Sales Performance Management Market by Component (Solutions (Incentive Compensation Management, Territory Management), Services), Organization Size, Deployment Mode, Vertical (BFSI, Telecommunications, & Manufacturing) and Region - Global Forecast to 2028

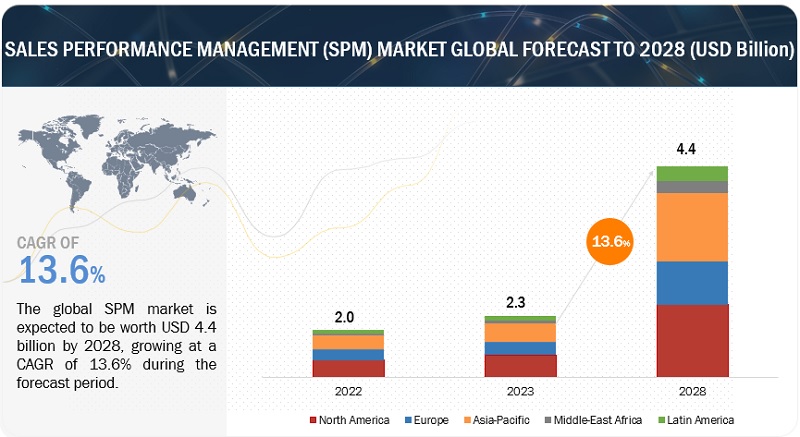

The global Sales Performance Management Market size was estimated at $2.3 billion in 2023 and is projected to reach $4.4 billion by 2028, growing at a CAGR of 13.6% during the forecast period.

Major factors that are expected to drive the growth of the SPM market include increasing automation to improve visibility and avoid calculation inaccuracies, the rising demand for metric-driven sales tools, and increasing enterprise mobility to boost agent engagement and performance. The increasing integration of audio-video conferencing Application Programming Interfaces (APIs) for increasing personalization and productivity and Machine Learning (ML) and Natural Language Processing (NLP) innovations to leverage data-driven recommendations would create numerous opportunities for SPM vendors in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the SPM Market

The global recession is expected to have a mixed impact on the SPM market. Due to a recession, businesses are facing budget constraints and prioritizing cost-cutting measures. Investments in new technologies, including SPM solutions, may be deprioritized or delayed as organizations focus on essential expenses and core operations. In a recession, organizations are expected to reduce their overall IT spending, which impacts the sales and marketing of an organization. Companies allocate their limited resources to areas perceived as more critical or directly tied to immediate cost savings. During a recession, businesses often emphasize cost efficiency and optimization. With the ongoing work-from-home scenario, global lockdowns, and economic uncertainties caused by COVID-19, the cloud transition has increased, further bolstering market growth. Companies have started using SPM solutions to optimize the planning and management of incentives, quotas, and territories and improve sales representatives’ performance. The impact of a recession on the SPM market is expected to be mixed. While budget constraints and reduced IT spending may pose challenges, increased security concerns, remote work trends, and regulatory compliance requirements create opportunities for SPM solution providers. Adapting to the economic landscape and effectively communicating data security and privacy value proposition will be crucial for the market’s growth during recessionary periods.

Sales Performance Management (SPM) Market Dynamics

Driver: Increasing emphasis on sales performance

Sales performance directly impacts an organization’s revenue growth and profitability. Organizations prioritize sales performance to maximize sales revenues, increase customer acquisition and retention, and improve profit margins. SPM solutions provide the necessary tools and capabilities to monitor, analyze, and enhance sales performance, enabling organizations to identify areas for improvement, implement targeted strategies, and drive revenue growth. Organizations constantly strive to gain a competitive edge in today’s highly competitive business landscape. Sales performance plays a crucial role in achieving this advantage. Organizations can optimize sales processes, improve customer engagement and satisfaction, and outperform competitors by focusing on sales performance. SPM solutions offer sales analytics, performance dashboards, and goal-tracking features, providing insights that empower organizations to make data-driven decisions and gain a competitive advantage. Organizations increasingly recognize the importance of aligning sales goals with overall business objectives. SPM solutions facilitate this alignment by enabling organizations to define and communicate sales goals, track progress, and measure performance against key performance indicators (KPIs) and targets. By aligning sales efforts with broader organizational goals, SPM solutions ensure that sales teams work towards common objectives, fostering a cohesive and results-oriented sales culture. The increasing emphasis on sales performance drives organizations to optimize their sales processes. Organizations can increase efficiency, reduce costs, and accelerate sales cycles by streamlining and improving sales processes. SPM solutions offer functionalities such as lead management, opportunity tracking, sales forecasting, and pipeline management, which enable organizations to automate and standardize sales processes, identify bottlenecks, and implement best practices. This process optimization leads to enhanced productivity and performance.

