Projection Mapping Market Size, Share, Industry Growth, Trends & Analysis by Offering (Hardware (Projector, Media Server), Software), Throw Distance, Dimension (2D, 3D, 4D), Lumens, Applications (Media, Venue, Retail, Entertainment), and Region 2026

Updated on : March 08, 2023

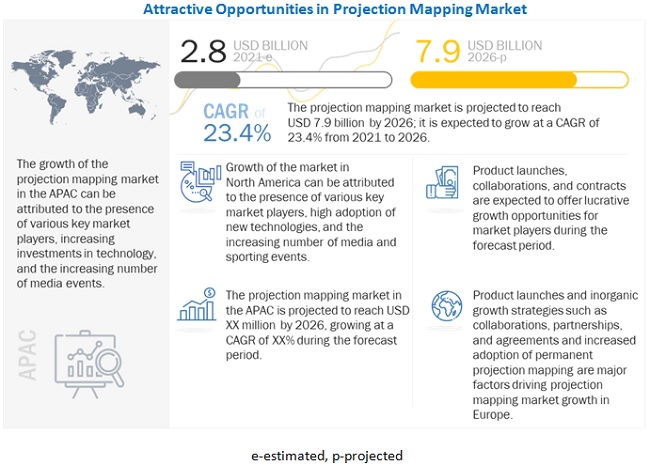

The projection mapping market Size, Share, Industry Growth, Trends & Analysis was valued at USD 3.3 billion in 2022 and is projected to reach USD 7.9 billion by 2026, growing at a CAGR of 23.4% between 2023 and 2026. 4D segment is expected to witness highest CAGR of 35.3%.

The increasing adoption of projection mapping in media events, rise in advertising expenditure and increasing demand for high brightness projectors are some of the prominent factors for the growth of the projection mapping industry globally.

Projection Mapping Market Grows with Expanding Applications in Media, Venues, and Retail

In-Store Experience: Inside stores, projection mapping is used to create interactive displays and virtual fitting rooms. Customers can see how products look in different settings or on their person without physically trying them on, enhancing the shopping experience and making it more convenient and enjoyable.To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Projection Mapping Market

Due to the COVID-19 pandemic, lockdowns and restriction measures have been imposed in many parts of the world and various events that comprised of massive crowd gatherings had been cancelled or postponed until the situation improves.

The projection mapping market size has witnessed a dip in the first three-quarters of FY 20-21 and various key players of the market such as Panasonic (Japan), Epson (Japan) and Barco (Belgium) have experienced a slowdown in their operations during this period. However, the market has also witnessed a steady recovery in the last quarter of FY 20-21.

New opportunities for the market have been created for indoor applications and smaller venues and technologies such as spatial augmented reality and projected AR is being extensively used to facilitate projection mapping while maintaining social distancing. The market is expected to recover in 2021 due to the steady increase in the number of media events and sporting events globally and the rise in advertising expenditure globally.

Projection Mapping Market Size Dynamics

Driver: Increasing demand for high brightness projectors

The size of the venue, throw distance and the ambient lighting at the venue are the key factors to be considered for selecting the projector suitable for the application.

The light processing components in a projector consist of a projector lamp which determines the brightness delivered and the color wheel which regulates the color output. Technically, higher brightness can be produced with the use of a higher wattage lamp.

Brightness is one of the most important specifications to be considered while selecting a projector. It is expressed in lumens or ANSI lumens. Lumens measure the strength of the light source in the projectors. Projectors for auditoriums or large venues begin at 7,000 lumens but if the venue is very large or brightly lit, projectors with 25,000 lumens or greater might be needed. A few industry experts have stated that for large screens or canvases, projectors up to 75,000 lumens are the most appropriate as installing one projector is easier than installing and aligning many as per the required needs, reducing the chances of failure.

In 2020, six of the nine new projector series launched by Epson were high brightness projectors. Projectors with higher lumen ratings produce clearer images, especially when there is ambient lighting along with the projection. High lumen-count is also necessary when projectors are being used for applications on large screen sizes or at large venues. According to a few industry experts, projectors up to 4,000 lumens can be used for smaller settings, up to 5,000 lumens can be used for mid-size settings, and projectors above 5,000 lumens can be used for larger settings.

Restraint: Projection Mapping incurs high cost

There have been several advancements in projectors and in the field of projection mapping over time. To render 3D content in resolutions such as 4K incurs significantly high costs.

Processes such as capturing the content and creating a 3D model as per the mapping surface and buying the projector with the required amount of throw with high brightness and high resolution is expected to incur high costs.

Cost is one of the parameters affecting consumer buying behavior and is a key factor for projection mapping product and service providers. In the current market, most projection mapping products and services are highly priced, which only the affluent can afford. The average projection mapping service costs approximately USD 10,000 per one minute of 3D video content for large venue applications. In addition to the cost of the development of the video which is based on time, projectors, media servers, and hard drives are other costs incurred for projection mapping.

Opportunity: Rising use of augmented and virtual reality

Augmented Reality (AR) and Virtual Reality (VR) offer significant potential in creating content for a wide range of audiences along with enhanced user experience.

Though AR or mixed reality applications are growing at a very fast pace due to the rising familiarity with these technologies, their potential can be leveraged further when these technologies are combined with projection mapping.

Projected AR is a technology that directly overlays digital projections onto the physical world. Unlike smartphones and conventional wearable devices that are required for AR, projected AR facilitates projection without the requirement for any intermediate device. Projection mapping can be combined with AR with the help of light cameras combined with 3D sensing systems such as depth cameras. By combining technologies such as AR and projection mapping, an enhanced physical and digital experience can be created, particularly with the interactions involving the sensation of touch, bridging the gap between the online and offline worlds.

The integration of VR and AR along with projection mapping can assist companies in building strong brand value, thereby facilitating a higher reach and highly interactive campaigns. Using AR and projection mapping, beautiful landmarks can be converted into brand experiences. For instance, tourism companies were among the first to adopt AR and VR as it is a fantastic way for consumers to experience their dream destinations. Automotive companies have also started using AR and VR to build an experience to satisfy the changing preferences of their target audiences. Hence, the growth in the projection mapping market can be enhanced by integrating the technique with technologies such as AR, mixed reality, or VR.

