Smart Speaker Market by IVA (Alexa, Google Assistant, Siri, DuerOS, Ali Genie), Component (Hardware (Speaker Driver, Connectivity IC, Processor, Audio IC, Memory, Power IC, Microphone) and Software), Application, and Region - Global Forecast to 2025

Smart Speaker Market

Smart Speaker Market and Top Companies

- Amazon Inc. (US) − Amazon is an e-commerce and cloud computing company offering a range of products and services through its websites. The company also manufactures and sells electronic devices, including Kindle e-readers, Fire tablets, Fire TVs, and Echo. It sells Echo series products under the retail segment. The company keeps on innovating its smart speaker series. Some of the Echo products launched by the company include Echo Dot and Echo Show. The company also offers its voice assistance platform, Alexa, for smart speakers.

- Harman International (US) − Harman operates as Samsung’s subsidiary. Harman International engages in designing, manufacturing, and marketing audio and infotainment solutions for automotive, consumer, and professional markets supported by brands such as AKG Acoustics (Australia), Harman Kardon (US), Infinity (US), JBL Incorporated (US), Lexicon (US), and Mark Levinson Audio System (US). The company offers various smart speakers through its subsidiaries—Harman Kardon (US) and JBL Incorporated (US). Harman Kardon offers Harman Kardon Allure and Invoke, while JBL Incorporated offers JBL Link 10, JBL Link 20, JBL Link 300, and JBL LINK View.

- Apple Inc. (US) − Apple designs, manufactures, and sells mobile communication and media devices, personal computers, and portable digital music players. In July 2017, the company launched HomePod, a wireless speaker. HomePod is a voice control device with an array of 6 microphones. The speaker is equipped with the features of Siri with wireless access to the entire Apple Music Library.

- Sonos (US) – Sonos manufactures wireless music systems, which include speakers, home theatres, and speaker components. The company offers its products online as well as through retail stores in more than 50 countries. The company’s product line includes Internet-connected speakers and hubs that are compatible with more than 60 Internet services, such as Apple’s Beats Music, Spotify, iHeartRadio, MOG, QQ Music, Amazon Music, and Pandora.

- Google Inc. (US) – Alphabet is the parent company of Google and primarily focuses on areas such as advertising, search, operating systems & platforms, and enterprise and hardware products. Google Home is a line of smart speakers developed under the Google Nest brand. The devices enable users to speak voice commands to interact with services through Google Assistant, the company's virtual assistant. Google Home allows to listen to music, control playback of videos or photos, or receive news updates entirely by voice. Google Nest devices also have integrated support for home automation, letting users control smart home appliances with voice commands.

- Bose Corporation (US) – Bose engineers, designs, develop, researches, markets, and retails sound systems. The company offers various speakers, such as portable speakers, multiroom speakers, home theatres, and stereo speakers. It also offers speaker accessories and portable personal amplification (PA) systems. Bose offers smart speakers compatible with Siri or Google Assistant.

- Alibaba (China) – Alibaba works as an online and mobile business organization. The company provides online and mobile marketplaces in retail and wholesale trade, along with cloud computing and other services. The company offers Tmall Genie X1, an AI-enabled personal assistant smart speaker, under its retail segment. AliGenie is the AI platform powering Tmall Genie.

- Lenovo (China) – Lenovo designs, develops, manufactures, and sells PCs, tablets, computers, smartphones, workstations, servers, electronic storage devices, IT management software, and smart televisions. It offers voice-controlled Lenovo Smart Display 7, Lenovo Smart Display 8, Lenovo Smart Display 10, and smart clock in the smart speaker market. This smart speaker is integrated with Google Assistant that helps users control smart devices through voice commands. The company also offers Home Assistant Pack, a voice-activated smart assistant with a screen integrated with Amazon Alexa.

- Baidu (China) – The company provides image search, online storage, enterprise search, news, voice assistance, multimedia files, and algorithmic search on its Baidu.com website. As a result of Baidu's acquisition of Raven Tech in February 2017, Baidu launched its first smart speaker—Raven H—with voice-controlled intelligent personal assistant service, DuerOS. DuerOS is installed on smart devices (in homes and hotels), smartphones, children’s watches, and story machines. It also released four DuerOS-powered Xiaodu branded smart devices in 2018, including Xiaodu smart speaker and Xiaodu smart display, the first smart speaker in China with a display.

Smart Speaker Market and Top Intelligent Virtual Assistants

- Alexa − Alexa is a highly preferred voice assistant for smart speakers. Alexa smart speakers are offered by companies such as Onkyo (Japan), Pioneer Electronics (Japan), Sonos (US), Harman International (US), Altec Lansing (US), Lenovo (US), Invoxia (France), and Ultimate Ears (US). Alexa offered by Amazon was the first voice assistant used in Echo smart speakers. The company launched Alexa IVA smart speaker Echo in 2014. Since then, the platform is used in Amazon’s Echo device series and smart speakers offered by most companies.

- Google Assistant − Google Assistant smart speakers are offered by companies such as Onkyo (Japan), Panasonic (Japan), Sony (Japan), Harman International (US), and Altec Lansing (US). In 2016, the company launched Google Assistant IVA for Google Home speakers. Google Assistant is supported by the data generated from its web search engine. It gives contextual information and generally gives longer and informative answers. Google Assistant also works with Google’s online services and cites source websites while providing the information.

- Siri − Siri voice assistant is one of the most advanced IVA technologies offered by Apple. Consumers who own an iPhone are most comfortable with Siri-enabled smart speakers. Siri can speak more than 20 languasges with localized accents for many languages, including English, French, Arabic, Cantonese, Mandarin, Korean, and Japanese. Moreover, the increasing demand for the HomeKit platform in home automation products creates a demand for Siri-enabled smart speakers.

- Baidu − DuerOS is a conversational AI system developed by Baidu's Duer Business Unit. DuerOS is based on the same kind of conversational abilities as Amazon’s Alexa and Google Assistant. Baidu’s current smart devices and new additions all use the company’s DuerOS assistant. It is Baidu’s voice assistant. DuerOS can support a wide range of hardware, devices such as mobile phones, televisions, speakers, household appliances, automobiles, and robots.

