Enterprise Performance Management Market by Component, Application (Enterprise Planning & Budgeting, Reporting & Compliance), Business Function, Deployment Type, Organization Size, Vertical and Region - Global Forecast to 2027

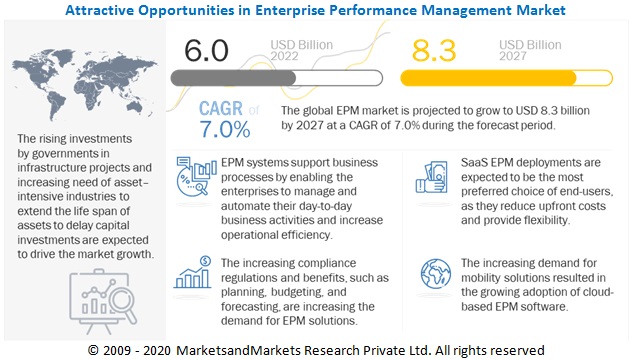

[282 Pages Report] The global Enterprise Performance Management (EPM) Market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.0% during the forecast period, to reach USD 8.3 billion by 2027 from USD 6.0 billion in 2022. The market is expected to grow on account of EPM solutions’ benefits, such as operational cost reduction, business process optimization, and adherence with security and regulatory compliance. This results in the improved operational efficiency and increased profitability. Further, the rising demand for EPM solutions from verticals, such as manufacturing, BFSI, retail, and consumer goods, is boosting the market growth significantly across the developing countries.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The need to maintain employees' safety during COVID-19 has forced many organizations to change their rules, regulations, compliance and policies. The major cause of the business disruption was the inability in the mobility of the workforce and coordination with HR unlike earlier. The restriction imposed by central and state governments to travel and cross borders are the causes for the same. Social distancing has forced enterprises to change their current ways of functioning and reconsider operational choices in order to maintain operational efficiency. Governments across are working closely with Cloud providers to fight the effect of COVID-19 pandemic. The MACIF Group, a leading French mutual insurance provider, was successful ensuring business continuity and maintaining the link between its employees with Google Suite, already deployed to its more than 8,000 employees. MACIF staff shifted from physical meetings to more than 1,300 Google Meet video conferences daily, and the extensive use of collaborative virtual rooms facilitated important human connectivity, interaction and responsiveness within an unexpected period of remote work.

Market Dynamics

How the reduction in operational cost is improving profitability?

Organizations utilize EPM systems to track day-to-day financial performance. A well-equipped EPM system enables the organization to maintain efficiency across the entire team and eliminate manual tasks. Enabling the key elements of various business processes with an EPM tool drives the growth, profitability, and accountability of organizations. EPM provides visibility across all business segments and tracks the cost and profitability of each of these business segments. This functionality can be utilized to predict and forecast the business requirements and respond to the changing economical requirements in the competitive market. Thus, the implementation of EPM offers higher returns and increased margins and identifies ways to improve profitability and business performance. For instance, EPM offers insurance companies with cost management and profitability analysis tool, which performs complex and detailed calculations to define the profit potential. EPM offers manufacturers precise cost and analysis tools on a real-time basis to gain profitability by protecting the margins.

How is lack of technological training and application complexity a barrier?

Lack of technical expertise and technological infrastructure are the risk factors associated with the successful implementation of EPM systems. EPM implementation requires technological advancements, such as installing new software and hardware. The application size requires determining the scope of the project, the number of end-users, and the team size. Since most organizations lack a well-equipped infrastructure to implement the EPM system to fit the business processes as per the application requirement, functional and technical expertise is critical to identifying the business requirements and designing the application accordingly. However, customizing the EPM system according to the current business processes could be costly and time-consuming.

Is lack of coordination and integration of cloud applications a challenge?

Organizations are moving toward digital transformation. As a result, organizations are rapidly adopting off-premises applications to overcome the cost of software and hardware upgrades. The organizations that are successful in adopting digital transformation are facing challenges in the integration of the existing infrastructure. Integration of cloud applications with business processes is a critical activity. As a result, organizations find that the existing infrastructure is not suitable for storing and managing the data as per the requirement. The correctness of EPM data depends on the integration and coordination between the metadata and the related properties. It is required to maintain the master data in the central system to interact between all the off-premises and on-premises software applications.

Further, EPM implementation requires a high degree of technical work via stronger configuration and capabilities and the need for significant integration with different systems, such as finance, supply chain , or other software tools. Hence, process and system functions must fit each other for proper integration.

Is the increase in adoption of cloud-based EPM software a catalyst to support business functions?

EPM software has gradually developed from a mainframe system to client-server, internet, and browser-based systems. There is an increasing demand for cloud-based software; the market is rapidly shifting to adopt cloud-based EPM software. Cloud-based software makes EPM accessible to more organizations because there is no requirement for well-equipped infrastructure to reduce the cost of implementing the EPM software. The cost of setting up cloud-based EPM software is one-fourth of the total cost of implementation of on-premises application software. Moreover, cloud empowers finance to support and control both the initial implementation and the ongoing maintenance of the EPM solution. Many organizations adopt cloud-based EPM software to extend support to various business functions. For instance, in 2020, Harper College, US, deployed an EPM cloud application to bring the HR and finance departments together, efficiently process the financial data, and track the project statuses.