Challenge: Projection Mapping is a complex procedure

Projection mapping is a complex procedure. This technique not only requires multiple devices like projectors, media servers, mapping, and modelling software but also needs skilled practitioners who can use the equipment to obtain the desired projection onto the screen or canvas.

Majorly, projection mapping is provided as a service by service providers who rent, install and operate the equipment at the desired venue. A major challenge to the growth projection mapping market is the complexity of the process. Though there have been significant developments in the technology, the skills required to operate the equipment and handle complex procedures such as using multiple projectors simultaneously cannot be substituted.

Media events held the largest market share of the projection mapping market in 2020 and is expected to dominate the market during the forecast period

The increasing number of media events and sporting events globally is creating new opportunities for projection mapping. Projection mapping is being extensively used in the opening ceremonies and half-time shows of major sporting events and at venues like auditoriums and places with massive crowd gatherings to enhance the visual experience and facilitate greater audience engagement.

Projection Mapping Market Segment Overview

Projection mapping market for projectors with brightness above 30,000 lumens to grow at the highest CAGR during the forecast period

Generally, projectors with a brightness of 10,000 lumens or more are used for projection mapping in large venues with massive crowd gatherings. However, projectors with a brightness of more than 30,000 lumens are preferred in bright environments.

The lumen-count increases based on the size of the venue and the ambient light present at the venue. In recent years, there has been a sharp increase in the demand for high brightness projectors to facilitate projection mapping during the day or in brightly lit venues.

2D projection mapping is expected to hold the largest share of the projection mapping market during the forecast period

Though 2D projection mapping is not as appealing and engaging as 3D and 4D projection mapping, various organizations use it extensively for its simplified usage and reduced cost. 3D and 4D projection mapping have a higher potential in providing higher audience engagement, but when executed properly, 2D projection mapping can also create a highly enhanced visual experience.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Projection Mapping industry

The major players in the projection mapping companies such as are Panasonic (Japan), Epson (US), BenQ (Taiwan), Barco (Belgium), and Christie Digital Systems (US).

Projection Mapping Market Scope

|

Report Metric |

Scope |

|

Estimated Market Size |

USD 2.8 Billion |

|

Projected Market Size |

USD 7.9 Billion |

|

Growth Rate |

23.4% |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million), and Volume (Million Units) |

|

Segments covered |

By Offering, Throw Distance, Dimension, Brightness/Lumens, and Application |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the projection mapping market are Panasonic (Japan), Epson (Japan), BenQ (Taiwan), Barco (Belgium), Christie Digital Systems (US), Optoma Corporation (Taiwan), Digital Projection Limited (UK), NEC Display Solutions (US), Vivitek (Netherlands), ViewSonic (US), and AV Stumpfl (Austria). |

The study categorizes the projection mapping market based on offering, throw distance, dimension, brightness/lumens, application at the regional and global level.

Projection Mapping Market By Offering

-

Hardware

- Projector

- Media Server

- Software

By Throw Distance

- Standard throw

- Short throw

By Dimension

- 2D

- 3D

- 4D

By Brightness/Lumens

- 3,500-10,000 Lumens

- 10,000-30,000 Lumens

- Above 30,000 Lumens

By Application

- Media Events

- Venue Openings

- Entertainment

- Product Launches

- Retail

- Others

Projection Mapping Market By Region

- North America

- Europe

- Asia Pacific

- Rest of World

Recent Developments in Projection Mapping Industry Trends

- In March 2021, Barco provided information about the F400-HR, the world's first truly native 4K single-chip DLP projector. This projector achieves the required resolution without the requirement for pixel stuffing.

- In March 2021, Seiko Epson Corporation introduced a versatile, compact and high lumen EB-PU1000 Series and EB-PU2010 laser projectors. These projectors provide an output ranging from 6,000 to 10,000 lumens, delivering bright and true-to-life images.

- In January 2021, Christie Digital Systems launched the Pandora’s Box V8 software license for real-time video processing and show control. This license agreement enables users to access only the functions of Pandora’s Box's software suite for enhanced media processing.

- In December 2020, Panasonic introduced PT-RZ16K, a 3-chip DLP projector that provides a brightness of 16,000 lumens and WUXGA resolution. This projector is also compatible with the geometry manager software that renders superior projection quality. This projector can be used for almost any venue.

- In November 2019, BenQ launched TH585, the budget-friendly, 1080p gaming projector. This projector provides an immersive entertainment experience by delivering 3,500 lumens brightness and offering a new RGBWYC color wheel that achieves 95% color space.

Frequently Asked Questions (FAQ):

How big projection mapping market?

The Projection Mapping Market Report size is expected to reach USD 7.9 billion by 2026 from USD 2.8 billion in 2021, at a CAGR of 23.4%.

Who are the winners in the global projection mapping market?

Companies such as Panasonic (Japan), Epson (Japan), BenQ (Taiwan), Barco (Belgium), Christie Digital Systems (US) fall under the winner's category.

What is the COVID-19 impact on projection mapping solution providers?

The key players in the projection mapping market such as Panasonic (Japan), Epson (Japan) and Barco (Belgium) have experienced a slowdown in their operations during the first three quarters of FY 20-21 due to the outbreak of the COVID-19 pandemic.

What is Projected AR?

Projected AR is a technology that directly overlays digital projections onto the physical world, without the requirement for any intermediate device.

How can AR and VR be integrated with projection mapping to enhance the user experience?

