Soft Tissue Repair Market by Product (Mesh/Tissue patch, Allograft, Xenograft, Suture Anchor, Interference Screws, Laparoscopic Instruments), Application (Hernia, Dural, Orthopedic, Skin, Dental, Vaginal, Breast augmentation) - Global Forecast to 2027

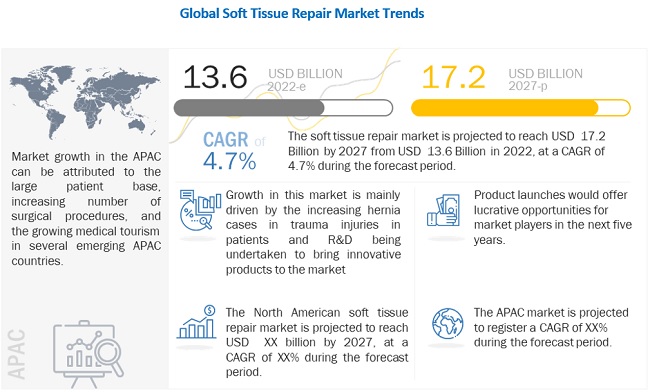

The global soft tissue repair market in terms of revenue was estimated to be worth $13.6 billion in 2022 and is poised to reach $17.2 billion by 2027, growing at a CAGR of 4.7% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in this market is mainly driven by the growing incidence of sports injuries, the increasing age of the population and the obesity rate, a strong focus on R&D leading to the launch of technologically advanced products, etc. But the uncomplimentary reimbursement scenario for soft tissue repair products is one of the key factors restraining the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Soft Tissue Repair Market Dynamics

Driver: increasing ageing population and obesity rate

Age-related physiological changes and metabolic inefficiencies often result in chronic diseases such as cystic fibrosis, hepatitis, cardiovascular disorders, and cancer. The elderly are more susceptible to various soft tissue injuries. For example, according to a register study from the United Kingdom, the prevalence of hernia increased with age, from 5% in the age group 25 to 34 years, through 10% in the age group 35 to 44 years, 18% in the age group 45 to 54 years, 24% in the age group 55 to 64 years, 31% in the age group 65 to 74 years, and 45% among men aged 75 and over. According to an article published in the Advances in Orthopedic Surgery journal, more than 40% of the population aged 60 years and older suffers from a rotator cuff tear.

In 2020, there will be 900 million people aged 65 and up worldwide. Women outlive men on average, so they make up the majority of the elderly, particularly at advanced ages. Over the next three decades, the number of older people worldwide is projected to more than double, reaching over 2 billion in 2050. All regions will see an increase in the size of the older population between 2020 and 2050. Globally, the share of the population aged 65 or over is expected to increase from 9.3 percent in 2020 to around 16.0 percent in 2050.

As per the FDA, more than one million hernia repairs are performed each year in the U.S. Approximately 800,000 are to repair inguinal hernias, and the rest are for other types of hernias. Similar trends are observed in other developed and developing countries as well. Thus, the increasing ageing population, coupled with rising disposable income and greater per capita healthcare expenditure, is expected to drive the demand for soft tissue repair surgeries in the forecast period of 2022–2025.

growing incidence of sports injuries

Globally, there is increasing awareness about the benefits of sports and physical activities on health. This has increased the popularity of sports among the youth. Due to this, the number of people participating in various sports has also increased significantly over the years. For instance, according to the National Basketball League of the United States, in 2020, the number of participants (aged six years and older) in basketball will amount to approximately 24.23 million.

These sports are also becoming popular in Asian countries such as China, Korea, India, and the Eastern Bloc countries. According to the annual High School Athletics Participation Survey conducted by the National Federation of State High School Associations (NFHS), the number of participants in high school sports increased for the 25th consecutive year in 2020–2021.

Research by the Sports Medicine Research Institute shows a significant rise in soft tissue injuries in a younger generation involved in athletic activities. Sports and many recreational activities for children can lead to a number of accidents and soft tissue injuries, as well as more serious injuries such as fractures. With the increasing sports participation across the globe, the number of sports-related soft tissue injuries is estimated to increase, which will drive the market.

According to the American Academy of Orthopaedic Surgeons (AAOS), an estimated 200,000 anterior cruciate ligament (ACL) injuries are reported annually in the U.S., with around 100,000 ACL reconstructions performed each year. According to papers published by the IEEE Journal of Biomedical and Health Informatics, the number of Americans suffering from ACL injury disease and knee joint osteoarthritis is estimated to reach 60 million by 2025. This significant increase in soft tissue injuries is expected to drive the market for soft tissue repair in the next decade.

A strong emphasis on R&D results in the release of technologically advanced products.

Over the last few decades, there has been a steady increase in R&D investments, particularly among established players. This has led to the development of soft tissue repair products for various applications. Smith & Nephew invested approximately USD 492 million in R&D in fiscal 2020, a 15.3% increase over fiscal 2019. Similarly, Baxter International spent approximately USD 521 million on R&D.

Regulatory bodies in several countries have approved various products, such as grafts and adhesion barriers, for use in a number of medical applications. A rising number of products are also getting approved for additional indications, which is increasing the application and use of these products and also helping companies enter additional markets with their existing products.

In September 2019, Medtronic launched several new procedural solutions, including Fibercel Viable Bone Matrix, to reinforce its product portfolio for spine surgeries.

increasing volume of surgeries and growing prevalence of severe trauma injuries

Over the years, there has been a significant rise in the number of surgical procedures across the globe. According to 2019 WHO estimations, approximately 235 million major surgical procedures are undertaken worldwide every year. This is attributed to the growing prevalence of obesity and other lifestyle diseases, the rising geriatric population, the increasing prevalence of orthopaedic conditions, and the increasing incidence of spinal injuries and sports-related injuries.

