Organ Preservation Market: Growth, Size, Share, and Trends

Organ Preservation Market by Solution Type (UW, Custodial HTK, Perfadex), Technique (Static Cold Storage, Hypothermic, Normothermic), Organ (Kidneys, Liver, Heart), End User (Transplant Centers, Hospitals, Specialty Clinics) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

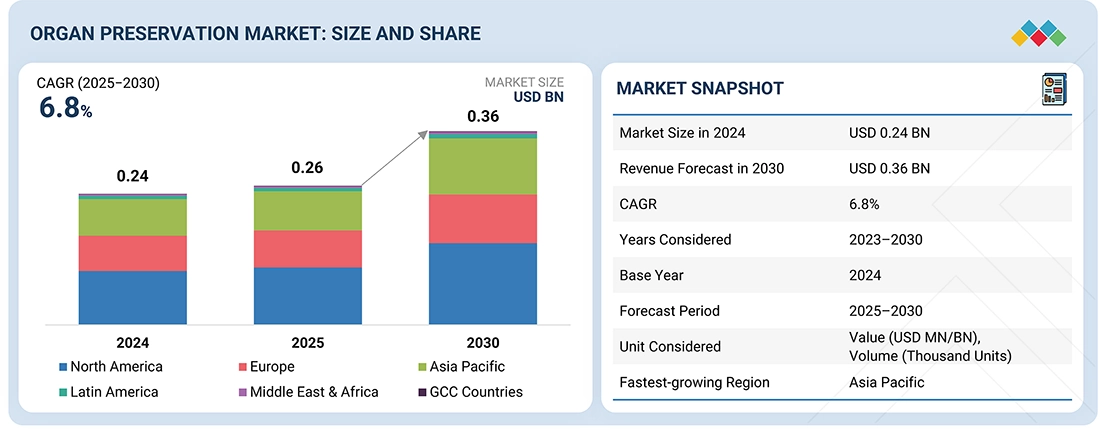

The organ preservation market is projected to reach USD 0.36 billion by 2030, from USD 0.26 billion in 2025, with a CAGR of 6.8%. The market is experiencing strong growth due to increasing incidences of chronic diseases, organ failure, and advancements in transplantation procedures. Rising rates of end-stage organ conditions, such as kidney, liver, and heart failure, along with a growing global demand for transplants, are other key factors driving market expansion. The aging population, which is more prone to organ dysfunction, further emphasizes the need for effective preservation methods to maintain organ viability before transplantation.

KEY TAKEAWAYS

-

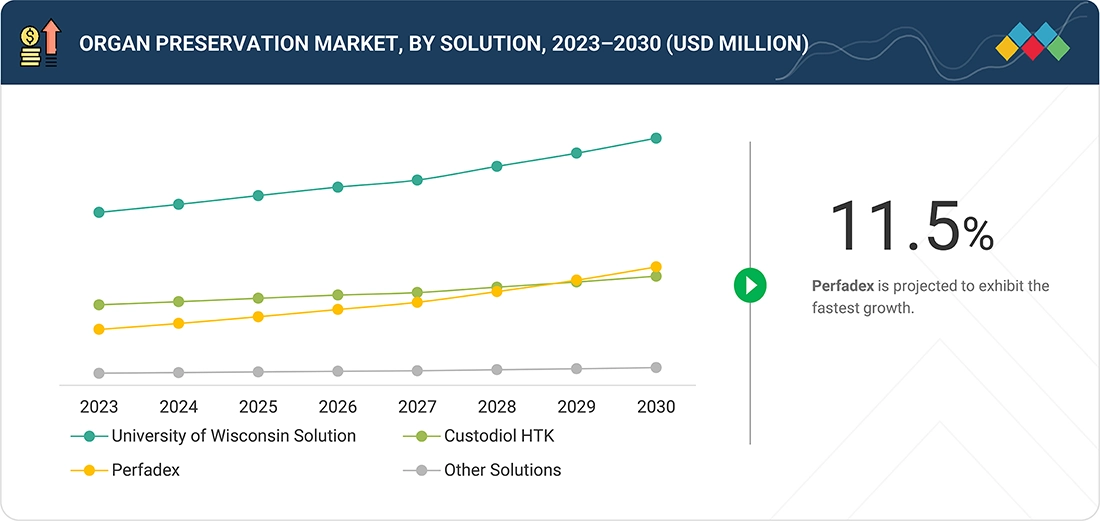

BY SOLUTIONThe UW solution segment holds the largest market share because of its effectiveness in flushing and preserving organs such as the kidneys, liver, and pancreas. Known as the standard for intracellular preservation, UW Solution’s widespread use comes from its inclusion of inert components like lactobionate and raffinose. These substances help reduce tissue damage and support better organ function, improving transplant success rates compared to other preservation methods.