Restraint: Implementation Challenges

Implementing a sales performance management (SPM) solution poses various challenges for organizations. These challenges can arise during the planning, execution, and post-implementation phases. Understanding and addressing these challenges is crucial to ensure a successful SPM implementation. Integrating an SPM solution with existing systems, such as customer relationship management (CRM) software, financial systems, and data warehouses, can be complex. Organizations may face challenges mapping and aligning data structures, ensuring data consistency and accuracy, and establishing seamless data flow between systems. Integration difficulties cause delays, data quality issues, and inconsistent sales performance metrics. SPM solutions rely on accurate and reliable data for performance measurement, incentive calculations, and reporting. However, organizations often encounter challenges related to data quality and availability. Incomplete or inconsistent data, data duplication, and outdated information lead to inaccurate performance metrics and flawed compensation calculations. Data cleansing and validation efforts are necessary to ensure the integrity of the data used in the SPM solution. Introducing a new SPM solution requires user adoption and change management efforts. Sales teams and other stakeholders may initially resist the implementation due to a fear of change or concerns about perceived micromanagement. Lack of understanding or training can also hinder user adoption. Organizations must invest in comprehensive training programs, clear communication, and stakeholder engagement to overcome resistance and ensure the successful adoption of the SPM solution. SPM solutions require ongoing maintenance and support to ensure smooth operation and optimal performance. Organizations need to allocate resources for system updates, bug fixes, data management, and user support. Adequate training and support should be provided to users to address any issues, improve user proficiency, and maximize the benefits of the SPM solution.

Opportunity: Machine learning and natural language processing innovations to leverage data-driven recommendations

AI and ML have changed the way how most sales technologies work. Hence, while selecting SPM solutions, enterprises are looking for AI and ML-integrated capabilities. Using NLP to detect the tone or words to rate the overall agent-customer interaction and suggest improvements further creates more opportunities for AI-based SPM solutions. The advantages of AI, ML, and NLP are a significant opportunity for other solution vendors in this ecosystem to gain a competitive advantage in the market by infusing AI and ML algorithms in their SPM systems. Machine learning (ML) and natural language processing (NLP) innovations have significant potential to leverage data-driven recommendations in the sales performance management (SPM) market. These technologies can analyze large volumes of sales data, extract valuable insights, and provide personalized recommendations to sales teams and managers. ML algorithms can analyze historical sales data, customer interactions, and other relevant data sources to identify patterns and trends. By leveraging predictive analytics, ML models can forecast future sales performance, identify opportunities for improvement, and provide actionable recommendations to sales teams. These recommendations include prioritizing leads, optimizing sales strategies, and predicting customer churn. ML models can analyze historical sales data, market trends, and external factors to generate accurate sales forecasts. ML-powered sales forecasting provides valuable insights for sales planning, resource allocation, and goal setting by considering various variables, such as seasonality, customer behavior, and market dynamics. This helps organizations optimize their sales strategies and improve performance. NLP techniques enable the analysis of sales call recordings, email communications, and customer interactions. By applying sentiment analysis, speech recognition, and language processing, NLP-powered systems can provide feedback and coaching recommendations to sales representatives, which helps improve their communication skills, identify areas for improvement, and enhance their overall sales performance.

Challenge: Prevailing apprehensions related to levels of intrusion

The hindrance from employees in adopting new technologies is somewhat of a challenge for organizations who is planning to deploy SPM solutions. This is mainly because of the employees’ hindrance to change as according to them continuous monitoring would cause a high level of intrusion and their privacy will be invaded. Such prevailing apprehensions cause high attrition and thus, a decline in sales productivity regarding employee effectiveness. The companies are training and educating their employees related to the benefits of SPM solutions that involve improved visibility into reward, commission, and compensation plans; gamification features; and faster payout processes as there has been an increase in the availability of SPM Return on Investment (RoI). Therefore; by introducing such support strategies for deploying SPM solutions and helping employees understand their benefits, the hindrance in adopting SPM solutions by employees is ephemeral.

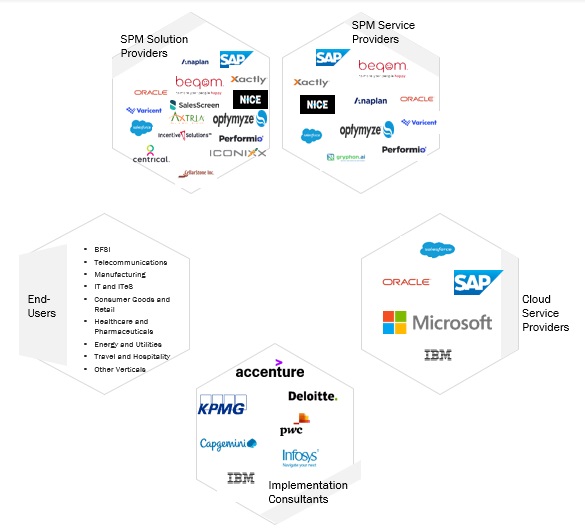

Sales Performance Management Market Ecosystem

The SPM market ecosystem comprises entities responsible for providing SPM solutions to end users via various deployment models. The demand for SPM solutions continues to grow and expand with ongoing enterprise mobility and workplace automation. Solution and service providers continue to enhance and mature their offerings to increase value addition. Various verticals across the world are availing SPM solutions to optimize planning and management of capacity, quota, and territory, sales forecasting and sales compensation management as well as to improve productivity by eliminating manual tasks associated with the management of SPM processes.

