Organic Electronics Market by Material (Semiconductor, Conductive, Dielectric, Substrate), Application (Display, Lighting, Solar Cells), End User (Consumer Electronics, Automotive, Healthcare) and Region - Global Forecast to 2028

Updated on : Sep 12, 2024

Organic Electronics Market Size, Share & Growth

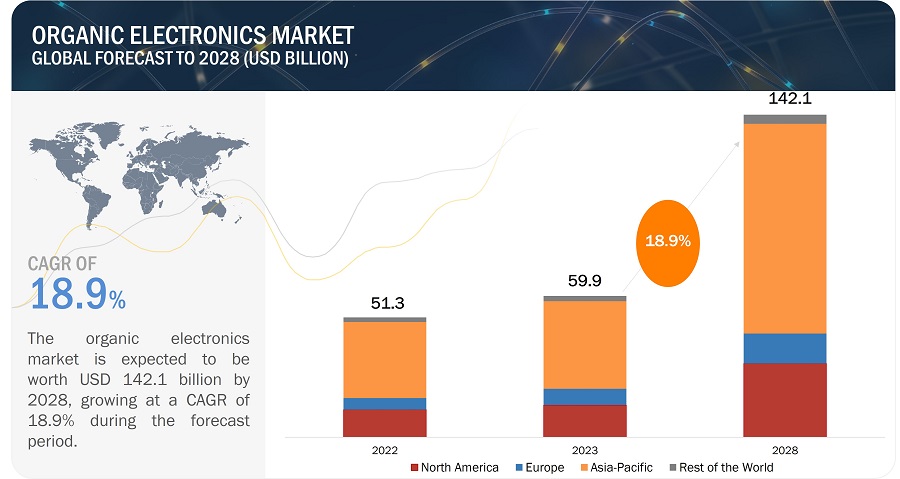

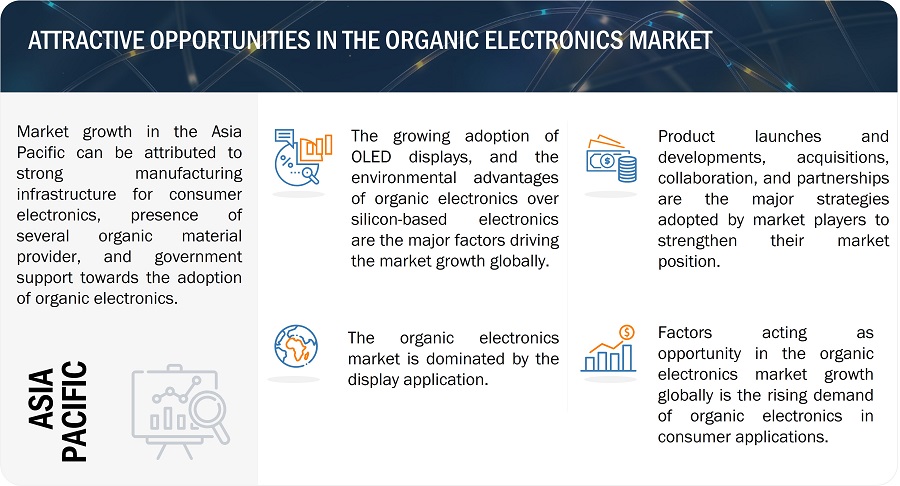

[275 Pages Report] The global organic electronics market is projected to grow from USD 59.9 billion in 2023 to USD 142.1 billion by 2028, registering a CAGR of 18.9% during the forecast period. The organic electronics market has experienced significant growth driven by rising adoption of OLED displays in various applications, rising demand for flexible and lightweight devices, and emerging applications in the automotive and healthcare industries. These factors have collectively contributed to the expansion of the market, as organic electronic devices offer unique advantages and cater to evolving consumer needs in various industries. Continued research and development efforts, along with new market-driven technologies such as, mini-LED and micro-LED, are expected to further propel the growth of the organic electronics market in the coming years.

Organic Electronics Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Organic Electronics Market Trends & Dynamics:

Driver: Surging adoption of OLED displays in various applications

The surging demand for OLED (Organic Light-Emitting Diode) displays in various applications has been a key driver of the growth in the organic electronics market. OLED displays offer numerous advantages over traditional display technologies, such as LCD (Liquid Crystal Display), including superior image quality, vibrant colors, high contrast ratios, wide viewing angles, and fast response times. OLED displays have gained significant popularity in the consumer electronics industry, with smartphones, televisions, and wearable devices being major applications. The demand for smartphones with OLED displays has grown substantially due to their slim form factor, energy efficiency, and ability to produce deep blacks and vibrant colors. Similarly, OLED televisions have garnered attention for their high picture quality and flexibility in design.

In addition to consumer electronics, OLED displays are finding applications in other industries. Due to their customizable designs and improved visibility, automotive manufacturers are incorporating OLED displays in vehicle dashboards, infotainment systems, and lighting solutions. The lighting industry is also adopting OLED technology for energy-efficient and aesthetically pleasing lighting solutions. The increasing adoption of OLED displays in various applications has driven the demand for organic electronic materials and components. Manufacturers are investing in research and development to improve OLED displays' performance, efficiency, and durability. Efforts are underway to increase the lifespan of OLED panels and reduce manufacturing costs to make them more accessible to a wider range of applications. Overall, the surging demand for OLED displays in various sectors is a significant driving force behind the growth of the organic electronics market. As technology advances and production costs decrease, OLED displays are expected to penetrate different industries further, propelling the expansion of the organic electronics market.

