Next-Generation Sequencing (NGS) Services Market Size, Growth, Share & Trends Analysis

Next-Generation Sequencing (NGS) Services Market by Type (Targeted, RNA-Seq, Exome, De Novo), Technology (Sequencing by Synthesis, Ion semiconductor, SMRT, Nanopore), & Application (Diagnostics, Oncology, Drug Discovery, Agriculture) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

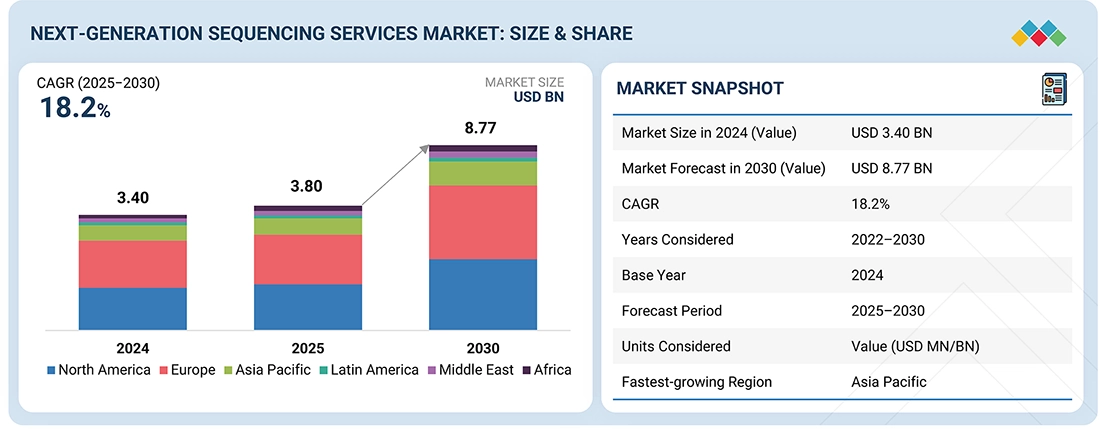

The next-generation sequencing services market, valued at US$3.40 billion in 2024, stood at US$3.80 billion in 2025 and is projected to advance at a resilient CAGR of 18.2% from 2025 to 2030, culminating in a forecasted valuation of US$8.77 billion by the end of the period. The global next-generation sequencing services market is growing as sequencing is used more widely in oncology, rare disease diagnostics, infectious disease monitoring, and broader precision medicine initiatives, with healthcare providers and biopharmaceutical companies increasingly outsourcing complex genomic workflows to specialized service partners.

KEY TAKEAWAYS

-

By RegionThe North American next-generation sequencing services market accounted for a 40.8% revenue share in 2024.

-

By OfferingsBy offering, the products segment dominated the next-generation sequencing services market in 2024.

-

By Service typeBy type, the services segment is expected to register the highest CAGR of 18.0%.

-

By End userIn the next-generation sequencing services end user market, the academic & research institutes segment is projected to grow at the fastest rate from 2025 to 2030.

-

By ApplicationBy application, the diagnostics segment is projected to grow at the fastest rate from 2025 to 2030.