-

BY TECHNIQUEThe static cold storage segment holds the largest market share. This traditional method is widely used and regarded as the standard for organ preservation because it can induce hypothermia, which reduces metabolic activity in donor organs. It is commonly used for preserving kidneys, liver, lungs, pancreas, and heart.

-

BY ORGAN TYPEThe kidney segment has the largest market share, mainly due to the increasing rate of end-stage renal disease (ESRD), for which kidney transplantation remains the most effective treatment option. As cases of kidney failure continue to rise, so does the number of transplant procedures, highlighting the need for efficient preservation of donor kidneys before implantation.

-

BY END USERThe organ transplant centers segment holds the largest market share. This growth can be attributed to the widespread development of healthcare facilities that operate dedicated transplant programs. These centers are crucial in performing organ retrieval, preservation, and transplantation, making them key consumers of preservation products and technologies.

-

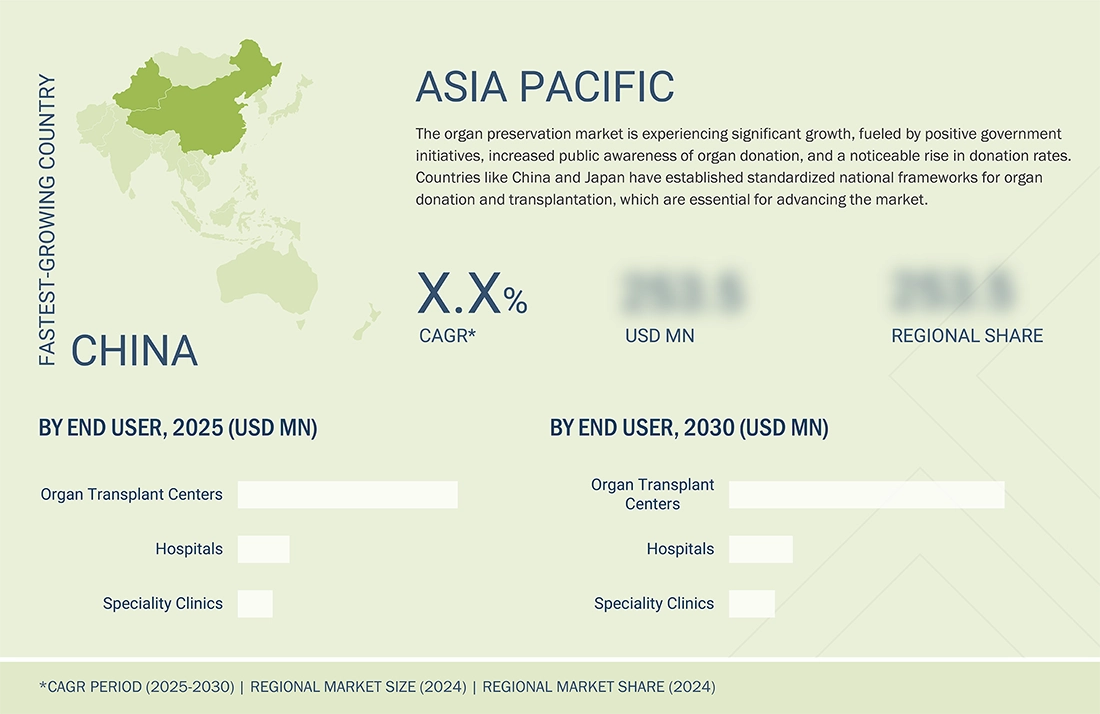

BY REGIONThe rapid growth of the Asia Pacific region is due to supportive government policies, increased public awareness about organ donation, and a surge in donation activities. Countries like China and Japan have established standardized national guidelines for organ donation and transplantation, which are crucial in advancing the market. Furthermore, improvements in healthcare infrastructure, the growing burden of chronic illnesses, and the rise of medical tourism across many Asia Pacific countries are expected to drive market growth during the forecast period.

