Millimeter Wave Technology Market by Product (Scanning System, Telecommunication Equipment, Radar and Satellite Communication System, Others), License Type, Component, Frequency Band, End Use and Region - Global Forecast to 2029

[258 Pages Report] The millimeter wave technology market is projected to grow from USD 3.0 billion in 2024 to USD 7.6 billion by 2029, registering a CAGR of 20.1% during the forecast period. The proliferation of wireless backhaul and growing adoption of 5G network, high demand for millimeter wave technology in security and radar applications , emergence of new applications in aerospace & defense industry are expected to propel the millimeter wave technology market in the next five years. However, challenges associated with physical properties of millimeter waves will likely pose challenges for industry players.

The objective of the report is to define, describe, and forecast the millimeter wave technology market based on component, product, frequency band, license type, end use, and region.

Millimeter Wave Technology Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Millimeter wave technology market dynamics.

Driver: Proliferation of Wireless Backhaul and growing adoption of 5G network

Millimeter wave bands offer a perfect fit for the high-capacity needs of 5G enhanced Mobile Broadband. They provide a wireless alternative for backhaul, making them ideal for the rapidly growing number of cell sites, especially in dense urban areas. Millimeter wave (mmWave) technology is becoming more prevalent in wireless backhaul networks due to the growing need for fast internet and 5G networks. mmWave technology offers a high-capacity wireless backhaul solution. This translates to faster data transfer rates between base stations and the core network, crucial for supporting the massive data traffic generated by applications like 5G, VR, and IoT. The mobile data traffic for 5G was approximately 14 exabytes per month by the end of 2022. It is expected to increase exponentially to reach ~305.8 exabytes per month by 2029; as more 4G subscribers migrate to 5G, average mobile data traffic per smartphone will increase. It represents the mobile data that people will consume using smartphones, laptops, and many new devices by 2029. It is expected that by 2029, the majority of the data traffic will come from the 5G network.

Restraint Low penetration power and harmful impact on the environment

The drawbacks of millimeter wave technology include the need for telecom operators to install more towers and other equipment in order to extend its limited range, which can also be increased by increasing transmitting power. However, this can lead to increased fuel consumption and radiation; significant space consumption by transmission towers also contributes to large-scale deforestation, mostly in rural areas; and several materials, including SiGe, GaAs, InP, and GaN, which are used in circuitries that work at millimeter wave frequency, are toxic and their extended use can be harmful to the environment.

Opportunities: Emergence of new applications in aerospace & defense industry

There are always new uses for millimeter wave technologies in the aerospace and defense industries. Over the next six years, satellite communication is another significant application that is anticipated to increase and employ unallocated E- and V-band spectrums. For safe and uninterrupted communication in the face of missile guidance systems, enemy threats, and other munition, millimeter wave is employed in a number of military applications. A number of military agencies, such as the Defense Advanced Research Projects Agency (DARPA) and the Air Force Research Laboratory (AFRL), have entered the millimeter wave technology sector as a result of the paucity of unallocated spectrum in microwave frequency. With innovations such as 5G and satellite communication backhaul on the rise, connectivity, bandwidth, and speed are becoming more important for the defense sector. Thus, millimeter wave-based products can play an important role in the defense sector.

Challenges: Challenges associated to physical properties of millimeter waves

Millimeter waves offer a vast amount of untapped potential due to the wide availability of spectrum in this frequency range. However, this hasn't been readily utilized because traditional technologies struggled to generate and receive these high-frequency signals. While advancements have been made, the bigger hurdle lies in the way millimeter waves travel. These high frequencies are significantly impacted by atmospheric conditions, open space (free-space path loss), and struggle to penetrate obstacles like foliage. In simpler terms, millimeter wave signals have a shorter range compared to lower frequencies, even with similar power levels. This can be a challenge, particularly for applications requiring wider coverage areas. The signal properties remain constant, regardless of factors such as antenna gain at the transmitter and receiver ends or reflection, absorption, and diffraction during signal transmission.

Market Map/Ecosystem

Millimeter Wave Technology Market: Key Trends.

The prominent players in the millimeter wave technology market are Axxcss Wireless Solutions (US), NEC Corporation (Japan), Ceragon (Isarel), L3Harris Technologies, Inc. (US), Aviat Networks (US), Smiths Group plc (UK), Eravant (US), Farran (Ireland), Keysight Technologies (US), Ducommun Incorporated (US), and Millimeter Wave Product, Inc, (US), and among others. These companies boast mixing trends with a comprehensive product portfolio and strong geographic footprint.

Telecommunication equipment are expected to grow at the highest CARG in the millimeter wave technology market during the forecast period.

During the projection period, the segment with the highest CAGR and largest share is anticipated to be telecommunication equipment. The section of telecommunication equipment has been further divided into small-cell equipment and mobile backhaul equipment, which comprises all indoor and outdoor radio equipment used in macro- and micro-cell backhaul. Due to its use in backhaul applications, namely in 5G infrastructure applications, the mobile backhaul equipment sector is predicted to dominate the market. In North America, there have been a lot of research projects and trials for millimeter wave items. This is anticipated to have a big impact on the expansion of mobile backhaul equipment and, eventually, telecom equipment.

