A2P Messaging Market by Application (Authentication Services, Promotional & Marketing Services, Customer Relationship Management Services, Pushed Content Services, Interactive Messaging Services, Notification & Alerts) - Global Forecast to 2029

A2P Messaging Market Overview

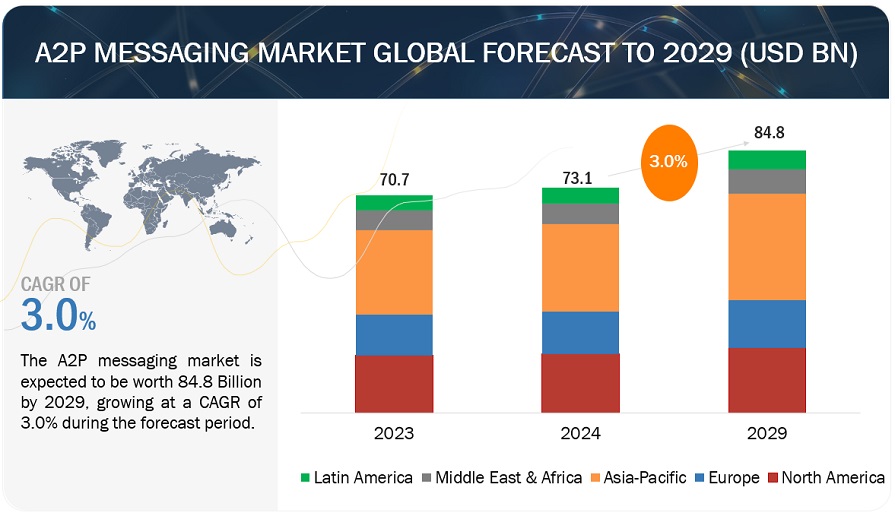

The gllobal A2P Messaging Market size was valued at US$70.7 billion in 2023 and is projected to grow from US$73.1 billion in 2024 to US$84.8 billion in 2029 at a CAGR of 3.0% during the forecast period.

A2P messaging facilitates real-time communication between businesses and customers, allowing for instant delivery of time-sensitive information, updates, and notifications. A2P messaging platforms increasingly support multichannel communication, including SMS, MMS, RCS, and OTT messaging apps, allowing businesses to reach customers through their preferred channels. Also, integration of A2P messaging platforms with Customer Relationship Management (CRM) systems enables businesses to streamline their communication processes, manage customer interactions more effectively, and track engagement metrics.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

A2P Messaging Market Dynamics

Driver: Growing use of A2P messaging among customer-centric industries

A2P messaging has witnessed large scale implementation in customer-centric industries, such as retail and eCommerce, travel and hospitality, Banking, Financial Services, and Insurance (BFSI), healthcare, and media and entertainment. With the heavy penetration of smartphones across consumers, these industries are embracing the power of A2P messaging to reach their wide base of customers. Since the inception of messaging services, A2P messaging has acted as a reliable and secure communication channel for enterprises to engage with their customers on a larger scale. For instance, in the mobile banking system, application messaging is at the center of the payment system, which helps mobile banking applications to send notifications to their customers, such as instant alerts, transaction details, and One Time Password (OTP) verifications. Mobile banking helps the A2P messaging market grow by deploying application messaging for banking and financial services through SMS aggregators and MNOs. Thus, MNOs and SMS aggregators need to focus on A2P messaging to accommodate the vast revenue coming from the enterprises.

Restraint: Regulatory constraints

Regulatory constraints exert a substantial influence on the A2P (Application-to-Person) messaging market, shaping its operations and strategies. These constraints primarily center around safeguarding consumer privacy, upholding data protection standards, and curbing the proliferation of spam and unsolicited messages. Laws such as the General Data Protection Regulation (GDPR) in Europe and the Telephone Consumer Protection Act (TCPA) in the United States impose stringent requirements on businesses regarding consent, data processing, and message content. Moreover, mobile network operators (MNOs) often enforce their own guidelines, adding another layer of compliance complexity. Service providers must navigate these regulations meticulously to avoid penalties, message blocking, or service termination. Ensuring compliance requires significant investment in technology, infrastructure, and legal expertise.

Opportunity: Rise in application usage

The surge in application usage presents a remarkable opportunity for the A2P (Application-to-Person) messaging market, offering a dynamic platform for businesses to interact with their customers seamlessly. As mobile applications proliferate across diverse sectors, they become pivotal touchpoints for delivering timely notifications, personalized messages, and transactional updates directly to users' devices. This trend reflects a fundamental shift in consumer behavior towards mobile-centric interactions, necessitating robust A2P messaging solutions to meet the growing demand for real-time communication. Integrated into these applications, A2P messaging not only enhances customer engagement but also streamlines transactional processes, such as banking transactions, e-commerce purchases, and service bookings. Moreover, the integration of messaging features within applications further amplifies the role of A2P messaging in facilitating seamless communication between users and businesses. With emerging markets embracing mobile technology at a rapid pace, the opportunities for A2P messaging providers to capitalize on this trend and drive market expansion are abundant.

Challenge: Messaging channel fragmentation

Messaging channel fragmentation presents a formidable challenge within the A2P messaging market, stemming from the diverse array of communication channels available to businesses and consumers alike. This proliferation, ranging from traditional SMS to an array of OTT messaging apps and social media platforms, complicates efforts to maintain a cohesive communication strategy. Businesses must grapple with resource-intensive management, interoperability issues, and the need to ensure consistency across channels while navigating complex regulatory landscapes. Mitigation strategies include prioritizing channels, leveraging integration solutions, and embracing automation and AI for optimization. Looking ahead, collaboration and innovation will be key in addressing these challenges, ensuring businesses can effectively engage with customers across a fragmented messaging landscape while delivering seamless and personalized experiences.