-

COMPETITIVE LANDSCAPEThe major market players have employed both organic and inorganic strategies, including partnerships, collaborations, and approvals. For example, in March 2025, TransMedics launched its National OCS Program (NOP) in additional US states, enhancing nationwide logistics and transplant coordination for heart, lung, and liver transplants through its proprietary normothermic technology platform.

The organ preservation market is mainly driven by the increasing need for organ transplants, the rising frequency of organ failure caused by chronic conditions such as diabetes, hypertension, and kidney disease, and the growing number of road accidents and trauma cases worldwide. However, limited donor organ availability and high costs related to preservation techniques and equipment continue to hinder wider market growth.

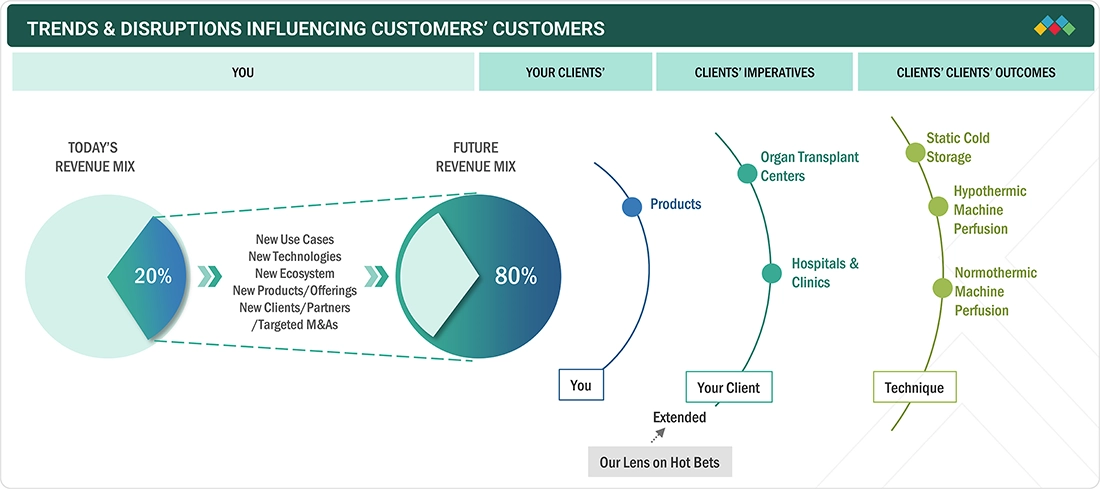

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The organ preservation market is experiencing significant change driven by global healthcare needs, increasing transplantation demand, and evolving regulations. Rising cases of organ failure, expanding transplant waiting lists, and shortages of viable donor organs are putting more pressure on healthcare systems. At the same time, growing use of normothermic machine perfusion (NMP), controlled hypothermic transport methods, and AI-powered viability assessment tools is transforming how organs are preserved, evaluated, and used. Rising healthcare costs, tighter compliance standards, and regional differences in organ donation rates are affecting procurement and adoption patterns. Sustainability efforts are encouraging the development of reusable, eco-friendly preservation systems, while digital integration enables real-time monitoring and predictive analytics to improve graft utilization. International competition, along with localization strategies, is influencing pricing and distribution, especially in emerging markets. These changes collectively prompt hospitals, transplant centers, and procurement agencies to seek solutions that extend preservation times, enhance graft quality, and maximize donor organ use, aiming for better patient outcomes while meeting cost, regulatory, and sustainability objectives.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing burden of chronic diseases

-

Increasing initiatives to promote public awareness and encourage organ donation

Level

-

High cost of organ transplantation

-

Religious concerns and misconceptions associated with organ donation

Level

-

Increasing healthcare investments

Level

-

Significant gap between number of organs donated and organs required annually

-

Development of artificial organs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing burden of chronic diseases

The increasing burden of chronic diseases, trauma, and end-stage organ failure has become a major driver for the growth of the organ preservation market. As the global demand for organ transplants continues to rise, fueled by higher rates of conditions like kidney, liver, and heart failure, there is a concurrent need for reliable and effective preservation solutions to keep organs viable during storage and transport. This rise in transplantation procedures has highlighted the crucial role of innovative preservation technologies and solutions. The market has seen a growing use of specialized preservation solutions such as UW (University of Wisconsin) solution, Custodiol HTK, and others, which are essential in maintaining the structural and functional integrity of donor organs. These solutions are key in reducing ischemic damage and increasing transplantation success rates.