Restraint: Limited market penetration

The limited market penetration of organic electronic devices can be attributed to several factors, including the technology’s relative immaturity and cost considerations. Organic electronics are still in the early stages of development, and while their performance and stability are improving, they have not yet reached the same level as traditional inorganic electronics. This can create reluctance among consumers and manufacturers to fully adopt organic electronic devices. Additionally, the production processes for organic electronics, such as printing or coating, are not as streamlined or cost-effective as those for inorganic electronics. As a result, the manufacturing costs of organic electronic devices can be higher, making them less competitive in terms of pricing. Achieving economies of scale becomes challenging due to the limited market size and the need for significant investments in research, development, and manufacturing infrastructure. However, ongoing advancements and increasing investments in the field are expected to address these limitations and gradually expand the market for organic electronic devices.

Opportunity: Developing new applications in the consumer electronic industry

Organic electronic devices are paving the way for exciting new applications. Flexible displays like foldable smartphones and curved OLED screens are revolutionizing the consumer electronics industry by offering unique form factors and enhanced user experiences. Additionally, organic electronic devices are being utilized to develop smart labels and packaging, enabling features like interactive product information, authentication, and real-time monitoring of product conditions. Another promising application is the integration of organic sensors into various industries, including healthcare, environmental monitoring, and smart homes. These sensors can detect and measure parameters like temperature, humidity, pressure, and chemical concentrations. By combining flexibility, lightweight design, and customizable properties, organic electronic devices drive innovation in multiple sectors and open up new possibilities for advanced electronics. The ongoing research and development efforts in organic electronics are expected to expand the range of applications further and accelerate the market penetration of these promising technologies.

Challenge: Competition from traditional electronic technologies

Organic electronics face stiff competition from traditional electronic technologies, particularly silicon-based electronics. Silicon-based technologies have a significant advantage in terms of their technological maturity and established manufacturing processes. They have been extensively researched, optimized, and commercialized for decades, resulting in high-performance, reliable devices with well-established production yields. In contrast, organic electronics are still in the early stages of development, and their performance and stability are continually being improved. However, organic electronics offer unique advantages such as flexibility, lightweight, and low-cost manufacturing, which make them suitable for specific applications. To overcome the competition, ongoing research and development efforts are focused on improving the performance, stability, and scalability of organic materials and devices and developing new manufacturing techniques. Increasing market demand, technological advancements, and collaborations between industry and academia are expected to drive the growth and adoption of organic electronics, leading to a more competitive position in the electronic devices market.

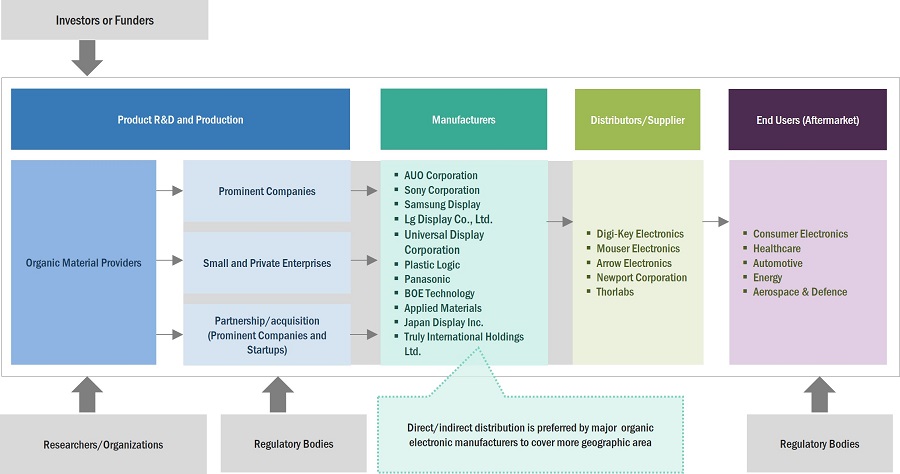

Organic Electronics Market Ecosystem

The organic electronic market ecosystem consists of various entities and components that contribute to developing, producing, distributing, and utilizing organic electronic products. Dominant companies in this market include Merck KGaA (Germany), BASF SE (Germany), Covestro (Germany), DuPont (US), AUO Corporation (Taiwan), Sony Corporation (Japan), Samsung Display (South Korea), LG Display Co., Ltd. (South Korea), Sumitomo Chemical Co., Ltd. (Japan), Universal Display Corporation (US), Konica Minolta, Inc. (Japan), and Novaled GmbH (Germany).

By material, semiconductor material to account for the largest share of the organic electronics market

Semiconductor materials dominate the organic electronics market, accounting for a significant portion of the market share. Semiconductor materials are vital for the fabrication of various organic electronic devices, including OLED displays and organic photovoltaic cells. Semiconductor materials in organic electronics primarily refer to organic semiconductors, which are carbon-based compounds with semiconducting properties, such as polymers. These materials possess the ability to transport charge carriers (electrons or holes) within the device structure. In OLED displays, organic semiconductors are used to create the emissive layers responsible for generating light when an electric current passes through them. These semiconductors enable the precise control of charge carriers, allowing for the production of vibrant colors and efficient light emission. Similarly, in organic photovoltaic cells (OPV), semiconductor materials are crucial for absorbing and converting light energy into electrical energy. Organic semiconductors act as the active layer in OPV devices, capturing photons and generating electron-hole pairs that lead to electricity production.

The dominance of semiconductor materials in the organic electronics market stems from their indispensable role in the functionality of key devices. As a result, research and development efforts continue to focus on optimizing semiconductor materials, improving their charge transport properties, stability, and efficiency to enhance the performance of organic electronic devices.

