Middle East Cloud Applications Market by Application (ERP, CRM, HCM, SCM, and Business Intelligence and Analytics), Organization Size, Vertical (BFSI, Manufacturing, and Telecommunications), and Country - Forecast to 2024

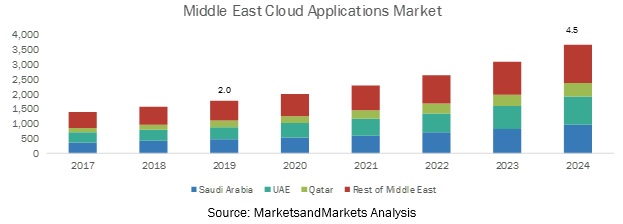

[110 Pages Report] MarketsandMarkets expects the Middle East cloud applications market size to grow from USD 2.0 billion in 2019 to USD 4.5 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 17.5% during the forecast period. Cloud applications can be implemented faster and provide scalability, flexibility, and agile computing services that help enterprises focus on their core businesses. These services help in reducing the cost of deploying IT infrastructure, hardware, and hiring skilled resources. These benefits are expected to drive the adoption of cloud applications in the Middle East region.

Among applications, the collaboration and content management segment to witness high growth during the forecast period

The adoption of cloud Enterprise Content Management (ECM) among SMEs and large enterprises has increased due to benefits, such as easy implementation, low operating costs, and increased storage space, which they achieve by digitalizing their operations over the cloud. Cloud ECM offers a central location for integrated information, which enables staff members to work from remote locations anytime and helps them in improving productivity and performance. Cloud collaboration enables sharing documents and files stored on cloud, where they can be accessed by others through cloud computing. Cloud collaboration solutions enable enterprises to store data in a centralized repository, while they also ensure optimum security policies. The cloud-based collaboration solutions have enabled multiple users to perform editing online and share documents with users in real time.

Among verticals, the BFSI vertical to hold the highest market share in 2019

The Banking, Financial Services, and Insurance (BFSI) vertical is adopting digitalization initiatives at a rapid pace to meet the rising customer expectations and sustain the highly competitive market. Cloud-based services help vendors efficiently meet IT needs, while they also save Capital Expenditure (CAPEX) and Operating Expenditure (OPEX). The banking sector needs to store and manage customers’ confidential information, such as credit card details, transaction details, and personal information. This data needs to be securely stored as losing such data might result in customer loss and may create a negative brand value in the market. This is leading to the growing adoption of cloud computing services.

Saudi Arabia to hold the largest market size during the forecast period

Saudi Arabia is one of the leading investors in IT technologies in the Middle East region. The growth of cloud applications is limited in the country as compared to other technologically developed countries; however, the enterprises in Saudi Arabia has been showing positive signs and inclination toward the usage of cloud-based applications. The growth of cloud applications is mainly driven by the initiatives undertaken by local government entities to foster the adoption of new technologies and increase awareness of the benefits of cloud-based enterprise applications among enterprises. The cloud application vendors have focused on expanding their presence in Saudi Arabia by partnering with local vendors, which is further expected to drive the adoption of cloud applications in the country.

Middle East Cloud Applications Companies

Major vendors offering cloud applications in the Middle East include SAP (Germany), Oracle (US), Microsoft (US), Infor (US), Salesforce (US), Sage Group (UK), IBM (US), Epicor (US), 3I Infotech (India), Ramco Systems (India), Prolitus Technologies (India), IFS (Sweden), and QAD (US). The research report also studies strategic alliances and lucrative acquisitions among various and local players in the cloud ecosystem. These players have majorly adopted the strategy of partnerships to enhance their business in the Middle East cloud applications market. They have also launched new products to cater to the needs of diverse end users across regions.