-

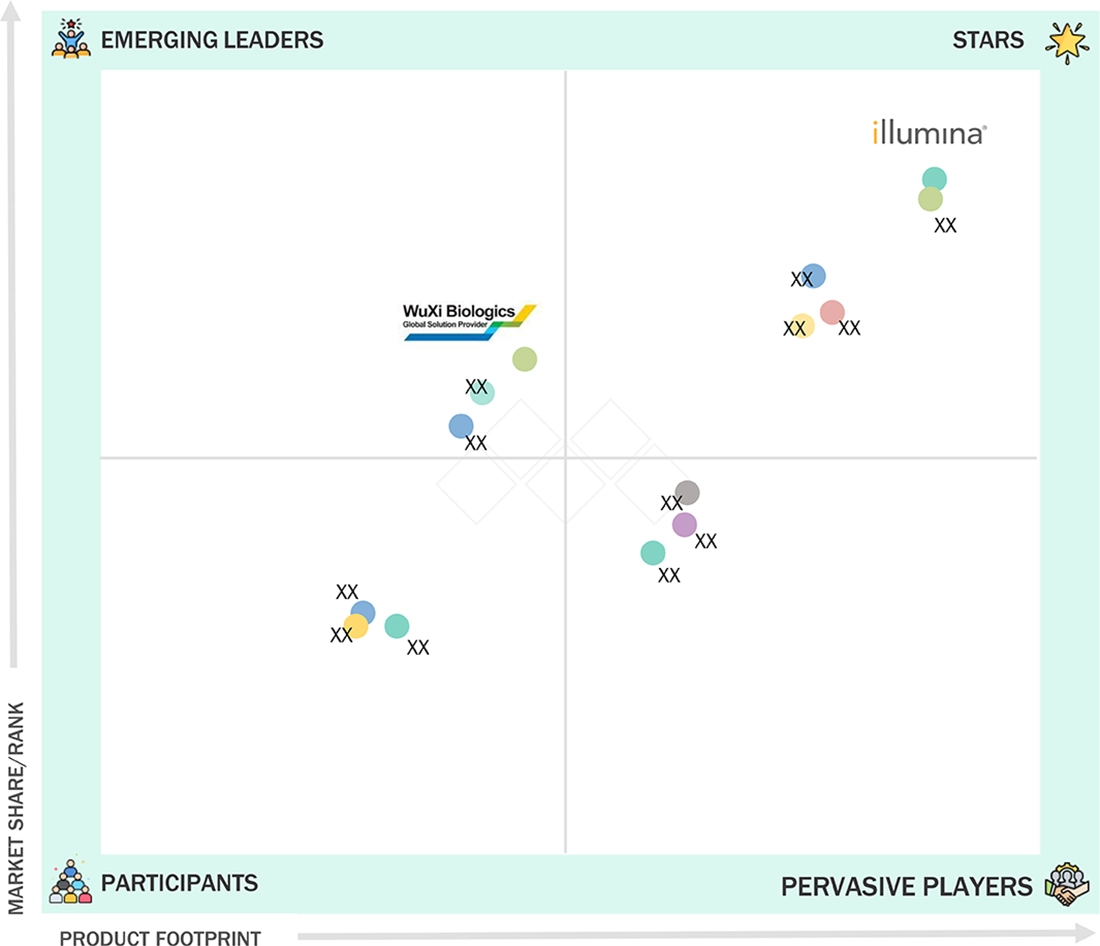

Competitive LandscapeIllumina, Inc., Thermo Fisher Scientific, and Eurofins Scientific were identified as some of the star players in the North American next-generation sequencing services market, given their strong market share and product footprint.

-

Competitive LandscapeNovogene, Co. Ltd., MedGenome, and Singular Genomics, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The global next-generation sequencing services market continues to grow significantly as a larger number of organizations decide to use sequencing services outside their own facilities to obtain quality genomic data. There is an increasing need for services that facilitate the earlier and more accurate detection of diseases, the selection of appropriate therapies, and the application of translational research, both in clinical and research domains. The speed of the cancer-related application (tumor profiling, MRD, liquid biopsy) usage, as well as rare and inherited diseases testing, reproductive health screening, and infectious disease surveillance, is going up.