By application, the display segment is expected to account for the largest share during the forecast period

The display applications represent the largest market segment for organic electronics. The popularity of OLED displays has significantly contributed to the growth of the organic electronics market, particularly in consumer electronic devices like smartphones, televisions, and laptops. OLED displays offer numerous advantages over traditional display technologies, including LCD (Liquid Crystal Display). They provide vibrant colors, high contrast ratios, wide viewing angles, fast response times, and the ability to achieve thin and flexible form factors. These features have made OLED displays increasingly popular among consumers, driving the demand for organic electronic materials and components. OLED displays have witnessed widespread adoption in the smartphone industry, with major manufacturers incorporating them into their flagship devices. The superior image quality, energy efficiency, and slim designs of OLED displays have contributed to their popularity in smartphones.

Additionally, OLED displays have found significant applications in the television industry. The ability to produce deep blacks and vibrant colors, along with the flexibility in design, has led to the production of high-quality OLED televisions. Furthermore, OLED displays have made their way into laptops, tablets, smartwatches, and other wearable devices. OLED displays' lightweight and flexible nature make them ideal for portable devices where form factor and energy efficiency are critical. The growing demand for OLED displays in these various devices has propelled the expansion of the organic electronics market, with display applications being the largest segment. As technology advances, OLED displays are expected to penetrate further into different sectors and drive the growth of the organic electronics market.

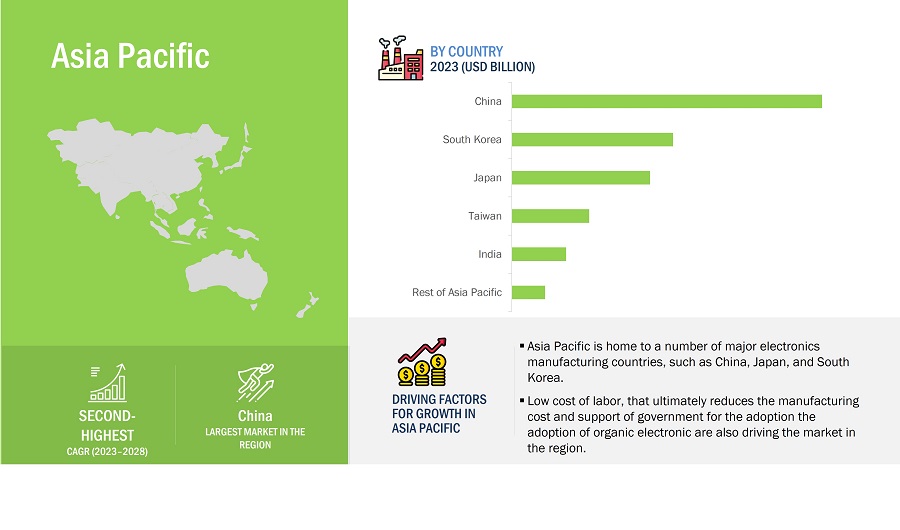

Asia Pacific is projected to account for the largest share of the overall organic electronics market by 2028

Organic Electronics Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific region is the largest market for organic electronics. This is primarily attributed to the presence of major electronics manufacturing countries within the region, including China, Japan, and South Korea. China, in particular, has emerged as a global hub for electronics manufacturing, with a vast consumer base and a well-established supply chain. The country’s large-scale production capabilities and cost-effective manufacturing processes have contributed to its dominance in the organic electronics market. China's robust electronics industry supports the production of a wide range of devices, including smartphones, televisions, and wearable devices, which are major applications for organic electronic components like OLED displays.

On the other hand, Japan has a long-standing reputation for technological innovation and is a major player in the electronics industry. The country has been at the forefront of organic electronics research and development, contributing to advancements in the field. Japanese companies have played a significant role in commercializing organic electronic devices, particularly in display applications. South Korea is another key player in the Asia Pacific organic electronics market. The country is known for its major electronics conglomerates that have significantly contributed to developing and producing organic electronic devices. South Korean companies have been pioneers in the mass production of OLED displays, driving the growth of the organic electronics market.

The strong presence of these electronics manufacturing countries, along with their investment in research and development, infrastructure, and production capabilities, has propelled the Asia Pacific region to become the largest market for organic electronics. The region's dominant position is expected to continue as demand for electronic devices and the adoption of organic electronic technologies further increase in the coming years.

Top Companies of Organic Electronics Market

Merck KGaA (Germany), BASF SE (Germany), Covestro AG (Germany), DuPont (US), AUO Corporation (Taiwan), Sony Corporation (Japan), Samsung Display (South Korea), Lg Display Co., Ltd. (South Korea), Sumitomo Chemical Co., Ltd. (Japan), and Universal Display Corporation (US) are some of the key players in the organic electronics companies.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Billion & Million) |

|

Segments Covered |

By material, application, end-user, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies Covered |

Merck KGaA (Germany), BASF SE (Germany), Covestro (Germany), DuPont (US), AUO Corporation (Taiwan), Sony Corporation (Japan), Samsung Display (South Korea), Lg Display Co., Ltd. (South Korea), Sumitomo Chemical Co., Ltd. (Japan), and Universal Display Corporation (US). Total 25 companies profiled |

Organic Electronics Market Highlights

This research report categorizes the organic electronics market based on material, application, end-user, and region.

|

Segment |

Subsegment |

|

By Material: |

|

|

By Application: |

|

|

By End User: |

|

|

By Region: |

|

Recent Developments

- In June 2023, Kaynemaile, a renowned worldwide provider of architectural mesh solutions for commercial, residential, and public buildings, has chosen Covestro's Makrolon RE for its innovative (resin) RE bio-circular architectural mesh. Makrolon RE, a sustainable polycarbonate material, has been selected by Kaynemaile to enhance their architectural mesh offerings' performance and environmental credentials.