Based on business function, Manufacturing segment to hold highest CAGR during the forecast period

The manufacturing segment includes automotive, aerospace, heavy machinery, chemicals, electronics, and semiconductors. The manufacturing segment has undergone significant changes due to global competition, urbanization, and government regulations. It is transforming processes, such as integrated supply chain, inventory management, and product designing, drastically in every business function. Manufacturers need a production performance management solution that optimizes supply, demand, and production decisions. EPM solutions integrate operational and production planning with financial plans, cash flow, modeling and forecasting, sales and operations, and project planning. They assist organizations in accelerating and improving monthly financial reporting and operating and capital expenditure planning.

Based on the deployment model, Cloud segment to hold a higher CAGR during the forecast period

The growth of EPM solutions is fueled by the growth of cloud services that is expected to be driven by government-funded infrastructure development projects; eGovernment initiatives; transformations in the BFSI and IT and ITeS verticals; and diversification strategies adopted by other verticals.

The adoption of cloud-based EPM solutions is increasing due to their scalability and flexibility. More businesses are utilizing this software to improve their financial processes. Cloud deployment is gaining popularity, as it uses modern advanced analytics, delivers real-time information, and offers integration of business processes. The cloud deployment type offers easy maintenance and upgradations and anytime access to the users. This, in turn, supports the growing demand for EPM software solutions.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific to grow at the highest CAGR during the forecast period

Asia Pacific’s growth in the region can be attributed to various factors, including the rising adoption of advanced technologies, economic developments, increasing rate of digitalization, and high investments by EPM solution providers. IBM, SAP, Oracle, and SAS are some prominent EPM vendors that offer services across Asia Pacific. Furthermore, various business enterprises offering EPM solutions and services are expanding their reach in Asia Pacific to deliver tailor-made offerings to local clients. In the Asia Pacific region, various industries across India, Japan, China, Australia, and Singapore, deploy EPM solutions to achieve benefits, such as cost-efficiency, transparency, visibility, and operational excellence. Hypercube Consulting, an EPM consultancy solution and service provider, helped Malaysia Airlines and Singapore Post deploy EPM solutions. The region has seen an increase in the deployment of EPM solutions by verticals to enhance efficiency and streamline their business processes. Due to these factors, the region is projected to grow at the highest CAGR during the forecast period.

Key Market Players

The enterprise performance management market is dominated by companies such as Unicom Systems (US), Planful (US), Unit4 (Netherlands), OneStream (US), SAP (Germany), Oracle (US), IBM (US), Infor (US), Anaplan (US),Workday (US), Epicor Software (US), BearingPoint (Netherlands), Broadcom (US), Board International (Switzerland), LucaNet (Germany), Prophix (Canada), Vena Solutions (Canada), Solver (US), Kepion (US), Jedox (Germany), Wolters Kluwer (Netherlands), Corporater (Norway), insight software (US), and others. These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which assists them to increase revenue generation.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Component, Application, Business Function, Deployment Model, Organization Size, Verticals, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa. and Latin America |

|

Companies covered |

Oracle (US), IBM (US), Infor (US), SAP (Germany), Anaplan (US), Workday (US), Epicor Software (US), Unicom Systems (US), Planful (US), Unit4 (Netherlands), OneStream (US), Workiva (US), BearingPoint (Netherlands), Broadcom (US), Board International (Switzerland), LucaNet (Germany), Prophix (Canada), Vena Solutions (Canada), Solver (US), Kepion (US), Jedox (Germany), Corporater (Norway), Wolters Kluwer (Netherlands), insight software (US), SAS (US), Longview (Canada), Bright Analytics (UK), Centage (US), InPhase (UK), Datarails (Israel), IDU (South Africa), Calumo (Australia), deFacto Global (US), Syntellis (US), and Achieveit (US). |

This research report categorizes the enterprise performance management market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Component:

- Solutions

- Services

Based on the Application:

- Enterprise Planning and Budgeting

- Financial Consolidation

- Reporting and Compliance

- Integrated Performance Management System

- Others

Based on the Business Function:

- Finance

- Human Resources

- Supply Chain

- Sales and Marketing

- IT

Based on the Deployment Model:

- Cloud

- On-Premises

Based on Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on Verticals:

- BFSI

- Manufacturing

- Healthcare and Lifesciences

- IT and ITES

- Government and Public Sector

- Telecommunications

- Retail and Consumer Goods

- Media and Entertainment

- Others

Based on Regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zeland

- Rest of APAC

-

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2021, UNICOM Systems, Inc. announced the release of UNICOM Digital Transformation Toolkit (UDTT) 10.2. UNICOM Digital Transformation Toolkit supports faster multichannel application development, especially for the banking industry. It provides runtime infrastructure based on IBM WebSphere Application Server to deliver targeted, multichannel marketing campaigns for retail banking. UDTT provides a development environment with design templates to support high-volume and transactional-oriented banking functions.