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Applications, Organization Size, Verticals, and Countries |

|

Countries covered |

Saudi Arabia, UAE, Qatar, and the rest of the Middle East |

|

List of Companies in Middle East Cloud Applications |

SAP (Germany), Oracle (US), Microsoft (US), Infor (US), Salesforce (US), Sage Group (UK), IBM (US), Epicor (US), 3I Infotech (India), Ramco Systems (India), Prolitus Technologies (India), IFS (Sweden), and QAD (US). |

This research report categorizes the Middle East cloud applications market to forecast revenue and analyze trends in each of the following submarkets:

Based on applications, the Middle East cloud applications market has been segmented as follows:

- Enterprise Resource Management (ERM)

- Customer Relationship Management (CRM)

- Human Capital Management (HCM)

- Supply Chain Management (SCM)

- Business Intelligence and Analytics

- Collaboration and Content Management

- Others (PPM and engineering applications)

Based on organization size, the Middle East cloud applications market has been segmented as follows:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on verticals, the Middle East cloud applications market has been segmented as follows:

- Banking, Financial Services, and Insurance (BFSI)

- Energy and Utilities

- Government and Public Sector

- Healthcare and Life Sciences

- Manufacturing

- Retail and Consumer Goods

- Telecommunications

- Others (education, travel and hospitality, and media and entertainment)

Based on regions, the Middle East cloud applications market has been segmented as follows:

- Saudi Arabia

- UAE

- Qatar

- Rest of Middle East

Recent Developments

- In October 2018, SAP added new services and cloud choices to its SAP Cloud platform. These services enable customers to easily connect their demand chains to their supply chains, adhere to new privacy and security regulations, and provide an enhanced cloud environment for business-critical applications. The company is focused on delivering intelligent enterprises to customers by providing enterprise software with visibility, focus, and agility required for accelerated change.

- In March 2018, Microsoft expanded its Azure Cloud services in the Middle East and Europe. It is increasing its investments in Abu Dhabi and Dubai, UAE. Additionally, it announced plans to expand its cloud services for the customers in Germany.

- In June 2019, Salesforce announced to acquire Tableau Software, a data visualization firm for USD 15.7 billion. The acquisition would enable Salesforce’s customers to accelerate innovation and make smarter decisions across every part of their business.

- In November 2019, Sage acquired CakeHR, a native cloud solution that simplifies and automates HR tasks for SMEs. The solution improves productivity and enhances customer experience. The acquisition has boosted Sage’s native cloud offering for SMEs and its SaaS offerings.

Key questions addressed by the report

- How is the adoption trend of cloud applications in the Middle East?

- What are the challenges faced by cloud application vendors in the Middle East?

- What are various developments happened in the Middle East cloud applications market?

Frequently Asked Questions (FAQ):

How big is the middle east cloud applications market?

The global middle east cloud applications market size was estimated at 2.0 billion in 2019 and is expected to reach USD 4.5 billion by 2024.

What is the middle east cloud applications market growth?

The global middle east cloud applications market is expected to grow at a compound annual growth rate of 17.5% from 2019 to 2024 to reach USD 4.5 billion by 2024.

Which region has the highest market share in the middle east cloud applications market?

Saudi Arabia is estimated to hold the market size by 2024, due to theincreasing adoption of cloud technologies across industry verticals in this country.

Which applications is expected to witness high adoption in the coming years?

The CRM application is expected to hold grow at higher rate as it provides enterprises a means to manage their relationships with the existing customers efficiently and aids in identifying new leads and prospects. The adoption of CRM applications is expected to increase due to benefits, such as enhanced sales productivity, improved customer satisfaction, increased customer retention, and higher efficiency.

Who are the major vendors in the middle east cloud applications market?

Despite the presence of a large number of vendors, the market is dominated mainly by vendors such as Microsoft (US), AWS (US), Infor (US), Oracle (US), SAP (Germany), Google (US), Sage (UK), Epicor (US), and IBM (US).

What are some of the latest trends that will shape the middle east cloud applications market in the future?

