Railway System Market by System Type (Auxiliary Power, HVAC, Propulsion, On-board Vehicle Control, Train Information & Train Safety), Transit Type, Application (Passenger & Freight Transportation), & Region - Global Forecast to 2027

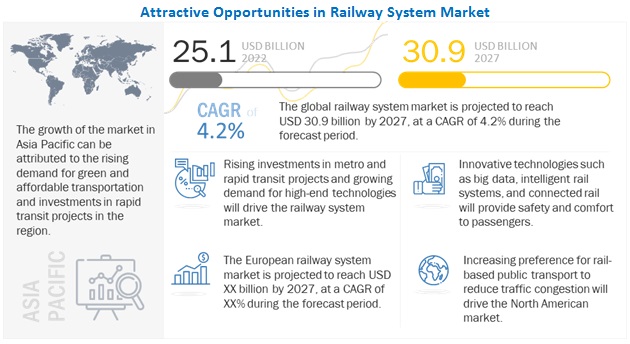

[199 Pages Report] The global railway system market was valued at USD 25.1 billion in 2022 and is expected to reach USD 30.9 billion by 2027, at a CAGR of 4.2% during the forecast period 2022 to 2027. Inadequate infrastructure and degradation of air quality are some of the key concerns of major metropolitan cities. High gasoline prices, traffic congestion, and GHG emissions are some of the other challenges for city dwellers. In such a scenario, public transportation offers several benefits over private conveyance. Urban transit systems help reduce traffic congestion and are more energy-efficient than other modes of transport. The increasing urbanization is expected to drive the growth of rapid transit systems such as metro, light rail, electric multiple units, and diesel multiple units. In addition, many countries are increasingly investing in metros to reduce traffic on the roads. India, China, Egypt, and Brazil are aggressively investing in the development of metro infrastructure. These metros are equipped with advanced systems such as train information systems, train safety systems, and HVAC systems. Thus, the increasing number of metro projects will fuel the market for railway systems.

To know about the assumptions considered for the study, Request for Free Sample Report

Railway System Market Dynamics:

Driver: Increasing preference for rail public transport to reduce traffic congestion

In the past few years, rising income levels have increased the demand for personal mobility and led to a rise in road traffic in major cities across the globe. However, road congestion and travel time in urban areas increased due to the insufficient road network infrastructure. Thus, urban planners and local governments are merging rapid transit networks and tramways with the existing city infrastructure. Commuters are also seeking eco-friendly, reliable, and cost-effective means of transportation. Developed nations such as Germany, France, and the UK are actively promoting the use of rapid transit systems to reduce traffic congestion. Moreover, countries such as India, China, Egypt, Brazil, and the UAE have increased investments in the development of metros. For example, in 2021, 823.5 km metro rail in India was under construction in more than 15 cities. In 2020, China planned an investment of USD 4.8 billion for 16 metro lines for a total length of 304.6 km and five railway projects for 132.1 km. Apart from this, in 2021, the Chinese government announced to invest USD 154.88 billion in expanding its railway network by 22,000 km by 2025. Also, other developed countries plan to increase their rail network, which would drive the railway system market.

Restraint: Capital-intensive and high development complexities

Rolling stock and supporting infrastructure are highly capital-intensive and necessitate huge financial support from local and country-level governments. As metropolitan regions witness traffic congestion and increased demand for public transport, government bodies plan to invest heavily in developing support infrastructure and improving existing infrastructure. These investments would result in new orders for rolling stock. However, the high cost of new rail vehicles could discourage investments and act as a restraint. For instance, the construction of Klang Valley Mass Rapid Transit Line 3 has been cancelled as a large investment was made for the development of MRT Line 1 and Line 2.

Also, the Return on Investment (ROI) period is long, which could hinder the growth of capital-intensive projects or technologies. For instance, the commercial adoption of Maglev is restricted because of the cost of related infrastructure, which can go up to USD 50 million to 200 million per mile, making it financially unviable for many.