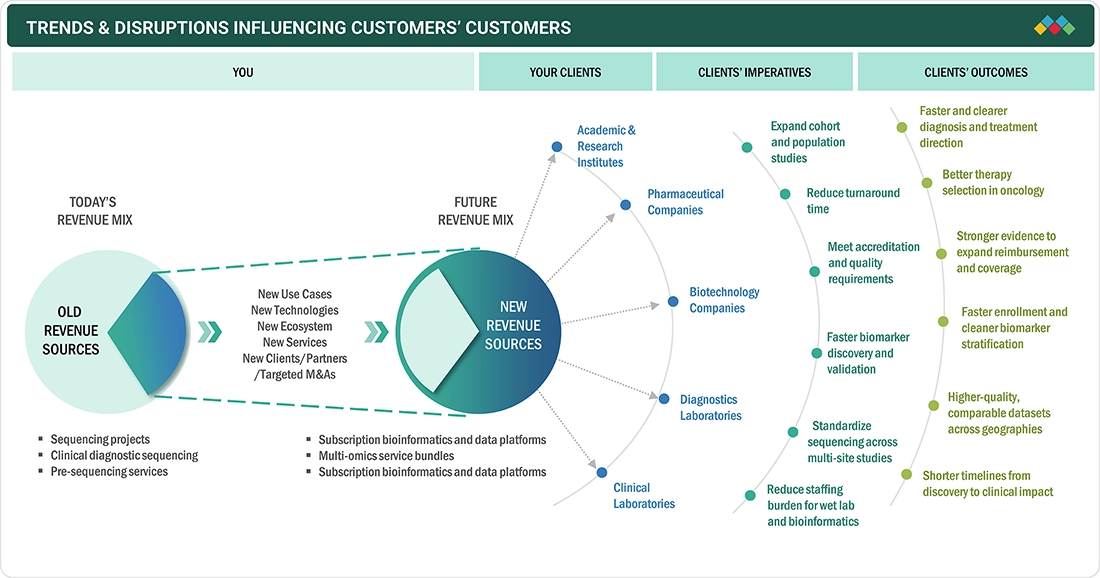

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on stakeholders of the next-generation sequencing services market is evolving in line with shifting healthcare priorities, rapid advancements in sequencing technologies and analytics, and increasing demand for personalized, data-rich care worldwide. Hospitals and clinical labs, as well as academic and public research centers, and pharmaceutical and biotechnology companies, are the primary customers for outsourced NGS services, which are deployed for oncology, rare disease testing, reproductive health, infectious disease applications, and drug discovery.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Population genomics and pathogen surveillance programs creating steady service volumes

-

Falling sequencing cost and easy access to scalable capacity

Level

-

Uneven reimbursement and limited coverage for clinical sequencing

Level

-

Multi-omics service bundles for drug discovery and translational research

-

Sample-to-report' diagnostic services with interpretation and reanalysis

Level

-

hortage of specialized talent in bioinformatics and clinical interpretation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Population genomics and pathogen surveillance programs creating steady service volumes

Many countries are funding large genomics and surveillance efforts. These programs require consistent throughput and repeated testing over extended periods. Service providers benefit because they can centralize workflows and scale quickly. This drives recurring demand for sequencing, plus analysis and reporting.

Restraint: Uneven reimbursement and limited coverage for clinical sequencing

Payment pathways still vary widely by country and payer. Hospitals may hesitate to send routine cases when reimbursement is unclear, which slows adoption in diagnostics, even when clinical value is recognized. Service volumes then grow unevenly across regions and indications.

Opportunity: Growth of multi-omics, data analytics, and biopharma collaborations

Clients are increasingly requiring the integration of genomics with transcriptomics and other omics layers. This improves target identification, biomarker work, and patient stratification. Service providers can solve bigger programs by offering one integrated workflow. Demand rises further when analysis, interpretation, and sequencing are included.

Challenge: Shortage of specialized talent in bioinformatics and clinical interpretation

Scaling services needs trained analysts, in addition to sequencing machines. Many regions face gaps in genomics data science and reporting expertise; this can hit turnaround time and create bottlenecks as volumes rise. Providers must invest in training, automation, and standardized pipelines to keep pace.