The emergence of serverless computing, containerization, edge computing, and hybrid cloud architectures are few trends that are expected to shape the market in the coming years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Middle East Cloud Applications Market

4.2 Middle East Cloud Applications Market, By Application (2019 Vs. 2024)

4.3 Middle East Cloud Applications Market, By Organization Size (2019 Vs. 2024)

4.4 Middle East Cloud Applications Market, By Vertical (2019 Vs. 2024)

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Investment in Digital Transformation By Governments

5.2.1.2 Business Expansion By Global Vendors to Gain the First-Mover Advantage

5.2.1.3 Initiatives By Government Organizations to Promote the Latest Technologies

5.2.1.4 Increased Awareness of the Benefits of Cloud and Its Adjacent Technologies Among Enterprises

5.2.2 Restraints

5.2.2.1 Difficulty in Addressing Governance and Compliance Requirements

5.2.2.2 Limited Bandwidth Providers and Lack of Access to High-Speed Internet

5.2.3 Opportunities

5.2.3.1 Improving Network Connectivity to Provide Seamless Saas Implementation

5.2.3.2 Telecom Service Providers Leveraging Existing Infrastructure to Offer Cloud-Based Services

5.2.4 Challenges

5.2.4.1 High Latency and Workload Complexities in the Cloud Environment

5.3 Regulatory Landscape

5.3.1 Regulations in United Arab Emirates

5.3.1.1 UAE Civil Code Number 5 of 1985 on the Civil Transactions Law

5.3.1.2 UAE Federal Law Number 2 on the Prevention of It Crimes

5.3.1.3 Federal Law Number 1 of 2006 Concerning Electronic Transactions and Ecommerce

5.3.1.4 Dubai International Financial Centre Law Number 5 of 2012

5.3.1.5 Electronic Transactions Law, Difc Law Number 2 of 2017

5.3.2 Regulations in Saudi Arabia

5.3.2.1 Law Number 20 of 2014 Pertaining to Electronic Transactions

5.3.2.2 Anti-Cyber Crime Law

5.3.2.3 Saudi Arabia Telecommunications Act

5.3.2.4 Shariah Principles

5.3.3 Regulations in Qatar

5.3.3.1 Penal Code: Law 11 of 2004

5.3.3.2 Electronic Commerce and Transactions Law

5.3.3.3 Telecommunications Law

5.3.3.4 Banking Law: Law 33 of 2006

5.3.3.5 Qatar Computer Emergency Response Team (Q–CERT)

5.3.3.6 Data Protection and Privacy Law

6 Middle East Cloud Applications Market, By Application (Page No. - 41)

6.1 Introduction

6.2 Enterprise Resource Management

6.2.1 Enterprise Resource Management: Middle East Cloud Applications Market Drivers

6.3 Customer Relationship Management

6.3.1 Customer Relationship Management: Middle East Cloud Applications Market Drivers

6.4 Human Capital Management

6.4.1 Human Capital Management: Middle East Cloud Applications Market Drivers

6.5 Supply Chain Management

6.5.1 Supply Chain Management: Middle East Cloud Applications Market Drivers

6.6 Business Intelligence and Analytics

6.6.1 Business Intelligence and Analytics: Middle East Cloud Applications Market Drivers

6.7 Collaboration and Content Management

6.7.1 Collaboration and Content Management: Middle East Cloud Applications Market Drivers

6.8 Others

7 Middle East Cloud Applications Market, By Organization Size (Page No. - 50)

7.1 Introduction

7.2 Large Enterprises

7.2.1 Large Enterprises: Middle East Cloud Applications Market Drivers

7.3 Small and Medium-Sized Enterprises

7.3.1 Small and Medium-Sized Enterprises: Middle East Cloud Applications Market Drivers

8 Middle East Cloud Applications Market, By Vertical (Page No. - 54)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.3 Energy and Utilities