AR and VR, along with projection mapping, can assist companies in building strong brand value and creating highly interactive campaigns. This integration can help bridge the gap between the online and offline worlds and provide a more immersive physical and digital experience, particularly with the sensation of touch.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.1.1 Inclusions and exclusions for the offering segment

1.2.1.2 Inclusions and exclusions for the brightness segment

1.2.1.3 Inclusions and exclusions for other segments (throw distance, dimension, application, and geography)

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 PROJECTION MAPPING MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH APPROACH

FIGURE 2 PROJECTION MAPPING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing the market share through the bottom-up analysis

FIGURE 3 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing the market share through the top-down analysis

FIGURE 4 TOP-DOWN APPROACH

2.2.3 PROJECTION MAPPING MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 5 MARKET: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 6 SUPPLY-SIDE MARKET ESTIMATION

2.2.5 GROWTH FORECAST ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 8 PROJECTION MAPPING MARKET: PRE- AND POST-COVID-19 SCENARIO ANALYSIS, 2017–2026 (USD MILLION)

3.1 REALISTIC SCENARIO (POST-COVID-19)

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

FIGURE 9 MEDIA EVENTS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

FIGURE 10 ABOVE 30,000 LUMENS PROJECTION MAPPING MARKET TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 11 SOFTWARE OFFERING SEGMENT TO GROW AT THE HIGHEST CAGR IN THE PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

FIGURE 12 SHORT THROW MARKET TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 13 THE 2D DIMENSION SEGMENT TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET DURING THE FORECAST PERIOD

FIGURE 14 THE MARKET IN APAC TO GROW AT THE HIGHEST CAGR IN THE PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL PROJECTION MAPPING MARKET

FIGURE 15 RAPID INCREASE IN THE NUMBER OF MEDIA EVENTS TO DRIVE THE GROWTH OF THE PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

4.2 MARKET IN EUROPE, BY APPLICATION AND COUNTRY

FIGURE 16 GERMANY ACCOUNTED FOR THE LARGEST SHARE OF THE PROJECTION MAPPING MARKET IN EUROPE IN 2020

4.3 ARKET, BY OFFERING

FIGURE 17 PROJECTORS SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF THE MARKET THROUGH 2026

4.4 MARKET, BY DIMENSION

FIGURE 18 2D DIMENSION PROJECTION MAPPING SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.5 REGIONAL ANALYSIS OF PROJECTION MAPPING MARKET

FIGURE 19 NORTH AMERICA TO ACCOUNT FOR THE LARGEST SHARE OF THE PROJECTION MAPPING MARKET IN 2021

4.6 MARKET, BY THROW DISTANCE

FIGURE 20 MARKET FOR STANDARD THROW SEGMENT TO ACCOUNT FOR THE LARGEST SHARE DURING THE FORECAST PERIOD

4.7 MARKET, BY BRIGHTNESS

FIGURE 21 PROJECTION MAPPING MARKET FOR THE 3,500-10,000 LUMENS SEGMENT TO ACCOUNT FOR THE LARGEST SHARE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 PROJECTION MAPPING MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of projection mapping for media events

5.2.1.2 Rising advertising expenditure

FIGURE 23 FORECAST GROWTH IN GLOBAL ADVERTISING SPEND, 2020 VS 2021, BY REGION

5.2.1.3 Adoption of projection mapping for medical applications

5.2.1.4 Increasing demand for high brightness projectors

FIGURE 24 AVERAGE LUMEN COUNT, BY TYPE OF SPACE

FIGURE 25 IMPACT ANALYSIS OF DRIVERS ON THE PROJECTION MAPPING MARKET

5.2.2 RESTRAINTS

5.2.2.1 Decrease in the number of outdoor events due to the pandemic

5.2.2.2 Projection is less effective under bright ambient light

5.2.2.3 Projection mapping incurs high cost

FIGURE 26 IMPACT ANALYSIS OF RESTRAINTS ON THE PROJECTION MAPPING MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of 4K and 8K resolution

FIGURE 27 4K TECHNOLOGY PRODUCT SHIPMENTS IN 2020, BY TYPE (MILLIONS)

5.2.3.2 Rising use of augmented and virtual reality

5.2.3.3 Increasing 3D and 4D content

FIGURE 28 IMPACT ANALYSIS OF OPPORTUNITIES ON THE PROJECTION MAPPING MARKET

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness and knowledge about projection mapping

5.2.4.2 Projection mapping is a complex procedure

FIGURE 29 IMPACT ANALYSIS OF CHALLENGES ON THE PROJECTION MAPPING MARKET

6 INDUSTRY TRENDS (Page No. - 71)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 30 PROJECTION MAPPING MARKET: VALUE CHAIN ANALYSIS

TABLE 1 MARKET: SUPPLY CHAIN ANALYSIS

6.3 PRICING ANALYSIS: AVERAGE SELLING PRICE TRENDS

FIGURE 31 PROJECTORS (ASP IN USD), BY BRIGHTNESS (LUMENS),2017-2026

TABLE 2 AVERAGE SELLING PRICES (ASP) OF PROJECTORS (USD), BY BRIGHTNESS (LUMENS)

6.4 LIST OF KEY PATENTS AND INNOVATIONS

FIGURE 32 NUMBER OF PATENTS APPROVED FOR PROJECTORS WORLDWIDE, 2018-2020

FIGURE 33 COMPANY-WISE ANALYSIS OF PATENTS FILED BY PLAYERS FOR PROJECTORS, 2018-2020

FIGURE 34 REGION-WISE ANALYSIS OF PATENTS FILED BY PLAYERS FOR PROJECTORS, 2018-2020

TABLE 3 KEY PATENTS AND INNOVATIONS IN THE MARKET, 2018-2020

6.5 KEY TECHNOLOGY TRENDS

6.5.1 REAL-TIME TRACKING AND PROJECTION MAPPING

6.5.2 SPATIAL AUGMENTED REALITY

6.5.3 PROJECTION MAPPING IN 4K

6.5.4 MEDICAL IMAGE PROJECTION SYSTEMS

6.6 PORTERS FIVE FORCES ANALYSIS

FIGURE 35 PROJECTION MAPPING MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 36 IMPACT OF PORTER’S FIVE FORCES ON THE PROJECTION MAPPING MARKET

