Network Probe Market by Component (Solution and Services (Consulting, Training and Support, and Integration and Deployment), Deployment Mode, Organization Size, End User (Service Providers and Enterprises) and Region - Global Forecast to 2027

Network Probe Market Analysis & Statistics, Global Industry Size Forecast

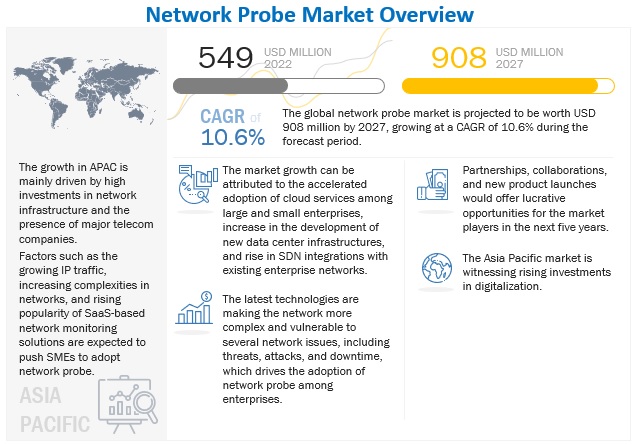

The global Network Probe Market size as per revenue was crossed $549 million in 2022 and is anticipated to increase over $908 million by the end of 2027, registering a CAGR of 10.6%.

The network probe market growth can be attributed to the large-scale adoption of cloud services, enterprise mobility, the rise in global IP traffic, IoT, and the growth in network infrastructure in nearly every region of the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

Network Probe Market Growth Dynamics

Driver: Increase in network stress due to exponential rise in IP traffic and complex IT infrastructure

With enterprises increasing their yearly investments in network infrastructure, the IT infrastructure is getting more complex. More complexity is added to the network layer to provide flexibility to the application layer. To overcome this issue, organizations are moving toward a centralized view of their entire infrastructure via visualized dashboards that enable them to monitor bandwidth, application traffic alerting, network traffic analysis, performance analysis dashboards, advanced application recognition, and customizable network traffic reports. This has led to major growth in the adoption of network monitoring tools and software solutions among enterprises and service providers, thereby boosting the growth of the network probe market.

Restraint: Lack of technical granularity

Network probe lacks technical granularity that can provide extreme visibility and control. Networks face blind spots that hinder the adoption of network monitoring tools to analyze every aspect of network traffic monitoring. While resolving IT incidents and security risks, every minute of data flow analysis counts. Mean-Time-To-Know (MTTK) is reduced to eliminate network blind spots, reduce wasted efforts, decrease costs, and generate high-quality traffic analysis. In real-time, granularity-level deep extreme analysis can enable organizations to discover problems and high-risk communication.

Opportunity: Need to handle massive network performance data

The increasing number of IT applications leads to topological complexities, making monitoring network performance very difficult. This increased complexity has led to an exponential rise in statistical data. According to the LiveAction 2019 report, approximately 38% of network professionals cannot proactively identify network performance issues. The global data center and cloud IP traffic is increasing across the globe owing to an upsurge in data center virtualization and cloud computing models. Enterprises’ focus on business agility and infrastructure cost reduction has also increased cloud and data center traffic. Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) cloud services are gaining momentum along with Business-as-a-Service (BaaS) and Network-as-a-Service (NaaS) cloud computing models. The facts above show that the network probe solution is of paramount importance and would have huge opportunities in the future.

Challenge: High cost of equipment

Network probe deployment is a costly affair. It requires a huge sum of investment. In addition to this, upgradation and network equipment costs are high. All the market companies are unwilling to constantly upgrade their equipment and solutions. However, end users require updated solutions because they would not buy an outdated or traditional solution that does not comply with the changing network requirements. Due to the requirement of heavy investments, the revenue of the network probe market would get affected, which in turn, may restrict the growth of the network probe market.

By organization size, small and medium sized enterprises to register higher CAGR during forecast period

SMEs are focusing more on network management solutions to streamline their network infrastructures and enhance their business functions. They face challenges related to network management due to the increasingly complex network infrastructure targeted by the growing network security attacks. SME businesses have gaps in their network security due to the lack of big budgets for network management. Network probe protects SMEs from digital intruders and helps in network monitoring and real-time network visibility and analysis to improve network performance and provide network security and privacy.

By component, solution segment to account for largest market share during forecast period

The network probe solution delivers exceptional Layer 2 to Layer 7 flow classification and metadata extraction. This metadata enables network administrators to regulate network traffic. It further enables administrators to tackle network and application issues by determining the cause of slowdowns, bottlenecks, and downtime. The network probe solution provides complete, real-time visibility into organizations’ network traffic, including encrypted and evasive traffic, and supports IoT/Supervisory Control and Data Acquisition (SCADA) traffic for hybrid IT networks.

