Oryzenin Market by Type (Isolates, Concentrates), Application (Bakery & Confectionery, Meat Analogs & Extenders, Sports & Energy Nutrition, Dairy Alternatives, Beverages), Form (Dry, Liquid), and Region - Global Forecast to 2022

[119 Pages Report] The oryzenin market stood at USD 79.36 million in 2015; it is projected to grow at a CAGR of 14.5% from 2016, to reach USD 198.25 million by 2022. The base year considered for the study is 2015 and the forecast period is from 2016 to 2022. The main objective of the report is to define, segment, and project the global market size for oryzenin on the basis of type, application, form, and region. It also helps to understand the structure of the oryzenin market by identifying its various segments. The other objectives include analyzing the opportunities in the market for stakeholders and providing a competitive landscape of market trends, analyzing the macro- and micro-indicators of this market, and projecting the size of the oryzenin market and its submarkets, in terms of value as well as volume.

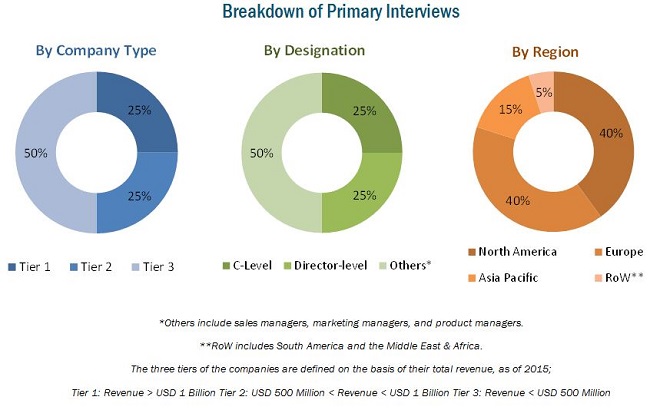

This report includes estimations of the market size in terms of value (USD million) and volume (tons). Both, the top-down and bottom-up approaches have been used to estimate and validate the size of the oryzenin market and to estimate the size of various other dependent submarkets in the overall market. The key players in the market have been identified through secondary research; some of these sources are press releases, paid databases such as Factiva and Bloomberg, annual reports, and financial journals; their market shares in respective regions have also been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. The figure below shows the breakdown of profiles of industry experts that participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the oryzenin market are manufacturers, oryzenin manufacturers, distributors & suppliers, associations and industry bodies, and end users. The key players profiled include Axiom Foods, Inc. (US), AIDP Inc. (US), RiceBran Technologies (US), Kerry Group plc (Ireland), and BENEO GmbH (Germany). The other players of the oryzenin market are Ribus, Inc. (US), Green Labs LLC (US), Golden Grain Group Limited (China), Shaanxi Fuheng (FH) Biotechnology Co., Ltd. (China), and Bioway (Xian) Organic Ingredients Co., Ltd. (China).

This report is targeted at the existing stakeholders in the industry, which include the following:

- Supply side: Oryzenin manufacturers, suppliers, formulators, traders, distributors, and suppliers

- Demand side: Plant protein manufacturers, food processing industries, whey producers, large sports drink manufacturing companies, and researchers

- Regulatory side: Organizations such as the Food and Drug Administration (FDA), European Food Safety Authority (EFSA), United States Department of Agriculture (USDA), and Food Standards Australia New Zealand (FSANZ)

The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.

Scope of the Report

On the basis of type, the oryzenin market has been segmented as follows:

- Isolates

- Concentrates

- Others (hydrolysates and ion exchange)

On the basis of application, the oryzenin market has been segmented as follows:

- Sports & energy nutrition

- Beverages

- Dairy alternatives

- Bakery & confectionery

- Meat analogs & extenders

- Others (soups, sauces, salad dressings, spices, pasta, frozen fruits, breakfast foods, flavor enhancements & savory flavors, and infant formula)

On the basis of function (qualitative), the oryzenin market has been segmented as follows:

- Emulsifying

- Texturizing

- Gelling

- Foaming

- Others (solubility, water binding, and viscosity)

On the basis of form, the oryzenin market has been segmented as follows:

- Dry

- Liquid

On the basis of region, the oryzenin market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Segment Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia Pacific oryzenin market, by country

- Further breakdown of the Rest of Europe oryzenin market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The oryzenin market is projected to grow at a CAGR of 14.5%, to reach a value of USD 198.25 million by 2022 from an estimated USD 88.19 million in 2016. Oryzenin, a rice glutelin, is an important constituent of rice protein. Glutelin comprises the major protein fraction of the rice grain and constitutes up to 80% of the total protein. The global market is estimated at USD 88.2 million in 2016 and is projected to reach USD 198.2 million by 2022, at a CAGR of 14.5% during the forecast period. The primary factors that drive the oryzenin market are the functional properties of rice protein and growth in the consumption of plant protein.