- In April 2021, IBM's new updates with IBM Planning Analytics will include a new statistical details page designed to provide more transparent and easy-to-understand facts about how a forecasting prediction was generated. As more businesses turn to predictive forecasting capabilities to strengthen their financial, sales, and supply chain planning, they require transparency in the models and data used to generate the forecast.

- In September 2020, Anaplan announced PlanIQ, a new intelligence framework that delivers advanced Artificial Intelligence (AI) and Machine Learning (ML) capabilities for predictive forecasting and continuous, agile scenario modeling. Designed to make advanced analytics more accessible, Plan IQ produces insights that are explainable and predictions that can improve the accuracy of plans and drive confident decision-making.

Frequently Asked Questions (FAQ):

What is the market size of Enterprise Performance Management Market?

What is the growth rate of Enterprise Performance Management Market?

What are the challenges in the Enterprise Performance Management Market?

Who are the key players in Enterprise Performance Management Market?

Who will be the leading hub for Enterprise Performance Management Market?

What is the Enterprise Performance Management Market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 ENTERPRISE PERFORMANCE MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

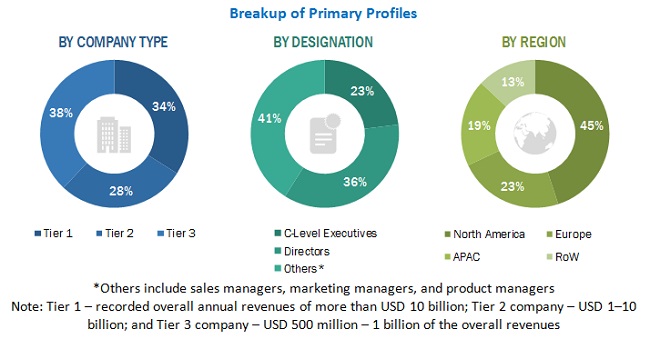

2.1.2.1 Breakup of primary profiles

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 ENTERPRISE PERFORMANCE MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE OF ENTERPRISE PERFORMANCE MANAGEMENT FROM VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF ENTERPRISE PERFORMANCE MANAGEMENT VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY-SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY-SIDE): CAGR PROJECTIONS FROM THE SUPPLY-SIDE

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND-SIDE): REVENUE GENERATED FROM EPM SOLUTIONS AND SERVICES (1/2)

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND-SIDE): REVENUE GENERATED FROM VERTICALS (2/2)

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 11 ENTERPRISE PERFORMANCE MANAGEMENT MARKET: GLOBAL SNAPSHOT

FIGURE 12 HIGH GROWTH SEGMENTS IN THE MARKET

FIGURE 13 ENTERPRISE PLANNING AND BUDGETING SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2027

FIGURE 14 ON-PREMISES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE BY 2027

FIGURE 15 TOP VERTICALS IN THE ENTERPRISES PERFORMANCE MANAGEMENT MARKET, 2022 VS. 2027

FIGURE 16 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE ENTERPRISE PERFORMANCE MANAGEMENT MARKET

FIGURE 17 FOCUS ON IMPROVING OPERATIONAL EFFICIENCY AND SIMPLIFYING PLANNING, FORECASTING, AND BUDGETING WORKFLOW DRIVING THE MARKET

4.2 MARKET, BY APPLICATION, 2022 VS. 2027

FIGURE 18 ENTERPRISE PLANNING AND BUDGETING SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2027

4.3 MARKET, BY DEPLOYMENT MODEL, 2022

FIGURE 19 ON-PREMISES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE

4.4 MARKET, BY ORGANIZATION SIZE, 2022

FIGURE 20 LARGE ENTERPRISES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE

4.5 MARKET, BY VERTICAL, 2022 VS. 2027

FIGURE 21 BFSI VERTICAL EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2027

4.6 ENTERPRISE PERFORMANCE MANAGEMENT MARKET: REGIONAL SCENARIO, 2022–2027

FIGURE 22 ASIA PACIFIC EXPECTED TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ENTERPRISE PERFORMANCE MANAGEMENT

5.2.1 DRIVERS

5.2.1.1 Increasing operational efficiency by optimizing business processes

5.2.1.2 Improved profitability by reducing the operational cost

5.2.1.3 Requirements for regulatory compliance and security

5.2.2 RESTRAINTS

5.2.2.1 High cost of deploying EPM systems

5.2.2.2 Lack of technological planning and application complexity

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in adoption of cloud-based EPM software to support business functions

5.2.3.2 Rising need for mobility to implement a flexible work system

5.2.4 CHALLENGES

5.2.4.1 Lack of proper training and skillset of employees

5.2.4.2 Lack of coordination and integration of cloud applications

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: RECONCILIATION OF BUSINESS PROCESSES