Opportunity: Government support for alternative fuel-powered railway operations

The increasing focus of government bodies across the globe on the adoption of emission-free public transport modes, including railway operations of passenger and freight transport, might create an opportunity for OEMs to develop more hybrid trains that are compliant with emission standards. Although railways are not the biggest source of air pollution as far as public and freight transport mediums are considered, opting for hybrid trains will significantly reduce the emission levels caused by conventional diesel trains. Also, hybrid trains are low on operating costs, which will save money for governments as well. Many governments have recognized the need for it and thus, are acting toward achieving the same. For instance, in 2018, the Indian government approved the proposal of 100% electrification of trains in the country by 2022, which will save the Indian Railways around 2.9 billion litres of diesel annually. The government also claimed savings of around INR 13,510 crore (~USD 1.9 billion) annually by 100% electrification. The UK government will be phasing out trains that run solely on diesel fuel by 2040. As of 2018-19, around 29% of total trains in the UK are operated only on diesel; thus, the decision to phase these out will create a significant opportunity for the railway system market in the future.

Challenge: High overhaul and maintenance costs

The performance of railway system maintenance has a great influence on passenger safety and comfort on board. Leading companies have developed advanced comfort and safety systems for vehicles. For instance, Hitachi has developed active suspensions for Shinkansen bullet trains (Japan). However, continuous advancements in comfort and safety functions have made the railway system complicated. As a result, the railway system needs periodic maintenance to ensure its reliability. Regular maintenance and repair of the railway system are expensive. Hence, the additional recurring expense of overhauls and maintenance could hinder the growth of the railway system market.

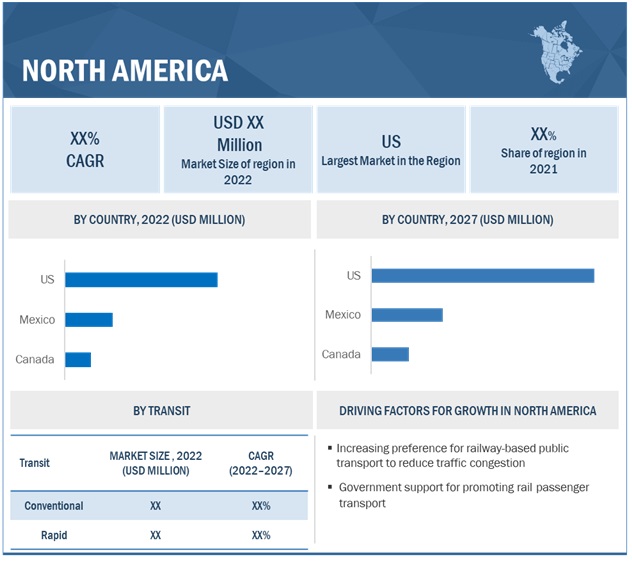

US is expected to witness significant growth in North America market during the forecast period

The US has the largest rail network in the world, covering over 250,000 km. Many decision-makers in the US support higher public transport investments to achieve more sustainable development and increased urban mobility. The US government has been involved in the redevelopment, expansion, and modernization of the existing transportation modes over the past few years. To promote rail passenger transportation, the US railways are being updated with new safety systems and new fundings made to complete pending projects. The train system will be redesigned with the help of USD 80 billion in federal funding as part of the US President’s USD 2.3 trillion infrastructure modernization plan. The "race" to potentially secure USD 80 billion in funding for Amtrak and other rail initiatives has begun. Amtrak outlines its 15-year plan in a document called Connect US.

Brazil is estimated to witness significant growth for in RoW region during the forecast period

Brazil is one of the fastest-growing markets for rolling stock and related railway systems in the RoW region. The availability of cheap labor has encouraged several key players to penetrate the manufacturing sector in Brazil. The railways in the country operate on broad, meter, standard, and dual gauges with a network length of 4,932 km, 23,773 km, 202.4 km, and 396 km, respectively. According to the Brazilian Association of the Railway Industry (ABIFER) September 2021 "Rail Month" report, investments in the rail industry in the country stood at more than USD 16.56 billion (BRL 91.972 billion). The federal government made a concerted effort during the month to attract private investments in the extension of the railway network and promote train travel from north to south through the Ministry of Infrastructure (MINFRA).

North America is expected to witness highest CAGR during the forecast period

OEMs based in the US have focused on manufacturing locomotives for all kinds of trains, including light rail, tramways, and metros and conventional trains, due to an increase in customer demand for comfort and safety. Many emerging players are offering advanced railway systems in the region. Thermo King, a US-based railway system manufacturer, provides HVAC for driver cabins that can clean the air from all viruses.

Diesel locomotives are mostly used in the US and Canada as the area of these countries is huge, and the distance travelled for goods and passenger transportation is large. This would significantly increase the cost of infrastructure in the case of electric locomotives. In the US, rolling stock is mostly used for freight transportation, and passenger transportation is primarily undertaken through airlines.

