Plant-based Meat Market by Source (Soy, Wheat, Blends, Pea), Product (Burger Patties, Strips & Nuggets, Sausages, Meatballs), Type (Beef, Chicken, Pork, Fish), Distribution Channel, Storage and Region - Global Forecast to 2027

Plant-based Meat Market Growth Opportunities and Forecast

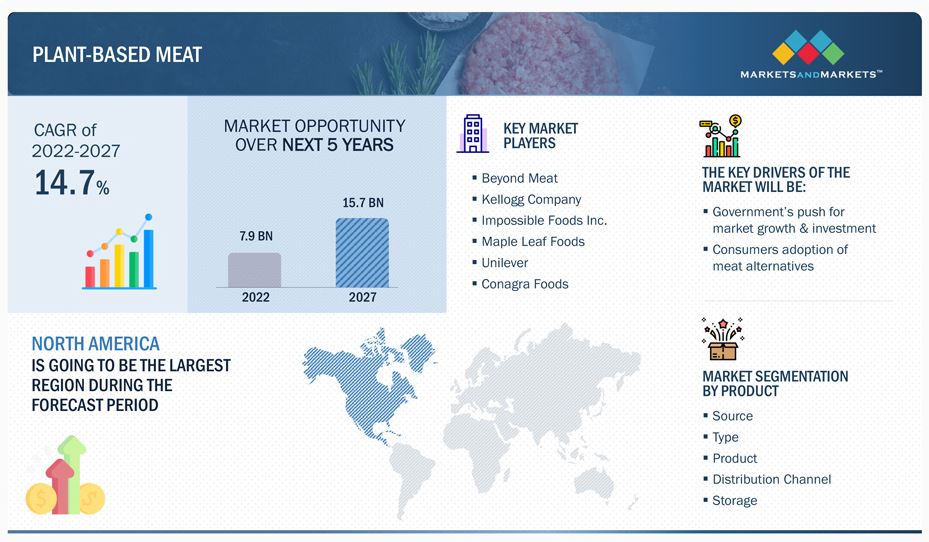

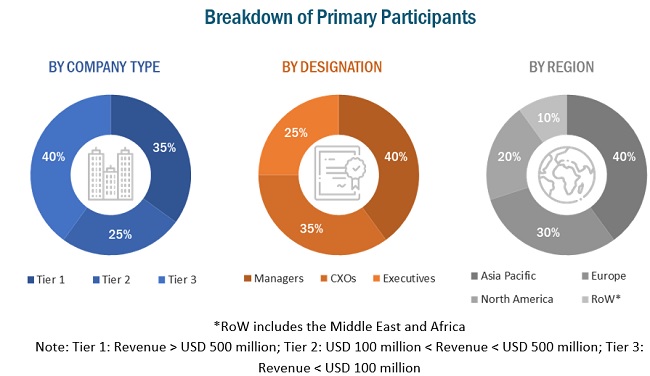

With a CAGR of 14.7% during the forecast period, the global plant-based meat market is anticipated to grow from USD 7.9 billion in 2022 to USD 15.7 billion in 2027. Plant-based food products are gaining widespread popularity. The plant-based trend continues to grow, encouraging people to eat more fruits, vegetables, legumes, nuts, and seeds.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics of Plant-based Meat Market

Drivers: Growth in government initiatives and significant investment

Government bodies across various countries are promoting the consumption of plant-based meat substitutes, owing to the health benefits offered by these products and the environmental concerns associated with animal-based meat. Also, government bodies are actively investing in research and product development activities for plant-based meat.

In latest development in August 2022, the US Department of Agriculture (USDA) has said that the market for Plant based meat is growing. Researchers at Germany’s TU Berlin and Karlsruhe Institute of Technology (KIT) are working on production methods for plant-based meat in a project named “Texturing Mechanisms in the Wet Extrusion of Soy and Pea Protein.”

Restraints: High price of products in comparison to traditional meat

Price is one of the major restraining factors in the plant-based meat market. Plant-based meat is uneconomical compared to animal-based meat, which is likely to impact its growth in price-sensitive markets, such as India, China, and South Africa. Companies offering plant-based meat alternatives are trying to reduce prices, as their high price over conventional meat hinders the rapidly growing plant-based industry.

Opportunities: Increase in consumers’ focus on meat alternatives

Various food products such as meat patties and sausages are being replaced by plant-based/plant-infused meat products, considering the growing health awareness among consumers, which is expected to drive demand for plant-based meat products. According to The Food Science and Health Database Organization, in 2018, “22 million UK citizens now identify as being a ‘flexitarian,’ viewed not as a fad diet, but instead, a permanent lifestyle choice, notably most popular among highly influential millennials.” Thus, the increasing vegan and flexitarian population is a big opportunity for plant-based meat manufacturers in the industry during the forecast period.

Challenges: Perception regarding the taste of plant-based meat products

Consumers perceive that there is a significant compromise in taste if they opt for meat substitutes. For instance, the off flavor of soy protein makes it undesirable for consumption. The off-flavor is caused by compounds such as aldehydes, ketones, furans, and alcohol. Medium-chain aldehydes are among the major reasons for soy products' beany and grassy taste.

By source, the wheat segment is estimated to hold the second-largest share of the plant-based meat market in 2022

Based on the source, the wheat segment is estimated to occupy the second-largest market share in the plant-based meat market. Various factors are responsible for the significant popularity of wheat as an alternative meat source. Wheat is among the most consumed cereal grains at a global level and is a source of antioxidants, vitamins, minerals, and fiber.

It is a vegetarian meat substitute and ingredient in various plant-based meat products, such as burgers, sausages, nuggets, and deli slices. Thus, leading players in the market are incorporating wheat as an ingredient in their plant-based products, making it one of the most popular sources in the market.

By type, the chicken segment is expected to grow at a significant CAGR in the plant-based meat market

Based on the type, the chicken segment is expected to grow at a significant CAGR by 2027 in terms of value. Chicken is popular meat globally and is a major ingredient in various strips, nuggets, cutlets, and burger patties. Thus, plant-based meat alternative for chicken is in high demand. Therefore, products developed by many food companies offer plant-based chicken in various forms, such as strips, nuggets, cutlets, and burger patties, which further cater to the rising demand for plant-based chicken meat. One of the major reasons for high chicken consumption is its protein constitution. The protein content in plant-based meat chicken products is about the same, while the other nutrients may vary, making it the perfect substitute for vegan consumers.

