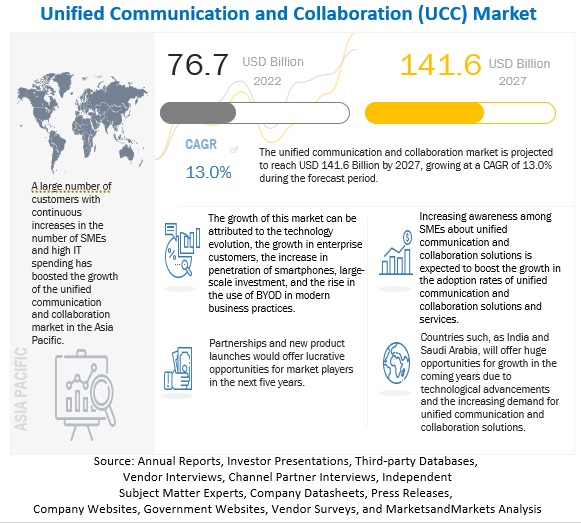

Unified Communication and Collaboration (UCC) Market by Component (Type (UCaaS (Conferencing, Unified Messaging), IP Telephony, and Video Conferencing System)), Organization Size, Deployment Mode, Vertical and Region - Global Forecast to 2027

The global Unified Communication and Collaboration (UCC) Market size is expected to grow from USD 76.7 billion in 2022 to USD 141.6 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 13.0% during the forecast period. Unified communications solutions serve as cutting-edge technology to achieve seamless user experience and optimized enterprise communications, allowing individuals to collaborate effectively from any location and on any device. It enables businesses to promote cooperation and improved communication among a digital-era enterprise workforce that is spread globally. In addition to more conventional tools such as email and fax, a unified communications system helps deliver a unified user interface and experience across multiple real-time communication channels such as instant messaging, presence information, VoIP (voice over internet protocol), audio, video, and web conferencing, desktop sharing, and more.

To know about the assumptions considered for the study, Request for Free Sample Report

Recession impact on the UCC Market

Owing to the lockdown imposed by governments of several countries during the COVID-19 outbreak, organizations had to adopt work-from-home (WFH) models. These sudden changes have forced the organization to reconsider their work models and digitalization became a priority for organizations to keep their businesses up and running. The global UCC market is expected to grow with the adoption of BYOD and the rose in the WFH culture. However, the ongoing recession is expected to slow down the market growth during the forecast period. According to International Monetary Fund, in 2020 global GDP fell by 3% year-over-year; the downturn correlates to an expected decline in revenue, which impacts corporate spending across departments. More than half of CFOs expect revenue to decline up to 30%, such factors are expected to impact the adoption of UCC solutions across organizations during the forecast period.

Market Dynamics

Driver: Rise in demand for real-time and remote collaboration tools

Collaboration tools enable in seamless communication between employees which in turn improves the operational efficiency and productivity of the employees, thereby helping organizations to attain their business goals. This increase in demand indicates that understanding collaborative software and how it works is becoming increasingly important. Communication via voice is reducing in proportion to other tools, such as voice messages, chat, and conferencing. When voice is used, it is usually in conjunction with video. There are approximately six billion mobile subscribers worldwide, and the rate of adoption is increasing exponentially each year. It can be said that individuals can share and receive information from nearly any location with cellular reception, thus the trend toward mobility is increasing. The arrival of Long-Term Evolution (LTE) has also boosted the concept of mobility. Additionally, employees can communicate knowledge in a more participatory way by using video conferencing. This can promote teamwork throughout a specific firm and enhance employee communication. Further, business cloud service platforms are complicated to install and require a higher cost of ownership. Earlier, organizations had to appoint infrastructure teams to manage their cloud infrastructure on their servers. Hence, video conferencing enables organizations to reduce investments in building the infrastructure as it is taken care of by managed Services Providers (MSPs).

Restraint: Security concerns over the cloud-based deployment

The security of corporate data has become a key concern for several enterprises. Enterprises look at a secure, reliable connection from a hosted service provider and control access to enterprise networks to ensure the integrity of the network and the content that flows in and out of it. Enterprises are concerned about security, as most of the UC services are provided through the cloud and managed by third parties. The security of corporate data has become a key concern for several enterprises. Enterprises look at a secure, reliable connection from a hosted service provider and control access to enterprise networks to ensure the integrity of the network and the content that flows in and out of it. Enterprises are concerned about security, as most of the UC services are provided through the cloud and managed by third parties. The world's developing and underdeveloped countries continue to rely on antiquated telecom infrastructure that is unable to provide low latency and high-capacity connectivity. Implementing UCC solutions such as cloud services and video conferencing is exceedingly challenging without high-speed internet. Organizations in these nations, therefore, rely more on audio-based communication to avoid the annoyance of poor visual and unexpected disconnections. Compared to video communications, audio-based communication requires substantially less bandwidth and can therefore be supported by communication infrastructure with far lesser capacity. Additionally, organizations are restricted from using cloud services such as remote desktops and apps, leaving them to rely entirely on messaging and file-sharing programs, which makes remote working less enjoyable.