OEMs such as Alstom SA (France) and Montreal Locomotive Works (Canada) are also planning to establish new production facilities in Mexico and Canada to cater to the rising demand, which is expected to drive the market in this region

To know about the assumptions considered for the study, download the pdf brochure

Key Players:

- CRRC (China)

- Alstom (France)

- ABB (Switzerland)

- Siemens (Germany)

- Thermo King (US)

- Knorr Bremse (Germany)

- Hyundai Rotem (South Korea)

- Mitsubishi Heavy Industries (Japan)

- Toshiba (Japan)

- Hitachi (South Korea)

Scope of the Report

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 25.1 billion |

|

Estimated Value by 2027 |

USD 30.9 billion |

|

Growth Rate |

Poised to grow at a CAGR of 4.2% |

|

Market Segmentation |

Application, System Type, Transit Type, and Region |

|

Market Driver |

Increasing preference for rail public transport to reduce traffic congestion |

|

Market Opportunity |

Government support for alternative fuel-powered railway operations |

|

Geographies covered |

Asia Pacific, Europe, North America, and RoW |

This research report categorizes the railway system market on the basis of application, transit type, system type, and region.

Railway System Market, by Application

- Passenger Transportation

- Freight Transportation

Railway System Market, by Transit Type

- Conventional

- Rapid

Railway System Market, by System Type

- Auxiliary Power System

- HVAC

- Propulsion System

- Onboard Vehicle Control

- Train Information System

- Train Safety System

Railway System Market, by Region

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In February 2022, The CRRC-developed 3000 hp permanent magnet hybrid shunting locomotive recently passed 2,000 kilometers of safe operation. The locomotive received significant appreciation from consumers for its exceptionally low energy consumption and environmental protection when compared to the conventional shunting diesel locomotive.

- In May 2022, Hitachi Rail launched several new innovations in the areas of automation and digitalization, which include PTC (Positive Train Control), railcar telematics, and dispatching systems.

- In January 2022, Siemens developed the new air-free brake system, also known as an electronic friction brake system, is the first totally electrically controlled friction brake to be used in rail vehicles (brake-by-wire). The braking system runs without the need for compressed air at all. In addition to numerous technological advantages, the new brake decreases vehicle weight and makes vehicles more quickly operational.

- In December 2021, Alstom, in partnership with Cylus, integrated an advanced rail cybersecurity solution on the Tel Aviv Red line to improve the protection of the line’s signaling and train control systems. CylusOne is a rail-specific, multi-layered cybersecurity solution powered by advanced AI and ML technologies.

Frequently Asked Questions (FAQ):

What is the current size of the global railway system market?

The global railway system market is estimated to be USD 25.1 billion in 2022 and projected to reach USD 30.9 million by 2027, at a CAGR of 4.2%

Which countries are considered in the European region?

The report includes European countries such as:

- Germany

- France

- Spain

- Russia

- Italy

- UK

We are interested in regional railway system market for system type? Does this report cover the region wise system type segments?

Yes, the report covers the railway system market for different system types at regional level.

Does this report further segments transit type?

Yes, the report covers the market size of different transit type at a global level .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 RAILWAY SYSTEM MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 CURRENCY EXCHANGE RATES (WRT USD)

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 RAILWAY SYSTEM MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 PRIMARY PARTICIPANTS

2.4 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.6 MARKET SIZE ESTIMATION

2.6.1 TOP-DOWN APPROACH

FIGURE 7 RAILWAY SYSTEM MARKET: TOP-DOWN APPROACH

2.7 FACTOR ANALYSIS

FIGURE 8 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.8 ASSUMPTIONS

2.9 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 9 RAILWAY SYSTEM MARKET OVERVIEW

FIGURE 10 MARKET, BY REGION, 2022–2027

FIGURE 11 MARKET, BY TRANSIT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 KEY PLAYERS OPERATING INMARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RAILWAY SYSTEM MARKET

FIGURE 13 INCREASING PREFEREN CE FOR RAIL-BASED PUBLIC TRANSPORT TO DRIVE MARKET

4.2 MARKET SHARE, BY REGION

FIGURE 14 EUROPE IS ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

4.3 MARKET, BY TRANSIT

FIGURE 15 RAPID TRANSIT SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.4 MARKET, BY APPLICATION

FIGURE 16 PASSENGER TRANSPORTATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.5 MARKET, BY SYSTEM

FIGURE 17 TRAIN INFORMATION SYSTEMS TO DOMINATE FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 RAILWAY SYSTEM MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing preference for public rail transport to reduce traffic congestion