- In May 2023, Merck introduced new silicon dielectrics processed ALD technology, enabling flexible OLEDs in superior display devices. The increasing popularity of free-form devices featuring fully flexible OLED displays highlights a significant trend in data-driven electronics.

- In April 2023, LAPP, a leading provider of integrated cable and connection technology solutions, partnered with BASF to incorporate a new bio-based plastic into their product range. This plastic, known as Organic ETHERLINE, is developed by BASF and offers a sustainable alternative for various cable applications.

- In January 2023, LG Display Co, Ltd. launched advanced automotive displays utilizing their P-OLED and LTPS LCD. The displays will provide enhanced picture quality, high resolution and wide viewing angle. The automotive P-OLED is based on Tandem technology, that uses two organic light emitting layers to offer greater brightness and durability than single-layered OLED.

- In December 2022, AUO Display Technology has partnered with Renovatio-pictures, a Hollywood-based visual effects company, to create a new production solution for the Taiwanese film industry. The solution combines AUO's high-quality display technology with Renovatio-pictures’ expertise in visual effects to create a more immersive and realistic viewing experience for audiences.

Frequently Asked Questions (FAQ):

Who are the key players in the organic electronics market? What are the major growth strategies they had taken to strengthen their position in the market?

Major companies operating in the organic electronics market include Merck KGaA (Germany), BASF SE (Germany), Covestro (Germany), DuPont (US), AUO Corporation (Taiwan), Sony Corporation (Japan), Samsung Display (South Korea), Lg Display Co., Ltd. (South Korea), Sumitomo Chemical Co., Ltd. (Japan), Universal Display Corporation (US), Konica Minolta, Inc. (Japan), and Novaled GmbH (Germany). These companies offer advanced organic Material or organic display panels with a global presence to meet the needs of their customers. Product launches and developments, acquisitions, collaborations, partnerships, and expansions were among the major strategies adopted by these players to compete in the market.

What are the new opportunities for emerging players in the organic electronics market?

Developing new applications in the consumer electronic industry and evolving new cutting-edge technology like micro-LED and mini-LED are some emerging opportunities in the market.

Which application is likely to drive the organic electronics market growth in the next five years?

The display application of organic electronics is poised to be a key market driver in the next five years. This is because OLED displays are becoming increasingly popular in various devices, such as smartphones, TVs, wearables, and laptops.

Which region will likely offer lucrative growth for the organic electronics market by 2028?

Asia Pacific is likely to lead the organic electronics market during the forecast period. Also, the region is expected to witness the highest growth rate between 2023 and 2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing applications of organic light-emitting diode displays- Growing demand for flexible and lightweight electronic devices- Rising demand for displays in automotive and healthcare industries- Growing demand for interactive displays in various applicationsRESTRAINTS- Lower market penetration than traditional inorganic electronics- Deployment of widescreen alternatives such as projectors and screenless displays and emergence of new display conceptsOPPORTUNITIES- Widening application scope in consumer electronics industry- Increasing applications of micro- and mini-LED technologies- Combination of organic electronics with innovative technologiesCHALLENGES- Competition from traditional electronic technologies- High cost associated with new display technology-based products

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) OF OLED DISPLAY PANELSAVERAGE SELLING PRICE (ASP) OF OLED DISPLAY-BASED PRODUCTS OFFERED BY THREE KEY PLAYERS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 TECHNOLOGY ANALYSISIMMERSIVE DISPLAYQUANTUM DOT-OLEDFLEXIBLE AND FOLDABLE DISPLAYMICRO-LEDE-PAPER TECHNOLOGYPROJECTION TECHNOLOGY

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISSYCUAN CASINO RESORT DEPLOYED SAMSUNG’S DIGITAL DISPLAYS TO INCREASE REVENUE BY PROMOTING TIMELY AND RELEVANT MESSAGESSONY HELPED SCIEMENT ENHANCE VISUALIZATION OF CONGENITAL HEART DEFECTS, CEREBRAL ANEURYSMS, AND COMPLEX BLOOD VESSELSPANASONIC HELPED AMU PLAZA KUMAMOTO PROVIDE TIMELY INFORMATION TO CUSTOMERSSAMSUNG HELPED BURT BROTHERS ENHANCE VISUAL EXPERIENCE OF CUSTOMERSSHARP INSTALLED NEW DISPLAY SOLUTION AT EUROLACKE’S OFFICE SPACE TO CREATE MODERN LOOK

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2025

-

5.14 TARIFFS, STANDARDS, AND REGULATIONSTARIFFSSTANDARDS- Global- Europe- Asia Pacific- North AmericaREGULATIONS- North America- Europe- Asia Pacific

-

6.1 INTRODUCTIONSEMICONDUCTOR- Offers numerous advantages over other organic materials- Small molecule- PolymerCONDUCTIVE- Enables efficient transport of charges and enhances performance and functionality of organic electronic devices- Organic- InorganicDIELECTRIC- Plays vital role in electrical insulation in organic electronic devices- Polycarbonate- Poly methyl methacrylate (PMMA)- Polypropylene (PP)- Polyvinyl alcohol (PVA)- Polyethylene terephthalate (PET)SUBSTRATE- Helps build stable foundation for innovative devices- Glass substrate- Plastic substrate- Metal foil