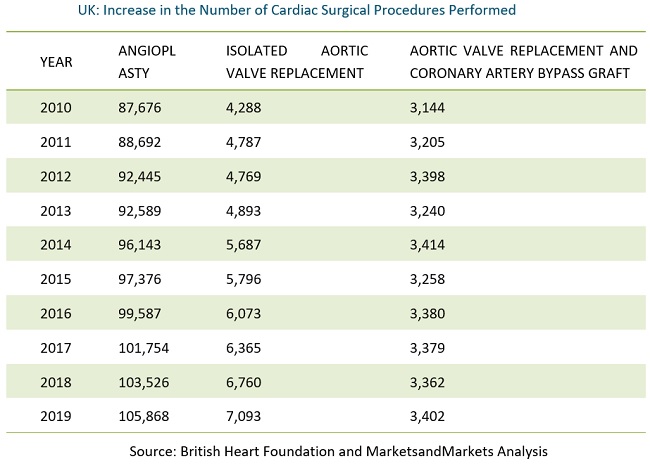

According to the Heart and Circulatory Disease Statistics 2019 from the British Heart Foundation (UK), there has been a significant increase in the number of cardiac surgical procedures such as angioplasty and aortic valve replacement in the UK over the last decade, and this trend is expected to continue in the coming years.

To know about the assumptions considered for the study, download the pdf brochure

Soft tissue repair products are finding substantial application in severe trauma injuries, including traumatic brain injuries (TBIs), spinal cord injuries, spine fractures, collapsed lungs, and subarachnoid hemorrhage. According to the Centers for Disease Control and Prevention (CDC), in 2019, TBIs accounted for about 61,000 injury-related deaths in the US, which is about 166 deaths due to TBIs every day. The growing prevalence of trauma injuries such as TBIs and injuries caused by falls and accidents is expected to increase the number of trauma surgeries performed across the globe. This is a key indicator of market growth during the forecast period.

Soft tissue repair products such as tissue, grafts, and suture anchors play a key role in cosmetic surgeries and reconstructive plastic surgeries. The American Society of Plastic Surgeons (ASPS) released its annual plastic surgery procedural statistics, reporting that 1.8 million surgical cosmetic procedures and 15.9 million minimally invasive cosmetic procedures were performed in the US in 2020; this represented an increase of 2% and 1% over the procedures conducted in 2017, respectively. In addition, 5.8 million reconstructive procedures were performed in the US during the same period.

Accident and trauma cases and sports injuries are among the major factors increasing the volume of surgeries performed across the globe. According to the WHO global status report (2020), there is a growth in the global number of accidents and trauma cases. About 1.35 million people die each year due to accidents, and about 20 to 50 million sustain non-fatal injuries due to road crashes.

Hands, upper extremities, and legs are the most vulnerable body parts to sports injuries. According to the facts and statistics for sports injuries provided by the National Safety Council (NSC, US), in 2020, the incidence of sports injuries across sports activities such as martial arts, boxing, and skateboarding increased by 3.7% from 2007 to 2020 in the US. The rising incidence of sports injuries is increasing the number of orthopaedic and reconstructive surgeries performed across the globe. This is expected to drive the growth of dependent markets, including the markets for tissue patches and mesh.

Restraint: unfavourable reimbursement scenario

The unfavourable reimbursement scenario in most countries across the globe is a major factor restricting the growth of the market. According to the Centers for Medicare & Medicaid Services (CMS), there have been a number of changes in payment policies and rates for physicians and non-physician practitioners with regard to services paid under the Medicare Physician Fee Schedule in 2020. CMS has issued a five-year review of work relative value units (RVUs) for orthopaedic procedures. The total RVU includes the following three components: the work RVU, which captures the time and effort required by the physician to perform the procedure; the practise expense RVU, which captures the cost in terms of staff labor, equipment, supplies, and rent; and the malpractice RVU, which captures a portion of the malpractice cost.

As a result of the CMS review, overall procedural reimbursements from Medicare have decreased. In 2019, RVUs for orthopaedic surgery decreased by about 1%. Any further decrease in Medicare reimbursements is expected to have a negative impact on the growth of the market in the coming years.

In addition to this, from 2011 to 2021, the national inflation rate was 16.3%. Unadjusted reimbursement rates for open and laparoscopic inguinal hernia repairs increased by 6.5% and 7.2%, respectively. There was an increase in unadjusted reimbursement for open appendectomies of 5.1% and 6.1% for laparoscopic procedures. Unadjusted reimbursement for open cholecystectomies increased by 4.4% but decreased by 6.8% for laparoscopic. When adjusted to 2021 values, reimbursement for all six operations decreased. Laparoscopic and open cholecystectomies experienced the largest decreases (19.8% and 10.2%, respectively).

The high price of soft tissue repair products and the rising cost of surgical procedures

The high cost, coupled with the unfavourable reimbursement scenario for these products in several countries, makes them unaffordable for a large section of the target patient population. Currently, the soft tissue market is extremely competitive in terms of pricing, owing to the high level of competition among existing players. Most of the products available in this market are priced at a premium. To reduce the growing costs of healthcare, governments in several countries across the globe have undertaken efforts to redesign their respective healthcare reimbursement systems. For instance, the US government has planned to reduce Medicare spending by USD 716 billion from 2012 to 2022. This is being achieved by bringing about a 2% cut in the Critical Access Hospitals (CAH) Medicare payments. The reduction in such expenditures has negatively affected the overall quality of healthcare provided to patients. In addition, in 2018, the CMS cut payments by 0.4% (USD 80 million) for home healthcare agencies over the 2017 budget.

Due to the high cost, this further restricts the adoption of many soft tissue repair products. Also, the products currently available on the market are made of complicated reconstitutions with a poor shelf life. Hence, there is a growing need for low-priced products that are easy to handle and have a better shelf life.