Solution providers in the SPM market develop a high-end solution based on the customer’s requirements and SPM strategies. They also offer consulting services, integration and implementation; and training, support, and maintenance services. Sometimes, SPM solution providers offer SPM solutions curated to the need of end users. End users span across verticals, such as BFSI, healthcare and pharmaceuticals, telecommunications, IT and ITeS, consumer goods and retail, manufacturing, travel and hospitality, and energy and utilities, are rapidly adopting SPM solutions during the forecast period. Implementation consultants are experts who assist customers in implementing SPM software within their organizations. They work closely with customers to understand their business processes, configure the software, and ensure a smooth transition. Implementation consultants provide guidance, training, and support to ensure the successful adoption and integration of SPM solutions. Cloud service providers offer scalable, flexible, and secure infrastructure and services that organizations can utilize for their SPM needs. By leveraging the cloud, organizations can benefit from reduced infrastructure costs, enhanced scalability, easier integration with other systems, and access to advanced analytics and machine learning capabilities

Based on solutions, the sales performance analytics & reporting segment is projected to witness the second-highest CAGR during the forecast period

Sales performance analytics and reporting solutions offer features such as data aggregation, data visualization, trend analysis, predictive analytics, and drill-down capabilities. They provide real-time access to sales data, enabling organizations to monitor performance against targets, identify areas of improvement, and take proactive actions. By leveraging these solutions, organizations can harness the power of data to drive sales effectiveness, optimize resource allocation, and continuously improve sales performance.

Based on vertical, the consumer goods& retail vertical is projected to witness the highest CAGR during the forecast period.

In the consumer goods and retail industry, sales performance management solutions are crucial for maximizing sales effectiveness and improving overall business performance. The consumer goods and retail industry often operates with complex sales structures, involving multiple sales channels, territories, and product categories. Sales performance management solutions provide the necessary tools to manage and track sales performance across these diverse structures. This allows organizations to gain insights into the effectiveness of each channel, identify top-performing regions, and optimize sales strategies accordingly.

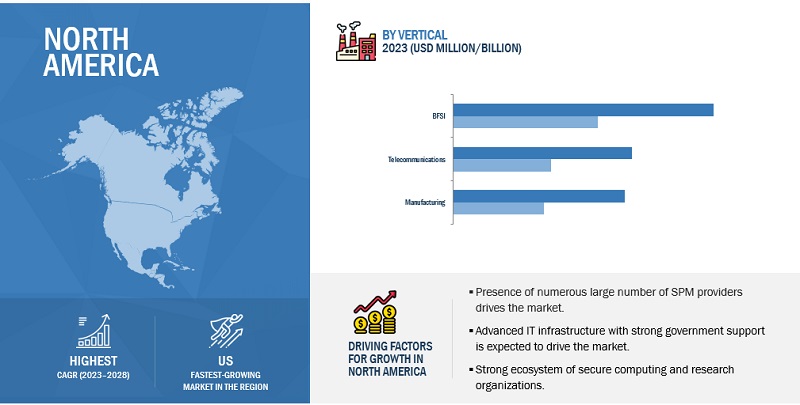

The US market is projected to contribute the largest share of the SPM market in North America.

The US is estimated to account for North America’s largest share of the sales performance management market in 2023, and the trend is expected to continue until 2028. Due to several factors, including advanced IT infrastructure, the existence of numerous businesses, and the availability of technical skills, it is the most developed market for adopting sales performance management solutions. The country’s market growth is driven by the presence of global mega-vendors, high adoption of advanced technologies, such as AI, ML, and the Internet of Things (IoT), and the highest readiness for adopting the cloud. Many mergers, acquisitions, and VC/private equity deals are happening in the country, making it the largest market for investors and vendors worldwide.

Sales Performance Management Companies

The sales performance management market is dominated by a few globally established players such as SAP (Germany), Oracle (US), NICE (Israel), Anaplan (US), and Xactly (US), among others, are the key vendors that secured SPM contracts in last few years. These vendors can bring global processes and execution expertise to the table, the local players only have local expertise. Driven by the increasing automation to improve visibility and avoid calculation inaccuracies, rising demand for metric-driven sales tools, and the growing enterprise mobility to boost agent engagement and performance in the SPM market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Million/Billion(USD) |

|

Segments Covered |

Component (Solutions, Services), Organization Size, Deployment Mode, and Vertical |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

List of Companies in Sales Performance Management |

Some of the major vendors offering SPM across the globe include SAP (Germany), Oracle (US), NICE (Israel), Anaplan (US), Xactly (US), Salesforce (US), Varicent (Canada), Optymyze (UK), beqom (Switzerland), Performio (US), Incentives Solutions (Israel), and more. |

This research report categorizes the SPM market based on component (solutions, services), organization size, deployment mode, verticals, and regions.

Based on the Component:

-

Solutions

- Incentive Compensation Management

- Territory Management

- Sales Planning & Monitoring

- Sales Performance Analytics & Reporting

- Other Solutions

-

Services

- Integration & Implementation

- Consulting

- Training & Education

- Support & Maintenance

Based on the Deployment Mode:

- On-Premises

- Cloud

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on the Vertical:

- BFSI

- Telecommunications

- Manufacturing

- IT & ITeS

- Consumer Goods & Retail

- Healthcare & Pharmaceuticals

- Energy & Utilities

- Travel & Hospitality

- Other Verticals

Based on the Region:

-

North America

- United States

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- Japan

- China

- Australia and New Zealand (ANZ)

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia (KSA)

- Rest of Middle East & Africa (MEA)

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments:

- In March 2023, Salesforce announced new product suites for sales and service teams, bringing together solutions from across the Customer 360 to help any company unlock cost savings and create exceptional customer experiences.

