Urology Devices Market: Growth, Size, Share, and Trends

Urology Devices Market by Product (Dialysis, Laser, Lithotripsy, Robotic, Insufflators, Guidewires, Catheters, Stents, Implants), Application (Kidney Diseases, Cancer, Pelvic Organ Prolapse, BPH, Stones), End User and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

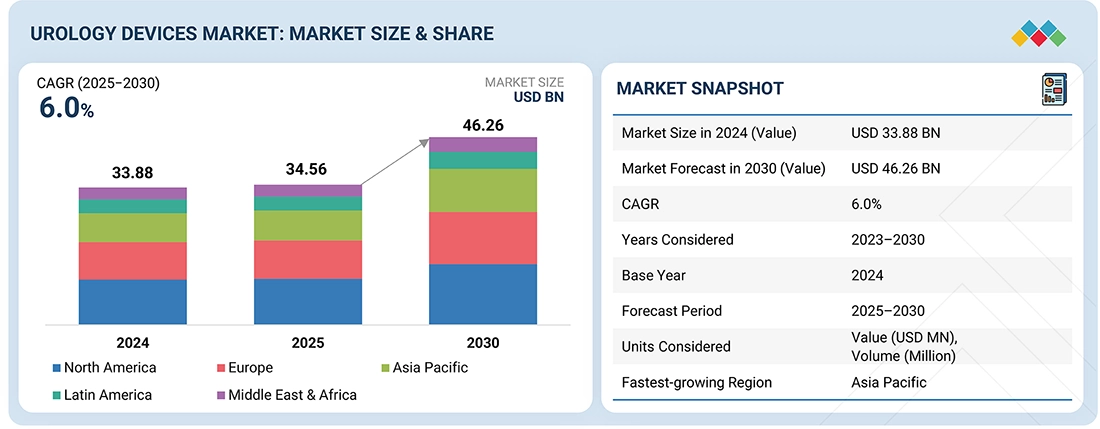

The global urology devices market is estimated at USD 35.56 billion in 2025 and is projected to reach USD 46.26 billion by 2030, growing at a CAGR of 6.0% during the forecast period. The rising prevalence of urological diseases, chronic metabolic conditions, and lifestyle-related disorders is strongly driving the market. The increasing incidence of benign prostatic hyperplasia, urological malignancies, and kidney disease cases has further increased the need for advanced urology devices. At the same time, the emergence of advanced diagnostic testing methodologies, particularly minimally invasive endoscopic techniques, is driving demand for technologically advanced urology devices that ensure diagnostic precision and procedural accuracy. Additionally, growing awareness among healthcare providers and patients about advanced treatment options and improved outcomes through urological interventions is contributing to the expansion of the market, particularly in emerging healthcare markets. Collectively, these factors are accelerating the adoption of advanced urology devices, improving patient care and clinical outcomes, and strengthening the overall growth trajectory of the global urology devices market.

KEY TAKEAWAYS

-

BY PRODUCTThe urology devices market is categorized into instruments and consumables & accessories, with instruments dominating the market share due to their essential role in diagnostic procedures, surgical interventions, and patient management across hospitals and specialty clinics. Surgical instruments, including endoscopes, laser lithotripsy systems, urodynamic equipment, and robotic surgical platforms, play a significant role in urological practice. These durable devices are used for complex procedures ranging from minimally invasive stone removal to advanced cancer-directed therapies, which drive the market for instruments. Consumables & accessories, while accounting for a smaller revenue share, demonstrate faster growth rates due to their recurring demand and consistent replacement cycles across surgical centers and dialysis facilities.