By product, the strips & nuggets segment is projected to occupy the second-largest market share during the forecast period

By product, the strips & nuggets segment is projected to occupy the second-largest market share in terms of value by 2027 in the plant-based meat market. The demand for strips & nuggets is on the rise because of their taste appeal and consumer popularity, particularly in American and European countries. Thus, due to their rising popularity, several companies are focusing on expanding their product portfolios by incorporating other strips & nuggets made from chickpeas, wheat, soy, corn, rice, and oats. All these factors together are projected to contribute to the market share of this product category by 2027.

The food retail segment among distribution channels is estimated to have the largest market

Based on the distribution channel, the food retail segment is estimated to account for the largest share of the plant-based meat market in 2022. Food retail refers to operating retail, supermarkets, hypermarket stores, and other stores where various products, such as grocery items, vegetables, uncooked meat, and frozen products, are made available to consumers. The distribution channel is already popular among consumers worldwide due to the wide availability of various products. Therefore, this distribution channel is being used by established plant-based meat companies and startups to increase the penetration of their products in the market, making it the largest segment during the forecast period in the plant-based meat market.

To know about the assumptions considered for the study, download the pdf brochure

North America is the fastest-growing region, with a significant CAGR in the plant-based meat market. For American consumers, meat is a very prominent part of their diets. However, as many researchers highlighted the health risks related to the consumption of red meat, consumers are increasingly shifting toward plant-based diets as they are a healthier option compared to animal meat. Many consumers in the region are adopting flexitarian lifestyles and incorporating plant-based foods into their daily diets. Along with this, the trend of veganism is gaining momentum in the region, which is further contributing to the growth of the plant-based meat market.

Top Companies in Plant-based Meat Market

- Beyond Meat (US)

- Kellogg Company (US)

- Impossible Foods Inc. (US)

- Maple Leaf Foods (Canada)

- Unilever (UK)

- Conagra Foods (US)

- Tofurky (US)

- Gold&Green Foods Ltd (Finland)

- Sunfed (New Zealand)

- Monde Nissin (Philippines).

Scope of the Report

|

Report Metric |

Details |

|

Market Size Value in 2022 |

US $7.9 billion |

|

Revenue forecast in 2027 |

US $15.7 billion |

|

Growth Rate |

CAGR of 14.7% from 2022 to 2027 |

|

Base year for estimation |

2021 |

|

Market size available for years |

2019-2027 |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Regional scope |

North America, Europe, Asia Pacific, South America, Central America, RoW |

|

Key Companies Profiled |

Beyond Meat (US), Kellogg Company (US), Impossible Foods Inc. (US),Maple Leaf Foods (Canada), Unilever (UK), Conagra Foods (US), Tofurky (US), Sunfed (New Zealand), Monde Nissin (Philippines), Planterra Foods (US), Fazendo Futuro (Brazil), Alpha Foods (US), Foods (Argentina), Before the Butcher (US), VBites Foods Ltd. (UK) |

|

Plant-based Meat Market Drivers |

The plant-based meat market is growing rapidly due to factors such as increasing health consciousness, environmental concerns, and changing consumer preferences. Technological advancements, celebrity endorsements, and improved accessibility have also contributed to its expansion, making it a promising industry with a sustainable future. |

Plant-based Meat Market Report Segments

This research report categorizes the plant-based meat market based on source, type, product, distribution channel, storage, and region.

|

Aspect |

Details |

|

By Source |

|

|

By Type |

|

|

By Products |

|

|

By Distribution Channel |

|

|

By Region |

|

Recent Development in Plant-based Meat Market

- In January 2022, Beyond Meat (US) collaborated with Pizza Hut (Canada); it has added a permanent menu item to meet the growing demand of consumers, which is Beyond Italian Sausages Crumble by Beyond Meat.

- In May 2021, Unilever announced that it would partner with ENOUGH, a food tech company, to bring new plant-based meat products. ENOUGH’s technology uses a unique zero-waste fermentation process to grow a high-quality protein. Wheat and corn feed natural fungi, producing ABUNDA mycoprotein, a complete food ingredient. This unique protein will be apt for Unilever’s fast-growing meat alternative brand, The Vegetarian Butcher.

- In January 2021, Taco Bell partnered with Gold&Green Pulled Oats to launch a brand-new range of plant-based fillings for their iconic tacos. The new veggie offering will be perfect for consumers looking to go meat-free. Also, for meat lovers, it will offer something new and tasty.

Frequently Asked Questions (FAQs):

What is plant-based meat?

Plant-based meat is a type of food made from plant-based ingredients that aims to replicate the taste and texture of animal-based meat products. It is typically made from soy, pea protein, or other plant-based sources.

What are the main types of plant-based meat?

There are several types of plant-based meat available, including:

- Soy-based meat: This type of plant-based meat is made from soy protein and is often used to create products such as tofu, tempeh, and soy-based burgers and sausages.

- Pea protein-based meat: This type of plant-based meat is made from pea protein and is often used to create products such as plant-based burgers and chicken-style products.

- Legume-based meat: This type of plant-based meat is made from legumes such as lentils and beans, and is often used to create products such as plant-based burgers and meatballs.

- Mushroom-based meat: This type of plant-based meat is made from mushrooms and is often used to create products such as plant-based burgers and sausages.

Is plant based meat good?

The nutritional value and overall healthfulness of plant-based meat can vary depending on the specific product and its ingredients. Some plant-based meat products may be lower in saturated fat and cholesterol than animal-based meat, and may also be a good source of protein and other nutrients.

Not all plant-based meat products are created equal, and some may be higher in salt, sugar, and other additives than others.

It's generally recommended to choose plant-based meat products that are made with whole, minimally processed ingredients and are lower in additives.

In addition to their nutritional value, many people choose plant-based meat for environmental or ethical reasons.

Overall, whether or not plant-based meat is "good" for you will depend on your individual nutritional needs and preferences, as well as the specific product you choose.

What is the current size of the global Plant-based Meat Market?

Plant-based Meat Market is expected to generate a revenue of USD 15.7 billion by 2027, with a CAGR of 14.7%, in terms of value between 2022 and 2027.

Which are leading plant based meat manufacturers in USA?

There are several companies that are leading the plant-based meat market including

Beyond Meat (US), Kellogg Company (US), Impossible Foods Inc. (US), Maple Leaf Foods (Canada), Unilever (UK), Conagra Foods (US), Tofurky (US), Gardein, Boca, and MorningStar Farms. Gold Green Foods Ltd (Finland), Sunfed (New Zealand), and Monde Nissin (Philippines).