-

7.1 INTRODUCTIONDISPLAY- Organic light-emitting diode- Quantum dot display- Electrochromic- Electroluminescent- ElectrophoreticSYSTEM COMPONENTS- Sensor- Conductive ink- Printed battery- Memory device- Organic radio frequency identification tagLIGHTING- Increasing applications in automotive sectorSOLAR CELLS- Developed for organic photovoltaic cells for solar energy systemsOTHERS- Smart applications- Disposable electronics- Paper substrate- Organic transistor

-

8.1 INTRODUCTIONCONSUMER ELECTRONICS- Integration of OLED displays into smartphones, laptops, and televisionsHEALTHCARE- Rise in demand for wearable devicesAUTOMOTIVE- Growth in demand for OLED displays attributed to enhanced flexibility, lightweight, and excellent energy efficiencyENERGY- Higher demand for flexible and lightweight organic photovoltaic cells than traditional silicon solar cellsAEROSPACE & DEFENSE- Rising focus on using sustainable materialsOTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAIMPACT OF RECESSION ON ORGANIC ELECTRONICS MARKET IN NORTH AMERICAUS- Robust consumer electronics industryCANADA- Increased adoption of displays in food service and transportation industriesMEXICO- Constantly growing consumer electronics and automotive industries

-

9.3 EUROPEIMPACT OF RECESSION ON ORGANIC ELECTRONICS MARKET IN EUROPEUK- Higher demand from smartphone and AR/VR technology developersGERMANY- Increased adoption of OLED displays in automotive sectorFRANCE- Growing aerospace & defense industryITALY- Rising adoption of organic electronics for sustainable developmentSPAIN- Robust automotive and electronics manufacturing sectorsREST OF EUROPE

-

9.4 ASIA PACIFICIMPACT OF RECESSION ON ORGANIC ELECTRONICS MARKET IN ASIA PACIFICCHINA- Supportive government initiatives and growing investments in consumer electronics sectorJAPAN- Presence of key organic material suppliers for organic electronicsSOUTH KOREA- Presence of leading OLED display panel manufacturersTAIWAN- Growing production of display panelsINDIA- Government initiatives to promote sustainable developmentREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLDIMPACT OF RECESSION ON ORGANIC ELECTRONICS MARKET IN ROWMIDDLE EAST & AFRICA- Growing investments in consumer electronics and energy sectorsSOUTH AMERICA- Increasing adoption of large-format displays in outdoor advertising

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

-

10.5 KEY COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSORGANIC ELECTRONICS MARKET: COMPANY FOOTPRINT

-

10.6 STARTUPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.7 COMPETITIVE SCENARIO AND TRENDSORGANIC ELECTRONICS MARKET- Product launches- Deals- Others

-

11.1 KEY PLAYERSMERCK KGAA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBASF SE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCOVESTRO AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDUPONT- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLG DISPLAY CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSUMITOMO CHEMICAL CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsAUO CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsSONY GROUP CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsSAMSUNG DISPLAY- Business overview- Products/Services/Solutions offered- Recent developmentsUNIVERSAL DISPLAY CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments

-

11.2 OTHER PLAYERSKONICA MINOLTA, INC.NOVALED GMBHEVONIK INDUSTRIES AGHELIATEKPOLYICAGC INC.CYNORA GMBHPLASTIC LOGICVISIONOX COMPANYTCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.PANASONICBOE TECHNOLOGY GROUP CO., LTD. (BOE)APPLIED MATERIALS, INC.JAPAN DISPLAY INC.TRULY INTERNATIONAL HOLDINGS LIMITED

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 RECESSION IMPACT ANALYSIS

- TABLE 3 ORGANIC ELECTRONICS MARKET: ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE (ASP) OF OLED DISPLAY-BASED PRODUCTS OFFERED BY THREE KEY PLAYERS (USD)

- TABLE 5 ORGANIC ELECTRONICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 IMPORT DATA FOR HS CODE: 853120, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE: 853120, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 10 ORGANIC ELECTRONICS MARKET: LIST OF KEY PATENTS, 2020–2022

- TABLE 11 ORGANIC ELECTRONICS MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 12 MFN TARIFF FOR PRODUCTS INCLUDED UNDER HS CODE: 853120 EXPORTED BY CHINA