- AliGenie − Alibaba Group Holding’s AI Labs unit in 2017 introduced AliGenie, an open development platform for voice-assistant applications for the Chinese market. AliGenie is the voice assistant, or to the human-machine interaction system, behind Tmall Genie smart speakers. The platform provides developers with functions including wake-on-voice, voice recognition, voiceprint recognition, semantic understanding, and speech synthesis to assist in the creation of new voice-based applications, which can be added to the AliGenie store.

Smart Speaker Market and Top Applications

- Smart Home – Smart home is the major application of smart speakers owing to their features and usability. Smart speakers can control smart devices with the user’s voice, thus making day-to-day tasks easy. With a voice command, the user can control all smart devices by connecting the device to the Internet. Smart speakers understand the natural way of speaking and are less complicated to operate than other smart devices, making them an easy-to-use tool for the elderly and busy people.

- Consumer − Smart speakers are increasingly adopted by the consumer owing to the convenience offered by the device. Smart speakers can control any smart devices through a smartphone and Internet connection. Further, smartphone users play a crucial role in increasing the adoption of voice-enabled apps, which, in turn, increases the demand for voice-controlled products, including smart speakers.

- Smart Office − Smart offices are getting more advanced with the increasing deployment of smart speakers. Smart speakers that make life easier and efficient for consumers in smart homes can be employed in work settings as well. Smart speakers are physically made to be compatible with office surroundings. Convenience is the key factor for the increasing demand for smart speakers in office automation. In a smart office environment, especially in customer service applications in retail and call centers, smart speakers know how the business is doing at present and help business owners make better and quick business decisions.