FIGURE 19 DRIVING TIME SPENT IN TRAFFIC CONGESTION, 2020

FIGURE 20 DRIVING TIME SPENT IN TRAFFIC CONGESTION IN US, BY CITY, 2021

5.2.1.2 Growing demand for energy-efficient transport

FIGURE 21 GLOBAL CO2 EMISSIONS FROM DIFFERENT TRANSPORT SEGMENTS, 2000-2030

5.2.1.3 Increasing penetration of EMUs

FIGURE 22 ENERGY DEMAND IN GLOBAL RAILWAY INDUSTRY, 2017-2050

FIGURE 23 ENERGY DEMAND IN GLOBAL RAILWAY INDUSTRY, 2017-2050

5.2.1.4 Refurbishment of existing rolling stock

5.2.2 RESTRAINTS

5.2.2.1 Capital-intensive and high development complexities

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing railway projects across the globe

TABLE 2 SOME LATEST RAILWAY PROJECTS AND THEIR COST

5.2.3.2 Government support for alternative fuel-powered railway operations

5.2.3.3 Inclination of emerging countries toward high-speed rail for rapid transit

FIGURE 24 WORLD’S LONGEST HIGH-SPEED RAIL NETWORKS

5.2.3.4 Increase in use of railways for industrial and mining activities

TABLE 3 DIFFERENT MODES OF FREIGHT TRANSPORTATION

5.2.4 CHALLENGES

5.2.4.1 High overhaul and maintenance costs

5.2.5 IMPACT OF MARKET DYNAMICS

TABLE 4 RAILWAY SYSTEM MARKET: IMPACT OF MARKET DYNAMICS

5.3 PORTER’S FIVE FORCES

TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON MARKET

FIGURE 25 PORTER’S FIVE FORCES: MARKET

5.3.1 INTENSITY OF COMPETITIVE RIVALRY

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 THREAT OF NEW ENTRANTS

5.4 TRENDS IMPACTING CUSTOMER BUSINESS

FIGURE 26 TRENDS IMPACTING CUSTOMER BUSINESS IN MARKET

5.5 PATENT ANALYSIS

5.5.1 INTRODUCTION

FIGURE 27 PATENT TREND, 2011–2021

5.5.2 LEGAL STATUS OF PATENTS

FIGURE 28 LEGAL STATUS OF PATENTS FILED FOR RAILWAY SYSTEMS

5.5.3 TOP PATENT APPLICANTS

FIGURE 29 RAILWAY SYSTEM PATENTS

TABLE 6 PATENT ANALYSIS: MARKET (ACTIVE PATENTS)

5.6 CASE STUDY ANALYSIS

TABLE 7 EXCAVATION OF BIG ANALOG DATA VALUE: COMPACTRIO & NI INSIGHTCM

5.6.1 GOLINC-M MODULES

5.7 TRADE ANALYSIS

FIGURE 30 IMPORT OF RAILWAY SYSTEMS, KEY COUNTRIES (2017-2021), USD MILLION

FIGURE 31 EXPORT OF RAILWAY SYSTEMS, KEY COUNTRIES, (2017-2021), USD MILLION

5.8 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 8 MARKET: LIST OF CONFERENCES & EVENTS

5.9 TARIFF AND REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10 MACROINDICATOR ANALYSIS

5.10.1 GROWTH OF MARKET

5.10.2 GDP (USD BILLION)

5.10.3 GNI PER CAPITA, ATLAS METHOD (USD)

5.10.4 GDP PER CAPITA PPP (USD)

5.10.5 MACROINDICATORS INFLUENCING MARKET, TOP THREE COUNTRIES

5.10.5.1 Germany

5.10.5.2 US

5.10.5.3 China

5.11 ECOSYSTEM ANALYSIS

FIGURE 32 MARKET: ECOSYSTEM ANALYSIS

TABLE 13 ROLE OF COMPANIES IN RAILWAY SYSTEM ECOSYSTEM

5.12 TECHNOLOGY ANALYSIS

5.12.1 INTRODUCTION

5.12.2 REGENERATIVE BRAKING IN TRAINS

5.12.3 AUTONOMOUS TRAINS

5.13 MARKET, SCENARIOS (2022–2027)

FIGURE 33 FUTURE TRENDS & SCENARIOS: MARKET, 2022–2027 (USD MILLION)