5.4.2 CASE STUDY 2: FUTURE-ORIENTED FINANCIAL PLANNING AND ANALYSIS

5.4.3 CASE STUDY 3: IMPROVED BUDGETING AND PLANNING PROCESS

5.4.4 CASE STUDY 4: CONSISTENT AND TIMELY FINANCIAL REPORTING

5.5 TECHNOLOGICAL ANALYSIS

5.5.1 BIG DATA AND ANALYTICS

5.5.2 CLOUD COMPUTING

5.5.3 ARTIFICIAL INTELLIGENCE

5.5.4 MACHINE LEARNING

5.5.5 ROBOTIC PROCESS AUTOMATION

5.6 PATENT ANALYSIS

FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2011-2021

FIGURE 25 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 4 TOP TEN PATENT OWNERS (US)

5.7 VALUE CHAIN ANALYSIS

FIGURE 26 ENTERPRISE PERFORMANCE MANAGEMENT MARKET: VALUE CHAIN

5.8 ECOSYSTEM

TABLE 5 ENTERPRISE PERFORMANCE MANAGEMENT: ECOSYSTEM

FIGURE 27 MARKET: ECOSYSTEM

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 28 ENTERPRISE PERFORMANCE MANAGEMENT: PORTER’S FIVE FORCES ANALYSIS

TABLE 6 ENTERPRISE PERFORMANCE MANAGEMENT: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 KEY STAKEHOLDERS & BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP BUSINESS FUNCTIONS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP BUSINESS FUNCTIONS (%)

5.10.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.11 KEY CONFERENCES AND EVENTS IN 2022-2023

TABLE 9 ENTERPRISE PERFORMANCE MANAGEMENT MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.12 PRICING ANALYSIS

TABLE 10 PRICING ANALYSIS OF ENTERPRISE PERFORMANCE MANAGEMENT VENDORS (1/2)

TABLE 11 PRICING ANALYSIS OF ENTERPRISE PERFORMANCE MANAGEMENT VENDORS (2/2)

5.12.1 AVERAGE SELLING PRICE TREND

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 31 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

5.14 REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 REGULATIONS, BY REGION

5.14.2.1 North America

5.14.2.2 Europe

5.14.2.3 Asia Pacific

5.14.2.4 Middle East & Africa

5.14.2.5 Latin America

6 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT (Page No. - 85)

6.1 INTRODUCTION

FIGURE 32 SERVICES SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

TABLE 16 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 17 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 GROWING DEMAND FOR REDUCING OPERATIONAL COSTS, ADOPTION OF CLOUD-BASED SOLUTIONS, AND IMPLEMENTATION OF DATA-DRIVEN SOLUTIONS

TABLE 18 SOLUTIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 19 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 ADVISING AND HELPING END-USERS TO INTEGRATE AND DEPLOY EPM SOLUTIONS

TABLE 20 SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

6.3.3 MANAGED SERVICES

7 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY APPLICATION (Page No. - 91)

7.1 INTRODUCTION

FIGURE 33 ENTERPRISE PLANNING AND BUDGETING SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2027

7.1.1 APPLICATION: MARKET DRIVERS

7.1.2 APPLICATION: COVID-19 IMPACT

TABLE 22 MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 23 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 ENTERPRISE PLANNING AND BUDGETING

7.2.1 EFFECTIVELY EXECUTING BUSINESS STRATEGIES AND ALIGNING THEM WITH THE EXECUTION PLAN

TABLE 24 ENTERPRISE PLANNING AND BUDGETING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 ENTERPRISE PLANNING AND BUDGETING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 FINANCIAL CONSOLIDATION

7.3.1 INCREASING NEED TO RECONCILE, TRANSLATE, ELIMINATE, CONSOLIDATE, AND REPORT FINANCIAL INFORMATION

TABLE 26 FINANCIAL CONSOLIDATION: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 FINANCIAL CONSOLIDATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 REPORTING AND COMPLIANCE

7.4.1 NEED TO INCREASE THE ACCURACY OF FINANCIAL REPORTING WHILE DECREASING THE TURNAROUND TIME

TABLE 28 REPORTING AND COMPLIANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 REPORTING AND COMPLIANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 INTEGRATED PERFORMANCE MANAGEMENT SYSTEM

7.5.1 INCREASING NEED TO HELP AN ENTERPRISE IN PLANNING, MEASURING, AND ANALYZING PERFORMANCE

TABLE 30 INTEGRATED PERFORMANCE MANAGEMENT SYSTEM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 INTEGRATED PERFORMANCE MANAGEMENT SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 OTHER APPLICATIONS

7.6.1 INCREASING DATA GENERATION THROUGH ERP, CRM, WAREHOUSE MANAGEMENT SYSTEM (WMS), AND TRANSPORTATION MANAGEMENT SYSTEM (TMS)

TABLE 32 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY BUSINESS FUNCTION (Page No. - 100)

8.1 INTRODUCTION

FIGURE 34 SALES AND MARKETING SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR BY 2027

8.1.1 BUSINESS FUNCTION: MARKET DRIVERS

8.1.2 BUSINESS FUNCTION: COVID-19 IMPACT

TABLE 34 MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD MILLION)