-

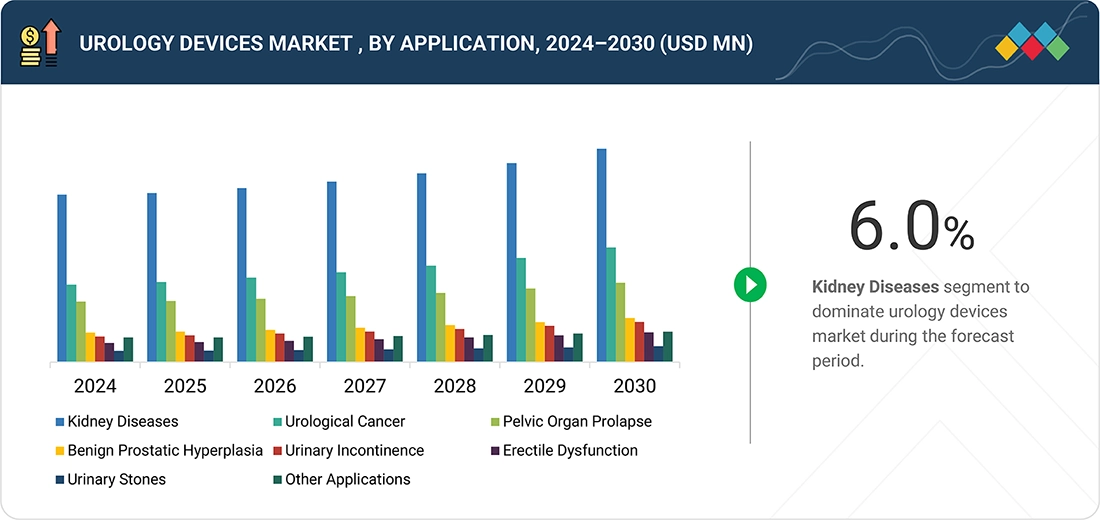

BY APPLICATIONThe urology devices market is categorized into kidney disease, urological cancer, benign prostatic hyperplasia, urinary incontinence, erectile dysfunction, pelvic organ prolapse, and urinary stones. Kidney disease has the largest market share due to its increased prevalence and intensive treatment requirements across dialysis centers and nephrology practices globally. This disease segment drives demand for kidney replacement equipment, dialysis machines, and comprehensive kidney management systems that address the needs of patients with end-stage renal disease and progressive renal dysfunction. Other applications, such as urological cancer management and BPH treatment, utilize distinct device categories, including robotically-assisted surgical systems and minimally invasive therapeutic platforms. The dominance of the kidney disease segment reflects the exponential rise in patient populations, the chronic nature of the condition requiring long-term device utilization, and substantial healthcare expenditures allocated to dialysis infrastructure development in both emerging and developed markets.