Opportunity: Rise in 5G to accelerate the adoption of UCC services

The rise of 5G technology has brought major changes to the cloud computing world. The low latency connectivity provided by 5G enables enterprises to provide smoother communications. The integration of 5G would lead to seamless file transfers, a smooth experience for cloud services, and high-quality and uninterrupted video conferencing solutions. Various data-intensive applications both individual and Business 2 Business (B2B) are emerging, such as AR, VR, and video applications. Industries, such as IT and telecom, retail, healthcare, automotive, media and entertainment, BFSI, and agriculture, have different types of video conferencing requirements, including high bandwidth, low power, ultra-low latency, and high speed. Business users demand high-performance connectivity on any device, anywhere, and on any device (via Wi-Fi or cellular networks). Additionally, wireless IoT devices are proliferating across numerous industries in business (manufacturing, healthcare, logistics, etc.). The IoT application wave has significantly altered the scale, volume, and security requirements for wireless networking. The information obtained through face-to-face and direct communication with various business departments, clients, distributors, suppliers, and customers helps organizations drive their businesses. Hence, organizations are spending more on the adoption of cloud services. Cloud conferencing, cloud infrastructure, and Business Intelligence (BI) software are expected to witness a rise in overall spending during the forecast period. Recently, the use of IoT in a particular healthcare application has gained massive popularity. In this application, IoT is used in a heart monitor device wherein the nurse or related attendee was notified of any critical or distressful condition of the heart through an automated medium. The integration of IoT in a heart monitor can help study the condition of a patient’s heart, by gathering necessary data and running it through a pre-processed algorithm.

Challenge: Internet bandwidth and technical glitch issues

The lack of strong communication tools significantly limits employee productivity. The noise during video or low-quality video can create misunderstandings or consume more time for employees. Several people are frustrated due to the bad quality of audio and video and other disturbances that occur during conferences. According to a Cisco global survey focused on the future of work, 98% of workers stated that they experienced frustration from distractions during video meetings when working from home. Two of the top five frustrations called out were related to background noise—either from other participants or their own side of the call. Several UCC solution providers are developing advanced noise-cancellation technologies. The majority of businesses prefer the traditional unified communication system due to its simplicity. Especially, large enterprises do not want to adopt UCC services as it is difficult for them to differentiate between the more traditional hosted and manage UCC platforms. The transition from traditional PBX communication to UCC will require the entire workforce to adopt the functionality faster to use the features to the full extent. Hence, this puts pressure on the IT department of a company and could, in turn, affect the timeline. It is difficult to make businesses realize the flexibility of unified communication solutions in terms of cost-saving and easy installation. The increased use of collaboration tools by businesses has raised the probability of malware and cyberattacks. Data breaches and web-based threats are typical security problems. It is a crucial problem that has to be fixed since there is no clear owner of the data produced through collaboration, which lessens any incentive to erase or archive the stored data. To secure the data created by messaging, file sharing, audio and video conferencing, cloud storage, and remote access solutions, businesses deploying unified communications solutions require installing external security solutions through security technology providers.

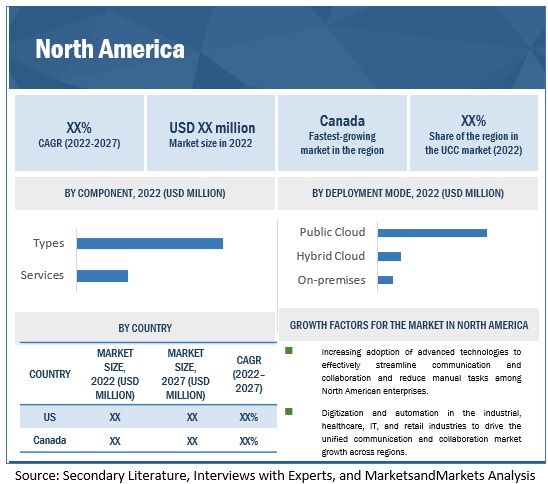

North America to account for the largest market size during the forecast period

The geographic analysis of the UCC market is segmented into regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In 2022, North America has captured most of the share, as the US and Canada are rapidly adopting UCC. North America has the presence of top vendors, including Zoom, Cisco, Oracle, Microsoft, Google, and Avaya Inc. The region is experiencing significant innovations in technology.

To know about the assumptions considered for the study, download the pdf brochure

As per organization size, large enterprises segment to hold the highest market size during the forecast period

The UCC market organization size segment is sub-segmented into SMEs and large enterprises. As per organization size, the large enterprises segment is expected to hold the highest market size during the forecast period. The UCC market is undergoing significant technological transitions, such as collaboration with social media, real-time solutions, and the usage of mobile devices, which are favorably welcomed and highly adopted by large organizations. Affordability and high economies of scale enable organizations to leverage the benefits of UCC. Hence, the UCC market size is relatively huge in large enterprises as compared to SMEs. UCC vendors help large enterprises with their special tools, such as unified messaging, conferencing, and meeting rooms, to maintain healthy communication among a large set of employees. Further, Large enterprises in verticals, such as BFSI, IT and telecom, retail and consumer goods, and healthcare, cannot afford to lose customers due to network issues. These enterprises, therefore, are opting to deploy cloud. Hence, organizations are expected to adopt on-premises, public cloud, and hybrid cloud deployments, as they have an increasing penetration in the UCC landscape and can help organizations serve their clients by delivering better service quality.