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

6.7 CASE STUDIES

6.7.1 IMMERSIVE VAN GOGH EXHIBIT

6.7.2 BECOMING JAPANESE ART-ROUND TWO

6.7.3 PROJECTION MAPPING AT KUNSTAREAL

6.7.4 FRIEZE LOS ANGELES AND LA PHIL CENTENNIAL

6.7.5 MAPPING THE MOMENT: ASTRAL PROJEKT

6.7.6 REVITALIZING ROSHEN FACTORY

6.7.7 VIBRANCY INITIATIVE AT ST. EDWARD’S UNIVERSITY

6.7.8 XPARK AQUARIUM

6.8 TRADE DATA

TABLE 5 EXPORT DATA FOR IMAGE PROJECTORS, PHOTOGRAPHIC ENLARGERS, AND REDUCERS, HS CODE: 9008 (USD MILLION)

FIGURE 37 IMAGE PROJECTORS, PHOTOGRAPHIC ENLARGERS, AND REDUCERS EXPORT VALUES FOR MAJOR COUNTRIES, 2015-2019

TABLE 6 IMPORT DATA FOR IMAGE PROJECTORS, PHOTOGRAPHIC ENLARGERS, AND REDUCERS, HS CODE: 9008 (USD MILLION)

FIGURE 38 IMAGE PROJECTORS, PHOTOGRAPHIC ENLARGERS, AND REDUCERS IMPORT VALUES FOR MAJOR COUNTRIES, 2015-2019

6.9 REGULATORY FRAMEWORK

6.9.1 SWEDISH CONFEDERATION OF PROFESSIONAL EMPLOYEES (TCO) CERTIFICATION

6.9.2 LASER REGULATIONS

6.10 PROJECTION MAPPING ECOSYSTEM

FIGURE 39 PROJECTION MAPPING MARKET: ECOSYSTEM

7 PROJECTION MAPPING MARKET, BY OFFERING (Page No. - 90)

7.1 INTRODUCTION

TABLE 7 PROJECTION MAPPING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 8 MARKET, BY OFFERING, 2021–2026 (USD MILLION)

7.2 HARDWARE

TABLE 9 MARKET FOR HARDWARE, BY HARDWARE COMPONENT, 2017–2020 (USD MILLION)

TABLE 10 MARKET FOR HARDWARE, BY HARDWARE COMPONENT, 2021–2026 (USD MILLION)

TABLE 11 MARKET FOR HARDWARE, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 12 MARKET FOR HARDWARE, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 13 MARKET FOR HARDWARE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 14 PROJECTION MAPPING MARKET FOR HARDWARE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 15 MARKET FOR HARDWARE, BY REGION, 2017–2020 (USD MILLION)

FIGURE 40 NORTH AMERICA TO CONTINUE TO ACCOUNT FOR THE LARGEST SHARE OF THE PROJECTION MAPPING MARKET FOR HARDWARE DURING THE FORECAST PERIOD

TABLE 16 MARKET FOR HARDWARE, BY REGION, 2021–2026 (USD MILLION)

7.2.1 PROJECTOR

7.2.1.1 DLP projectors

7.2.1.1.1 The ability to project images with higher contrast make DLP projectors highly suited for standalone projection applications

7.2.1.2 LCD projectors

7.2.1.2.1 Rich color dynamics in ambient light and low power consumption is facilitating the use of LCD projectors for projection mapping applications

7.2.2 MEDIA SERVERS

7.2.2.1 Media servers are being increasingly used for simplifying complex processes such as previsualizing content, real-time playback, media output management, and synchronization among projectors

7.3 SOFTWARE

7.3.1 INCREASED ADOPTION OF PROJECTION MAPPING ON IRREGULAR AND COMPLEX SURFACES IS DRIVING THE GROWTH OF THE PROJECTION MAPPING MARKET FOR SOFTWARE

TABLE 17 MARKET FOR SOFTWARE, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 18 MARKET FOR SOFTWARE, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 19 MARKET FOR SOFTWARE, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 41 THE PRODUCT LAUNCHES SEGMENT TO GROW AT THE HIGHEST CAGR IN THE PROJECTION MAPPING MARKET FOR SOFTWARE DURING THE FORECAST PERIOD

TABLE 20 MARKET FOR SOFTWARE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 21 MARKET FOR SOFTWARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 MARKET FOR SOFTWARE, BY REGION, 2021–2026 (USD MILLION)

8 PROJECTION MAPPING MARKET, BY THROW DISTANCE (Page No. - 100)

8.1 INTRODUCTION

TABLE 23 PROJECTION MAPPING MARKET, BY THROW DISTANCE, 2017–2020 (USD MILLION)

FIGURE 42 SHORT THROW MARKET TO GROW AT THE HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 24 MARKET, BY THROW DISTANCE, 2021–2026 (USD MILLION)

8.2 STANDARD THROW

8.2.1 INCREASING NUMBER OF LARGE VENUE APPLICATIONS AND MEDIA EVENTS IS DRIVING THE GROWTH OF THE SHORT THROW PROJECTION MAPPING MARKET

TABLE 25 MARKET FOR STANDARD THROW, BY REGION, 2017–2020 (USD MILLION)

FIGURE 43 APAC TO GROW AT THE HIGHEST CAGR IN THE STANDARD THROW MARKET DURING THE FORECAST PERIOD

TABLE 26 PROJECTION MAPPING MARKET FOR STANDARD THROW, BY REGION, 2021–2026 (USD MILLION)

8.3 SHORT THROW

8.3.1 INCREASING PROJECTION MAPPING OPPORTUNITIES IN SMALL AND MEDIUM SIZED VENUES IS DRIVING THE GROWTH OF THE SHORT THROW PROJECTION MAPPING MARKET

TABLE 27 MARKET FOR SHORT THROW, BY REGION, 2017–2020 (USD MILLION)

FIGURE 44 APAC TO GROW AT THE HIGHEST CAGR IN SHORT THROW PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

TABLE 28 PROJECTION MAPPING MARKET FOR SHORT THROW, BY REGION, 2021–2026 (USD MILLION)

9 PROJECTION MAPPING MARKET, BY DIMENSION (Page No. - 106)

9.1 INTRODUCTION

TABLE 29 MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

FIGURE 45 2D TO CONTINUE TO ACCOUNT FOR THE LARGEST SHARE IN THE PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

TABLE 30 MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

9.2 2-DIMENSION

9.2.1 SIMPLER IMPLEMENTATION AND REDUCED COST EXPECTED TO DRIVE THE GROWTH OF THE 2D PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