8.4 Government and Public Sector

8.5 Healthcare and Life Sciences

8.6 Manufacturing

8.7 Retail and Consumer Goods

8.8 Telecommunications

8.9 Other Verticals

9 Middle East Cloud Applications Market, By Country (Page No. - 64)

9.1 Introduction

9.2 Saudi Arabia

9.2.1 Saudi Arabia: Middle East Cloud Applications Market Drivers

9.3 United Arab Emirates

9.3.1 United Arab Emirates: Middle East Cloud Applications Market Drivers

9.4 Qatar

9.4.1 Qatar: Middle East Cloud Applications Market Drivers

9.5 Rest of Middle East

9.5.1 Rest of Middle East: Middle East Cloud Applications Market Drivers

10 Competitive Landscape (Page No. - 77)

10.1 Introduction

10.2 Competitive Scenario

10.2.1 New Product Launches

10.2.2 Acquisitions

10.2.3 Partnerships

10.2.4 Business Expansions

11 Company Profiles (Page No. - 82)

11.1 Introduction

(Business Overview, Applications Offered, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.2 SAP

11.3 Microsoft

11.4 Oracle

11.5 Infor

11.6 Salesforce

11.7 Sage

11.8 IBM

11.9 Epicor

11.10 Ramco Systems

11.11 3i Infotech

11.12 Prolitus Technologies

11.13 IFS

11.14 QAD

*Details on Business Overview, Applications Offered, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 103)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (38 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2018

Table 2 Middle East Cloud Applications Market Size, By Application, 2017–2024 (USD Million)

Table 3 Enterprise Resource Management: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 4 Customer Relationship Management: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 5 Human Capital Management: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 6 Supply Chain Management: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 7 Business Intelligence and Analytics: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 8 Collaboration and Content Management: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 9 Other Applications: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 10 Middle East Cloud Applications Market Size, By Organization Size, 2017–2024 (USD Million)

Table 11 Large Enterprises: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 12 Small and Medium-Sized Enterprises: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 13 Middle East Cloud Applications Market Size, By Vertical, 2017–2024 (USD Million)

Table 14 Banking, Financial Services, and Insurance: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 15 Energy and Utilities: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 16 Government and Public Sector: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 17 Healthcare and Life Sciences: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 18 Manufacturing: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 19 Retail and Consumer Goods: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 20 Telecommunications: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 21 Other Verticals: Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 22 Middle East Cloud Applications Market Size, By Country, 2017–2024 (USD Million)

Table 23 Saudi Arabia: Middle East Cloud Applications Market Size, By Application, 2017–2024 (USD Million)

Table 24 Saudi Arabia: Middle East Cloud Applications Market Size, By Organization Size, 2017–2024 (USD Million)

Table 25 Saudi Arabia: Middle East Cloud Applications Market Size, By Vertical, 2017–2024 (USD Million)

Table 26 United Arab Emirates: Middle East Cloud Applications Market Size, By Application, 2017–2024 (USD Million)

Table 27 United Arab Emirates: Middle East Cloud Applications Market Size, By Organization Size, 2017–2024 (USD Million)

Table 28 United Arab Emirates: Middle East Cloud Applications Market Size, By Vertical, 2017–2024 (USD Million)

Table 29 Qatar: Middle East Cloud Applications Market Size, By Application, 2017–2024 (USD Million)

Table 30 Qatar: Middle East Cloud Applications Market Size, By Organization Size, 2017–2024 (USD Million)

Table 31 Qatar: Middle East Cloud Applications Market Size, By Vertical, 2017–2024 (USD Million)

Table 32 Rest of Middle East: Middle East Cloud Applications Market Size, By Application, 2017–2024 (USD Million)

Table 33 Rest of Middle East: Middle East Cloud Applications Market Size, By Organization Size, 2017–2024 (USD Million)

Table 34 Rest of Middle East: Middle East Cloud Applications Market Size, By Vertical, 2017–2024 (USD Million)

Table 35 New Product Launches, 2018

Table 36 Acquisitions, 2017–2019

Table 37 Partnerships, 2017–2019

Table 38 Business Expansions, 2018

List of Figures (28 Figures)

Figure 1 Middle East Cloud Applications Market: Research Design

Figure 2 Middle East Cloud Applications Market: Market Estimation and Forecast Methodology