On the basis of application, the oryzenin market was led by sports & energy nutrition, followed by beverages, in 2015. Sports & energy nutrition was the leading segment, owing to the increase in the consumption of sports & energy drinks due to the trend of healthy living among consumers. The application of oryzenin in sports & energy nutrition is attributed to its high amino acid profile and branched chain amino acids (BCAAs), which are essential for athletes and bodybuilders for muscle recovery. Oryzenin increased lean body mass skeletal muscle hypertrophy, power, and strength similar to whey protein. This segment has potential for growth in the near future, with increasing application of oryzenin as a nutrition enhancer in food products.

On the basis of form, the dry segment accounted for a larger market share in 2015. The dry form dominated the oryzenin market as it is easy to handle and can be transported easily with lower expenses, which has increased the demand for dry oryzenin powder. In addition, the liquid form needs further processing to be extracted from the dry form, thus increasing the investment.

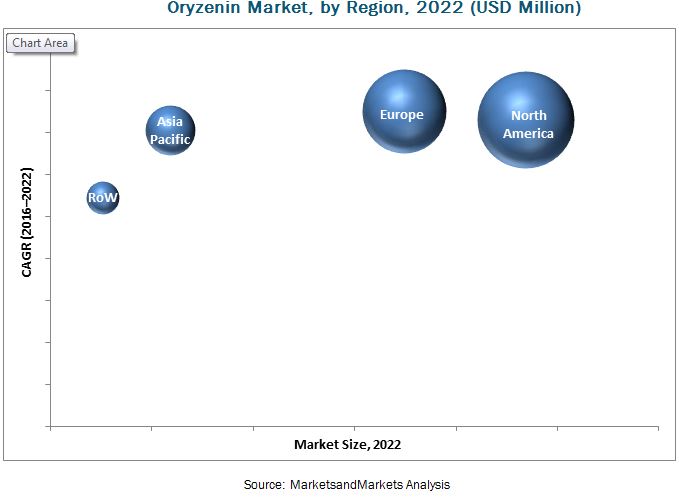

The North American region accounted for the major market share for oryzenin between 2016 and 2022. The rise in demand for processed food & beverage products and various nutraceutical products in the North American region is driving the oryzenin market, as it provides all the essential amino acids. The increase in the application of plant-based proteins in nutraceuticals, food & beverages, and health supplements is projected to fuel the market growth for oryzenin in the next few years.

The major restraints in the oryzenin market are the low consumer awareness about oryzenin proteins and limited R&D activity, with the market for oryzenin being in the nascent stage of development. The global oryzenin market is highly fragmented, with a few multinational companies accounting for a majority share and the rest operating in an unorganized market. The oryzenin market in developed countries is projected to witness a huge growth in demand with the increasing awareness toward plant protein and growing product availability and applications.

The key players in the oryzenin market are Axiom Foods, Inc. (US), AIDP Inc. (US), RiceBran Technologies (US), Kerry Group plc (Ireland), and BENEO GmbH (Germany). The other players of the oryzenin market are Ribus, Inc. (US), Green Labs LLC (US), Golden Grain Group Limited (China), Shaanxi Fuheng (FH) Biotechnology Co., Ltd. (China), and Bioway (Xian) Organic Ingredients Co., Ltd. (China).

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered for the Study

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

1.8 Limitations

2 Research Methodology (Page No. - 16)

2.1 Introduction

2.2 Research Data

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primaries

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Opportunities in this Market

4.2 Key Oryzenin Markets

4.3 Market, By Type

4.4 Europe: Market, By Application & Country

4.5 Market, By Form & Region

4.6 Developed vs Emerging Oryzenin Markets

4.7 Life Cycle Analysis: Market, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.2.3 By Form

5.2.4 By Function (Qualitative)

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Rice Protein Due to Its Functional Properties

5.3.1.2 Cost-Effective Production of Plant Protein

5.3.1.3 Organic Rice Protein Helps Manufacturers With the Product Label Regulations

5.3.1.4 Growing Health Consciousness of Consumers

5.3.1.5 Increase in Demand for Plant Proteins

5.3.1.6 Increase in Applications of Rice Protein

5.3.2 Restraints

5.3.2.1 Rice Protein Still at Development Stage

5.3.2.2 Low Consumer Awareness About Rice Proteins

5.3.3 Opportunities

5.3.3.1 Rice Protein Can Meet the Needs of Consumers Looking for Non-Allergen, Lactose-Free, and Gluten-Free Source of Protein