We also looked briefly at what they do.

- Impossible Foods: This company is known for its plant-based burgers and has partnerships with many major restaurant chains.

- Tofurky: This company has been around for over 25 years and is known for its plant-based deli meat, sausages, and roasts.

- Field Roast: This company offers a variety of plant-based meat products, including sausages, deli slices, and roasts.

- Lightlife: This company offers a range of plant-based burgers, hot dogs, and ground meat.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 73)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 PERIODS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.5 VOLUME UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 78)

2.1 RESEARCH DATA

FIGURE 2 PLANT-BASED MEAT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE (BASED ON DISTRIBUTION CHANNEL, BY REGION)

2.2.2 APPROACH TWO – TOP-DOWN (BASED ON GLOBAL MARKET)

FIGURE 3 APPROACH TWO- TOP DOWN (SUPPLY SIDE)

2.3 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 88)

TABLE 2 PLANT-BASED MEAT MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 5 MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 6 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 7 MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 8 MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

FIGURE 9 PLANT-BASED MEAT MARKET (VALUE), BY REGION

4 PREMIUM INSIGHTS (Page No. - 93)

4.1 BRIEF OVERVIEW OF THE PLANT-BASED MEAT MARKET

FIGURE 10 GROWING VEGAN AND FLEXITARIAN POPULATION ACROSS THE WORLD TO PROPEL THE MARKET

4.2 EUROPE: PLANT-BASED MEAT MARKET, BY SOURCE AND COUNTRY

FIGURE 11 UK AND SOY TO ACCOUNT FOR THE LARGEST SHARES IN 2022

4.3 PLANT-BASED MEAT MARKET, BY SOURCE

FIGURE 12 SOY TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 PLANT-BASED MEAT MARKET, BY TYPE

FIGURE 13 BEEF SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 PLANT-BASED MEAT MARKET, BY PRODUCT AND REGION

FIGURE 14 EUROPE AND BURGER PATTIES SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.6 PLANT-BASED MEAT MARKET, BY DISTRIBUTION CHANNEL

FIGURE 15 FOOD RETAIL SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 98)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 PLANT-BASED MEAT MARKET DYNAMICS

5.2.1 MACROECONOMIC FACTORS

FIGURE 17 US: ANNUAL SALES OF PLANT-BASED FOOD & BEVERAGES, 2018–2021 (USD BILLION)

5.2.2 DRIVERS

5.2.2.1 Growing vegan and flexitarian population across the world

FIGURE 18 UNITED KINGDOM: VEGAN POPULATION, 2014-2018

5.2.2.2 Rising awareness about the health benefits of plant-based meat products over animal-meat products

TABLE 3 NUTRIENTS PRESENT IN SOURCES OF PLANT-BASED MEAT

5.2.2.3 Growth in government initiatives and significant investments

TABLE 4 TOP UNIVERSITIES FUNDED FOR PLANT-BASED MEAT RESEARCH

5.2.2.4 Major food industries investing in plant-based meat products

5.2.3 RESTRAINTS

5.2.3.1 Population allergic to plant-based meat sources, such as soy and wheat

5.2.3.2 Higher price of products in comparison to traditional meat

5.2.3.3 Possibilities of nutritional and vitamin deficiencies among vegans

5.2.4 OPPORTUNITIES

5.2.4.1 Favorable marketing and correct positioning of plant-based meat

5.2.4.2 Increase in consumers’ focus on meat alternatives

FIGURE 19 GLOBAL MEAT DEMAND, 2005 VS. 2050 (MILLION TONS)

5.2.5 CHALLENGES

5.2.5.1 Perception regarding the taste of plant-based meat products

5.2.5.2 Genetically modified (GM) soybeans

6 INDUSTRY TRENDS (Page No. - 108)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION AND PROCESSING

6.2.4 DISTRIBUTION

6.2.5 MARKETING & SALES

FIGURE 20 VALUE CHAIN ANALYSIS OF THE PLANT-BASED MEAT MARKET

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 21 PLANT-BASED MEAT MARKET: SUPPLY CHAIN

6.4 TECHNOLOGY ANALYSIS

6.5 PRICING ANALYSIS: PLANT-BASED MEAT MARKET

6.5.1 AVERAGE SELLING PRICE, BY PRODUCT

FIGURE 22 GLOBAL: AVERAGE SELLING PRICE, BY PRODUCT

TABLE 5 GLOBAL PLANT-BASED MEAT AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

TABLE 6 GLOBAL PLANT-BASED MEAT AVERAGE SELLING PRICE (ASP), BY PRODUCT, 2020–2022 (USD/TON)

6.6 MARKET MAPPING AND ECOSYSTEM OF PLANT-BASED PROTEIN

6.6.1 DEMAND SIDE

6.6.2 SUPPLY SIDE

FIGURE 23 PLANT-BASED MEAT: MARKET MAP

TABLE 7 PLANT-BASED MEAT MARKET: SUPPLY CHAIN (ECOSYSTEM)

FIGURE 24 PLANT-BASED MEAT: ECOSYSTEM MAPPING

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 25 REVENUE SHIFT FOR THE PLANT-BASED MEAT MARKET

6.8 PLANT-BASED MEAT MARKET: PATENT ANALYSIS

FIGURE 26 NUMBER OF PATENTS GRANTED BETWEEN 2017 AND 2021

FIGURE 27 TOP 10 INVENTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 28 LEADING APPLICANTS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 8 PATENTS PERTAINING TO PLANT-BASED MEAT, 2020–2021

6.9 TRADE DATA: PLANT-BASED MEAT MARKET

6.9.1 2021: PLANT-BASED PROTEIN SOURCES

TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF SOYBEAN, 2021 (KG)

TABLE 10 TOP 10 IMPORTERS AND EXPORTERS OF WHEAT, 2021 (KG)

TABLE 11 TOP 10 IMPORTERS AND EXPORTERS OF PEA, 2021 (KG)