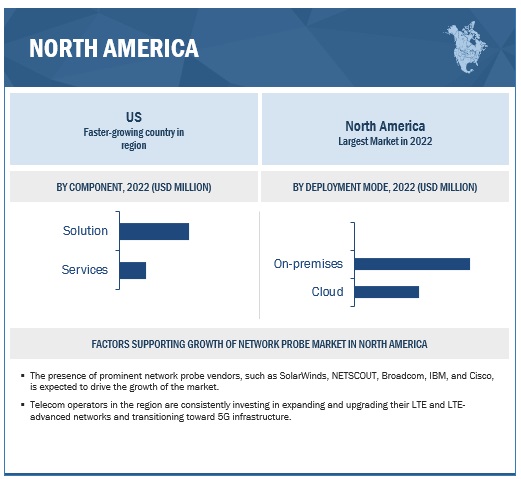

North America to account for the largest market share during the forecast period

North America is expected to hold the largest share of the overall network probe market. The US has high adoption of network probe technologies in this region. North America leads network probe usage, with the US and Canada at the forefront. These countries have sustainable and well-established economies, which empower them to invest strongly in R&D activities, thereby contributing to developing new technologies. Network operators in this region constantly invest in expanding and upgrading their telecom networks and transition toward 5G infrastructure. This leverages technologies, such as cloud edge computing and network slicing, thereby actuating the adoption of network probe solutions and services.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The network probe market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in this market include SolarWinds (US), NETSCOUT (US), Broadcom (US), IBM (US), Cisco (US), Nokia (Finland), NEC (Japan), AppNeta (US), Catchpoint (US), Accedian (Canada), Paessler (Germany), ManageEngine (US), Progress (US), Nagios (US), Dynatrace (US), HelpSystems (US), Riverbed (US), ExtraHop (US), Micro Focus (UK), Cubro (Austria), Plixer (US), Kentik (US), ObjectPlanet (Norway), Flowmon (Czech Republic), Qosmos (France), Radcom (Israel), Firstwave (Australia), and 3Columns (Australia). The study includes an in-depth competitive analysis of these key market players along with their profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

| Market Size Value in 2022 | $549 million |

| Revenue Forercast Size Value in 2027 | $908 million |

| Growth Rate | 10.6% CAGR |

| Key Market Drivers | Increase in network stress due to exponential rise in IP traffic and complex IT infrastructure |

| Key Market Opportunities | Need to handle massive network performance data |

| Market size available for years | 2020-2027 |

| Base year considered | 2021 |

| Forecast period | 2022-2027 |

| Forecast units | Value (USD Million/Billion) |

| Segments covered | By component, organization size, deployment mode, end users and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

| Companies covered | SolarWinds (US), NETSCOUT (US), Broadcom (US), IBM (US), Cisco (US), Nokia (Finland), NEC (Japan), AppNeta (US), Catchpoint (US), Accedian (Canada), Paessler (Germany), ManageEngine (US), Progress (US), Nagios (US), Dynatrace (US), HelpSystems (US), Riverbed (US), ExtraHop (US), Micro Focus (UK), Cubro (Austria), Plixer (US), Kentik (US), ObjectPlanet (Norway), Flowmon (Czech Republic), Qosmos (France), Radcom (Israel), Firstwave (Australia), and 3Columns (Australia). |

This research report categorizes the network probe market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Solution

-

Services

- Consulting

- Integration and deployment

- Training and support

By Organization Size:

- SMEs

- Large Enterprises

By Deployment Mode

- On-premises

- Cloud

By End Users

- Service Providers

-

Enterprises

- BFSI

- IT and ITeS

- Government

- others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Spain

- Italy

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

Middle East

- United Arab Emirates

- Kingdom of Saudi Arabia

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Nigeria

- Rest of Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2021, IBM acquired Turbonomic, a US-based Network Performance Management (NPM) software provider. The acquisition would provide businesses with full-stack application observability and management to assure performance and minimize costs using AI to optimize resources.

- In April 2021, SolarWinds partnered with DNSFilter to help MSPs protect customers from online security threats with advanced DNS technology. DNSFilter would integrate its cloud-based security solution with N-Central to provide MSPs with threat protection and content filtering.

- In January 2021, Nokia partnered with Tele2 to accelerate its digitalization with distributed cloud core. As a part of the partnership, Nokia would provide NetAct Network Management System to further secure, automate, and scale network management operations.

Frequently Asked Questions (FAQ):

What is a Network Probe?

How big is the Network Probe Market?

Which are the key drivers supporting the Network Probe Market growth?

Who are the Major Vendors in the Network Probe Market?