Key Market Players

Some of the major UCC vendors are Zoom (US), Cisco (US), Microsoft (US), Avaya Inc. (US), Fuze (US), Google (US), Goto (US), RingCentral (US), Verizon (US), BT (UK), Dialpad (US), Orange S.A. (France), StarBlue (Ireland), Windstream Holdings (US), Revation Systems (US), 8X8 Inc. (US), Vonage Holdings (US), Star2Star Communications (US), Zoho (India), NEC Corporation (Japan), Platronics (US), and Mitel (Canada).

Scope of the Report

|

Report Metrics |

Details |

| Market size available for years | 2017–2027 |

| Base year considered | 2022 |

| Forecast period | 2022–2027 |

| Forecast units | Million/Billion (USD) |

| Segments covered | Component (Type [UCaaS {Conferencing, Unified Messaging}, IP Telephony, and Video Conferencing System]), Organization Size, Deployment Mode, Vertical, and Region |

| Geographies covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Companies covered | Zoom (US), Cisco (US), Microsoft (US), Avaya Inc. (US), Fuze (US), Google (US), Goto (US), RingCentral (US), Verizon (US), BT (UK), Dialpad (US), Orange S.A. (France), StarBlue (Ireland), Windstream Holdings (US), Alcatel-Lucent Enterprise (France), Intrado Corporation (US), NTT Communications Corporation (Japan), Masergy Communications, Inc. All (US), Revation Systems (US), 8X8 Inc. (US), Vonage Holdings (US), Star2Star Communications (US), Zoho (India), NEC Corporation (Japan), Platronics (US), and Mitel (Canada). |

This research report categorizes the UCC market based on Components, Organization Sizes, Deployment Modes, Verticals, and Regions.

Based on the components:

- Types

- Services

Based on the Types:

-

UCaaS

- Telephony

- Unified Messaging

- Conferencing

- Collaboration Platforms and Applications

-

IP Telephony

- Hardware

- Software

-

Video Conferencing Systems

- Hardware

- Solutions

Based on the services:

- UC Managed Services

- Professional Services

Based on the Deployment Mode:

- On-premises

- Public Cloud

- Hybrid Cloud

Based on the Organization Size:

- Large Enterprises

- Small and Medium- Sized Enterprises (SMEs)

Based on the vertical:

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Healthcare

- Public Sector and Utilities

- Logistics and Transportation

- Travel and Hospitality

- Other Verticals (Education, Manufacturing and Media and Entertainment)

Based on regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Saudi Arabia

- UAE

- Rest of Middle East

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments:

- In August 2022, Microsoft enhanced the Teams application with several features, including Virtual visits and Electronic Healthcare Record (EHR) integration, secure messaging, and care coordination and collaboration to help healthcare organizations. These healthcare functionalities are part of the Microsoft Cloud for Healthcare.

- In August 2022, Avaya introduced new capabilities in its Avaya Spaces, the all-in-one video collaboration app for the digital workplace. The new capabilities include 61- a participant “concert” style HD video layout; enhanced video layouts with the flexibility to accommodate different meeting types; modernized collaboration control to accommodate various use cases; and intelligent moderation, including smart mute, host control of participant cameras, and microphones, and “raise hand” features for the effective management of sessions.

- In July 2021, Fuze launched a new solution for Recruiting Agencies and Corporate recruiting teams, Fuze for Recruiting, which allows calling, messaging, and SMS capabilities all from one central application. This solution empowers organizations to address the evolving needs of recruiting professionals by introducing two specific new bundles: Fuze for Recruiting Essentials and Fuze for Recruiting Contact Center.

- In June 2021, GoTo released new offerings in the Contact-Center-as-a-Service (CCaaS) space with a new outbound calling solution designed for sales organizations and expanded inbound capabilities. All of these contact center features are fully integrated into GoTo’s robust Unified-Communications-as-a-Service platform, GoToConnect.

- In June 2021, RingCentral released new enhancements to RingCentral Rooms. The enhancements, specific to its video meetings capabilities within RingCentral’s Message Video Phone offering and RingCentral Video, the company's video meetings solution with team messaging, will enable people to connect, communicate, and collaborate seamlessly.

Frequently Asked Questions (FAQ):

What are UCC?

According to GoTo, A group of services that are combined for business communications and collaboration comprises UCC. These services are offered via a single platform or as various products with a standardized user interface. Unified Communications include a wide range of real-time and non-real-time applications like voice, chat, text/SMS, presence monitoring, video conferencing, email, and fax. Unified Communications has become a marketing buzzword that is often used interchangeably with UC&C, UCaaS, and unified messaging.

According to Cisco, people collaborate in various ways. Additionally, companies make extensive use of a variety of collaboration tools, including voice calling over IP, presence and instant messaging, web and video conferencing, mobility, desktop sharing, and voice mail. Solutions for unified communications and collaboration (UC&C) enable the integration of various instruments with smooth user interfaces, enhancing teamwork. anywhere and on any gadget. They utilize APIs to interact with common business apps and combine real-time communication from your phone system and conference solutions along with texting and chat. UC solutions are available as on-premises software, partner-hosted solutions, or as a service (UCaaS) from cloud providers.

Which regions are early adopters of the UCC?

North America and Europe are at the initial stage of adoption of Cloud Computing.