6.10 CASE STUDIES

6.10.1 BEYOND MEAT: PLANT-BASED BEEF JERKY

6.11 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 12 KEY CONFERENCES & EVENTS IN THE PLANT-BASED MEAT MARKET

6.12 TARIFF & REGULATORY LANDSCAPE

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12.1 NORTH AMERICA

6.12.1.1 United States (US)

6.12.1.2 Canada

TABLE 16 COMPOSITION AND LABELLING REQUIREMENTS FOR SIMULATED MEAT AND POULTRY PRODUCTS

6.12.2 EUROPE

6.12.3 ASIA PACIFIC

6.12.3.1 China

6.12.3.2 Japan

6.12.3.3 India

6.12.3.4 Singapore

6.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 17 PLANT-BASED MEAT MARKET: PORTER’S FIVE FORCES ANALYSIS

6.13.1 DEGREE OF COMPETITION

6.13.2 BARGAINING POWER OF SUPPLIERS

6.13.3 BARGAINING POWER OF BUYERS

6.13.4 THREAT OF SUBSTITUTES

6.13.5 THREAT OF NEW ENTRANTS

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE SOURCES

TABLE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE SOURCES (%)

6.14.2 BUYING CRITERIA

TABLE 19 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

FIGURE 30 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 PLANT-BASED MEAT MARKET, BY SOURCE (Page No. - 131)

7.1 INTRODUCTION

FIGURE 31 PLANT-BASED MEAT MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 20 MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 21 MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 22 MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 23 MARKET, BY SOURCE, 2022–2027 (TONS)

7.2 SOY

7.2.1 ADOPTION OF FLEXITARIAN AND VEGETARIAN DIETS TO DRIVE THE CONSUMPTION OF SOY

TABLE 24 SOY: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 25 SOY: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 26 SOY: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 27 SOY: MARKET, BY REGION, 2022–2027 (TONS)

7.3 WHEAT

7.3.1 WHEAT SERVES AS A SOURCE OF ANTIOXIDANTS, VITAMINS, MINERALS, AND FIBER

TABLE 28 WHEAT: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 29 WHEAT: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 30 WHEAT: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 31 WHEAT: MARKET, BY REGION, 2022–2027 (TONS)

7.4 BLENDS

7.4.1 BLENDS OF PROTEIN HELP IN MEETING PROTEIN QUALITY STANDARDS

TABLE 32 BLENDS: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 33 BLENDS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 BLENDS: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 35 BLENDS: MARKET, BY REGION, 2022–2027 (TONS)

7.5 PEA

7.5.1 PEA SERVES AS A SOURCE OF MINERALS THAT PROMOTES GOOD HEALTH

TABLE 36 PEA: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 37 PEA: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 PEA: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 39 PEA: MARKET, BY REGION, 2022–2027 (TONS)

7.6 OTHER SOURCES

7.6.1 MANUFACTURERS TO INTRODUCE INNOVATIVE INGREDIENTS TO PRODUCE PLANT-BASED PRODUCTS

TABLE 40 OTHER SOURCES: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 41 OTHER SOURCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 OTHER SOURCES: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 43 OTHER SOURCES: MARKET, BY REGION, 2022–2027 (TONS)

8 PLANT-BASED MEAT MARKET, BY TYPE (Page No. - 143)

8.1 INTRODUCTION

FIGURE 32 PLANT-BASED MEAT MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 44 MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 45 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 46 MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 47 MARKET, BY TYPE, 2022–2027 (TONS)

8.2 BEEF

8.2.1 AWARENESS ASSOCIATED WITH THE CONSUMPTION OF BEEF PROTEIN THROUGH HIGH NUTRITIONAL FOOD

TABLE 48 BEEF: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 49 BEEF: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 BEEF: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 51 BEEF: MARKET, BY REGION, 2022–2027 (TONS)

8.3 CHICKEN

8.3.1 GROWTH IN THE CONSUMPTION OF CHICKEN PROTEIN DRIVES THE DEMAND FOR PLANT-BASED CHICKEN MEAT

TABLE 52 CHICKEN: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 53 CHICKEN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 CHICKEN: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 55 CHICKEN: MARKET, BY REGION, 2022–2027 (TONS)

8.4 PORK

8.4.1 PORK MEAT OFFERS VARIOUS MICRONUTRIENTS LIKE VITAMINS AND MINERALS

TABLE 56 PORK: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 57 PORK: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 PORK: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 59 PORK: MARKET, BY REGION, 2022–2027 (TONS)

8.5 FISH

8.5.1 RISING DEMAND FOR FISH PRODUCTS ENABLES MANUFACTURERS TO PRODUCE PLANT-BASED FISH PRODUCTS

TABLE 60 FISH: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 61 FISH: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 FISH: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 63 FISH: MARKET, BY REGION, 2022–2027 (TONS)

8.6 OTHER TYPES

8.6.1 RISING CONSUMER PREFERENCE FOR MEAT-FREE FESTIVE DINNERS TO DRIVE THE MARKET

TABLE 64 OTHER TYPES: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 65 OTHER TYPES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 OTHER TYPES: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 67 OTHER TYPES: MARKET, BY REGION, 2022–2027 (TONS)

9 PLANT-BASED MEAT MARKET, BY PRODUCT (Page No. - 155)

9.1 INTRODUCTION

FIGURE 33 PLANT-BASED MEAT MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

TABLE 68 MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 69 MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 70 MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 71 MARKET, BY PRODUCT, 2022–2027 (TONS)

9.2 BURGER PATTIES

9.2.1 IMPOSSIBLE FOODS (US) AND BEYOND MEAT (US) TO OFFER PLANT-BASED BURGERS

TABLE 72 BURGER PATTIES: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 73 BURGER PATTIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 BURGER PATTIES: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 75 BURGER PATTIES: MARKET, BY REGION, 2022–2027 (TONS)

9.3 SAUSAGES

9.3.1 GROWING HEALTH AND WELLNESS TRENDS TO INCREASE THE POPULARITY OF PLANT-BASED SAUSAGES

TABLE 76 SAUSAGES: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 77 SAUSAGES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 SAUSAGES: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 79 SAUSAGES: MARKET, BY REGION, 2022–2027 (TONS)

9.4 STRIPS & NUGGETS

9.4.1 KEY PLAYERS TO OFFER PLANT-BASED CHICKEN STRIPS & NUGGETS

TABLE 80 STRIPS & NUGGETS: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 81 STRIPS & NUGGETS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 82 STRIPS & NUGGETS: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 83 STRIPS & NUGGETS: MARKET, BY REGION, 2022–2027 (TONS)

9.5 MEATBALLS

9.5.1 RISING DEMAND FOR VARIANTS OF PLANT-BASED MEAT PRODUCTS

TABLE 84 MEATBALLS: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 85 MEATBALLS: PLANT-BASED MEAT MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 86 MEATBALLS: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 87 MEATBALLS: MARKET, BY REGION, 2022–2027 (TONS)