- In February 2023, Performio launched its new product, Analytics Studio. The new analytics capabilities leverage predictive artificial intelligence (AI) to generate insights into payable and attainment trends by team, territory, or products, which informs and improves territory, quota, and comp recommendations. In addition, it reports on estimated compensation payables based on the current pipeline in a customer’s CRM system to better plan and manage company-wide commission payouts.

- In June 2022, Beqom opened an office in Tokyo as part of its ongoing Asia-Pacific expansion, naming industry veteran John Kirch as Head of Sales in Japan. The move follows Beqom’s recent announcement of global expansion plans fueled by a $300 million investment by Sumeru Equity Partners.

- In April 2022, Xactly announced the addition of Commission Earnings Forecasting to the Xactly Intelligent Revenue Platform. This solution eliminates lengthy manual processes and reduces financial risk related to unexpected commission expenses.

- In March 2022, Xactly announced the Xcelerate Partner Program, focusing on best-in-class enterprise software partners and systems integrators to support customer revenue growth.

- In August 2021, Varicent acquired Concert Finance (Concert), an innovative provider of commission software designed by compensation experts. The move to acquire Concert Finance started in May when Concert sought to scale its rapid growth. Varicent wanted to expand its Incentive Compensation Management (ICM) portfolio into the SMB market. The deal closed on July 9, 2021.

Frequently Asked Questions (FAQ):

What is Sales Performance Management?

SPM is a suite of software applications that help improve sales processes and sales performance by facilitating planning and management of sales territories, quotas, and incentives; continuous monitoring; proper commission payout; coaching; and gamification. SPM solutions include Incentive Compensation Management (ICM), Territory Management, Sales Planning and Monitoring, Sales Performance Analytics and Reporting, and others, such as Sales Coaching and Gamification.

Which country are early adopters of Sales Performance Management?

The US is at the initial stage of adopting Sales Performance Management.

Which are key verticals adopting Sales Performance Management?

Key verticals adopting the Sales Performance Management market include: -

- BFSI

- Telecommunications

- Manufacturing

- IT & ITeS

- Consumer Goods & Retail

- Healthcare & Pharmaceuticals

- Energy & Utilities

- Travel & Hospitality

- Other Verticals

Which are the key vendors exploring Sales Performance Management?

Some of the major vendors offering SPM solutions and services across the globe are SAP (Germany), Oracle (US), NICE (Israel), Anaplan (US), Xactly (US), Salesforce (US), Varicent (Canada), Optymyze (UK), beqom (Switzerland), Performio (US), Incentives Solutions (Israel), Axtria (US), Iconixx (US), Gryphon Networks (US), ZS (US), CellarStone (US), Board (Switzerland), Zoho (India), InsideSales (US), Accent Technologies (US), Silvon Software (US), CaptivateIQ (US), Spiff (US), Ascent Cloud (Switzerland), Adventace (US), Plecto (Denmark), Spotio (US), SalesScreen (Norway), Centrical (US), Spinify (US), Ambition (US), Everstage (India), and InnoVyne (US).

What is the expected total CAGR for the Sales Performance Management market from 2023-2028?

The Sales Performance Management market is expected to record a CAGR of 13.6% during 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing automation to improve visibility and avoid calculation inaccuracies- Rising demand for metric-driven sales tools- Rising enterprise mobility to enhance agent engagement and performance- Increasing emphasis on sales performance- Favorable regulatory compliancesRESTRAINTS- Skepticism among SMEs to avoid additional costs or altering of organizational structure- Implementation challenges- Data privacy and security concernsOPPORTUNITIES- Integration of audio-video conferencing APIs to increase productivity- ML and NLP innovations to leverage data-driven recommendations- Rising demand for data-driven decision-making to assess and evaluate performanceCHALLENGES- Prevailing apprehensions related to levels of intrusion- Complexity associated with compensation plans

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: OPENSYMMETRY HELPED CO-OPERATORS ENCOMPASS SPM SYSTEM FROM PRE-DEPLOYMENT TO POST-DEPLOYMENTCASE STUDY 2: ANAPLAN HELPED ALKEM LABORATORIES ENHANCE BONUS AND COMPENSATION CALCULATIONS AND PROVIDE REAL-TIME INSIGHTSCASE STUDY 3: FLOWSERVE ACHIEVED REAL-TIME VISIBILITY TO PIVOT SALES PLANS BY DEPLOYING XACTLY INCENT’S SOLUTIONCASE STUDY 4: ORACLE HELPED EMIRATES NBD AUTOMATE DAILY COMPENSATION TRANSACTIONS AND IMPROVE VISIBILITYCASE STUDY 5: TURKCELL ENHANCED SALES PLANNING AND QUOTA AND TERRITORIES MANAGEMENT WITH BEQOM’S SPM

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 MARKET MAP/ECOSYSTEM

-

5.6 TECHNOLOGICAL ANALYSISARTIFICIAL INTELLIGENCE AND AUTOMATION- RPA- ML and NLPCUSTOMER RELATIONSHIP MANAGEMENTFORECASTING AND PREDICTIVE ANALYTICS

- 5.7 PRICING ANALYSIS

-

5.8 PATENT ANALYSIS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 TARIFFS AND REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST AND SOUTH AFRICALATIN AMERICA

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.12 TRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS’ BUSINESSES