Which countries are considered in the North American region?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 MARKET FORECAST

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN NETWORK PROBE MARKET

4.2 MARKET, BY DEPLOYMENT MODE

4.3 NORTH AMERICAN MARKET, BY ORGANIZATION SIZE AND COUNTRY (2022)

4.4 ASIA PACIFIC MARKET, BY ORGANIZATION SIZE AND COUNTRY (2022)

4.5 MARKET, BY COUNTRY

5 MARKET OVERVIEW AND INDUSTRY TRENDS

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 INDUSTRY TRENDS

5.3.1 VALUE CHAIN

5.3.2 ECOSYSTEM

5.3.3 PORTER’S FIVE FORCE MODEL

5.3.3.1 THREAT OF NEW ENTRANTS

5.3.3.2 THREAT OF SUBSTITUTES

5.3.3.3 BARGAINING POWER OF BUYERS

5.3.3.4 BARGAINING POWER OF SUPPLIER

5.3.3.5 COMPETITIVE RIVALRY

5.3.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.3.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

5.3.4.2 BUYING CRITERIA

5.3.5 TECHNOLOGY ANALYSIS

5.3.6 TRENDS AND DISRUPTIONS IMPACTING BUYERS

5.3.7 PATENT ANALYSIS

5.3.8 PRICING ANALYSIS

5.3.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION

5.3.8.2 AVERAGE SELLING PRICE TREND

5.3.9 USE CASES

5.3.10 KEY CONFERENCES & EVENTS IN 2022 TO 2023

5.3.11 TARIFF AND REGULATORY IMPACT

5.3.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

6 NETWORK PROBE MARKET, BY COMPONENT

6.1 INTRODUCTION

6.1.1 MARKET, BY COMPONENT: DRIVERS

6.1.2 MARKET, BY COMPONENT: RECESSION IMPACT

6.2 COMPONENT

6.2.1 SOLUTION

6.2.2 SERVICES

6.2.2.1 CONSULTING

6.2.2.2 TRAINING AND SUPPORT

6.2.2.3 INTEGRATION AND DEPLOYMENT

7 NETWORK PROBE MARKET, BY DEPLOYMENT MODE

7.1 INTRODUCTION

7.1.1 MARKET, BY DEPLOYMENT MODE: DRIVERS

7.1.2 MARKET, BY DEPLOYMENT MODE: RECESSION IMPACT

7.2 ON-PREMISES

7.3 CLOUD

8 NETWORK PROBE MARKET, BY ORGANIZATION SIZE

8.1 INTRODUCTION

8.1.1 MARKET, BY ORGANIZATION SIZE: DRIVERS

8.1.2 MARKET, BY ORGANIZATION SIZE: RECESSION IMPACT

8.2 LARGE ENTERPRISES

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

9 NETWORK PROBE MARKET, BY END USER

9.1 INTRODUCTION

9.1.1 MARKET, BY END USER: DRIVERS

9.1.2 MARKET, BY END USER: RECESSION IMPACT

9.2 SERVICE PROVIDERS

9.2.1 TELECOM SERVICE PROVIDERS

9.2.2 CLOUD SERVICE PROVIDERS

9.2.3 OTHER SERVICE PROVIDERS

9.3 ENTERPRISES

9.3.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.3.2 IT AND ITES

9.3.3 GOVERNMENT

9.3.4 OTHERS

11 NETWORK PROBE MARKET, BY REGION

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: PESTLE ANALYSIS

11.2.2 NORTH AMERICA: RECESSION IMPACT

11.2.3 UNITED STATES

11.2.4 CANADA

11.3 EUROPE

11.3.1 EUROPE: PESTLE ANALYSIS

11.3.2 EUROPE: RECESSION IMPACT

11.3.3 UNITED KINGDOM

11.3.4 GERMANY

11.3.5 FRANCE

11.3.6 ITALY

11.3.7 SPAIN

11.3.8 NORDICS

11.3.9 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: PESTLE ANALYSIS

11.4.2 ASIA PACIFIC: RECESSION IMPACT

11.4.3 CHINA

11.4.4 JAPAN

11.4.5 INDIA

11.4.6 AUSTRALIA AND NEW ZEALAND

11.4.7 SOUTH EAST ASIA

11.4.8 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: PESTLE ANALYSIS

11.5.2 MIDDLE EAST AND AFRICA: RECESSION IMPACT

11.5.3 MIDDLE EAST

11.5.3.1 UAE

11.5.3.2 KSA

11.5.3.3 REST OF MIDDLE EAST

11.5.4 AFRICA

11.5.4.1 SOUTH AFRICA

11.5.4.2 EGYPT

11.5.4.3 NIGERIA

11.5.4.4 REST OF AFRICA

11.6 LATIN AMERICA

11.5.1 LATIN AMERICA: PESTLE ANALYSIS

11.5.2 LATIN AMERICA: RECESSION IMPACT

11.5.3 BRAZIL

11.5.4 MEXICO

11.5.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

12.3 COMPETITIVE SCENARIO AND TRENDS

12.3.1 PRODUCT LAUNCHES

12.3.2 DEALS

12.3.3 OTHERS

12.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

12.5 HISTORICAL REVENUE ANALYSIS

12.6 COMPANY EVALUATION MATRIX OVERVIEW

12.7 COMPANY EVALUATION QUADRANT

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE PLAYERS

12.7.4 PARTICIPANTS

12.8 PRODUCT FOOTPRINT ANALYSIS OF COMPANIES

12.9 MARKET RANKING ANALYSIS OF COMPANIES

12.10 STARTUP/SME EVALUATION QUADRANT

12.10.1 PROGRESSIVE COMPANIES

12.10.2 RESPONSIVE COMPANIES