-

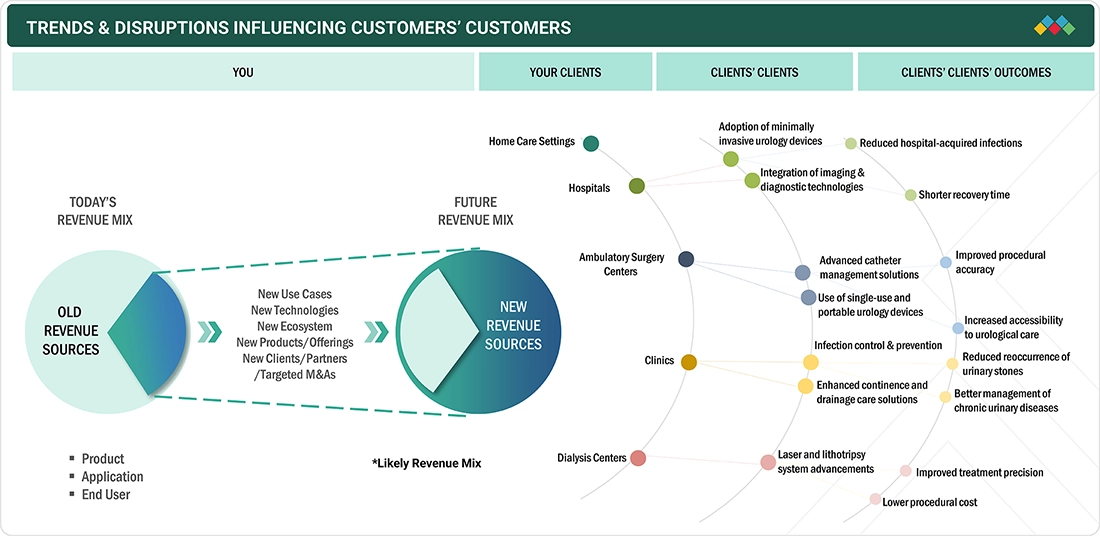

BY END USERThe urology devices market is categorized by end user into hospitals, ambulatory surgery centers, clinics, dialysis centers, and home care settings, with hospitals representing the primary market segments due to their high volume of patients, surgical procedures, and specialized urological interventions conducted daily. Dialysis centers have emerged as a distinct and rapidly expanding end-user category, accounting for a substantial portion of device utilization, as they provide comprehensive replacement therapy and long-term management solutions for patients with kidney disease and end-stage renal disease.

-

BY REGIONThe urology devices market is divided into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America dominates this sector, benefiting from advanced healthcare infrastructure, large patient populations, and a high prevalence of urological conditions, supported by major manufacturers and widespread access to specialized services. The Asia Pacific region is set to experience the fastest growth as expanded healthcare access, stronger adoption of preventive screening, and rising investment in modern hospitals and clinics fuel increased usage of advanced urology devices across China, India, Japan, and Southeast Asia, especially for addressing unmet needs in both large cities and fast-developing rural areas.

-

COMPETITIVE LANDSCAPEMajor players in the urology devices market have adopted a mix of organic and inorganic growth strategies, including partnerships, collaborations, and investments, to expand their product portfolios and global reach. The top five players in the market include Fresenius Medical Care AG & Co. KGaA (Germany), Boston Scientific Corporation (US), Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), and Olympus Corporation (Japan). These companies focus on introducing advanced urology solutions, enhancing manufacturing capabilities, and strengthening distribution networks to cater to the growing global demand for safe and efficient urology procedures.

The global urology devices market is experiencing significant growth, driven by the rising prevalence of urological diseases, an aging population, and the expansion of healthcare infrastructure worldwide. The increasing incidence of trauma cases and accidents drives demand for emergency urological interventions. Technological advancements in minimally invasive procedures enable more effective disease detection and improved treatment outcomes. Investment in new hospitals, surgical centers, and dialysis facilities across both developed and emerging markets is creating a growing demand for advanced urology equipment. Additionally, growing patient awareness is driving market expansion, particularly in regions with increasing healthcare spending and improved medical accessibility.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The urology devices market is undergoing significant change as rising rates of chronic kidney disease, urinary incontinence, and urological cancers drive the need for both preventive care and frequent monitoring. Hospitals, ambulatory surgery centers, clinics, dialysis centers, and home care settings are the leading users of urology devices, adopting new systems for safer and more efficient diagnosis and treatment. Key developments such as rising adoption of minimally invasive and robotic-assisted surgical technologies, as well as improvements in urine analysis and endoscopic imaging, are modernizing clinical workflows. These advances increase purchasing for instruments, consumables, and accessories, helping urology device manufacturers achieve stronger growth and a more competitive market position.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising incidence of urological diseases

-

Growing preference for minimally invasive procedures

Level

-

High degree of consolidation among key players

Level

-

Potential growth opportunities in emerging economies

Level

-

Increasing number of product recalls by key players

-

Shortage of urologists and trained professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising incidence of urological diseases

The steadily increasing prevalence of chronic and lifestyle-related diseases such as diabetes and cancer is significantly driving the urology devices market. Regular diagnostic testing plays a critical role in disease detection, management, and monitoring, thereby boosting demand for reliable and accurate urological diagnostic systems. Additionally, the global focus on preventive healthcare and early diagnosis encourages the implementation of routine health screening programs, further propelling the adoption of advanced urology devices across hospitals, dialysis centers, and clinics. These factors collectively support sustained market growth and expanded clinical use of innovative urological technologies worldwide.

Restraint: High degree of consolidation among key players

The urology devices market is highly consolidated, dominated by a few major players with strong brand presence and significant R&D capabilities. The market’s structure presents high entry barriers due to the substantial capital investments required for research, development, and manufacturing. Established companies leverage their technological expertise and product portfolios to maintain competitiveness, while new entrants face challenges in differentiating themselves. The trend toward minimally invasive and robotic systems continues to shape innovation, with firms focusing on enhancing precision, usability, and patient outcomes. However, high costs and infrastructure requirements remain key obstacles to broader market adoption, especially among smaller healthcare facilities.