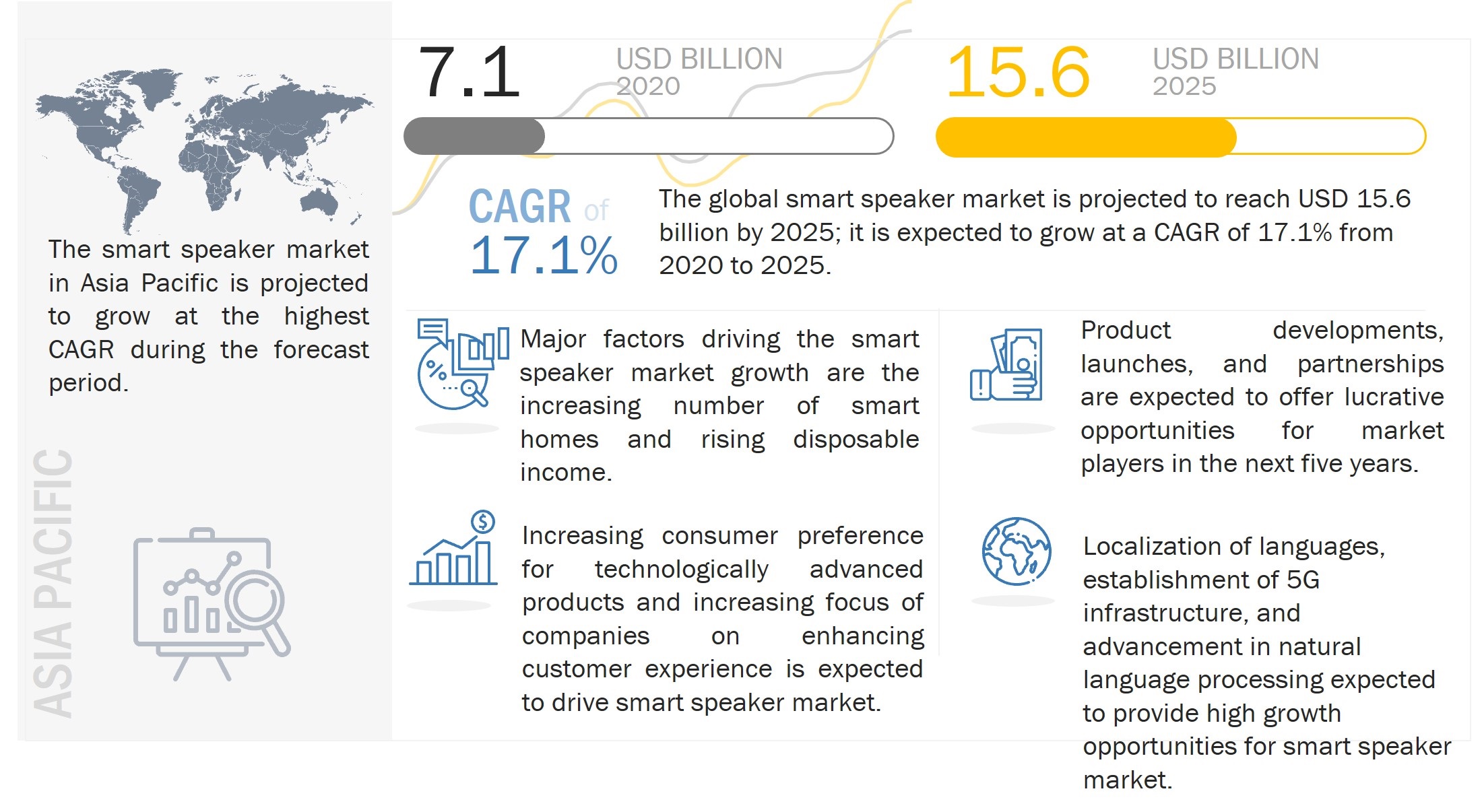

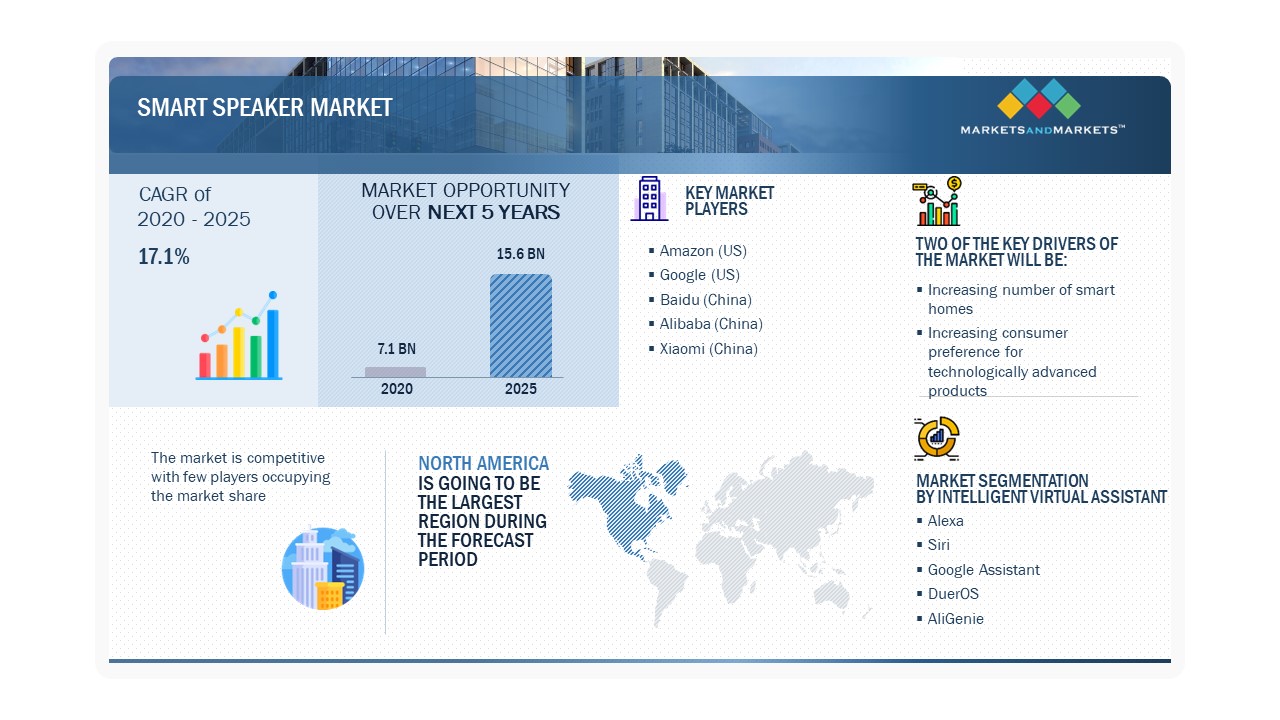

[136 Pages Report] The global smart speaker marke is projected to grow from USD 7.1 billion in 2020 to USD 15.6 Billion by 2025, at a CAGR of 17.1% from 2020 to 2025. A smart speaker is a type of wireless speaker and voice command device (VCD) with an intelligent virtual assistant (artificial intelligence) that offers its users a way to interact with the speaker and operate other smart devices, including smart thermostats, light bulbs, switches, door locks, energy monitors, window shades, appliances, motion sensors, and wireless cameras.

Smart Speaker Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

A smart speaker performs operations such as browsing the web, streaming music, and purchasing groceries. There is an increase in demand for Al-enabled smart speakers in smart home and smart office applications. However, smart speakers face challenges regarding connectivity range, compatibility, and power. The increasing need to enhance consumer convenience fuels the demand for smart speakers, especially in the smart home application.

Smart speakers offer interactive actions and hands-free activation with the help of one or several keywords. They have features that can connect to multiple smart devices while enhancing the ease of use and provide additional functionality compared with traditional speakers. Technological advancements in artificial intelligence (Al) and the Internet of Things (IOT) have led to the emergence of numerous firms in the smart speaker market. Players such as Alphabet (US), Amazon (US), and Xiaomi (China) offer smart speakers with an IVA platform.

Each smart speaker's skills, features, and compatibility vary with the brand. For example, Amazon Alexa has more features, skills, compatible products, compatible apps, and services than Google Home. Alexa supports more than 15,000 skills and various services, such as Spotify, Pandora, Amazon Music, iHeart Radio, Tuneln, SiriusXM, and Uber. Additionally, users can order groceries from Amazon by voice commands. Smart homeowners find smart speakers helpful, fun to use, and valuable addition to smart home devices. Smart homeowners who already have multiple smart devices are adding smart speakers to manage and control devices.

Smart Speaker Market Dynamics:

Driver: Increasing number of smart homes

The continuous need for convenient and comfortable lifestyles among homeowners has led to the rapid development of connected solutions in smart homes. The number of smart products introduced in the market has gradually increased since 2012. The ability to control home products with an Internet connection and a mobile device is shifting consumers' focus toward smart products. The growth of smart devices in smart homes can be attributed to the advancements in IOT; growing need for security, safety, and convenience; and the increasing demand for energy-saving products and solutions. Smart speakers allow consumers to control connected devices in their homes with their speech remotely. Owing to this, smart speakers, acting as a smart home hub, are the most significant and preferred devices in smart homes. The built-in smart home hub makes it easy to connect with smart devices and perform operations such as controlling lights, playing music, and browsing information on the Internet. Its wireless connectivity with mobile devices provides convenience to users. Smart speakers also consume lesser space than traditional home theatres. Owing to these advantages, people in both technologically advanced and advancing regions are rapidly moving from traditional speakers to smart speakers. The growth of smart home devices is expected to propel the growth of virtual assistant-enabled smart speakers in the coming years.

Restraint: Issues related to connectivity range, compatibility, and power

The major factor hindering the growth of this market is connectivity and app-related issues. Smart speaker usage is limited to the availability of Internet connectivity. Users must always connect to the Internet to connect with smart speakers to control apps. Additionally, smart

speakers are connected to sensors and other devices. Therefore, issues with sensor connectivity cause a disconnection between the app and the smart speaker. Users are supposed to place the smart speaker such that it receives signals from the router and can access/connect other smart devices at the same time.

Opportunity: Increasing consumer preference for technologically advanced products

With increasing consumer expenditure on smart devices that are portable, easy to use, and inbuilt with advanced technology, there has been a significant shift in consumer preference regarding the use of technology in daily lives. Moreover, consumer demand for multifunctional, fast, varied, and reliable solutions has pushed many speaker manufacturers to integrate voice assistance into speakers.

Connected devices and solutions have become prevalent among consumers owing to their user-friendliness. The emergence of smart speakers has enabled users to connect with online platforms and facilitated real-time communication on the go with increased comfort, convenience, safety, and security.