5.13.1 MOST LIKELY SCENARIO

TABLE 14 MOST LIKELY SCENARIO: MARKET, BY REGION, 2022–2027 (USD MILLION)

5.13.2 OPTIMISTIC SCENARIO

TABLE 15 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2022–2027 (USD MILLION)

5.13.3 PESSIMISTIC SCENARIO

TABLE 16 PESSIMISTIC SCENARIO: EV TEST EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

6 RAILWAY SYSTEM MARKET, BY TRANSIT (Page No. - 80)

6.1 INTRODUCTION

FIGURE 34 RAILWAY SYSTEM MARKET, BY TRANSIT, 2022 VS. 2027 (USD MILLION)

TABLE 17 MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

6.2 OPERATIONAL DATA

TABLE 19 RAILWAY SYSTEM OFFERINGS, BY COMPANY

6.2.1 ASSUMPTIONS

TABLE 20 ASSUMPTIONS: BY TRANSIT

6.2.2 RESEARCH METHODOLOGY

6.3 CONVENTIONAL

6.3.1 GROWING TREND OF ELECTRIFICATION

6.3.2 DIESEL LOCOMOTIVES

6.3.3 ELECTRIC LOCOMOTIVES

6.3.4 ELECTRO-DIESEL LOCOMOTIVES

6.3.5 COACHES

TABLE 21 CONVENTIONAL TRANSIT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 CONVENTIONAL TRANSIT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 RAPID

6.4.1 INCREASING INVESTMENTS BY EMERGING COUNTRIES IN METRO PROJECTS

6.4.2 DIESEL MULTIPLE UNIT (DMU)

6.4.3 ELECTRIC MULTIPLE UNIT (EMU)

6.4.4 LIGHT RAIL/TRAM

6.4.5 METRO/SUBWAYS

TABLE 23 RAPID TRANSIT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 RAPID TRANSIT: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 RAILWAY SYSTEM MARKET, BY SYSTEM (Page No. - 88)

7.1 INTRODUCTION

FIGURE 35 MARKET, BY SYSTEM, 2022 VS. 2027 (USD MILLION)

TABLE 25 MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 26 MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

7.2 OPERATIONAL DATA

TABLE 27 MARKET, BY SYSTEM

7.2.1 ASSUMPTIONS

TABLE 28 ASSUMPTIONS: BY SYSTEM

7.2.2 RESEARCH METHODOLOGY

7.3 PROPULSION SYSTEM

7.3.1 GROWING DEMAND FOR HYBRID AND BATTERY-OPERATED TRAINS

TABLE 29 PROPULSION SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 PROPULSION SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 AUXILIARY POWER SYSTEM

7.4.1 NEED FOR MODERN, LIGHTWEIGHT AUXILIARY POWER SYSTEMS

TABLE 31 AUXILIARY POWER SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 AUXILIARY POWER SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 TRAIN INFORMATION SYSTEM

7.5.1 INTEGRATION OF IT AND EDGE COMPUTING

TABLE 33 TRAIN INFORMATION SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 TRAIN INFORMATION SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 TRAIN SAFETY SYSTEM

7.6.1 FOR SAFE AND COMFORTABLE PASSENGER TRANSPORT

TABLE 35 TRAIN SAFETY SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 TRAIN SAFETY SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 HVAC SYSTEM

7.7.1 REQUIRED TO REDUCE DEGREE OF INFECTIONS POST-COVID-19

TABLE 37 HVAC SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 HVAC SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.8 ON-BOARD VEHICLE CONTROL

7.8.1 TECHNOLOGY COLLABORATIONS LEAD TO ADVANCEMENTS

TABLE 39 ON-BOARD VEHICLE CONTROL SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 ON-BOARD VEHICLE CONTROL SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 RAILWAY SYSTEM MARKET, BY APPLICATION (Page No. - 100)

8.1 INTRODUCTION

FIGURE 36 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 41 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 42 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.1.1 OPERATIONAL DATA

FIGURE 37 FREIGHT TRANSPORTATION SERVICES INDEX, DECEMBER 2018 – DECEMBER 2021

8.1.2 ASSUMPTIONS

TABLE 43 ASSUMPTIONS: BY APPLICATION

8.1.3 RESEARCH METHODOLOGY

8.2 FREIGHT TRANSPORTATION

8.2.1 GROWING MINING AND INDUSTRIAL ACTIVITIES

TABLE 44 FREIGHT TRANSPORTATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 FREIGHT TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 PASSENGER TRANSPORTATION

