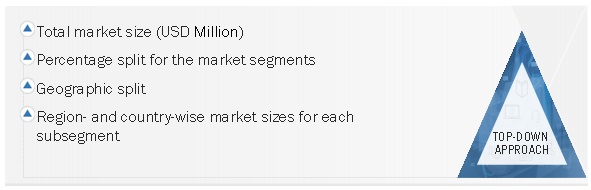

The study involved 4 major activities in estimating the current size of micro-LED market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the micro-LED market begins with capturing the data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for the technical and commercial study of the micro-LED market. Secondary sources also include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, market’s value chain, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the micro-LED market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the micro-LED market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the micro-LED market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Micro-LED Market: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the micro-LED market segmented based on application, panel size, vertical, and geography, in terms of value

- To forecast the size of various segments with respect to 4 main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To estimate the commercialization potential of micro-LED technology for different display applications based on current and futuristic manufacturing capabilities, mass transfer capabilities, yield improvements, and configuration/specification requirements

- To provide detailed information and analysis of major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the value chain of the micro-LED market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the micro-LED market

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze growth strategies such as product launches, acquisitions, expansions, and agreements adopted by major market players

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Micro-LED Market