One Component Polyurethane Foam Market by Raw Material (MDI, Polyether Polyols, Polyester Polyols, Others), Application, End-Use (Door & Window Frame Jambs, Ceiling & Floor Joints, Partition Walls, Water Pipes), Region - Global Forecast to 2025

Updated on : June 18, 2024

One Component Polyurethane Foam Market

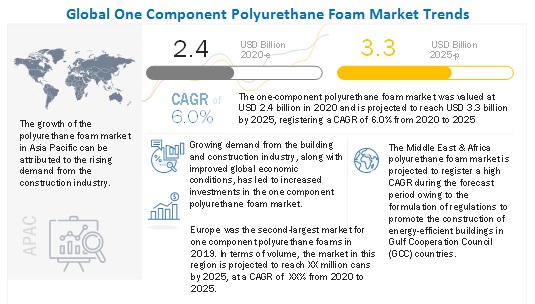

The one component polyurethane foam market was valued at USD 2.4 billion in 2020 and is projected to reach USD 3.3 billion by 2025, growing at 6.0% cagr from 2020 to 2025. The market is witnessing growth due to factors such as rising construction industries in emerging economies and the stringent regulations regarding energy savings in residential and commercial buildings around the world. One component, polyurethane foam, is extensively used for insulation applications in energy-efficient buildings.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global One Component Polyurethane Foam Market

The pandemic is estimated to have a huge impact on various factors of the value chain of one component polyurethane foam, which is expected to reflect during the forecast period, especially in the year 2020. The various impact of COVID-19 are as follows:

Impact on raw material (MDI):

Asia Pacific

During the first two months of 2020, the demand for Methylene Diphenyl Diisocyanate (MDI) from Asia Pacific countries, such as China, Taiwan, and India, was high as these countries were booking large quantities of MDI to cater to the anticipatory demand for polyurethane raw materials from April onwards. However, with the imposition of COVID-19 lockdowns across the world, this demand decreased significantly from March to June 2020. The key buyers in Asia Pacific either canceled their advance orders or delayed their purchases.

Europe

Manufacturers such as BASF and Covestro started operations in some of their facilities in Europe as there was no official announcement from governments of different countries of the region to shut down manufacturing plants. The weak demand for polyurethane foam from the automotive sector was a key factor for the declining demand for MDI in Europe.

Middle East

The COVID-19 outbreak and its spread led to major supply chain disruptions worldwide, resulting in the non-delivery of raw materials used for manufacturing polyurethanes in the Middle East. There was a negligible demand for polyurethane foam from the region in May and June 2020 as most of the polyurethane plants in the Middle East were shut.

US

During the first quarter of 2020, there was enough supply of MDI in the US. However, sliding demand for MDI resulted in its overstocking in the country. There was some demand for it from the construction sector of the US as a few projects that were in the pipeline or underway resumed in late April in some states of the country. However, the weak economic activities in the US resulted in low demand for MDI and MDI-based products.

Impact on end-use industries:

According to the International Monetary Fund (IMF), the real global gross domestic product (GDP) is expected to shrink by ~3% in 2020, which is 5.9% points lesser than the 2.9% GDP growth recorded in 2019. The impact of COVID-19 on the construction industry is estimated to vary in different regions across the world. The IMF has predicted that there will be heavy layoffs in the construction sector and other industries in the US. In Europe, the building & construction industry is anticipated to contract by 60–70% in 2020. However, in Asia Pacific, the economy of China is improving as the construction and automotive sectors in most parts of the country have resumed normal activities. This led to the growth of the economy of the country by 4% in the second quarter of 2020. According to the Financial Express, the construction industry in India suffered significant losses from April to June 2020. It predicts the construction industry in the country to witness a decline of 12–16% in investments in the current fiscal year as compared to the previous year.

One Component Polyurethane Foam Market Dynamics

Driver: Increased use of one component polyurethane foam in building insulation for energy conservation

Growth in the building and construction industry has fueled the demand for one component polyurethane foam globally in the past few years. This demand trend is also expected to continue in the coming years due to the increasing energy conservation regulations and rising trend of green buildings around the world. One component polyurethane foam helps in reducing total infrastructural costs by minimizing energy consumption in buildings. This foam is used in residential and commercial buildings for sealing, gap filling, and thermal and acoustic insulation applications. The foam enables architects to insulate buildings in an improved manner, thereby reducing the consumption of gas, oil, and electricity in residential and commercial buildings. One component polyurethane foam is easily available, affordable, durable, and considered a cost-effective and safest option for energy conservation, leading to a reduction in carbon emissions.

Restraint: Stringent environmental regulations related to manufacturing one component polyurethane foam

One component polyurethane foam falls under the category of flexible polyurethane foam. The various regulations on flexible polyurethane foam manufacturing are considered a restraint to the one component polyurethane foam market growth. The National Emission Standards for Hazardous Air Pollutants (NESHAP) environmental regulations formulated by the US Environmental Protection Agency (EPA) include some rules for new and existing plant sites that manufacture flexible polyurethane foam. These rules were implemented in 1998 to control the emissions of methylene chloride, 2,4-toluene diisocyanate (TDI), methyl chloroform, methylene diphenyl diisocyanate (MDI), methanol, diethanolamine, propylene oxide, methyl ethyl ketone, and toluene

Opportunity: Rise in production of bio-based polyols and low-VOC, green, & sustainable foam

Polyols are majorly used to manufacture polyurethane foam. Growing concerns regarding the use of fossil fuels and the impact of plastics on the environment have led the one component polyurethane foam industry to continuously strive for sustainable business practices. The FY2019–20 has been highly volatile in terms of pricing of oil, and this has a significant impact on the profitability of the one component polyurethane foam industry. The year presented the market participants with an excellent opportunity to develop bio-based polyols to be used for the manufacturing of polyurethane foam, as well as for use in other applications.

