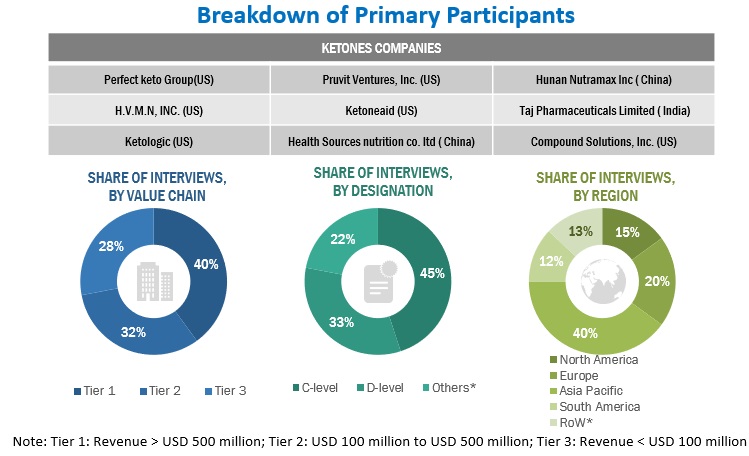

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the Ketones market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), U.S. Food and Drug Administration (FDA) U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), World Health Organization (WHO), Consumer Healthcare Products Association (CHPA), European Federation of Associations of Health Product Manufacturers (EHPM), Canadian Health Food Association (CHFA), and Health Food Manufacturers' Association (HFMA), associations were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The Ketones market encompasses various stakeholders involved in the supply chain, raw material manufacturers, raw material suppliers, regulatory organizations, and research institutions. To gather comprehensive information, primary sources from both the supply and demand sides were engaged. Primary interviewees from the supply side consisted of manufacturers, distributors, importers, and technology providers involved in the production and distribution of Ketones. On the demand side, key opinion leaders, executives, and CEOs of companies in the Ketones market were approached through questionnaires, emails, and telephonic interviews. This approach ensured a comprehensive and well-rounded understanding of the Ketones market from various perspectives.

To know about the assumptions considered for the study, download the pdf brochure

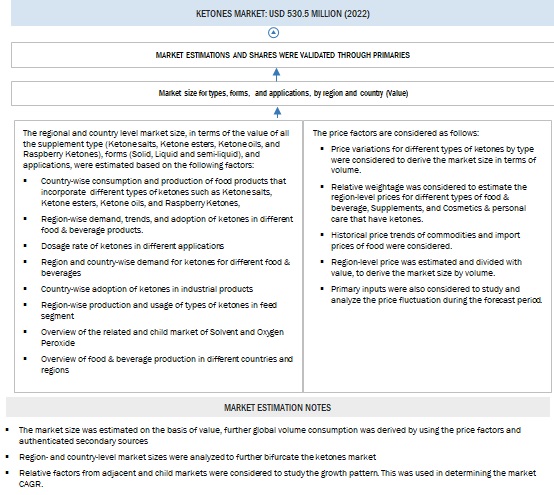

Market Size Estimation

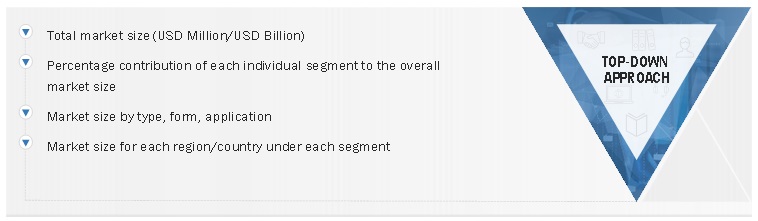

The top-down and bottom-up approaches were used to estimate and validate the size of the marketand various dependent submarkets. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global Ketones Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Ketones Market Size: Top-Down Approach

Market Definition

Ketones are organic compounds that are characterized by the presence of the carbonyl group, in which carbon atom is covalently bonded to an oxygen atom and are also known as ketone bodies. Ketones are the by-products of the human body that break down fats for energy. They are chemicals that are usually produced in the liver, particularly due to insufficient stored glucose or sugar to turn into energy. Three types of ketones are burned in the body during ketosis, namely, acetoacetate, beta-hydroxybutyric acid, and acetone.

Data Triangulation

The data triangulation and market breakdown procedures explained above were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Key Stakeholders

-

Food & beverage suppliers and manufacturers

-

Food & beverage importers and exporters

-

Food & beverage traders and distributors

-

Government and research organizations

-

Associations and industry bodies

-

World Health Organization (WHO)

-

Food and Drug Administration (FDA)

-

Institute of Food and Agricultural Sciences (IFAS)

-

Global Food & Beverage Association (GFBA)

-

The National Food Safety and Quality Service (SENASA)

-

Food Safety and Standards Authority of India (FSSAI)

-

US Department of Agriculture (USDA)

-

Food Standards Australia New Zealand (FSANZ)

-

Institute of Food Technologists

-

Food and Agriculture Organization (FAO)

-

EC EUROPA

Report Objectives

-

To define, segment, and project the global market for Ketones based on type, form, application, and region.

-

To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

-

To strategically analyze the micro markets for individual growth trends, prospects, and their contribution to the total market

-

To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

-

To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

-

To strategically profile the key players and comprehensively analyze their market position and core competencies.

-

To analyze competitive developments in the Ketones market, including joint ventures, mergers & acquisitions, new product developments, and research & development activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

-

Further breakdown of the Rest of the European Ketones market, by key country

-

Further breakdown of the Rest of the Asia Pacific Ketones market, by key country

-

Further breakdown of the Rest of South America Ketones market, by key country

Company Information

-

Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Ketones Market