Supply Chain Analytics Market Component, Software (Supplier Performance Analytics, Demand Analysis & Forecasting, and Spend & Procurement Analytics), Service, Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2027

Supply Chain Analytics - Key Market Insights

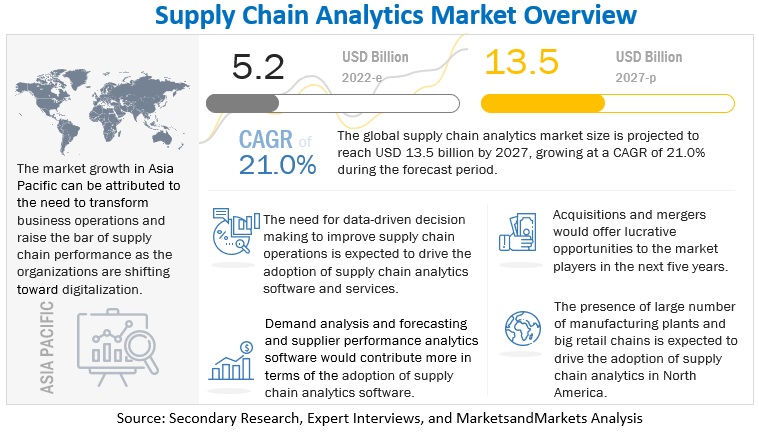

The global Supply Chain Analytics Market size was reasonably estimated to be approximately $5.2 billion in 2022 and is poised to generate revenue over $13.5 billion by the end of 2027, projecting a CAGR of around 21.0% from 2022 to 2027.

SME initiatives in the area are focused on cloud services, which would speed up artificial intelligence and business analytics. Cloud will play a crucial role in enabling new platforms, services, and facilities that governments and businesses want to enable as digitalization occurs throughout the area. The supply chain analytics market is segmented based on components, applications, deployment modes, organization sizes, verticals, and regions.

To know about the assumptions considered for the study, Request for Free Sample Report

Supply Chain Analytics Market Growth Dynamics

Driver: Rising adoption of Big Data technologies

Organizations are continuously collecting significantly more data because of the expansion of the Internet of Things (IoT), social media, and multimedia, which has led to a prodigious flow of data. Data generated by robots and humans is growing at a rate 10 times faster than traditional business data. Additionally, it is predicted that by 2027, there will be about USD 41 billion worth of gadgets that collect, analyze, and exchange this data on the market globally. Several enterprises and individuals have adopted big data analytics because of the rising demand for huge amounts of structured and unstructured datasets to be stored, processed, and analyzed. This adoption is projected to drive market growth.

Restraint: Rising cyber threats hindering adoption of SCA solutions

Companies are analyzing data sets to make strategic choices due to the growth of big data across all business sectors. But data scientists across the world are concerned about data set inaccuracies. Unethical behavior and the rise in cyber threats may cause organizations to worry and, to some extent, hinder the adoption of SCA solutions. Despite the seeming promise of integrating technology into supply chain processes, industry executives continue to worry about possible security and data breaches. Data sets that contain errors, inconsistencies, or out-of-date information run the risk of undermining the company's efforts to develop a robust supply chain analytics project. According to IBM, the US economy loses a staggering USD 3.1 trillion yearly because of poor data, which includes inconsistent, out-of-date, and irrelevant data. Salesforce said that 70% of the data in a company's customer relationship management system (CRM) is outdated or useless every year and that 91% of that data is incomplete. Data modeling that is predictive and prescriptive is a part of the analytics workflows. Predictive and prescriptive analytics predict and prescribe future outcomes by examining historical data, events, and behaviors to produce significant insights that are essential to businesses for future usage. The patterns discovered by analytics models could not be linked with future trends due to the unreliability of the data sets. As a result, data set errors are a significant market restriction.

Opportunity: Growing use of supply chain analytics on cloud

Organizations are leaning toward the use of cloud-based supply chain analytics solutions due to the rising complexity and the growing demand for real-time analysis of data throughout the supply chain ecosystem. The usage of cloud-based analytics solutions primarily aids in tracking and evaluating the total supply chain activities throughout the ecosystems of the forward and backward supply chains. Additionally, the cloud's advantages over other supply chain management system providers, including its affordability, agility, simplicity of use and integration, planning, and scalability, are stimulating them. The substantial installations or adjustments required for the global supply chain systems add to the secondary expenses for businesses and raise the investment costs. Organizations adopt end-to-end supply chain visibility, such as a cloud-based supply system for transportation management, in response to the growth in complexity costs. Enterprises can connect, interact, and communicate with clients, partners, and suppliers due to cloud based SCA solutions in logistics and transportation. Additionally, it aids businesses in creating a safe, dependable, and integrated transportation management system that provides customers with real-time information. These advantages support the expansion of cloud-based supply chain analytics solutions in a variety of industry sectors, including the production of electronic equipment, automobiles, food and beverage products, machinery, and industrial equipment, as well as pharmaceutical, the public sector, energy, and utilities.