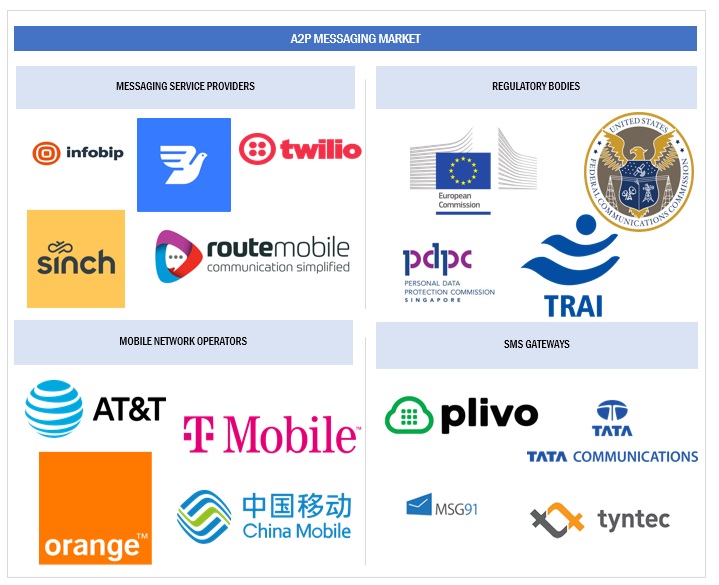

A2P Messaging Market Ecosystem

Prominent companies in this market have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and marketing networks. Prominent companies in this market include AT&T (US), China Mobile (China), Sinch (Sweden), Twilio (US), Infobip (UK), Vonage (US), Orange (France), Comviva (India), Route Mobile (India), BICS (Belgium).

Based on end user, the healthcare segment is expected to grow with the highest CAGR during the forecast period

The global population increase, shifts in lifestyle, and heightened awareness of health-related matters have fueled substantial growth in the healthcare sector. To ensure top-notch service delivery, healthcare providers must engage in effective, personalized communication with their patients. Many healthcare providers have already embraced A2P messaging as a means to disseminate diagnostic test results, appointment reminders, claim statuses, health advice, payment notifications, location inquiries, and to enhance the overall patient experience. A2P messaging solutions are utilized by healthcare enterprises to foster better patient relationships while upholding privacy standards and adhering to HIPAA regulations in the US. These solutions encompass various functionalities such as machine-to-human alerts, pager replacements, wellness notifications, safety training updates, and scheduling communications.

By end user, the BFSI segment to hold the largest market size during the forecast period

Given the rapid expansion of mobile subscriber bases, a significant majority of clients now prefer accessing banking services via their mobile devices. Over recent years, the global mobile banking sector has experienced notable growth. Banks and similar financial entities widely employ A2P messaging services, primarily for dispatching OTPs to validate transactions or authenticate customers for eCommerce dealings. SMS messaging is not only utilized by most financial institutions for informational purposes but also serves as a pivotal tool for confirming transactions through two-factor authentication. Furthermore, A2P messaging finds application in various areas, including fraud prevention, disseminating server monitoring alerts to technicians, updating applications, and issuing payment reminders. Organizations and financial establishments commonly utilize SMS for transmitting access codes and notifications pertinent to specific accounts. Such messages are typically solicited by recipients, serving as a secure means of communication for services requiring two-factor authentication.

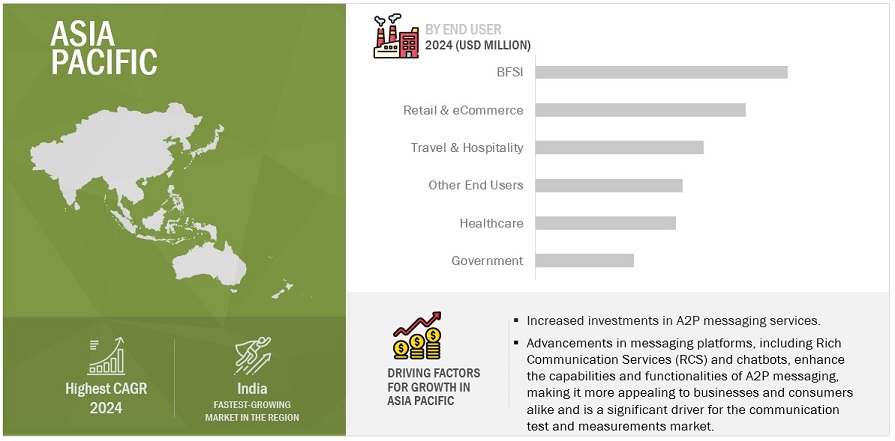

Based on region, Asia Pacific is expected to grow with the highest CAGR during the forecast period

The A2P messaging market in Asia Pacific has been experiencing significant growth and development driven by ongoing digitalization efforts and the evolving needs of businesses to connect with consumers effectively. OTT messaging platforms in Asia Pacific have shifted communication preferences, drawing users away from traditional SMS for personal and business interactions. Businesses now leverage OTT platforms for cost-effective A2P messaging, offering richer content and interactivity to enhance user engagement. However, the increasing competition and fragmentation in the market pose challenges, requiring businesses to navigate multiple platforms and address integration complexities. Despite varying regulatory environments, companies are adapting to compliance requirements while embracing innovations such as AI and chatbots to enhance customer engagement.