Bio-derived materials, such as soy-based polyols, offer significant advantages over conventional polyols in terms of sustainability and cost-effectiveness. They also reduce dependence on petroleum-based raw materials. Bio-derived materials are also characterized by higher thermal stability and lesser sensitivity to hydrolysis than conventional polyols.

Challenge: High raw material costs leading to pricing pressures on one component polyurethane foam manufacturers

The one component polyurethane foam market has experienced significant pricing pressure over the past few years owing to volatile feedstock prices. The high costs of key feedstock materials, such as toluene diisocyanate, methyl di-p-phenylene, and polymeric isocyanate, which are used for manufacturing polyurethane foam, lead to the increased production costs of polyurethane foam. The one component polyurethane foam market has witnessed a substantial price rise owing to a continuous record increase in MDI feedstock values, which have not lowered yet. Initial capital and raw material costs primarily account for a major portion of the production costs of polyurethane foam, resulting in increased pricing pressure on the manufacturers of this foam.

MDI is estimated to be the leading segment of one component polyurethane foam market from 2020 to 2025, in terms of volume.

MDI (methylene diphenyl diisocyanate) is projected to be the largest raw material segment in one component polyurethane foam market in 2020, in terms of volume. It is majorly due to the excellent properties offered by the MDI-based one component polyurethane foam products. MDI-based polyurethane foam is the most effective insulation material available and is a major contributor to energy conservation. The increased use of MDI-based one component polyurethane foam products in residential and commercial construction, is boosted by the fact that they are recyclable, safe, and environmentally responsible. Due to all the superior properties and compatibility with the increased energy efficiency needs, MDI-based one-component polyurethane foam products are widely preferred and are expected to witness very high demand in the coming years.

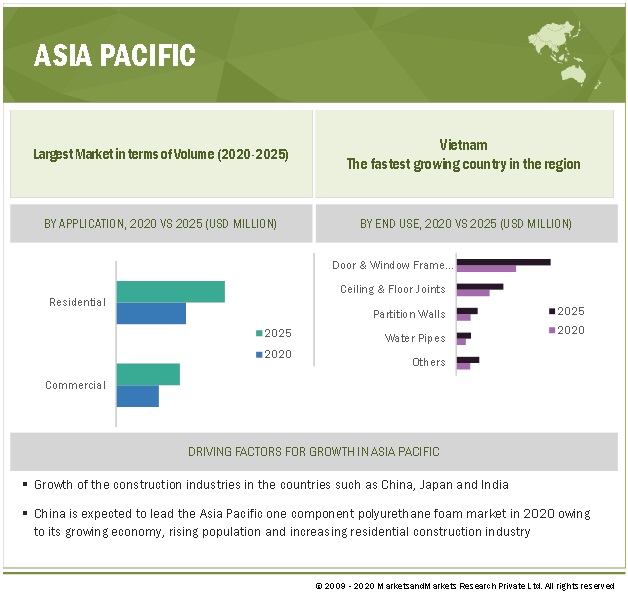

Residential application is estimated to be the fastest-growing segment of one component polyurethane foam market

Residential is expected to be the fastest-growing application segment of the one component polyurethane foam market during the forecast period. The rapidly growing population and rising economy of Asia Pacific countries, such as China and India, are expected to fuel residential construction activities in the region, subsequently driving the demand for one component polyurethane foam in residential construction.

Door & window frame jambs end-use segment is estimated to hold the largest market share in 2020

The gaps around window and door frames allow unwanted air to enter residential or commercial buildings and may cause heavy energy losses. However, one component, polyurethane foam, efficiently fills, seals, and insulates these gaps and other rough openings. The application of the self-expanding one component polyurethane foam on door and window frame jambs blocks the flow of air, provides greater comfort, and helps reduce energy bills by forming a durable, airtight, and water-resistant seal between the window and door frames.

Asia Pacific dominated the one component polyurethane foam market, in terms of volume in 2020.

Asia Pacific is estimated to account for the largest share of the one component polyurethane foam market in 2020, in terms of volume. Growing demand for building insulation and the increasing presence of global market players in the region drives the Asia Pacific one component polyurethane foam market. In addition, steady economic progress and improvement in the living standards of Asia Pacific countries contributing to the growth of the construction industry. This, in turn, is expected to fuel the growth of the one component polyurethane foam market in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

One Component Polyurethane Foam Market Players

Soudal Group (Belgium), Henkel AG & Co. (Germany), Hanno-Werk GmbH & Co. KG (Germany), Selena Group (Poland), Tremco illbruck Group (Germany), GNS Group (China), Profflex Mounting Foams (Russia), Den Braven Sealants (Netherlands), Aerosol – service a.s (Czech Republic), DAP Products, Inc. (US), McCoy Soudal Sealants Adhesives & Foams Private Limited (India), Akkim Construction Chemicals (Turkey), TKK d.o.o. (Slovenia), Krimelte OÜ (Estonia), DuPont (US) ,Gorcci International Limited (China), Kater Adhesive Industrial Co. (China), Fomo Products, Inc. (US), Polyurethane Ltd. (Israel), Larsen Building Products (Ireland), and Castelein Sealants (Belgium) are some of the key players in the one component polyurethane foam market.

