Smart Space Market by Component (Solutions and Services (professional & managed)), Application (Energy Optimization and Management, Emergency Management, & Security Management), Premises Type (Commercial, Residential), and Region - Global Forecast to 2025

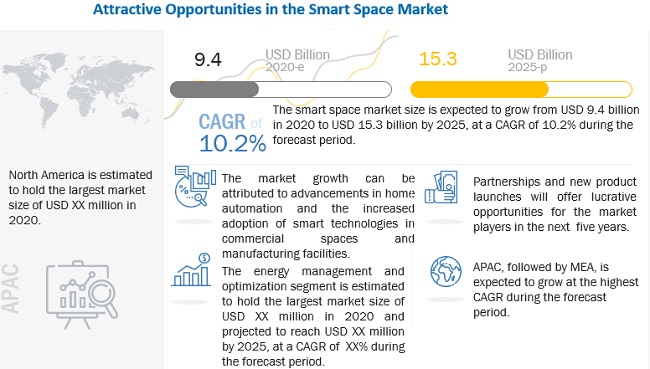

The global Smart Space Market size was valued at $9.4 billion in 2020 and it is projected to reach $15.3 billion by the end of 2025 at a CAGR of 10.2% during the forecast period. The increasing venture capital funding, green building initiatives and environmental concerns, and growing investments in smart space technology to drive market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis

The COVID-19 outbreak has impacted every possible industry globally, including smart space market. The smart space market ecosystem is diverse, due to which the overall ecosystem will experience differentiated impact. A few sectors within this ecosystem will be positively impacted by the outbreak, while others might witness a decline. For instance, post-COVID-19, enterprises have adopted the work from home model, which increases the need for better optimization of residential premises. During the pandemic, the business continuity is one of the major concerns for organizations; this, in turn, has led to a considerable increase in the supporting and associated services. The smart space vendors globally have been more active in supporting the end-users for securing the physical environment. This has resulted in increased demand in security management solutions. With the lockdown being lifted in major cities of the world, companies in the smart space market are expected to experience a decrease in the demand for smart space and smart building solutions, resulting in decreased revenues for the next two quarters.

Based on application, the emergency management to grow at the highest CAGR during the forecast period

With a right set of information and an adequate amount of time in hand, occupants can act fast to minimize or to avoid the damage entirely. Devices such as smart cameras with improved image sensor can now keep a watch on the remote corners 24*7 to improve the security aspect of the any facility. Similarly, ultrasonic location tracking system in research labs, power plants, and other highly secured areas can easily detect the movements, locations, and orientation of the occupants. The systems come with a storage option for saving the data for a specified amount of time, which can be used for future reference as well. Smart floor is another technology which is currently offered in the entertainment center and kitchen area, to track the location and identify the residents when they fall along with reporting it to the emergency services. In the UK, British Telecom (BT), Everything Everywhere (EE), and HCT have developed a new system that can turn on the Global Navigation Satellite System (GNSS) and Wi-Fi and is termed as Advanced Mobile Location (AML). Once the emergency number has dialed, the system would automatically share the exact location details to the emergency service provider, and it is 4,000 times more accurate the current system in the use.

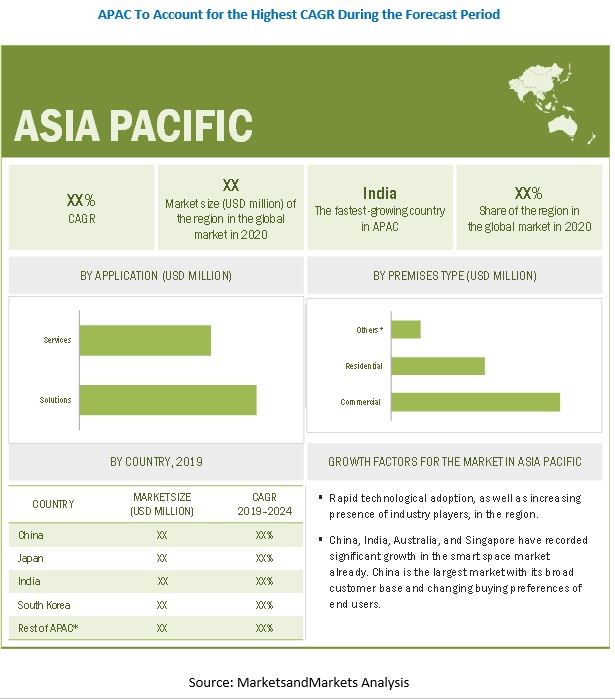

APAC is expected to witness significant growth over the next 5 years. The region is growing fastest in the global smart space market. APAC is undergoing dynamic changes in terms of the adoption of innovative and advanced business-related technologies along with home automation. China, India, Australia, and Singapore have witnessed significant growth in the smart space market already. China is the largest market in APAC, because of its broad customer base and changing buying preferences of end users. In March 2016, the Singapore government announced its intentions to become a smart nation, which makes the country a market with many opportunities. APAC was one of the first regions to be impacted by the COVID-19 pandemic. The rapid spread of the virus in countries such as the Philippines, China, Japan, India, Singapore, Indonesia, Myanmar, and Bangladesh has led to panic and lockdown, resulting in a pause to the major industries operating in these countries. However, the adoption of smart space solutions is expected to pick up pace as governments are relaxing the lockdown restrictions in these countries.

Smart Space Market Dynamics

Driver: Green building initiatives and environmental concerns

With the increase in growth of the sustainable green building initiatives due to environmental concerns and penetration of technology in our day to day life, there is an increase in growth of adoption rate. Green buildings are the buildings that majorly focus on efficiency, effective lifecycle, and performance of the building. These buildings are dependent on smart technologies, which are integrated with the entire system to enhance the performance and functions of the building. These technologies not only store valuable data but also analyze them and provide the respective personal with necessary inputs. When increasingly sophisticated communications and control systems are integrated into a building from the inception, the door is opened to endless innovations. When incorporated into construction procedures and throughout its life span the energy consumption is contained, and the environment is better protected. Through smart construction, a more comfortable built environment can be created while simultaneously reducing a site’s carbon footprint. Self-sustaining buildings will be the best solution for meeting the ever-growing technological and energy demand as well as many countries’ stated goals of independence from carbon-based energy sources.