List of Top A2P Messaging Market Companies :

The major players in the A2P messaging market are AT&T (US), China Mobile (China), Sinch (Sweden), Twilio (US), Infobip (UK). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the A2P messaging market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2024 |

USD 73.1 billion |

|

Revenue forecast for 2029 |

USD 84.8 billion |

|

Growth Rate |

3.0% CAGR |

|

Market size available for years |

2019-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD) Billion |

|

Segments Covered |

Offering (Platform, Services), Application (Authentication Services, Promotional and Marketing Services, Pushed Content Services, Interactive Messaging Services, Customer Relationship Management Services, Other Applications), Communication Channel (SMS, Operator IP, Third-party Apps, Fixed Fees), SMS traffic (Domestic, International), End User (BFSI, Retail & eCommerce, Government, Healthcare, Travel & Hospitality, Other End Users) and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

AT&T (US), China Mobile (China), Sinch (Sweden), Twilio (US), Infobip (UK), Vonage (US), Orange (France), Comviva (India), Route Mobile (India), BICS (Belgium), Monty Mobile (UK), Tata Communications (India), Syniverse (US), Tyntec (UK), Soprano Design (Australia), Genesys (US), Clickatell (US), CEQUENS (Egypt), MSG91 (India), Plivo (US), Mitto (Switzerland), Bird (Netherlands), Telewhale (Cyprus), EnableX.io (Singapore), TextUs (US), Voxvalley (Singapore) |

This research report categorizes the A2P messaging market based on offering, test solution, type of test, end user, and region.

Based on Offering:

- Platform

- Services

Based on Application:

- Authentication Services

- Promotional and Marketing Services

- Pushed Content Services

- Interactive Messaging Services

- Customer Relationship Management Services

- Other Applications

Based on Communication Channel:

- SMS

- Operator IP

- Third-party Apps

- Fixed Fees

Based on SMS Traffic:

- Domestic

- International

Based on End User:

- BFSI

- Retail & eCommerce

- Government

- Healthcare

- Travel & Hospitality

- Other End Users

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2024, Communications Platform-as-a-Service (CPaaS) solutions firm Sinch India launched its new solution, Sinch Trust, to bring transparency and trustworthiness to business messaging. Sinch Trust addressed critical needs in the Indian SMS market by offering much-needed transparency and reliability and equipping businesses with the tools to capitalize on missed opportunities that turn into potential gains.

- In February 2024, Vonage partnered with KDDI Web Communications to bring Vonage Communications APIs to customers in Japan. With Vonage’s Communications APIs, businesses in Japan would be able to bring new communications capabilities to customers through online calling and two-way messaging and build better connections and deeper engagement. In addition, security could be enhanced with simple, seamless two-factor authentication powered by the Verify API, while Vonage’s conversational commerce application, powered by Jumper.ai, enabled businesses to create AI-powered omnichannel experiences that boost sales and increase customer satisfaction.

- In February 2024, Infobip introduced its Rich Communication Services (RCS) Business Messaging solution to enable MNOs and enterprises to engage with customers and create memorable experiences by delivering rich conversational messages.

- In February 2024, Route Mobile partnered with Billeasy to introduce a first-of-its-kind ticket purchase experience through Rich Communication Services (RCS) Business Messaging for Maha Metro Pune. Through this strategic partnership, users would have the convenience of purchasing Maha Metro Pune e-tickets directly via RCS Messages on phones.

- In November 2023, AT&T introduced AT&T ActiveArmor, offering new text-filtering features for even more protection, blocking spam text messages, and even taking down malicious websites.

Frequently Asked Questions (FAQ):

What is the definition of the A2P messaging market?

A2P (Application-to-Person) messaging refers to the process where an application sends messages to a user, typically through SMS (Short Message Service) but also via other messaging channels, including Over-the-Top (OTT) messaging platforms such as WhatsApp, Telegram, or Facebook Messenger. This type of messaging is used primarily by businesses and organizations to communicate directly with customers for a variety of purposes, such as sending alerts, reminders, promotional content, authentication codes, and transaction confirmations. OTT messaging platforms offer a rich, cost-effective alternative to traditional SMS, allowing for the inclusion of multimedia content, interactive elements, and encryption for privacy.

What is the market size of the A2P messaging market?

The A2P messaging market size is projected to grow USD 73.1 billion in 2024 to USD 84.8 billion by 2029, at a CAGR of 3.0% during the forecast period.

What are the major drivers in the A2P messaging market?

The major drivers of the A2P messaging market are rapid technological advancements, growing number of mobile subscribers to fuel A2P messaging, and growing use of A2P messaging among customer-centric industries.

Who are the key players operating in the A2P messaging market?

The major players in the A2P messaging market are AT&T (US), China Mobile (China), Sinch (Sweden), Twilio (US), Infobip (UK), Vonage (US), Orange (France), Comviva (India), Route Mobile (India), BICS (Belgium), Monty Mobile (UK), Tata Communications (India), Syniverse (US), Tyntec (UK), Soprano Design (Australia), Genesys (US), Clickatell (US), CEQUENS (Egypt), MSG91 (India), Plivo (US), Mitto (Switzerland), Bird (Netherlands), Telewhale (Cyprus), EnableX.io (Singapore), TextUs (US), Voxvalley (Singapore).

What are the opportunities for new market entrants in the A2P messaging market?