8.3.1 RAPID URBANIZATION EXPECTED TO FUEL SEGMENT

TABLE 46 PASSENGER TRANSPORTATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 PASSENGER TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 RAILWAY SYSTEM MARKET, BY REGION (Page No. - 106)

9.1 INTRODUCTION

FIGURE 38 RAILWAY SYSTEM MARKET, BY REGION, 2022–2027

TABLE 48 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 50 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 51 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.1 CHINA

9.2.1.1 High investments in railway infrastructure

TABLE 52 CHINA: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 53 CHINA: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.2.2 INDIA

9.2.2.1 Upcoming railway projects

TABLE 54 INDIA: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 55 INDIA: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Technological advancements in high-speed trains

TABLE 56 JAPAN: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 57 JAPAN: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 Expansion of urban rail networks

TABLE 58 SOUTH KOREA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 59 SOUTH KOREA: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.3 EUROPE

FIGURE 40 EUROPE: MARKET, BY COUNTRY, 2022 VS. 2027

TABLE 60 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.1 FRANCE

9.3.1.1 Increasing adoption of light rails/trams

TABLE 62 FRANCE: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 63 FRANCE: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 High investments in digital technologies

TABLE 64 GERMANY: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 65 GERMANY: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.3.3 ITALY

9.3.3.1 Ambitious investment programs for rapid transit

TABLE 66 ITALY: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 67 ITALY: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.3.4 RUSSIA

9.3.4.1 Government initiatives to promote public transport

TABLE 68 RUSSIA: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 69 RUSSIA: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Investments in high-speed trains

TABLE 70 SPAIN: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 71 SPAIN: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.3.6 UK

9.3.6.1 Upcoming projects and government funding

TABLE 72 UK: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 73 UK: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.4 NORTH AMERICA

9.4.1 UPCOMING RAPID TRANSIT PROJECTS IN NORTH AMERICA

TABLE 74 MAJOR RAPID TRANSIT PROJECTS IN NORTH AMERICA

FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

TABLE 75 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.2 US

9.4.2.1 Increasing urban mobility and OEM investments

TABLE 77 US: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 78 US: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.4.3 MEXICO

9.4.3.1 Emergence of private players in conventional transit

TABLE 79 MEXICO: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 80 MEXICO: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.4.4 CANADA

9.4.4.1 Growing concerns over traffic congestion

TABLE 81 CANADA: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 82 CANADA: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.5 REST OF THE WORLD (ROW)

FIGURE 42 REST OF THE WORLD: MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 83 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 84 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 High spending on urban mobility projects

TABLE 85 BRAZIL: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 86 BRAZIL: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

9.5.2 UNITED ARAB EMIRATES (UAE)

9.5.2.1 Increasing use of technologically advanced metro trains

TABLE 87 UAE: MARKET, BY TRANSIT, 2018–2021 (USD MILLION)

TABLE 88 UAE: MARKET, BY TRANSIT, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 131)

10.1 OVERVIEW

TABLE 89 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ROLLING STOCK MARKET

10.2 MARKET RANKING ANALYSIS

FIGURE 43 MARKET RANKING, 2021

10.3 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 44 TOP PLAYERS IN RAILWAY SYSTEM MARKET DURING LAST THREE YEARS

10.4 COMPETITIVE SCENARIO

10.4.1 NEW PRODUCT DEVELOPMENTS

TABLE 90 NEW PRODUCT DEVELOPMENTS, 2019–2022

10.4.2 PARTNERSHIPS/SUPPLY CONTRACTS/COLLABORATIONS/ JOINT VENTURES/LICENSE AGREEMENTS

TABLE 91 PARTNERSHIPS/SUPPLY CONTRACTS/COLLABORATIONS/JOINT VENTURES/ AGREEMENTS, 2019–2022

10.4.3 EXPANSIONS

TABLE 92 EXPANSIONS, 2019–2022

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STARS

10.5.2 PERVASIVE COMPANIES

10.5.3 EMERGING LEADERS

10.5.4 PARTICIPANTS

FIGURE 45 RAILWAY SYSTEM MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

10.6 COMPANY EVALUATION QUADRANT

TABLE 93 COMPANY REGION FOOTPRINT

TABLE 94 COMPANY APPLICATION TYPE FOOTPRINT

TABLE 95 COMPANY APPLICATION & REGION FOOTPRINT

10.7 SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 46 RAILWAY SYSTEM MARKET: COMPANY EVALUATION MATRIX FOR SMES, 2021