Restraint: High initial capital expenditure

Smart space solutions and services are new to the market and many companies are entering this market with innovative products and services. Due to this, early adopters are paying a huge sum of money to have this technology on-boarded. Moreover, governments are also taking more efforts to make the spaces smarter with the upcoming technologies. It is easy to understand that even while governments possess the need, vision, and clarity for such transformations, lack of budgetary allocations for any large-scale implementations hinders the pace of the transformation process directly or indirectly. Such heavy investments could also add to the economic burden of debt-ridden governments or local municipal authorities which adversely affects future general budgets. However, there are many use cases which share the view that the original cost gets justified over the period based on reduced bills, efforts, time, and energy. For instance, when General Electric Company (GE) set up its state-of-the-art automated dishwasher plant, it originally justified the costs based on savings over time, but the plant has experienced payoffs from the investment in unanticipated ways. The quality of the product improved, lower manufacturing costs led to an expansion of market share, and the plant proved to be able to serve as a manufacturing site for other products. Each time managers document such nontraditional benefits; they make it easier to justify similar investments later.

Opportunity: Emerging 5G technology to enhance connectivity

5G is the next generation broadband connection. It uses radio frequency to transmit and receive voice and data. These frequencies can transfer heap of data within no time, but it travels very short distance as compared to its predecessor, i.e., 4G. Moreover, they have difficulty getting around walls and buildings. These shortfalls can be overcome by adding mini antennas everywhere. However, once implemented successfully, it can help the community in many ways. It will instantly connect billions of devices with low latency and enables new generation applications, services, and business opportunities that have not seen before. Massive machine to machine communication would not be a challenge anymore, which will revolutionize the current functioning of different industries, such as manufacturing, agriculture, and mining. With very low latency in communication, it will give a massive boost to real-time controlling of remote devices which are mission-critical, industrial robotics, autonomous vehicles, and safety systems.

Challenge: Lack of resources and infrastructure in developing countries

The smart space market is concentrated in many western countries, including the UK, the US, France, Germany, Sweden, and some parts of South East Asia. This distribution is due to a lack of potential market and the associated industries in the local area. However, due to Foreign Direct Investment (FDI) and ease of entering into these markets, most of the companies are offering their services in other countries as well. Implementation and adoption of smart technologies are also a major challenge in developing countries. Investing a huge sum of money in training human resources is something the companies always try to avoid, rather they would be interested in hiring already trained professionals. These trained professionals are scarce in these geographical areas, which also hinders the entrance of such technologies into the market. Lack of education and understanding of these technologies also plays a major role; if the offered service or product is not adopted properly, the company may fail in the market and would lose time and valuable efforts.

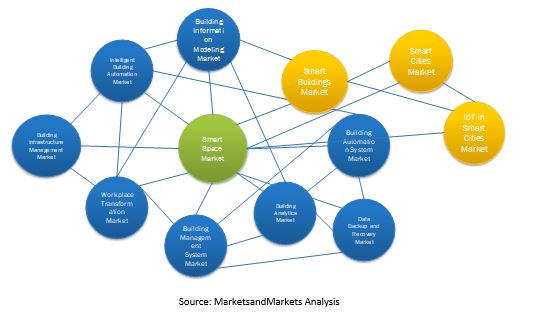

Market Interconnection

Key Market Players

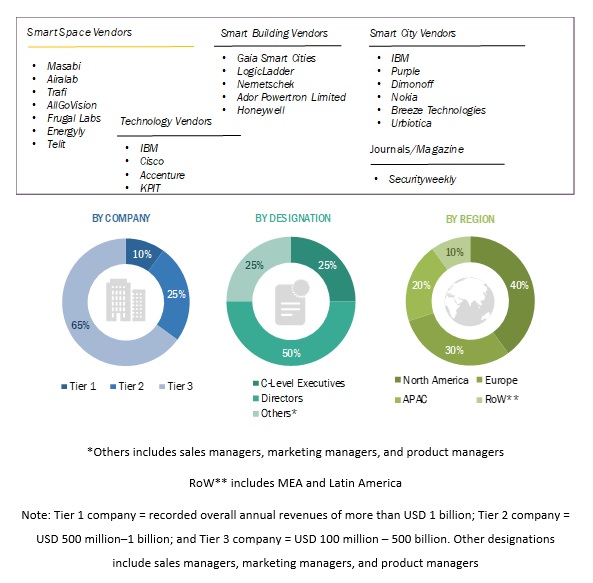

This research study outlines the market potential, market dynamics, and key and innovative vendors in the smart space market include ABB (Switzerland), Cisco (US), Siemens (Germany), Huawei Technologies (China), IBM (US), Schneider Electric (France), Smartspace Software (UK), Hitachi Vantara (US), ICONICS (US), Coor (Sweden), Ubisense (UK), Smarten Spaces (Singapore), Spacewell (Belgium), Softweb Solutions (US), Eutech Cybernetic (Singapore), Adappt (US), IMEC (Belgium), Nexus (Sweden), Smart Spaces (UK), reelyActive (Canada), Telit (UK), AllGoVision Technologies (India), Energyly (India), Frugal Labs (Inbdia), and Aira Tech Corp (US).

The study includes an in-depth competitive analysis of these key players in the smart space market with their company profiles, recent developments, and key market strategies.

Scope the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, Application, Premises Type, and Region. |

|

Geographies covered |

North America, Europe, APAC, Middle East and Africa, and Latin America. |

|

Major companies covered |

include ABB (Switzerland), Cisco (US), Siemens (Germany), Huawei Technologies (China), IBM (US), Schneider Electric (France), Smartspace Software (UK), Hitachi Vantara (US), ICONICS (US), Coor (Sweden), Ubisense (UK), Smarten Spaces (Singapore), Spacewell (Belgium), Softweb Solutions (US), Eutech Cybernetic (Singapore), Adappt (US), IMEC (Belgium), Nexus (Sweden), Smart Spaces (UK), reelyActive (Canada), Telit (UK), AllGoVision Technologies (India), Energyly (India), Frugal Labs (Inbdia), and Aira Tech Corp (US). |

This research report categorizes the smart space to forecast revenues and analyze trends in each of the following submarkets:

Based on component:

- Solutions

-

Services

- Managed Services

-

Professional Services

- Support and Maintenance

- Deployment and Integration

- Consulting

Based on the application:

- Energy Management and Optimization

- Emergency Management

- Security Management

- Others

Based on premises type:

- Commercial

- Residential

- Others

Based on the region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- France

- Germany

- Spain

- Rest of Europe (EU and Non-EU countries)

-

APAC

- China

- India

- Singapore

- Japan

- Rest of APAC (Indonesia, Taiwan, and South Korea)

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In October 2020, Huawei launched its scenario intelligent connectivity solutions. These solutions include intelligent distributed access solutions for homes, intelligent campus networks, intelligent premium private lines, and intelligent cloud network solutions for enterprises. These solutions will accelerate the digital transformation across industries.