The major opportunities of the A2P messaging market are rise in application usage, growing trend of mobile marketing via messaging, and increased adoption of A2P SMS by OTT players to drive revenue for MNOs. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 MARKET OVERVIEW

-

5.2 MARKET DYNAMICSDRIVERS- Rapid technological advancements- Growing number of mobile subscribers- Rise in use of A2P messaging among customer-centric industriesRESTRAINTS- Regulatory constraints- Stringent government regulations and policiesOPPORTUNITIES- Rise in application usage- Growth in trend of mobile marketing via messaging- Increase in adoption of A2P SMS by OTT players to drive revenue for MNOsCHALLENGES- Messaging channel fragmentation- Increase in messaging frauds and security concerns- Difficulty in maximizing monetization of A2P messaging

-

5.3 INDUSTRY TRENDSBRIEF HISTORY OF A2P MESSAGING MARKET- 1990–2000- 2000–2010- 2010–2020- 2020–PresentDISRUPTIONS IMPACTING BUYERS/CUSTOMERS IN A2P MESSAGING MARKETPRICING ANALYSIS- Average selling price trend of key players, by offering- Indicative pricing analysis of A2P messaging, by SMS trafficVALUE CHAIN ANALYSISECOSYSTEM/MARKET MAPTECHNOLOGY ANALYSIS- Key Technologies- Adjacent Technologies- Complementary TechnologiesPATENT ANALYSIS- MethodologyCASE STUDIESKEY CONFERENCES & EVENTSCURRENT AND EMERGING BUSINESS MODELS- Subscription Model- Per Message Pricing Model- Bulk Messaging Model- Blockchain-based Messaging Model- API Monetization Model- Subscription Plus ModelBEST PRACTICES IN A2P MESSAGING MARKETTOOLS, FRAMEWORKS, AND TECHNIQUESFUTURE LANDSCAPE OF A2P MESSAGING MARKET- A2P messaging technology roadmap till 2030REGULATORY LANDSCAPE- Regulatory bodies, government agencies, and other organizations- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryKEY STAKEHOLDERS & BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaINVESTMENT AND FUNDING SCENARIO

-

6.1 INTRODUCTIONOFFERING: A2P MESSAGING MARKET DRIVERS

-

6.2 PLATFORMSINCREASE IN COMPLEXITY OF SMS SYSTEM SETUP

-

6.3 SERVICESINCREASED MOBILE INTERNET PENETRATION AND HASSLE-FREE COMMUNICATION WITH CUSTOMERS

-

7.1 INTRODUCTIONAPPLICATION: A2P MESSAGING MARKET DRIVERS

-

7.2 AUTHENTICATION SERVICESCOST-EFFECTIVE AND PREFERRED SECURITY ENABLED BY A2P MESSAGING SERVICES

-

7.3 PROMOTIONAL & MARKETING SERVICESINCREASE IN PROMOTIONAL CAMPAIGNS BY ENTERPRISES AND BUSINESSES GLOBALLY

-

7.4 PUSHED CONTENT SERVICESMOBILE MARKETING AND PROMOTIONAL NOTIFICATIONS CAPITALIZE ON CUSTOMER ENGAGEMENT THROUGH MOBILE APPLICATIONS

-

7.5 INTERACTIVE MESSAGE SERVICESDEMAND FOR UNIQUE INTERACTIVE PROMOTIONAL EXPERIENCES FOR CUSTOMERS

-

7.6 CUSTOMER RELATIONSHIP MANAGEMENT SERVICESGROWTH IN ECOMMERCE AND BFSI INDUSTRIES

- 7.7 OTHER APPLICATIONS

-

8.1 INTRODUCTIONCOMMUNICATION CHANNEL: A2P MESSAGING MARKET DRIVERS

-

8.2 SMSSMS FUNCTIONS AS INTEGRAL MULTIPURPOSE CHANNEL FOR BUSINESSES ACROSS SECTORS

-

8.3 OPERATOR IPINTEGRATING OPERATOR IP INTO A2P MESSAGING WORKFLOWS TO OPTIMIZE RELIABILITY, EFFICIENCY, AND SECURITY

-

8.4 THIRD-PARTY APPSTHIRD-PARTY A2P MESSAGING APPS TO HELP MAINTAIN CUSTOMER ENGAGEMENT, ULTIMATELY CONTRIBUTING TO SUCCESS OF BUSINESSES

-

8.5 FIXED FEESBENEFITS OF COST PREDICTABILITY, SIMPLIFYING BILLING PROCESSES AND INCENTIVIZING SCALABILITY

-

9.1 INTRODUCTIONSMS TRAFFIC: A2P MESSAGING MARKET DRIVERS

- 9.2 DOMESTIC

- 9.3 INTERNATIONAL

-

10.1 INTRODUCTIONEND USER: MARKET DRIVERS

-

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)RAPID GROWTH IN MOBILE BANKING

-

10.3 RETAIL & ECOMMERCESIGNIFICANT GROWTH IN PROMOTIONS VIA SMS COMPARED TO EMAILS

-

10.4 GOVERNMENTENABLING CITIZENS TO ACCESS INFORMATION DIRECTLY FROM GOVERNMENTS

-

10.5 HEALTHCARENEED TO DELIVER TIMELY PATIENT INFORMATION, IMPROVE PHARMACY EFFICIENCY, AND SUPPORT EMERGENCY HEALTH SERVICES

-

10.6 TRAVEL & HOSPITALITYNEED TO MUST CAPITALIZE ON EVERY CUSTOMER INTERACTION TO CLOSE SALE AND WIN REPEAT BUSINESS

- 10.7 OTHER END USERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: A2P MESSAGING MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUSCANADA

-

11.3 EUROPEEUROPE: A2P MESSAGING MARKET DRIVERSEUROPE: RECESSION IMPACTUKGERMANYITALYFRANCEREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: A2P MESSAGING MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINAJAPANINDIAREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: A2P MESSAGING MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTGCC COUNTRIES- UAE- KSA- Rest of GCC CountriesSOUTH AFRICAREST OF MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: A2P MESSAGING MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZILMEXICOREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