9.6 OTHER PRODUCTS

9.6.1 IMPROVED TASTE AND TEXTURE, ALONG WITH CONSUMER PREFERENCE, TO DRIVE THIS SEGMENT

TABLE 88 OTHER PRODUCTS: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 89 OTHER PRODUCTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 90 OTHER PRODUCTS: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 91 OTHER PRODUCTS: MARKET, BY REGION, 2022–2027 (TONS)

10 PLANT-BASED MEAT MARKET, BY DISTRIBUTION CHANNEL (Page No. - 167)

10.1 INTRODUCTION

FIGURE 34 PLANT-BASED MEAT MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

TABLE 92 MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 93 MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 94 MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 95 MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

10.2 FOOD RETAIL

10.2.1 FOOD RETAIL CHANNELS OFFER MULTIPLE OPTIONS OF PLANT-BASED MEAT PRODUCTS

TABLE 96 FOOD RETAIL: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 97 FOOD RETAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 98 FOOD RETAIL: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 99 FOOD RETAIL: MARKET, BY REGION, 2022–2027 (TONS)

10.3 FOOD SERVICES

10.3.1 PLANT-BASED MEAT COMPANIES FACED REDUCED REVENUES FROM THE FOOD SERVICE INDUSTRY DUE TO THE PANDEMIC

TABLE 100 FOOD SERVICES: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 101 FOOD SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 102 FOOD SERVICES: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 103 FOOD SERVICES: MARKET, BY REGION, 2022–2027 (TONS)

10.4 E-COMMERCE

10.4.1 INCREASING DEMAND FOR PLANT-BASED MEAT PRODUCTS TO DRIVE SALES THROUGH E-COMMERCE PLATFORMS

TABLE 104 E-COMMERCE: PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 105 E-COMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 106 E-COMMERCE: MARKET, BY REGION, 2019–2021 (TONS)

TABLE 107 E-COMMERCE: MARKET, BY REGION, 2022–2027 (TONS)

11 PLANT-BASED MEAT MARKET, BY STORAGE (Page No. - 175)

11.1 INTRODUCTION

11.2 FROZEN

11.2.1 SUSTAINABLE FREEZING OF PLANT-BASED MEAT PRODUCTS TO INCREASE THE AFFORDABILITY OF PRODUCTS

11.3 REFRIGERATED

11.3.1 REFRIGERATED PLANT-BASED PRODUCTS HELP IN EASY TRANSPORTATION OF PLANT-BASED MEAT PRODUCTS

11.4 SHELF-STABLE

11.4.1 EASY STORAGE OF PLANT-BASED PRODUCTS IMPACTS THE NEED FOR SHELF-STABLE STORAGE PRODUCTS

12 PLANT-BASED MEAT MARKET, BY REGION (Page No. - 177)

12.1 INTRODUCTION

FIGURE 35 GEOGRAPHIC SNAPSHOT (2022-2027): RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOT SPOTS

TABLE 108 PLANT-BASED MEAT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 109 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 110 MARKET, BY REGION, 2019–2021 (TONS)

TABLE 111 MARKET, BY REGION, 2022–2027 (TONS)

12.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: PLANT-BASED MEAT MARKET SNAPSHOT

TABLE 112 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (TONS)

TABLE 115 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (TONS)

TABLE 116 NORTH AMERICA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 119 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 120 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 123 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 124 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 127 NORTH AMERICA: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 128 NORTH AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 131 NORTH AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.2.1 US

12.2.1.1 Presence of key companies and a wide distribution network to fuel the growth of the global market

TABLE 132 US: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 133 US: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 134 US: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 135 US: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 136 US: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 137 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 138 US: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 139 US: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 140 US: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 141 US: PLANT-BASED MEAT MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 142 US: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 143 US: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 144 US: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 145 US: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 146 US: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 147 US: PLANT-BASED MEAT MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.2.2 CANADA

12.2.2.1 Investment of the Canadian government in plant-based proteins to lead to the growth of the global market

TABLE 148 CANADA: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 149 CANADA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 150 CANADA: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 151 CANADA: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 152 CANADA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 153 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 154 CANADA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 155 CANADA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 156 CANADA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 157 CANADA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 158 CANADA: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 159 CANADA: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 160 CANADA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 161 CANADA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 162 CANADA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 163 CANADA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.2.3 MEXICO

12.2.3.1 Mexico’s meat-based traditional food offers a great opportunity for plant-based meat manufacturers

TABLE 164 MEXICO: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 165 MEXICO: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 166 MEXICO: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 167 MEXICO: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 168 MEXICO: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 169 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 170 MEXICO: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 171 MEXICO: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 172 MEXICO: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 173 MEXICO: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 174 MEXICO: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 175 MEXICO: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 176 MEXICO: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 177 MEXICO: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 178 MEXICO: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 179 MEXICO: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.3 EUROPE

FIGURE 37 EUROPE: PLANT-BASED MEAT MARKET SNAPSHOT

TABLE 180 EUROPE: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 181 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 182 EUROPE: MARKET, BY COUNTRY, 2019–2021 (TONS)

TABLE 183 EUROPE: MARKET, BY COUNTRY, 2022–2027 (TONS)

TABLE 184 EUROPE: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 185 EUROPE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 186 EUROPE: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 187 EUROPE: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 188 EUROPE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 189 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 190 EUROPE: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 191 EUROPE: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 192 EUROPE: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 193 EUROPE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 194 EUROPE: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 195 EUROPE: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 196 EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 197 EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 198 EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 199 EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.3.1 UK

12.3.1.1 Increasing flexitarian population along with rising awareness about health and the environment to drive the market in the UK

TABLE 200 UK: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 201 UK: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 202 UK: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 203 UK: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 204 UK: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 205 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 206 UK: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 207 UK: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 208 UK: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 209 UK: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 210 UK: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 211 UK: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 212 UK: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 213 UK: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 214 UK: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 215 UK: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.3.2 GERMANY

12.3.2.1 Exponentially growing trend of veganism to drive the German plant-based meat market

TABLE 216 GERMANY: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 217 GERMANY: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 218 GERMANY: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 219 GERMANY: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 220 GERMANY: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 221 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 222 GERMANY: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 223 GERMANY: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 224 GERMANY: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 225 GERMANY: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 226 GERMANY: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 227 GERMANY: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 228 GERMANY: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 229 GERMANY: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 230 GERMANY: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 231 GERMANY: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.3.3 ITALY