- In September 2020, ABB launched its first series of Virtual Innovation Shows for smart buildings. The shows will include a panel of experts from ABB and participants will get fully immersive experience of virtual building space to create intelligent and energy efficient buildings and homes. Also, the solution will include the latest products from ABB including ABB ibus KNX switch actuators, Cylon controls for HVAC applications and Naveo Pro emergency lighting system.

- In July 2020, Cisco acquired Modcam, a video analytics company that develops smart camera solutions. This acquisition helps Cisco Meraki MV smart camera to incorporate micro-level information regarding motion detection and ML based object detection to enable multiple cameras to provide macro level view of the real world.

- In June 2020, Siemens partnered with Salesforce, provider of customer relationship management services, to develop a new workplace technology suite for safer workplace. This partnership will combine Siemen’s Smart Infrastructure Solutions with Salesforce’s Work.com for creating touchless office solutions.

- In June 2020. IBM launched Watson Works, a curated set of products which embeds Watson AI models and applications to assist enterprise to address return-to-workplace challenges for lockdown put in place to slow the spread of Covid-19. Watson Works allows enterprises to manage facilities, optimize space allocation, prioritize employee health, communicate with employees, vendors and stakeholders, and maximize effective contact tracing.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in the smart space market with information on the closest approximations of the revenue numbers for the overall smart space market and its sub-segments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

Key Questions addressed by the report:

- Define, describe, and forecast the smart space market based on component, application, premises type, and region.

- Detailed analysis of the market’s sub-segments with respect to individual growth trends, prospects, and contributors to the total market.

- Revenue forecast of the market’s segments with respect to four major regions, namely, North America, Europe, Asia Pacific (APAC), and RoW.

- Detailed analysis of the competitive developments, such as mergers and acquisitions, new product developments, and business expansion activities, in the market.

- Analysis of major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market.

Frequently Asked Questions (FAQ):

How big is the Smart Space Market?

What is the Smart Space Market Growth?

Which region has the highest market share in the smart space market?

Which application segment is expected to witness a higher adoption rate in the coming years?

Who are the major vendors in the smart space market?

Which component is expected to grow at the highest CAGR during the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 57)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECAST FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 67)

2.1 RESEARCH DATA

FIGURE 6 SMART SPACE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF SMART SPACE VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OF SMART SPACE VENDORS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP DOWN (DEMAND SIDE): SHARE OF SMART SPACE IN OVERALL INFORMATION TECHNOLOGY MARKET

2.4 IMPLICATION OF COVID-19 ON SMART SPACE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: COVID-19 SMART SPACE MARKET

2.4.1 IMPACT OF COVID-19 PANDEMIC

2.5 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.6 COMPETITIVE EVALUATION MATRIX METHODOLOGY

FIGURE 11 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 80)

FIGURE 12 SMART SPACE MARKET SIZE AND GROWTH RATE, 2018–2025 (USD MILLION, Y-O-Y %)

FIGURE 13 MARKET TO WITNESS MODERATE DECLINE DURING COVID-19 PERIOD

FIGURE 14 SEGMENTS WITH HIGH GROWTH RATES DURING FORECAST PERIOD

FIGURE 15 GEOGRAPHIC ANALYSIS OF MARKET

4 PREMIUM INSIGHTS (Page No. - 84)

4.1 ATTRACTIVE OPPORTUNITIES IN SMART SPACE MARKET

FIGURE 16 INCREASING NEED TO ANALYZE REAL-TIME CONSUMER DATA FOR DECISION-MAKING TO BE MAJOR FACTOR CONTRIBUTING TO MARKET GROWTH

4.2 MARKET, BY COMPONENT, 2020 VS. 2025

FIGURE 17 SOLUTIONS SEGMENT TO HOLD HIGHER MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY SERVICE, 2020 VS. 2025

FIGURE 18 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR HIGHER MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY APPLICATION, 2020 VS. 2025

FIGURE 19 ENERGY MANAGEMENT AND OPTIMIZATION SEGMENT TO LEAD MARKET IN 2020

4.5 MARKET, BY PREMISES TYPE, 2020 VS. 2025

FIGURE 20 COMMERCIAL SEGMENT TO LEAD MARKET IN 2020

4.6 MARKET INVESTMENT SCENARIO

FIGURE 21 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 87)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMART SPACE MARKET

5.2.1 DRIVERS

5.2.1.1 Proliferation of IoT

5.2.1.2 Green building initiatives and environmental concerns

5.2.2 RESTRAINTS

5.2.2.1 High initial capital expenditure

5.2.3 OPPORTUNITIES

5.2.3.1 Government initiatives for smart cities

5.2.3.2 Emerging 5G technology to enhance connectivity

5.2.3.3 Rising urban population

5.2.4 CHALLENGES

5.2.4.1 Risks of breach in security and privacy due to device malfunctioning

5.2.4.2 Lack of resources and infrastructure in developing countries

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 ECOSYSTEM

5.4.1 SMART SPACE MARKET ECOSYSTEM

5.5 MARKET: USE CASES

5.5.1 USE CASE 1: IMPROVING WORKPLACE EFFICIENCY BY MAXIMIZING DESK AND MEETING SPACE UTILIZATION

5.5.2 USE CASE 2: OPTIMIZING ENERGY CONSUMPTION AND ENHANCING STAFF COMFORT AND EXPERIENCE

5.5.3 USE CASE 3: MAXIMIZING ENERGY EFFICIENCY AND SUSTAINABILITY OF OFFICE BUILDING

5.6 TECHNOLOGY ANALYSIS

5.6.1 IOT

6 SMART SPACE MARKET, BY COMPONENT (Page No. - 96)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 23 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