Which are key verticals adopting UCC?

Key verticals adopting UCC solutions and services include: -

- BFSI

- IT & Telecom

- Public Sector & Utilities

- Retail & Consumer Goods

- Logistics and Transportation

- Travel and Hospitality

- Healthcare

- Other Verticals

Which are the key vendors exploring UCC?

Some of the major UCC market vendors are Zoom (US), Cisco (US), Microsoft (US), Avaya Inc. (US), Fuze (US), Google (US), Goto (US), RingCentral (US), Verizon (US), BT (UK), Dialpad (US), Orange S.A. (France), StarBlue (Ireland), Windstream Holdings (US), Revation Systems (US), 8X8 Inc. (US), Vonage Holdings (US), Star2Star Communications (US), Zoho (India), NEC Corporation (Japan), Platronics (US), and Mitel (Canada). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 1 UNIFIED COMMUNICATION AND COLLABORATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

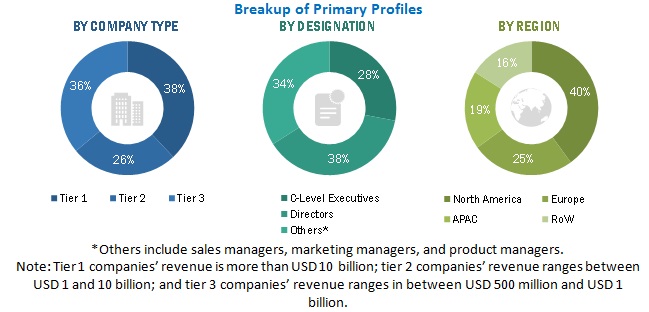

2.1.2.1 Breakup of primary profiles

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 UNIFIED COMMUNICATION AND COLLABORATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF UNIFIED COMMUNICATION AND COLLABORATION FROM VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY—BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF UCC VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM COMPONENT (1/2)

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 59)

FIGURE 10 UNIFIED COMMUNICATION AND COLLABORATION MARKET: GLOBAL SNAPSHOT

FIGURE 11 TOP-GROWING SEGMENTS IN MARKET

FIGURE 12 TYPES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 13 IP TELEPHONY SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 14 TELEPHONY SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 15 SOFTWARE SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 16 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 17 UNIFIED COMMUNICATION MANAGED SERVICES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 18 PUBLIC CLOUD SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 19 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 20 TOP VERTICALS IN MARKET, 2022–2027 (USD MILLION)

FIGURE 21 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 69)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN UNIFIED COMMUNICATION AND COLLABORATION MARKET

FIGURE 22 DRASTIC DEMOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE UNIFIED COMMUNICATION AND COLLABORATION GROWTH

4.2 MARKET, BY COMPONENT (2022 VS. 2027)

FIGURE 23 TYPES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY DEPLOYMENT MODE (2022 VS. 2027)

FIGURE 24 PUBLIC CLOUD SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY ORGANIZATION SIZE (2022 VS. 2027)

FIGURE 25 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY VERTICAL (2022 VS. 2027)

FIGURE 26 IT AND TELECOM VERTICAL TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.6 MARKET INVESTMENT SCENARIO

FIGURE 27 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 72)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: UNIFIED COMMUNICATION AND COLLABORATION MARKET

5.2.1 DRIVERS

5.2.1.1 Flexibility of unified communication and collaboration in WFH solutions during COVID-19 pandemic

5.2.1.2 Rise in demand for real-time and remote collaboration tools

5.2.1.3 Increasing demand for UCC from both large enterprises and SMEs

5.2.1.4 Growth in mobility and BYOD trends

5.2.1.5 High adoption of video conferencing tools

5.2.2 RESTRAINTS

5.2.2.1 Security concerns over cloud-based deployment

5.2.2.2 Issues of privacy and security

5.2.2.3 Network connectivity and infrastructure issues

5.2.3 OPPORTUNITIES

5.2.3.1 Rise of 5G for latest low-latency IoT applications

5.2.3.2 Rise in cloud-native enterprises

5.2.3.3 Growing adoption of IoT in UC to boost market

5.2.4 CHALLENGES

5.2.4.1 Internet bandwidth and technical glitches

5.2.4.2 Low readiness to move to modern UC solutions

5.3 CASE STUDY ANALYSIS

5.3.1 RINGCENTRAL DEPLOYED CLOUD COMMUNICATIONS SOLUTION TO GOOSEHEAD INSURANCE TO MANAGE BUSINESS

5.3.2 MITEL PROVIDED UNIFIED SYSTEM TO CARLSBERG BREWERIES TO SAVE COST AND IMPROVE EMPLOYEE EXPERIENCE

5.3.3 HUBSPOT DEPLOYED ZOOM’S VIDEO CONFERENCING SOLUTION FOR EFFICACY

5.3.4 WOODSIDE DEPLOYED CISCO’S WEBEX SOLUTION TO RETAIN BEST TALENT

5.4 ECOSYSTEM/MAPPING

FIGURE 29 ECOSYSTEM ANALYSIS: UNIFIED COMMUNICATION AND COLLABORATION MARKET

5.5 PATENT ANALYSIS

FIGURE 30 NUMBER OF PATENTS PUBLISHED, 2011–2021

FIGURE 31 TOP TEN PATENT APPLICANTS, 2021

TABLE 4 TOP PATENT OWNERS

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 32 SUPPLY CHAIN ANALYSIS: MARKET