Opportunity: Increasing adoption of soft tissue repair products in emerging markets

The penetration of soft tissue repair products is increasing across emerging countries in the Asia Pacific, Latin America, the Middle East, and Africa. In the coming years, countries such as China, India, and Brazil are expected to offer significant growth opportunities for players operating in the market. This is because the markets in these countries are characterised by a large patient base for target indications (such as cardiovascular, orthopedic, general/abdominal, and gynaecological disorders), rising health awareness, growing healthcare expenditure, rising medical tourism, and rapidly developing healthcare infrastructure. For instance, cardiovascular diseases are currently the leading cause of mortality in India. Heart disease and stroke will account for approximately 25% of deaths in India by 2020, accounting for approximately 80% of the healthcare burden.

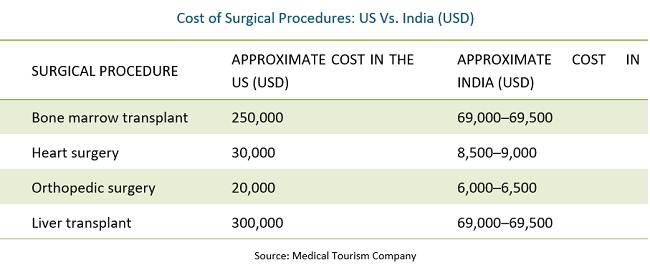

Over the last few decades, countries such as India and Malaysia have emerged as hubs for medical tourism. This is because the cost of medical procedures in these emerging countries is significantly lower in comparison to developed countries such as the US, Germany, France, and the UK. Also, the presence of skilled surgeons and the availability of well-equipped surgical care facilities across private hospital chains are driving the number of medical tourists travelling to these countries for treatment.

Government agencies in several Asia-Pacific countries are undertaking initiatives to support their respective healthcare systems. Owing to the healthcare reforms in China and the 13th Five-year Plan, about 1.35 billion people participated in the basic medical insurance program, and about 95% of Chinese citizens were insured. Similarly, according to 2020 statistics from the World Bank, healthcare spending in Latin America increased to about 7.93% of total GDP in 2019 from about 6.53% of total GDP in 2002. Such developments have further opened up the market across emerging countries. As a result, a number of players operating in the global market are focusing on capturing a greater share in emerging markets. With the growing market potential in the APAC region, many leading players in the biosurgery market are making significant investments in emerging APAC countries.

Similarly, countries such as Saudi Arabia and the UAE are focusing on building healthcare facilities for primary care, the secondary hospital segment, and preventive and diagnostic care for their populations. Authorities in the UAE are also undertaking initiatives to convert the country into a medical tourism hub. This is expected to create various growth opportunities for stakeholders operating in the healthcare market in the Middle East.

The rising use of grouping materials for enhancing product efficacy

The performance of soft tissue repair products significantly depends on the type of biologics and materials used in their manufacturing. The use of new materials and agents is helping vendors overcome the limitations (related to biocompatibility, infection, and inflammation) of conventional products and launch products that outperform popular products in terms of biological response and effectiveness.

Several vendors are using the combination approach, which makes use of the best traits of two different materials in an attempt to provide better care. For instance, many vendors are offering polyester- and polytetrafluoroethylene-based combined meshes for use in hernia repair procedures. With the increasing success rate of combination materials and the benefits offered by the unique combination of materials, several companies are focusing on the development and launch of these products. For example, the Fibrin-PTH (KUR-113) product candidate is about to enter Phase 2a clinical trials in the US. The product is a drug-biological combination for use in spinal interbody fusion.

Such innovative approaches to material use have assisted vendors in improving product performance and reducing the length of patient stays across healthcare settings (following surgical procedures). As a result, soft tissue products made using combined biocompatible materials are gaining rapid adoption, thereby providing lucrative growth opportunities to market players.

Challenge: Stringent regulatory framework

The development of new soft tissue repair products requires significant investments, and new products generally take more than 7–8 years to gain marketing approval. For instance, in the US, the FDA has made it mandatory for soft tissue repair product manufacturers to obtain premarket approval (PMA) for their products before they are introduced in the market. For this, the product has to demonstrate proper clinical trial data, which has to be submitted along with the application for PMA. The cost and time required for a product to enter the clinical trial stage and then clear the clinical trials are very high, with very low chances of the product gaining approval. Also, the possibility of obtaining clinically significant data showing clinical trial clearance has been low for soft tissue repair products such as adhesion barriers, semi-synthetic sealants, and hemostatic agents. Soft tissue repair products are considered Class III products, owing to which they require strict adherence to regulatory guidelines. Hence, despite huge investments in research and development, the risk of failure is very high in the case of soft tissue repair products. This is a major factor limiting the development of novel soft tissue repair products on the market.

In the US, for specific applications such as in ophthalmology, urology, and neurology, approval requires preclinical and clinical data demonstrating safety and efficacy during surgical use. Thus, stringent regulations, the requirement of significant investments for clinical studies, and the uncertainty of approval during studies make the development and commercialization of soft tissue products a challenging task for vendors.

requirement of skilled personnel for the effective use of soft tissue repair products

Conventional products used in wound closure, such as sutures and staples, are increasingly being replaced by advanced biosurgery products. Though these products offer improved outcomes, they need skilled surgeons and physicians for their effective utilization. As the use of soft tissue repair products has different effects and contradictions, the application of these products is very complex. For instance, improper application of these products can lead to complications such as anastomotic leaks in patients.

Currently, the lack of skilled surgeons, both in developed and developing economies, is one of the major factors limiting the adoption of these products. For instance, the Association of American Medical Colleges (AAMC) projects a shortage of about 122,000 physicians by 2032 in the US. Of these, a shortage of 67,000 specialists and 23,000 surgeons is expected to occur by 2032. Similarly, the Health Resource and Services Administration (HRSA) projects a shortage of 5,080 orthopedic surgeons in the US by 2025.