Restraint: High cost of organ transplantation

Organ transplantation is a complex and costly medical procedure that involves multiple high-value components, including skilled surgeons, specialized transportation, and expensive medications. The total costs, which include hospital stays, organ retrieval and preservation, as well as post-operative care and immunosuppressive therapies, significantly increase the financial burden on patients. Beyond medical expenses, patients often face additional costs for travel, accommodation, meals, diagnostic tests, and follow-up visits at transplant centers, especially during extended observation periods. These expenses can be prohibitive for patients from low-income backgrounds, who may need to prioritize basic needs like housing, food, and clothing, making organ transplants largely inaccessible without external financial support.

Opportunity: Increasing healthcare investments

Governments worldwide are prioritizing the improvement of healthcare infrastructure to provide more comprehensive and accessible medical services. For instance, in India, the Brihanmumbai Municipal Corporation (BMC) allocated ~USD 924 million (INR 7,000 crore), or 15% of its 2022–2023 budget, to enhance healthcare delivery systems. This funding aims to establish 100 healthcare centers and support over 100 types of diagnostic tests focused on preventive and primary care within BMC jurisdictions. These infrastructure developments are expected to significantly increase the number of healthcare facilities capable of managing brain-dead patients who could become organ donors. Additionally, expanding diagnostic laboratories is likely to streamline essential pre-transplant procedures such as donor-recipient matching, genetic profiling, and other diagnostic assessments.

Challenge: Significant gap between number of organs donated and organs required annually

A significant gap exists between the yearly demand for organs and the number of successful donations. As of January 2022, over 100,000 patients in the US were waiting for organs, yet only 41,354 transplants took place in 2021 (Source: Organ Procurement and Transplantation Network, US). This gap is mainly caused by limited public awareness, insufficient legislation, and the increased risk of organ trafficking. Governments are actively working to address this by enacting reformed laws, such as opt-out donation systems, and launching various initiatives to promote organ donation.

Organ Preservation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Ex vivo lung perfusion (EVLP) systems for lung transplantation | Extends preservation time, allows assessment of marginal donor lungs, improves transplant outcomes |

|

SherpaPak cardiac and lung transport systems using controlled hypothermic preservation | Stable temperature control, reduces ischemic injury, improves graft survival rates |

|

Organ care system for heart, lung, and liver – portable normothermic perfusion | Maintains organs in near-physiologic state, increases viable donor pool, reduces post-transplant complications |

|

Preservation solutions (Belzer UW, HTK) for liver, kidney, and pancreas | Proven clinical use, maintains cellular integrity, reduces cold ischemia injury |

|

Composite materials in unmanned aerial vehicles | Lightweight design, higher endurance, improved stealth capabilities |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The organ preservation ecosystem includes medical device manufacturers, component suppliers, healthcare providers, regulatory agencies, and research institutions. Manufacturers work with OEMs and technology partners to develop innovations in optics, sensor integration, and AI-powered diagnostics. Hospitals, ambulatory surgical centers, and specialty clinics are the main end-users, boosting demand through increased use of minimally invasive procedures. Regulatory agencies like the FDA and EMA ensure product safety and compliance, shaping product design and timeframes for market release. Strategic alliances, R&D funding, and government healthcare investments further drive market growth. Additionally, medical training centers and professional organizations are vital for physician education, promoting clinical adoption and strengthening the overall ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Organ Preservation Market, By Solution

In 2024, the UW solution segment held the largest share in the organ preservation market, mainly because of its effectiveness in flushing and preserving organs such as the kidneys, liver, and pancreas. Known as the standard for intracellular preservation, UW Solution’s wide acceptance comes from its inclusion of metabolically inert components like lactobionate and raffinose. These compounds help reduce tissue damage and improve the physiological function of organs, increasing transplant success rates compared to other preservation methods.