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONCOMPONENT: SALES PERFORMANCE MANAGEMENT MARKET DRIVERS

-

6.2 SOLUTIONSINCENTIVE COMPENSATION MANAGEMENT- ICM solutions to enhance business outcomes and align sales representatives’ behavior with organizational goalsTERRITORY MANAGEMENT- Need to enhance strategic insights by calculating budgetary impact of different territorial configurations to drive marketSALES PLANNING & MONITORING- Sales planning & monitoring solutions to facilitate and monitoring, setting targets, and creating actionable strategiesSALES PERFORMANCE ANALYTICS & REPORTING- Sales performance analytics & reporting solutions to provide real-time insights into sales representative performanceOTHER SOLUTIONS

-

6.3 SERVICESINTEGRATION & IMPLEMENTATION- Integration & implementation services to ensure seamless process and optimal utilization of SPM solutionsCONSULTING- Need for expert guidance to optimize sales performance management processes and implement strategies to drive marketTRAINING & EDUCATION- Training & education services to empower organizations to maximize value of SPM solutions and optimize sales performanceSUPPORT & MAINTENANCE- Support & maintenance services to identify and resolve issues or errors encountered and ensure secure operation of SPM solutions

-

7.1 INTRODUCTIONORGANIZATION SIZE: SALES PERFORMANCE MANAGEMENT MARKET DRIVERS

-

7.2 LARGE ENTERPRISESSPM TO OFFER ADVANCED REPORTING AND ANALYTICS CAPABILITIES WITH REAL-TIME INSIGHTS

-

7.3 SMALL & MEDIUM-SIZED ENTERPRISESSPM SOLUTIONS TO MANAGE SALES QUOTAS, EMPLOYEE PERFORMANCE, AND INCENTIVES AND DRIVE EMPLOYEE ENGAGEMENT

-

8.1 INTRODUCTIONDEPLOYMENT MODE: SALES PERFORMANCE MANAGEMENT MARKET DRIVERS

-

8.2 ON-PREMISESON-PREMISES SPM SOLUTIONS TO HELP MANAGE RISKS AND BUSINESS PROCESSES WHILE ADHERING TO EXTERNAL COMPLIANCE REQUIREMENTS

-

8.3 CLOUDCLOUD-BASED SPM SOLUTIONS TO MANAGE INCENTIVE COMPENSATION, QUOTA, AND TERRITORIES AND ANALYZE PERFORMANCE

-

9.1 INTRODUCTIONVERTICAL: SALES PERFORMANCE MANAGEMENT MARKET DRIVERS

-

9.2 BFSISPM SOLUTIONS TO OPTIMIZE SALES PROCESSES, IMPROVE SALES PERFORMANCE, AND ENSURE COMPLIANCE WITHIN INDUSTRY

-

9.3 TELECOMMUNICATIONSSPM SOLUTIONS TO MANAGE AND OPTIMIZE SALES CHANNELS, TRACK SALES ACTIVITIES, AND ENSURE CONSISTENCY ACROSS CHANNELS

-

9.4 MANUFACTURINGSPM SOLUTIONS TO ENHANCE EMPLOYEE ENGAGEMENT AND TRACK AND ANALYZE ACCURATE PAYOUT INCENTIVE BONUSES

-

9.5 IT & ITESSPM SOLUTIONS TO PROVIDE REAL-TIME TRACKING & MONITORING OF SALES PERFORMANCE AND SET CLEAR AND MEASURABLE SALES GOALS

-

9.6 CONSUMER GOODS & RETAILSPM SOLUTIONS TO STREAMLINE SALES ADMINISTRATION TASKS AND IMPROVE INCENTIVE COMPENSATION ACCURACY

-

9.7 HEALTHCARE & PHARMACEUTICALSSPM SOLUTIONS TO STREAMLINE INCENTIVE PROGRAMS WHILE ADHERING TO INDUSTRY REGULATIONS

-

9.8 ENERGY & UTILITIESSPM SOLUTIONS TO MANAGE SALES TERRITORIES AND CUSTOMER ACCOUNTS EFFICIENTLY

-

9.9 TRAVEL & HOSPITALITYSPM SOLUTIONS TO DEFINE TERRITORIES BASED ON GEOGRAPHICAL AREAS, CUSTOMER SEGMENTS, OR ACCOMMODATION TYPES

- 9.10 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: SALES PERFORMANCE MANAGEMENT MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Presence of several key SPM solution providers, availability of skilled workforce, and advanced IT infrastructure to propel marketCANADA- Increasing adoption of advanced digital technologies and presence of startups focused on SPM to drive market

-

10.3 EUROPEEUROPE: SALES PERFORMANCE MANAGEMENT MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Focus on data privacy, security, and regulatory compliance and rising digitalization to drive marketGERMANY- Need for audit trails, compliance tracking, and transparent reporting and presence of diverse opportunities to drive marketFRANCE- SPM solutions to provide auditing capabilities, track compliance, and generate accurate reportsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: SALES PERFORMANCE MANAGEMENT MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Focus on digital transformation, technology adoption, relationship-building, and customer engagement to propel marketJAPAN- Need to leverage AI, automation, and analytics to provide data-driven insights and automate sales processes to drive marketAUSTRALIA AND NEW ZEALAND (ANZ)- Need to enhance sales effectiveness, improve sales processes, and drive revenue growth to boost demand for SPM solutionsREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: SALES PERFORMANCE MANAGEMENT MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKINGDOM OF SAUDI ARABIA (KSA)- Focus of governments, regulatory bodies, and private sectors on emerging technologies to boost demand for SPM solutionsREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: SALES PERFORMANCE MANAGEMENT MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Implementation of LGPD and presence of major SPM players to accelerate marketREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS

- 11.3 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

- 11.4 COMPANY FINANCIAL METRICS

- 11.5 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

11.6 KEY COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 EVALUATION MATRIX FOR STARTUPS/SMESRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 11.8 KEY MARKET DEVELOPMENTS

- 12.1 INTRODUCTION

-

12.2 MAJOR PLAYERSSAP- Business overview- Product/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNICE- Business overview- Products/Solutions/Services offered- MnM viewANAPLAN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewXACTLY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSALESFORCE- Business overview- Products/Solutions/Services offered- Recent developmentsVARICENT- Business overview- Products/Solutions/Services offered- Recent developmentsOPTYMYZE- Business overview- Products/Solutions/Services offeredBEQOM- Business overview- Products/Solutions/Services offered- Recent developmentsPERFORMIO- Business overview- Products/Solutions/Services offered- Recent developmentsINCENTIVES SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developments

-

12.3 OTHER PLAYERSAXTRIAICONIXXGRYPHON NETWORKSZSCELLARSTONEBOARDZOHOINSIDESALESACCENT TECHNOLOGIESSILVON SOFTWARE

-

12.4 STARTUPS/SMESCAPTIVATEIQSPIFFASCENT CLOUDADVENTACEPLECTOSPOTIOSALESSCREENCENTRICALSPINIFYAMBITIONEVERSTAGEINNOVYNE

-

13.1 INTRODUCTIONRELATED MARKETSLIMITATIONS

- 13.2 ENTERPRISE PERFORMANCE MANAGEMENT MARKET

- 13.3 HUMAN CAPITAL MANAGEMENT MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2015–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ASSUMPTIONS

- TABLE 4 SALES PERFORMANCE MANAGEMENT MARKET: PRICING ANALYSIS

- TABLE 5 TOP TEN PATENT APPLICANTS (US)

- TABLE 6 MARKET: PATENT ANALYSIS

- TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- TABLE 10 KEY BUYING CRITERIA FOR END USERS

- TABLE 11 MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 12 MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 13 COMPONENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 14 COMPONENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 15 MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 16 MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 17 SOLUTIONS: SALES PERFORMANCE MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 18 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 INCENTIVE COMPENSATION MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 20 INCENTIVE COMPENSATION MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 TERRITORY MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 TERRITORY MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SALES PLANNING & MONITORING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 SALES PLANNING & MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 SALES PERFORMANCE ANALYTICS & REPORTING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 SALES PERFORMANCE ANALYTICS & REPORTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 OTHER SOLUTIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 OTHER SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 30 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 31 SERVICES: SALES PERFORMANCE MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 INTEGRATION & IMPLEMENTATION: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 INTEGRATION & IMPLEMENTATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 CONSULTING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 TRAINING & EDUCATION: MARKET, BY REGION, 2019–2022 (USD MILLION

- TABLE 38 TRAINING & EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 ORGANIZATION SIZE: MARKET, 2019–2022 (USD MILLION)

- TABLE 42 ORGANIZATION SIZE: MARKET, 2023–2028 (USD MILLION)

- TABLE 43 ORGANIZATION SIZE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 ORGANIZATION SIZE: SALES PERFORMANCE MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 LARGE ENTERPRISES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 SMALL & MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 SMALL & MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 50 MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 51 DEPLOYMENT MODE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 DEPLOYMENT MODE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 ON-PREMISES: SALES PERFORMANCE MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 CLOUD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 58 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 59 VERTICAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 VERTICAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 BFSI: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 TELECOMMUNICATIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 TELECOMMUNICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 MANUFACTURING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 IT & ITES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 IT & ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 CONSUMER GOODS & RETAIL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 CONSUMER GOODS & RETAIL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 HEALTHCARE & PHARMACEUTICALS: SALES PERFORMANCE MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 HEALTHCARE & PHARMACEUTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 ENERGY & UTILITIES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 ENERGY & UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 OTHER VERTICALS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: SALES PERFORMANCE MANAGEMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 US: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 96 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 97 US: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 98 US: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 99 CANADA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 100 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 101 CANADA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 102 CANADA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 108 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 112 EUROPE: SALES PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 116 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 UK: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 118 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 119 UK: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 120 UK: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 121 GERMANY: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 122 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 123 GERMANY: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 124 GERMANY: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 125 FRANCE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 126 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 127 FRANCE: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 128 FRANCE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 129 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 130 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 131 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 132 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: SALES PERFORMANCE MANAGEMENT MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 147 CHINA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 148 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 149 CHINA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 150 CHINA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 151 JAPAN: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 152 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 153 JAPAN: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 154 JAPAN: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 155 ANZ: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 156 ANZ: SALES PERFORMANCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 157 ANZ: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 158 ANZ: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 177 KSA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 178 KSA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 179 KSA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 180 KSA: SALES PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 189 LATIN AMERICA: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 192 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 193 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 194 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 195 LATIN AMERICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 196 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 197 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 198 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 199 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 200 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 201 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 202 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 203 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 204 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 205 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 206 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 207 MARKET SHARE OF KEY VENDORS IN 2022

- TABLE 208 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 209 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2023