The technology landscape and application areas of soft tissue repair products are changing rapidly, owing to technological advancements in this field. This necessitates physicians and other healthcare providers to acquire the necessary skills to apply advanced soft tissue repair products such as allograft, xenograft, and synthetic mesh. Therefore, surgeons and physicians in hospitals and clinics are reluctant to use advanced surgical products for wound closure.

Tissue pounded or mashed accounted for the largest share in the soft tissue repair industry by product type.

Based on product, the soft tissue repair market is segmented into tissue patches, mashes, and laproscopic intrument injectors. Tissue patches and mesh were responsible for 91.9% of the market in 2021. This product segment is projected to reach USD 15,892.3 million by 2027, up from USD 12,547.2 million in 2022, at a CAGR of 4.8% during the forecast period. The large share of this segment is attributed to the increasing use of synthetic mesh across different types of orthopaedic surgeries as it reduces surgical time.

Hernia repair accounted for the largest share in the soft tissue repair industry by application.

Based on application type, the soft tissue repair market is segmented into hernia repair, dural repair, vaginal sling procedures, skin repair, orthopaedic repair, dental repair, breast reconstruction repair, and other applications. Hernia repair is expected to account for the largest share of the market in 2021, accounting for 26.5% by application. The increasing incidence of hernia cases, sports injuries, and the growing prevalence of lifestyle disorders, such as arthritis, osteoporosis, and obesity (leading to orthopaedic problems), are some of the major factors responsible for the growth in the number of soft tissue repair surgeries performed globally.

The hospital segment accounted for the largest share in the soft tissue repair industry by end user.

Based on end users, the soft tissue repair market is segmented into hospitals, clinics, and other end users (ambulatory surgery centers, emergency care centers, burn care centers, and research institutes). In 2021, hospitals held the largest share of the market, accounting for 93.3% of the total. This is primarily attributed to the increasing number of surgeries taking place across the globe due to the rising geriatric population and the incidence of various diseases. Moreover, the increasing need to control blood loss and achieve efficient hemostasis and wound closure in trauma cases, injuries, or surgical procedures is leading to the increased adoption of soft tissue repair products by surgeons.

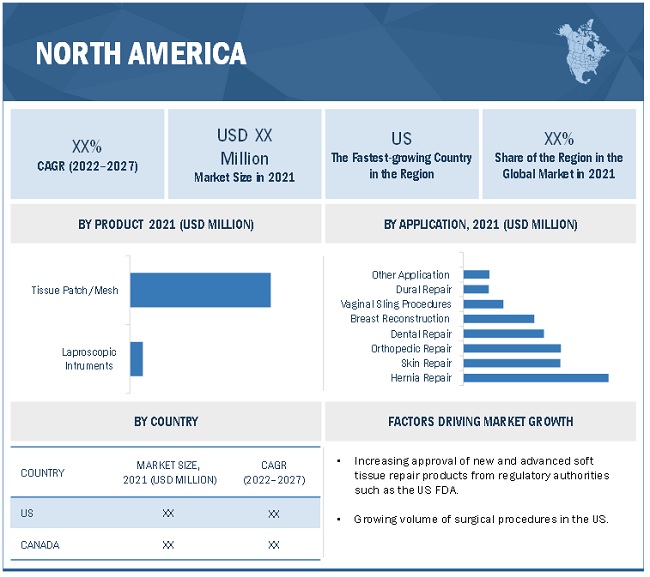

The North America segment accounted for the largest share in the soft tissue repair industry by region.

On the basis of region, the soft tissue repair market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2021, North America accounted for the largest share of 43.5% of the market, followed by Europe, the Asia Pacific, Latin America, and the Middle East and Africa. The large share of the North American market is attributed to the presence of an advanced healthcare system in the region, the high and growing number of surgical procedures, the higher adoption of advanced products, and the presence of several leading market players in the US.

Geographic Snapshot: Soft Tissue Repair Market

Prominent players in the soft tissue repair market include Becton, Dickinson and Company (US), Smith & Nephew Plc. (UK), Stryker Corporation (US), Arthrex, Inc. (US), Johnson & Johnson (US), Medtronic Plc. (IRELAND), LifeNet Health, Inc. (US), Zimmer Biomet (US), CryoLife, Inc. (US), Organogenesis Inc. (US), Baxter International, Inc. (US), ACell Inc. (US), Tissue Regenix Group Plc (UK) and Aroa Biosurgery Ltd. (NZ).

Scope of the Soft Tissue Repair Industry

|

Report Metrics |

Details |

|

Market Revenue in 2022 |

$13.6 billion |

|

Projected Revenue in 2027 |

$17.2 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 4.7% |

|

Market Driver |

Increasing aging population and obesity rate |

|

Market Opportunity |

Increasing adoption of soft tissue repair products in emerging markets |

The research report categorizes soft tissue repair market to forecast revenue and analyze trends in each of the following submarkets:

by Product

-

Tissue Patch/Mesh

- Synthetic Mesh

-

Biological Mesh

- Allograft

- Xenograft

-

Fixation Products

- Suture Anchors

- Interference Screws

- Other Fixation Devices

- Laparoscopic Instruments

By Application

- Hernia Repair

- Dural Repair

- Vaginal Sling Procedures

- Skin Repair

- Orthopedic

- Dental

- Breast Reconstruction Repair

- Other applications

By End user

- Hospitals

- Clinics

- Other end users

By Region

-

North America

- Us

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of europe

-

Asia pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin america

- Middle east & africa

Recent Developments of Soft Tissue Repair Industry

- In January 2021, Smith & Nephew acquires the Extremity Orthopaedics business of Integra LifeSciences Holdings Corporation.

- In December 2021, BD acquired Tissuemed, Ltd. (UK), This acquisition complements BD's core portfolio by adding an broadly applicable surgical sealant to a suite of BD biosurgery products already relied upon in the operating room.