Opportunity: Potential growth opportunities in emerging economies

Emerging economies are presenting strong growth opportunities for the urology devices market due to improving healthcare infrastructure, favorable regulations, expanding patient bases, and increasing healthcare spending. Supportive government policies, particularly in the Asia Pacific region, are fostering innovation and accessibility in the medical device sector. The rapid expansion of the middle-class population and the growing private healthcare sector are further boosting demand for advanced medical technologies. As disposable incomes and healthcare awareness rise, manufacturers of urology devices are focusing on developing strategies to meet the evolving medical needs of these regions, driving sustained market growth.

Challenge: Increasing number of product recalls by key players

Product recalls in the medical device industry serve as crucial regulatory actions to ensure patient safety and compliance with quality standards. The FDA classifies recalls based on the level of risk posed to users, ranging from serious health threats to minimal or no harm. In recent times, the urology device market has experienced multiple recalls primarily due to manufacturing defects. These incidents, involving prominent industry players, underscore the challenges manufacturers face in maintaining stringent quality control and regulatory compliance, ultimately posing obstacles to market growth and brand reputation.

urology-devices-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides advanced dialysis systems, urological disposables, and minimally invasive solutions for the treatment of chronic kidney disease and urinary disorders in hospitals, clinics, and dialysis centers worldwide. | Enables reliable kidney disease devices, improves patient outcomes in acute and chronic kidney failure cases, supports safety standards, and optimizes workflow efficiency for healthcare providers and patients. |

|

Offers a comprehensive portfolio of urology and pelvic health solutions, including stone management devices, endourology systems, BPH therapies, and minimally invasive technologies used in both diagnostic and therapeutic urology procedures. | Enhances precision during diagnosis and treatment, reduces procedure times with innovative tools, improves patient safety and comfort, and supports versatility across a wide range of urological interventions. |

|

Manufactures catheters, dilators, retrieval baskets, guidewires, and diagnostic solutions utilized throughout the urinary tract for minimally invasive interventions in kidney stones, strictures, and urinary retention, providing critical support for clinicians. | Ensures accurate device placement, lowers risk of complications, supports repeatable outcomes, complies with international safety guidelines, and improves overall throughput in endoscopic and catheter-based urologic procedures. |

|

Supplies a broad selection of urological catheters, nephrostomy sets, irrigation systems, and surgical urology instruments, with a focus on single-use and sterile solutions to minimize infection risks across both hospital and outpatient environments. | Improves sterility and patient safety, reduces healthcare-acquired infections, meets strict regulatory requirements, simplifies post-procedural care, and enhances workflow in busy hospital and home care settings. |

|

Specializes in high-definition endoscopy equipment, resectoscopes, laser lithotripsy devices, and visualization systems for urological diagnostics and minimally invasive surgeries, trusted globally in clinical and operating environments. | Delivers clear visualization and precise surgical access, assists in rapid and accurate diagnosis, enables more minimally invasive urologic surgery, lowers recovery times, and sets benchmarks for innovation in urology imaging and care. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The urology devices market serves a wide range of end users, including hospitals, ambulatory surgical centers, clinics, dialysis centers, and home care settings. These facilities rely on urology devices for the diagnosis, treatment, and management of urinary tract disorders, kidney diseases, and related conditions. The increasing incidence of urological disorders, coupled with the growing number of surgical and minimally invasive procedures, is driving product utilization across these settings. Moreover, the adoption of advanced technologies such as digital imaging and robotic-assisted systems is enhancing procedural efficiency. Supportive healthcare initiatives, rising awareness of preventive urological care, and the expansion of healthcare infrastructure continue to stimulate demand across all end-user segments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Urology Devices Market, By Product

The urology devices market is segmented into instruments and consumables & accessories. Among these, the instruments segment holds a larger market share, driven by their extensive use in diagnostic, surgical, and therapeutic urological procedures. Instruments such as endoscopes, resectoscopes, lithotripters, and cystoscopes are essential for performing a wide range of minimally invasive and complex surgeries, ensuring precision, efficiency, and improved patient outcomes. The growing prevalence of urological disorders, along with increasing adoption of advanced imaging and surgical technologies, continues to strengthen demand for these devices. While consumables and accessories, including catheters, guidewires, and drainage bags, play a crucial role in supporting daily clinical operations, the instruments segment remains the dominant contributor to market revenue due to their higher cost, technological sophistication, and recurring use across healthcare facilities.