5.7 PRICING ANALYSIS

5.7.1 INTRODUCTION

FIGURE 33 PRICES OFFERED BY KEY UNIFIED COMMUNICATION AND COLLABORATION SOLUTIONS PROVIDERS

5.8 TECHNOLOGY ANALYSIS

5.8.1 MACHINE LEARNING AND ARTIFICIAL INTELLIGENCE

5.8.2 FACIAL & VOICE RECOGNITION

5.8.3 CLOUD TECHNOLOGY

5.8.4 INTERNET OF THINGS

5.8.5 5G NETWORK

5.9 PORTER’S FIVE FORCES MODEL

FIGURE 34 UNIFIED COMMUNICATION AND COLLABORATION MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT FROM NEW ENTRANTS

5.9.2 THREAT FROM SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 TARIFF & REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

5.10.3 GENERAL DATA PROTECTION REGULATION

5.10.4 SEC RULE 17A-4

5.10.5 ISO/IEC 27001

5.10.6 SYSTEM AND ORGANIZATION CONTROLS 2 TYPE 2 COMPLIANCE

5.10.7 FINANCIAL INDUSTRY REGULATORY AUTHORITY

5.10.8 FREEDOM OF INFORMATION ACT

5.10.9 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.11 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 35 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

6 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY COMPONENT (Page No. - 96)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

FIGURE 36 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 10 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 11 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 TYPES

FIGURE 37 IP TELEPHONY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 12 MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 13 MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2.1 UCAAS

6.2.1.1 UCaaS is less expensive and provides more value than existing phone systems

FIGURE 38 COLLABORATION PLATFORM AND APPLICATIONS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 14 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY UCAAS, 2017–2021 (USD MILLION)

TABLE 15 MARKET, BY UCAAS, 2022–2027 (USD MILLION)

TABLE 16 UCAAS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 17 UCAAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.2 Telephony

6.2.1.2.1 International calls are less expensive while domestic long-distance calls are free

TABLE 18 TELEPHONY: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 19 TELEPHONY: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.3 Unified messaging

6.2.1.3.1 Quicker response time and flexibility of device independence

TABLE 20 UNIFIED MESSAGING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 UNIFIED MESSAGING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.4 Conferencing

6.2.1.4.1 Inclusion of powerful search features for multilingual and voice search

TABLE 22 CONFERENCING: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 CONFERENCING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.5 Collaboration platform and applications

6.2.1.5.1 Modern collaboration tools to help create dynamic workflows and team agility

TABLE 24 COLLABORATION PLATFORM AND APPLICATIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 COLLABORATION PLATFORM AND APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 IP TELEPHONY

6.2.2.1 IP telephony application and backend Internet connection to enable voice and data communication

FIGURE 39 SOFTWARE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 26 MARKET, BY IP TELEPHONY, 2017–2021 (USD MILLION)

TABLE 27 MARKET, BY IP TELEPHONY, 2022–2027 (USD MILLION)

TABLE 28 IP TELEPHONY: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 IP TELEPHONY: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2.2 Hardware

6.2.2.2.1 IP telephony hardware enables users to make calls over internet-enabled devices

TABLE 30 IP TELEPHONY, HARDWARE: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 IP TELEPHONY, HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2.3 Software

6.2.2.3.1 Easy-to-use interface with many built-in caller settings

TABLE 32 IP TELEPHONY, SOFTWARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 IP TELEPHONY, SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 VIDEO CONFERENCING SYSTEMS

6.2.3.1 Need to solve internet connectivity and speed issues

FIGURE 40 SOLUTIONS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 34 MARKET, BY VIDEO CONFERENCING SYSTEM, 2017–2021 (USD MILLION)

TABLE 35 BORATION MARKET, BY VIDEO CONFERENCING SYSTEM, 2022–2027 (USD MILLION)

TABLE 36 VIDEO CONFERENCING SYSTEMS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 VIDEO CONFERENCING SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3.2 Hardware

6.2.3.2.1 Enables team members to access all business documents and apps, driving higher efficiency, agility, and productivity

TABLE 38 VIDEO CONFERENCING SYSTEMS, HARDWARE: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 VIDEO CONFERENCING SYSTEMS, HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3.3 Solutions

6.2.3.3.1 Employees state that video conferencing helps with relationship-building inside and outside company

TABLE 40 VIDEO CONFERENCING SYSTEMS, SOLUTIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 VIDEO CONFERENCING SYSTEMS, SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 41 PROFESSIONAL SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 42 MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 43 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

6.3.1 UC MANAGED SERVICES

6.3.1.1 Resolves issues with onsite technical support

TABLE 44 UC MANAGED SERVICES: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 UC MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

6.3.2.1 Greater customer demands place ongoing pressure on businesses to maximize resource utilization and boost billable hours

TABLE 46 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY DEPLOYMENT MODE (Page No. - 117)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODES: MARKET DRIVERS

FIGURE 42 HYBRID CLOUD SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 48 MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 49 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 ON-PREMISES

7.2.1 ON-PREMISES APPLICATIONS MORE EXPENSIVE

TABLE 50 ON-PREMISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 PUBLIC CLOUD