- In January 2021, Relign was acquired by Zimmer Biomet to help fill an important gap in their sports medicine business.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the soft tissue repair market?

The soft tissue repair market boasts a total revenue value of $17.2 billion by 2027.

What is the estimated growth rate (CAGR) of the soft tissue repair market?

The global market for soft tissue repair has an estimated compound annual growth rate (CAGR) of 4.7% and a revenue size in the region of $13.6 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 SOFT TISSUE REPAIR INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 MARKETS COVERED – BY REGION

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH APPROACH

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Key data from primary sources

2.1.2.3 Breakdown of primaries

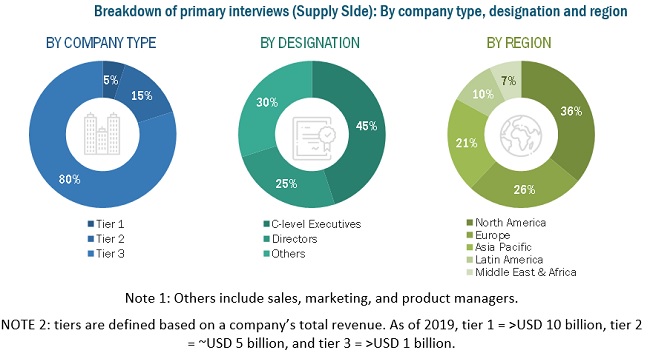

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

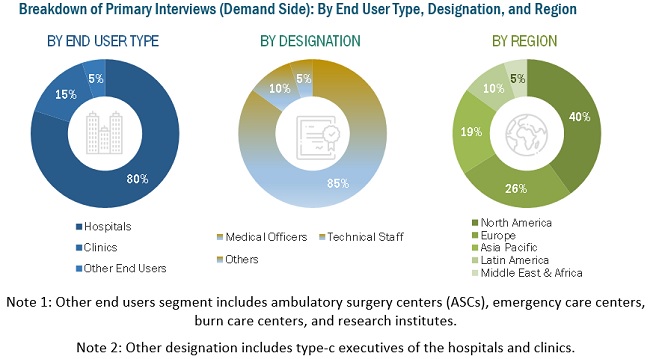

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 SOFT TISSUE REPAIR INDUSTRY SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2020)

FIGURE 5 SUPPLY-SIDE ANALYSIS: SOFT TISSUE REPAIR MARKET

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MARKET (2022–2027)

2.3 GROWTH FORECAST

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS OF THE MARKET (2021)

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.5 KEY INDUSTRY INSIGHTS

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

2.8 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 10 SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 SOFT TISSUE REPAIR INDUSTRY, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE SOFT TISSUE REPAIR INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 SOFT TISSUE REPAIR SYSTEM MARKET OVERVIEW

FIGURE 14 INCREASING HERNIA CASES AND TRAUMA INJURIES AND GROWING R&D DRIVE THE MARKET

4.2 REGIONAL MIX: SOFT TISSUE REPAIR MARKET

FIGURE 15 APAC TO REGISTER THE HIGHEST CAGR OF DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC: SOFT TISSUE REPAIR INDUSTRY, BY PRODUCT AND COUNTRY (2021)

FIGURE 16 TISSUE PATCHES/MESHES ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2021

4.4 GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 17 CHINA TO REGISTER THE HIGHEST REVENUE GROWTH DURING THE FORECAST PERIOD

4.5 DEVELOPED VS. DEVELOPING MARKETS

FIGURE 18 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

5 SOFT TISSUE REPAIR MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 SOFT TISSUE REPAIR INDUSTRY DYNAMICS: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Increasing aging population and obesity rate

5.2.1.2 Growing incidence of sports injuries

5.2.1.3 Strong focus on R&D

5.2.1.4 Increasing volume of surgeries and growing prevalence of severe trauma injuries

TABLE 2 UK: INCREASE IN THE NUMBER OF CARDIAC SURGICAL PROCEDURES PERFORMED

5.2.2 RESTRAINTS

5.2.2.1 Unfavorable reimbursement scenario

5.2.2.2 High product and procedure costs

5.2.3 OPPORTUNITIES

5.2.3.1 Growing adoption of advanced soft tissue repair products in emerging markets

TABLE 3 COST OF SURGICAL PROCEDURES: US VS. INDIA (USD)

5.2.3.2 Growing use of combination materials for enhancing product efficacy

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory framework

5.2.4.2 Need for skilled personnel

5.3 ASSESSMENT OF THE IMPACT OF COVID-19 ON ECONOMIC SCENARIO IN MARKET

5.4 ECOSYSTEM ANALYSIS

FIGURE 19 MARKET: ECOSYSTEM ANALYSIS

5.5 PRICING ANALYSIS

TABLE 4 AVERAGE SELLING PRICE FOR SOFT TISSUE REPAIR PRODUCTS

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 20 SUPPLY CHAIN ANALYSIS (2021)

5.7 PATENT ANALYSIS

5.7.1 PATENT PUBLICATION TRENDS FOR MARKET

FIGURE 21 GLOBAL PATENT PUBLICATION TRENDS IN SOFT TISSUE REPAIR, 2016–2021

5.7.2 TOP APPLICANTS (COMPANIES) OF SOFT TISSUE REPAIR PATENTS

FIGURE 22 TOP COMPANIES THAT APPLIED FOR SOFT TISSUE REPAIR PRODUCT PATENTS, 2016–2021

5.7.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN THE MARKET

FIGURE 23 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR SOFT TISSUE REPAIR PATENTS, 2016–2021

5.8 VALUE CHAIN ANALYSIS

FIGURE 24 MARKET: VALUE CHAIN ANALYSIS (2021)