- TABLE 13 ORGANIC ELECTRONICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 14 ORGANIC ELECTRONICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 15 ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 16 ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 17 DISPLAY: ORGANIC ELECTRONICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 18 DISPLAY: ORGANIC ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 19 DISPLAY: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 20 DISPLAY: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 21 DISPLAY: ORGANIC ELECTRONICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 DISPLAY: ORGANIC ELECTRONICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SYSTEM COMPONENTS: ORGANIC ELECTRONICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 24 SYSTEM COMPONENTS: ORGANIC ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 25 SYSTEM COMPONENTS: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 26 SYSTEM COMPONENTS: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 27 SYSTEM COMPONENTS: ORGANIC ELECTRONICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 SYSTEM COMPONENTS: ORGANIC ELECTRONICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 LIGHTING: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 30 LIGHTING: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 31 LIGHTING: ORGANIC ELECTRONICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 LIGHTING: ORGANIC ELECTRONICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 SOLAR CELLS: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 34 SOLAR CELLS: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 35 SOLAR CELLS: ORGANIC ELECTRONICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 SOLAR CELLS: ORGANIC ELECTRONICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 OTHERS: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 38 OTHERS: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 39 OTHERS: ORGANIC ELECTRONICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 OTHERS: ORGANIC ELECTRONICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 42 ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 43 CONSUMER ELECTRONICS: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 44 CONSUMER ELECTRONICS: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 45 HEALTHCARE: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 46 HEALTHCARE: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 AUTOMOTIVE: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 48 AUTOMOTIVE: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 49 ENERGY: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 ENERGY: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 AEROSPACE & DEFENSE: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 52 AEROSPACE & DEFENSE: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 53 OTHERS: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 54 OTHERS: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 ORGANIC ELECTRONICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 ORGANIC ELECTRONICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: ORGANIC ELECTRONICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: ORGANIC ELECTRONICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: ORGANIC ELECTRONICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: ORGANIC ELECTRONICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 65 US: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 US: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 US: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 68 US: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 69 CANADA: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 70 CANADA: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 CANADA: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 72 CANADA: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 73 EUROPE: ORGANIC ELECTRONICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 74 EUROPE: ORGANIC ELECTRONICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 EUROPE: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 76 EUROPE: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 EUROPE: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 78 EUROPE: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 79 EUROPE: ORGANIC ELECTRONICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 80 EUROPE: ORGANIC ELECTRONICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 81 UK: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 82 UK: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 UK: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 84 UK: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 85 GERMANY: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 GERMANY: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 GERMANY: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 88 GERMANY: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 89 FRANCE: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 FRANCE: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 FRANCE: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 92 FRANCE: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: ORGANIC ELECTRONICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: ORGANIC ELECTRONICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: ORGANIC ELECTRONICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: ORGANIC ELECTRONICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 101 CHINA: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 102 CHINA: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 CHINA: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 104 CHINA: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 105 JAPAN: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 JAPAN: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 JAPAN: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 108 JAPAN: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 109 SOUTH KOREA: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 SOUTH KOREA: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 112 SOUTH KOREA: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 113 ROW: ORGANIC ELECTRONICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 114 ROW: ORGANIC ELECTRONICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 ROW: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 116 ROW: ORGANIC ELECTRONICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 ROW: ORGANIC ELECTRONICS MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 118 ROW: ORGANIC ELECTRONICS MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 119 ROW: ORGANIC ELECTRONICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 120 ROW: ORGANIC ELECTRONICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 121 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ORGANIC MATERIAL MARKET

- TABLE 122 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ORGANIC DISPLAY MARKET

- TABLE 123 ORGANIC ELECTRONICS MARKET: DEGREE OF COMPETITION (ORGANIC MATERIAL PROVIDERS)

- TABLE 124 ORGANIC ELECTRONICS MARKET: DEGREE OF COMPETITION (ORGANIC DISPLAY PROVIDERS)

- TABLE 125 COMPANY FOOTPRINT

- TABLE 126 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 127 COMPANY FOOTPRINT, BY END USER

- TABLE 128 COMPANY FOOTPRINT, BY REGION

- TABLE 129 ORGANIC ELECTRONICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 130 ORGANIC ELECTRONICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 131 ORGANIC ELECTRONICS MARKET: PRODUCT LAUNCHES (MAY 2019– MAY 2023)

- TABLE 132 ORGANIC ELECTRONICS MARKET: DEALS (AUGUST 2019–JUNE 2023)

- TABLE 133 ORGANIC ELECTRONICS MARKET: OTHERS (AUGUST 2019–MARCH 2022)

- TABLE 134 MERCK KGAA: COMPANY OVERVIEW

- TABLE 135 MERCK KGAA: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 136 MERCK KGAA: PRODUCT LAUNCHES

- TABLE 137 MERCK KGAA: DEALS

- TABLE 138 MERCK KGAA: OTHERS

- TABLE 139 BASF SE: COMPANY OVERVIEW

- TABLE 140 BASF SE: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 141 BASF SE: PRODUCT LAUNCHES

- TABLE 142 BASF SE: DEALS

- TABLE 143 BASF SE: OTHERS

- TABLE 144 COVESTRO AG: COMPANY OVERVIEW

- TABLE 145 COVESTRO AG: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 146 COVESTRO AG: PRODUCT LAUNCHES

- TABLE 147 COVESTRO AG: DEALS

- TABLE 148 COVESTRO AG: OTHERS

- TABLE 149 DUPONT: COMPANY OVERVIEW

- TABLE 150 DUPONT: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 151 DUPONT: DEALS

- TABLE 152 DUPONT: OTHERS

- TABLE 153 LG DISPLAY CO., LTD.: COMPANY OVERVIEW

- TABLE 154 LG DISPLAY CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 155 LG DISPLAY CO., LTD.: PRODUCT LAUNCHES

- TABLE 156 LG DISPLAY CO., LTD.: DEALS

- TABLE 157 LG DISPLAY CO., LTD.: OTHERS

- TABLE 158 SUMITOMO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 159 SUMITOMO CHEMICAL CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 160 SUMITOMO CHEMICAL CO., LTD.: PRODUCT LAUNCHES

- TABLE 161 SUMITOMO CHEMICAL CO., LTD.: OTHERS

- TABLE 162 AUO CORPORATION: COMPANY OVERVIEW

- TABLE 163 AUO CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 164 AUO CORPORATION: PRODUCT LAUNCHES

- TABLE 165 AUO CORPORATION: DEALS

- TABLE 166 SONY GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 167 SONY GROUP CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 168 SONY GROUP CORPORATION: PRODUCT LAUNCHES

- TABLE 169 SONY GROUP CORPORATION: DEALS

- TABLE 170 SAMSUNG DISPLAY: COMPANY OVERVIEW

- TABLE 171 SAMSUNG DISPLAY: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 172 SAMSUNG DISPLAY: PRODUCT LAUNCHES

- TABLE 173 UNIVERSAL DISPLAY CORPORATION: COMPANY OVERVIEW

- TABLE 174 UNIVERSAL DISPLAY CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 175 UNIVERSAL DISPLAY CORPORATION: DEALS