5.3.4 Challenges

5.3.4.1 Competition From Other Plant Proteins Existing in the Market

5.4 Value Chain Analysis

6 Oryzenin Market, By Type (Page No. - 44)

6.1 Introduction6.2 Isolates

6.3 Concentrates

6.4 Other Types

7 Oryzenin Market, By Application (Page No. - 49)

7.1 Introduction7.2 Sports & Energy Nutrition

7.3 Beverages

7.4 Bakery & Confectionery

7.5 Meat Analogs & Extenders

7.6 Dairy Alternatives

7.7 Other Applications

8 Oryzenin Market, By Form (Page No. - 57)

8.1 Introduction8.2 Dry

8.3 Liquid

9 Oryzenin Market, By Function (Page No. - 62)

9.1 Introduction 9.2 Emulsifying

9.3 Texturing

9.4 Gelling

9.5 Foaming

10 Oryzenin Market, By Region (Page No. - 65)

10.1 Introduction 10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 France

10.3.2 Germany

10.3.3 U.K.

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 Australia

10.4.4 India

10.4.5 Indonesia

10.4.6 Vietnam

10.4.7 Rest of Asia-Pacific

10.5 RoW

10.5.1 South America

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 92)

11.1 Overview

11.2 Market Share Analysis of the Oryzenin Market

11.3 Competitive Situations & Trends

12 Company Profiles (Page No. - 96)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Introduction

12.2 Axiom Foods, Inc.

12.3 AIDP, Inc.

12.4 Ricebran Technologies, Inc.

12.5 Beneo GmbH

12.6 Kerry Group PLC

12.7 Ribus, Inc.

12.8 The Green Labs LLC

12.9 Golden Grain Group Limited

12.10 Shaanxi Fuheng (FH) Biotechnology Co., Ltd

12.11 Bioway (XI'an) Organic Ingredients Co., Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 109)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Intelligenece

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (63 Tables)

Table 1 Oryzenin Market Snapshot

Table 2 Plant Protein Production vs Animal Protein Production

Table 3 Market Size, By Type, 20142022 (USD Thousand)

Table 4 Market Size, By Type, 20142022 (Tons)

Table 5 Isolates Market Size, By Region, 20142022 (USD Thousand)

Table 6 Concentrates Market Size, By Region, 20142022 (USD Thousand)

Table 7 Other Types Market Size, By Region, 20142022 (USD Thousand)

Table 8 Market Size, By Application, 20142022 (USD Thousand)

Table 9 Market Size For Oryzenin, By Application, 20142022 (Tonnes)

Table 10 Oryzenin in Sports & Energy Nutrition Market Size, By Region, 20142022 (USD Thousand)

Table 11 Oryzenin in Beverages Market Size, By Region, 20142022 (USD Thousand)

Table 12 Oryzenin in Bakery & Confectionery Market Size, By Region, 20142022 (USD Thousand)

Table 13 Oryzenin in Meat Analogs & Extenders Market Size, By Region, 20142022 (USD Thousand)

Table 14 Oryzenin in Dairy Alternatives Market Size, By Region, 20142022 (USD Thousand)

Table 15 Oryzenin in Other Applications Market Size, By Region, 20142022 (USD Thousand)

Table 16 Market Size, By Form, 20142022 (USD Thousand)

Table 17 Market Size For Oryzenin, By Form, 20142022 (Tons)

Table 18 Dry Form: Market Size For Oryzenin, By Region, 20142022 (USD Thousand)

Table 19 Dry Form: Market Size For Oryzenin, By Region, 20142022 (Tons)

Table 20 Liquid Form: Market Size For Oryzenin, By Region, 20142022 (USD Thousand)

Table 21 Liquid Form: Market Size For Oryzenin, By Region, 20142022 (Tons)

Table 22 Market Size, By Region, 20142022 (USD Thousand)

Table 23 Market Size For Oryzenin, By Region, 20142022 (Tons)

Table 24 North America: Market Size, By Country, 20142022 (USD Thousand)

Table 25 North America: Market Size For Oryzenin, By Country, 20142022 (Tons)

Table 26 North America: Market Size, By Type, 20142022 (USD Thousand)

Table 27 North America: Market Size For Oryzenin, By Application, 20142022 (USD Thousand)

Table 28 North America: Market Size For Oryzenin, By Form, 20142022 (USD Thousand)

Table 29 U.S.: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 30 Canada: Market Size, By Type, 20142022 (USD Thousand)