One Component Polyurethane Foam Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD Million and USD Billion) and Volume (Kilotons and Million Cans) |

|

Segments Covered |

Raw Material, Application, End Use, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Soudal Group (Belgium), Henkel AG & Co. (Germany), Hanno-Werk GmbH & Co. KG (Germany), Selena Group (Poland), Tremco illbruck Group (Germany), GNS Group (China), Profflex Mounting Foams (Russia), Den Braven Sealants (Netherlands), Aerosol – service a.s (Czech Republic), DAP Products, Inc. (US), McCoy Soudal Sealants Adhesives & Foams Private Limited (India), Akkim Construction Chemicals (Turkey), TKK d.o.o. (Slovenia), Krimelte OÜ (Estonia), DuPont (US). Gorcci International Limited (China), Kater Adhesive Industrial Co. (China), Fomo Products, Inc. (US), Polyurethane Ltd. (Israel), Larsen Building Products (Ireland), and Castelein Sealants (Belgium), are some of the key players in the one component polyurethane foam market (Total of 21 companies) |

This research report categorizes the one component polyurethane foam market based on raw material, application, end use and region.

Based on Raw Material, the one component polyurethane foam market has been segmented as follows:

- MDI

- Polyether Polyols

- Polyester Polyols

- Others (Blowing Agents)

Based on Application, the one component polyurethane foam market has been segmented as follows:

- Residential

- Commercial

Based on End Use, the one component polyurethane foam market has been segmented as follows:

- Door & Window Frame Jambs

- Ceiling & Floor Joints

- Partition Walls

- Water Pipes

- Others (Wire Penetrations, Fire Resistance, Soundproofing, and Bonding Insulation Material)

Based on Region, one component polyurethane foam market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

-

In February 2020, Selena Group announced the establishment of its new subsidiary trading as Mexico S.de R.L. de C.V., located in Guadalajara, Federal Republic of Mexico.

The subsidiary’s business will consist of the sale of Selena Group’s products in Mexico and neighboring countries. The establishment of Mexico S. de R.L. de C.V. in Mexico is expected to strengthen its position in Central and South America. By setting up the new subsidiary, Selena Group intends to reach out to new users with a wide range of innovative construction chemicals. - In December 2019, Henkel AG & Co. opened a new Henkel Adhesives Technical Center in the east of Hanoi, Vietnam, for adhesive solutions. The introduction of this new high-tech facility is projected to help the company strengthen its local production capabilities and market footprint in Vietnam.

Frequently Asked Questions (FAQ):

What is the current size of the global one component polyurethane foam market?

The one component polyurethane foam market was valued at USD 2.8 billion in 2019 and is projected to reach USD 3.3 billion by 2025, registering a CAGR of 6.0% from 2020 to 2025.

Who are the star in the global one component polyurethane foam market?

Companies such as Soudal Group (Belgium), Henkel AG & Co. (Germany), Hanno-Werk GmbH & Co. KG (Germany), Selena Group (Poland), and Tremco illbruck Group (Germany) are the major players in the one component polyurethane foam market.

What is the COVID-19 impact on one component polyurethane foam value chain?

COVID-19 outbreak is expected to have significant impact on the global demand for one component polyurethane foam in the construction industry. The outbreak and the spread of the COVID-19 led to major supply chain disruptions across the world, thereby resulting in non-delivery of raw material (MDI), used for manufacturing one component polyurethane foam market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 COMPETITIVE INTELLIGENCE

1.3 MARKET DEFINITION

1.4 SCOPE OF THE STUDY

1.4.1 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 PACKAGE SIZE

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 INCLUSIONS & EXCLUSIONS

1.10 SUMMARY OF CHANGES MADE IN THE REVAMPED VERSION

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews

2.1.2.2 Key data from primary sources

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 PRIMARY AND SECONDARY RESEARCH

2.3 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 36)

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES IN ONE COMPONENT POLYURETHANE FOAM MARKET

4.2 MARKET, BY REGION

4.3 ASIA PACIFIC ONE COMPONENT POLYURETHANE FOAM MARKET, BY COUNTRY AND END USE

4.4 FOAM MARKET, BY APPLICATION

4.5 ONE COMPONENT POLYURETHANE FOAM MARKET, BY END USE

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased use of one component polyurethane foam in building insulation for energy conservation

5.2.1.2 Rising demand from emerging economies

5.2.1.3 Versatility and unique physical properties of one component polyurethane foam

5.2.2 RESTRAINTS

5.2.2.1 Stringent environmental regulations related to manufacturing one component polyurethane foam

5.2.2.2 Sustainability and toxicity concerns regarding one component polyurethane foam products

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in production of bio-based polyols and low-VOC, green, & sustainable foam

5.2.4 CHALLENGES

5.2.4.1 High raw material costs leading to pricing pressures on one component polyurethane foam manufacturers

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 INDUSTRY OUTLOOK: CONSTRUCTION