6.1.3 MARKET ESTIMATES AND FORECAST SIZE, BY COMPONENT, 2016–2025 (USD MILLION)

TABLE 3 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 4 PRE-COVID-19: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 5 POST-COVID-19: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 6 COMPONENTS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 7 PRE-COVID-19: SMART SPACE COMPONENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 8 POST-COVID-19: SMART SPACE COMPONENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: SMART SPACE MARKET DRIVERS

6.2.2 SOLUTIONS: COVID-19 IMPACT

6.2.3 MARKET ESTIMATES AND FORECAST SIZE, BY SOLUTION, 2016–2025 (USD MILLION)

TABLE 9 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 10 PRE-COVID-19: SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 11 POST-COVID-19: SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: MARKET DRIVERS

6.3.2 SERVICES: COVID-19 IMPACT

FIGURE 24 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

6.3.3 MARKET ESTIMATES AND FORECAST SIZE, BY SERVICE, 2016–2025 (USD MILLION)

TABLE 12 SMART SPACE MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 13 PRE-COVID-19: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 14 POST-COVID-19: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 15 SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 PRE-COVID-19: SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 17 POST-COVID-19: SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3.4 MANAGED SERVICES

6.3.4.1 Managed services: market drivers

6.3.4.2 Managed services: COVID-19 impact

6.3.4.3 Market estimates and forecast size, by managed service, 2016–2025 (USD Million)

TABLE 18 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 PRE-COVID-19: MANAGED SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 20 POST-COVID-19: MANAGED SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3.5 PROFESSIONAL SERVICES

6.3.5.1 Professional services: Smart space market drivers

6.3.5.2 Professional services: COVID-19 impact

TABLE 21 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 PRE-COVID-19: PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 23 POST-COVID-19: PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

FIGURE 25 CONSULTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

6.3.5.3 Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 24 SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 25 PRE-COVID-19: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 26 POST-COVID-19: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

6.3.5.4 Deployment and integration

6.3.5.4.1 Seamless integration and easy installation to fuel the growth of deployment and integration services

6.3.5.4.2 Market estimates and forecast size, by deployment and integration, 2016–2025 (USD Million)

TABLE 27 DEPLOYMENT AND INTEGRATION: SMART SPACE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 PRE-COVID-19: DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 29 POST-COVID-19: DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3.5.5 Consulting

6.3.5.5.1 Growing demand for business transformation to boost consulting services growth

6.3.5.5.2 Market estimates and forecast size, by consulting, 2016–2025 (USD Million)

TABLE 30 CONSULTING: SMART SPACE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 PRE-COVID-19: CONSULTING MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 32 POST-COVID-19: CONSULTING MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3.5.6 Support and Maintenance

6.3.5.6.1 Increasing need for assistance during asset life cycle to spur the demand for support and maintenance services

6.3.5.6.2 Market estimates and forecast size, by support and maintenance , 2016–2025 (USD Million)

TABLE 33 SUPPORT AND MAINTENANCE: SMART SPACE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 PRE-COVID-19: SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 35 POST-COVID-19: SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 SMART SPACE MARKET, BY APPLICATION (Page No. - 113)

7.1 INTRODUCTION

7.1.1 APPLICATIONS: MARKET DRIVERS

7.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 26 EMERGENCY MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

7.1.3 MARKET ESTIMATES AND FORECAST SIZE, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 36 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 37 PRE-COVID-19: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 38 POST-COVID-19: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 39 APPLICATIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 PRE-COVID-19: SMART SPACE APPLICATION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 41 POST-COVID-19: SMART SPACE APPLICATION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.2 ENERGY MANAGEMENT AND OPTIMIZATION

7.2.1 ENERGY MANAGEMENT AND OPTIMIZATION: SMART SPACE MARKET DRIVERS

7.2.2 ENERGY MANAGEMENT AND OPTIMIZATION: COVID-19 IMPACT

7.2.3 MARKET ESTIMATES AND FORECAST SIZE, BY EMERGENCY MANAGEMENT AND OPTIMIZATION, 2016–2025 (USD MILLION)

TABLE 42 ENERGY MANAGEMENT AND OPTIMIZATION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 PRE-COVID-19: ENERGY MANAGEMENT AND OPTIMIZATION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 44 POST-COVID-19: ENERGY MANAGEMENT AND OPTIMIZATION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.3 EMERGENCY MANAGEMENT

7.3.1 EMERGENCY MANAGEMENT: SMART SPACE MARKET DRIVERS

7.3.2 EMERGENCY MANAGEMENT: COVID-19 IMPACT

7.3.3 MARKET ESTIMATES AND FORECAST SIZE, BY EMERGENCY MANAGEMENT, 2016–2025 (USD MILLION)

TABLE 45 EMERGENCY MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 PRE-COVID-19: EMERGENCY MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 47 POST-COVID-19: EMERGENCY MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.4 SECURITY MANAGEMENT

7.4.1 SECURITY MANAGEMENT: SMART SPACE MARKET DRIVERS

7.4.2 SECURITY MANAGEMENT: COVID-19 IMPACT

7.4.3 MARKET ESTIMATES AND FORECAST SIZE, BY SECURITY MANAGEMENT, 2016–2025 (USD MILLION)

TABLE 48 SECURITY MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 PRE-COVID-19: SECURITY MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 50 POST-COVID-19: SECURITY MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.5 OTHERS

7.5.1 OTHERS: SMART SPACE MARKET DRIVERS

7.5.2 OTHERS: COVID-19 IMPACT

7.5.3 MARKET ESTIMATES AND FORECAST SIZE, BY OTHER, 2016–2025 (USD MILLION)

TABLE 51 OTHER APPLICATION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 PRE-COVID-19: OTHER APPLICATION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 53 POST-COVID-19: OTHER APPLICATION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 SMART SPACE MARKET, BY PREMISES TYPE (Page No. - 124)

8.1 INTRODUCTION

FIGURE 27 COMMERCIAL SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

8.1.1 MARKET ESTIMATES AND FORECAST SIZE, BY PREMISES TYPE, 2016–2025 (USD MILLION)

TABLE 54 MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 55 PRE-COVID-19: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 56 POST-COVID-19: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 57 PREMISES TYPE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 58 PRE-COVID-19: SMART SPACE PREMISES TYPE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 59 POST-COVID-19: SMART SPACE PREMISES TYPE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.2 COMMERCIAL