Challenge: High security risk

Voice assistant-enabled smart speakers are becoming increasingly prevalent in smart homes with integrated personal data of users. One of the major concerns of smart speaker users is the unintentional activation of smart speakers through voice commands embedded in websites or TV advertisements. Most smart speakers could also connect with any local network and with any device in the same network, thus changing the settings of the smart speaker or performing a factory reset without the user's permission. A secure local network and a strong account password are essential to overcome such risks. Smart speakers are also linked to other smart devices, including smartphones, smart locks, TVs, and radios, which are accessible to other people. Some smart speakers can also conduct voice purchases, which means another person can also use assistance to order goods online. Further, if a smart speaker is linked to the Amazon Prime account, it can be enabled with one-click order. Hence, users need to secure the settings and monitor notifications.

Smart Speaker Market Segment Insights:

Based on Intelligent Virtual Assistance (IVA), Alexa is expected to hold largest market share from 2020 to 2025

Alexa is a highly preferred voice assistant for smart speakers. Alexa smart speakers are offered by companies such as Onkyo (Japan), Pioneer Electronics (Japan), Sonos (US), Harman International (US), Altec Lansing (US), Lenovo (US), Invoxia (France), and Ultimate Ears (US). Alexa offered by Amazon was the first voice assistant used in Echo smart speakers. The company launched Alexa IVA smart speaker Echo in 2014. Since then, the platform is used in Amazon's Echo device series and smart speakers offered by most companies. Alexa speaker is offered in more than 80 countries, thus covering a wide audience from which the company gathers usage data and continually improves its service.

Based on components, the smart speaker market for software is expected to grow at a higher CAGR during the forecast period

IVA platform in a smart speaker complements hardware by storing and recalling spatial data and allows live data streaming rather than static data. These functions require software with high computing and functionality, which would require advanced software. Additionally, due to its ease of use, consumer preference for IVA-enabIed devices encourages companies to develop more productive IVA platforms. For example, Lucida is an open-source intelligent personal assistant (IPA) platform developed by the University of Michigan (US). SoundHound (US) is another company offering Hound and Houndify virtual assistant development platforms that allow developers to add a voice interface to any app and support advanced IVA functions, such as recommending places of interest and financial information, along with basic functions.

Based on application, the smart office market is expected to grow at the highest CAGR during the forecast period

Smart offices are getting more advanced with the increasing deployment of smart speakers. Smart speakers that make life easier and efficient for consumers in smart homes can also be employed in work settings. Smart speakers are physically made to be compatible with office surroundings. Convenience is the key factor in increasing demand for smart speakers in office automation. In a smart office environment, especially in customer service applications in retail and call centers, smart speakers know how the business is doing at present and help business owners make better and quick business decisions. In a smart office environment, employees can reserve meeting rooms, extend their meetings, or set reminders for conference calls through voice commands to smart speakers. In the construction, food service, and transportation industries, which have a mobile workforce, owners can keep track of their employees by giving voice commands to smart speakers.

Regional Insights:

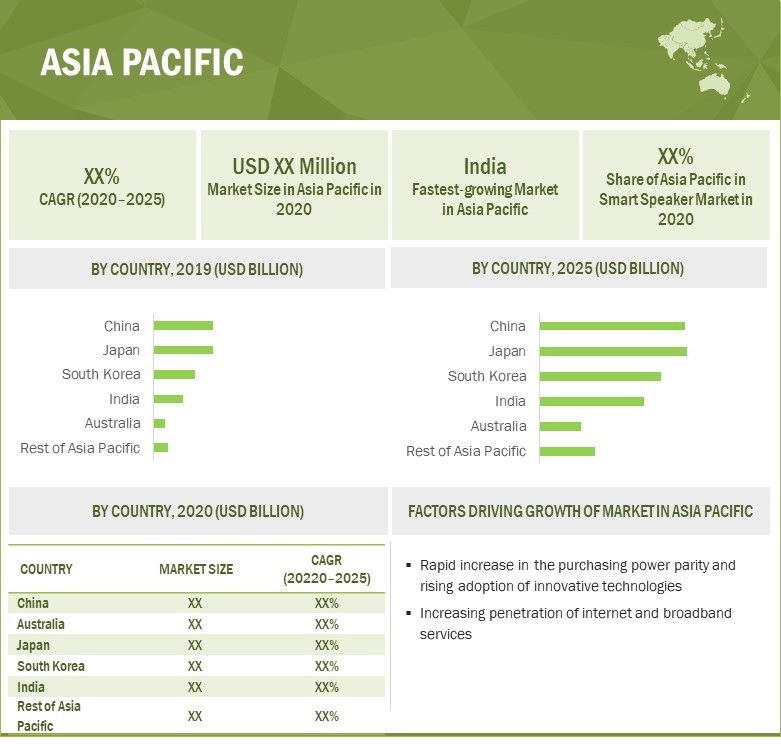

The Asia Pacific region is projected to Grow at highest CAGR during the forecast period

Asia Pacific is the leading market for smart speakers and is expected to witness significant growth in the coming years. The smart speaker market in Asia Pacific is growing rapidly owing to the proliferation of Internet services and rapid Internet penetration. Countries such as China, Japan,

India, and South Korea in Asia Pacific have adopted smart speakers owing to their ease of use and portability. The rising production of consumer electronics and increasing demand for wireless connectivity are the major factors supporting the smart speaker market growth. Smart speakers with local language support have enormous potential to grow in technologically advancing countries of Asia Pacific. The growing population, the rapid increase in purchasing power parity (PPP), and the adoption of innovative technologies are the major factors for the fast market growth in this region.

Smart Speaker Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The North America region held the significant share of the smart speaker market in 2020

North America represents one of the most well-defined and controlled economies in terms of resources, gross domestic product (GDP), infrastructure, and technological advancements across the globe, with a large number of smart homes, smart offices, and advanced vehicles. Further, North America has been extremely responsive to the latest technological advancements, such as the integration of artificial intelligence (Al) and the Internet of things (IOT). Industries, SMEs, or large enterprises in North America mainly consider smart devices with voice assistants to improve their client-centric approaches and customer engagement. Major North American smart speaker market drivers are large-scale investments in customer engagement solutions and automated, cost-effective customer care products and services. North America, especially the US, is one of the largest markets for smart speakers owing to the increasing need for automated products and services in smart homes and smart offices. Moreover, the growing popularity of connected and smart devices is driving the growth of the smart speaker market in this region.