5.4.2 INDUSTRY OUTLOOK: MANUFACTURING

5.5 VALUE CHAIN ANALYSIS

5.6 ECO-SYSTEM/MARKET MAP

5.7 CASE STUDY: ASSESSMENT OF ONE COMPONENT POLYURETHANE FOAM MARKET

5.8 YCC SHIFT: FUTURE REVENUE MIX WILL BE IMPACTED BY CLIENT’S IMPERATIVE

5.9 PATENT ANALYSIS

6 COVID-19 IMPACT ON ONE COMPONENT POLYURETHANE FOAM MARKET (Page No. - 54)

6.1 INTRODUCTION

6.2 IMPACT OF COVID-19 ON ONE COMPONENT POLYURETHANE FOAM SUPPLY CHAIN

6.2.1 IMPACT ON RAW MATERIAL

6.2.1.1 MDI

6.2.1.2 Europe

6.2.1.3 Middle East

6.2.1.4 US

6.2.2 POLYURETHANE FOAM MANUFACTURERS

6.2.2.1 Europe

6.2.2.2 Austria, Germany, and Switzerland – Operating at much-reduced capacity

6.2.2.3 Benelux – Operating at much-reduced capacity

6.2.2.4 France – Closure of foam plants

6.2.2.5 Greece, Balkans, and Cyprus – Mostly operational but at much-reduced capacity

6.2.2.6 Hungary, Czechia, Croatia, Slovakia, and Slovenia – Operating at much-reduced capacity

6.2.2.7 Spain and Portugal – Closure of most foam plants

6.2.2.8 Italy – Foam plants shutoff

6.2.2.9 Poland – Operating at much-reduced capacity

6.2.3 END-USE INDUSTRIES

6.2.3.1 Economic impact of COVID-19 on construction industry

7 ONE COMPONENT POLYURETHANE FOAM MARKET, BY RAW MATERIAL (Page No. - 57)

7.1 INTRODUCTION

7.2 MDI (METHYLENE DIPHENYL DIISOCYANATE)

7.2.1 COMPLIANCE WITH ENERGY REGULATIONS IN BUILDING CONSTRUCTION DRIVING DEMAND FOR MDI

7.2.2 MDI PRODUCTION PROCESS

7.3 POLYETHER POLYOLS

7.3.1 LOW COST AIDS GROWTH OF POLYETHER POLYOLS SEGMENT

7.4 POLYESTER POLYOLS

7.4.1 POLYESTER POLYOLS SEGMENT PROJECTED TO RECORD MODERATE GROWTH DURING FORECAST PERIOD

7.5 OTHERS

8 ONE COMPONENT POLYURETHANE FOAM MARKET, BY END USE (Page No. - 68)

8.1 INTRODUCTION

8.2 DOOR & WINDOW FRAME JAMBS

8.2.1 EASE OF APPLICATION DRIVING DEMAND FOR ONE COMPONENT PU FOAM IN DOOR & WINDOW FRAME JAMBS

8.3 CEILING & FLOOR JOINTS

8.3.1 STRINGENT ENERGY SAVING REGULATIONS DRIVING DEMAND FOR ONE COMPONENT POLYURETHANE FOAM IN CEILING & FLOOR JOINTS

8.4 PARTITION WALLS

8.4.1 ONE COMPONENT POLYURETHANE FOAM, DUE TO EXCELLENT ACOUSTIC INSULATION PROPERTIES, IS USED IN PARTITION WALLS

8.5 WATER PIPES

8.5.1 ONE COMPONENT POLYURETHANE FOAM IS USED TO FILL GAPS BETWEEN WATER PIPES AND WALLS IN BUILDINGS

8.6 OTHERS

9 ONE COMPONENT POLYURETHANE FOAM MARKET, BY APPLICATION (Page No. - 80)

9.1 INTRODUCTION

9.2 RESIDENTIAL

9.2.1 GROWING ECONOMY AND POPULATION OF ASIA PACIFIC LEADING TO RISING DEMAND FOR ONE COMPONENT POLYURETHANE FOAM IN RESIDENTIAL CONSTRUCTION

9.3 COMMERCIAL

9.3.1 STRINGENT REGULATIONS REGARDING ENERGY SAVINGS IN COMMERCIAL BUILDINGS TO FUEL DEMAND FOR ONE COMPONENT POLYURETHANE FOAM

10 GEOGRAPHIC ANALYSIS (Page No. - 87)

10.1 INTRODUCTION

10.2 ASIA PACIFIC

10.2.1 CHINA

10.2.1.1 Growing dependence of one component polyurethane foam manufacturers on China for raw material supply

10.2.2 JAPAN

10.2.2.1 Increasing construction of zero-energy buildings to drive one component polyurethane foam market

10.2.3 INDIA

10.2.3.1 Improving socio-economic conditions and ongoing industrialization to increase demand for one component polyurethane foam

10.2.4 SOUTH KOREA

10.2.4.1 Ongoing industrialization to drive growth of one component polyurethane foam market

10.2.5 THAILAND

10.2.5.1 Growing construction industry to drive one component polyurethane foam market from 2020 to 2025

10.2.6 MALAYSIA

10.2.6.1 Increasing awareness regarding benefits offered by eco-friendly and energy-efficient one component polyurethane foam

10.2.7 INDONESIA

10.2.7.1 Surging demand for one component polyurethane foam for use in construction applications

10.2.8 VIETNAM

10.2.8.1 Growing construction industry driving demand for building insulation products

10.2.9 REST OF ASIA PACIFIC

10.3 EUROPE

10.3.1 GERMANY

10.3.1.1 Federal government policies on energy-efficient buildings to drive demand for one component polyurethane foam insulation products

10.3.2 RUSSIA

10.3.2.1 Growing demand for energy-efficient building construction

10.3.3 FRANCE

10.3.3.1 Surging demand for one component polyurethane foam from commercial construction sector

10.3.4 ITALY

10.3.4.1 Budget Law of 2017 expected to support construction growth during forecast period

10.3.5 UK

10.3.5.1 Rising use of one component polyurethane foam in building construction

10.3.6 TURKEY

10.3.6.1 Stringent energy-saving regulations in buildings

10.3.7 ESTONIA

10.3.7.1 Door & window frame jambs segment estimated to dominate one component polyurethane foam market in Estonia

10.3.8 REST OF EUROPE

10.4 NORTH AMERICA

10.4.1 US

10.4.1.1 Increasing energy costs driving demand for polyurethane foam for building insulations

10.4.2 CANADA

10.4.2.1 Surging demand for eco-friendly and sustainable building insulation products

10.4.3 MEXICO

10.4.3.1 Flourishing construction sector

10.5 MIDDLE EAST & AFRICA

10.5.1 SAUDI ARABIA

10.5.1.1 Vision 2030 expected to support one component polyurethane foam market growth

10.5.2 UAE

10.5.3 FLOURISHING BUILDING & CONSTRUCTION INDUSTRY

10.5.4 IRAN

10.5.5 GROWING AWARENESS REGARDING HIGH ENERGY CONSUMPTION IN BUILDINGS

10.5.6 REST OF MIDDLE EAST & AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.1.1 Brazil dominates one component polyurethane foam market in South America