Organ Preservation Market, By Technique

The static cold storage segment held the largest market share in 2024. This traditional method is widely used and regarded as the standard for organ preservation because it can induce hypothermia, which helps decrease metabolic activity in donor organs. It is commonly used to preserve kidneys, liver, lungs, pancreas, and heart.

Organ Preservation Market, By Organ Type

In 2024, the kidney segment held the largest share of the organ preservation market. This dominance is due to the rising number of ESRD cases, with kidney transplantation as the preferred treatment option. This trend is expected to increase the number of kidney transplant procedures, resulting in a higher incidence of organ preservation for donor kidneys before transplantation into recipients.

Organ Preservation Market, By End User

In 2024, the organ transplant centers segment held the largest market share. This dominance is due to the global rise in the establishment of such centers, increased incidences of multi-organ failure, and government initiatives to promote organ donation.

REGION

Asia Pacific to be fastest-growing region in global Organ Preservation market during forecast period

Asia Pacific is expected to experience the fastest growth globally during the forecast period. This is mainly due to healthcare infrastructure growth, increased healthcare spending, and rapid adoption of minimally invasive surgeries in populous countries like China and India. These nations are investing significantly in improving diagnostic and surgical capabilities, especially addressing the growing incidence of chronic diseases. With universal insurance coverage, Japan’s well-established healthcare system ensures broad access to advanced endoscopic procedures. Additionally, increasing medical tourism, supportive government policies, and the growing use of minimally invasive technologies are driving market penetration, establishing Asia Pacific as a high-growth region in the organ preservation market.