Key Market Players:

Some of the leading players in this market are Amazon (US), Harman International (US), Apple Inc. (US), Sonos (US), Alibaba Group (China), Alphabet Inc. (US), Baidu, Inc. (China), Bose Corporation (US), Sony Corporation (Japan), Samsung Electronics (South Korea). These players have adopted various growth strategies, such as new product launches, product developments, and partnerships further to expand their presence in the smart speaker market.

Amazon (US) has been following the strategy of reducing the cost of old products after introducing a new version of the product in the market. This strategy allows the company to capture high margins with early adopters and brand-conscious consumers. The company's continuous innovation and forward focus have allowed it to stay ahead of its competitors. Besides, after the introduction of the Echo, the company started introducing new versions of Echo inbuilt with Alexa. It has displayed impressive top-line growth through its innovative product lines. It has a sound liquidity position with a large amount of cash in hand. This enables the company to make huge strategic investments in different types of technologies. It has a wide range of distinguished products, which fuels the growth of its proprietary products in the market. It has been a trendsetter in the market and a technology leader in the industry. The company has collaborated with key players such as BMW (Germany) and Microsoft (US) to increase its share in the smart speaker market.

Alphabet Inc. (US) is one of the most diversified companies, with products ranging from consumer durables to business solutions for enterprises. The company has a strong portfolio with Google Home product series and Google Assistant intelligent voice assistance in the smart speaker market. The company has collaborated with several companies to integrate Google Assistant into smart devices, thus increasing its market share. Alphabet is known for its continuous innovation in its products. The company has made efforts to expand its Al offerings. Google has adopted organic growth strategies to maintain its position in the smart speaker market. In September 2018, the company launched Google Nest Hub, a smart display with a voice-controlled virtual assistant to sustain in the highly competitive smart speaker market. The company collaborated with key players such as LG Electronics and Sony to design the device. This device follows voice commands and has features similar to smart devices. The company is also partnering with automobile manufacturers to integrate its voice assistant technology into cars. For instance, in September 2019, General Motors and Google teamed up to install the tech giant's voice assistant and apps, including Google Maps, into GM vehicles beginning in 2021.

Scope of the Report

|

Report Metric |

Details |

|

Review period |

2017–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) in million/billion |

|

Segments covered |

|

|

Regions covered |

|

|

Companies covered |

Amazon, Inc (Amazon) (US), Harman International (US), Apple Inc. (Apple) (US), Sonos (US), Alphabet Inc (Alphabet) (US), Baidu, Inc (Baidu) (China), Bose Corporation (Bose) (US), Sony Corporation (Sony) (Japan), Onkyo Corporation (Onkyo) (Japan), Samsung Electronics (Samsung) (South Korea), Panasonic Corporation (Panasonic) (Japan), Alibaba Group (Alibaba) (China), Altec Lansing (US), Lenovo Group Ltd. (Lenovo) (China), Xiaomi Inc. (Xiaomi) (China), SK Telecom Co., Ltd. (SK Telecom) (South Korea), Facebook (US), and LG Electronics (South Korea) |

Smart Speaker Market Segmentation:

The global smart speaker market, in this research report, was segmented on the basis of the below segments.

Smart Speaker Market by Intelligent Virtual Assistant

- Alexa

- Google Assistant

- DuerOS

- AliGenie

- Xiao AI

- Siri

- Others

Smart Speaker Market by Component

- Hardware

- Software

Smart Speaker Market by Application:

- Smart Home

- Consumer

- Smart Office

- Others

Smart Speaker Market by Region:

- North America

- Europe

- APAC

- RoW

Smart Speaker Market Highlights:

What is new?

- Increasing focus of companies on enhancing customer experience through the development of intelligent voice assistance (IVA)

Intelligent voice assistance is one of the significant technologies in smart speakers offering personalized services to customers. It is expected to play a huge role in enhancing the customer experience in the coming years. Key players offering smart speakers focus more on offering voice assistance to enhance the customer experience. Voice assistance is ideal for busy users, as it is convenient and easy to use. Smart speakers inbuilt with Alexa and other voice assistants help customers stream music, search for information, and order stuff, all via voice commands.

- Addition/refinement in segmentation–Increase in depth or width of segmentation of the market.

- Bluetooth

- Wi-Fi

- Bluetooth + Wi-Fi

- Airplay

- Coverage of new market players and change in the market share of existing players of the smart speaker market.

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have total 25 players (15 major, 10 Other key companies).

- Updated financial information and product portfolios of players operating in the smart speaker market.

Newer and improved representation of financial information: The latest edition of the report provides updated financial information in the context of the smart speaker market till 2021/2022 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to quickly analyze the present status of profiled companies in terms of their financial strength, profitability, critical revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- Updated market developments of the profiled players.

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new product launches, investments, and funding, have been mapped for the years 2019 to 2022.

Recent Developments

- In September 2022, Amazon introduced the next generation of Echo Dot and Echo Auto, giving users more ways to bring the convenience of Alexa to every room of the home and into the car.

- In May 2022, Apple announced that it plans to launch a new version of its HomePod smart speaker in late 2022 or early 2023.

- In July 2022, Xiaomi launched its second ever smart speaker in India. The Xiaomi smart speaker comes with new and improved features such as IR Control, smart home control center, balanced sound field, LED clock display, and much more. The speaker comes with a built-in smart voice assistant and Bluetooth 5.0.

Frequently Asked Questions (FAQs):

What is the current size of the smart speaker market?

The smart speaker market is projected to grow from USD 7.1 billion in 2020 to USD 15.6 Billion by 2025, at a CAGR of 17.1% from 2020 to 2025.

Who are the key players in the smart speaker market?

Some of the leading players in this market are Amazon (US), Harman International (US), Apple Inc. (US), Sonos (US), Alibaba Group (China), Alphabet Inc. (US), Baidu, Inc. (China), Bose Corporation (US), Sony Corporation (Japan), Samsung Electronics (South Korea).

What are the opportunities for new market entrants?

Increasing consumer preference for technologically advanced products, localization of languages, establishment of 5G infrastructure, and advancement in natural language processing expected to provide growing opportunities for smart speaker market.

Which intelligent virtual assistant is expected to dominate the smart speaker market?