Urology Devices Market, By Application

The urology devices market is categorized based on applications into kidney diseases, urological cancers, pelvic organ prolapse, benign prostatic hyperplasia (BPH), urinary incontinence, erectile dysfunction, urinary stones, and other urological conditions. Among these, kidney disease applications account for the largest share, driven by the increasing prevalence of chronic kidney disease (CKD) and the rising demand for advanced diagnostic and therapeutic solutions. Urology devices play a critical role in managing kidney-related disorders through procedures such as dialysis, nephroscopy, and minimally invasive interventions. While other applications, such as the management of urinary incontinence, prostate enlargement, and urological cancers, also contribute significantly to market demand, the growing burden of kidney diseases and the expansion of renal care infrastructure continue to be key drivers for the urology devices market.

Urology Devices Market, By End User

The urology devices market is categorized by end user into hospitals, ambulatory surgical centers (ASCs), clinics, dialysis centers, and home care settings. Among these, hospitals account for the largest share of the market, attributed to the high volume of urological procedures, advanced diagnostic capabilities, and availability of specialized urology departments. Hospitals perform a wide range of urological surgeries and treatments, including those for kidney disorders, urinary tract diseases, and prostate conditions, driving substantial demand for both instruments and consumables. ASCs and clinics also represent significant end-user segments, supported by the growing adoption of minimally invasive and outpatient urological procedures. Dialysis centers contribute notably to the market due to the increasing prevalence of chronic kidney disease and the expanding network of renal care facilities. Meanwhile, home care settings are witnessing steady growth, driven by the rising use of portable and patient-friendly urology devices for long-term care. Overall, the continuous expansion of healthcare infrastructure and growing procedural volumes are expected to boost the adoption of urology devices across all end user segments.

REGION

North America accounted for the largest share of the global urology devices market during the forecast period.

The urology devices market in North America is experiencing steady growth, driven by a well-established healthcare infrastructure, advanced diagnostic capabilities, and high healthcare expenditure. The increasing prevalence of urological disorders such as kidney diseases, urinary incontinence, and prostate conditions is fueling the demand for effective diagnostic and therapeutic solutions. Moreover, technological advancements in minimally invasive and robotic-assisted procedures, coupled with favorable reimbursement frameworks and the strong presence of leading medical device manufacturers, are supporting market expansion. The growing adoption of home-based urology care, along with ongoing product innovations, further strengthens the region’s position in the global urology devices market.