TABLE 35 MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

8.2 FINANCE

8.2.1 INCREASING NEED TO ADDRESS A WIDE RANGE OF BUDGETING, PLANNING, AND FORECASTING REQUIREMENTS

TABLE 36 FINANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 FINANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 HUMAN RESOURCES

8.3.1 NEED TO MAXIMIZE THE POTENTIAL OF THE WORKFORCE WHILE INCREASING EFFICIENCY

TABLE 38 HUMAN RESOURCES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 HUMAN RESOURCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 SUPPLY CHAIN

8.4.1 NEED TO MAKE TIMELY VALUE-BASED DECISIONS TO RESPOND QUICKLY TO THE SHIFTS IN DEMAND AND CUSTOMER NEEDS

TABLE 40 SUPPLY CHAIN: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 SUPPLY CHAIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 SALES AND MARKETING

8.5.1 ALIGNING MARKETING CAMPAIGNS AND PROGRAM PLANS TO SALES STAFFING AND REVENUE PLANS

TABLE 42 SALES AND MARKETING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 43 SALES AND MARKETING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 IT

8.6.1 ALIGNING IT PLANS WITH STRATEGIC BUSINESS GOALS TO ENSURE A PROPER SERVICE LEVEL FOR BUSINESS OPERATIONS

TABLE 44 IT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 IT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 108)

9.1 INTRODUCTION

FIGURE 35 LARGE ENTERPRISES SEGMENT EXPECTED TO GROW AT A LARGER MARKET SIZE BY 2027

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

9.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 46 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 47 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.2 LARGE ENTERPRISES

9.2.1 MONITORING AND CONTROLLING FINANCIAL PERFORMANCE AND COORDINATING TASKS ACROSS OTHER DEPARTMENTS

TABLE 48 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 49 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

9.3.1 INCREASING NEED TO PROVIDE STRUCTURED REPORTING, CUSTOMIZATION, IMPROVED EFFICIENCY, AND VISIBILITY

TABLE 50 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE (Page No. - 113)

10.1 INTRODUCTION

FIGURE 36 ON-PREMISES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE BY 2027

10.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

10.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

TABLE 52 MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 53 MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.2 CLOUD

10.2.1 MULTIPLE USERS ACCESSING THE INFORMATION THROUGH THE INTERNET AND REDUCED OPERATIONAL COSTS

TABLE 54 CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 55 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 ON-PREMISES

10.3.1 INCREASING NEED TO IMPROVE EFFICIENCY AND CONSISTENCY IN FINANCIAL REPORTING, SECURITY, AND REGULATORY COMPLIANCE

TABLE 56 ON-PREMISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 ON PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY VERTICAL (Page No. - 118)

11.1 INTRODUCTION

FIGURE 37 BFSI SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

11.1.1 VERTICALS: MARKET DRIVERS

11.1.2 VERTICALS: COVID-19 IMPACT

TABLE 58 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 59 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

11.2.1 FINANCIAL INSTITUTIONS STREAMLINING THEIR FINANCIAL PLANNING AND ANALYSIS, PERFORMANCE MANAGEMENT, REPORTING, AND COMPLIANCE PROCESSES

TABLE 60 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 61 BANKING, FINANCIAL SERVICES, AND INSURANCE: EMARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 IT AND ITES

11.3.1 NEED FOR IMPROVING RESPONSE TIME, ANALYZING TRAFFIC, CONTINUOUS EVOLVEMENT, AND STUDYING PRODUCT AFFINITY

TABLE 62 IT AND ITES: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 63 IT AND ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 RETAIL AND CONSUMER GOODS

11.4.1 EXTRACTING REAL-TIME INSIGHTS INTO SALES AND OPERATIONAL PERFORMANCE AND MAKING BETTER DECISIONS

TABLE 64 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 65 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 GOVERNMENT AND PUBLIC SECTOR

11.5.1 NEED TO DEAL WITH LARGE SILOS OF DATA AND PRODUCE ACTIONABLE INSIGHTS

TABLE 66 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 67 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 MEDIA AND ENTERTAINMENT

11.6.1 IMPROVING PERFORMANCE, COMPLYING WITH REGULATIONS, AND UNDERSTANDING FINANCIAL IMPACT OF DECISIONS

TABLE 68 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 69 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 HEALTHCARE AND LIFE SCIENCES

11.7.1 INCREASING NEED TO KEEP TRACK OF EQUIPMENT AND REDUCE THE RISK OF EQUIPMENT DOWNTIME

TABLE 70 HEALTHCARE AND LIFE SCIENCES: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 71 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 MANUFACTURING

11.8.1 NEED TO OPTIMIZE SUPPLY, DEMAND, AND PRODUCTION DECISIONS AND INTEGRATE OPERATIONAL AND PRODUCTION PLANNING WITH FINANCIAL PLANS

TABLE 72 MANUFACTURING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 73 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.9 TELECOMMUNICATIONS