10.8 SME EVALUATION QUADRANT

TABLE 96 SME REGION FOOTPRINT

TABLE 97 SME APPLICATION FOOTPRINT

TABLE 98 SME APPLICATION & REGION FOOTPRINT

11 COMPANY PROFILES (Page No. - 145)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

11.1 KEY PLAYERS

11.1.1 CRRC

TABLE 99 CRRC: BUSINESS OVERVIEW

FIGURE 47 CRRC: COMPANY SNAPSHOT

TABLE 100 CRRC: PRODUCTS OFFERED

TABLE 101 CRRC: NEW PRODUCT LAUNCHES

TABLE 102 CRRC: DEALS

11.1.2 ALSTOM

TABLE 103 ALSTOM: BUSINESS OVERVIEW

FIGURE 48 ALSTOM: COMPANY SNAPSHOT

TABLE 104 ALSTOM: PRODUCTS OFFERED

TABLE 105 ALSTOM: NEW PRODUCT LAUNCHES

TABLE 106 ALSTOM: DEALS

TABLE 107 ALSTOM: OTHERS

11.1.3 ABB

TABLE 108 ABB: BUSINESS OVERVIEW

FIGURE 49 ABB: COMPANY SNAPSHOT

TABLE 109 ABB: PRODUCTS OFFERED

TABLE 110 ABB: DEALS

11.1.4 KNORR-BREMSE

TABLE 111 KNORR-BREMSE: BUSINESS OVERVIEW

TABLE 112 KNORR-BREMSE: PRODUCTS OFFERED

TABLE 113 KNORR-BREMSE: OTHERS

11.1.5 THERMO KING

TABLE 114 THERMO KING: BUSINESS OVERVIEW

FIGURE 50 THERMO KING: COMPANY SNAPSHOT

TABLE 115 THERMO KING: PRODUCTS OFFERED

TABLE 116 THERMO KING: NEW PRODUCT DEVELOPMENTS

11.1.6 SIEMENS

TABLE 117 SIEMENS: BUSINESS OVERVIEW

FIGURE 51 SIEMENS: COMPANY SNAPSHOT

TABLE 118 SIEMENS: PRODUCTS OFFERED

TABLE 119 SIEMENS: NEW PRODUCT LAUNCHES

TABLE 120 SIEMENS: DEALS

TABLE 121 HYUNDAI ROTEM: BUSINESS OVERVIEW

FIGURE 52 HYUNDAI ROTEM COMPANY: COMPANY SNAPSHOT

TABLE 122 HYUNDAI ROTEM: PRODUCTS OFFERED

TABLE 123 HYUNDAI ROTEM: DEALS

11.1.8 MITSUBISHI HEAVY INDUSTRIES

TABLE 124 MITSUBISHI HEAVY INDUSTRIES: BUSINESS OVERVIEW

TABLE 125 MITSUBISHI HEAVY INDUSTRIES: PRODUCTS OFFERED

TABLE 126 MITSUBISHI HEAVY INDUSTRIES: DEALS

11.1.9 TOSHIBA

TABLE 127 TOSHIBA: BUSINESS OVERVIEW

FIGURE 53 TOSHIBA: COMPANY SNAPSHOT

TABLE 128 TOSHIBA: PRODUCTS OFFERED

TABLE 129 TOSHIBA: OTHERS

11.1.10 HITACHI

TABLE 130 HITACHI: BUSINESS OVERVIEW

FIGURE 54 HITACHI: COMPANY SNAPSHOT

11.1.10.2 Products offered

TABLE 131 HITACHI: PRODUCTS OFFERED

11.1.10.3 Recent Developments

TABLE 132 HITACHI: PRODUCT LAUNCHES

TABLE 133 HITACHI: DEALS

TABLE 134 HITACHI: OTHERS

11.2 OTHER KEY PLAYERS

11.2.1 CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES (CAF)

TABLE 135 CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES (CAF): BUSINESS OVERVIEW