-

12.4 MARKET SHARE ANALYSISMARKET RANKING ANALYSIS

-

12.5 COMPANY EVALUATION MATRIX: KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS

-

12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHES & ENHANCEMENTSDEALS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 EV/EBITDA

- 12.10 COMPANY VALUATION

-

13.1 KEY PLAYERSAT&T- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHINA MOBILE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSINCH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTWILIO- Business overview- Products/Solutions/Services offered- MnM viewINFOBIP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVONAGE- Business overview- Products/Solutions/Services offered- Recent developmentsORANGE- Business overview- Products/Solutions/Services offeredCOMVIVA- Business overview- Products/Solutions/Services offered- Recent developmentsROUTE MOBILE- Business overview- Products/Solutions/Services offered- Recent developmentsBICS- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSMONTY MOBILETATA COMMUNICATIONSSYNIVERSETYNTECSOPRANO DESIGNGENESYS

-

13.3 SMES/STARTUPSCLICKATELLCEQUENSMSG91PLIVOMITTOBIRDTELEWHALEENABLEX.IOTEXTUSVOXVALLEY

- 14.1 INTRODUCTION TO ADJACENT MARKETS

- 14.2 LIMITATIONS

-

14.3 COMMUNICATION PLATFORM AS A SERVICE MARKETMARKET DEFINITION

-

14.4 RICH COMMUNICATION SERVICES (RCS) MARKETMARKET DEFINITION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2021–2023

- TABLE 3 PRIMARY INTERVIEWS WITH EXPERTS

- TABLE 4 FACTOR ANALYSIS

- TABLE 5 GOVERNMENT REGULATIONS/POLICIES/INITIATIVES TO SAFEGUARD SMS FROM ATTACKERS

- TABLE 6 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SMS TRAFFIC (USD)

- TABLE 7 INDICATIVE PRICING ANALYSIS OF A2P MESSAGING, BY SMS TRAFFIC (USD)

- TABLE 8 A2P MESSAGING MARKET: ECOSYSTEM

- TABLE 9 LIST OF KEY PATENTS

- TABLE 10 RAZORPAY USED MSG91’S SYSTEM FOR EFFICIENT REAL-TIME CUSTOMER COMMUNICATION

- TABLE 11 TEXTLOCAL HELPED TASTECARD INCREASE MEMBERSHIP PURCHASES

- TABLE 12 INFOBIP HELPED MRSPEEDY SCALE AND WORK EFFICIENTLY WHEN REMOTE

- TABLE 13 ALLO USED GMS TO IMPROVE PROMO CAMPAIGN CONVERSION RATE

- TABLE 14 SINCH HELPED MOBICOM INCREASE INTERNATIONAL MESSAGING WITH ENHANCED A2P TRAFFIC

- TABLE 15 PARFYM.SE USED SINCH TO PERSONALIZE MESSAGES TO STAND OUT AMONG PROMOTIONS

- TABLE 16 A2P MESSAGING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024–2025

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 A2P MESSAGING MARKET: PORTER’S FIVE FORCE MODEL ANALYSIS

- TABLE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 25 A2P MESSAGING MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 26 A2P MESSAGING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 27 A2P MESSAGING PLATFORMS MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 28 A2P MESSAGING PLATFORMS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 29 A2P MESSAGING SERVICES MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 30 A2P MESSAGING SERVICES MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 31 A2P MESSAGING MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 32 A2P MESSAGING MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 33 MARKET FOR AUTHENTICATION SERVICES, BY REGION, 2019–2023 (USD MILLION)

- TABLE 34 MARKET FOR AUTHENTICATION SERVICES, BY REGION, 2024–2029 (USD MILLION)

- TABLE 35 MARKET FOR PROMOTIONAL & MARKETING SERVICES, BY REGION, 2019–2023 (USD MILLION)

- TABLE 36 MARKET FOR PROMOTIONAL & MARKETING SERVICES, BY REGION, 2024–2029 (USD MILLION)

- TABLE 37 MARKET FOR PUSHED CONTENT SERVICES, BY REGION, 2019–2023 (USD MILLION)

- TABLE 38 MARKET FOR PUSHED CONTENT SERVICES, BY REGION, 2024–2029 (USD MILLION)

- TABLE 39 MARKET FOR INTERACTIVE MESSAGE SERVICES, BY REGION, 2019–2023 (USD MILLION)

- TABLE 40 MARKET FOR INTERACTIVE MESSAGE SERVICES, BY REGION, 2024–2029 (USD MILLION)

- TABLE 41 MARKET FOR CUSTOMER RELATIONSHIP MANAGEMENT SERVICES, BY REGION, 2019–2023 (USD MILLION)

- TABLE 42 MARKET FOR CUSTOMER RELATIONSHIP MANAGEMENT SERVICES, BY REGION, 2024–2029 (USD MILLION)

- TABLE 43 MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2023 (USD MILLION)

- TABLE 44 MARKET FOR OTHER APPLICATIONS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 45 MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 46 MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 47 MARKET VIA SMS, BY REGION, 2019–2023 (USD MILLION)

- TABLE 48 MARKET VIA SMS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 49 MARKET VIA OPERATOR IP, BY REGION, 2019–2023 (USD MILLION)

- TABLE 50 MARKET VIA OPERATOR IP, BY REGION, 2024–2029 (USD MILLION)

- TABLE 51 MARKET VIA THIRD-PARTY APPS, BY REGION, 2019–2023 (USD MILLION)

- TABLE 52 MARKET VIA THIRD-PARTY APPS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 53 MARKET VIA FIXED FEES, BY REGION, 2019–2023 (USD MILLION)