5.9 TECHNOLOGY ANALYSIS

5.10 KEY CONFERENCES & EVENTS IN 2022–2023

5.11 REGULATORY LANDSCAPE

TABLE 5 REGULATORY STANDARDS/APPROVALS REQUIRED FOR SOFT TISSUE REPAIR PRODUCTS, BY COUNTRY/REGION

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT FROM NEW ENTRANTS

5.12.2 COMPETITIVE RIVALRY

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 BARGAINING POWER OF SUPPLIERS

5.12.5 THREAT FROM SUBSTITUTES

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.13.2 BUYING CRITERIA

FIGURE 26 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 8 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

6 SOFT TISSUE REPAIR MARKET, BY PRODUCT (Page No. - 73)

6.1 INTRODUCTION

TABLE 9 SOFT TISSUE REPAIR INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 TISSUE PATCHES/MESHES

TABLE 10 MARKET FOR TISSUE PATCHES/MESHES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 11 MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

6.2.1 SYNTHETIC MESHES

6.2.1.1 Growing popularity is attributed to the availability of raw materials, lack of infectious disease transmission, cost-effectiveness

TABLE 12 MARKET FOR SYNTHETIC MESHES, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2 BIOLOGICAL MESHES

TABLE 13 MARKET FOR BIOLOGICAL MESHES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 14 MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

6.2.2.1 Allografts

6.2.2.1.1 Biocompatibility and superior aesthetic results drive the use of allografts

TABLE 15 MARKET FOR ALLOGRAFTS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.2 Xenografts

6.2.2.2.1 Xenografts are more viable than allografts due to availability and size ranges

TABLE 16 MARKET FOR XENOGRAFTS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3 FIXATION PRODUCTS

TABLE 17 MARKET FOR FIXATION PRODUCTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 18 MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

6.2.3.1 Suture anchors

6.2.3.1.1 Growing injury incidence and need for surgery drive demand for suture anchors

TABLE 19 MARKET FOR SUTURE ANCHORS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3.2 Interference screws

6.2.3.2.1 Availability of advanced biodegradable screws and development of biocomposites drives the market growth

TABLE 20 MARKET FOR INTERFERENCE SCREWS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3.3 Other fixation products

TABLE 21 MARKET FOR OTHER FIXATION PRODUCTS, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 LAPAROSCOPIC INSTRUMENTS

6.3.1 QUICK RECOVERY, LOW PAIN & INFECTION RATES DRIVE DEMAND FOR LAPAROSCOPIC SURGERY AND ASSOCIATED INSTRUMENTS

TABLE 22 MARKET FOR LAPAROSCOPIC INSTRUMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

7 SOFT TISSUE REPAIR MARKET, BY APPLICATION (Page No. - 86)

7.1 INTRODUCTION

TABLE 23 SOFT TISSUE REPAIR INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 HERNIA REPAIR

7.2.1 HERNIA REPAIR ACCOUNTS FOR THE LARGEST SHARE OF THE MARKET

TABLE 24 MARKET FOR HERNIA REPAIR, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 SKIN REPAIR

7.3.1 INCREASING CASES OF CHRONIC WOUNDS, DIABETIC ULCERS, AND BURNS CONTRIBUTE TO GROWTH OF SKIN REPAIR MARKET

TABLE 25 MARKET FOR SKIN REPAIR, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 ORTHOPEDIC REPAIR

7.4.1 INCREASING NUMBER OF SPORTS INJURIES DRIVES ORTHOPEDIC REPAIR MARKET

TABLE 26 MARKET FOR ORTHOPEDIC REPAIR, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 DENTAL REPAIR

7.5.1 RISING DEMAND FOR PREVENTIVE AND COSMETIC DENTAL PROCEDURES DRIVES THE DENTAL REPAIR MARKET

TABLE 27 MARKET FOR DENTAL REPAIR, BY COUNTRY, 2020–2027 (USD MILLION)

7.6 BREAST RECONSTRUCTION

7.6.1 RISING BREAST CANCER PREVALENCE SUPPORTS MARKET GROWTH

TABLE 28 MARKET FOR BREAST RECONSTRUCTION, BY COUNTRY, 2020–2027 (USD MILLION)

7.7 DURAL REPAIR

7.7.1 RISING PREVALENCE OF NEUROVASCULAR DISORDERS AND AWARENESS DRIVES THE DURAL MARKET

TABLE 29 SOFT TISSUE REPAIR INDUSTRY FOR DURAL REPAIR, BY COUNTRY, 2020–2027 (USD MILLION)

7.8 VAGINAL SLING PROCEDURES

7.8.1 DEMAND FOR VAGINAL SLING PROCEDURES BOLSTERED BY GROWING CASES OF STRESS-INDUCED URINARY INCONTINENCE (SUI) IN WOMEN

TABLE 30 MARKET FOR VAGINAL SLING PROCEDURES, BY COUNTRY, 2020–2027 (USD MILLION)

7.9 OTHER APPLICATIONS

TABLE 31 MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8 SOFT TISSUE REPAIR MARKET, BY END USER (Page No. - 96)

8.1 INTRODUCTION

TABLE 32 SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

8.2 HOSPITALS

8.2.1 HOSPITALS ARE THE LARGEST END USERS OF SOFT TISSUE REPAIR PRODUCTS

TABLE 33 MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 CLINICS

8.3.1 QUICKER CONSULTATION SERVICES AND MINIMAL PATIENT STAYS ARE ADVANTAGES OFFERED BY CLINICS OVER HOSPITALS

TABLE 34 MARKET FOR CLINICS, BY COUNTRY, 2020–2027(USD MILLION)

8.4 OTHER END USERS

TABLE 35 MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

9 SOFT TISSUE REPAIR MARKET, BY REGION (Page No. - 101)

9.1 INTRODUCTION

FIGURE 27 INDIA AND CHINA TO REGISTER HIGHEST GROWTH RATES IN THE SOFT TISSUE REPAIR INDUSTRY

TABLE 36 SOFT TISSUE REPAIR INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: SOFT TISSUE REPAIR MARKET SNAPSHOT

TABLE 37 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Presence of prominent market players and high per capita income supports market growth in the US