Alexa is a highly preferred voice assistant for smart speakers. Alexa smart speakers are offered by companies such as Onkyo (Japan), Pioneer Electronics (Japan), Sonos (US), Harman International (US), Altec Lansing (US), Lenovo (US), Invoxia (France), Ultimate Ears (US).

Which region is expected to lead the smart speaker market?

Asia Pacific is the leading market for smart speakers and is expected to witness significant growth in the coming years. The smart speaker market in Asia Pacific is growing at a rapid rate owing to the proliferation of Internet services and rapid Internet penetration

How big is the smart speaker market in North America?

Major North American smart speaker market drivers are large-scale investments in customer engagement solutions and automated, cost-effective customer care products and services. North America, especially the US, is one of the largest markets for smart speakers owing to the increasing need for automated products and services in smart homes and smart offices. Moreover, the growing popularity of connected and smart devices is driving the growth of the smart speaker market in this region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 DISCLAIMER

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 19)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Primary interviews with experts

2.1.2.3 Breakdown of primaries

2.1.2.4 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing the market size using the bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing the market size using the top-down analysis (supply side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 27)

4 PREMIUM INSIGHTS (Page No. - 32)

4.1 BRIEF OVERVIEW OF THE SMART SPEAKER MARKET DURING THE FORECAST PERIOD

4.2 SMART SPEAKER MARKET FOR ALEXA, BY APPLICATION

4.3 MARKET FOR CONSUMER APPLICATION, BY REGION

4.4 MARKET FOR SMART HOME APPLICATION, BY INTELLIGENT VIRTUAL ASSISTANT

4.5 MARKET FOR HARDWARE, BY COMPONENT

4.6 APAC MARKET, BY COUNTRY AND APPLICATION

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing number of smart homes

5.2.1.2 Growing trend of smart speakers with display

5.2.1.3 Rising disposable income

5.2.1.4 Rapid proliferation of multifunctional devices

5.2.1.5 Growing trend of personalization

5.2.2 RESTRAINTS

5.2.2.1 Issues related to connectivity range, compatibility, and power

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing consumer preference for technologically advanced products

5.2.3.2 Increasing focus of companies on enhancing customer experience

5.2.4 CHALLENGES

5.2.4.1 High-security risk

5.2.4.2 Availability of substitutes

5.3 VALUE CHAIN ANALYSIS

5.4 IMPACT OF COVID-19 ON THE SMART SPEAKER MARKET

6 SMART SPEAKER MARKET, BY INTELLIGENT VIRTUAL ASSISTANT (Page No. - 43)

6.1 INTRODUCTION

6.2 ALEXA

6.2.1 OFFERS MORE FEATURES THAN OTHER IVA PLATFORMS

6.3 GOOGLE ASSISTANT

6.3.1 GOOGLE ASSISTANT IS SUPPORTED BY THE DATA GENERATED FROM ITS WEB SEARCH ENGINE

6.4 SIRI

6.4.1 INCREASING DEMAND FOR THE HOMEKIT PLATFORM IN HOME AUTOMATION PRODUCTS CREATES A DEMAND FOR SIRI-ENABLED SMART SPEAKERS

6.5 DUEROS

6.5.1 DUEROS’ INSTALLATION BASE PASSED 400 MILLION AS VOICE QUERIES TOPPED 3.6 BILLION

6.6 ALIGENIE

6.6.1 ALIGENIE IS INTEGRATED WITH MORE THAN 660 IOT PLATFORMS

6.7 XIAO AI

6.7.1 XIAO AI POWERING XIAOMI SMART SPEAKERS, SMARTPHONES, AND SMART HOME PRODUCTS FOR THE CHINESE MARKET

6.8 OTHERS

7 SMART SPEAKER MARKET, BY COMPONENT (Page No. - 53)

7.1 INTRODUCTION

7.2 HARDWARE

7.2.1 HARDWARE CONSTITUTES A MAJOR PORTION OF A SMART SPEAKER

7.2.2 PROCESSOR

7.2.3 MEMORY

7.2.4 POWER IC

7.2.5 CONNECTIVITY IC

7.2.6 MICROPHONE

7.2.7 SPEAKER DRIVER

7.2.8 AUDIO IC

7.2.9 OTHERS

7.3 SOFTWARE

7.3.1 SOFTWARE EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

8 SMART SPEAKER MARKET, BY APPLICATION (Page No. - 58)

8.1 INTRODUCTION

8.2 SMART HOME

8.2.1 SMART SPEAKER MARKET FOR SMART HOME WILL CONTINUE TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

8.3 CONSUMER

8.3.1 TECHNOLOGY COMPANIES ARE COLLABORATING WITH THIRD-PARTY VOICE APP DEVELOPERS TO INCREASE THE ADOPTION OF VOICE-ENABLED SMART DEVICES IN CONSUMER APPLICATIONS

8.4 SMART OFFICE

8.4.1 CONVENIENCE IS THE KEY FACTOR FOR THE INCREASING DEMAND FOR SMART SPEAKERS IN OFFICE AUTOMATION

8.5 OTHERS

9 GEOGRAPHIC ANALYSIS (Page No. - 68)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 High adoption of smart devices with advanced technologies, such as IoT and AI, has pushed sales figures for smart speakers in the US

9.2.2 CANADA

9.2.2.1 Smart Office application presents opportunities for smart speakers

9.2.3 MEXICO

9.2.3.1 Smart home and automotive applications present opportunities for the growth of the smart speaker market

9.3 EUROPE

9.3.1 UK

9.3.1.1 Smart home applications drive the demand for smart speakers

9.3.2 GERMANY

9.3.2.1 High penetration of smart devices in the residential market

9.3.3 FRANCE

9.3.3.1 Increasing demand for smart audio products driving the smart speaker market

9.3.4 REST OF EUROPE

9.4 APAC

9.4.1 CHINA

9.4.1.1 Increasing penetration of Chinese players in the smart speaker industry

9.4.2 JAPAN

9.4.2.1 Huge demand for consumer electronics has boosted the demand for smart speakers

9.4.3 SOUTH KOREA

9.4.3.1 Continued innovation across different Korean AI assistant platforms

9.4.4 INDIA

9.4.4.1 Increasing Internet penetration and consumer spending power will likely drive the market

9.4.5 REST OF APAC

9.5 REST OF THE WORLD

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Increasing penetration of smart devices in the Middle Eastern countries is expected to fuel the demand for smart speakers in the region