Challenge: Reluctance to switch from manual methods to advanced reporting processes

The emergence of big data, smart cities, and IoT has rapidly boosted the volume of data and data sources. Company leaders now have the chance to obtain more pertinent customer- and supply chain operations-focused insights, as well as develop business plans based on them, due to this vast data creation. Companies are still having a difficult time implementing supply chain analytics systems, however, for a variety of reasons. Most of the data created is unstructured. The management of this unstructured data and converting it to a structured manner is a significant issue for organizations. To make the data more extrapolative for greater insights, it is crucial to obtain it in an organized way. According to research by Accenture, 97% of the executives polled found it difficult to integrate a supply chain program into their operations. The poll went on to point out that just 17% of respondents used supply chain technology in all their operations. It is also seen that firms are reluctant to switch from manual methods to advanced reporting and dashboard processes, which is why the adoption of supply chain analytics systems is not accelerating. Most businesses have a relaxed attitude toward new technologies and rely more on their gut than they do on cutting-edge technologies to make wise business decisions. Due to the conventional corporate culture of basing business choices on past company data and occurrences, most of the advanced analytics technologies are experiencing low adoption rates.

By component, Inventory analytics segment to register at the highest CAGR during the forecast period

The supply chain analytics market by component is segmented into: demand analysis and forecasting, supplier performance analytics, spend and procurement analytics, inventory analytics, and distribution analytics. The Inventory analytics to grow at a highest CAGR during the forecast period. The supply chain analytics market is witnessing increased growth opportunities in the Inventory analytics vertical.

Inventory management deals with raw materials, finished/for-sale commodities, MRO (maintenance, repair, and operations) goods, etc. The key challenge handled by inventory analytics is to precisely have the correct number of necessary products in the right place at precisely the right moment. Inventory analytics keeps a tab on various parameters that include Stock Control, Channel Performance Evaluation, Shelf Planning, and Reducing Inventory Levels.

SMEs segments to register to register at the highest CAGR during the forecast period

Due to its innovative business approach and competitive advantage, supply chain management (SCM) has seen a sharp increase in attention. Small and medium-sized businesses (SMEs) are lagging in understanding how an integrated supply chain generates notable changes in company processes and works with good outcomes in improved quality services, cost savings, and efficiency.

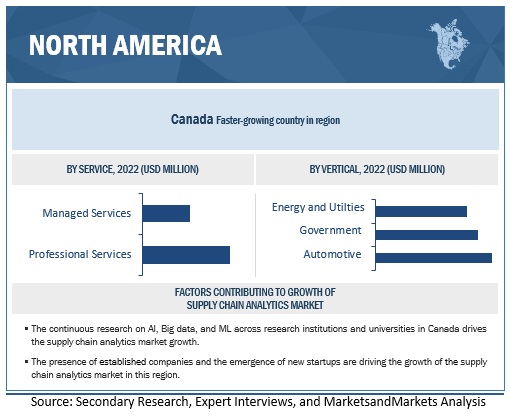

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the supply chain analytics market. One of the other key factors driving market development is the growing need for fast analytics solutions for monitoring and managing the regional distribution chain. The area also has a strong economy and has seen significant investments in infrastructure that is Al-enabled; as a result, established businesses as well as startups are placing increasing emphasis on creating cutting-edge analytical solutions that can serve a variety of industrial verticals. The major users of supply chain analytics systems in North America are business sectors including retail and e-commerce, healthcare, automotive, transportation & logistics, food & beverage, and manufacturing.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The supply chain analytics vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global supply chain analytics market include SAP (Germany), Oracle (US), IBM (US), SAS Institute (US), Software AG (Germany), MicroStrategy (US), Tableau (US), Qlik (US), TIBCO (US), Cloudera (US), Logility (US), Savi Technology (US), Infor (US), RELEX Solutions (Finland), TARGIT(Denmark), Voxware (US), The AnyLogic Company (US), Antuit (US), Axway (US), AIMMS (Netherlands), BRIDGEi2i (India), Domo (US), Datameer (US), 1010data(US), Rosslyn Analytics(UK), Manhattan Associates (US), Salesforce (US), Zebra Technologies (US), Dataiku (US), Intugine Technologies (India), Lumachain (Australia), Hum Industrial Technology (US), Pafaxe (UK), SS Supply Chain Solutions (US), and DataFactZ (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market Size Value in 2022 |

US$ 5.2 billion |

|

Revenue Forecast Size Value in 2027 |

US$ 13.5 billion |

|

Growth Rate |

21.0% CAGR from 2022 to 2027 |

|

Largest Market |

North America |

|

Key Market Drivers |

Rising adoption of Big Data technologies |

|

Key Market Opportunities |

Growing use of supply chain analytics on cloud |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, Service, Deployment Mode, Organization Size, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