Table 31 Mexico: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 32 Europe: Market Size, By Country, 20142022 (USD Thousand)

Table 33 Europe: Market Size For Oryzenin, By Country, 20142022 (Tons)

Table 34 Europe: Market Size, By Type, 20142022 (USD Thousand)

Table 35 Europe: Market Size For Oryzenin, By Application, 20142022 (USD Thousand)

Table 36 Europe: Market Size For Oryzenin, By Form, 20142022 (USD Thousand)

Table 37 France: Market Size, By Type, 20142022 (USD Thousand)

Table 38 Germany: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 39 U.K.: Market Size, By Type, 20142022 (USD Thousand)

Table 40 Italy: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 41 Spain: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 42 Rest of Europe: Market Size, By Type, 20142022 (USD Thousand)

Table 43 Asia-Pacific: Market Size For Oryzenin, By Country, 20142022 (USD Thousand)

Table 44 Asia-Pacific: Market Size For Oryzenin, By Country, 20142022 (Tons)

Table 45 Asia-Pacific: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 46 Asia-Pacific: Market Size For Oryzenin, By Application, 20142022 (USD Thousand)

Table 47 Asia-Pacific: Market Size For Oryzenin, By Form, 20142022 (USD Thousand)

Table 48 China: Market Size, By Type, 20142022 (USD Thousand)

Table 49 Japan: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 50 Australia: Market Size, By Type, 20142022 (USD Thousand)

Table 51 India: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 52 Indonesia: Market Size, By Type, 20142022 (USD Thousand)

Table 53 Vietnam: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 54 Rest of Asia-Pacific: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 55 RoW: Market Size, By Country, 20142022 (USD Thousand)

Table 56 RoW: Market Size For Oryzenin, By Country, 20142022 (Tons)

Table 57 RoW: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 58 RoW: Market Size For Oryzenin, By Application, 20142022 (USD Thousand)

Table 59 RoW: Market Size For Oryzenin, By Form, 20142022 (USD Thousand)

Table 60 South America: Market Size, By Type, 20142022 (USD Thousand)

Table 61 Middle East: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 62 Africa: Market Size For Oryzenin, By Type, 20142022 (USD Thousand)

Table 63 Developments in Market, 20112016

List of Figures (34 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Isolates Segment to Dominate the Oryzenin Market Through 2022

Figure 7 Sports & Energy Nutrition Application is Projected to Be the Fastest-Growing Segment in the Oryzenin Market Through 2022

Figure 8 Dry Form to Dominate the Oryzenin Market Through 2022

Figure 9 North America is Estimated to Dominate the Oryzenin Market in 2016

Figure 10 Overall Oryzenin Market, 2016 vs 2022

Figure 11 Europe to Register the Highest CAGR From 2016 to 2022

Figure 12 North America is Estimated to Dominate the Oryzenin Market, By Type, in 2016

Figure 13 Sports & Energy Nutrition Segment is Expected to Dominate the European Oryzenin Market in 2016

Figure 14 Dry Form Segment is Projected to Dominate the Oryzenin Market in 2016

Figure 15 Developed Countries are Projected to Be the Most Attractive Markets for Oryzenin Through 2022

Figure 16 Europe is Projected to Grow at the Highest Rate From 2016 to 2022

Figure 17 Market, By Type

Figure 18 Market For Oryzenin, By Application

Figure 19 Market For Oryzenin, By Form

Figure 20 Market For Oryzenin, By Function

Figure 21 Market For Oryzenin, By Region

Figure 22 Rising Demand From the Food & Beverage Industry is the Key Driver of the Oryzenin Market

Figure 23 Biological Values of Common Proteins

Figure 24 Plant Protein Ingredients Market Share (Value), 2012

Figure 25 Value Chain Analysis: Major Value is Added During Manufacturing and Assembly

Figure 26 Market Size For Oryzenin, By Type, 2016 vs 2022 (USD Thousand)

Figure 27 Sports & Energy Drinks is Projected to Be the Fastest-Growing Segment in the Oryzenin Market From 2016 to 2022

Figure 28 Market Size For Oryzenin, By Form, 2016 vs 2022 (USD Thousand)

Figure 29 Regional Snapshot (2015): the Markets in Europe and Asia-Pacific are Emerging as New Hotspots

Figure 30 North America: Market Snapshot

Figure 31 Europe: Market Snapshot

Figure 32 Asia-Pacific: Market Snapshot

Figure 33 Expansions & New Product Launches Were the Key Growth Strategies Adopted Between 2011 and 2016

Figure 34 Market Share, By Key Player, 2015

Growth opportunities and latent adjacency in Oryzenin Market