7.3.1 PUBLIC CLOUD DEPLOYMENT MODEL OFFERS SCALABILITY, RELIABILITY, FLEXIBILITY, AND LOCATION-INDEPENDENCE SERVICES

TABLE 52 PUBLIC CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 PUBLIC CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 HYBRID CLOUD

7.4.1 HYBRID CLOUD USAGE TO RISE DUE TO INCREASING MICROSERVICE AND MANAGEMENT SERVICE DATA ENVIRONMENT

TABLE 54 HYBRID CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 55 HYBRID CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY ORGANIZATION SIZE (Page No. - 123)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZES: MARKET DRIVERS

FIGURE 43 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 56 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 57 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 LARGE ENTERPRISES NEED FUNCTIONAL PRODUCTIVITY GAINS TO GENERATE DEMAND FOR UNIFIED COMMUNICATION AND COLLABORATION SERVICES

TABLE 58 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 59 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 ADOPTION OF CLOUD TECHNOLOGIES ENABLES SMES TO AUTOMATE BUSINESS FORECASTS AND REDUCE RISK EXPOSURE

TABLE 60 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 61 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY VERTICAL (Page No. - 128)

9.1 INTRODUCTION

9.1.1 VERTICALS: MARKET DRIVERS

FIGURE 44 IT & TELECOM VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 62 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 63 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.2.1 ABILITY TO PROVIDE EXTENDED CUSTOMER ENGAGEMENT IN BANKING AND FINANCIAL INDUSTRY TO DRIVE DEMAND FOR UCC TECHNOLOGIES

TABLE 64 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 65 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 IT & TELECOM

9.3.1 PROVIDING FLEXIBILITY AND SCALABILITY FOR CORE BUSINESS TASKS

TABLE 66 IT & TELECOM: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 67 IT & TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 HEALTHCARE & LIFE SCIENCES

9.4.1 HELPS CONNECTING WITH PATIENTS IN DIFFERENT WAYS, INCLUDING VIDEO CONFERENCING AND AUDIO INTERACTIONS

TABLE 68 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 69 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 RETAIL & CONSUMER GOODS

9.5.1 ENABLES RETAILERS TO CONSOLIDATE AND CONTROL COSTS AS COMMUNICATIONS EXPENSES ROLL INTO ONE CLOUD PROVIDER

TABLE 70 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 71 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 PUBLIC SECTOR & UTILITIES

9.6.1 EASIER TO TRACK COMPLIANCE AND AUDIT INTERACTIONS IN UNIFIED ENVIRONMENT

TABLE 72 PUBLIC SECTOR & UTILITIES: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 73 PUBLIC SECTOR & UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 LOGISTICS & TRANSPORTATION

9.7.1 UC ENHANCES SHIPMENT AND DELIVERY NOTIFICATIONS TO FIELD SERVICE TRACKING, PRODUCTIVITY, AND CUSTOMER EXPERIENCE

TABLE 74 LOGISTICS & TRANSPORTATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 75 LOGISTICS & TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 TRAVEL & HOSPITALITY

9.8.1 EASIER TO MANAGE CUSTOMER QUERIES AND DEAL WITH REQUESTS

TABLE 76 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 77 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHER VERTICALS

TABLE 78 OTHER VERTICALS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 79 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY REGION (Page No. - 141)

10.1 INTRODUCTION

FIGURE 45 ASIA PACIFIC TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

TABLE 80 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 81 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: RECESSION IMPACT

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

TABLE 82 NORTH AMERICA: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY UCAAS, 2017–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY UCAAS, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY IP TELEPHONY, 2017–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY IP TELEPHONY, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY VIDEO CONFERENCING SYSTEM, 2017–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY VIDEO CONFERENCING SYSTEM, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.3 US

10.2.3.1 Availability of robust telecom and cloud infrastructure

TABLE 102 US: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 103 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.2.4 CANADA

10.2.4.1 Increased demand for video conferencing tools to support collaborative operations

TABLE 104 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 105 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: RECESSION IMPACT

TABLE 106 EUROPE: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY UCAAS, 2017–2021 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY UCAAS, 2022–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY IP TELEPHONY, 2017–2021 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY IP TELEPHONY, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY VIDEO CONFERENCING SYSTEM, 2017–2021 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY VIDEO CONFERENCING SYSTEM, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Growing adoption of cloud and AI technologies

TABLE 126 UK: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 127 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.4 GERMANY

10.3.4.1 Investment in advanced technologies, such as big data and AI, for robust unified communication and collaboration tools

TABLE 128 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 129 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.5 FRANCE

10.3.5.1 Cloud-based services from large IT corporations offer numerous opportunities for expansions

TABLE 130 FRANCE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 131 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 132 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 133 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: RECESSION IMPACT

FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 134 ASIA PACIFIC: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY UCAAS, 2017–2021 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY UCAAS, 2022–2027 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY IP TELEPHONY, 2017–2021 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY IP TELEPHONY, 2022–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY VIDEO CONFERENCING SYSTEM, 2017–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY VIDEO CONFERENCING SYSTEM, 2022–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.3 CHINA