11.2.2 STRUKTON

TABLE 136 STRUKTON: BUSINESS OVERVIEW

11.2.3 WOOJIN INDUSTRIAL SYSTEMS

TABLE 137 WOOJIN INDUSTRIAL SYSTEMS: BUSINESS OVERVIEW

11.2.4 AMERICAN EQUIPMENT COMPANY

TABLE 138 AMERICAN EQUIPMENT COMPANY: BUSINESS OVERVIEW

11.2.5 INGETEAM

TABLE 139 INGETEAM: BUSINESS OVERVIEW

11.2.6 CALAMP

TABLE 140 CALAMP: BUSINESS OVERVIEW

11.2.7 SINARA TRANSPORT MACHINES

TABLE 141 SINARA TRANSPORT MACHINES: BUSINESS OVERVIEW

11.2.8 FUJI ELECTRIC

TABLE 142 FUJI ELECTRIC: BUSINESS OVERVIEW

11.2.9 SKODA TRANSPORTATION

TABLE 143 SKODA TRANSPORTATION: BUSINESS OVERVIEW

11.2.10 MEDCOM

TABLE 144 MEDCOM: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 188)

12.1 ASIA PACIFIC TO BE MAJOR MARKET FOR RAILWAY SYSTEMS

12.2 DEVELOPMENT OF NEXT-GEN CLEAN PROPULSION SYSTEMS

12.3 RAPID TRANSIT TO BE MOST PROFITABLE SEGMENT OF RAILWAY SYSTEM MARKET

12.4 CONCLUSION

13 APPENDIX (Page No. - 191)

13.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

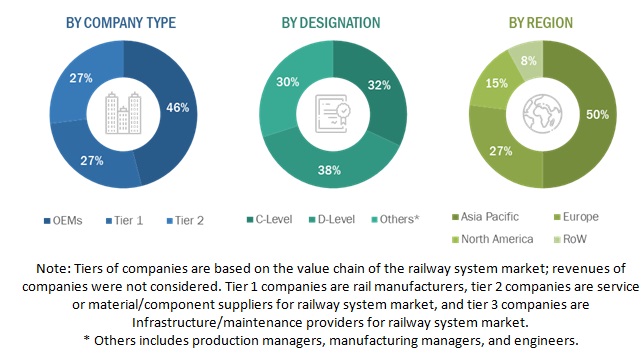

The study involves four main activities to estimate the current size of the railway system market. Exhaustive secondary research was done to collect information on the market such as the use of various systems in various applications and transit types. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. A top-down approach was employed to estimate the complete market size of different segments considered in this study.

Secondary Research

The secondary sources referred to in this research study include railway industry organizations such as the Association of the European Rail Industry (UNIFE), American Railway Association (ARA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the scenario of the railway system market through secondary research. Several primary interviews were conducted with market experts from both, demand-side (in terms of component supply, country-level government associations, and trade associations) and supply-side (OEMs and component manufacturers) across 4 major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). Primary data was collected through questionnaires, emails, and telephonic interviews. In our canvassing of primaries, we strived to cover various departments within organizations, which included sales, operations, and administration, to provide a holistic viewpoint of the market in our report.

After interacting with the industry participants, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings as described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The railway system market, by application, has been calculated using the top-down approach. Extensive secondary and primary researches have been carried out to understand the global market scenario for the applications of railway systems. Several primary interviews were conducted with key opinion leaders involved in the development of the market including OEMs and Tier I companies. Various qualitative aspects such as drivers, restraints, opportunities, and challenges influencing the growth of the market were taken into consideration while calculating and forecasting the size of the market.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends in the demand and supply sides of the railway system market.

Report Objectives

- To define, segment, and forecast the railway system market, in terms of value, during the forecast period

- To provide a detailed analysis of various factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To segment and forecast the size of the market based on system type, application, transit type, and region

- To forecast the size of the market for 4 regions, namely, Asia Pacific, Europe, North America, and Rest of the World (RoW)

- To segment and forecast the size of the market, in terms of value, based on transit type (conventional and rapid)

- To segment and forecast the size of the market, in terms of value, based on system type (auxiliary power system, HVAC, propulsion system, onboard vehicle control, train information system, and train safety system)

- To segment and forecast the size of the market, in terms of value, based on application (passenger transportation and freight transportation)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by the key players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Additional Company Profiles

- Business Overview

- SWOT Analysis

- Recent Developments

- MnM View

Detailed analysis of the railway system market, by system type

Detailed analysis of the railway system market, by transit type

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Railway System Market