11.9.1 IMPLEMENTATION OF AI AND MACHINE LEARNING TO OPTIMIZE THE DECISION-MAKING PROCESS

TABLE 74 TELECOMMUNICATIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 75 TELECOMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.10 OTHER VERTICALS

11.10.1 PLANNING, MONITORING, AND ASSESSING THE INVESTMENT AFFECTS ON CASH FLOW, INTEREST EXPENSE, AND PROFITABILITY

TABLE 76 OTHER VERTICALS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 77 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY REGION (Page No. - 131)

12.1 INTRODUCTION

FIGURE 38 NORTH AMERICA EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

TABLE 78 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 79 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 80 NORTH AMERICA: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.3 UNITED STATES

12.2.3.1 Protecting sensitive data and infrastructure a serious economic challenge for organizations

TABLE 94 UNITED STATES: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 95 UNITED STATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 96 UNITED STATES: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 97 UNITED STATES: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.2.4 CANADA

12.2.4.1 Rising demand for business planning models among small and medium-sized enterprises

TABLE 98 CANADA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 99 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 100 CANADA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 101 CANADA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: ENTERPRISE PERFORMANCE MANAGEMENT MARKET DRIVERS

12.3.2 EUROPE: COVID-19 IMPACT

TABLE 102 EUROPE: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.3 UNITED KINGDOM

12.3.3.1 Focus of EPM providers on providing performance management solutions to help organizations concentrate on business analysis and strategic decision-making

TABLE 116 UNITED KINGDOM: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 117 UNITED KINGDOM: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 118 UNITED KINGDOM: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 119 UNITED KINGDOM: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 Increasing developments in advanced technologies, such as big data, machine learning, analytics, IoT, and cloud

TABLE 120 GERMANY: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 121 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 122 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 123 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.3.5 FRANCE

12.3.5.1 Organizations replacing their legacy systems with new advanced infrastructure covering the classic IT infrastructure

TABLE 124 FRANCE: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 125 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 126 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 127 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.3.6 REST OF EUROPE

12.3.6.1 Automation becoming an integral part of the business to achieve a way to maximize effectiveness

TABLE 128 REST OF EUROPE: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 129 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 130 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 131 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: ENTERPRISE PERFORMANCE MANAGEMENT MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 132 ASIA PACIFIC: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

12.4.3 CHINA

12.4.3.1 Rise in IT spending driving workplace automation

TABLE 146 CHINA: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 147 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 148 CHINA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 149 CHINA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 Increasing adoption of cloud, edge computing, AI, and big data analytics

TABLE 150 JAPAN: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 151 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 152 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 153 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.4.5 AUSTRALIA & NEW ZEALAND

12.4.5.1 BFSI, IT and ITeS, and retail and consumer goods domains adopting EPM solutions at a higher rate

TABLE 154 AUSTRALIA & NEW ZEALAND: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 155 AUSTRALIA & NEW ZEALAND: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 156 AUSTRALIA & NEW ZEALAND: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 157 AUSTRALIA & NEW ZEALAND: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

12.4.6.1 Organizations shifting toward adopting emerging technologies and digital business strategies

TABLE 158 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

12.5.1 MIDDLE EAST & AFRICA: ENTERPRISE PERFORMANCE MANAGEMENT MARKET DRIVERS

12.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.3 KINGDOM OF SAUDI ARABIA

12.5.3.1 Government’s interest in accelerating the adoption of cloud and ‘Vision 2030’ initiative

TABLE 176 KINGDOM OF SAUDI ARABIA: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 177 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 178 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 179 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.5.4 UNITED ARAB EMIRATES

12.5.4.1 Government collaborations with enterprises expected to boost technological advancements

TABLE 180 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 181 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 182 UNITED ARAB EMIRATES: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 183 UNITED ARAB EMIRATES: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.5.5 SOUTH AFRICA

12.5.5.1 Increasing awareness of benefits of EPM solutions

TABLE 184 SOUTH AFRICA: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 185 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 186 SOUTH AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 187 SOUTH AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.5.6 REST OF MIDDLE EAST & AFRICA

12.5.6.1 Governments’ support for development of ICT sector

TABLE 188 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 189 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 190 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 191 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: ENTERPRISE PERFORMANCE MANAGEMENT MARKET DRIVERS

12.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 192 LATIN AMERICA: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.3 BRAZIL

12.6.3.1 Need to keep up with the rapid pace of the market’s demands and fulfill consumer needs

TABLE 206 BRAZIL: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 207 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 208 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 209 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.6.4 MEXICO

12.6.4.1 Increasing trade and rising customer base

TABLE 210 MEXICO: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 211 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 212 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 213 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

12.6.5 REST OF LATIN AMERICA

12.6.5.1 Rapid changes in technologies and innovations transforming businesses

TABLE 214 REST OF LATIN AMERICA: ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 215 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 216 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 217 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 186)

13.1 INTRODUCTION

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 41 MARKET EVALUATION FRAMEWORK, 2020-2022