TABLE 31 MARKET FOR 2D, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 46 PRODUCT LAUNCHES PROJECTED TO GROW AT THE HIGHEST CAGR IN THE 2D PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

TABLE 32 MARKET FOR 2D, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 33 MARKET FOR 2D, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 34 MARKET FOR 2D, BY OFFERING, 2021–2026 (USD MILLION)

9.3 3-DIMENSION

9.3.1 INCREASED INVESTMENTS IN TECHNOLOGY AND ADVERTISING EXPENDITURE EXPECTED TO DRIVE THE GROWTH OF THE 3D PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

TABLE 35 MARKET FOR 3D, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 47 MEDIA EVENTS TO CONTINUE TO ACCOUNT FOR THE LARGEST SHARE IN THE 3D PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

TABLE 36 MARKET FOR 3D, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 37 MARKET FOR 3D, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR 3D, BY OFFERING, 2021–2026 (USD MILLION)

9.4 4-DIMENSION

9.4.1 INCREASED NEED FOR COMPANIES TO DIFFERENTIATE THEMSELVES FROM THEIR COMPETITORS IS CREATING NEW OPPORTUNITIES FOR 4D PROJECTION MAPPING

TABLE 39 PROJECTION MAPPING MARKET FOR 4D, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR 4D, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 41 PROJECTION MAPPING MARKET FOR 4D, BY OFFERING, 2017–2020 (USD MILLION)

FIGURE 48 SOFTWARE SEGMENT TO GROW AT THE HIGHEST CAGR IN THE 4D MARKET DURING THE FORECAST PERIOD

TABLE 42 MARKET FOR 4D, BY OFFERING, 2021–2026 (USD MILLION)

10 PROJECTION MAPPING MARKET, BY BRIGHTNESS/LUMENS (Page No. - 115)

10.1 INTRODUCTION

TABLE 43 MARKET, BY BRIGHTNESS/LUMENS, 2017–2020 (USD MILLION)

FIGURE 49 ABOVE 30,000 LUMENS PROJECTION MAPPING MARKET TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 44 MARKET, BY BRIGHTNESS/LUMENS, 2021–2026 (USD MILLION)

TABLE 45 PROJECTION MAPPING MARKET, BY BRIGHTNESS/LUMENS, 2017–2020 (THOUSAND UNITS)

TABLE 46 MARKET, BY BRIGHTNESS/LUMENS, 2021–2026 (THOUSAND UNITS)

10.2 3,500-10,000 LUMENS

10.2.1 INCREASED OPPORTUNITIES FOR PROJECTION MAPPING IN SMALL AND MEDIUM SIZED VENUES IS DRIVING THE GROWTH OF THE 3,500-10,000 LUMENS PROJECTION MAPPING MARKET

TABLE 47 MARKET FOR 3,500-10,000 LUMENS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 50 NORTH AMERICA TO CONTINUE TO ACCOUNT FOR THE LARGEST SHARE OF THE 3,500-10,000 LUMENS PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

TABLE 48 MARKET FOR 3,500-10,000 LUMENS, BY REGION, 2021–2026 (USD MILLION)

10.3 10,000-30,000 LUMENS

10.3.1 VENUE OPENINGS AND PRODUCT LAUNCHES ARE DRIVING THE GROWTH OF THE 10,000-30,000 LUMENS PROJECTION MAPPING MARKET

TABLE 49 MARKET FOR 10,000-30,000 LUMENS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 51 APAC TO GROW AT THE HIGHEST CAGR FOR THE 10,000-30,000 LUMENS PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

TABLE 50 MARKET FOR 10,000-30,000 LUMENS, BY REGION, 2021–2026 (USD MILLION)

10.4 ABOVE 30,000 LUMENS

10.4.1 HIGH ADOPTION OF PROJECTION MAPPING IN TOURISM AND SPORTING EVENTS IS INCREASING THE DEMAND FOR HIGH LUMEN PROJECTORS

TABLE 51 PROJECTION MAPPING MARKET FOR ABOVE 30,000 LUMENS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 52 EUROPE TO GROW AT THE HIGHEST CAGR FOR ABOVE 30,000 LUMENS PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

TABLE 52 MARKET FOR ABOVE 30,000 LUMENS, BY REGION, 2021–2026 (USD MILLION)

11 PROJECTION MAPPING MARKET, BY APPLICATION (Page No. - 124)

11.1 INTRODUCTION

TABLE 53 PROJECTION MAPPING MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 53 MEDIA EVENTS ARE PROJECTED TO CONTINUE TO ACCOUNT FOR LARGEST SHARE OF THE PROJECTION MAPPING MARKET DURING THE FORECAST PERIOD

TABLE 54 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.2 MEDIA EVENTS

11.2.1 INCREASING NUMBER OF MEDIA EVENTS GLOBALLY IS OFFERING NEW OPPORTUNITIES FOR PROJECTION MAPPING

TABLE 55 MARKET FOR MEDIA EVENTS, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 56 MARKET FOR MEDIA EVENTS, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 57 MARKET FOR MEDIA EVENTS, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 58 MARKET FOR MEDIA EVENTS, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 59 MARKET FOR MEDIA EVENTS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 54 APAC REGION TO GROW AT THE HIGHEST CAGR IN THE PROJECTION MAPPING MARKET FOR MEDIA EVENTS DURING THE FORECAST PERIOD

TABLE 60 MARKET FOR MEDIA EVENTS, BY REGION, 2021–2026 (USD MILLION)

11.3 VENUE OPENINGS

11.3.1 VENUE OPENINGS ARE BEING TRANSFORMED INTO ENHANCED VISUAL SPECTACLES WITH THE HELP OF PROJECTION MAPPING

TABLE 61 MARKET FOR VENUE OPENINGS, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 62 MARKET FOR VENUE OPENINGS, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 63 MARKET FOR VENUE OPENINGS, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR VENUE OPENINGS, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 65 MARKET FOR VENUE OPENINGS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 55 THE MARKET IN THE APAC REGION TO GROW AT THE HIGHEST CAGR IN PROJECTION MAPPING FOR VENUE OPENINGS DURING THE FORECAST PERIOD