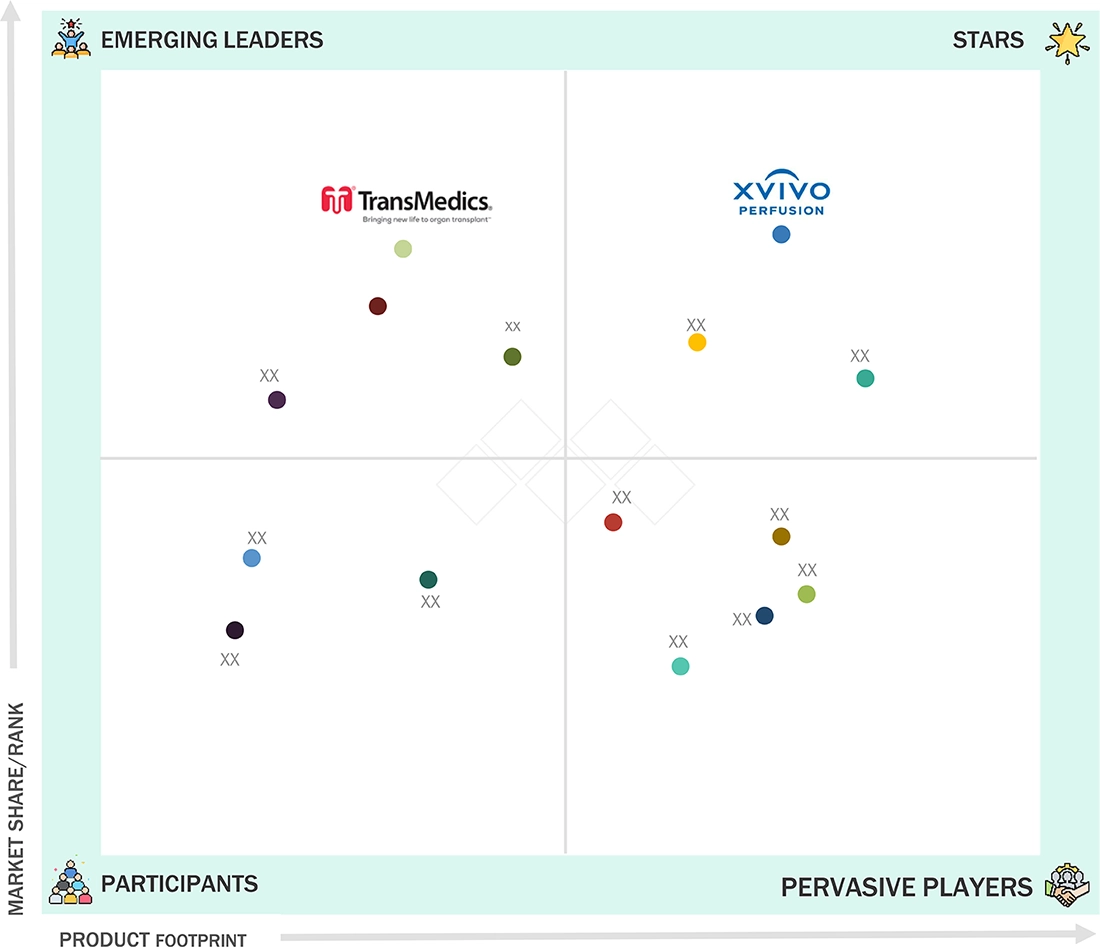

Organ Preservation Market: COMPANY EVALUATION MATRIX

In the company evaluation matrix for the organ preservation market, XVIVO Perfusion AB (Star) leads with scale, extensive distribution, and a broad endoscopes portfolio. Transmedics (Emerging Leader) is gaining momentum with innovative organ preservation. Both XVIVO and Transmedics stand out by offering advanced organ preservation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.24 BN |

| Revenue Forecast in 2030 (Value) | USD 0.36 BN |

| Growth Rate | 6.8% |

| Years Considered | 2023–2030 |

| Base year | 2024 |

| Forecast Period | 2025–2030 |

| Unit Considered | Value (USD MN/BN), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

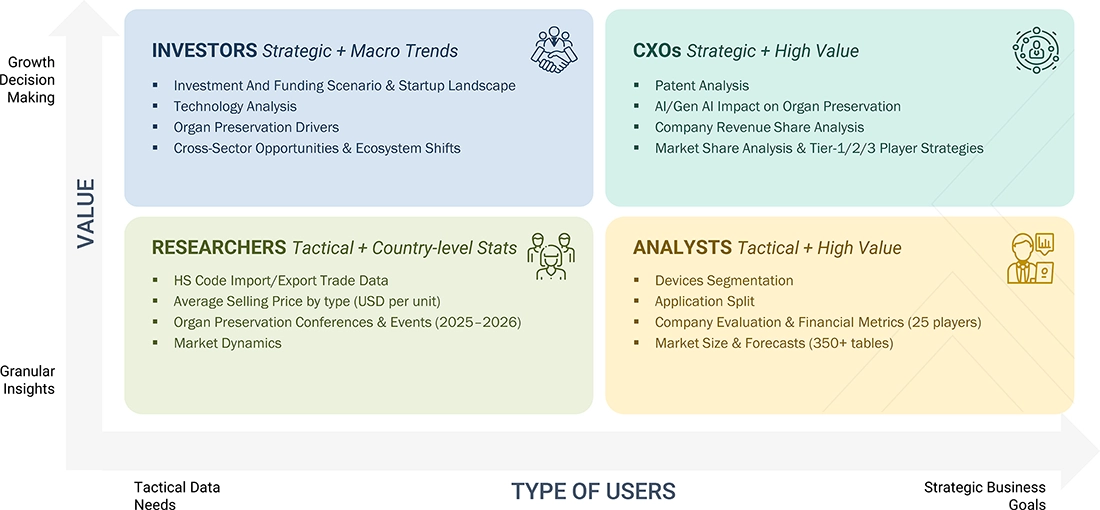

WHAT IS IN IT FOR YOU: Organ Preservation Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- March 2025 : TransMedics expanded its National OCS Program (NOP) to additional US states, enhancing nationwide logistics and transplant coordination for heart, lung, and liver transplants through its proprietary normothermic technology platform.

- January 2024 : X-Therma Inc. announced the successful completion of preclinical trials for its XT-ViVo organ preservation platform. The trials showed increased organ viability during extended cold storage, supporting the company’s plans for upcoming clinical validation and regulatory submissions.

- January 2024 : Shanghai Genext Medical Technology partnered with a leading transplant hospital in Southeast Asia to pilot its next-generation perfusion machine for kidney preservation. The pilot aims to generate clinical evidence supporting a broader regional rollout.

- May 2024 : BioLife Solutions introduced a new version of its HypoThermosol FRS preservation solution, designed for greater stability and longer shelf life. The product aims to enhance the preservation of cells, tissues, and organs during cold storage.

- October 2023 : OrganOx Limited expanded clinical trials of its Metra normothermic liver perfusion device into additional European transplant centers. This strategy aims to accelerate adoption and facilitate regulatory submissions across regions.