10.6.2 CHILE

10.6.2.1 Growing construction industry driving growth of one component polyurethane foam market

10.6.3 ARGENTINA

10.6.3.1 Surging demand for one component polyurethane foam in construction industry

10.6.4 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 162)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

11.3 MARKET SHARE ANALYSIS

11.3.1 MARKET SHARE ANALYSIS OF TOP PLAYERS IN ONE COMPONENT POLYURETHANE FOAM MARKET

11.4 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2019

11.4.1 STAR

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

11.5 COMPETITIVE BENCHMARKING

11.5.1 STRENGTH OF PRODUCT PORTFOLIO

11.5.2 BUSINESS STRATEGY EXCELLENCE

11.6 SME MATRIX, 2019

11.6.1 STAR

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

11.6.4 EMERGING LEADERS

11.7 KEY MARKET DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 174)

12.1 KEY PLAYERS

12.1.1 SOUDAL GROUP

12.1.1.1 Business overview

12.1.1.2 Products offered

12.1.1.3 Recent developments

12.1.1.4 MnM view

12.1.1.4.1 Key strengths/right to win

12.1.1.4.2 Strategic choices made

12.1.1.4.3 Weaknesses and competitive threats

12.1.2 HENKEL AG & CO

12.1.2.1 Business overview

12.1.2.2 Products offered

12.1.2.3 Recent developments

12.1.2.4 Impact of COVID-19

12.1.2.5 MnM view

12.1.2.5.1 Key strengths/right to win

12.1.2.5.2 Strategic choices made

12.1.2.5.3 Weaknesses and competitive threats

12.1.3 SELENA GROUP

12.1.3.1 Business overview

12.1.3.2 Products offered

12.1.3.3 Recent developments

12.1.3.4 Impact of COVID-19

12.1.3.5 MnM view

12.1.3.5.1 Key strengths/right to win

12.1.3.5.2 Strategic choices made

12.1.3.5.3 Weaknesses and competitive threats

12.1.4 HANNO-WERK GMBH & CO. KG

12.1.4.1 Business overview

12.1.4.2 Products offered

12.1.4.3 Recent developments

12.1.4.4 MnM view

12.1.4.4.1 Key strengths/right to win

12.1.4.4.2 Strategic choices made

12.1.4.4.3 Weaknesses and competitive threats

12.1.5 TREMCO ILLBRUCK GROUP

12.1.5.1 Business overview

12.1.5.2 Products offered

12.1.5.3 Recent developments

12.1.5.4 Impact of COVID-19

12.1.5.5 MnM view

12.1.5.5.1 Key strengths/right to win

12.1.5.5.2 Strategic choices made

12.1.5.5.3 Weaknesses and competitive threats

12.1.6 GNS GROUP

12.1.6.1 Business overview

12.1.6.2 Products offered

12.1.6.3 Recent developments

12.1.7 PROFFLEX MOUNTING FOAMS

12.1.7.1 Business overview

12.1.7.2 Products offered

12.1.7.3 Recent developments

12.1.8 DEN BRAVEN SEALANTS

12.1.8.1 Business overview

12.1.8.2 Products offered

12.1.8.3 Recent developments

12.1.9 AEROSOL – SERVICE A.S.

12.1.9.1 Business overview

12.1.9.2 Products offered

12.1.9.3 Recent developments

12.1.10 DAP PRODUCTS, INC.

12.1.10.1 Business overview

12.1.10.2 Products offered

12.1.10.3 Recent developments

12.1.11 MCCOY SOUDAL SEALANTS ADHESIVES & FOAMS PRIVATE LIMITED

12.1.11.1 Business overview

12.1.11.2 Products offered

12.1.11.3 Recent developments

12.1.12 AKKIM CONSTRUCTION CHEMICALS

12.1.12.1 Business overview

12.1.12.2 Products offered

12.1.12.3 Recent developments

12.1.13 TKK D.O.O.

12.1.13.1 Business overview

12.1.13.2 Products offered

12.1.13.3 Recent developments

12.1.14 KRIMELTE OÜ

12.1.14.1 Business overview

12.1.14.2 Products offered

12.1.14.3 Recent developments

12.1.15 DUPONT

12.1.15.1 Business overview

12.1.15.2 Products offered

12.1.15.3 Recent developments

12.2 OTHER PLAYERS

12.2.1 GORCCI INTERNATIONAL LTD.

12.2.2 KATER ADHESIVE INDUSTRIAL CO.

12.2.3 FOMO PRODUCTS, INC.

12.2.4 POLYURETHANE LTD.

12.2.5 LARSEN BUILDING PRODUCTS

12.2.6 CASTELEIN SEALANTS

13 APPENDIX (Page No. - 208)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (243 Tables)

TABLE 1 POLYURETHANE FOAM MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2018–2025 (KILOTONS)

TABLE 2 POLYURETHANE FOAM MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2018–2025 (USD MILLION)

TABLE 3 EUROPE CONSTRUCTION MARKET GROWTH, BY COUNTRY, 2016–2022 (%)

TABLE 4 ASIA PACIFIC CONSTRUCTION MARKET GROWTH, BY COUNTRY, 2016–2022 (%)