TABLE 66 MARKET FOR VENUE OPENINGS, BY REGION, 2021–2026 (USD MILLION)

11.4 ENTERTAINMENT

11.4.1 PROJECTION MAPPING IS BEING INCREASINGLY ADOPTED TO TRANSFORM THE SURFACES OF AUDITORIUMS INTO ART CANVASES

TABLE 67 PROJECTION MAPPING MARKET FOR ENTERTAINMENT, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 68 MARKET FOR ENTERTAINMENT, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 69 MARKET FOR ENTERTAINMENT, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 70 PROJECTION MAPPING MARKET FOR ENTERTAINMENT, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 71 MARKET FOR ENTERTAINMENT, BY REGION, 2017–2020 (USD MILLION)

FIGURE 56 APAC REGION TO CONTINUE TO ACCOUNT FOR THE LARGEST SHARE OF THE PROJECTION MAPPING MARKET FOR ENTERTAINMENT DURING THE FORECAST PERIOD

TABLE 72 MARKET FOR ENTERTAINMENT, BY REGION, 2021–2026 (USD MILLION)

11.5 PRODUCT LAUNCHES

11.5.1 PROJECTION MAPPING IS HELPING COMPANIES CREATE INCREASINGLY ENGAGING PROMOTIONAL CAMPAIGNS

TABLE 73 MARKET FOR PRODUCT LAUNCHES, BY OFFERING, 2017–2020 (USD MILLION)

FIGURE 57 SOFTWARE SEGMENT TO GROW AT THE HIGHER CAGR IN THE PROJECTION MAPPING MARKET FOR PRODUCT LAUNCHES DURING THE FORECAST PERIOD

TABLE 74 MARKET FOR PRODUCT LAUNCHES, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 75 MARKET FOR PRODUCT LAUNCHES, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 76 MARKET FOR PRODUCT LAUNCHES, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 77 MARKET FOR PRODUCT LAUNCHES, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR PRODUCT LAUNCHES, BY REGION, 2021–2026 (USD MILLION)

11.6 RETAIL

11.6.1 PROJECTION MAPPING IS HELPING RETAIL OUTLETS ATTRACT HIGHER NUMBERS OF CUSTOMERS

TABLE 79 PROJECTION MAPPING MARKET FOR RETAIL, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 80 MARKET FOR RETAIL, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 81 MARKET FOR RETAIL, BY DIMENSION, 2017–2020 (USD MILLION)

FIGURE 58 4D SEGMENT TO GROW AT THE HIGHEST CAGR IN THE PROJECTION MAPPING MARKET FOR RETAIL DURING THE FORECAST PERIOD

TABLE 82 MARKET FOR RETAIL, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 83 MARKET FOR RETAIL, BY REGION, 2017–2020 (USD MILLION)

TABLE 84 MARKET FOR RETAIL, BY REGION, 2021–2026 (USD MILLION)

11.7 OTHERS

TABLE 85 MARKET FOR OTHER APPLICATIONS, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR OTHER APPLICATIONS, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 87 MARKET FOR OTHER APPLICATIONS, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR OTHER APPLICATIONS, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 89 MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 59 NORTH AMERICA TO CONTINUE TO ACCOUNT FOR THE LARGEST SHARE OF THE PROJECTION MAPPING MARKET FOR OTHER APPLICATIONS DURING THE FORECAST PERIOD

TABLE 90 PROJECTION MAPPING MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

12 GEOGRAPHIC ANALYSIS (Page No. - 142)

12.1 INTRODUCTION

FIGURE 60 INDIA, FOLLOWED BY SPAIN AND SOUTH KOREA, TO GROW AT HIGHEST CAGRS IN THE PROJECTION MAPPING MARKET FROM 2021 TO 2026

TABLE 91 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 92 MARKET, BY REGION, 2021–2026 (USD MILLION)

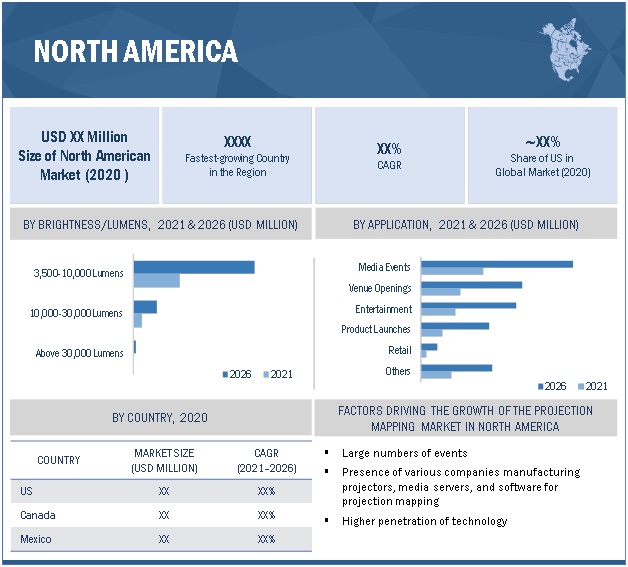

12.2 NORTH AMERICA

FIGURE 61 SNAPSHOT: PROJECTION MAPPING MARKET IN NORTH AMERICA, 2020

TABLE 93 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 94 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 95 MARKET IN NORTH AMERICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 96 MARKET IN NORTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 97 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 99 MARKET IN NORTH AMERICA, BY THROW DISTANCE, 2017–2020 (USD MILLION)

TABLE 100 MARKET IN NORTH AMERICA, BY THROW DISTANCE, 2021–2026 (USD MILLION)

TABLE 101 PROJECTION MAPPING MARKET IN NORTH AMERICA, BY BRIGHTNESS (LUMENS), 2017–2020 (USD MILLION)

TABLE 102 MARKET IN NORTH AMERICA, BY BRIGHTNESS (LUMENS), 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 Presence of various key market players and increasing number of media events is driving the projection mapping market in the US