- TABLE 210 SALES PERFORMANCE MANAGEMENT MARKET: DEALS, 2020–2023

- TABLE 211 SAP: COMPANY OVERVIEW

- TABLE 212 SAP: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 213 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 214 SAP: DEALS

- TABLE 215 ORACLE: COMPANY OVERVIEW

- TABLE 216 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 ORACLE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 218 ORACLE: DEALS

- TABLE 219 NICE: COMPANY OVERVIEW

- TABLE 220 NICE: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 221 ANAPLAN: COMPANY OVERVIEW

- TABLE 222 ANAPLAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ANAPLAN: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 224 ANAPLAN: DEALS

- TABLE 225 XACTLY: COMPANY OVERVIEW

- TABLE 226 XACTLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 XACTLY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 228 XACTLY: DEALS

- TABLE 229 SALESFORCE: COMPANY OVERVIEW

- TABLE 230 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 232 SALESFORCE: DEALS

- TABLE 233 VARICENT: COMPANY OVERVIEW

- TABLE 234 VARICENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 VARICENT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 236 VARICENT: DEALS

- TABLE 237 OPTYMYZE: COMPANY OVERVIEW

- TABLE 238 OPTYMYZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 BEQOM: COMPANY OVERVIEW

- TABLE 240 BEQOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 BEQOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 242 BEQOM: DEALS

- TABLE 243 BEQOM: OTHERS

- TABLE 244 PERFORMIO: BUSINESS OVERVIEW

- TABLE 245 PERFORMIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 PERFORMIO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 247 PERFORMIO: DEALS

- TABLE 248 PERFORMIO: OTHERS

- TABLE 249 INCENTIVES SOLUTIONS: BUSINESS OVERVIEW

- TABLE 250 INCENTIVES SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 INCENTIVES SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 252 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 253 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 254 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 255 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 256 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD MILLION)

- TABLE 257 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

- TABLE 258 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 259 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 260 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

- TABLE 261 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 262 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 263 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 264 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 265 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 266 HUMAN CAPITAL MANAGEMENT MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

- TABLE 267 HUMAN CAPITAL MANAGEMENT MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 268 HUMAN CAPITAL MANAGEMENT MARKET, BY SOFTWARE, 2017–2020 (USD MILLION)

- TABLE 269 HUMAN CAPITAL MANAGEMENT MARKET, BY SOFTWARE, 2021–2026 (USD MILLION)

- TABLE 270 HUMAN CAPITAL MANAGEMENT MARKET, BY SERVICE, 2017–2020 (USD MILLION)

- TABLE 271 HUMAN CAPITAL MANAGEMENT MARKET, BY SERVICE, 2021–2026 (USD MILLION)

- TABLE 272 HUMAN CAPITAL MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

- TABLE 273 HUMAN CAPITAL MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

- TABLE 274 HUMAN CAPITAL MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

- TABLE 275 HUMAN CAPITAL MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 276 HUMAN CAPITAL MANAGEMENT MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

- TABLE 277 HUMAN CAPITAL MANAGEMENT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 278 HUMAN CAPITAL MANAGEMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 279 HUMAN CAPITAL MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 SALES PERFORMANCE MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY PROFILES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET: DATA TRIANGULATION

- FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING SALES PERFORMANCE MANAGEMENT SOLUTIONS AND SERVICES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM SOLUTIONS AND SERVICES

- FIGURE 7 ILLUSTRATION OF COMPANY SALES PERFORMANCE MANAGEMENT REVENUE ESTIMATION

- FIGURE 8 MARKET PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET PROJECTIONS FROM DEMAND SIDE

- FIGURE 10 FASTEST-GROWING SEGMENTS IN MARKET DURING FORECAST PERIOD

- FIGURE 11 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 12 SALES PLANNING & MONITORING SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 13 INTEGRATION & IMPLEMENTATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 14 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 15 ON-PREMISES DEPLOYMENT MODE TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 16 BFSI VERTICAL TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 17 SALES PERFORMANCE MANAGEMENT MARKET: REGIONAL SNAPSHOT

- FIGURE 18 NEED TO ALIGN JOBS WITH SALES STRATEGIES, IMPROVE SALES COMMISSION CALCULATION ACCURACIES, AND MINIMIZE SALES ATTRITION TO DRIVE MARKET

- FIGURE 19 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 SALES PLANNING & MONITORING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 INTEGRATION & IMPLEMENTATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 22 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 23 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 24 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SALES PERFORMANCE MANAGEMENT MARKET

- FIGURE 26 TOP SALES PERFORMANCE METRICS

- FIGURE 27 BENEFITS OF MACHINE LEARNING IN MARKETING AND SALES

- FIGURE 28 MARKET: SUPPLY CHAIN

- FIGURE 29 MARKET: MARKET MAP

- FIGURE 30 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 31 TOP FIVE PATENT OWNERS (GLOBAL)

- FIGURE 32 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 33 MARKET: TRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS’ BUSINESSES

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 35 KEY BUYING CRITERIA FOR END USERS

- FIGURE 36 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 TERRITORY MANAGEMENT SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 TRAINING & EDUCATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 SMALL & MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 40 CLOUD DEPLOYMENT MODE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 CONSUMER GOODS & RETAIL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 45 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 46 SALES PERFORMANCE MANAGEMENT MARKET: MARKET SHARE ANALYSIS