13.3 MARKET RANKING

FIGURE 42 TOP FIVE PLAYERS IN THE ENTERPRISE MANAGEMENT MARKET, 2022

13.4 MARKET SHARE ANALYSIS

TABLE 218 ENTERPRISE MANAGEMENT MARKET: DEGREE OF COMPETITION

FIGURE 43 MARKET SHARE ANALYSIS OF COMPANIES IN ENTERPRISE PERFORMANCE MANAGEMENT MARKET

13.5 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 44 HISTORICAL REVENUE ANALYSIS, 2017-2021

13.6 COMPANY EVALUATION QUADRANT

13.6.1 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 45 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

13.6.2 STARS

13.6.3 EMERGING LEADERS

13.6.4 PERVASIVE PLAYERS

13.6.5 PARTICIPANTS

TABLE 219 GLOBAL COMPANY FOOTPRINT

TABLE 220 COMPANY VERTICAL FOOTPRINT (1/2)

TABLE 221 COMPANY VERTICAL FOOTPRINT (2/2)

TABLE 222 COMPANY REGION FOOTPRINT

TABLE 223 COMPANY APPLICATION FOOTPRINT

FIGURE 46 GLOBAL COMPANY EVALUATION QUADRANT, ENTERPRISE PERFORMANCE MANAGEMENT MARKET

13.7 SME EVALUATION QUADRANT

FIGURE 47 START-UPS/SME EVALUATION QUADRANT: CRITERIA WEIGHTAGE

13.7.1 RESPONSIVE PLAYERS

13.7.2 PROGRESSIVE PLAYERS

13.7.3 DYNAMIC PLAYERS

13.7.4 STARTING BLOCKS

FIGURE 48 SME EVALUATION QUADRANT, MARKET

13.8 COMPETITIVE BENCHMARKING

TABLE 224 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 225 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES] (1/2)

TABLE 226 ENTERPRISE PERFORMANCE MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES] (2/2)

13.9 COMPETITIVE SCENARIO

TABLE 227 ENTERPRISE ASSET MANAGEMENT: PRODUCT LAUNCHES AND ENHANCEMENTS, 2019-2021

TABLE 228 ENTERPRISE ASSET MANAGEMENT: DEALS, 2020-2022

14 COMPANY PROFILES (Page No. - 206)

14.1 MAJOR PLAYERS

(Business Overview, Products & Services offered, Recent Developments, MnM View)*

14.1.1 ORACLE

TABLE 229 ORACLE: BUSINESS OVERVIEW

FIGURE 49 ORACLE: COMPANY SNAPSHOT

TABLE 230 ORACLE: PRODUCTS OFFERED

TABLE 231 ORACLE: SERVICES OFFERED

TABLE 232 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

14.1.2 SAP

TABLE 233 SAP: BUSINESS OVERVIEW

FIGURE 50 SAP: COMPANY SNAPSHOT

TABLE 234 SAP: PRODUCTS OFFERED

TABLE 235 SAP: SERVICES OFFERED

TABLE 236 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 237 SAP: DEALS

14.1.3 IBM

TABLE 238 IBM: BUSINESS OVERVIEW

FIGURE 51 IBM: COMPANY SNAPSHOT

TABLE 239 IBM: PRODUCTS OFFERED

TABLE 240 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 241 IBM: DEALS

14.1.4 ANAPLAN

TABLE 242 ANAPLAN: BUSINESS OVERVIEW

FIGURE 52 ANAPLAN: COMPANY SNAPSHOT

TABLE 243 ANAPLAN: PRODUCTS OFFERED

TABLE 244 ANAPLAN: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 245 ANAPLAN: DEALS

14.1.5 INFOR

TABLE 246 INFOR: BUSINESS OVERVIEW

TABLE 247 INFOR: PRODUCTS OFFERED

TABLE 248 INFOR: SERVICES OFFERED

TABLE 249 INFOR: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 250 INFOR: DEALS

14.1.6 UNICOM SYSTEMS

TABLE 251 UNICOM SYSTEMS: BUSINESS OVERVIEW

TABLE 252 INFOR: PRODUCTS OFFERED

TABLE 253 UNICOM SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

14.1.7 WORKDAY

TABLE 254 WORKDAY: BUSINESS OVERVIEW

FIGURE 53 WORKDAY: COMPANY SNAPSHOT

TABLE 255 WORKDAY: PRODUCTS OFFERED

TABLE 256 WORKDAY: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 257 WORKDAY: DEALS

14.1.8 PLANFUL

TABLE 258 PLANFUL: BUSINESS OVERVIEW

TABLE 259 PLANFUL: PRODUCTS OFFERED

TABLE 260 PLANFUL: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 261 PLANFUL: DEALS

14.1.9 UNIT4

TABLE 262 UNIT4: BUSINESS OVERVIEW

TABLE 263 UNIT4: PRODUCTS OFFERED

TABLE 264 UNIT4: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 265 UNIT4: DEALS