TABLE 5 MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTONS)

TABLE 6 MARKET SIZE, BY RAW MATERIAL, 2020–2025 (KILOTONS)

TABLE 7 MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY RAW MATERIAL, 2020–2025 (USD MILLION)

TABLE 9 MDI TYPES AND APPLICATIONS

TABLE 10 MARKET SIZE FOR MDI, BY REGION, 2016–2019 (KILOTONS)

TABLE 11 MARKET SIZE FOR MDI, BY REGION, 2018–2025 (KILOTONS)

TABLE 12 MARKET SIZE FOR MDI, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 MARKET SIZE FOR MDI, BY REGION, 2020–2025 (USD MILLION)

TABLE 14 MARKET SIZE FOR POLYETHER POLYOLS, BY REGION, 2016–2019 (KILOTONS)

TABLE 15 MARKET SIZE FOR POLYETHER POLYOLS, BY REGION, 2018–2025 (KILOTONS)

TABLE 16 MARKET SIZE FOR POLYETHER POLYOLS, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 MARKET SIZE FOR POLYETHER POLYOLS, BY REGION, 2020–2025 (USD MILLION)

TABLE 18 MARKET SIZE FOR POLYESTER POLYOLS, BY REGION, 2016–2019 (KILOTONS)

TABLE 19 MARKET SIZE FOR POLYESTER POLYOLS, BY REGION, 2018–2025 (KILOTONS)

TABLE 20 MARKET SIZE FOR POLYESTER POLYOLS, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 MARKET SIZE FOR POLYESTER POLYOLS, BY REGION, 2020–2025 (USD MILLION)

TABLE 22 MARKET SIZE FOR OTHER RAW MATERIALS, BY REGION, 2016–2019 (KILOTONS)

TABLE 23 MARKET SIZE FOR OTHER RAW MATERIALS, BY REGION, 2018–2025 (KILOTONS)

TABLE 24 MARKET SIZE FOR OTHER RAW MATERIALS, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 MARKET SIZE FOR OTHER RAW MATERIALS, BY REGION, 2020–2025 (USD MILLION)

TABLE 26 MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 27 MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 28 MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 29 MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 30 MARKET SIZE IN DOOR & WINDOW FRAME JAMBS, BY REGION, 2016–2019 (MILLION CANS)

TABLE 31 MARKET SIZE IN DOOR & WINDOW FRAME JAMBS, BY REGION, 2020–2025 (MILLION CANS)

TABLE 32 MARKET SIZE IN DOOR & WINDOW FRAME JAMBS, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 MARKET SIZE IN DOOR & WINDOW FRAME JAMBS, BY REGION, 2020–2025(USD MILLION)

TABLE 34 MARKET SIZE IN CEILING & FLOOR JOINTS, BY REGION, 2016–2019 (MILLION CANS)

TABLE 35 MARKET SIZE IN CEILING & FLOOR JOINTS, BY REGION, 2020–2025 (MILLION CANS)

TABLE 36 MARKET SIZE IN CEILING & FLOOR JOINTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 MARKET SIZE IN CEILING & FLOOR JOINTS, BY REGION, 2020–2025(USD MILLION)

TABLE 38 MARKET SIZE IN PARTITION WALLS, BY REGION, 2016–2019 (MILLION CANS)

TABLE 39 MARKET SIZE IN PARTITION WALLS, BY REGION, 2020–2025 (MILLION CANS)

TABLE 40 MARKET SIZE IN PARTITION WALLS, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 MARKET SIZE IN PARTITION WALLS, BY REGION, 2020–2025 (USD MILLION)

TABLE 42 MARKET SIZE IN WATER PIPES, BY REGION, 2016–2019 (MILLION CANS)

TABLE 43 MARKET SIZE IN WATER PIPES, BY REGION, 2020–2025 (MILLION CANS)

TABLE 44 MARKET SIZE IN WATER PIPES, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 MARKET SIZE IN WATER PIPES, BY REGION, 2020–2025(USD MILLION)

TABLE 46 MARKET SIZE IN OTHER END USES, BY REGION, 2016–2019 (MILLION CANS)

TABLE 47 MARKET SIZE IN OTHER END USES, BY REGION, 2020–2025 (MILLION CANS)

TABLE 48 MARKET SIZE IN OTHER END USES, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 MARKET SIZE IN OTHER END USES, BY REGION, 2020–2025(USD MILLION)

TABLE 50 MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION CANS)

TABLE 51 MARKET SIZE, BY APPLICATION, 2020–2025 (MILLION CANS)

TABLE 52 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 53 MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 54 MARKET SIZE, FOR RESIDENTIAL APPLICATION, BY REGION, 2016–2019 (MILLION CANS)

TABLE 55 MARKET SIZE FOR RESIDENTIAL APPLICATION, BY REGION, 2018–2025 (MILLION CANS)

TABLE 56 MARKET SIZE FOR RESIDENTIAL APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 MARKET SIZE FOR RESIDENTIAL APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 58 MARKET SIZE FOR COMMERCIAL APPLICATION, BY REGION, 2016–2019 (MILLION CANS)

TABLE 59 MARKET SIZE FOR COMMERCIAL APPLICATION BY REGION, 2018–2025 (MILLION CANS)

TABLE 60 MARKET SIZE FOR COMMERCIAL APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 61 MARKET SIZE FOR COMMERCIAL APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 62 MARKET SIZE, BY REGION, 2016–2019 (MILLION CANS)

TABLE 63 MARKET SIZE, BY REGION, 2020–2025 (MILLION CANS)

TABLE 64 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 65 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 66 ASIA PACIFIC: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION CANS)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION CANS)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION CANS)

