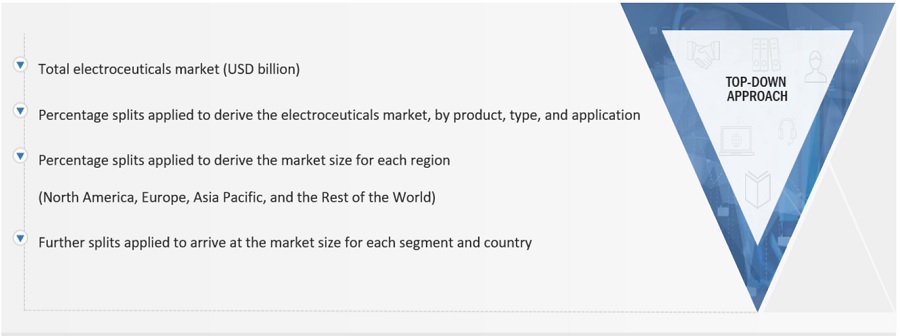

This study involved four major activities in estimating the current size of the electroceuticals market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships of the leading players, the competitive landscape of the electroceuticals market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, market breakdown and data triangulation were used.

The four steps involved in estimating the market size are:

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the electroceuticals market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the electroceuticals market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as hospitals, clinics and ambulatory surgery centers (ASCs)) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

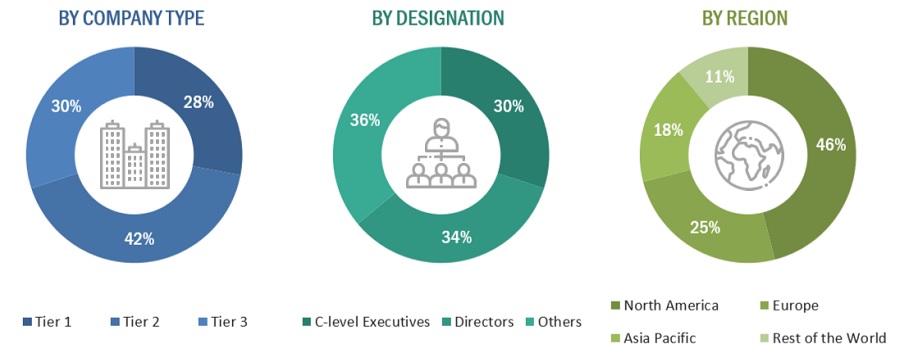

A breakdown of the primary respondents is provided below:

The following is a breakdown of the primary respondents

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2023: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All major product manufacturers offering various electroceuticals products were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value electroceuticals market was also split into various segments and subsegments at the region and country level based on:

-

Product mapping of various manufacturers for each type of electroceuticals market at the regional and country-level

-

Relative adoption pattern of each electroceuticals market among key application segments at the regional and/or country-level

-

Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country-level.

-

Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Electroceuticals Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the electroceuticals device industry.

Market Definition

Electroceuticals are medical devices that use electrical impulses to modulate the body’s neural circuits as an alternative to drug-based intervention. Electroceuticals, also known as bioelectric medicine, combines molecular medicine, bioengineering, and neuroscience to discover and develop nerve stimulating & sensing technologies to regulate biological processes and treat diseases.

Key Stakeholders

-

Manufacturing Companies of Electroceuticals and Related Devices

-

Original Equipment Manufacturers

-

Suppliers and Distributors of Electroceutical Devices

-

Healthcare Service Providers

-

Teaching Hospitals and Academic Medical Centers (AMCs)

-

Health Insurance Payers

-

Research and Consulting Firms

-

Medical Research Institutes

-

Healthcare Institutes/Providers (Hospitals, Medical Groups, Physicians’ Practices, Diagnostic Centers, and Outpatient Clinics)

-

Venture Capitalists

-

Community Centers

Report Objectives

-

To define, describe, segment, and forecast the global electroceuticals market by product, type, application, and region

-

To forecast the size of the global electroceuticals market with respect to five regional segments, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall electroceuticals market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To profile the key players in the electroceuticals market and comprehensively analyze their market shares and core competencies2 in terms of market developments and growth strategies

-

To track and analyze competitive developments such as product launches, agreements, collaborations, partnerships, expansions, and acquisitions in the electroceuticals market

-

To benchmark players within the electroceuticals market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

-

Electroceuticals market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa.

Company profiles

-

Product portfolio matrix for leading market players.

David

May, 2022

Research and sales information of Electroceuticals Market / Bioelectric Medicine Market.

Liam

May, 2022

Insights on current market scenario of Bioelectric Medicine Market.