8.2.1 COMMERCIAL: SMART SPACE MARKET DRIVERS

8.2.2 COMMERCIAL: COVID-19 IMPACT

8.2.3 MARKET ESTIMATES AND FORECAST SIZE, BY COMMERCIAL, 2016–2025 (USD MILLION)

TABLE 60 COMMERCIAL: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 61 PRE-COVID-19: COMMERCIAL MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 62 POST-COVID-19: COMMERCIAL MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.3 RESIDENTIAL

8.3.1 RESIDENTIAL: MARKET DRIVERS

8.3.2 RESIDENTIAL: COVID-19 IMPACT

8.3.3 MARKET ESTIMATES AND FORECAST SIZE, BY RESIDENTIAL, 2016–2025 (USD MILLION)

TABLE 63 RESIDENTIAL: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 64 PRE-COVID-19: RESIDENTIAL MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 65 POST-COVID-19: RESIDENTIAL MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.4 OTHERS

8.4.1 OTHERS: SMART SPACE MARKET DRIVERS

8.4.2 OTHERS: COVID-19 IMPACT

8.4.3 MARKET ESTIMATES AND FORECAST SIZE, BY OTHER, 2016–2025 (USD MILLION)

TABLE 66 OTHER PREMISES TYPE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 PRE-COVID-19: OTHER PREMISES TYPE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 68 POST-COVID-19: OTHER PREMISES TYPE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9 SMART SPACE MARKET, BY REGION (Page No. - 133)

9.1 INTRODUCTION

FIGURE 28 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 29 INDIA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

TABLE 69 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 70 PRE-COVID-19: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 71 POST-COVID-19: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

9.2.3 NORTH AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY COMPONENT, 2016–2025 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 73 PRE-COVID-19: NORTH AMERICA: SMART SPACE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 74 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.2.4 NORTH AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY SERVICE, 2016–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 76 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 77 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

9.2.5 NORTH AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY PROFESSIONAL SERVICE, 2016–2025 (USD MILLION)

TABLE 78 NORTH AMERICA: SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 79 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 80 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.2.6 NORTH AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 82 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 83 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.7 NORTH AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY PREMISES TYPE, 2016–2025 (USD MILLION)

TABLE 84 NORTH AMERICA: SMART SPACE MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 85 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 86 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.2.8 NORTH AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 88 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 89 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.2.8.1 United States

9.2.8.1.1 Increasing demand for voice over and automated systems at workplaces and homes to drive the US smart space market

9.2.8.2 United States: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 90 UNITED STATES: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 91 PRE-COVID-19: UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 92 POST-COVID-19: UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.2.8.3 United States: Market estimates and forecast size, by service, 2016–2025 (USD Million)

TABLE 93 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 94 PRE-COVID-19: UNITED STATES: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 95 POST-COVID-19: UNITED STATES: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

9.2.8.4 United States: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 96 UNITED STATES: SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 97 PRE-COVID-19: UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 98 POST-COVID-19: UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.2.8.5 United States: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 99 UNITED STATES: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 100 PRE-COVID-19: UNITED STATES: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 101 POST-COVID-19: UNITED STATES: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.8.6 United States: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 102 UNITED STATES: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 103 PRE-COVID-19: UNITED STATES: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 104 POST-COVID-19: UNITED STATES: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.2.8.7 Canada

9.2.8.7.1 Rising adoption of automated systems to drive the growth of market in Canada

9.2.8.8 Canada: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 105 CANADA: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 106 PRE-COVID-19: CANADA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 107 POST-COVID-19: CANADA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.2.8.9 Canada: Market estimates and forecast size, by service, 2016–2025 (USD Million)

TABLE 108 CANADA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 109 PRE-COVID-19: CANADA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 110 POST-COVID-19: CANADA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

9.2.8.10 Canada: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 111 CANADA: SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 112 PRE-COVID-19: CANADA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 113 POST-COVID-19: CANADA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.2.8.11 Canada: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 114 CANADA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 115 PRE-COVID-19: CANADA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 116 POST-COVID-19: CANADA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.8.12 Canada: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 117 CANADA: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 118 PRE-COVID-19: CANADA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 119 POST-COVID-19: CANADA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

9.3.3 EUROPE: MARKET ESTIMATES AND FORECAST SIZE, BY COMPONENT, 2016–2025 (USD MILLION)

TABLE 120 EUROPE: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 121 PRE-COVID-19: EUROPE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 122 POST-COVID-19: EUROPE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.3.4 EUROPE: MARKET ESTIMATES AND FORECAST SIZE, BY SERVICES, 2016–2025 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 124 PRE-COVID-19: EUROPE: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 125 POST-COVID-19: EUROPE: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.3.5 EUROPE: MARKET ESTIMATES AND FORECAST SIZE, BY PROFESSIONAL SERVICE, 2016–2025 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 127 PRE-COVID-19: EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 128 POST-COVID-19: EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.3.6 EUROPE: MARKET ESTIMATES AND FORECAST SIZE, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 130 PRE-COVID-19: EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 131 POST-COVID-19: EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.7 EUROPE: MARKET ESTIMATES AND FORECAST SIZE, BY PREMISES TYPE, 2016–2025 (USD MILLION)

TABLE 132 EUROPE: SMART SPACE MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 133 PRE-COVID-19: EUROPE: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 134 POST-COVID-19: EUROPE: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.3.8 EUROPE: MARKET ESTIMATES AND FORECAST SIZE, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 136 PRE-COVID-19: EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 137 POST-COVID-19: EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.3.8.1 United Kingdom

9.3.8.1.1 Rising focus of government on advanced technologies to significantly impact the smart space market

9.3.8.2 United Kingdom: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 138 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 139 PRE-COVID-19: UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 140 POST-COVID-19: UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.3.8.3 United Kingdom: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 141 UNITED KINGDOM: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 142 PRE-COVID-19: UNITED KINGDOM: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 143 POST-COVID-19: UNITED KINGDOM: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.3.8.4 United Kingdom: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 144 UNITED KINGDOM: SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 145 PRE-COVID-19: UNITED KINGDOM: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 146 POST-COVID-19: UNITED KINGDOM: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.3.8.5 United Kingdom: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 147 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 148 PRE-COVID-19: UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 149 POST-COVID-19: UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.8.6 United Kingdom: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 150 UNITED KINGDOM: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 151 PRE-COVID-19: UNITED KINGDOM: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 152 POST-COVID-19: UNITED KINGDOM: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.3.8.7 France