12.2.2 CANADA

12.2.2.1 Increased adoption of new technologies is driving the projection mapping market in Canada

12.2.3 MEXICO

12.2.3.1 Investments in technology and digitalization are expected to fuel the growth of the projection mapping market in Mexico

12.3 EUROPE

FIGURE 62 SNAPSHOT: PROJECTION MAPPING MARKET IN EUROPE, 2020

TABLE 103 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 104 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 105 MARKET IN EUROPE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 107 MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 109 MARKET IN EUROPE, BY THROW DISTANCE, 2017–2020 (USD MILLION)

TABLE 110 MARKET IN EUROPE, BY THROW DISTANCE, 2021–2026 (USD MILLION)

TABLE 111 MARKET IN EUROPE, BY BRIGHTNESS/LUMENS, 2017–2020 (USD MILLION)

TABLE 112 MARKET IN EUROPE, BY BRIGHTNESS/LUMENS, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Increased adoption of projection mapping in large venues and historic buildings is driving the projection mapping market in Germany

12.3.2 UK

12.3.2.1 Rising number of media events is fueling the growth of the projection mapping market in the UK

12.3.3 FRANCE

12.3.3.1 High-quality infrastructure and large venue applications are driving the growth of the projection mapping market in France

12.3.4 SPAIN

12.3.4.1 Increased number of media events is fueling the growth of the projection mapping market in Spain

12.3.5 ITALY

12.3.5.1 Extensive usage of projection mapping in auditoriums and houses of worship is driving the growth of the projection mapping market in Italy

12.3.6 REST OF EUROPE

12.3.6.1 Inorganic growth strategies are significant for the growth of the projection mapping market in the Rest of Europe

12.4 APAC

FIGURE 63 SNAPSHOT: PROJECTION MAPPING MARKET IN THE APAC, 2020

TABLE 113 MARKET IN THE APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN THE APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 115 MARKET IN THE APAC, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 116 MARKET IN THE APAC, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 117 MARKET IN THE APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 118 PROJECTION MAPPING MARKET IN THE APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 119 MARKET IN THE APAC, BY THROW DISTANCE, 2017–2020 (USD MILLION)

TABLE 120 MARKET IN THE APAC, BY THROW DISTANCE, 2021–2026 (USD MILLION)

TABLE 121 MARKET IN THE APAC, BY BRIGHTNESS (LUMENS), 2017–2020 (USD MILLION)

TABLE 122 MARKET IN THE APAC, BY BRIGHTNESS (LUMENS), 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Increased adoption of projection mapping for tourism is leading to market growth

12.4.2 JAPAN

12.4.2.1 Presence of key market players and associations supporting technology are driving the growth of the projection mapping market in Japan

12.4.3 SOUTH KOREA

12.4.3.1 Increased adoption of projection mapping for product launches is driving the market in South Korea

12.4.4 INDIA

12.4.4.1 Rising numbers of events and increasing advertising expenditure is driving the growth of the projection mapping market in India

12.4.5 SINGAPORE

12.4.5.1 High number of media events is a significant growth driver for the projection mapping market in Singapore

12.4.6 REST OF APAC

12.4.6.1 Rising awareness and investments in technology are driving the growth of the projection mapping market in the Rest of APAC

12.5 ROW

TABLE 123 PROJECTION MAPPING MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 124 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 125 MARKET IN ROW, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 126 MARKET IN ROW, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 127 MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 128 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 129 MARKET IN ROW, BY THROW DISTANCE, 2017–2020 (USD MILLION)

TABLE 130 MARKET IN ROW, BY THROW DISTANCE, 2021–2026 (USD MILLION)

TABLE 131 MARKET IN ROW, BY BRIGHTNESS/LUMENS, 2017–2020 (USD MILLION)

TABLE 132 MARKET IN ROW, BY BRIGHTNESS/LUMENS, 2021–2026 (USD MILLION)

12.5.1 MIDDLE EAST

12.5.1.1 Rising tourism and rising number of large venue applications are fueling the growth of the projection mapping market in the Middle East

12.5.2 SOUTH AMERICA

12.5.2.1 Increasing number of sporting events and increased advertising expenditure are the key growth drivers of the projection mapping market in South America

12.5.3 AFRICA

12.5.3.1 Rising technological awareness and investments in technology are the key growth drivers of the projection mapping market in Africa

13 COMPETITIVE LANDSCAPE (Page No. - 167)

13.1 INTRODUCTION

FIGURE 64 COMPANIES ADOPTED PRODUCT LAUNCHES AS THE KEY GROWTH STRATEGY FROM 2017–2020

13.2 MARKET SHARE ANALYSIS

TABLE 133 MARKET SHARE ANALYSIS OF KEY PLAYERS IN THE PROJECTION MAPPING MARKET, 2020

13.3 HISTORICAL REVENUE ANALYSIS, 2015-2019

FIGURE 65 HISTORICAL REVENUE ANALYSIS OF MAJOR COMPANIES IN THE PROJECTION MAPPING MARKET, 2015-2019 (USD BILLION)

13.4 COMPANY EVALUATION QUADRANT

13.4.1 STAR

13.4.2 EMERGING LEADER

13.4.3 PERVASIVE

13.4.4 PARTICIPANT

FIGURE 66 PROJECTION MAPPING MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2020

13.5 STARTUP/SME EVALUATION MATRIX

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 DYNAMIC COMPANIES

13.5.4 STARTING BLOCKS

FIGURE 67 PROJECTION MAPPING MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2020

TABLE 134 COMPANY FOOTPRINT

TABLE 135 COMPANY APPLICATION FOOTPRINT

TABLE 136 COMPANY OFFERING FOOTPRINT

TABLE 137 COMPANY REGION FOOTPRINT

13.6 COMPETITIVE SCENARIO

13.6.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 138 PRODUCT LAUNCHES AND DEVELOPMENTS, 2018-2021