12.3.3.1 Rising vegetarian population to drive the plant-based meat market in Italy

TABLE 232 ITALY: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 233 ITALY: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 234 ITALY: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 235 ITALY: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 236 ITALY: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 237 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 238 ITALY: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 239 ITALY: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 240 ITALY: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 241 ITALY: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 242 ITALY: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 243 ITALY: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 244 ITALY: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 245 ITALY: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 246 ITALY: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 247 ITALY: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.3.4 FRANCE

12.3.4.1 Rising awareness of adverse health effects associated with animal meat leading to increasing demand for plant-based meat

TABLE 248 FRANCE: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 249 FRANCE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 250 FRANCE: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 251 FRANCE: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 252 FRANCE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 253 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 254 FRANCE: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 255 FRANCE: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 256 FRANCE: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 257 FRANCE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 258 FRANCE: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 259 FRANCE: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 260 FRANCE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 261 FRANCE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 262 FRANCE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 263 FRANCE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.3.5 NETHERLANDS

12.3.5.1 Presence of plant-based companies and research institutions to fuel the growth of the global market

TABLE 264 NETHERLANDS: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 265 NETHERLANDS: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 266 NETHERLANDS: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 267 NETHERLANDS: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 268 NETHERLANDS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 269 NETHERLANDS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 270 NETHERLANDS: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 271 NETHERLANDS: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 272 NETHERLANDS: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 273 NETHERLANDS: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 274 NETHERLANDS: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 275 NETHERLANDS: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 276 NETHERLANDS: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 277 NETHERLANDS: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 278 NETHERLANDS: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 279 NETHERLANDS: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.3.6 SWEDEN

12.3.6.1 Consumers shifting toward plant-based diets due to sustainability and ethical reasons

TABLE 280 SWEDEN: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 281 SWEDEN: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 282 SWEDEN: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 283 SWEDEN: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 284 SWEDEN: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 285 SWEDEN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 286 SWEDEN: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 287 SWEDEN: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 288 SWEDEN: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 289 SWEDEN: PLANT-BASED MEAT MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 290 SWEDEN: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 291 SWEDEN: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 292 SWEDEN: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 293 SWEDEN: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 294 SWEDEN: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 295 SWEDEN: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.3.7 SPAIN

12.3.7.1 Innovative products offered by leading players and plant-based meat startups to drive the market

TABLE 296 SPAIN: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 297 SPAIN: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 298 SPAIN: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 299 SPAIN: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 300 SPAIN: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 301 SPAIN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 302 SPAIN: PLANT-BASED MEAT MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 303 SPAIN: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 304 SPAIN: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 305 SPAIN: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 306 SPAIN: PLANT-BASED MEAT MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 307 SPAIN: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 308 SPAIN: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 309 SPAIN: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 310 SPAIN: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 311 SPAIN: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.3.8 DENMARK

12.3.8.1 Danish government’s focus on the acceleration of the green transition to drive the demand for plant-based meat products

TABLE 312 DENMARK: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 313 DENMARK: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 314 DENMARK: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 315 DENMARK: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 316 DENMARK: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 317 DENMARK: PLANT-BASED MEAT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 318 DENMARK: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 319 DENMARK: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 320 DENMARK: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 321 DENMARK: PLANT-BASED MEAT MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 322 DENMARK: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 323 DENMARK: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 324 DENMARK: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 325 DENMARK: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 326 DENMARK: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 327 DENMARK: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.3.9 REST OF EUROPE

12.3.9.1 Growing number of plant-based companies and restaurants to drive the global market

TABLE 328 REST OF EUROPE: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 329 REST OF EUROPE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 330 REST OF EUROPE: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 331 REST OF EUROPE: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 332 REST OF EUROPE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 333 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 334 REST OF EUROPE: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 335 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 336 REST OF EUROPE: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 337 REST OF EUROPE: PLANT-BASED MEAT MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 338 REST OF EUROPE: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 339 REST OF EUROPE: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 340 REST OF EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 341 REST OF EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 342 REST OF EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 343 REST OF EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4 ASIA PACIFIC

TABLE 344 ASIA PACIFIC: PLANT-BASED MEAT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 345 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 346 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (TONS)

TABLE 347 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (TONS)

TABLE 348 ASIA PACIFIC: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 349 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 350 ASIA PACIFIC: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 351 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 352 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 353 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 354 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 355 ASIA PACIFIC: PLANT-BASED MEAT MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 356 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 357 ASIA PACIFIC: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 358 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 359 ASIA PACIFIC: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 360 ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 361 ASIA PACIFIC: PLANT-BASED MEAT MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 362 ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 363 ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.1 CHINA

12.4.1.1 Inclination of Chinese consumers toward healthier products to drive the growth of plant-based meat

TABLE 364 CHINA: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 365 CHINA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 366 CHINA: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 367 CHINA: PLANT-BASED MEAT MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 368 CHINA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 369 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 370 CHINA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 371 CHINA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 372 CHINA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 373 CHINA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 374 CHINA: PLANT-BASED MEAT MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 375 CHINA: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 376 CHINA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 377 CHINA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 378 CHINA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 379 CHINA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.2 JAPAN

12.4.2.1 Manufacturers are offering several types of plant-based meat products to provide a variety of options to consumers

TABLE 380 JAPAN: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 381 JAPAN: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 382 JAPAN: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 383 JAPAN: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 384 JAPAN: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 385 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 386 JAPAN: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 387 JAPAN: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 388 JAPAN: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 389 JAPAN: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 390 JAPAN: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 391 JAPAN: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 392 JAPAN: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 393 JAPAN: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 394 JAPAN: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 395 JAPAN: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.3 AUSTRALIA & NEW ZEALAND

12.4.3.1 Increasing inclination toward nutritional food to drive the market during the forecast period

TABLE 396 AUSTRALIA & NEW ZEALAND: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 397 AUSTRALIA & NEW ZEALAND: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 398 AUSTRALIA & NEW ZEALAND: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 399 AUSTRALIA & NEW ZEALAND: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 400 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 401 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 402 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 403 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 404 AUSTRALIA & NEW ZEALAND: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 405 AUSTRALIA & NEW ZEALAND: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 406 AUSTRALIA & NEW ZEALAND: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 407 AUSTRALIA & NEW ZEALAND: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 408 AUSTRALIA & NEW ZEALAND: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 409 AUSTRALIA & NEW ZEALAND: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 410 AUSTRALIA & NEW ZEALAND: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 411 AUSTRALIA & NEW ZEALAND: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.4 SINGAPORE