9.3.8.7.1 Growing adoption of emerging technologies to spur the demand for smart space solutions in France

9.3.8.8 France: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 153 FRANCE: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 154 PRE-COVID-19: FRANCE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 155 POST-COVID-19: FRANCE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.3.8.9 France: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 156 FRANCE: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 157 PRE-COVID-19: FRANCE: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 158 POST-COVID-19: FRANCE: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.3.8.10 France: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 159 FRANCE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 160 PRE-COVID-19: FRANCE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 161 POST-COVID-19: FRANCE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.3.8.11 France: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 162 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 163 PRE-COVID-19: FRANCE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 164 POST-COVID-19: FRANCE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.8.12 France: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 165 FRANCE: SMART SPACE MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 166 PRE-COVID-19: FRANCE: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 167 POST-COVID-19: FRANCE: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.3.8.13 Germany

9.3.8.13.1 Focus on optimizing operations through real-time predictions to drive the market in Germany

9.3.8.14 Germany: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 168 GERMANY: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 169 PRE-COVID-19: GERMANY: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 170 POST-COVID-19: GERMANY: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.3.8.15 Germany: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 171 GERMANY: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 172 PRE-COVID-19: GERMANY: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 173 POST-COVID-19: GERMANY: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.3.8.16 Germany: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 174 GERMANY: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 175 PRE-COVID-19: GERMANY: SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 176 POST-COVID-19: GERMANY: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.3.8.17 Germany: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 177 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 178 PRE-COVID-19: GERMANY: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 179 POST-COVID-19: GERMANY: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.8.18 Germany: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 180 GERMANY: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 181 PRE-COVID-19: GERMANY: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 182 POST-COVID-19: GERMANY: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.3.8.19 Spain

9.3.8.19.1 Increasing use of emerging technologies to drive the market in Spain

9.3.8.20 Spain: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 183 SPAIN: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 184 PRE-COVID-19: SPAIN: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 185 POST-COVID-19: SPAIN: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.3.8.21 Spain: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 186 SPAIN: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 187 PRE-COVID-19: SPAIN: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 188 POST-COVID-19: SPAIN: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.3.8.22 Spain: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 189 SPAIN: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 190 PRE-COVID-19: SPAIN: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 191 POST-COVID-19: SPAIN: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.3.8.23 Spain: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 192 SPAIN: SMART SPACE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 193 PRE-COVID-19: SPAIN: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 194 POST-COVID-19: SPAIN: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.8.24 Spain: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 195 SPAIN: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 196 PRE-COVID-19: SPAIN: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 197 POST-COVID-19: SPAIN: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.3.8.25 Rest of Europe

9.3.8.26 Rest of Europe: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 198 REST OF EUROPE: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 199 PRE-COVID-19: REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 200 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.3.8.27 Rest of Europe: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 201 REST OF EUROPE: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 202 PRE-COVID-19: REST OF EUROPE: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 203 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.3.8.28 Rest of Europe: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 204 REST OF EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 205 PRE-COVID-19: REST OF EUROPE: SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 206 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.3.8.29 Rest of Europe: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 207 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 208 PRE-COVID-19: REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 209 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.8.30 Rest of Europe: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 210 REST OF EUROPE: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 211 PRE-COVID-19: REST OF EUROPE: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 212 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

9.4.3 ASIA PACIFIC: MARKET ESTIMATES AND FORECAST SIZE, BY COMPONENT, 2016–2025 (USD MILLION)

TABLE 213 ASIA PACIFIC: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 214 PRE-COVID-19: ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 215 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.4.4 ASIA PACIFIC: MARKET ESTIMATES AND FORECAST SIZE, BY SERVICES, 2016–2025 (USD MILLION)

TABLE 216 ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 217 PRE-COVID-19: ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 218 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.4.5 ASIA PACIFIC: MARKET ESTIMATES AND FORECAST SIZE, BY PROFESSIONAL SERVICE, 2016–2025 (USD MILLION)

TABLE 219 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 220 PRE-COVID-19: ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 221 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.4.6 ASIA PACIFIC: MARKET ESTIMATES AND FORECAST SIZE, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 222 ASIA PACIFIC: SMART SPACE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 223 PRE-COVID-19: ASIA PACIFIC: SMART SPACE MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 224 POST-COVID-19: ASIA PACIFIC: SMART SPACE MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.7 ASIA PACIFIC: MARKET ESTIMATES AND FORECAST SIZE, BY PREMISES TYPE, 2016–2025 (USD MILLION)

TABLE 225 ASIA PACIFIC: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 226 PRE-COVID-19: ASIA PACIFIC: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 227 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.4.8 ASIA PACIFIC: MARKET ESTIMATES AND FORECAST SIZE, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 228 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 229 PRE-COVID-19: ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 230 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.4.8.1 China

9.4.8.1.1 Increasing adoption of advanced technologies and rising number of tech startups to boost the growth of smart space market

9.4.8.2 China: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 231 CHINA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 232 PRE-COVID-19: CHINA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 233 POST-COVID-19: CHINA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.4.8.3 China: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 234 CHINA: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 235 PRE-COVID-19: CHINA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 236 POST-COVID-19: CHINA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.4.8.4 China: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 237 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 238 PRE-COVID-19: CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 239 POST-COVID-19: CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.4.8.5 China: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 240 CHINA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 241 PRE-COVID-19: CHINA: SMART SPACE MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 242 POST-COVID-19: CHINA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.8.6 China: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 243 CHINA: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 244 PRE-COVID-19: CHINA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 245 POST-COVID-19: CHINA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.4.8.7 India

9.4.8.7.1 Growing technological adoption to fuel the demand for smart space solutions in India

9.4.8.8 India: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 246 INDIA: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 247 PRE-COVID-19: INDIA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 248 POST-COVID-19: INDIA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.4.8.9 India: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 249 INDIA: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 250 PRE-COVID-19: INDIA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 251 POST-COVID-19: INDIA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.4.8.10 India: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 252 INDIA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 253 PRE-COVID-19: INDIA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 254 POST-COVID-19: INDIA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.4.8.11 India: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 255 INDIA: SMART SPACE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 256 PRE-COVID-19: INDIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 257 POST-COVID-19: INDIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.8.12 India: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 258 INDIA: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 259 PRE-COVID-19: INDIA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 260 POST-COVID-19: INDIA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.4.8.13 Singapore