14.1.10 EPICOR SOFTWARE

TABLE 266 EPICOR SOFTWARE: BUSINESS OVERVIEW

TABLE 267 EPICOR SOFTWARE: PRODUCTS OFFERED

TABLE 268 EPICOR SOFTWARE: SERVICES OFFERED

TABLE 269 EPICOR SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 270 EPICOR SOFTWARE: DEALS

*Details on Business Overview, Products & Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14.2 OTHER PLAYERS

14.2.1 ONESTREAM

14.2.2 WORKIVA

14.2.3 BROADCOM

14.2.4 SAS

14.2.5 BOARD INTERNATIONAL

14.2.6 LUCANET

14.2.7 PROPHIX

14.2.8 VENA SOLUTIONS

14.2.9 SOLVER

14.2.10 LONGVIEW

14.2.11 JEDOX

14.2.12 CORPORATER

14.2.13 WOLTERS KLUWER

14.2.14 INSIGHT SOFTWARE

14.2.15 CENTAGE

14.2.16 INPHASE

14.2.17 DATARAILS

14.2.18 IDU

14.2.19 CALUMO

14.2.20 DEFACTO GLOBAL

14.2.21 SYNTELLIS

14.2.22 ACHIEVEIT

14.2.23 KEPION

14.2.24 BRIGHT ANALYTICS

15 ADJACENT/RELATED MARKETS (Page No. - 260)

15.1 INTRODUCTION

15.1.1 RELATED MARKETS

15.1.2 LIMITATIONS

15.2 CLOUD ERP MARKET

TABLE 271 CLOUD ERP MARKET, BY VERTICAL, 2014–2018 (USD MILLION)

TABLE 272 CLOUD ERP MARKET, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 273 BFSI: CLOUD ERP MARKET, BY REGION, 2014–2018 (USD MILLION)

TABLE 274 BFSI: CLOUD ERP MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 275 TELECOM: CLOUD ERP MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 276 TELECOM: CLOUD ERP MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 277 HEALTHCARE AND LIFE SCIENCES: CLOUD ERP MARKET, BY REGION, 2014–2018 (USD MILLION)

TABLE 278 HEALTHCARE AND LIFE SCIENCES: CLOUD ERP MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 279 MANUFACTURING: CLOUD ERP MARKET, BY REGION, 2014–2018 (USD MILLION)

TABLE 280 MANUFACTURING: CLOUD ERP MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 281 GOVERNMENT AND PUBLIC SECTOR: CLOUD ERP MARKET, BY REGION, 2014–2018 (USD MILLION)

TABLE 282 GOVERNMENT AND PUBLIC SECTOR: CLOUD ERP MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 283 AEROSPACE AND DEFENSE: CLOUD ERP MARKET, BY REGION, 2014–2018 (USD MILLION)

TABLE 284 AEROSPACE AND DEFENSE: CLOUD ERP MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 285 RETAIL: CLOUD ERP MARKET, BY REGION, 2014–2018 (USD MILLION)

TABLE 286 RETAIL: CLOUD ERP MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 287 EDUCATION: CLOUD ERP MARKET, BY REGION, 2014–2018 (USD MILLION)

TABLE 288 EDUCATION: CLOUD ERP MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 289 OTHER VERTICALS: CLOUD ERP MARKET, BY REGION, 2014–2018 (USD MILLION)

TABLE 290 OTHER VERTICALS: CLOUD ERP MARKET, BY REGION, 2019–2025 (USD MILLION)

15.3 CLOUD APPLICATIONS MARKET

TABLE 291 CLOUD APPLICATIONS MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 292 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD APPLICATIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 293 ENERGY AND UTILITIES: CLOUD APPLICATIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 294 GOVERNMENT AND PUBLIC SECTOR: CLOUD APPLICATIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 295 HEALTHCARE AND LIFE SCIENCES: CLOUD APPLICATIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 296 MANUFACTURING: CLOUD APPLICATIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 297 RETAIL AND CONSUMER GOODS: CLOUD APPLICATIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 298 TELECOMMUNICATIONS: CLOUD APPLICATIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 299 TRANSPORTATION AND LOGISTICS: CLOUD APPLICATIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 300 TRAVEL AND HOSPITALITY: CLOUD APPLICATIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 301 OTHER VERTICALS: CLOUD APPLICATIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

16 APPENDIX (Page No. - 272)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, data center associations, vendor data sheets, product demos, Cloud Computing Association (CCA), Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to identify and collect information useful for this technical, market-oriented, and commercial study of the enterprise performance management market. The primary sources were mainly several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

The market size of companies offering enterprise performance management was derived on the basis of the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from enterprise performance management vendors, industry associations, and independent consultants; and key opinion leaders.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the enterprise performance management market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the cloud system market.

Report Objectives

- To define, segment, and project the global market size of the enterprise performance management market

- To understand the structure of the market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 5 major regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments, such as expansions and investments, new product launches, mergers and acquisitions, joint ventures, and agreements, in the enterprise performance management market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enterprise Performance Management Market

Need for analysis on Enterprise Performance Management solution providers in the Asia Pacific region

Understand the EPM outsourcing market in CPG, BFS & LS