10.4.3.1 Need to ensure data security in cloud platforms to boost demand

TABLE 154 CHINA: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 155 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.4 JAPAN

10.4.4.1 SMEs moving toward cloud adoption and huge R&D investments

TABLE 156 JAPAN: BORATION MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 157 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.5 AUSTRALIA AND NEW ZEALAND

10.4.5.1 Continuous upgrades of IT infrastructure and applications to help drive unified communication and collaboration services

TABLE 158 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 159 AUSTRALIA AND NEA ZEALAND: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.6 INDIA

10.4.6.1 Growing investments in new technologies to drive demand for unified communication and collaboration services

TABLE 160 INDIA: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 161 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

TABLE 162 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

TABLE 164 MIDDLE EAST & AFRICA: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY UCAAS, 2017–2021 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY UCAAS, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY IP TELEPHONY, 2017–2021 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY IP TELEPHONY, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY VIDEO CONFERENCING SYSTEM, 2017–2021 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY VIDEO CONFERENCING SYSTEM, 2022–2027 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 SAUDI ARABIA

10.5.3.1 Adoption of cloud services and cloud-based solutions due to increasing access to Internet

TABLE 184 SAUDI ARABIA: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 185 SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.4 UAE

10.5.4.1 Assurance of lower IT costs and scalability to help IT decision-makers move business-critical data to cloud infrastructure

TABLE 186 UAE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 187 UAE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 188 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 189 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: RECESSION IMPACT

TABLE 190 LATIN AMERICA: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY UCAAS, 2017–2021 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY UCAAS, 2022–2027 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY IP TELEPHONY, 2017–2021 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY IP TELEPHONY, 2022–2027 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY VIDEO CONFERENCING SYSTEM, 2017–2021 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET, BY VIDEO CONFERENCING SYSTEM, 2022–2027 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 201 LATIN AMERICA: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Growing complexity in cloud environment to drive implementation and spending on services

TABLE 210 BRAZIL: UNIFIED COMMUNICATION AND COLLABORATION MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 211 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.4 REST OF LATIN AMERICA

TABLE 212 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 213 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 193)

11.1 INTRODUCTION

FIGURE 48 MARKET EVALUATION FRAMEWORK

11.2 MARKET RANKING

FIGURE 49 MARKET RANKING IN 2021

11.3 MARKET SHARE OF TOP VENDORS

TABLE 214 UNIFIED COMMUNICATION AND COLLABORATION: DEGREE OF COMPETITION

FIGURE 50 UNIFIED COMMUNICATION AND COLLABORATION MARKET: VENDOR SHARE ANALYSIS

11.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 51 HISTORICAL REVENUE ANALYSIS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 52 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

TABLE 215 COMPANY SOLUTION FOOTPRINT

TABLE 216 COMPANY VERTICAL FOOTPRINT

TABLE 217 COMPANY REGION FOOTPRINT

TABLE 218 COMPANY FOOTPRINT

11.6 COMPETITIVE SCENARIO

TABLE 219 UNIFIED COMMUNICATION AND COLLABORATION MARKET: NEW LAUNCHES, 2019–2022

TABLE 220 MARKET: DEALS, 2022–2019

12 COMPANY PROFILES (Page No. - 216)

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weakness competitive threats) *

12.1 MAJOR PLAYERS

12.1.1 GOOGLE

TABLE 221 GOOGLE: BUSINESS OVERVIEW

FIGURE 53 GOOGLE: COMPANY SNAPSHOT

TABLE 222 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 223 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 224 GOOGLE: DEALS

12.1.2 ZOOM

TABLE 225 ZOOM: BUSINESS OVERVIEW

FIGURE 54 ZOOM: COMPANY SNAPSHOT

TABLE 226 ZOOM: SERVICES OFFERED

TABLE 227 ZOOM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 228 ZOOM: DEALS

12.1.3 CISCO

TABLE 229 CISCO: BUSINESS OVERVIEW

FIGURE 55 CISCO: COMPANY SNAPSHOT

TABLE 230 CISCO: SOLUTIONS OFFERED

TABLE 231 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 232 CISCO: DEALS

12.1.4 MICROSOFT

TABLE 233 MICROSOFT: BUSINESS OVERVIEW

FIGURE 56 MICROSOFT: COMPANY SNAPSHOT

TABLE 234 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 235 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 236 MICROSOFT: DEALS

12.1.5 AVAYA

TABLE 237 AVAYA: BUSINESS OVERVIEW

FIGURE 57 AVAYA: COMPANY SNAPSHOT

TABLE 238 AVAYA: SERVICES OFFERED

TABLE 239 AVAYA: PRODUCT LAUNCHES & ENHANCEMENT

TABLE 240 AVAYA: DEALS

12.1.6 FUZE

TABLE 241 FUZE: BUSINESS OVERVIEW

TABLE 242 FUZE: SERVICES OFFERED

TABLE 243 FUZE: PRODUCT LAUNCHES & ENHANCEMENT

TABLE 244 FUZE: DEALS

12.1.7 GOTO

TABLE 245 GOTO: BUSINESS OVERVIEW

TABLE 246 GOTO: SERVICES & SOLUTIONS OFFERED

TABLE 247 GOTO: SERVICE LAUNCHES & BUSINESS EXPANSIONS

TABLE 248 GOTO: DEALS

12.1.8 RINGCENTRAL

TABLE 249 RINGCENTRAL: BUSINESS OVERVIEW

FIGURE 58 RINGCENTRAL: COMPANY SNAPSHOT

TABLE 250 RINGCENTRAL: SOLUTIONS OFFERED

TABLE 251 RINGCENTRAL: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 252 RINGCENTRAL: DEALS