- TABLE 176 UNIVERSAL DISPLAY CORPORATION: OTHERS

- FIGURE 1 ORGANIC ELECTRONICS MARKET: SEGMENTATION

- FIGURE 2 ORGANIC ELECTRONICS MARKET: REGIONAL SCOPE

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 RESEARCH APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE ANALYSIS)–REVENUE GENERATED BY COMPANIES FROM ORGANIC ELECTRONICS MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE ANALYSIS)—SHARE OF ORGANIC ELECTRONICS APPLICATIONS

- FIGURE 8 BOTTOM-UP APPROACH

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 ORGANIC ELECTRONICS MARKET, 2019–2028 (USD MILLION)

- FIGURE 12 LIGHTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 SEMICONDUCTOR SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 14 HEALTHCARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC HELD LARGEST MARKET SHARE IN 2022

- FIGURE 16 INCREASING DEMAND FOR ORGANIC ELECTRONICS FROM DISPLAY MANUFACTURERS

- FIGURE 17 SEMICONDUCTOR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 18 DISPLAY SEGMENT TO WITNESS HIGHEST GROWTH FROM 2023 TO 2028

- FIGURE 19 SENSOR SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 20 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 21 ORGANIC ELECTRONICS MARKET IN ASIA PACIFIC TO WITNESS HIGH GROWTH FROM 2023 TO 2028

- FIGURE 22 ORGANIC ELECTRONICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 ORGANIC ELECTRONICS MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 24 ORGANIC ELECTRONICS MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 25 ORGANIC ELECTRONICS MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 26 ORGANIC ELECTRONICS MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 27 ORGANIC ELECTRONICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 ORGANIC ELECTRONICS MARKET: ECOSYSTEM

- FIGURE 29 AVERAGE SELLING PRICE (ASP) OF OLED DISPLAY-BASED PRODUCTS OFFERED BY THREE KEY PLAYERS

- FIGURE 30 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN ORGANIC ELECTRONICS MARKET

- FIGURE 31 ORGANIC ELECTRONICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 35 IMPORT DATA FOR HS CODE: 853120, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 36 EXPORT DATA FOR HS CODE: 853120, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 37 ORGANIC ELECTRONICS MARKET: PATENTS GRANTED, 2013–2022

- FIGURE 38 REGIONAL ANALYSIS OF GRANTED PATENTS, 2013–2022

- FIGURE 39 ORGANIC ELECTRONICS MARKET, BY MATERIAL

- FIGURE 40 SEMICONDUCTOR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 41 ORGANIC ELECTRONICS MARKET, BY APPLICATION

- FIGURE 42 LIGHTING SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 SENSOR SEGMENT TO ACCOUNT LARGEST SHARE OF ORGANIC ELECTRONICS MARKET FOR SYSTEM COMPONENTS IN 2028

- FIGURE 44 ORGANIC ELECTRONICS MARKET, BY END USER

- FIGURE 45 CONSUMER ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 46 ORGANIC ELECTRONICS MARKET, BY REGION

- FIGURE 47 CANADA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 49 IMPACT OF RECESSION ON ORGANIC ELECTRONICS MARKET IN NORTH AMERICA

- FIGURE 50 NORTH AMERICA: ORGANIC ELECTRONICS MARKET SNAPSHOT

- FIGURE 51 IMPACT OF RECESSION ON ORGANIC ELECTRONICS MARKET IN EUROPE

- FIGURE 52 EUROPE: ORGANIC ELECTRONICS MARKET SNAPSHOT

- FIGURE 53 IMPACT OF RECESSION ON ORGANIC ELECTRONICS MARKET IN ASIA PACIFIC

- FIGURE 54 ASIA PACIFIC: ORGANIC ELECTRONICS MARKET SNAPSHOT

- FIGURE 55 IMPACT OF RECESSION ON ORGANIC ELECTRONICS MARKET IN ROW

- FIGURE 56 ROW: ORGANIC ELECTRONICS MARKET SNAPSHOT

- FIGURE 57 ORGANIC MATERIAL PROVIDERS IN ORGANIC ELECTRONICS MARKET: MARKET SHARE ANALYSIS (2022)

- FIGURE 58 ORGANIC DISPLAY PROVIDERS IN ORGANIC ELECTRONICS MARKET: MARKET SHARE ANALYSIS (2022)

- FIGURE 59 ORGANIC MATERIAL PROVIDERS FOR ORGANIC ELECTRONICS MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS (2018–2022)

- FIGURE 60 ORGANIC DISPLAY PROVIDERS FOR ORGANIC ELECTRONICS MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS (2018–2022)

- FIGURE 61 ORGANIC ELECTRONICS MARKET (GLOBAL): KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 62 ORGANIC ELECTRONICS MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 63 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 64 BASF SE: COMPANY SNAPSHOT

- FIGURE 65 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 66 DUPONT: COMPANY SNAPSHOT

- FIGURE 67 LG DISPLAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 68 SUMITOMO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 69 AUO CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 UNIVERSAL DISPLAY CORPORATION: COMPANY SNAPSHOT