- TABLE 54 MARKET VIA FIXED FEES, BY REGION, 2024–2029 (USD MILLION)

- TABLE 55 MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 56 MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 57 DOMESTIC MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 58 DOMESTIC MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 59 INTERNATIONAL MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 60 INTERNATIONAL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 61 MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 62 MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 63 MARKET FOR BFSI END USERS, BY REGION, 2019–2023 (USD MILLION)

- TABLE 64 MARKET FOR BFSI END USERS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 65 MARKET FOR RETAIL & ECOMMERCE END USERS, BY REGION, 2019–2023 (USD MILLION)

- TABLE 66 MARKET FOR RETAIL & ECOMMERCE END USERS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 67 MARKET FOR GOVERNMENT END USERS, BY REGION, 2019–2023 (USD MILLION)

- TABLE 68 MARKET FOR GOVERNMENT END USERS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 69 MARKET FOR HEALTHCARE END USERS, BY REGION, 2019–2023 (USD MILLION)

- TABLE 70 MARKET FOR HEALTHCARE END USERS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 71 MARKET FOR TRAVEL & HOSPITALITY END USERS, BY REGION, 2019–2023 (USD MILLION)

- TABLE 72 MARKET FOR TRAVEL & HOSPITALITY END USERS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 73 MARKET FOR OTHER END USERS, BY REGION, 2019–2023 (USD MILLION)

- TABLE 74 MARKET FOR OTHER END USERS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 75 MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 76 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 89 US: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 90 US: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 91 US: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 92 US: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 93 US: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 94 US: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 95 US: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 96 US: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 97 US: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 98 US: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 99 CANADA: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 100 CANADA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 101 CANADA: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 102 CANADA: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 103 CANADA: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 104 CANADA: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 105 CANADA: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 106 CANADA: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 107 CANADA: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 108 CANADA: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 109 EUROPE: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 115 EUROPE: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 116 EUROPE: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 117 EUROPE: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 118 EUROPE: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 119 EUROPE: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 120 EUROPE: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 121 UK: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 122 UK: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 123 UK: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 124 UK: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 125 UK: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 126 UK: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 127 UK: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 128 UK: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 129 UK: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 130 UK: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 131 GERMANY: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 132 GERMANY: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 133 GERMANY: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 134 GERMANY: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 135 GERMANY: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 136 GERMANY: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 137 GERMANY: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 138 GERMANY: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 139 GERMANY: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 140 GERMANY: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 141 ITALY: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 142 ITALY: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 143 ITALY: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 144 ITALY: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 145 ITALY: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 146 ITALY: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 147 ITALY: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 148 ITALY: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 149 ITALY: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 150 ITALY: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 155 ASIA PACIFIC: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 157 ASIA PACIFIC: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 158 ASIA PACIFIC: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 159 ASIA PACIFIC: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 160 ASIA PACIFIC: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 161 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 162 ASIA PACIFIC: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 163 CHINA: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 164 CHINA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 165 CHINA: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 166 CHINA: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 167 CHINA: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 168 CHINA: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 169 CHINA: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 170 CHINA: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 171 CHINA: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 172 CHINA: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 173 JAPAN: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 174 JAPAN: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 175 JAPAN: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 176 JAPAN: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 177 JAPAN: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 178 JAPAN: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 179 JAPAN: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 180 JAPAN: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 181 JAPAN: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 182 JAPAN: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 183 INDIA: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 184 INDIA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 185 INDIA: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 186 INDIA: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 187 INDIA: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 188 INDIA: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 189 INDIA: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 190 INDIA: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 191 INDIA: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 192 INDIA: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 205 GCC COUNTRIES: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 206 GCC COUNTRIES: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 207 GCC COUNTRIES: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 208 GCC COUNTRIES: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 209 GCC COUNTRIES: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 210 GCC COUNTRIES: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 211 GCC COUNTRIES: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 212 GCC COUNTRIES: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 213 GCC COUNTRIES: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 214 GCC COUNTRIES: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 215 GCC COUNTRIES: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 216 GCC COUNTRIES: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 217 SOUTH AFRICA: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 218 SOUTH AFRICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 219 SOUTH AFRICA: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 220 SOUTH AFRICA: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 221 SOUTH AFRICA: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 222 SOUTH AFRICA: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 223 SOUTH AFRICA: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 224 SOUTH AFRICA: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 225 SOUTH AFRICA: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 226 SOUTH AFRICA: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 227 LATIN AMERICA: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 228 LATIN AMERICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 229 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 230 LATIN AMERICA: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 231 LATIN AMERICA: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 232 LATIN AMERICA: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 233 LATIN AMERICA: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 234 LATIN AMERICA: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 235 LATIN AMERICA: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 236 LATIN AMERICA: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 237 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 238 LATIN AMERICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 239 BRAZIL: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 240 BRAZIL: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 241 BRAZIL: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 242 BRAZIL: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 243 BRAZIL: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 244 BRAZIL: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 245 BRAZIL: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 246 BRAZIL: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 247 BRAZIL: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 248 BRAZIL: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 249 MEXICO: MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 250 MEXICO: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 251 MEXICO: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 252 MEXICO: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 253 MEXICO: MARKET, BY COMMUNICATION CHANNEL, 2019–2023 (USD MILLION)

- TABLE 254 MEXICO: MARKET, BY COMMUNICATION CHANNEL, 2024–2029 (USD MILLION)

- TABLE 255 MEXICO: MARKET, BY SMS TRAFFIC, 2019–2023 (USD MILLION)

- TABLE 256 MEXICO: MARKET, BY SMS TRAFFIC, 2024–2029 (USD MILLION)