Table of Contents

Methodology

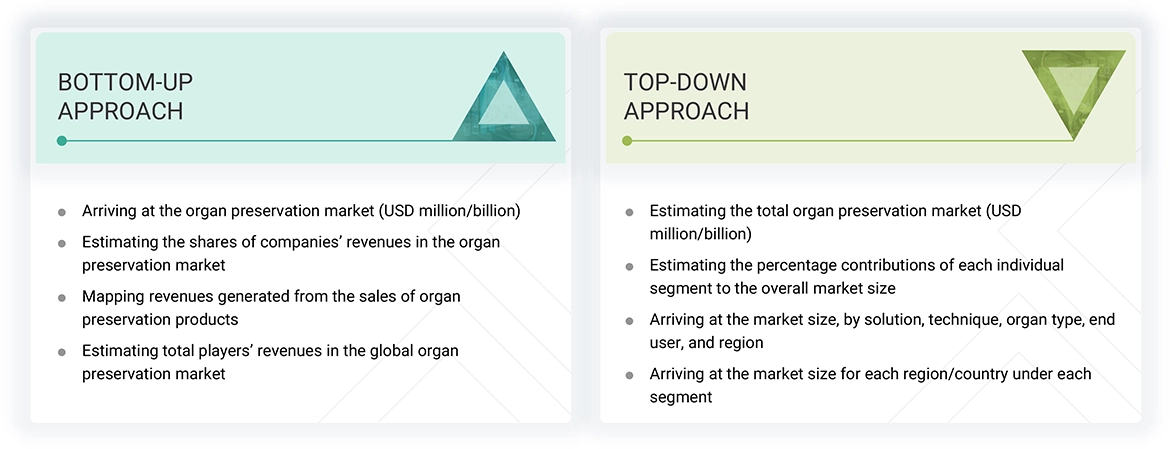

The study involved four major activities to estimate the current size of the organ preservation market—exhaustive secondary research collected information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources were utilized to identify and gather information to study the organ preservation market. These sources included company annual reports, press releases, investor presentations, white papers, certified publications, and articles by recognized authors. We also consulted reputable websites, regulatory bodies, and databases such as D&B Hoovers, Bloomberg Business, and Factiva.

This research aimed to gather crucial information about the leading companies in the industry, market classification, and segmentation based on industry trends down to the most detailed levels, including geographic markets. Additionally, we focused on key developments related to the market. Through this secondary research, a database of key industry leaders was created.

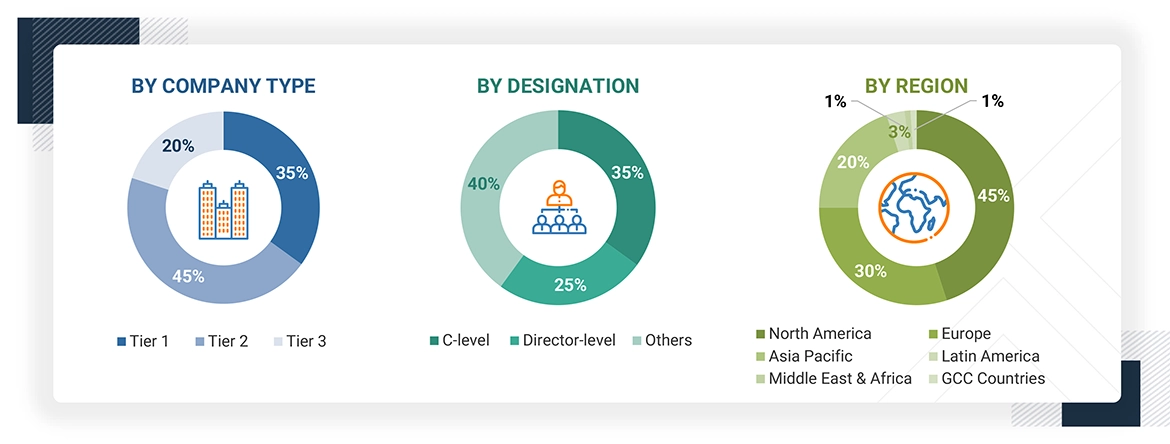

Primary Research

Extensive primary research was conducted after gathering information about the organ preservation market through secondary research. Several primary interviews were held with market experts from both the demand and supply sides across major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Data was collected through questionnaires, emails, and telephone interviews. The primary sources from the supply side included various industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), Directors of business development, marketing, product development/innovation teams, and other key executives from manufacturers and distributors operating in the organ preservation market, as well as key opinion leaders.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the organ preservation market includes the following details.