NEXT-GENERATION SEQUENCING (NGS) SERVICES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Scientists studying Usutu virus sent viral nucleic acid to Eurofins Genomics for a dedicated RNA-virus sequencing service (INVIEW virus sequencing) on an Illumina NovaSeq 6000 to generate whole-genome data for analysis and comparison with other methods | Quick access to high-quality viral genomes | High-throughput sequencing without adding lab capacity | Supports surveillance and phylogenetics | Clean data for downstream bioinformatics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global next-generation sequencing services market environment comprises sequencing service providers, specialty clinical labs, and research-focused genomics partners. These entities perform high-throughput workflows for whole-genome, whole-exome, targeted panels, RNA sequencing, metagenomics, and single-cell projects. A large number of them also offer the services of sample handling, library preparation, QC, bioinformatics, and interpretation, so that customers obtain the most processed results and not just raw data. On the demand side, biopharma companies, CROs, hospitals, reference labs, academic centers, and public health agencies are the primary users. They use service providers as a means to scale their programs in oncology, rare disease testing, reproductive health, infectious disease surveillance, and drug ??????discovery.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

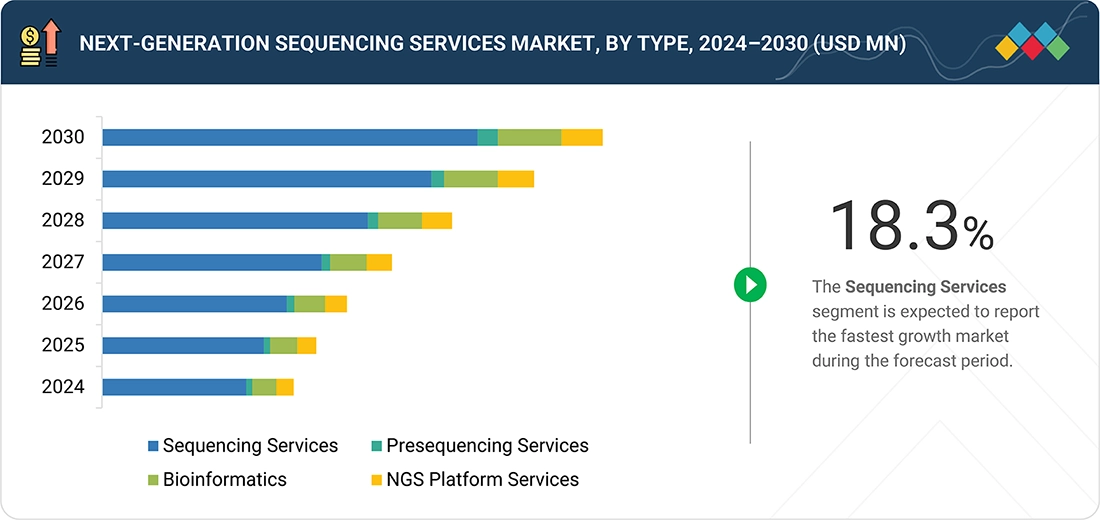

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

NGS Services Market, By Service type

As of 2024, sequencing services accounted for the largest share of the global next-generation sequencing services market and are expected to remain the leading service type over the next several years. This is driven by steady demand from clinical labs, hospitals, academic centers, and biopharmaceutical companies for scalable access to whole-genome sequencing, whole-exome sequencing, targeted panels, RNA sequencing, and metagenomics without the need to expand in-house capacity.

NGS Services Market, By Workflow

As of 2024, the sequencing step accounted for the largest share of the global next-generation sequencing services market by workflow and is expected to remain the dominant step over the next several years. This is because sequencing is the core value-creating activity that determines data yield, accuracy, turnaround time, and cost per sample. Service providers generate the majority of their workflow revenue by running high-throughput sequencing across WGS, WES, targeted panels, RNA-seq, and metagenomics for clinical and research customers.

NGS Services Market, By Application

As of 2024, the diagnostics sector was the major contributor to the global next-generation sequencing services market in terms of application and is anticipated to maintain its dominance for the following years. A key factor supporting this trend is the fact that clinical users are turning to external sequencing services more and more in order to obtain ready-to-report results without the need to set up large in-house sequencing and bioinformatics teams. The highest demand for diagnostic services is associated with oncology profiling (support for tissue and liquid biopsies), genetic and rare disease testing, reproductive health screening, as well as infectious disease identification and surveillance.