TABLE 44 US: MACROECONOMIC INDICATORS

TABLE 45 US: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 46 US: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 47 US: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 48 US: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 49 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 50 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rising healthcare expenditure and favorable public and private funding supports market growth

TABLE 51 CANADA: MACROECONOMIC INDICATORS

TABLE 52 CANADA: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 53 CANADA: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 CANADA: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 CANADA: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 56 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 57 CANADA: SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

FIGURE 29 EUROPE: SOFT TISSUE REPAIR MARKET SNAPSHOT

TABLE 58 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 59 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 60 EUROPE: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 EUROPE: SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany holds the largest share of the European market

TABLE 65 GERMANY: MACROECONOMIC INDICATORS

TABLE 66 GERMANY: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 67 GERMANY: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 GERMANY: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 GERMANY: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 70 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Presence of a well-established healthcare system and growing geriatric population to boost the market growth

TABLE 72 FRANCE: MACROECONOMIC INDICATORS

TABLE 73 FRANCE: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 74 FRANCE: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 FRANCE: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 FRANCE: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 78 FRANCE: SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.3 UK

9.3.3.1 Growing volume of hernia repair surgeries and cardiovascular surgeries in the UK stimulating market growth

TABLE 79 UK: MACROECONOMIC INDICATORS

TABLE 80 UK: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 81 UK: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 UK: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 UK: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 85 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increasing volume of surgeries to drive the demand for soft tissue repair products in the country

TABLE 86 ITALY: MACROECONOMIC INDICATORS

TABLE 87 ITALY: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 88 ITALY: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 ITALY: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 90 ITALY: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 92 ITALY: SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Growing healthcare budget and rising efforts for boosting the local manufacturing of medical products to drive market growth

TABLE 93 SPAIN: MACROECONOMIC INDICATORS

TABLE 94 SPAIN: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 95 SPAIN: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 SPAIN: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 SPAIN: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 99 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 100 ROE: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 101 ROE: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 ROE: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 ROE: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 ROE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 105 ROE: SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: SOFT TISSUE REPAIR MARKET SNAPSHOT

TABLE 106 APAC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 107 APAC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 108 APAC: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 APAC: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 APAC: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 APAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 112 APAC: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Strong healthcare system and rising geriatric population to support market growth in Japan

TABLE 113 JAPAN: MACROECONOMIC INDICATORS

TABLE 114 JAPAN: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 115 JAPAN: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 JAPAN: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 JAPAN: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 119 JAPAN: SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Growing number of hospitals and healthcare policy reforms stimulating market growth

TABLE 120 CHINA: MACROECONOMIC INDICATORS

TABLE 121 CHINA: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 122 CHINA: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 CHINA: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 CHINA: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 126 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Rising healthcare awareness and favorable government support to stimulate market growth in India

TABLE 127 INDIA: MACROECONOMIC INDICATORS

TABLE 128 INDIA: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 129 INDIA: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 INDIA: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 INDIA: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 133 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 134 ROAPAC: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 135 ROAPAC: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 ROAPAC: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 ROAPAC: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 138 ROAPAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 139 ROAPAC: SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 LOW-COST SURGERIES ATTRACT MEDICAL TOURISTS TO LATIN AMERICA

TABLE 140 LATIN AMERICA: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 141 LATIN AMERICA: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 142 LATIN AMERICA: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 143 LATIN AMERICA: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 145 LATIN AMERICA: SOFT TISSUE REPAIR INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 MEA IS THE SMALLEST REGIONAL MARKET FOR BIOSURGERY PRODUCTS

TABLE 146 MEA: SOFT TISSUE REPAIR MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 147 MEA: MARKET FOR TISSUE PATCHES/MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 MEA: MARKET FOR BIOLOGICAL MESHES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 149 MEA: MARKET FOR FIXATION PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 MEA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 151 MEA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 153)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 31 REVENUE ANALYSIS OF THE TOP PLAYERS IN THE SOFT TISSUE REPAIR MARKET

10.4 MARKET SHARE ANALYSIS

FIGURE 32 SOFT TISSUE REPAIR MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 PERVASIVE PLAYERS

10.5.3 EMERGING LEADERS

10.5.4 PARTICIPANTS

FIGURE 33 SOFT TISSUE REPAIR MARKET: COMPANY EVALUATION MATRIX, 2021

10.6 COMPETITIVE LEADERSHIP MAPPING FOR SMES & START-UPS

10.6.1 PROGRESSIVE COMPANIES

10.6.2 DYNAMIC COMPANIES

10.6.3 STARTING BLOCKS

10.6.4 RESPONSIVE COMPANIES

FIGURE 34 SOFT TISSUE REPAIR MARKET: COMPANY EVALUATION MATRIX FOR SMES & START-UP

10.7 COMPETITIVE BENCHMARKING

10.7.1 OVERALL COMPANY FOOTPRINT

TABLE 152 OVERALL COMPANY FOOTPRINT (25 COMPANIES)

TABLE 153 COMPANY FOOTPRINT: BY PRODUCT (25 COMPANIES)

TABLE 154 COMPANY FOOTPRINT: BY APPLICATION (25 COMPANIES)

TABLE 155 COMPANY FOOTPRINT: BY REGION (25 COMPANIES)

10.8 COMPETITIVE SCENARIO

10.8.1 DEALS

TABLE 156 DEALS

10.8.2 OTHER DEVELOPMENTS

TABLE 157 OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 167)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1 KEY PLAYERS

11.1.1 ARTHREX INC.

TABLE 158 ARTHREX INC.: BUSINESS OVERVIEW

11.1.2 SMITH & NEPHEW PLC

TABLE 159 SMITH & NEPHEW PLC: BUSINESS OVERVIEW

FIGURE 35 SMITH & NEPHEW PLC: COMPANY SNAPSHOT (2020)