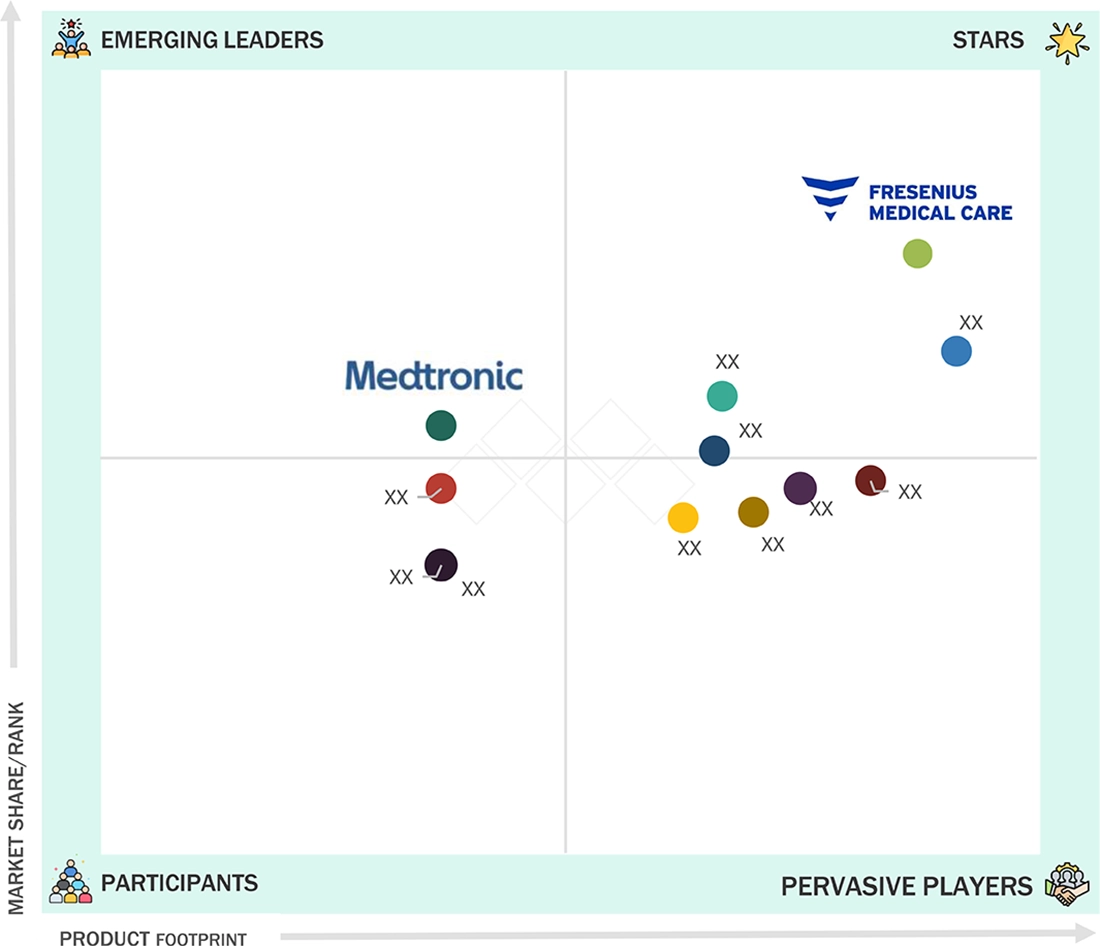

urology-devices-market: COMPANY EVALUATION MATRIX

In the urology devices market matrix, Fresenius Medical Care AG & Co. KGaA (Star) leads with a substantial market share and an extensive product footprint, driven by its advanced urology solutions and high-performance medical devices widely adopted in clinical and hospital settings. Cardinal Health (Emerging Leader) is gaining visibility with its specialized devices and tailored solutions for urological applications, strengthening its position through innovation and niche product offerings. While Fresenius Medical Care AG & Co. KGaA dominates through scale and a diverse portfolio, Cardinal Health shows significant potential to move toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Fresenius Medical Care AG & Co. KGaA (Germany)

- Boston Scientific Corporation (US)

- Becton, Dickinson and Company (US)

- B. Braun Melsungen AG (Germany)

- Cardinal Health (US)

- Olympus Corporation (Japan)

- Intuitive Surgical (US)

- Coloplast A/S (Denmark)

- Stryker Corporation (US)

- Teleflex Incorporated (US)

- Convatec Group PLC (UK)

- Medtronic PLC (Ireland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 33.88 Billion |

| Revenue Forecast in 2030 | USD 46.26 Billion |

| Growth Rate | CAGR of 6.0% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America and the Middle East & Africa |