12.4.4.1 Introduction of plant-based meat products in the supermarket to drive growth

TABLE 412 SINGAPORE: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 413 SINGAPORE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 414 SINGAPORE: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 415 SINGAPORE: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 416 SINGAPORE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 417 SINGAPORE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 418 SINGAPORE: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 419 SINGAPORE: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 420 SINGAPORE: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 421 SINGAPORE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 422 SINGAPORE: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 423 SINGAPORE: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 424 SINGAPORE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 425 SINGAPORE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 426 SINGAPORE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 427 SINGAPORE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.5 SOUTH KOREA

12.4.5.1 Growing flexitarian and the vegan population are expected to drive the plant-based meat market

TABLE 428 SOUTH KOREA: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 429 SOUTH KOREA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 430 SOUTH KOREA: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 431 SOUTH KOREA: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 432 SOUTH KOREA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 433 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 434 SOUTH KOREA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 435 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 436 SOUTH KOREA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 437 SOUTH KOREA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 438 SOUTH KOREA: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 439 SOUTH KOREA: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 440 SOUTH KOREA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 441 SOUTH KOREA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 442 SOUTH KOREA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 443 SOUTH KOREA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.6 HONG KONG

12.4.6.1 Easy availability of plant-based meat products in supermarkets to drive the market

TABLE 444 HONG KONG: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 445 HONG KONG: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 446 HONG KONG: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 447 HONG KONG: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 448 HONG KONG: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 449 HONG KONG: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 450 HONG KONG: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 451 HONG KONG: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 452 HONG KONG: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 453 HONG KONG: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 454 HONG KONG: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 455 HONG KONG: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 456 HONG KONG: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 457 HONG KONG: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 458 HONG KONG: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 459 HONG KONG: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.7 THAILAND

12.4.7.1 Thai companies investing in plant-based meat market to drive the demand for plant-based meat in the country

TABLE 460 THAILAND: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 461 THAILAND: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 462 THAILAND: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 463 THAILAND: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 464 THAILAND: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 465 THAILAND: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 466 THAILAND: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 467 THAILAND: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 468 THAILAND: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 469 THAILAND: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 470 THAILAND: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 471 THAILAND: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 472 THAILAND: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 473 THAILAND: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 474 THAILAND: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 475 THAILAND: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.8 PHILIPPINES

12.4.8.1 Rising consumption of alternative proteins to drive the plant-based meat market

TABLE 476 PHILIPPINES: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 477 PHILIPPINES: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 478 PHILIPPINES: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 479 PHILIPPINES: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 480 PHILIPPINES: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 481 PHILIPPINES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 482 PHILIPPINES: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 483 PHILIPPINES: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 484 PHILIPPINES: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 485 PHILIPPINES: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 486 PHILIPPINES: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 487 PHILIPPINES: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 488 PHILIPPINES: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 489 PHILIPPINES: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 490 PHILIPPINES: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 491 PHILIPPINES: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.9 VIETNAM

12.4.9.1 Presence of plant-based sources for manufacturing plant-based meat is expected to fuel the growth of the market

TABLE 492 VIETNAM: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 493 VIETNAM: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 494 VIETNAM: MARKET, BY SOURCE 2019–2021 (TONS)

TABLE 495 VIETNAM: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 496 VIETNAM: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 497 VIETNAM: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 498 VIETNAM: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 499 VIETNAM: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 500 VIETNAM: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 501 VIETNAM: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 502 VIETNAM: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 503 VIETNAM: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 504 VIETNAM: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 505 VIETNAM: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 506 VIETNAM: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 507 VIETNAM: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.10 INDIA

12.4.10.1 Plant-based meat industry is at infant stage as the meat consumption in the region is very low

TABLE 508 INDIA: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 509 INDIA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 510 INDIA: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 511 INDIA: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 512 INDIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 513 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 514 INDIA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 515 INDIA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 516 INDIA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 517 INDIA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 518 INDIA: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 519 INDIA: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 520 INDIA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 521 INDIA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 522 INDIA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 523 INDIA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.4.11 REST OF ASIA PACIFIC

12.4.11.1 Huge growth opportunities in the forecast period

TABLE 524 REST OF ASIA PACIFIC: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 525 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 526 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 527 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 528 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 529 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 530 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 531 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 532 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 533 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 534 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 535 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 536 REST OF ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 537 REST OF ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 538 REST OF ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 539 REST OF ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.5 SOUTH AMERICA & CENTRAL AMERICA

TABLE 540 SOUTH & CENTRAL AMERICA: PLANT-BASED MEAT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 541 SOUTH & CENTRAL AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 542 SOUTH & CENTRAL AMERICA: MARKET, BY COUNTRY, 2019–2021 (TONS)

TABLE 543 SOUTH & CENTRAL AMERICA: MARKET, BY COUNTRY, 2022–2027 (TONS)

TABLE 544 SOUTH & CENTRAL AMERICA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 545 SOUTH & CENTRAL AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 546 SOUTH & CENTRAL AMERICA: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 547 SOUTH & CENTRAL AMERICA: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 548 SOUTH & CENTRAL AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 549 SOUTH & CENTRAL AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 550 SOUTH & CENTRAL AMERICA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 551 SOUTH & CENTRAL AMERICA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 552 SOUTH & CENTRAL AMERICA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 553 SOUTH & CENTRAL AMERICA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 554 SOUTH & CENTRAL AMERICA: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 555 SOUTH & CENTRAL AMERICA: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 556 SOUTH & CENTRAL AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 557 SOUTH & CENTRAL AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 558 SOUTH & CENTRAL AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 559 SOUTH & CENTRAL AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.5.1 BRAZIL

12.5.1.1 Adoption of plant-based food products to drive the plant-based meat market

TABLE 560 BRAZIL: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 561 BRAZIL: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 562 BRAZIL: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 563 BRAZIL: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 564 BRAZIL: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 565 BRAZIL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 566 BRAZIL: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 567 BRAZIL: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 568 BRAZIL: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 569 BRAZIL: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 570 BRAZIL: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 571 BRAZIL: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 572 BRAZIL: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 573 BRAZIL: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 574 BRAZIL: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 575 BRAZIL: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.5.2 ARGENTINA