The consumer & commercial segment is expected to hold the second highest CAGR of the millimeter wave technology market during the forecast period.

Throughout the projection period, the consumer and commercial segment is anticipated to grow at the second-highest rate. The use of millimeter waves in wireless security and sensor applications—particularly in smart city applications—is covered in this segment. Commercial structures like malls, hotels, offices, sports complexes, and warehouses also use millimeter wave-based scanning systems. These types of buildings are anticipated to replace conventional body scanners with millimeter wave-based scanners because of the additional security and privacy benefits of the latter.

The millimeter wave technology market is expected to have a high market share in China from the Asia Pacific region during the forecast period.

The millimeter wave technology industry is prominent in the Asia Pacific region. Asia Pacific has adopted millimeter wave technology items at a faster rate than other regions. The high population density in Asia Pacific, which makes millimeter wave technology more appropriate for use in the region, is responsible for the market's rise in this area. This is because of the technology's high data transfer capacities and its non-genotoxic capacity to pass past barriers. China is one of the key markets for millimeter wave technology in Asia Pacific. It is the leading telecommunication equipment provider in this region. China-based manufacturers of telecommunication equipment are turning to the countries of South America, Southeast Asia, and Africa for business opportunities and are enhancing their share in the millimeter wave technology market in these countries.

China was at the forefront of the millimeter wave technology market in Asia Pacific in 2023 and is likely to continue its dominance during the forecast period, in terms of market size. Huawei and ZTE have a stronghold in 5G technology with wider coverage than Nokia and Ericsson owing to their chips, terminals, systems, and specialized end-to-end 5G solutions. Moreover, the Government of China launched “Made in China 2025” to improve manufacturing competitiveness. The initiative is modeled on Germany’s “Industrial 4.0.” The country aims to strengthen its global position in the manufacturing sector, with this initiative. It is taking aggressive initiatives to upsurge the IT infrastructure, enabling commercial users to adopt cutting-edge technology.

Millimeter Wave Technology Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the millimeter wave technology companies include Axxcss Wireless Solutions (US), NEC Corporation (Japan), Ceragon (Isarel), L3Harris Technologies, Inc. (US), Aviat Networks (US), Smiths Group plc (UK), Eravant (US), Farran (Ireland), Keysight Technologies (US), Ducommun Incorporatedb (US), and Millimeter Wave Product, Inc, (US), and among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Units |

Value (USD Million/USD Billion), Volume (Million Units) |

|

Segments Covered |

Product, Frequency Band, License Type, End Use, Component, and Region |

|

Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Axxcss Wireless Solutions (US), NEC Corporation (Japan), Ceragon (Israel), L3Harris Technologies, Inc. (US), Aviat Networks (US), Smiths Group plc (UK), Eravant (US), Farran (Ireland), Keysight Technologies (US), Ducommun Incorporated (US), and Millimeter Wave Product, Inc, (US), and among others. |

Millimeter Wave Technology Market Highlights

This report categorizes the millimeter wave technology market based on product, frequency band, license type, end use, component, and region.

|

Segment |

Subsegment |

|

By Component |

|

|

By Product |

|

|

By Product |

|

|

By License Type |

|

|

By End Use |

|

|

By Region |

|

Recent developments

- In February 2024, Ceragon announced the plans to unveil its new lineup of industry-first innovations at Mobile World Congress (MWC) 2024. The highlights will include a Neptune SoC-based, live demonstration of Ceragon's upcoming millimeter wave technology, showcasing an unparalleled 4000 MHz channel bandwidth, 16K QAM, which when paired with XPIC and MIMO technologies, enables a mmW link capable of 100 Gbps, far surpassing competitor capabilities.

- In January 2024, Aviat Networks announced a strategic collaboration with PT Smartfren Telecom Tbk to deliver high speed, ultra-reliable wireless connectivity, private wireless indoor and outdoor networks, and industry digitalization and automation services to private networks customers across Indonesia.

- In February 2023, Cisco and NEC Corporation collaborated to include system integration solutions and potential opportunities in 5G xHaul and private 5G. This would help customers to transform their architecture and connect more people and things.

Frequently Asked Questions (FAQs):

Which are the major companies in the millimeter wave technology market? What are their primary strategies to strengthen their market presence?

Axxcss Wireless Solutions (US), NEC Corporation (Japan), Ceragon (Israel), L3Harris Technologies, Inc. (US), Aviat Networks (US) are among the leading players in the market. These companies have adopted inorganic and organic growth strategies such as partnerships, product launches, and acquisitions, to gain a competitive advantage in the market.

Which is the potential market for the end use?

Mobile & telecommunication, healthcare, and automotive & transportation are end-user industries with high growth opportunities owing to advancements in technology.

What are the opportunities for new market entrants?

Factors such as the emergence of autonomous vehicles , growing adoption of V-band millimeter waves for last-mile connectivity , and emergence of new applications in the aerospace & defense industry are creating opportunities for the players in the market

Which product is expected to drive market growth in the next six years?