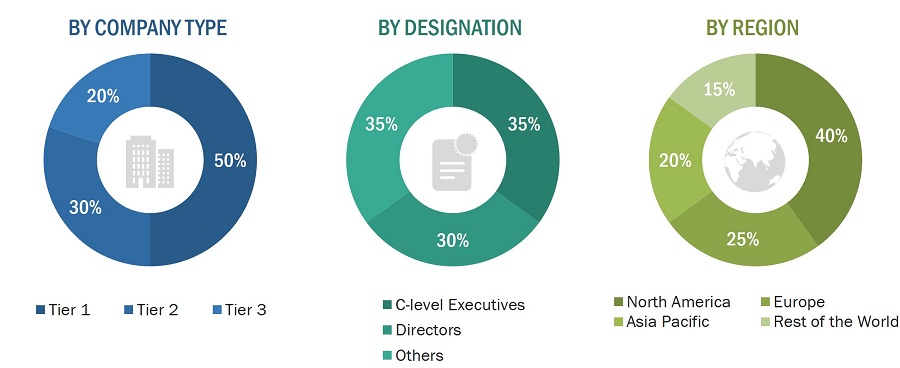

The study involved four major activities in estimating the organic electronics market size. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the organic electronics market. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the organic electronics market has been obtained from the secondary data available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry's supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends and key developments undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information about the market across four main regions—Asia Pacific, North America, Europe, and the Rest of the World (the Middle East & Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and other related key executives from major companies and organizations operating in the organic electronic market or related markets.

After completing market engineering, primary research was conducted to gather information and verify and validate critical numbers from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most primary interviews have been conducted with the market's supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

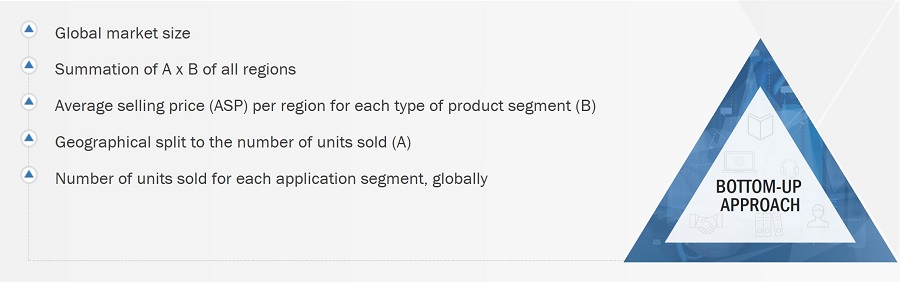

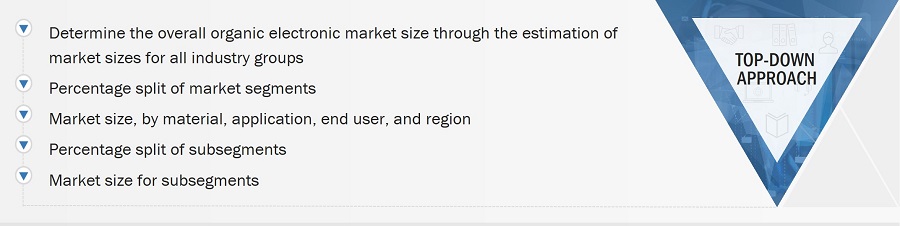

In the complete engineering process, both top-down and bottom-up approaches and several data triangulation methods have been used to estimate and validate the size of the overall organic electronics market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market positions in the respective geographies have been determined through both primary and secondary research. This entire procedure includes studying top market players' annual and financial reports and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights (qualitative and quantitative).

All percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Global Organic Electronics Market Size: Bottom-Up Approach

Global Organic Electronics Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation has been employed to complete the market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

The organic electronics market refers to the global market for electronic devices and components based on organic materials. Organic electronics utilize organic compounds, such as polymers and small molecules, as conductive or semiconductive materials. These materials offer unique properties, such as flexibility, lightweight design, and low power consumption, making them suitable for various applications. The market encompasses various organic electronic devices, including organic light-emitting diode (OLED) displays, organic solar cells, organic transistors, and sensors. It includes the production, distribution, and adoption of these devices across various end-use industries such as consumer electronics, automotive, healthcare, and others. The organic electronics market is characterized by ongoing advancements in organic materials, manufacturing techniques, and applications and increasing demand for energy-efficient and environmentally friendly electronic solutions.

Key Stakeholders

- Raw materials and manufacturing equipment suppliers

- Electronic Design Automation (EDA) and Design tool vendors

- Integrated Device Manufacturers (IDMs)

- Organic electronics foundry members

- Organic electronics intellectual property players

- Organic electronics technology platform developers

- Organic electronics semiconductor device manufacturers

- Organic electronics component manufacturers

- Organic Electronics Product Manufacturers (ODMs)

- Organic Electronics Original Equipment Manufacturers (OEMs)

- ODM and OEM technology solution providers

- Assembly, Testing, and Packaging vendors

- Distributors and traders

- Research organizations

- Organizations, forums, alliances, and associations

Report Objectives

- To define, describe, and forecast the organic electronics market based on material, application, end-user, and geography

- To forecast the market size, in terms of value, for various segments with regard to four main regions, namely, North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To understand and analyze the impact of evolving technologies on the overall value chain of the organic electronics market and upcoming trends in the ecosystem

- To highlight the impact of porter's five forces on the organic electronic ecosystem and analyze the underlying market opportunities

- To analyze the associated use cases in the organic electronic business and their impact on the business strategies adopted by key players

- To provide key industry trends and associated important regulations impacting the global organic electronics market

- To strategically analyze the micromarkets with respect to the individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high growth segments of the global organic electronics market

- To forecast and compare the market size of pre-recession with that of the post-recession at global, and regional levels

- To strategically profile the key players and comprehensively analyze their market shares and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as joint ventures, mergers and acquisitions, new product developments, expansions, and research & development in the global organic electronics market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5 players) based on various blocks of the supply chain

Growth opportunities and latent adjacency in Organic Electronics Market