SAP (Germany), Oracle (US), IBM (US), SAS Institute (US), Software AG (Germany), MicroStrategy (US), Tableau (US), Qlik (US), TIBCO (US), Cloudera (US), Logility (US), Savi Technology (US), Infor (US), RELEX Solutions (Finland), TARGIT(Denmark), Voxware (US), The AnyLogic Company (US), Antuit (US), Axway (US), AIMMS (Netherlands), BRIDGEi2i (India), Domo (US), Datameer (US), 1010data(US), Rosslyn Analytics(UK), Manhattan Associates (US), Salesforce (US), Zebra Technologies (US), Dataiku (US), Intugine Technologies (India), Lumachain (Australia), Hum Industrial Technology (US), Pafaxe (UK), SS Supply Chain Solutions (US), and DataFactZ (US). |

This research report categorizes the supply chain analytics market based on components, solutions, application, deployment mode, organization size, vertical, and regions.

By Component:

- Software

- Services

By Solutions:

- Includes Demand Analysis and Forecasting

- Supplier Performance Analytics

- Spend and Procurement Analytics

- Inventory Analytics

- Distribution Analytics

By Services:

- Professional Services

- Managed Services

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large Enterprises

- SMEs

By Vertical:

- Automotive

- Retail & Consumer Goods

- F&B Manufacturing

- Machinery & Industrial Equipment Manufacturing

- Pharmaceutical

- Government

- Energy & Utilities

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- ASEAN

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- Israel

- Turkey

- Qatar

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In January 2023, the partnership between project44 and SAS combines the largest global real-time transportation data repository with the most intelligent supply chain planning tools available, enabling accuracy and visibility in E2E global supply chains.

- In November 2022, IBM (introduced IBM Business Analytics Enterprise to assist businesses in rapidly making data-driven choices and dealing with unanticipated disruptions.

- In October 2022, Oracle announced a partnership with WellSpan Health to streamline operations and increase business visibility.

- In May 2021, by allowing the deployment of its TrendMiner analytics software on SAP's S/4HANA Cloud, Software AG expanded its partnership with SAP into the field of digital supply chains.

- In February 2021, to enhance product quality, Software AG and SAP have partnered to better surface supply chain management data.

Frequently Asked Questions (FAQ):

What is the projected market value of Supply Chain Analytics Market?

What is the estimated growth rate (CAGR) of the global Supply Chain Analytics Market?

What are the major key players in the global Supply Chain Analytics Market?

What are the major revenue pockets in the global Supply Chain Analytics Market currently?

Which are the key drivers supporting the Supply Chain Analytics Market growth?

Which are the key Opportunities supporting the Supply Chain Analytics Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

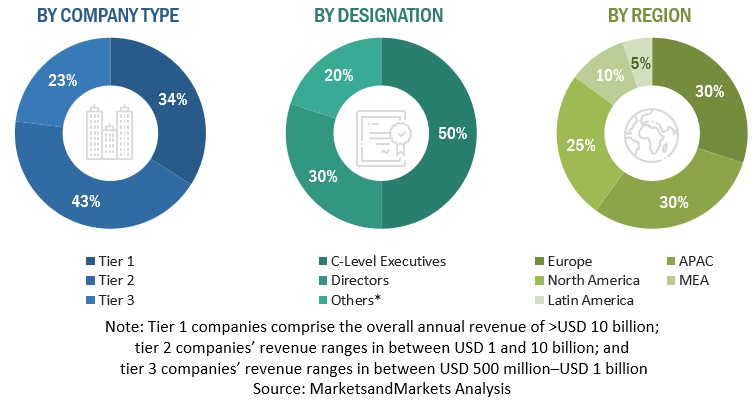

The research methodology for the global supply chain analytics market report involved the use of extensive secondary sources and directories, as well as various reputed opensource databases to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including the key opinion leaders, subject matter experts, high-level executives of various companies offering supply chain analytics software and services, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources.

The secondary research was mainly used to obtain the key information about the industry’s value chain, market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the supply chain analytics market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing supply chain analytics software; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both the top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the key information/insights throughout the report.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the supply chain analytics market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global supply chain analytics market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the supply chain analytics market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of software and services, deployment modes, organization size, and verticals. The aggregate of all the revenues of the companies was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of supply chain analytics software and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of supply chain analytics software and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on supply chain analytics solutions based on some of the key use cases. These factors for the supply chain analytics tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the supply chain analytics market based on software, service, deployment model, organization size, industry verticals, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market segments with respect to all the five major regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze the recent developments and their positioning related to the supply chain analytics market

- To analyze competitive developments, such as mergers and acquisitions, product developments, and research and development (R&D) activities, in the market

- To analyze the impact of recession across all the regions across the supply chain analytics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American supply chain analytics market

- Further breakup of the European supply chain analytics market

- Further breakup of the Asia Pacific supply chain analytics market

- Further breakup of the Latin American supply chain analytics market

- Further breakup of the Middle East & Africa supply chain analytics market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Supply Chain Analytics Market