NGS Services Market, By End user

As?????? of 2024, academic & research institutes were the major contributors to the global next-generation sequencing services market by end user and are projected to remain the leading segment during the forecast period. These institutions, universities, and research centers are involved in numerous projects, including whole-genome, whole-exome, RNA-seq, metagenomics, and single-cell studies. To get high-throughput capacity and save on the costs of instruments and staff in their labs, they frequently outsource ??????sequencing.

REGION

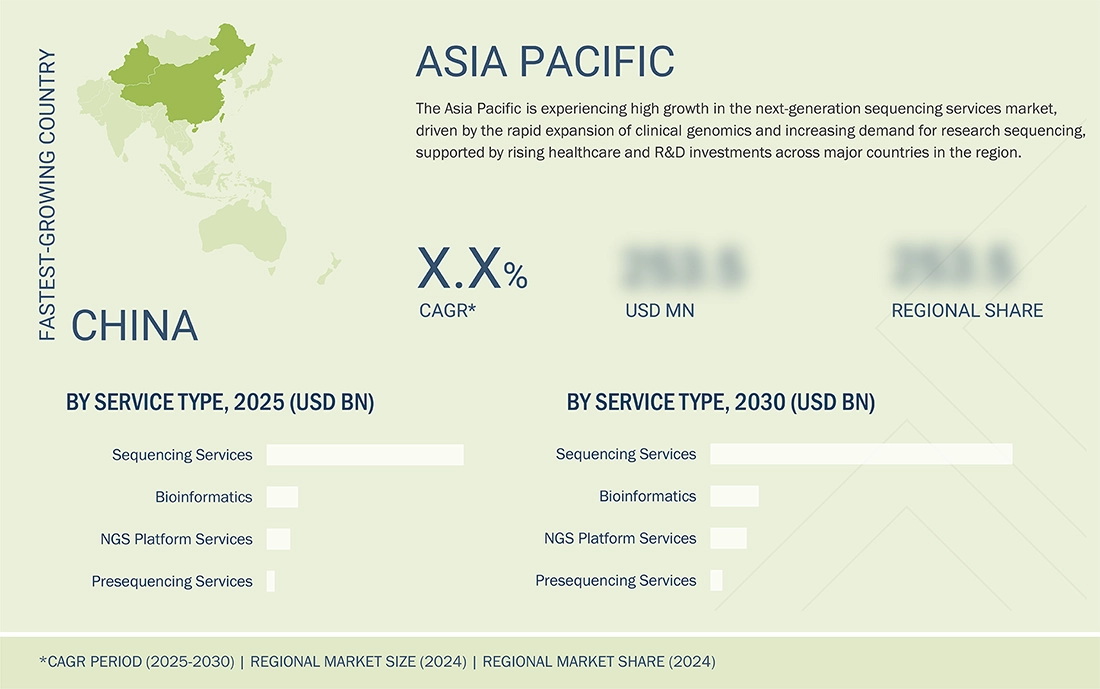

Asia Pacific to be the fastest-growing region in the global NGS services market during the forecast period

The next-generation sequencing services market is expected to grow significantly over the forecast period, driven by the expansion of genomics and precision medicine programs across countries such as China, India, Japan, and South Korea. Growth is further propelled by rising biopharmaceutical R&D and clinical trials that rely on NGS-based biomarker discovery, together with a rapidly expanding molecular diagnostics and oncology testing ecosystem and increasing investments in automation, AI-enabled bioinformatics, and cloud-based data platforms to support high-throughput and decentralized sequencing workflows.