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (MILLION CANS)

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 75 ASIA PACIFIC: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 78 CHINA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 79 CHINA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 80 CHINA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 81 CHINA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 82 JAPAN: MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 83 JAPAN: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 84 JAPAN: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 85 JAPAN: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 86 INDIA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 87 INDIA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 88 INDIA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 89 INDIA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 90 SOUTH KOREA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END-USE, 2016–2019 (MILLION CANS)

TABLE 91 SOUTH KOREA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 92 SOUTH KOREA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 93 SOUTH KOREA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 94 THAILAND: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 95 THAILAND: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 96 THAILAND: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 97 THAILAND: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 98 MALAYSIA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 99 MALAYSIA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 100 MALAYSIA:MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 101 MALAYSIA:MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 102 INDONESIA:ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 103 INDONESIA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 104 INDONESIA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 105 INDONESIA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 106 VIETNAM: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 107 VIETNAM: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 108 VIETNAM: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 109 VIETNAM: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 110 REST OF ASIA PACIFIC: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 111 REST OF ASIA PACIFIC: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 112 REST OF ASIA PACIFIC: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 113 REST OF ASIA PACIFIC: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 114 EUROPE: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION CANS)

TABLE 115 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION CANS)

TABLE 116 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION CANS)

TABLE 119 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (MILLION CANS)

TABLE 120 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 123 EUROPE: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 124 EUROPE: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 126 GERMANY: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 127 GERMANY: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 128 GERMANY: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 129 GERMANY: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 130 RUSSIA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 131 RUSSIA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 132 RUSSIA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 133 RUSSIA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 134 FRANCE: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 135 FRANCE: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 136 FRANCE: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 137 FRANCE: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 138 ITALY: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 139 ITALY: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 140 ITALY: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 141 ITALY: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 142 UK: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 143 UK: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 144 UK: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 145 UK: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 146 TURKEY: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 147 TURKEY: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 148 TURKEY: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 149 TURKEY: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 150 ESTONIA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 151 ESTONIA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 152 ESTONIA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 153 ESTONIA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 154 REST OF EUROPE: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 155 REST OF EUROPE: MARKET SIZE, Y END USE, 2020–2025 (MILLION CANS)

TABLE 156 REST OF EUROPE: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 157 REST OF EUROPE: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 158 NORTH AMERICA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 159 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 160 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION CANS)

TABLE 161 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION CANS)

TABLE 162 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION CANS)

TABLE 163 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (MILLION CANS)

TABLE 164 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 165 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 166 NORTH AMERICA: MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 167 NORTH AMERICA: MARKET SIZE, Y END USE, 2020–2025 (MILLION CANS)

TABLE 168 NORTH AMERICA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 169 NORTH AMERICA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 170 US: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 171 US: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 172 US: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 173 US: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 174 CANADA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 175 CANADA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 176 CANADA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 177 CANADA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 178 MEXICO: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 179 MEXICO: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 180 MEXICO: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 181 MEXICO: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION CANS)

TABLE 183 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION CANS)

TABLE 184 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION CANS)

TABLE 187 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (MILLION CANS)

TABLE 188 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 191 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 192 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 194 SAUDI ARABIA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 195 SAUDI ARABIA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 196 SAUDI ARABIA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 197 SAUDI ARABIA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 198 UAE: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 199 UAE: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 200 UAE: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 201 UAE: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 202 IRAN: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 203 IRAN: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 204 IRAN: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 205 IRAN: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 206 REST OF MIDDLE EAST & AFRICA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 207 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 208 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 209 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 210 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION CANS)

TABLE 211 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION CANS)

TABLE 212 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 213 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 214 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION CANS)

TABLE 215 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (MILLION CANS)

TABLE 216 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 217 SOUTH AMERICA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 218 SOUTH AMERICA: MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 219 SOUTH AMERICA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 220 SOUTH AMERICA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 221 SOUTH AMERICA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 222 BRAZIL: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 223 BRAZIL: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 224 BRAZIL: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 225 BRAZIL: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 226 CHILE: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 227 CHILE: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 228 CHILE: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 229 CHILE: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 230 ARGENTINA: ONE COMPONENT POLYURETHANE FOAM MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 231 ARGENTINA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 232 ARGENTINA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 233 ARGENTINA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 234 REST OF SOUTH AMERICA: MARKET SIZE, BY END USE, 2016–2019 (MILLION CANS)

TABLE 235 REST OF SOUTH AMERICA: MARKET SIZE, BY END USE, 2020–2025 (MILLION CANS)

TABLE 236 REST OF SOUTH AMERICA: MARKET SIZE, BY END USE, 2016–2019 (USD MILLION)

TABLE 237 REST OF SOUTH AMERICA: MARKET SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 238 EXPANSIONS, 2018–2020

TABLE 239 ACQUISITIONS, 2018–2020

TABLE 240 PARTNERSHIPS, 2018–2020

TABLE 241 JOINT VENTURES, 2018–2020

TABLE 242 INVESTMENTS, 2018–2020

TABLE 243 PRODUCT LAUNCHES, 2018–2020

LIST OF FIGURES (32 Figures)

FIGURE 1 ONE COMPONENT POLYURETHANE FOAM MARKET SEGMENTATION

FIGURE 2 ONE COMPONENT POLYURETHANE FOAM MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION:

FIGURE 4 MARKET SIZE ESTIMATION, BY END USE

FIGURE 5 ONE COMPONENT POLYURETHANE FOAM MARKET: DATA TRIANGULATION

FIGURE 6 BY END USE, DOOR & WINDOW FRAME JAMBS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2020 TO 2025 IN TERMS OF VALUE