13.6.2 DEALS

TABLE 139 PROJECTION MAPPING MARKET, DEALS (PARTNERSHIPS, AGREEMENTS, COLLABORATIONS AND JOINT VENTURES), 2018-2021

14 COMPANY PROFILES (Page No. - 190)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 PANASONIC

TABLE 140 PANASONIC: COMPANY OVERVIEW

FIGURE 68 PANASONIC: COMPANY SNAPSHOT

14.2.2 SEIKO EPSON CORPORATION

TABLE 141 EPSON: COMPANY OVERVIEW

FIGURE 69 EPSON: COMPANY SNAPSHOT

14.2.3 BENQ

TABLE 142 BENQ: COMPANY OVERVIEW

14.2.4 BELGIAN AMERICAN RADIO CORPORATION (BARCO)

TABLE 143 BARCO: COMPANY OVERVIEW

FIGURE 70 BARCO: COMPANY SNAPSHOT

14.2.5 CHRISTIE DIGITAL SYSTEMS

TABLE 144 CHRISTIE DIGITAL SYSTEMS: COMPANY OVERVIEW

14.2.6 OPTOMA CORPORATION

TABLE 145 OPTOMA CORPORATION: COMPANY OVERVIEW

14.2.7 DIGITAL PROJECTION LIMITED

TABLE 146 DIGITAL PROJECTION LIMITED: COMPANY OVERVIEW

14.2.8 NEC DISPLAY SOLUTIONS

TABLE 147 NEC DISPLAY SOLUTIONS: COMPANY OVERVIEW

14.2.9 VIVITEK

TABLE 148 VIVITEK: COMPANY OVERVIEW

14.2.10 VIEWSONIC

TABLE 149 VIEWSONIC: COMPANY OVERVIEW

14.2.11 AV STUMPFL

TABLE 150 AV STUMPFL: COMPANY OVERVIEW

14.3 OTHER KEY PLAYERS

14.3.1 NUFORMER

14.3.2 INFOCUS

14.3.3 SONY

14.3.4 ADOBE

14.3.5 RESOLUME

14.3.6 GARAGECUBE

14.3.7 GREEN HIPPO

14.3.8 BLUE PONY

14.3.9 LUMITRIX

14.3.10 HEAVYM

14.3.11 PIXEL RAIN DIGITAL

14.3.12 LIGHTFORM, INC.

14.3.13 VIOSO

14.3.14 DISGUISE

14.3.15 PROIETTA

14.3.16 SHOWTECH PRODUCTIONS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 238)

15.1 INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

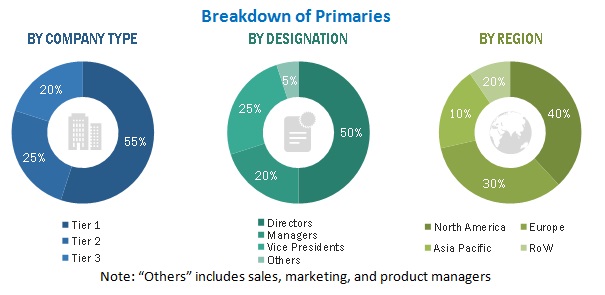

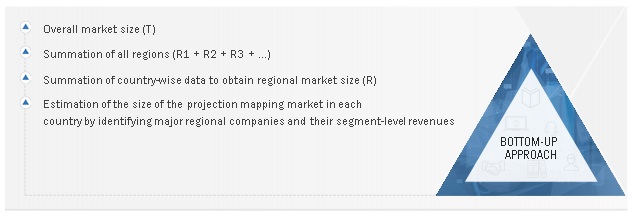

The research study involved 4 major activities in estimating the size of the projection mapping market. Exhaustive secondary research has been done to obtain important information on the projection mapping market, peer market, and parent market. The validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been used to estimate the global market size. Post which the market breakdown and data triangulation have been adopted to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary sources referred for this research study include Projection Mapping Association of Japan, Projection Mapping Central, Projector Reviews, LED Products Manufacturer’s Association (LEDMA), Museum Association, ON Services, Display Daily, LightForm, Projector Central, Projector Point, AV Magazine and Laser Illuminated Projector Association.

In the projection mapping market report, the top-down as well as the bottom-up approaches have been used to estimate and validate the size of the projection mapping market, along with several other dependent submarkets. The major players in the projection mapping market were identified by extensive secondary research and their presence in the market by primary and secondary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the projection mapping market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific (APAC), and the Rest of the World (The South America, Middle East, and Africa). Approximately 25% of the primary interviews have been conducted with the demand side vendors and 75% with the supply side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to determine and validate the size of the projection mapping market, as well as that of various other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top line investments and spending in the ecosystems. Further, the split by new installations, upgrades of hardware and software components, and major developments in the key market area have been considered.

- Information related to the revenue generated by key projection mapping hardware and software providers has been obtained.

- Multiple discussions have been conducted with key opinion leaders from major companies that develop hardware components and software, service providers as well as supply related services.

- Geographic splits have been estimated using secondary sources based on various factors, such as the number of players in a specific country and region, types of hardware components and levels of services offered.

- Analyzing the projection mapping market in each country and identifying hardware and related service providers in the projection mapping market

- Estimating the size of the market for projectors, media servers and software in each country

- Estimating the size of the market in each region by the summation of country-wise markets

- Tracking the ongoing and upcoming implementation of projection mapping projects by various companies in each region and forecasting the market based on these developments and other important parameters

- Arriving at the global market size by the summation of the market size in all regions

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall projection mapping market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics, the data triangulation and market breakdown procedures have been adopted, wherever applicable. The data has been triangulated by studying and analyzing various demand-side and supply-side factors and trends. Along with this, the projection mapping market has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, segment and forecast the size of the projection mapping market by offering, throw distance, dimension, brightness/lumens and application in terms of value.

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW) in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micro markets with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) in the market

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To analyze competitive developments such as contracts, product launches/developments, expansions, and research & development (R&D) activities carried out by players in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis for projection mapping with projectors delivering brightness more than 50,000 lumens.

- Detailed analysis of ultra-short throw projectors for projection mapping

- Country-wise Information: Further breakdown for specific country level information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Projection Mapping Market