Scanning systems are expected to remain the major technology driving millimeter wave technology demand.

What are the major strategies adopted by millimeter wave technology companies?

The millimeter wave technology companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the millimeter wave technology market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

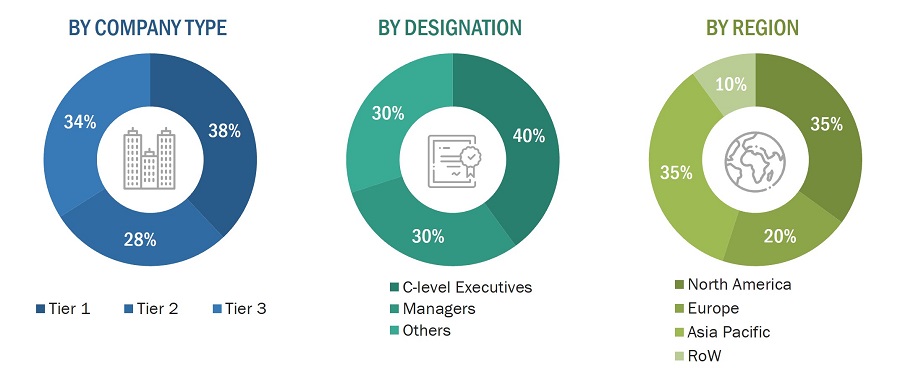

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the millimeter wave technology market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the millimeter wave technology market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the millimeter wave technology market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers; millimeter wave technology products-related journals; certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the millimeter wave technology market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

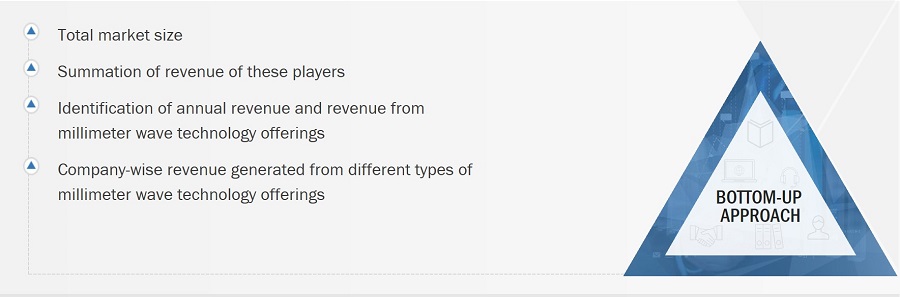

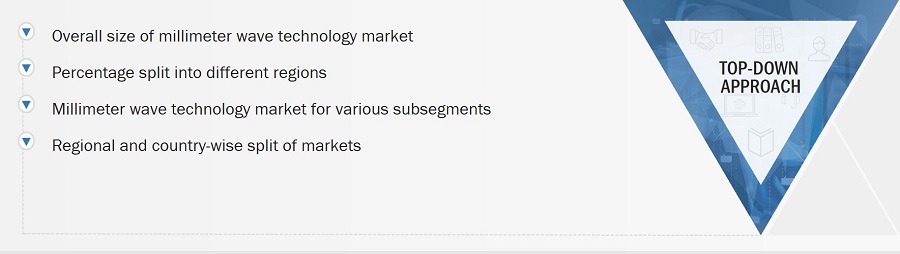

Market size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the millimeter wave technology market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Millimeter wave technology market: Bottom-Up Approach.

Millimeter wave technology market: Top-Down Approach.

Data Triangulation

After arriving at the overall size of the millimeter wave technology market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

Millimeter wave, also known as extremely high frequency (EHF) or very high frequency (VHF), is the band of spectrum between 30 gigahertz (GHz) and 300 GHz. These waves are named so because their wavelengths range from 1 millimeter to 10 millimeters. Previously, millimeter waves were mainly used in military and satellite communication applications. However, this technology has been gaining traction in mobile and telecom applications, mainly for 5G. In the context of wireless communication, millimeter waves generally refer to bands of the spectrum of around 38 GHz, 60 GHz, and 94 GHz.

Key Stakeholders

- Companies in the millimeter wave technology market

- Providers of millimeter wave components

- Technical standards organizations

- Research institutes and organizations

- Government and financial institutions

- Venture capitalists

- Private equity firms

Report Objectives

- To define, describe, and forecast the millimeter wave technology market based on product, frequency band, license type, end use, component, and region.

-

To forecast the sizes of various segments with respect to four major regions—

North America, Europe, Asia Pacific, and Rest of the World (RoW) - To provide a detailed analysis of the millimeter wave technology supply chain.

- To analyze the impact of the recession on millimeter wave technology market

- To strategically analyze the micromarkets1 with respect to individual growth trends and prospects and their contributions to the total market

- To analyze competitive developments such as expansions, agreements, partnerships, acquisitions, product developments, and research and development (R&D) in the millimeter wave technology market

- To analyze the opportunities for market players and provide details of the competitive landscape of the market.

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios.

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market.

Available customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Millimeter Wave Technology Market