FIGURE 7 BY APPLICATION, RESIDENTIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2020 TO 2025 IN TERMS OF VALUE

FIGURE 8 EUROPE TO ACCOUNT FOR LARGEST SHARE OF ONE COMPONENT POLYURETHANE FOAM MARKET FROM 2020 TO 2025, IN TERMS OF VALUE

FIGURE 9 INCREASING USE FOR THERMAL AND ACOUSTIC INSULATION PURPOSES TO DRIVE GROWTH OF ONE COMPONENT POLYURETHANE FOAM MARKET

FIGURE 10 ASIA PACIFIC TO ACCOUNT FOR LARGEST SIZE OF ONE COMPONENT POLYURETHANE FOAM MARKET FROM 2020 TO 2025 IN TERMS OF VOLUME

FIGURE 11 DOOR & WINDOW FRAME JAMBS SEGMENT AND CHINA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARES IN ASIA PACIFIC IN 2020 IN TERMS OF VOLUME

FIGURE 12 RESIDENTIAL SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SIZE OF ONE COMPONENT POLYURETHANE FOAM MARKET IN 2020 IN TERMS OF VOLUME

FIGURE 13 DOOR & WINDOW FRAME JAMBS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF ONE COMPONENT POLYURETHANE FOAM MARKET FROM 2020 TO 2025 IN TERMS OF VOLUME

FIGURE 14 ONE COMPONENT POLYURETHANE FOAM MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 15 PORTER’S FIVE FORCES ANALYSIS OF ONE COMPONENT POLYURETHANE FOAM MARKET

FIGURE 16 BY RAW MATERIAL, MDI SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2020 TO 2025

FIGURE 17 DOOR & WINDOW FRAME JAMBS TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2020 TO 2025

FIGURE 18 BY APPLICATION, RESIDENTIAL SEGMENT TO LEAD ONE COMPONENT POLYURETHANE FOAM MARKET FROM 2020 TO 2025

FIGURE 19 GEOGRAPHIC SNAPSHOT

FIGURE 20 ASIA PACIFIC ONE COMPONENT POLYURETHANE FOAM MARKET SNAPSHOT

FIGURE 21 EUROPE ONE COMPONENT ONE COMPONENT POLYURETHANE FOAM MARKET SNAPSHOT

FIGURE 22 NORTH AMERICA ONE COMPONENT POLYURETHANE FOAM MARKET SNAPSHOT

FIGURE 23 OVERALL ENERGY CONSUMPTION SHARE IN US, BY END USE SECTOR, 2019 (%)

FIGURE 24 COMPANIES ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2018 AND SEPTEMBER 2020

FIGURE 25 MARKET EVALUATION FRAMEWORK: 2020 SAW EXPANSIONS LEADING THIS SPACE

FIGURE 26 ONE COMPONENT POLYURETHANE FOAM MARKET: COMPETITIVE LANDSCAPE MAPPING, 2019

FIGURE 27 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ONE COMPONENT POLYURETHANE FOAM MARKET

FIGURE 28 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ONE COMPONENT POLYURETHANE FOAM MARKET

FIGURE 29 ONE COMPONENT POLYURETHANE FOAM MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 30 SOUDAL GROUP: COMPANY SNAPSHOT

FIGURE 31 HENKEL AG & CO.: COMPANY SNAPSHOT

FIGURE 32 DUPONT: COMPANY SNAPSHOT

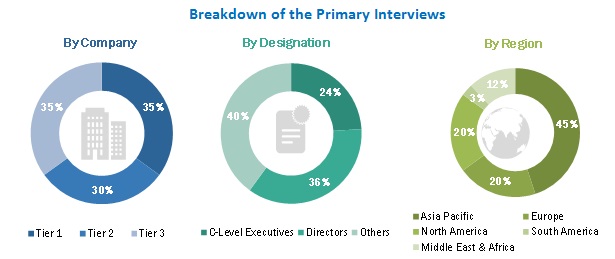

The study involved four major activities in estimating the current size of the one component polyurethane foam market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the one component polyurethane foam value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The one-component polyurethane foam market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, service providers, end-product manufacturers, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the one component polyurethane foam market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the one component polyurethane foam market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

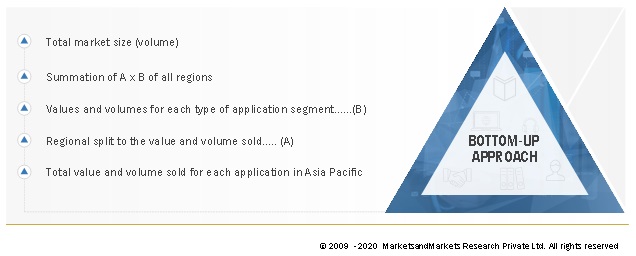

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the one component polyurethane foam market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the one component polyurethane foam market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global One component polyurethane foam Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To determine and project the size of the one component polyurethane foam market with respect to type, end-use industry, and region, over five years, from 2020 to 2025

- To identify attractive opportunities in the market by determining the largest and the fastest-growing segments across key regions

- To project the size of the market segments, in terms of value and volume, with respect to five regions: Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, opportunities, restraints, and challenges)

- To analyze competitive developments, such as expansions, acquisitions, investments, partnerships, joint ventures, and product launches in the one component polyurethane foam market

- To analyze the demand-side factors based on the impact of macroeconomic and microeconomic factors on different segments of the market across different regions

Competitive Intelligence

- To identify and profile key players in the one component polyurethane foam market

- To determine the market share of key players operating in the market

-

To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further country-level breakdown of the Rest of Europe into Denmark, Poland and Sweden, in the one component polyurethane foam market

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in One Component Polyurethane Foam Market