12.10.3 DYNAMIC COMPANIES

12.10.4 STARTING BLOCKS

12.11 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS

13 COMPANY PROFILES

13.1 KEY PLAYERS

13.1.1 SOLARWINDS

13.1.2 NETSCOUT

13.1.3 BROADCOM

13.1.4 IBM

13.1.5 CISCO

13.1.6 NOKIA

13.1.7 NEC

13.1.8 APPNETA

13.1.9 CATCHPOINT

13.1.10 ACCEDIAN

13.1.11 PAESSLER

13.1.12 MANAGEENGINE

13.1.13 KENTIK

13.2 STARTUPS/SMES

13.2.1 FLOWMON

13.2.2 QOSMOS

13.2.3 PROGRESS

13.2.4 NAGIOS

13.2.5 DYNATRACE

13.2.6 HELPSYSTEMS

13.2.7 RIVERBED

13.2.8 EXTRAHOP

13.2.9 MICRO FOCUS

13.2.10 CUBRO

13.2.11 PLIXER

13.2.12 OBJECTPLANET

14 APPENDIX AND ADJACENT MARKETS

14.1 ADJACENT/RELATED MARKETS

14.1.1 INTRODUCTION

14.1.2 LIMITATIONS

14.2 NETWORK ANALYTICS MARKET

14.3 NETWORK AUTOMATION MARKET

14.4 DISCUSSION GUIDE

14.5 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.6 AVAILABLE CUSTOMIZATIONS

14.7 RELATED REPORTS

14.8 AUTHOR DETAILS

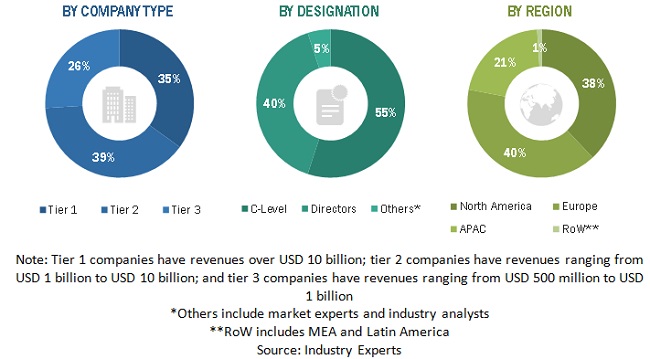

The network probe market study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Market-related sources, such as journals and white papers from industry associations, were also considered while conducting the secondary research. Primary sources were industry experts from the core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These respondents included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

Secondary Research

The market size of the companies offering network probe solutions, and services globally was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of the major companies and rating companies based on their performance and quality.

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles from recognized associations and government publishing sources. Several journals such as the International Journal of Computer Science and Information Technology and Security (IJCSITS), ScienceDirect, ResearchGate, Academic Journals, and Scientific.Net, and various telecom and network associations/forums, Citizens Broadband Radio Service (CBRS) Alliance, MulteFire Alliance, and 3GPP were referred to for this study. Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from network probe solution vendors, system integrators, professional service providers, industry associations, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from the hardware, solutions, and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped understand various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and installation teams of the governments/end users that use network probe solutions were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current use of network probe solutions, which is projected to impact the overall network probe market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation of the network probe market. The first approach involved estimating the market size by the summation of company revenues generated by companies through the sale of network components, such as solutions and services. The top-down and bottom-up approaches were used to estimate and validate the size of the network probe market and various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players are not limited to SolarWinds (US), NETSCOUT (US), Broadcom (US), IBM (US), Cisco (US), Nokia (Finland), NEC (Japan), and AppNeta (US); other players in the market were identified through extensive secondary research, and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the network probe market based on component, organization size, deployment mode, end users and region from 2022 to 2027, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the network probe market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities, in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per a company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Network Probe Market

please explain pitfalls, present scenario and growth prospects from 2022 to 2027