NEXT-GENERATION SEQUENCING (NGS) SERVICES MARKET: COMPANY EVALUATION MATRIX

In the global next-generation sequencing services matrix, Illumina (Star) is combining a technological ecosystem to capture a large share of the outsourced sequencing capacity globally, which supports its leading position. By using Illumina platforms, service providers and large reference labs carry out high-throughput whole-genome, whole-exome, targeted panel, and RNA sequencing. WuXi Biologics (Emerging Leader) is becoming more prominent on the services side as biopharma customers increasingly seek partners who can provide them with end-to-end development support, along with strong analytical capabilities. Although WuXi Biologics is not a purely sequencing lab, its expanding involvement in biologics development and manufacturing is attracting more demand for sequencing-enabled workflows linked to cell line and clone characterization, genetic stability, and translational support.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Illumina, Inc. (US)

- Thermo Fisher Scientific, Inc. (US)

- Eurofins Scientific (Luxembourg)

- Wuxi Biologics (China)

- Qiagen (Netherlands)

- Revvity (US)

- BGI Group (China)

- Macrogen, Inc. (South Korea)

- Azenta US (US)

- Novogene Co. Ltd (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.40 Billion |

| Market Forecast in 2030 (Value) | USD 8.78 Billion |

| Growth Rate | CAGR of 18.2% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

| Parent & Related Segment Reports |

Next generation Sequencing Market North America Next Generation Sequencing Market Europe Next Generation Sequencing Market Asia Pacific Next Generation Sequencing Market Single-Molecule Real Time (SMRT) Sequencing Market |

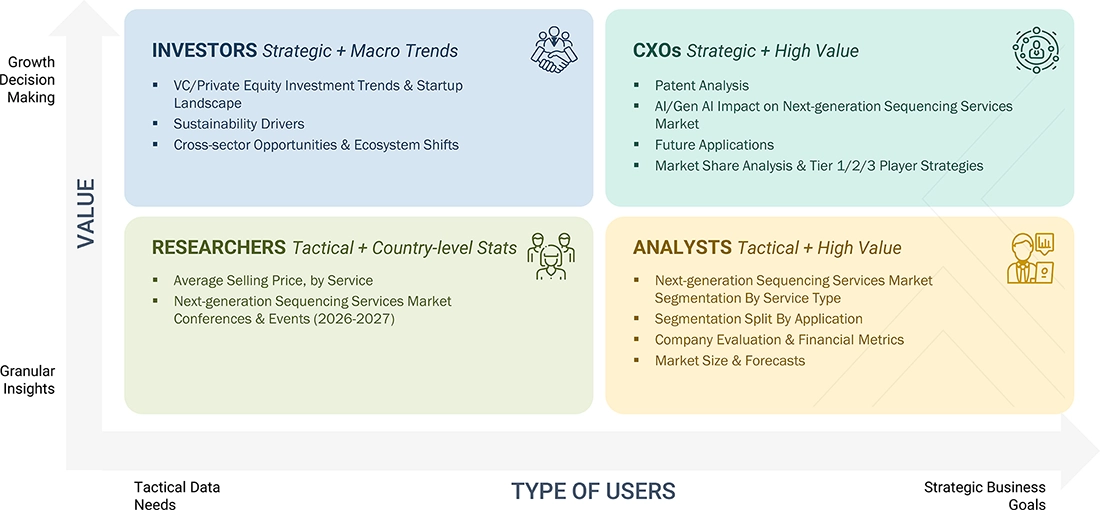

WHAT IS IN IT FOR YOU: NEXT-GENERATION SEQUENCING (NGS) SERVICES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global NGS service provider / sequencing lab network | Competitive benchmarking of global NGS service providers by service menu (WGS/WES/panels/RNA-seq/metagenomics/single-cell), pricing bands, and turnaround times |

|

| Bioinformatics / software platform company |

|

|

RECENT DEVELOPMENTS

- April 2024 : Eurofins Scientific (Luxembourg) entered into a collaboration agreement with Oncocyte Corporation (US) to develop and commercialize transplant monitoring products.

- October 2023 : Revvity (US) collaborated with Element Biosciences (US) to upgrade the genomic analysis of samples.