12.5.2.1 Reduction in meat consumption to show consumers’ demand for plant-based meat products

TABLE 576 ARGENTINA: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 577 ARGENTINA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 578 ARGENTINA: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 579 ARGENTINA: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 580 ARGENTINA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 581 ARGENTINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 582 ARGENTINA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 583 ARGENTINA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 584 ARGENTINA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 585 ARGENTINA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 586 ARGENTINA: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 587 ARGENTINA: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 588 ARGENTINA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 589 ARGENTINA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 590 ARGENTINA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 591 ARGENTINA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.5.3 CHILE

12.5.3.1 Growing food-tech startups in the region to drive the plant-based meat market in Chile

TABLE 592 CHILE: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 593 CHILE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 594 CHILE: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 595 CHILE: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 596 CHILE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 597 CHILE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 598 CHILE: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 599 CHILE: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 600 CHILE: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 601 CHILE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 602 CHILE: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 603 CHILE: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 604 CHILE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 605 CHILE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 606 CHILE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 607 CHILE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.5.4 COLOMBIA

12.5.4.1 Campaigns organized to promote veganism and plant-based protein in Colombia

TABLE 608 COLOMBIA: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 609 COLOMBIA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 610 COLOMBIA: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 611 COLOMBIA: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 612 COLOMBIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 613 COLOMBIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 614 COLOMBIA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 615 COLOMBIA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 616 COLOMBIA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 617 COLOMBIA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 618 COLOMBIA: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 619 COLOMBIA: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 620 COLOMBIA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 621 COLOMBIA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 622 COLOMBIA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 623 COLOMBIA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.5.5 CARIBBEAN

12.5.5.1 Growing health concerns among the population to drive the demand for plant-based meat

TABLE 624 CARIBBEAN: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 625 CARIBBEAN: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 626 CARIBBEAN: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 627 CARIBBEAN: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 628 CARIBBEAN: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 629 CARIBBEAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 630 CARIBBEAN: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 631 CARIBBEAN: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 632 CARIBBEAN: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 633 CARIBBEAN: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 634 CARIBBEAN: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 635 CARIBBEAN: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 636 CARIBBEAN: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 637 CARIBBEAN: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 638 CARIBBEAN: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 639 CARIBBEAN: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.5.6 REST OF SOUTH AND CENTRAL AMERICA

12.5.6.1 Measures being taken to promote the veganism and plant-based trend in the region

TABLE 640 REST OF SOUTH & CENTRAL AMERICA: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 641 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 642 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 643 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 644 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 645 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 646 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 647 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 648 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 649 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 650 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 651 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 652 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 653 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 654 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 655 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.6 REST OF THE WORLD (ROW)

12.6.1 MIDDLE EAST

TABLE 656 MIDDLE EAST: PLANT-BASED MEAT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 657 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 658 MIDDLE EAST: MARKET, BY COUNTRY, 2019–2021 (TONS)

TABLE 659 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (TONS)

TABLE 660 MIDDLE EAST: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 661 MIDDLE EAST: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 662 MIDDLE EAST: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 663 MIDDLE EAST: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 664 MIDDLE EAST: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 665 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 666 MIDDLE EAST: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 667 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 668 MIDDLE EAST: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 669 MIDDLE EAST: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 670 MIDDLE EAST: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 671 MIDDLE EAST: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 672 MIDDLE EAST: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 673 MIDDLE EAST: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 674 MIDDLE EAST: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 675 MIDDLE EAST: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.6.1.1 UAE

12.6.1.1.1 Rising awareness about health and diet to drive the demand for plant-based meat

TABLE 676 UAE: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 677 UAE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 678 UAE: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 679 UAE: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 680 UAE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 681 UAE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 682 UAE: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 683 UAE: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 684 UAE: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 685 UAE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 686 UAE: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 687 UAE: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 688 UAE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 689 UAE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 690 UAE: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 691 UAE: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.6.1.2 Saudi Arabia

12.6.1.2.1 The promotion of plant-based trend by influential people to fuel the growth of the plant-based meat market

TABLE 692 SAUDI ARABIA: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 693 SAUDI ARABIA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 694 SAUDI ARABIA: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 695 SAUDI ARABIA: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 696 SAUDI ARABIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 697 SAUDI ARABIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 698 SAUDI ARABIA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 699 SAUDI ARABIA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 700 SAUDI ARABIA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 701 SAUDI ARABIA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 702 SAUDI ARABIA: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 703 SAUDI ARABIA: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 704 SAUDI ARABIA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 705 SAUDI ARABIA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 706 SAUDI ARABIA: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 707 SAUDI ARABIA: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.6.1.3 Rest of the Middle East

12.6.1.3.1 Easy availability of plant-based meat products to fuel the growth of the plant-based meat market

TABLE 708 REST OF THE MIDDLE EAST: PLANT-BASED MEAT MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 709 REST OF THE MIDDLE EAST: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 710 REST OF THE MIDDLE EAST: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 711 REST OF THE MIDDLE EAST: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 712 REST OF THE MIDDLE EAST: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 713 REST OF THE MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 714 REST OF THE MIDDLE EAST: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 715 REST OF THE MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 716 REST OF THE MIDDLE EAST: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 717 REST OF THE MIDDLE EAST: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 718 REST OF THE MIDDLE EAST: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 719 REST OF THE MIDDLE EAST: MARKET, BY PRODUCT, 2022–2027 (TONS)

TABLE 720 REST OF THE MIDDLE EAST: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 721 REST OF THE MIDDLE EAST: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

TABLE 722 REST OF THE MIDDLE EAST: MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (TONS)

TABLE 723 REST OF THE MIDDLE EAST: MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (TONS)

12.6.2 AFRICA

TABLE 724 AFRICA: PLANT-BASED MEAT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 725 AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 726 AFRICA: MARKET, BY COUNTRY, 2019–2021 (TONS)

TABLE 727 AFRICA: MARKET, BY COUNTRY, 2022–2027 (TONS)

TABLE 728 AFRICA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 729 AFRICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 730 AFRICA: MARKET, BY SOURCE, 2019–2021 (TONS)

TABLE 731 AFRICA: MARKET, BY SOURCE, 2022–2027 (TONS)

TABLE 732 AFRICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 733 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 734 AFRICA: MARKET, BY TYPE, 2019–2021 (TONS)

TABLE 735 AFRICA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 736 AFRICA: MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 737 AFRICA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 738 AFRICA: MARKET, BY PRODUCT, 2019–2021 (TONS)

TABLE 739 AFRICA: MARKET, BY PRODUCT, 2022–2027 (TONS)