- FIGURE 47 HISTORICAL REVENUE ANALYSIS, 2018–2022 (USD MILLION)

- FIGURE 48 TRADING COMPARABLE (EV/CY25E EBITDA)

- FIGURE 49 SALES PERFORMANCE MANAGEMENT MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- FIGURE 50 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 51 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 52 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- FIGURE 53 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE, 2022

- FIGURE 54 EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 55 OVERALL COMPANY FOOTPRINT FOR STARTUPS/SMES

- FIGURE 56 SAP: COMPANY SNAPSHOT

- FIGURE 57 ORACLE: COMPANY SNAPSHOT

- FIGURE 58 NICE: COMPANY SNAPSHOT

- FIGURE 59 ANAPLAN: COMPANY SNAPSHOT

- FIGURE 60 SALESFORCE: COMPANY SNAPSHOT

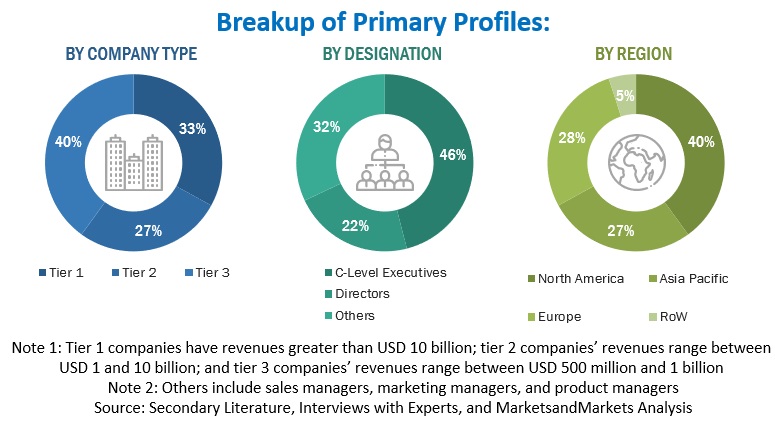

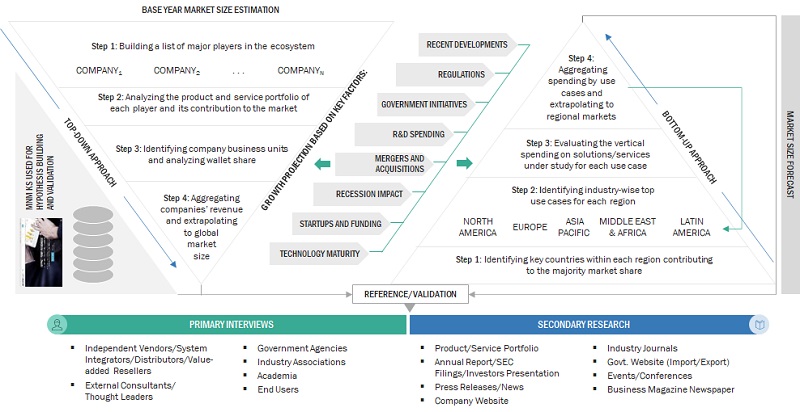

The study involved four major activities in estimating the size of the SPM market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering SPM solutions and services was determined based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies.

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both markets- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the SPM market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); the installation teams of governments/end users using SPM solutions and services; and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of software solutions, which would affect the overall SPM market.

To know about the assumptions considered for the study, download the pdf brochure

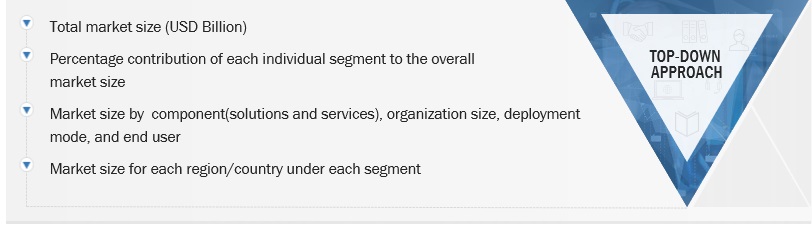

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the SPM market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Top Down and Bottom Up Approach of Sales Performance Management Market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down and bottom-up approaches were used to estimate and validate the size of the SPM market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

Key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research.

This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Top Down Approach of Sales Performance Management Market

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply in BFSI; consumer goods & retail; telecommunications; manufacturing; IT & ITeS; energy & utilities; travel & hospitality; healthcare & pharmaceuticals; and others (education, real estate & construction, and media & entertainment).

Market Definition

SPM is a suite of software applications that help improve sales processes and sales performance by facilitating planning and management of sales territories, quotas, and incentives; continuous monitoring; proper commission payout; coaching; and gamification. SPM solutions include Incentive Compensation Management (ICM), Territory Management, Sales Planning and Monitoring, Sales Performance Analytics and Reporting, and others, such as Sales Coaching and Gamification.

Key Stakeholders

- SPM solutions and services providers

- Professional service providers

- Cloud Service Providers (CSPs)

- Consulting service providers and consulting companies

- Government organizations, forums, alliances, and associations

- Technology providers

- System Integrators (SIs)

- Value-added Resellers (VARs) and distributors

- Venture Capitalists (VCs), Private Equity Firms, and Startup Companies

- End users

Report Objectives

- To define, describe, and forecast the global SPM market based on components (solutions and services), deployment mode, organization size, verticals, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the SPM market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sales Performance Management Market