- July 2022 : BGI Group (China) announced the launch of HotMPS sequencing chemistry and services in the UK

Table of Contents

Methodology

This study on the Next-Generation Sequencing (NGS) Services Market employed secondary sources, directories, and databases to gather pertinent information. To gather and validate important qualitative and quantitative data and evaluate market growth prospects, in-depth interviews were conducted with many primary respondents including key industry participants, subject-matter experts (SMEs), C-level executives from key market players, and industry consultants. After estimating the Next-Generation Sequencing (NGS) Services Market using several research strategies, the size of the final market was obtained by triangulating data from primary research.

Secondary Research

The secondary sources referred to for this research study include publications from government sources. These include the Centers for Disease Control and Prevention (CDC), the US Food and Drug Administration (FDA), the World Health Organization (WHO), the American Cancer Society (ACS), the National Center for Biotechnology Information (NCBI), the National Institutes of Health (NIH), National Human Genome Research Institute (NHGRI), International Agency for Research on Cancer (IARC), National Institute for Infectious Diseases (IRCCS), Association for Clinical Genomic Science (ACGS), American Society of Human Genetics (ASHG), European Society of Human Genetics (ESHG), Asia Pacific Society of Human Genetics (APSHG), Nature Reviews Genetics, Nature Methods, Biotechnology and Biological Sciences Research Council (BBSRC), Organisation for Economic Co-operation and Development (OECD), Genome Research, National Cancer Institute (NCI), European Medicines Agency (EMA), Population Health Research Institute (PHRI), PubMed, World Bank, and the World Health Organization (WHO), among others. Secondary sources also included corporate & regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines & research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global Next-Generation Sequencing (NGS) Services Market , which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global Next-Generation Sequencing (NGS) Services Market scenario through secondary research. Several primary interviews were conducted with market experts from the supply side, such as C-level and D-level executives, operational managers, marketing & sales managers of key manufacturers, distributors, and channel partners of companies providing NGS; experts from the demand side, such as personnel from academic & research institutes, hospitals, clinics and diagnostic labs, pharmaceutical & biopharmaceutical industries, CROs, and other end users. These interviews were conducted across six major regions, including North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa. Approximately 70% and 30% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Next-Generation Sequencing (NGS) Services Market . These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

NGS refers to non-Sanger-based, high-throughput DNA sequencing technologies. DNA strands can be sequenced simultaneously, yielding substantially more throughput and minimizing the need for fragment-cloning methods often used in the Sanger sequencing of genomes. NGS is fundamentally based on sequencing by synthesis (SBS), ion semiconductor sequencing, single-molecule real-time (SMRT) sequencing, and nanopore sequencing.

Stakeholders

- NGS instrument manufacturers, vendors, and distributors

- NGS service providers

- NGS bioinformatics/data analysis companies

- Research laboratories and academic institutes

- Venture capitalists and other government funding organizations

- Research and consulting firms

- Healthcare institutions (hospitals and diagnostic clinics)

- Pharmaceutical and biotechnology companies

- Academic and government research institutes

- Life science companies

Report Objectives

- To define, describe, and forecast the Next-Generation Sequencing (NGS) Services Market based on offerings, product type, platform technology, product workflow, product end user, service type, service workflow, service end user, application, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall next-generation sequencing market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to six main regions, namely, North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa

- To profile the key players in the global Next-Generation Sequencing (NGS) Services Market and comprehensively analyze their platforms, reagents, kits, consumables, and services portfolios, market positions, and core competencies

- To track and analyze competitive developments such as product & service launches, expansions, agreements, and collaborations in the next-generation sequencing market

- To benchmark players within the Next-Generation Sequencing (NGS) Services Market using the ‘Company Evaluation Matrix' framework, which analyzes market players based on various parameters within the broad categories of business and service strategy

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Next-Generation Sequencing (NGS) Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Next-Generation Sequencing (NGS) Services Market