- TABLE 257 MEXICO: MARKET, BY END USER, 2019–2023 (USD MILLION)

- TABLE 258 MEXICO: MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 259 OVERVIEW OF STRATEGIES DEPLOYED BY KEY A2P MESSAGING VENDORS

- TABLE 260 MARKET: DEGREE OF COMPETITION

- TABLE 261 REGIONAL FOOTPRINT, 2023

- TABLE 262 OFFERING FOOTPRINT, 2023

- TABLE 263 END USER FOOTPRINT, 2023

- TABLE 264 DETAILED LIST OF KEY STARTUPS/SMES, 2023

- TABLE 265 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 266 MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2020–FEBRUARY 2024

- TABLE 267 MARKET: DEALS, JANUARY 2020–FEBRUARY 2024

- TABLE 268 AT&T: COMPANY OVERVIEW

- TABLE 269 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 AT&T: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 271 AT&T: DEALS

- TABLE 272 CHINA MOBILE: COMPANY OVERVIEW

- TABLE 273 CHINA MOBILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 CHINA MOBILE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 275 SINCH: COMPANY OVERVIEW

- TABLE 276 SINCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 SINCH: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 278 SINCH: DEALS

- TABLE 279 TWILIO: COMPANY OVERVIEW

- TABLE 280 TWILIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 INFOBIP: BUSINESS OVERVIEW

- TABLE 282 INFOBIP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 INFOBIP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 284 INFOBIP: DEALS

- TABLE 285 VONAGE: COMPANY OVERVIEW

- TABLE 286 VONAGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 VONAGE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 288 VONAGE: DEALS

- TABLE 289 ORANGE: COMPANY OVERVIEW

- TABLE 290 ORANGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 COMVIVA: COMPANY OVERVIEW

- TABLE 292 COMVIVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 COMVIVA: DEALS

- TABLE 294 ROUTE MOBILE: COMPANY OVERVIEW

- TABLE 295 ROUTE MOBILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 ROUTE MOBILE: DEALS

- TABLE 297 BICS: COMPANY OVERVIEW

- TABLE 298 BICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 BICS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 300 ADJACENT MARKETS AND FORECASTS

- TABLE 301 COMMUNICATION PLATFORM AS A SERVICE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 302 COMMUNICATION PLATFORM AS A SERVICE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 303 COMMUNICATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 304 COMMUNICATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 305 COMMUNICATION PLATFORM AS A SERVICE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 306 COMMUNICATION PLATFORM AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 307 COMMUNICATION PLATFORM AS A SERVICE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 308 COMMUNICATION PLATFORM AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 309 RICH COMMUNICATION SERVICES MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

- TABLE 310 RICH COMMUNICATION SERVICES MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

- TABLE 311 RICH COMMUNICATION SERVICES MARKET, BY END USER, 2016–2019 (USD MILLION)

- TABLE 312 RICH COMMUNICATION SERVICES MARKET, BY END USER, 2020–2025 (USD MILLION)

- TABLE 313 RICH COMMUNICATION SERVICES MARKET, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

- TABLE 314 RICH COMMUNICATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

- TABLE 315 RICH COMMUNICATION SERVICES MARKET, BY ENTERPRISE VERTICAL, 2016–2019 (USD MILLION)

- TABLE 316 RICH COMMUNICATION SERVICES MARKET, BY ENTERPRISE VERTICAL, 2020–2025 (USD MILLION)

- TABLE 317 RICH COMMUNICATION SERVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 318 RICH COMMUNICATION SERVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 MARKET: GEOGRAPHIC SCOPE

- FIGURE 3 YEARS CONSIDERED FOR STUDY

- FIGURE 4 MARKET: RESEARCH DESIGN

- FIGURE 5 SECONDARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARIES, BY COMPANY, DESIGNATION, AND REGION

- FIGURE 7 PRIMARY SOURCES

- FIGURE 8 KEY INDUSTRY INSIGHTS

- FIGURE 9 APPROACH 1 (SUPPLY-SIDE): REVENUE OF OFFERINGS IN MARKET

- FIGURE 10 APPROACH 2: DEMAND-SIDE ANALYSIS

- FIGURE 11 MARKET SIZE ESTIMATION: TOP-DOWN & BOTTOM-UP APPROACHES

- FIGURE 12 DATA TRIANGULATION

- FIGURE 13 MARKET, 2022–2029 (USD MILLION)

- FIGURE 14 MARKET: REGIONAL SHARE, 2024

- FIGURE 15 GROWING TREND OF MOBILE MARKETING VIA MESSAGING TO ACT AS OPPORTUNITY IN MARKET

- FIGURE 16 A2P MESSAGING SERVICES AND US TO ACCOUNT FOR RESPECTIVE LARGER SHARES NORTH AMERICAN MARKET

- FIGURE 17 A2P MESSAGING SERVICES AND CHINA TO ACCOUNT FOR RESPECTIVE LARGER SHARES OF ASIA PACIFIC MARKET

- FIGURE 18 AUTHENTICATION SERVICES TO BE LARGEST APPLICATION OF A2P MESSAGING IN 2024

- FIGURE 19 BFSI TO ACCOUNT FOR LARGEST SHARES AMONG ALL END USERS OF A2P MESSAGING IN 2024

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

- FIGURE 21 SUBSCRIBER PENETRATION AND SMARTPHONE ADOPTION TRENDS BY 2030

- FIGURE 22 BRIEF HISTORY OF A2P MESSAGING

- FIGURE 23 DISRUPTION TRENDS IMPACTING BUYERS/CUSTOMERS IN MARKET

- FIGURE 24 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SMS TRAFFIC (USD)

- FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 A2P MESSAGING ECOSYSTEM

- FIGURE 27 LIST OF KEY PATENTS FOR A2P MESSAGING

- FIGURE 28 A2P MESSING TOOLS, FRAMEWORKS, AND TECHNIQUES

- FIGURE 29 MARKET: PORTER’S FIVE FORCES MODEL

- FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE END-USERS

- FIGURE 32 INVESTMENT AND FUNDING, 2019–2023 (USD MILLION)

- FIGURE 33 A2P MESSAGING PLATFORMS TO WITNESS HIGHER CAGR THAN SERVICES DURING FORECAST PERIOD

- FIGURE 34 AUTHENTICATION SERVICES TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 THIRD-PARTY APPS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 INTERNATIONAL SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 HEALTHCARE SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 MARKET: REGIONAL SNAPSHOT, 2024

- FIGURE 39 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 42 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS, 2019–2023 (USD MILLION)

- FIGURE 43 MARKET SHARE ANALYSIS OF A2P MESSAGING COMPANIES, 2023

- FIGURE 44 MARKET RANKING ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 45 A2P MESSAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 46 OVERALL COMPANY FOOTPRINT, 2023

- FIGURE 47 A2P MESSAGING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 48 PROMINENT A2P MESSAGING SOLUTIONS

- FIGURE 49 EV/EBITDA, 2023

- FIGURE 50 COMPANY VALUATION OF KEY A2P MESSAGING VENDORS

- FIGURE 51 AT&T: COMPANY SNAPSHOT

- FIGURE 52 CHINA MOBILE: COMPANY SNAPSHOT

- FIGURE 53 SINCH: COMPANY SNAPSHOT

- FIGURE 54 TWILIO: COMPANY SNAPSHOT

- FIGURE 55 ORANGE: COMPANY SNAPSHOT

- FIGURE 56 ROUTE MOBILE: COMPANY SNAPSHOT

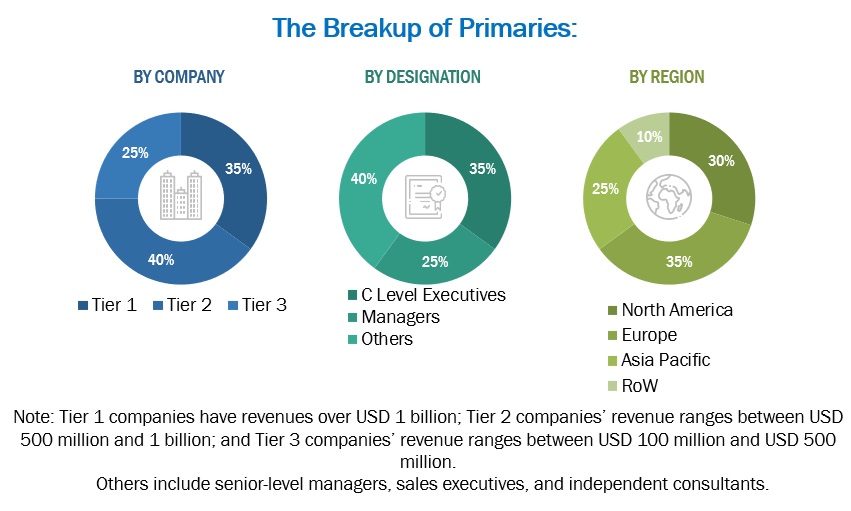

The study involved four major activities in estimating the current size of the global A2P messaging market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total A2P messaging market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the A2P messaging market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Route Mobile |

Senior Manager |

|

Plivo |

VP |

|

Sinch |

Business Executive |

Market Size Estimation

For making market estimates and forecasting the A2P messaging market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global A2P messaging market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the A2P messaging market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

A2P messaging market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

A2P messaging market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

A2P (Application-to-Person) messaging refers to the process where an application sends messages to a user, typically through SMS (Short Message Service) but also via other messaging channels, including Over-the-Top (OTT) messaging platforms such as WhatsApp, Telegram, or Facebook Messenger. This type of messaging is used primarily by businesses and organizations to communicate directly with customers for a variety of purposes, such as sending alerts, reminders, promotional content, authentication codes, and transaction confirmations. OTT messaging platforms offer a rich, cost-effective alternative to traditional SMS, allowing for the inclusion of multimedia content, interactive elements, and encryption for privacy.

Key Stakeholders

- Network infrastructure enablers

- Technology vendors

- Mobile Network Operators (MNOs)

- Communication Service Providers (CSPs)

- System Integrators (SIs)

- A2P platform vendors and software application providers

- Resellers

- Value-added resellers (VARs)

- Compliance regulatory authorities

- Government authorities

- Investment firms

- Cloud service providers

- A2P messaging alliances/groups

- Original Design Manufacturers (ODMs)

- Original Equipment Manufacturers (OEMs)

- Enterprises/businesses

Report Objectives

- To determine, segment, and forecast the global A2P messaging market based on offering, application, communication channel, SMS traffic, end user, and region in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the A2P messaging market.

- To study the complete value chain and related industry segments and perform a value chain analysis of the A2P messaging market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total A2P messaging market.

- To analyze the industry trends, patents, and innovations related to the A2P messaging market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the A2P messaging market.

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in A2P Messaging Market

Yet, the popularity of A2P (Application-to-Person) communications has been rising recently, and this trend is probably going to continue, according to trends through 2021. Up until 2021, some of the major themes in A2P messaging include the following: • Increased adoption of Rich Communication Services (RCS) • More personalized messaging • Continued growth in chatbots and AI-powered messaging • Enhanced security and privacy • Integration with other technologies

What are the trends in A2P messaging in 2023?