9.4.8.13.1 Government initiatives to drive the market in Singapore

9.4.8.14 Singapore: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 261 SINGAPORE: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 262 PRE-COVID-19: SINGAPORE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 263 POST-COVID-19: SINGAPORE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.4.8.15 Singapore: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 264 SINGAPORE: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 265 PRE-COVID-19: SINGAPORE: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 266 POST-COVID-19: SINGAPORE: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.4.8.16 Singapore: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 267 SINGAPORE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 268 PRE-COVID-19: SINGAPORE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 269 POST-COVID-19: SINGAPORE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.4.8.17 Singapore: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 270 SINGAPORE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 271 PRE-COVID-19: SINGAPORE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 272 POST-COVID-19: SINGAPORE: SMART SPACE MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.8.18 Singapore: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 273 SINGAPORE: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 274 PRE-COVID-19: SINGAPORE: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 275 POST-COVID-19: SINGAPORE: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.4.8.19 Japan

9.4.8.19.1 Increasing use of smart phones and voice assistants to drive the smart space market in Japan

9.4.8.20 Japan: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 276 JAPAN: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 277 PRE-COVID-19: JAPAN: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 278 POST-COVID-19: JAPAN: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.4.8.21 Japan: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 279 JAPAN: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 280 PRE-COVID-19: JAPAN: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 281 POST-COVID-19: JAPAN: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.4.8.22 Japan: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 282 JAPAN: SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 283 PRE-COVID-19: JAPAN: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 284 POST-COVID-19: JAPAN: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.4.8.23 Japan: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 285 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 286 PRE-COVID-19: JAPAN: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 287 POST-COVID-19: JAPAN: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.8.24 Japan: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 288 JAPAN: SMART SPACE MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 289 PRE-COVID-19: JAPAN: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 290 POST-COVID-19: JAPAN: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.4.8.25 Rest of Asia Pacific

9.4.8.26 Rest of Asia Pacific: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 291 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 292 PRE-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 293 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.4.8.27 Rest of Asia Pacific: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 294 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 295 PRE-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 296 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.4.8.28 Rest of Asia Pacific: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 297 REST OF ASIA PACIFIC: SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 298 PRE-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 299 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.4.8.29 Rest of Asia Pacific: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 300 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 301 PRE-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 302 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.8.30 Rest of Asia Pacific: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 303 REST OF ASIA PACIFIC: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 304 PRE-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 305 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: SMART SPACE MARKET DRIVERS

9.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

9.5.3 MIDDLE EAST AND AFRICA: MARKET ESTIMATES AND FORECAST SIZE, BY COMPONENT, 2016–2025 (USD MILLION)

TABLE 306 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 307 PRE-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 308 POST-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.5.4 MIDDLE EAST AND AFRICA: MARKET ESTIMATES AND FORECAST SIZE, BY SERVICES, 2016–2025 (USD MILLION)

TABLE 309 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 310 PRE-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 311 POST-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.5.5 MIDDLE EAST AND AFRICA: MARKET ESTIMATES AND FORECAST SIZE, BY PROFESSIONAL SERVICE, 2016–2025 (USD MILLION)

TABLE 312 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 313 PRE-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 314 POST-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.5.6 MIDDLE EAST AND AFRICA: MARKET ESTIMATES AND FORECAST SIZE, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 315 MIDDLE EAST AND AFRICA: SMART SPACE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 316 PRE-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 317 POST-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.7 MIDDLE EAST AND AFRICA: MARKET ESTIMATES AND FORECAST SIZE, BY PREMISES TYPE, 2016–2025 (USD MILLION)

TABLE 318 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 319 PRE-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 320 POST-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.5.8 MIDDLE EAST AND AFRICA: MARKET ESTIMATES AND FORECAST SIZE, BY SUB REGION, 2016–2025 (USD MILLION)

TABLE 321 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUB REGION, 2016–2019 (USD MILLION)

TABLE 322 PRE-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUB REGION, 2020–2025 (USD MILLION)

TABLE 323 POST-COVID-19: MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUB REGION, 2020–2025 (USD MILLION)

9.5.8.1 Middle East

9.5.8.1.1 Technological advancements to drive the adoption rate of smart space solutions in the Middle East

9.5.8.2 Middle East: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 324 MIDDLE EAST: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 325 PRE-COVID-19: MIDDLE EAST: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 326 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.5.8.3 Middle East: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 327 MIDDLE EAST: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 328 PRE-COVID-19: MIDDLE EAST: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 329 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.5.8.4 Middle East: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 330 MIDDLE EAST: SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 331 PRE-COVID-19: MIDDLE EAST: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 332 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.5.8.5 Middle East: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 333 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 334 PRE-COVID-19: MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 335 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.8.6 Middle East: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 336 MIDDLE EAST: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 337 PRE-COVID-19: MIDDLE EAST: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 338 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.5.8.7 Africa

9.5.8.7.1 Transformations in the overall infrastructure industry to boost the adoption of smart space solutions in Africa

9.5.8.8 Africa: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 339 AFRICA: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 340 PRE-COVID-19: AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 341 POST-COVID-19: AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.5.8.9 Africa: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 342 AFRICA: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 343 PRE-COVID-19: AFRICA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 344 POST-COVID-19: AFRICA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.5.8.10 Africa: Market estimates and forecast size, BY PROFESSIONAL SERVICE, 2016–2025 (USD Million)

TABLE 345 AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 346 PRE-COVID-19: AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 347 POST-COVID-19: AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.5.8.11 Africa: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 348 AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 349 PRE-COVID-19: AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 350 POST-COVID-19: AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.8.12 Africa: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 351 AFRICA: SMART SPACE MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 352 PRE-COVID-19: AFRICA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 353 POST-COVID-19: AFRICA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: MARKET DRIVERS

9.6.2 LATIN AMERICA: COVID-19 IMPACT

9.6.3 LATIN AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY COMPONENT, 2016–2025 (USD MILLION)

TABLE 354 LATIN AMERICA: SMART SPACE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 355 PRE-COVID-19: LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 356 POST-COVID-19: LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.6.4 LATIN AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY SERVICES, 2016–2025 (USD MILLION)

TABLE 357 LATIN AMERICA: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 358 PRE-COVID-19: LATIN AMERICA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 359 POST-COVID-19: LATIN AMERICA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.6.5 LATIN AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY PROFESSIONAL SERVICE, 2016–2025 (USD MILLION)