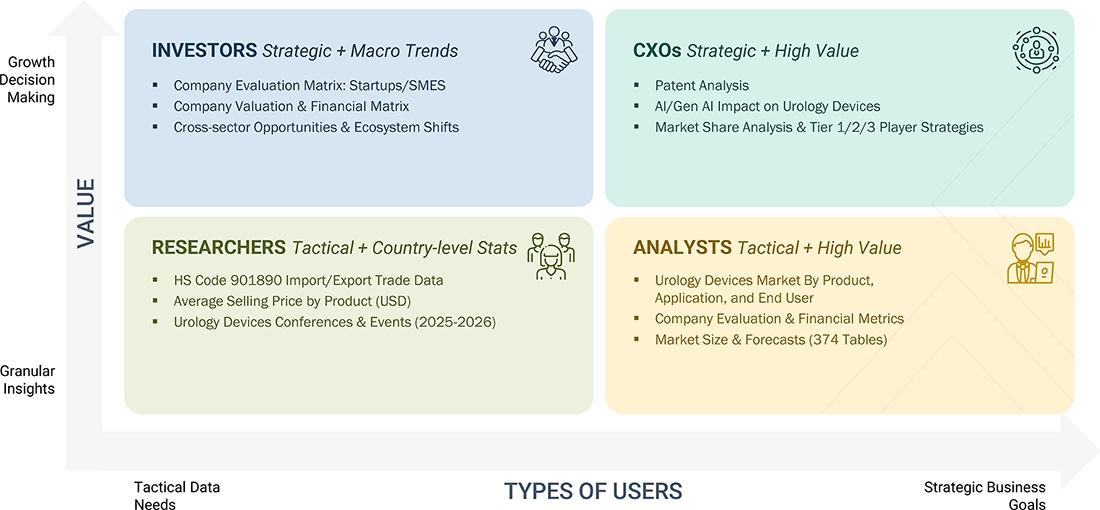

WHAT IS IN IT FOR YOU: urology-devices-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Product matrix, which provides a detailed comparison of the product portfolio of each company in the urology devices market | Enables easy comparison of competitors’ offerings, helping identify gaps, overlaps, and differentiation opportunities |

| Company Information | An additional five company profiles of players operating in the urology devices market | Provides insights into competitors’ strategies, innovation focus, and partnerships, supporting strategic planning |

| Geographic Analysis | Additional country-level analysis of the urology devices market | Guides market entry, localization, and targeted launch strategies by highlighting regional demand and opportunities |

RECENT DEVELOPMENTS

- June 2025 : Boston Scientific Corporation is expanding its presence in the US urology devices market through the accelerated commercialization of its advanced robotic-assisted urology platform, achieving significant regulatory and clinical milestones in its mission to deliver minimally invasive surgical solutions for patients with urological malignancies and benign prostatic hyperplasia, thereby strengthening its competitive position in the high-growth urology devices sector.

- April 2025 : BD has launched the Phasix ST Umbilical Hernia Patch, the first fully absorbable mesh designed explicitly for umbilical hernia repair. The product has received FDA 510(k) clearance and utilizes the same surgical technique as permanent mesh procedures, providing a new option for safer and more effective hernia treatment.

- November 2024 : Boston Scientific Corporation has acquired Axonics, enhancing its urology portfolio with advanced solutions for urinary and bowel dysfunction, and expanding into new treatment areas with a more comprehensive product offering.

- May 2023 : Olympus launched the POWERSEAL Sealer/Divider in the Europe, Middle East, and Africa (EMEA) region. This advanced bipolar surgical device is part of the POWERSEAL family, designed to enhance surgical performance and ergonomics. It supports surgeons across various medical specialties by offering improved efficiency and precision during procedures.