9.5.2 SOUTH AMERICA

9.5.2.1 Smart home and consumer applications will propel the growth of smart speakers in South America

10 COMPETITIVE LANDSCAPE (Page No. - 91)

10.1 INTRODUCTION

10.2 SMART SPEAKER MARKET RANKING ANALYSIS

10.3 COMPETITIVE SCENARIO

10.3.1 PRODUCT LAUNCHES AND NEW PRODUCT DEVELOPMENTS

10.3.2 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

10.3.3 EXPANSIONS

10.4 COMPETITIVE LEADERSHIP MAPPING

10.4.1 VISIONARY LEADERS

10.4.2 INNOVATORS

10.4.3 DYNAMIC DIFFERENTIATORS

10.4.4 EMERGING COMPANIES

11 COMPANY PROFILES (Page No. - 97)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1.1 AMAZON

11.1.2 ALPHABET

11.1.3 BAIDU

11.1.4 ALIBABA

11.1.5 XIAOMI

11.1.6 HARMAN INTERNATIONAL

11.1.7 APPLE

11.1.8 SONOS

11.1.9 BOSE

11.1.10 LENOVO

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 FACEBOOK

11.2.2 SAMSUNG

11.2.3 SONY

11.2.4 ONKYO CORPORATION

11.2.5 SK TELECOM

11.2.6 LG ELECTRONICS

11.2.7 PANASONIC

11.2.8 ALTEC LANSING

11.2.9 LIBRATONE

11.2.10 MOBVOI

12 APPENDIX (Page No. - 128)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

LIST OF TABLES (74 TABLES)

TABLE 1 SMART SPEAKER MARKET, BY INTELLIGENT VIRTUAL ASSISTANT, 2017–2025 (USD MILLION)

TABLE 2 MARKET, BY INTELLIGENT VIRTUAL ASSISTANT, 2017–2025 (MILLION UNITS)

TABLE 3 MARKET FOR ALEXA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 4 MARKET FOR ALEXA, BY APPLICATION, 2017–2025 (MILLION UNITS)

TABLE 5 MARKET FOR GOOGLE ASSISTANT, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 6 MARKET FOR GOOGLE ASSISTANT, BY APPLICATION, 2017–2025 (MILLION UNITS)

TABLE 7 MARKET FOR SIRI, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 8 MARKET FOR SIRI, BY APPLICATION, 2017–2025 (MILLION UNITS)

TABLE 9 MARKET FOR DUEROS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 10 MARKET FOR DUEROS, BY APPLICATION, 2017–2025 (MILLION UNITS)

TABLE 11 MARKET FOR ALIGENIE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 12 MARKET FOR ALIGENIE, BY APPLICATION, 2017–2025 (MILLION UNITS)

TABLE 13 MARKET FOR XIAO AI, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 14 MARKET FOR XIAO AI, BY APPLICATION, 2017–2025 (MILLION UNITS)

TABLE 15 MARKET FOR OTHERS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 16 MARKET FOR OTHERS, BY APPLICATION, 2017–2025 (MILLION UNITS)

TABLE 17 MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 18 MARKET FOR HARDWARE, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 19 MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 20 MARKET, BY APPLICATION, 2017–2025 (MILLION UNITS)

TABLE 21 MARKET FOR SMART HOME, BY REGION, 2017–2025 (USD MILLION)

TABLE 22 MARKET FOR SMART HOME, BY INTELLIGENT VIRTUAL ASSISTANT, 2017–2025 (USD MILLION)

TABLE 23 MARKET FOR SMART HOME, BY INTELLIGENT VIRTUAL ASSISTANT, 2017–2025 (MILLION UNITS)

TABLE 24 MARKET FOR CONSUMER, BY REGION, 2017–2025 (USD MILLION)

TABLE 25 MARKET FOR CONSUMER, BY INTELLIGENT VIRTUAL ASSISTANT, 2017–2025 (USD MILLION)

TABLE 26 MARKET FOR CONSUMER, BY INTELLIGENT VIRTUAL ASSISTANT, 2017–2025 (MILLION UNITS)

TABLE 27 MARKET FOR SMART OFFICE, BY REGION, 2017–2025 (USD MILLION)

TABLE 28 MARKET FOR SMART OFFICE, BY INTELLIGENT VIRTUAL ASSISTANT, 2017–2025 (USD MILLION)

TABLE 29 MARKET FOR SMART OFFICE, BY INTELLIGENT VIRTUAL ASSISTANT, 2017–2025 (MILLION UNITS)

TABLE 30 MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2025 (USD MILLION)

TABLE 31 MARKET FOR OTHER APPLICATIONS, BY INTELLIGENT VIRTUAL ASSISTANT, 2017–2025 (USD MILLION)

TABLE 32 MARKET FOR OTHER APPLICATIONS, BY INTELLIGENT VIRTUAL ASSISTANT, 2017–2025 (MILLION UNITS)

TABLE 33 MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: SMART SPEAKER MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET FOR SMART HOME, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET FOR CONSUMER, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET FOR SMART OFFICE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 40 US: SMART SPEAKER MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 41 CANADA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 42 MEXICO: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 43 EUROPE: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 44 EUROPE: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 45 EUROPE: MARKET FOR SMART HOME, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 46 EUROPE: MARKET FOR CONSUMER, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 47 EUROPE: MARKET FOR SMART OFFICE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 48 EUROPE: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 49 UK: SMART SPEAKER MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 50 GERMANY: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 51 FRANCE: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 52 REST OF EUROPE: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 53 APAC: SMART SPEAKER MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 54 APAC: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 55 APAC: MARKET FOR SMART HOME, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 56 APAC: MARKET FOR CONSUMER, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 57 APAC: MARKET FOR SMART OFFICE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 58 APAC: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 59 CHINA: SMART SPEAKER MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 60 JAPAN: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 61 SOUTH KOREA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 62 INDIA: SMART SPEAKER MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 63 REST OF APAC: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 64 ROW: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 65 ROW: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 66 ROW: MARKET FOR SMART HOME, BY REGION, 2017–2025 (USD MILLION)