The market sizing was undertaken from the global side.

Country-level Analysis: The size of the organ preservation market was obtained from the annual presentations of leading players and secondary data available in the public domain. Shares of products in the overall organ preservation market were obtained from secondary data and validated by primary participants to arrive at the total organ preservation market. Primary participants further validated the numbers.

Geographic Market Assessment (By Region & Country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

Industry experts contacted during primary research validated the assumptions and approaches at each point. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall organ preservation market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Organ Preservation Market Size: Bottom-up Approach & Top-down Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying various factors and trends from both the demand and supply sides in the organ preservation market.

Market Definition

Organ preservation solutions are used to protect and preserve the viability of organs during organ transplantation. Utilizing distinct methodologies, organ preservation starts with the surgical removal of the donor organ and concludes with its placement in the recipient. Various solutions (such as the University of Wisconsin solution and Custodiol HTK) and techniques (such as static cold storage and hypothermic machine perfusion) are used to preserve organs.

Stakeholders

- Association of Organ Procurement Organizations (AOPO)

- American Transplant Congress (ATC)

- United Network for Organ Sharing (UNOS)

- Network & Alliance of Transplant Coordinators (NATCO)

- Consortium for Organ Preservation in Europe (COPE)

- European Society for Organ Transplantation (ESOT)

- Asian Society of Transplantation (AST)

- National Health Service (UK NHS)

- International Registry on Organ Donation and Transplantation (IRODaT)

- Global Observatory on Donation and Transplants (GODT)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

- Organisation for Economic Co-operation and Development (OECD)

- Centers for Disease Control and Prevention (CDC)

- Annual Reports/SEC Filings, Investor Presentations, and Press Releases of Key Players

- White Papers, Journals/Magazines, and News Articles

Report Objectives

- To define, describe, and forecast the organ preservation market based on solution, technique, organ type, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall organ preservation market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To estimate the market size and growth potential of the market segments with respect to six regions: North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries

- To profile the key players operating in the organ preservation market and comprehensively analyze their revenue shares and core competencies2

- To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, collaborations, expansions, joint ventures, and acquisitions in the organ preservation market

- To benchmark players in the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business strategy and product offering

Key Questions Addressed by the Report

Which are the top industry players in the global organ preservation market?

The top market players include Paragonix Technologies (US), XVIVO Perfusion AB (Sweden), Dr. Franz Köhler Chemie GmbH (Germany), Essential Pharmaceuticals, LLC (US), TransMedics (US), OrganOx Limited (UK), 21st Century Medicine (US), Shanghai Genext Medical Technology (China), Bridge to Life Limited (US), Waters Medical Systems (US), Preservation Solutions (US), Carnamedica (Poland), Transplant Biomedicals (Spain), Institut Georges Lopez (France), and Global Transplant Solutions (US).

Which global organ preservation solutions have been included in this report?

University of Wisconsin Solution, Custodial HTK, Perfadex, and Other Solutions (Celsior and Euro-collins).

Which geographical region dominates in the global organ preservation market?

North America dominates the market due to a high incidence of chronic diseases, increasing demand for transplants, strong presence of industry players, and advanced healthcare infrastructure.

What strategies are adopted by the top market players to penetrate emerging regions?

Key strategies include partnerships, expansions, distribution agreements, product launches, and product approvals.

What is the expected addressable market value of the organ preservation market in the coming years between 2025 and 2030?

The market is projected to reach USD 0.3 billion by 2030 from USD 0.2 billion in 2025, growing at a CAGR of 6.8%.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Organ Preservation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Organ Preservation Market

Marta

May, 2022

We have an investigation at the University on Organ Preservation Market and we want to analyze if it has potential. Thank you.

Benjamin

May, 2022

Interest in the organ preservation market, specifically organ preservation solutions.

Jacob

Oct, 2022

I want more detailed information on the market size estimation methodologies followed for the study of Organ Preservation Market.