12.1.9 VERIZON

TABLE 253 VERIZON: BUSINESS OVERVIEW

FIGURE 59 VERIZON: COMPANY SNAPSHOT

TABLE 254 VERIZON: SOLUTIONS OFFERED

TABLE 255 VERIZON: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 256 VERIZON: DEALS

12.1.10 BT

TABLE 257 BT: BUSINESS OVERVIEW

FIGURE 60 BT: COMPANY SNAPSHOT

TABLE 258 BT: SOLUTIONS OFFERED

TABLE 259 BT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 260 BT: DEALS

12.2 OTHER PLAYERS

12.2.1 DIALPAD, INC.

12.2.2 ORANGE S.A.

12.2.3 STARBLUE

12.2.4 WINDSTREAM HOLDINGS

12.2.5 ALCATEL-LUCENT ENTERPRISE

12.2.6 INTRADO CORPORATION

12.2.7 NTT COMMUNICATIONS CORPORATION

12.2.8 MASERGY COMMUNICATIONS, INC.

12.2.9 REVATION SYSTEMS, INC.

12.2.10 8X8, INC.

12.2.11 VONAGE HOLDINGS

12.2.12 STAR2STAR COMMUNICATIONS

12.2.13 ZOHO CORPORATION PVT. LTD

12.2.14 NEC CORPORATION

12.2.15 PLANTRONICS (POLY)

12.2.16 MITEL

12.2.17 NEXTIVA

12.2.18 OOMA

12.3 STARTUPS/SME PLAYERS

12.3.1 STARLEAF

12.3.2 VOTACALL

12.3.3 PEXIP

12.3.4 TRUECONF

12.3.5 SNAPSOLVE

12.3.6 MELP APP

12.3.7 ROUTE MOBILE

12.3.8 SIMPPLR

12.3.9 AGORA

12.3.10 YUWEE

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weakness competitive threats might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 305)

13.1 INTRODUCTION

13.1.1 ADJACENT/RELATED MARKETS

13.1.2 LIMITATIONS

13.2 ENTERPRISE COLLABORATION MARKET

TABLE 261 ENTERPRISE COLLABORATION MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 262 ENTERPRISE COLLABORATION MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 263 IT AND TELECOMMUNICATIONS: ENTERPRISE COLLABORATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 264 IT AND TELECOMMUNICATIONS: ENTERPRISE COLLABORATION MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 265 BANKING, FINANCIAL SERVICES, AND INSURANCE: ENTERPRISE COLLABORATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 266 BANKING, FINANCIAL SERVICES, AND INSURANCE: ENTERPRISE COLLABORATION MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 267 PUBLIC SECTOR: ENTERPRISE COLLABORATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 268 PUBLIC SECTOR: ENTERPRISE COLLABORATION MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 269 HEALTHCARE AND LIFE SCIENCES: ENTERPRISE COLLABORATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 270 HEALTHCARE AND LIFE SCIENCES: ENTERPRISE COLLABORATION MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 271 EDUCATION: ENTERPRISE COLLABORATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 272 EDUCATION: ENTERPRISE COLLABORATION MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 273 ENERGY AND UTILITIES: ENTERPRISE COLLABORATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 274 ENERGY AND UTILITIES: ENTERPRISE COLLABORATION MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 275 RETAIL AND CONSUMER GOODS: ENTERPRISE COLLABORATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 276 RETAIL AND CONSUMER GOODS: ENTERPRISE COLLABORATION MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 277 MANUFACTURING: ENTERPRISE COLLABORATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 278 MANUFACTURING: ENTERPRISE COLLABORATION MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 279 TRAVEL AND HOSPITALITY: ENTERPRISE COLLABORATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 280 TRAVEL AND HOSPITALITY: ENTERPRISE COLLABORATION MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 281 OTHERS: ENTERPRISE COLLABORATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 282 OTHERS: ENTERPRISE COLLABORATION MARKET, BY REGION, 2021–2026 (USD MILLION)

14 APPENDIX (Page No. - 314)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the Unified Communication and Collaboration (UCC) market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering UCC was derived on the basis of the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was majorly used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from UCC vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, component, deployment, and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using UCC, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall UCC market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make the estimates and forecasts for the UCC market and other dependent submarkets, both top-down and bottom-up approaches were used. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of the other individual markets via percentage splits of the market segments.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in BFSI, IT and telecom, retail and consumer goods, healthcare, public sector and utilities, logistics and transportation, travel and hospitality, and other verticals. Other Verticals include education, media & entertainment, and manufacturing.

Report Objectives

- To describe and forecast the global unified communication and collaboration (UCC) market based on components (types and services), deployment modes, organization size, enterprises, and regions.

- To forecast the market size of regional segments: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze recession and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American unified communication and collaboration market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle East & Africa market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Unified Communication and Collaboration (UCC) Market