Table of Contents

Methodology

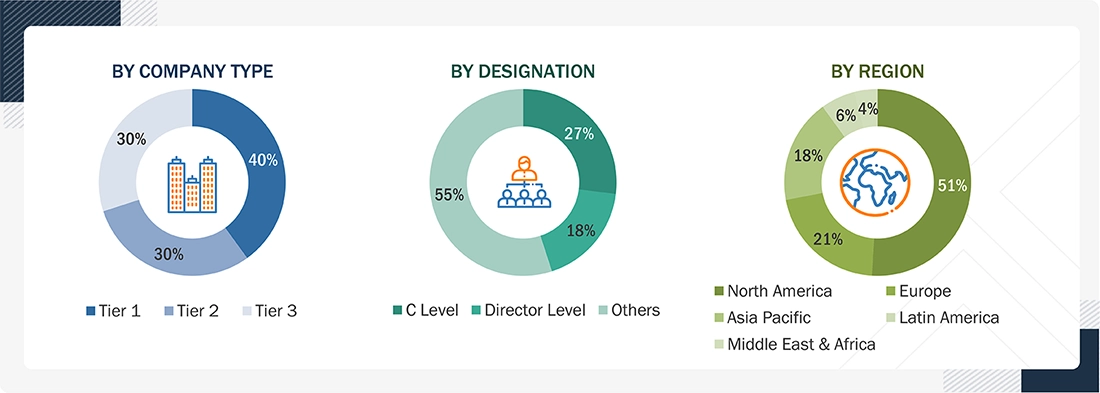

This research study extensively used secondary sources, directories, and databases to identify and collect valuable information to analyze the global urology devices market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative & quantitative information and assess the growth prospects in the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used primarily to identify & collect information for the extensive, technical, market-oriented, and commercial study. The secondary sources used for this study include annual reports, SEC filings, investor presentations, World Health Organization (WHO), US Food and Drug Administration (US FDA), National Center for Biotechnology Information (NCBI), Health Canada, European Medicines Agency (EMA), and Centers for Disease Control and Prevention (CDC). These sources also obtained key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative & quantitative information and assess the prospects of the market. Various primary sources from both the supply & demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

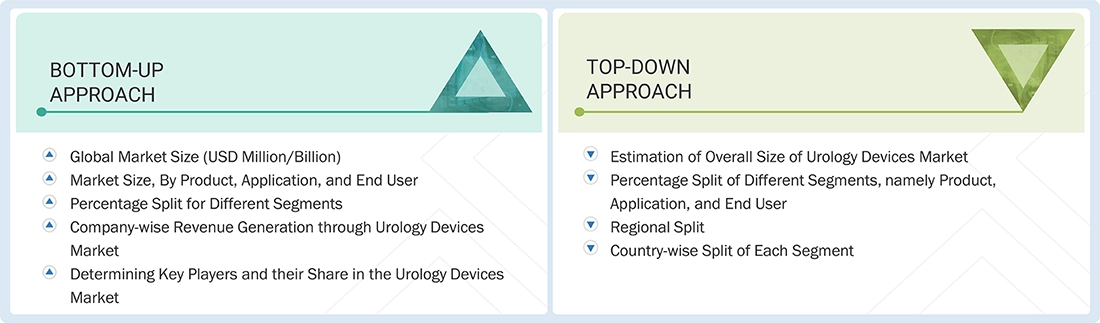

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the urology devices market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Urology Devices Market : Top-Down and Bottom-Up Approach

Data Triangulation

The total market was split into several segments and subsegments after arriving at the overall market size from the estimation process. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Urology is a medical specialty that deals with the physiology, diseases, and disorders of the human urinary tract and male reproductive organs. Urology devices comprise various types of equipment used during the diagnosis, surgery, and treatment of urological diseases, such as chronic kidney diseases, renal failure, urinary stones, benign prostate hyperplasia (BPH), pelvic organ prolapse (POP), prostate cancer, kidney cancer, bladder cancer, and erectile dysfunction.

Key Stakeholders

- Manufacturers and Distributors of Urology Devices

- Hospitals and ASCs

- Academic Research Institutes

- Urology Clinics

- Urology Device Service Providers

- Venture Capitalists and Investors

- Clinical Research Organizations (CROs)

Report Objectives

- To define, describe, and forecast the urology devices market by product, application, end user, and region

- To forecast the size of the urology devices market with respect to five regional segments, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall urology devices market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in the urology devices market and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as product launches, product approvals, mergers, agreements, collaborations, partnerships, expansions, and acquisitions in the urology devices market

- To benchmark players within the urology devices market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, collaborations, and partnerships in the urology devices market

Customization Options

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for this report:

Portfolio Assessment

- Product Matrix gives a detailed comparison of the product portfolios of the top five companies.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographical Analysis

- A further breakdown of the Rest of Europe’s urology devices market into countries

- A further breakdown of the Rest of Asia Pacific’s urology devices market into countries

- A further breakdown of Latin America’s urology devices market into countries

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Urology Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Urology Devices Market