11.1.3 JOHNSON & JOHNSON

TABLE 160 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 36 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2020)

11.1.4 BECTON, DICKINSON & COMPANY

TABLE 161 BECTON, DICKINSON & COMPANY: BUSINESS OVERVIEW

FIGURE 37 BECTON, DICKINSON & COMPANY: COMPANY SNAPSHOT (2020)

11.1.5 STRYKER CORPORATION

TABLE 162 STRYKER CORPORATION: BUSINESS OVERVIEW

FIGURE 38 STRYKER CORPORATION: COMPANY SNAPSHOT (2020)

11.1.6 MEDTRONIC PLC.

TABLE 163 MEDTRONIC PLC.: BUSINESS OVERVIEW

FIGURE 39 MEDTRONIC PLC.: COMPANY SNAPSHOT (2020)

11.1.7 ZIMMER BIOMET

TABLE 164 ZIMMER BIOMET: BUSINESS OVERVIEW

FIGURE 40 ZIMMER BIOMET: COMPANY SNAPSHOT (2020)

11.1.8 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

TABLE 165 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 41 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT (2020)

11.1.9 CRYOLIFE INC.

TABLE 166 CRYOLIFE INC.: BUSINESS OVERVIEW

FIGURE 42 CRYOLIFE INC.: COMPANY SNAPSHOT (2020)

11.1.10 ORGANOGENESIS INC.

TABLE 167 ORGANOGENESIS INC.: BUSINESS OVERVIEW

FIGURE 43 ORGANOGENESIS INC.: COMPANY SNAPSHOT (2020)

11.2 OTHER PLAYERS

11.2.1 LIFENET HEALTH INC.

TABLE 168 LIFENET HEALTH INC.: BUSINESS OVERVIEW

11.2.2 BAXTER INTERNATIONAL, INC.

TABLE 169 BAXTER INTERNATIONAL, INC.: BUSINESS OVERVIEW

FIGURE 44 BAXTER INTERNATIONAL: COMPANY SNAPSHOT (2020)

11.2.3 TISSUE REGENIX GROUP PLC

TABLE 170 TISSUE REGENIX GROUP PLC: BUSINESS OVERVIEW

FIGURE 45 TISSUE REGENIX GROUP PLC: COMPANY SNAPSHOT (2020)

11.2.4 CONMED CORPORATION

TABLE 171 CONMED CORPORATION: BUSINESS OVERVIEW

FIGURE 46 CONMED CORPORATION: COMPANY SNAPSHOT (2020)

11.2.5 MERIL LIFE SCIENCES PVT. LTD.

TABLE 172 MERIL LIFE SCIENCES PVT. LTD.: BUSINESS OVERVIEW

11.2.6 RTI SURGICAL

TABLE 173 RTI SURGICAL: BUSINESS OVERVIEW

11.2.7 SAMYANG HOLDINGS CORPORATION

TABLE 174 SAMYANG HOLDINGS CORPORATION: BUSINESS OVERVIEW

11.2.8 AROA BIOSURGERY LTD.

TABLE 175 AROA BIOSURGERY LTD.: BUSINESS OVERVIEW

11.2.9 ACERA SURGICAL INC.

TABLE 176 ACERA SURGICAL INC.: BUSINESS OVERVIEW

11.2.10 ORTHOCELL LTD.

TABLE 177 ORTHOCELL LTD.: BUSINESS OVERVIEW

11.2.11 ACELL INC.

TABLE 178 ACELL INC.: BUSINESS OVERVIEW

11.2.12 BIOCER ENTWICKLUNGS-GMBH

TABLE 179 BIOCER ENTWICKLUNGS-GMBH: BUSINESS OVERVIEW

11.2.13 ISTO BIOLOGICS

TABLE 180 ISTO BIOLOGICS: BUSINESS OVERVIEW

11.2.14 BETATECH MEDICAL

TABLE 181 BETATECH MEDICAL: BUSINESS OVERVIEW

11.2.15 MIMEDX

TABLE 182 MIMEDX: BUSINESS OVERVIEW

FIGURE 47 MIMEDX: COMPANY SNAPSHOT (2020)

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 222)

12.1 INDUSTRY INSIGHTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major approaches in estimating the current soft tissue repair market size. Extensive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved widespread secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the market. It was also used to obtain important information about key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the market. Primary sources from the demand side include personnel from hospitals, hospital staff and C-level executives.

Market Size Estimation

The total size of the soft tissue repair market was arrived at after data triangulation from four different approaches, as mentioned below.

Bottom-up Approach: Revenues of individual companies were gathered from public sources and databases. Shares of the soft tissue businesses of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the business unit was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach and strength. Individual shares or revenue estimates were validated through expert interviews.

Country level Analysis: The size of the market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of soft tissue repair products in the overall market was obtained from secondary data and validated by primary participants to arrive at the total market. Primary participants further validated the numbers.

Primary Interviews: As a part of the primary research process, individual respondent insights on the market size and growth were taken during the interview (regional and global, as applicable). All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall soft tissue repair market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Approach to derive the market size and estimate market growth

The market rankings for leading players were ascertained after a detailed assessment of their revenues from the soft tissue repair business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts.

Objectives of the Study

- To define, describe, analyze, and forecast the soft tissue repair market by product, application, end user, and region

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To strategically profile key players in the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as product launches, expansions, acquisitions, partnerships, and agreements, in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Further segmentation of individual product segments by application and end user

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific soft tissue repair market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe soft tissue repair market into Belgium, Russia, the Netherlands, Switzerland, and others

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Soft Tissue Repair Market

Which are the key factors driving the growth of the Global Soft Tissue Repair market?

Which segment, based on product type, accounted for the highest demand in Soft Tissue Repair Market?

What are the key factors hampering the growth of the Soft Tissue Repair Market?