TABLE 360 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 361 PRE-COVID-19: LATIN AMERICA: SMART SPACE MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 362 POST-COVID-19: LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.6.6 LATIN AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 363 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 364 PRE-COVID-19: LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 365 POST-COVID-19: LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.7 LATIN AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY PREMISES TYPE, 2016–2025 (USD MILLION)

TABLE 366 LATIN AMERICA: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 367 PRE-COVID-19: LATIN AMERICA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 368 POST-COVID-19: LATIN AMERICA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.6.8 LATIN AMERICA: MARKET ESTIMATES AND FORECAST SIZE, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 369 LATIN AMERICA: SMART SPACE MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 370 PRE-COVID-19: LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 371 POST-COVID-19: LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.6.8.1 Brazil

9.6.8.1.1 Investments by multinational companies to drive the market in Brazil

9.6.8.2 Brazil: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 372 BRAZIL: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 373 PRE-COVID-19: BRAZIL: SMART SPACE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 374 POST-COVID-19: BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.6.8.3 Brazil: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 375 BRAZIL: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 376 PRE-COVID-19: BRAZIL: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 377 POST-COVID-19: BRAZIL: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.6.8.4 Brazil: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 378 BRAZIL: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 379 PRE-COVID-19: BRAZIL: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 380 POST-COVID-19: BRAZIL: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.6.8.5 Brazil: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 381 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 382 PRE-COVID-19: BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 383 POST-COVID-19: BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.8.6 Brazil: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 384 BRAZIL: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 385 PRE-COVID-19: BRAZIL: SMART SPACE MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 386 POST-COVID-19: BRAZIL: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.6.8.7 Mexico

9.6.8.7.1 Growing government initiatives and increasing demand for smart spaces to trigger market growth in Mexico

9.6.8.8 Mexico: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 387 MEXICO: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 388 PRE-COVID-19: MEXICO: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 389 POST-COVID-19: MEXICO: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.6.8.9 Mexico: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 390 MEXICO: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 391 PRE-COVID-19: MEXICO: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 392 POST-COVID-19: MEXICO: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.6.8.10 Mexico: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 393 MEXICO: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 394 PRE-COVID-19: MEXICO: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 395 POST-COVID-19: MEXICO: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.6.8.11 Mexico: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 396 MEXICO: SMART SPACE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 397 PRE-COVID-19: MEXICO: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 398 POST-COVID-19: MEXICO: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.8.12 Mexico: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 399 MEXICO: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 400 PRE-COVID-19: MEXICO: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 401 POST-COVID-19: MEXICO: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

9.6.8.13 Rest of Latin America

9.6.8.14 Rest of Latin America: Market estimates and forecast size, by component, 2016–2025 (USD Million)

TABLE 402 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 403 PRE-COVID-19: REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 404 POST-COVID-19: REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

9.6.8.15 Rest of Latin America: Market estimates and forecast size, by services, 2016–2025 (USD Million)

TABLE 405 REST OF LATIN AMERICA: SMART SPACE MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 406 PRE-COVID-19: REST OF LATIN AMERICA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

TABLE 407 POST-COVID-19: REST OF LATIN AMERICA: MARKET SIZE, BY SERVICES, 2020–2025 (USD MILLION)

9.6.8.16 Rest of Latin America: Market estimates and forecast size, by professional service, 2016–2025 (USD Million)

TABLE 408 REST OF LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 409 PRE-COVID-19: REST OF LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 410 POST-COVID-19: REST OF LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

9.6.8.17 Rest of Latin America: Market estimates and forecast size, by application, 2016–2025 (USD Million)

TABLE 411 REST OF LATIN AMERICA: SMART SPACE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 412 PRE-COVID-19: REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 413 POST-COVID-19: REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.8.18 Rest of Latin America: Market estimates and forecast size, by premises type, 2016–2025 (USD Million)

TABLE 414 REST OF LATIN AMERICA: MARKET SIZE, BY PREMISES TYPE, 2016–2019 (USD MILLION)

TABLE 415 PRE-COVID-19: REST OF LATIN AMERICA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

TABLE 416 POST-COVID-19: REST OF LATIN AMERICA: MARKET SIZE, BY PREMISES TYPE, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 254)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 32 MARKET EVALUATION FRAMEWORK

10.3 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 33 MARKET SHARE ANALYSIS OF SMART SPACE MARKET IN 2020

10.4 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.4.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY SMART SPACE VENDORS

10.5 COMPANY EVALUATION MATRIX, 2020

10.5.1 STAR

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE

10.5.4 PARTICIPANTS

FIGURE 34 SMART SPACE MARKET, COMPANY EVALUATION MATRIX, 2020

10.5.5 STRENGTH OF PRODUCT PORTFOLIO FOR MAJOR PLAYERS IN MARKET

FIGURE 35 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

10.5.6 BUSINESS STRATEGY EXCELLENCE OF MAJOR PLAYERS IN MARKET

FIGURE 36 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

10.6 HISTORICAL REVENUE ANALYSIS

FIGURE 37 HISTORICAL FIVE -YEAR REVENUE ANALYSIS OF LEADING SMART SPACE PROVIDERS

10.7 RANKING OF KEY PLAYERS IN SMART SPACE MARKET, 2020

FIGURE 38 RANKING OF KEY PLAYERS, 2020

11 COMPANY PROFILES (Page No. - 262)

11.1 INTRODUCTION

(Business Overview, Products Offered, Recent Developments, MNM View, Key Strengths, Strategic Choices Made, and Weaknesses and Competitive Threats)*

11.2 ABB

FIGURE 39 ABB: COMPANY SNAPSHOT

11.3 CISCO

FIGURE 40 CISCO: COMPANY SNAPSHOT

11.4 SIEMENS

FIGURE 41 SIEMENS: COMPANY SNAPSHOT

11.5 HUAWEI

FIGURE 42 HUAWEI: COMPANY SNAPSHOT

11.6 IBM

FIGURE 43 IBM: COMPANY SNAPSHOT

11.7 SCHNEIDER ELECTRIC

FIGURE 44 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

11.8 SMARTSPACE SOFTWARE

FIGURE 45 SMARTSPACE SOFTWARE PLC: COMPANY SNAPSHOT