Figure 3 Middle East Cloud Applications Market Snapshot, 2017–2024

Figure 4 Segments With High Growth Rates During the Forecast Period

Figure 5 Collaboration and Content Management Segment to Hold the Largest Market Size During the Forecast Period

Figure 6 Large Enterprises Segment to Hold a Larger Market Size During the Forecast Period

Figure 7 Banking, Financial Services, and Insurance Vertical to Hold the Largest Market Size During the Forecast Period

Figure 8 Saudi Arabia to Hold the Largest Market Size During the Forecast Period

Figure 9 Saudi Arabia to Account for the Highest Market Share in 2019

Figure 10 Digital Initiatives By Regional Governments and Business Expansions By Well-Established Players to Drive the Adoption of Cloud Applications in the Middle East

Figure 11 Collaboration and Content Management Segment to Account for the Highest Market Share During the Forecast Period

Figure 12 Large Enterprises Segment to Account for a Higher Market Share During the Forecast Period

Figure 13 Banking, Financial Services, and Insurance Vertical to Register the Highest Market Share During the Forecast Period

Figure 14 Drivers, Restraints, Opportunities, and Challenges: Middle East Cloud Applications Market

Figure 15 Customer Relationship Management Segment to Grow at the Highest Rate During the Forecast Period

Figure 16 Small and Medium-Sized Enterprises Segment to Grow at a Higher Rate During the Forecast Period

Figure 17 Retail and Consumer Goods Vertical to Grow at the Highest Rate During the Forecast Period

Figure 18 United Arab Emirates to Grow at the Highest Rate During the Forecast Period

Figure 19 Saudi Arabia: Market Snapshot

Figure 20 United Arab Emirates: Market Snapshot

Figure 21 Key Developments By the Leading Players in the Middle East Cloud Applications Market During 2017–2019

Figure 22 SAP: Company Snapshot

Figure 23 Microsoft: Company Snapshot

Figure 24 Oracle: Company Snapshot

Figure 25 Infor: Company Snapshot

Figure 26 Salesforce: Company Snapshot

Figure 27 Sage: Company Snapshot

Figure 28 IBM: Company Snapshot

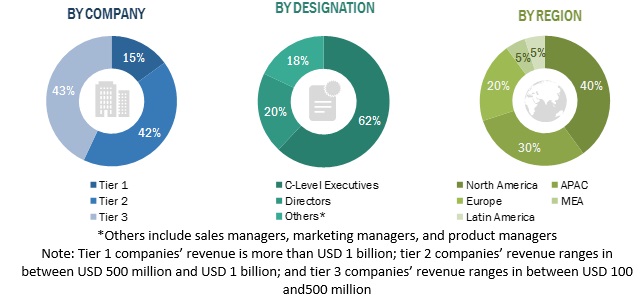

The study involved four major activities in estimating the current market size of the Middle East cloud applications market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, DiscoverOrg, and Factiva, have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The Middle East cloud applications market comprises several stakeholders, such as cloud application vendors, cloud solution providers, cloud service brokers, system integrators, consulting service providers, managed service providers, resellers and distributors, research organizations, government agencies, enterprise users, venture capitalists, private equity firms, and startup companies. The demand side of the Middle East cloud applications market consists of enterprises from different end users, such as Banking, Financial Services, and Insurance (BFSI), energy and utilities, government and public sector, healthcare and life sciences, manufacturing, retail and consumer goods, telecommunications, and others (education, travel and hospitality, and media and entertainment). The supply side includes cloud application and software providers offering cloud applications, software, and services in the Middle East. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Middle East cloud applications market. These methods were also used extensively to determine the extent of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in different industries and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the Middle East cloud applications market by application, organization size, vertical, and country

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments for countries, such as Saudi Arabia, the United Arab Emirates (UAE), Qatar, and the rest of the Middle East

- To profile the key players of the market and comprehensively analyze their market size and core competencies2 in the market

- To track and analyze competitive developments, such as new product launches; acquisitions; and partnerships and agreements, in the Middle East cloud applications market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Middle East Cloud Applications Market