TABLE 67 ROW: SMART SPEAKER MARKET FOR CONSUMER, BY REGION, 2017–2025 (USD MILLION)

TABLE 68 ROW: MARKET FOR SMART OFFICE, BY REGION, 2017–2025 (USD MILLION)

TABLE 69 ROW: MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2025 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 71 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 72 PRODUCT LAUNCHES AND NEW PRODUCT DEVELOPMENTS (2018–2020)

TABLE 73 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS (2018–2020)

TABLE 74 EXPANSIONS (2018–2020)

LIST OF FIGURES (34 FIGURES)

FIGURE 1 SMART SPEAKER MARKET: RESEARCH DESIGN

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 4 DATA TRIANGULATION

FIGURE 5 GLOBAL SMART SPEAKER MARKET BETWEEN 2017 AND 2025

FIGURE 6 MARKET FOR ALEXA EXPECTED TO REGISTER THE LARGEST SHIPMENT DURING THE FORECAST PERIOD

FIGURE 7 SMART HOME APPLICATION TO HOLD THE LARGEST MARKET SIZE FOR SMART SPEAKER BY 2025

FIGURE 8 MARKET FOR SOFTWARE TO GROW AT A HIGHER CAGR BETWEEN 2020 AND 2025

FIGURE 9 NORTH AMERICA TO HOLD THE LARGEST SHARE OF THE SMART SPEAKER MARKET IN 2020

FIGURE 10 INCREASE IN THE NUMBER OF SMART HOMES DRIVES THE SMART SPEAKER MARKET

FIGURE 11 SMART HOME TO HOLD THE LARGEST MARKET SIZE FOR SMART SPEAKER FOR ALEXA BY 2025

FIGURE 12 NORTH AMERICA TO HOLD THE LARGEST SHARE OF THE SMART SPEAKER MARKET FOR CONSUMER APPLICATION BETWEEN 2020 AND 2025

FIGURE 13 GOOGLE ASSISTANT TO HOLD THE LARGEST MARKET SIZE BETWEEN 2020 AND 2025

FIGURE 14 SPEAKER DRIVER TO HOLD THE LARGEST MARKET SIZE FOR SMART SPEAKER FOR HARDWARE BETWEEN 2020 AND 2025

FIGURE 15 CHINA HELD THE LARGEST MARKET SHARE FOR SMART SPEAKER IN APAC IN 2019

FIGURE 16 GROWING DEMAND FOR IOT AND AI TECHNOLOGIES IN VARIOUS APPLICATIONS DRIVES THE SMART SPEAKER MARKET GROWTH

FIGURE 17 INSTALLATION OF CONNECTED DEVICES IN SMART HOMES WITHIN SMART CITIES

FIGURE 18 CONCEPTUAL FRAMEWORK ON CONSUMER ACCEPTANCE OF NEW TECHNOLOGIES

FIGURE 19 VALUE CHAIN: SMART SPEAKER MARKET, 2019

FIGURE 20 GEOGRAPHIC SNAPSHOT OF THE SMART SPEAKER MARKET (CAGR, 2020-2025)

FIGURE 21 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 22 EUROPE: MARKET SNAPSHOT

FIGURE 23 APAC: MARKET SNAPSHOT

FIGURE 24 PRODUCT LAUNCHES ARE THE KEY STRATEGIES ADOPTED BY PLAYERS IN THE MARKET (2018–2020)

FIGURE 25 RANKING OF TOP 5 PLAYERS IN THE SMART SPEAKER MARKET (2019)

FIGURE 26 SMART SPEAKER MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 27 AMAZON: COMPANY SNAPSHOT

FIGURE 28 ALPHABET: COMPANY SNAPSHOT

FIGURE 29 BAIDU: COMPANY SNAPSHOT

FIGURE 30 ALIBABA: COMPANY SNAPSHOT

FIGURE 31 XIAOMI: COMPANY SNAPSHOT

FIGURE 32 APPLE: COMPANY SNAPSHOT

FIGURE 33 SONOS: COMPANY SNAPSHOT

FIGURE 34 LENOVO: COMPANY SNAPSHOT

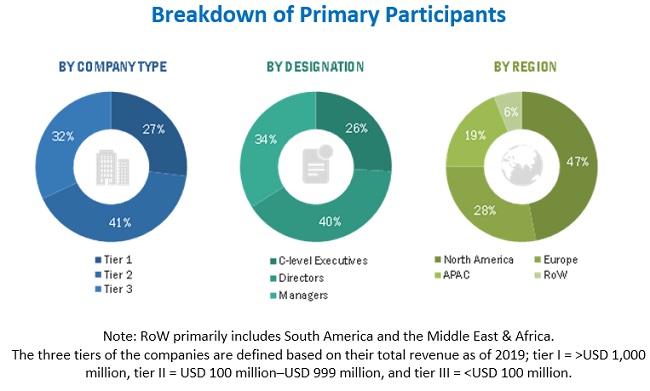

This study involved four major activities for estimating the current market size of the smart speaker market. Exhaustive secondary research was conducted to collect information on the market, as well as its peer and parent markets. The next step involved the validation of these findings, assumptions, and sizing with industry experts across the value chain, i.e., through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. These secondary sources include the Wireless Speaker and Audio Association (WiSA), the Consumer Technology Associations (CTA), Smart Homes & Building Association (SH&BA), journals, press releases and financials of companies, white papers and certified publications, and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information important for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the smart speaker market. After the complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information, as well as verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the smart speaker market and other dependent submarkets listed in this report.

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global smart speaker market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends related to different verticals, identified from both demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

The following are the major objectives of the study:

- To define, describe, and forecast the overall smart speaker market, in terms of value and volume, segmented on the basis of intelligent virtual assistants and applications

- To define, describe, and forecast the overall smart speaker market, in terms of value, segmented on the basis of components

- To forecast the market size for various segments with regard to four main regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the smart speaker market

- To provide the value chain analysis pertaining to the smart speaker market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the overall smart speaker market for stakeholders by identifying the high-growth segments

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies, and provide details of the competitive landscape for the smart speaker market leaders

- To analyze competitive developments such as contracts, mergers and acquisitions, product developments, and research and development (R&D) in the overall smart speaker market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for the smart speaker market report:

- Market size for 2022 and 2024 for all the covered segments

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Smart Speaker Market